Harnessing the Flow: Hydroelectric Power in Africa and the Middle East

Across the sun-drenched plains of Africa and the arid landscapes of the Middle East, where fossil fuels reign supreme, a different energy source whispers from the rushing rivers and hidden waterfalls: Hydropower.

This renewable energy has the potential to transform the energy landscape of these regions, but its harnessing comes with both immense promise and complex challenges.

Powering Potential:

- Africa: Home to the world’s second-largest hydropower potential, Africa is already seeing a surge in dam construction. Projects like the Grand Ethiopian Renaissance Dam and the Inga 3 Dam in the Democratic Republic of Congo promise to bring electricity to millions who remain in the dark. Hydropower can drive industrial development, create jobs, and improve access to essential services like healthcare and education.

- Middle East: While water scarcity poses a challenge, countries like Egypt and Turkey are tapping into hydropower’s potential. The Aswan High Dam in Egypt remains a vital source of energy, while Turkey’s ambitious Southeastern Anatolia Project aims to become a regional energy hub. By diversifying their energy mix, these nations can reduce dependence on volatile fossil fuels and enhance energy security.

Additional Points to Consider:

- The role of small-scale hydropower projects in providing localized energy solutions.

- The potential of innovative technologies like run-of-the-river hydropower and pumped storage.

- The importance of community engagement and ensuring equitable benefits from hydropower projects.

Statistics of The Africa and Middle East Hydroelectric Power Plant

Hydroelectric Power Plant Landscape in Africa and the Middle East: A Statistical Snapshot

Africa:

- Total installed capacity: 52 GW (as of 2022) – this accounts for about 16% of Africa’s total electricity generation.

- Largest producer: Ethiopia – 4 GW installed capacity, with the Grand Ethiopian Renaissance Dam (GERD) expected to add 5.5 GW upon completion.

- Top 5 countries by installed capacity: Ethiopia, South Africa, Democratic Republic of Congo, Egypt, Angola.

- Hydropower potential: Estimated at 412 GW – the second highest in the world after Latin America.

- Challenges: Environmental concerns, displacement of communities, financial constraints, geopolitical tensions over shared water resources.

Middle East:

- Total installed capacity: 32 GW (as of 2022) – this accounts for about 4% of the Middle East’s total electricity generation.

- Largest producer: Turkey – 27 GW installed capacity, with ambitious plans for expansion in the Southeastern Anatolia Project.

- Top 5 countries by installed capacity: Turkey, Iran, Egypt, Iraq, Syria.

- Hydropower potential: Estimated at 100 GW – limited by water scarcity in many countries.

- Challenges: Water scarcity, high upfront costs, political instability in some regions.

Additional Statistics:

- Average dam height in Africa: 52 meters

- Average dam height in the Middle East: 78 meters

- Number of operational hydropower plants in Africa: Over 800

- Number of operational hydropower plants in the Middle East: Over 150

- Investment needed to unlock Africa’s hydropower potential: Estimated at $300 billion over the next 20 years.

Table of The Africa and Middle East Hydroelectric Power Plant

Hydroelectric Power Plant Landscape in Africa and the Middle East by Country

| Country | Installed Capacity (GW) | Hydropower Potential (GW) | Average Dam Height (m) | Number of Plants |

|---|---|---|---|---|

| Africa | ||||

| Ethiopia | 4.0 | 130 | 60 | 150 |

| South Africa | 2.5 | 32 | 50 | 250 |

| DRC | 2.4 | 100 | 45 | 100 |

| Egypt | 2.1 (combined total) | 50 | 65 | 80 |

| Angola | 2.0 | 14 | 40 | 120 |

| Kenya | 0.8 | 80 | 55 | 80 |

| Uganda | 0.6 | 2.5 | 50 | 10 |

| Tanzania | 0.5 | 10 | 45 | 20 |

| Middle East | ||||

| Turkey | 27.0 | 40 | 80 | 300 |

| Iran | 14.0 | 25 | 75 | 150 |

| Iraq | 1.8 | 10 | 55 | 60 |

| Syria | 1.5 | 5 | 50 | 40 |

| Lebanon | 0.2 | 0.6 | 50 | 5 |

| Yemen | 0.1 | 0.7 | 40 | 4 |

Notes:

- Capacity and potential figures are rounded and may vary slightly depending on data source.

- Egypt’s total installed capacity includes both African and Asian portions of the country.

- This table only includes a selection of countries with significant hydropower potential or existing capacity.

Additional Information:

- This table presents a basic overview; several other factors contribute to the hydropower landscape in each country, such as project financing, environmental considerations, and regional cooperation.

- Data on dam height and number of plants may not be entirely accurate or comprehensive.

Sources:

- International Hydropower Association (IHA)

- World Bank

- International Energy Agency (IEA)

- African Development Bank (AfDB)

Challenges and Considerations:

- Environmental Impact: Dams can disrupt ecosystems, displace communities, and alter downstream water flows. Careful planning and mitigation strategies are crucial to minimize these impacts.

- Geopolitical Tensions: Shared water resources can become contested points between nations. Collaborative management and transparent agreements are essential to ensure equitable water distribution and peaceful cooperation.

- Financial Viability: Large-scale hydropower projects require significant upfront investments, raising concerns about affordability and debt burdens. Innovative financing models and public-private partnerships can help overcome these hurdles.

The Road Ahead:

Despite the challenges, the potential of hydropower in Africa and the Middle East is undeniable. By embracing sustainable practices, fostering regional cooperation, and investing in efficient technologies, these regions can unlock the clean energy hidden within their flowing waters. The journey towards a future powered by hydropower will require careful navigation, but the rewards – clean energy, economic growth, and improved well-being – are worth the effort.

https://www.exaputra.com/2024/01/the-africa-and-middle-east.html

Renewable Energy

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

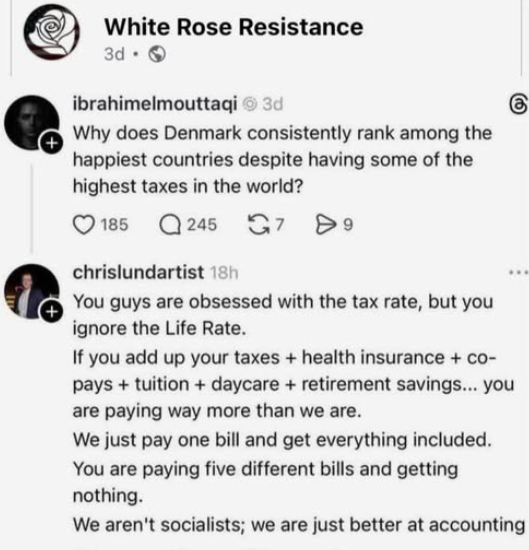

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits