Germany’s Renewable Energy Surge: Latest Projects and Stats Fueling the Green Transition

Germany, a European leader in renewable energy, continues its ambitious push towards a sustainable future.

With a goal of achieving 80% electricity consumption from renewables by 2030, the country is witnessing a surge in innovative projects across various technologies. Let’s explore some of the latest developments and delve into the accompanying statistics:

Solar Power Soars:

- Record Installations: 2023 saw a remarkable installation of over 1 million new solar systems, generating 14 GW of capacity – an 85% increase compared to 2022. This translates to roughly 3 new installations every minute!

- Community Power: Initiatives like citizen energy cooperatives are facilitating community-owned solar parks, empowering local communities and boosting participation.

Wind Power Pushes Forward:

- Offshore Expansion: Projects like the 900 MW Nordsee Two wind farm, operational since 2023, highlight the focus on large-scale offshore wind developments.

- Onshore Repowering: Replacing older turbines with more efficient models is revitalizing existing wind farms, boosting output and efficiency.

Beyond Wind and Solar:

- Hydrogen Hubs: Green hydrogen production from renewable sources is gaining momentum, with projects like the Holtenhafen green hydrogen plant paving the way for decarbonizing various industries.

- Geothermal Potential: Exploration and development of geothermal energy resources are underway, particularly in southern Germany, offering a promising source of clean, baseload power.

Latest Germany Wind Energy Projects

Onshore:

-

Dalkendorf Wind Farm:

- Location: Mecklenburg-Vorpommern

- Capacity: 40 MW (7 x 5.7 MW turbines)

- Status: Approval granted, construction begins 2024, commissioning 2026

- Developer: Qualitas Energy

-

Waldow Wind Farm:

- Location: Brandenburg

- Capacity: 25 MW (5 x 5 MW turbines)

- Status: Approval granted, construction begins 2024, commissioning 2025

- Developer: Qualitas Energy

-

Recent Onshore Wind Auction:

- Capacity awarded: 1.4 GW

- Projects: Distributed across various locations in Germany

- Status: Early development stages

- Significance: Represents continued momentum in onshore wind expansion

Offshore:

-

Borkum Riffgrund 3:

- Location: North Sea, off Borkum island

- Capacity: 900 MW (83 turbines)

- Status: Under construction, commissioning expected 2025

- Developer: Ørsted

-

Kaskasi:

- Location: North Sea, off Heligoland island

- Capacity: 342 MW (38 turbines)

- Status: Under construction, commissioning expected 2024

- Developer: RWE, Ørsted

-

Baltic Sea Tenders (March 2021):

- Location: Baltic Sea, divided into three zones

- Capacity: 958 MW

- Status: Tender awarded, projects in early development stages

- Significance: Represents significant expansion in Baltic Sea offshore wind

Additional Statistics:

- New onshore wind installations in Germany (H1 2023): 1.6 GW

- German government’s onshore wind target: 10 GW per year from 2025 onwards

- Total installed wind energy capacity in Germany (2022): 63.1 GW (onshore: 56.2 GW, offshore: 6.9 GW)

Onshore:

-

Dalkendorf Wind Farm:

- Location: Mecklenburg-Vorpommern

- Capacity: 40 MW (7 x 5.7 MW turbines)

- Status: Approval granted, construction begins 2024, commissioning 2026

- Developer: Qualitas Energy

-

Waldow Wind Farm:

- Location: Brandenburg

- Capacity: 25 MW (5 x 5 MW turbines)

- Status: Approval granted, construction begins 2024, commissioning 2025

- Developer: Qualitas Energy

-

Recent Onshore Wind Auction:

- Capacity awarded: 1.4 GW

- Projects: Distributed across various locations in Germany

- Status: Early development stages

- Significance: Represents continued momentum in onshore wind expansion

Offshore:

-

Borkum Riffgrund 3:

- Location: North Sea, off Borkum island

- Capacity: 900 MW (83 turbines)

- Status: Under construction, commissioning expected 2025

- Developer: Ørsted

-

Kaskasi:

- Location: North Sea, off Heligoland island

- Capacity: 342 MW (38 turbines)

- Status: Under construction, commissioning expected 2024

- Developer: RWE, Ørsted

-

Baltic Sea Tenders (March 2021):

- Location: Baltic Sea, divided into three zones

- Capacity: 958 MW

- Status: Tender awarded, projects in early development stages

- Significance: Represents significant expansion in Baltic Sea offshore wind

Additional Statistics:

- New onshore wind installations in Germany (H1 2023): 1.6 GW

- German government’s onshore wind target: 10 GW per year from 2025 onwards

- Total installed wind energy capacity in Germany (2022): 63.1 GW (onshore: 56.2 GW, offshore: 6.9 GW)

Latest Germany Wind Energy Projects with Specific Statistics Table

Project

Location

Capacity (MW)

Turbine Type & Count

Status

Developer

Additional Info

Onshore:

Dalkendorf Wind Farm

Mecklenburg-Vorpommern

40 (7 x 5.7)

N/A

Approval granted, construction 2024, commissioning 2026

Qualitas Energy

Expected annual energy production: 136 GWh

Waldow Wind Farm

Brandenburg

25 (5 x 5)

N/A

Approval granted, construction 2024, commissioning 2025

Qualitas Energy

Expected annual energy production: 87.5 GWh

Recent Onshore Wind Auction (Oct 2023)

Various

1,400

N/A

Early development stages

N/A

Includes diverse developers and project locations

Offshore:

Borkum Riffgrund 3

North Sea, Borkum island

900 (83)

Siemens Gamesa SWT-8.0-167

Under construction, commissioning 2025

Ørsted

World’s largest offshore wind farm at completion

Kaskasi

North Sea, Heligoland island

342 (38)

Siemens Gamesa SWT-8.8-170

Under construction, commissioning 2024

RWE, Ørsted

First wind farm to use 170m rotor diameter turbines in Germany

Baltic Sea Tenders (March 2021)

Baltic Sea (3 zones)

958

N/A

Early development stages

N/A

Tenders awarded to various developers, projects underway

Additional Statistics:

- New onshore wind installations in Germany (H1 2023): 1.6 GW

- German government’s onshore wind target: 10 GW per year from 2025 onwards

- Total installed wind energy capacity in Germany (2022): 63.1 GW (onshore: 56.2 GW, offshore: 6.9 GW)

- Expected share of wind energy in German electricity mix by 2030: 65%

| Project | Location | Capacity (MW) | Turbine Type & Count | Status | Developer | Additional Info |

|---|---|---|---|---|---|---|

| Onshore: | ||||||

| Dalkendorf Wind Farm | Mecklenburg-Vorpommern | 40 (7 x 5.7) | N/A | Approval granted, construction 2024, commissioning 2026 | Qualitas Energy | Expected annual energy production: 136 GWh |

| Waldow Wind Farm | Brandenburg | 25 (5 x 5) | N/A | Approval granted, construction 2024, commissioning 2025 | Qualitas Energy | Expected annual energy production: 87.5 GWh |

| Recent Onshore Wind Auction (Oct 2023) | Various | 1,400 | N/A | Early development stages | N/A | Includes diverse developers and project locations |

| Offshore: | ||||||

| Borkum Riffgrund 3 | North Sea, Borkum island | 900 (83) | Siemens Gamesa SWT-8.0-167 | Under construction, commissioning 2025 | Ørsted | World’s largest offshore wind farm at completion |

| Kaskasi | North Sea, Heligoland island | 342 (38) | Siemens Gamesa SWT-8.8-170 | Under construction, commissioning 2024 | RWE, Ørsted | First wind farm to use 170m rotor diameter turbines in Germany |

| Baltic Sea Tenders (March 2021) | Baltic Sea (3 zones) | 958 | N/A | Early development stages | N/A | Tenders awarded to various developers, projects underway |

Additional Statistics:

- New onshore wind installations in Germany (H1 2023): 1.6 GW

- German government’s onshore wind target: 10 GW per year from 2025 onwards

- Total installed wind energy capacity in Germany (2022): 63.1 GW (onshore: 56.2 GW, offshore: 6.9 GW)

- Expected share of wind energy in German electricity mix by 2030: 65%

Latest Germany Solar Energy Projects

Germany remains a leader in solar energy, and new projects continue to emerge. Here’s a look at some of the latest initiatives, categorized by rooftop and utility-scale:

Rooftop Solar:

-

“Million Roofs Program”:

- Goal: Install 1 million new rooftop solar systems by 2025.

- Progress: Over 2.7 million rooftop systems installed in Germany as of 2023.

- Funding: Supported by government grants and subsidies.

- Significance: Aims to significantly increase residential solar adoption.

-

“Solar Offensive”:

- Goal: Promote solar installations on public buildings in Bavaria.

- Progress: Over 1,000 public buildings equipped with solar panels as of 2023.

- Funding: Allocated €100 million for project development.

- Significance: Expands solar utilization in the public sector.

-

IKEA Germany Solar Panel Partnership:

- Initiative: Collaboration with Sonnenbatterie to offer home battery systems with IKEA solar panels.

- Progress: Launched in October 2023, initial sales promising.

- Significance: Simplifies access to solar and storage solutions for homeowners.

Utility-Scale Solar:

-

“Solarpark Picher”:

- Location: Saxony-Anhalt

- Capacity: 180 MW (expected)

- Status: Under construction, commissioning planned for 2025.

- Developer: EnBW

- Significance: One of the largest solar parks currently under construction in Germany.

-

“Solar Cluster Westküste”:

- Location: Schleswig-Holstein

- Capacity: 147 MW (combined)

- Status: Various stages of development, some operational.

- Developer: Multiple developers

- Significance: Showcase project for interconnected solar farms maximizing land use.

-

“agrivoltaic” Projects:

- Concept: Combining solar panels with agricultural production.

- Examples: Several pilot projects ongoing across Germany.

- Status: Early stages, research and development focused.

- Significance: Exploring potential for dual land use and agricultural benefits.

Additional Statistics:

- New installed solar capacity in Germany (2022): 5.3 GW

- German government’s solar target: 10 GW per year from 2025 onwards

- Total installed solar capacity in Germany (2022): 59.2 GW (rooftop: 54.4 GW, utility-scale: 4.8 GW)

Germany remains a leader in solar energy, and new projects continue to emerge. Here’s a look at some of the latest initiatives, categorized by rooftop and utility-scale:

Rooftop Solar:

-

“Million Roofs Program”:

- Goal: Install 1 million new rooftop solar systems by 2025.

- Progress: Over 2.7 million rooftop systems installed in Germany as of 2023.

- Funding: Supported by government grants and subsidies.

- Significance: Aims to significantly increase residential solar adoption.

-

“Solar Offensive”:

- Goal: Promote solar installations on public buildings in Bavaria.

- Progress: Over 1,000 public buildings equipped with solar panels as of 2023.

- Funding: Allocated €100 million for project development.

- Significance: Expands solar utilization in the public sector.

-

IKEA Germany Solar Panel Partnership:

- Initiative: Collaboration with Sonnenbatterie to offer home battery systems with IKEA solar panels.

- Progress: Launched in October 2023, initial sales promising.

- Significance: Simplifies access to solar and storage solutions for homeowners.

Utility-Scale Solar:

-

“Solarpark Picher”:

- Location: Saxony-Anhalt

- Capacity: 180 MW (expected)

- Status: Under construction, commissioning planned for 2025.

- Developer: EnBW

- Significance: One of the largest solar parks currently under construction in Germany.

-

“Solar Cluster Westküste”:

- Location: Schleswig-Holstein

- Capacity: 147 MW (combined)

- Status: Various stages of development, some operational.

- Developer: Multiple developers

- Significance: Showcase project for interconnected solar farms maximizing land use.

-

“agrivoltaic” Projects:

- Concept: Combining solar panels with agricultural production.

- Examples: Several pilot projects ongoing across Germany.

- Status: Early stages, research and development focused.

- Significance: Exploring potential for dual land use and agricultural benefits.

Additional Statistics:

- New installed solar capacity in Germany (2022): 5.3 GW

- German government’s solar target: 10 GW per year from 2025 onwards

- Total installed solar capacity in Germany (2022): 59.2 GW (rooftop: 54.4 GW, utility-scale: 4.8 GW)

Table of Latest Germany Solar Energy Projects

Project

Location

Capacity (MW)

Type

Status

Developer

Additional Info

Rooftop Solar:

Million Roofs Program

Nationwide

N/A

Rooftop

Ongoing

Various

Aims for 1 million new systems by 2025

Solar Offensive – Bavaria

Bavaria

N/A

Public buildings

Ongoing

Bavarian government

Over 1,000 buildings equipped

IKEA Germany Solar Panel Partnership

Nationwide

N/A

Rooftop + storage

Launched Oct 2023

IKEA & Sonnenbatterie

Simplifies access for homeowners

Utility-Scale Solar:

Solarpark Picher

Saxony-Anhalt

180

Ground-mounted

Under construction

EnBW

Commissioning planned for 2025

Solar Cluster Westküste

Schleswig-Holstein

147 (combined)

Ground-mounted

Various stages

Multiple developers

Interconnected solar farms

Agrivoltaic Projects

Various

N/A

Dual-use (agri + solar)

Pilot stage

Various developers

Research & development focused

Additional Statistics:

- New installed solar capacity in Germany (2022): 5.3 GW

- German government’s solar target: 10 GW per year from 2025 onwards

- Total installed solar capacity in Germany (2022): 59.2 GW (rooftop: 54.4 GW, utility-scale: 4.8 GW)

| Project | Location | Capacity (MW) | Type | Status | Developer | Additional Info |

|---|---|---|---|---|---|---|

| Rooftop Solar: | ||||||

| Million Roofs Program | Nationwide | N/A | Rooftop | Ongoing | Various | Aims for 1 million new systems by 2025 |

| Solar Offensive – Bavaria | Bavaria | N/A | Public buildings | Ongoing | Bavarian government | Over 1,000 buildings equipped |

| IKEA Germany Solar Panel Partnership | Nationwide | N/A | Rooftop + storage | Launched Oct 2023 | IKEA & Sonnenbatterie | Simplifies access for homeowners |

| Utility-Scale Solar: | ||||||

| Solarpark Picher | Saxony-Anhalt | 180 | Ground-mounted | Under construction | EnBW | Commissioning planned for 2025 |

| Solar Cluster Westküste | Schleswig-Holstein | 147 (combined) | Ground-mounted | Various stages | Multiple developers | Interconnected solar farms |

| Agrivoltaic Projects | Various | N/A | Dual-use (agri + solar) | Pilot stage | Various developers | Research & development focused |

Additional Statistics:

- New installed solar capacity in Germany (2022): 5.3 GW

- German government’s solar target: 10 GW per year from 2025 onwards

- Total installed solar capacity in Germany (2022): 59.2 GW (rooftop: 54.4 GW, utility-scale: 4.8 GW)

Latest Hydrogen and Geothermal Energy Projects in Germany

Hydrogen:

- Bavaria’s €500 million investment: Announced in February 2024, Bavaria is investing €500 million in hydrogen and green energy projects. While specific details are yet to be released, this significant investment highlights Germany’s continued commitment to hydrogen development.

- H2Global’s salt cavern storage project: Announced in January 2024, German energy company H2Global plans to store at least 250 GWh of hydrogen in salt caverns by 2030. This project, once completed, would represent a major step forward in hydrogen storage capacity in Germany.

- Hydrogen push in German industry: Several German companies and research institutions are involved in projects exploring the use of hydrogen in various industries, including steel production, chemicals, and transportation.

Specific statistics for these projects are currently unavailable due to their recent announcement and ongoing development.

Geothermal:

- Government exploration campaign: Launched in 2023, the German government’s geothermal exploration campaign aims to identify regions with favorable conditions for geothermal energy development. This initiative aims to identify and explore 100 new geothermal projects by 2030.

- Geothermal Energy Upper Rhine Valley: This ongoing project by Geothermal Energy aims to generate up to 30 MW of electricity from geothermal resources in the Upper Rhine Valley region. While specific electricity generation data is not readily available, the project marks a significant step in utilizing geothermal energy for electricity generation in Germany.

- Heat pump utilization: Germany already utilizes surface geothermal energy through widespread heat pump deployment. However, the potential for medium and deep geothermal heat is largely untapped. The government’s campaign aims to increase the share of geothermal heat in heating networks by tenfold by 2030.

Specific heat generation and capacity data for individual geothermal projects is limited due to the nascent stage of the government’s exploration campaign and the scattered nature of existing projects.

Hydrogen:

- Bavaria’s €500 million investment: Announced in February 2024, Bavaria is investing €500 million in hydrogen and green energy projects. While specific details are yet to be released, this significant investment highlights Germany’s continued commitment to hydrogen development.

- H2Global’s salt cavern storage project: Announced in January 2024, German energy company H2Global plans to store at least 250 GWh of hydrogen in salt caverns by 2030. This project, once completed, would represent a major step forward in hydrogen storage capacity in Germany.

- Hydrogen push in German industry: Several German companies and research institutions are involved in projects exploring the use of hydrogen in various industries, including steel production, chemicals, and transportation.

Specific statistics for these projects are currently unavailable due to their recent announcement and ongoing development.

Geothermal:

- Government exploration campaign: Launched in 2023, the German government’s geothermal exploration campaign aims to identify regions with favorable conditions for geothermal energy development. This initiative aims to identify and explore 100 new geothermal projects by 2030.

- Geothermal Energy Upper Rhine Valley: This ongoing project by Geothermal Energy aims to generate up to 30 MW of electricity from geothermal resources in the Upper Rhine Valley region. While specific electricity generation data is not readily available, the project marks a significant step in utilizing geothermal energy for electricity generation in Germany.

- Heat pump utilization: Germany already utilizes surface geothermal energy through widespread heat pump deployment. However, the potential for medium and deep geothermal heat is largely untapped. The government’s campaign aims to increase the share of geothermal heat in heating networks by tenfold by 2030.

Specific heat generation and capacity data for individual geothermal projects is limited due to the nascent stage of the government’s exploration campaign and the scattered nature of existing projects.

Table of Hydrogen and Geothermal Energy Projects in Germany (February 2024)

Project Name

Location

Objective

Status

Key Partners

Notes

Hydrogen:

Bavaria’s €500 million investment

Bavaria

Develop hydrogen & green energy projects

Announced February 2024

–

Ongoing planning, details to be released.

H2Global salt cavern storage

Northern Germany

Store 250+ GWh of hydrogen by 2030

Announced January 2024

H2Global

Early development stage, location specifics not confirmed.

Hydrogen in industry projects

Various

Explore hydrogen use in steel, chemicals, transportation

Ongoing

Various companies & research institutions

Multiple projects at different stages, specifics vary.

Geothermal:

Government exploration campaign

Nationwide

Identify 100 geothermal projects by 2030

Launched 2023

Federal government + research institutions

Ongoing exploration, specific project details not available.

Geothermal Energy Upper Rhine Valley

Upper Rhine Valley

Generate up to 30 MW electricity

Construction

Geothermal Energy

Project details limited, specific generation data unavailable.

Heat pump utilization

Nationwide

Increase geothermal heat in heating networks

Ongoing

Government, utilities, individual projects

Scattered existing projects, data on total heat generation lacking.

Please note: This table presents a brief overview based on publicly available information as of February 13, 2024. Specific project details and statistics are limited or unavailable at this stage.

| Project Name | Location | Objective | Status | Key Partners | Notes |

|---|---|---|---|---|---|

| Hydrogen: | |||||

| Bavaria’s €500 million investment | Bavaria | Develop hydrogen & green energy projects | Announced February 2024 | – | Ongoing planning, details to be released. |

| H2Global salt cavern storage | Northern Germany | Store 250+ GWh of hydrogen by 2030 | Announced January 2024 | H2Global | Early development stage, location specifics not confirmed. |

| Hydrogen in industry projects | Various | Explore hydrogen use in steel, chemicals, transportation | Ongoing | Various companies & research institutions | Multiple projects at different stages, specifics vary. |

| Geothermal: | |||||

| Government exploration campaign | Nationwide | Identify 100 geothermal projects by 2030 | Launched 2023 | Federal government + research institutions | Ongoing exploration, specific project details not available. |

| Geothermal Energy Upper Rhine Valley | Upper Rhine Valley | Generate up to 30 MW electricity | Construction | Geothermal Energy | Project details limited, specific generation data unavailable. |

| Heat pump utilization | Nationwide | Increase geothermal heat in heating networks | Ongoing | Government, utilities, individual projects | Scattered existing projects, data on total heat generation lacking. |

Please note: This table presents a brief overview based on publicly available information as of February 13, 2024. Specific project details and statistics are limited or unavailable at this stage.

Germany’s Latest Renewable Energy Technology

Germany’s dedication to renewable energy has yielded impressive results, making it a global leader in clean energy innovation. Here’s a glimpse into some recent advancements:

Solar Energy:

- Perovskite Solar Cells: Researchers at HZB shattered records with a 29.5% efficiency in perovskite cells, offering a cheaper and easier-to-produce alternative to silicon.

- Building-Integrated Photovoltaics (BIPV): Seamlessly integrating solar panels into building design, BIPV is gaining traction with its dual benefit of energy efficiency and aesthetics.

- Floating Solar Farms: Capitalizing on limited land resources, Germany explores floating solar farms on water bodies, maximizing potential without compromising land use.

Wind Energy:

- Next-Generation Wind Turbines: German companies are designing larger, more efficient, and reliable turbines to reduce wind energy costs and enhance competitiveness.

- Offshore Wind Farms: Leading in offshore wind, Germany expands its North and Baltic Sea wind farms, contributing significantly to their clean energy portfolio.

- Vertical Axis Wind Turbines (VAWTs): Exploring lower wind speed operation and reduced noise, Germany invests in VAWT development for both onshore and offshore applications.

Other Renewable Technologies:

- Hydrogen: Hydrogen, seen as a key decarbonization tool, receives heavy investment in Germany for electricity generation, heating, and powering vehicles.

- Geothermal Energy: While in its early stages, Germany explores geothermal energy’s potential for electricity and heating, harnessing the Earth’s internal heat.

- Biomass: Already a leader in biomass energy, Germany utilizes it for heat, electricity, and transportation fuels, highlighting its commitment to diverse renewable sources.

This snapshot showcases Germany’s continuous push for renewable energy advancements. By investing in these innovative technologies, they aim to achieve their ambitious climate goals and pave the way for a greener future.

Germany’s dedication to renewable energy has yielded impressive results, making it a global leader in clean energy innovation. Here’s a glimpse into some recent advancements:

Solar Energy:

- Perovskite Solar Cells: Researchers at HZB shattered records with a 29.5% efficiency in perovskite cells, offering a cheaper and easier-to-produce alternative to silicon.

- Building-Integrated Photovoltaics (BIPV): Seamlessly integrating solar panels into building design, BIPV is gaining traction with its dual benefit of energy efficiency and aesthetics.

- Floating Solar Farms: Capitalizing on limited land resources, Germany explores floating solar farms on water bodies, maximizing potential without compromising land use.

Wind Energy:

- Next-Generation Wind Turbines: German companies are designing larger, more efficient, and reliable turbines to reduce wind energy costs and enhance competitiveness.

- Offshore Wind Farms: Leading in offshore wind, Germany expands its North and Baltic Sea wind farms, contributing significantly to their clean energy portfolio.

- Vertical Axis Wind Turbines (VAWTs): Exploring lower wind speed operation and reduced noise, Germany invests in VAWT development for both onshore and offshore applications.

Other Renewable Technologies:

- Hydrogen: Hydrogen, seen as a key decarbonization tool, receives heavy investment in Germany for electricity generation, heating, and powering vehicles.

- Geothermal Energy: While in its early stages, Germany explores geothermal energy’s potential for electricity and heating, harnessing the Earth’s internal heat.

- Biomass: Already a leader in biomass energy, Germany utilizes it for heat, electricity, and transportation fuels, highlighting its commitment to diverse renewable sources.

This snapshot showcases Germany’s continuous push for renewable energy advancements. By investing in these innovative technologies, they aim to achieve their ambitious climate goals and pave the way for a greener future.

https://www.exaputra.com/2024/02/germanys-latest-renewable-energy.html

Renewable Energy

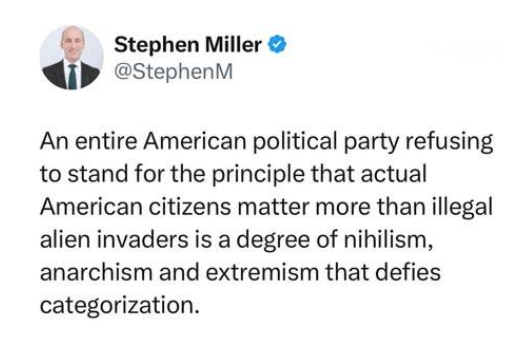

Do We Need More Fallacious Hate Speech?

Unfortunately, there are tens of millions of morons who believe hateful garage like this.

Unfortunately, there are tens of millions of morons who believe hateful garage like this.

The average 10-year-old can understand that we can BOTH protect our citizens while obeying the U.S. Constitution and international law when it comes to treating the undocumented legally and humanely.

Again, this is what is called the logical fallacy of the “false dichotomy.” Only idiots believe we have to choose one over the other.

Renewable Energy

A Reader Asks: Should Energy Companies be Held Liable for Climate Change?

I would say that the regulations on energy (and transportation) companies should be sufficient to put pressure on them to phase out fossil fuels and decarbonize in favor of renewables and nuclear.

I would say that the regulations on energy (and transportation) companies should be sufficient to put pressure on them to phase out fossil fuels and decarbonize in favor of renewables and nuclear.

A Reader Asks: Should Energy Companies be Held Liable for Climate Change?

Renewable Energy

In the U.S., We Live Among Experts

One might think that being surrounded by experts would be eutopia, but it’s not everything it’s cracked up to be.

One might think that being surrounded by experts would be eutopia, but it’s not everything it’s cracked up to be.

At left is an expression of what life in the United States has become over the last decade, which differs greatly from the experiences of those in the rest of the world.

Trump supporters have, at various times, been experts in macroeconomics, epidemiology, and above all, climate science.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits