China’s power sector is both the world’s largest emitter and the largest source of clean-energy growth, making it essential to global climate efforts.

This means it will be a key part of China’s next nationally determined contribution (NDC) – its climate pledge under the Paris Agreement for 2035 – which all countries are expected to publish by this year.

Yet, at the same time, Chinese policymakers are grappling with perceived tensions between ensuring a reliable energy supply amid uncertain demand growth and future cost trajectories, which have the potential to weigh down climate ambition.

In our new study, co-authored with experts from Tsinghua University and published in Cell Reports Sustainability, we model pathways for China’s power system up to 2035 that are consistent with its wider climate goals, incorporating a wide range of scenarios and uncertainties currently being debated in the country.

We find that China would need to deploy 2,350-2,780 gigawatts (GW) of wind and solar by 2030 and 2,910-3,800GW by 2035 – roughly double current levels – to be consistent with a target of limiting the rise in global temperatures to 2C this century.

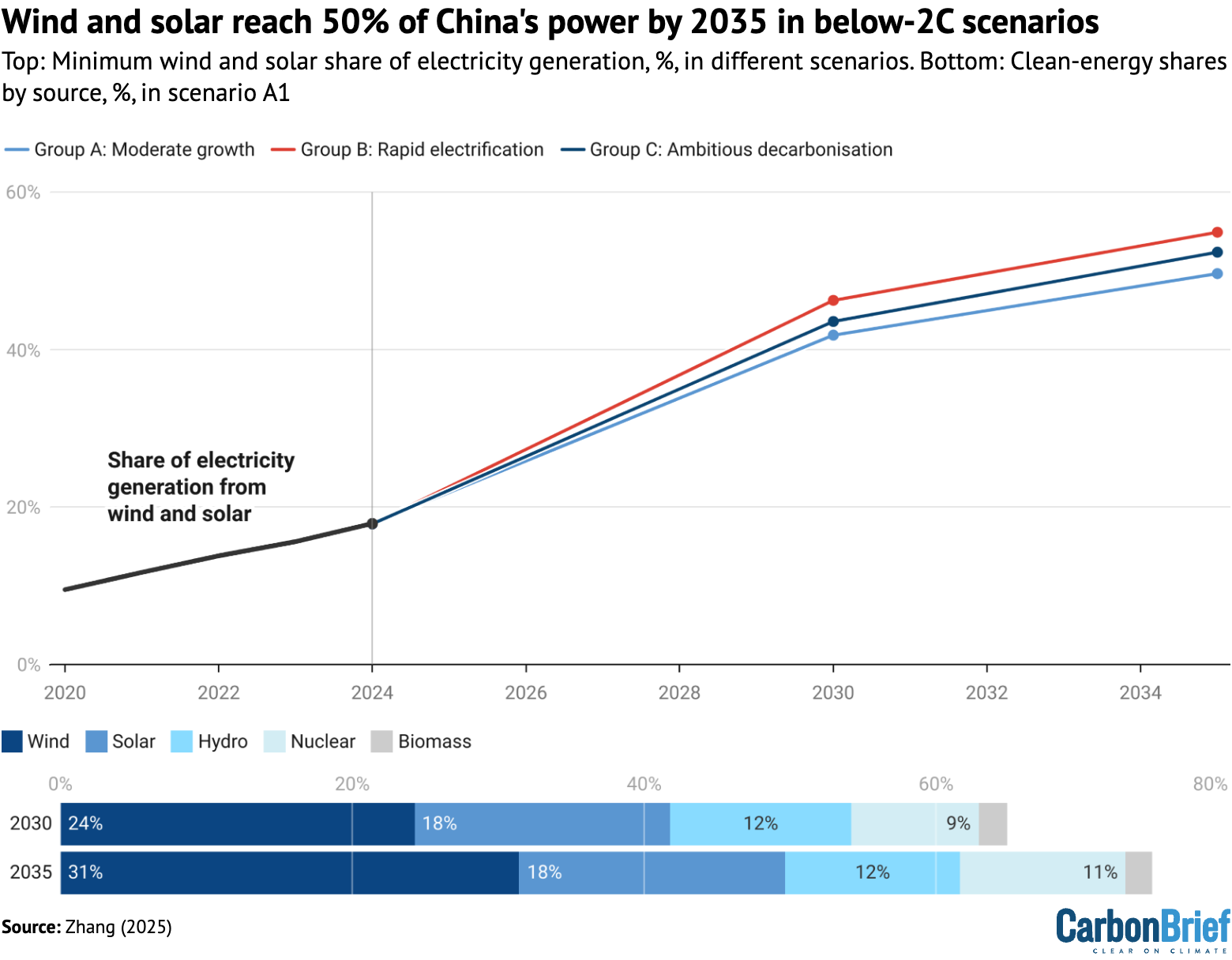

Furthermore, ensuring that the share of wind and solar generation reaches around 40% by 2030 and 50% by 2035 would set the power sector up for the longer-term transition to carbon neutrality by 2060.

Electricity generation from non-fossil fuels more broadly would reach around 50% by 2030 and more than 70% by 2035.

China’s climate ambitions

China’s “dual-carbon” goals, announced in 2020, aim to peak carbon emissions by 2030 and reach carbon neutrality by 2060. The country has already surpassed its 2030 renewable deployment target – 1,200GW of wind and solar – six years ahead of schedule, due to record-breaking annual additions of around 300GW of new capacity for two years in a row.

However, new coal-power developments and rapid growth in electricity demand pose a threat to meeting China’s other targets, such as emissions intensity and share of non-fossil fuel in the energy mix.

China began building nearly 95GW of new coal capacity in 2024, representing 93% of the world’s new coal capacity under construction.

If completed, China’s coal fleet – already the largest in the world – would expand to an installed capacity of 1,190GW.

This resurgence stems in large part from concerns surrounding energy security. China faced unprecedented power shortages in 2021 and 2022, while annual electricity demand has recently reached 10 petawatt-hours (PWh, or 10,000 terawatt hours) – a level that most studies predicted would not be reached until 2030.

This keeps the door open to continued growth in China’s electricity generation and emissions from coal, unless the expansion of clean energy is able to keep pace.

Setting the renewable energy pace

Our research looks at the rate of growth from clean energy that would be required to not only meet China’s rapidly rising demand for electricity, but also to push down its coal generation and squeeze emissions from the power sector.

We simulate a range of system “baselines” for 2030 and “scenarios” for 2035, under varying assumptions about electricity demand growth, carbon emissions limits, renewable energy costs and meteorological conditions.

The model includes detailed representations of where renewable energy capacity could be built and how the power sector could be operated efficiently.

It evaluates wind and solar resources and deployment potential at a level that is detailed enough to help capture regional differences and localised impacts, such as land use, socio-economic benefits and infrastructure needs.

The results are organised into 15 scenarios, categorised into three main groups: moderate growth in electricity demand (group A); rapid electrification (group B); and ambitious decarbonisation (group C).

The modelling is based around two different scenarios for China that are compatible with a global limit of 2C warming this century.

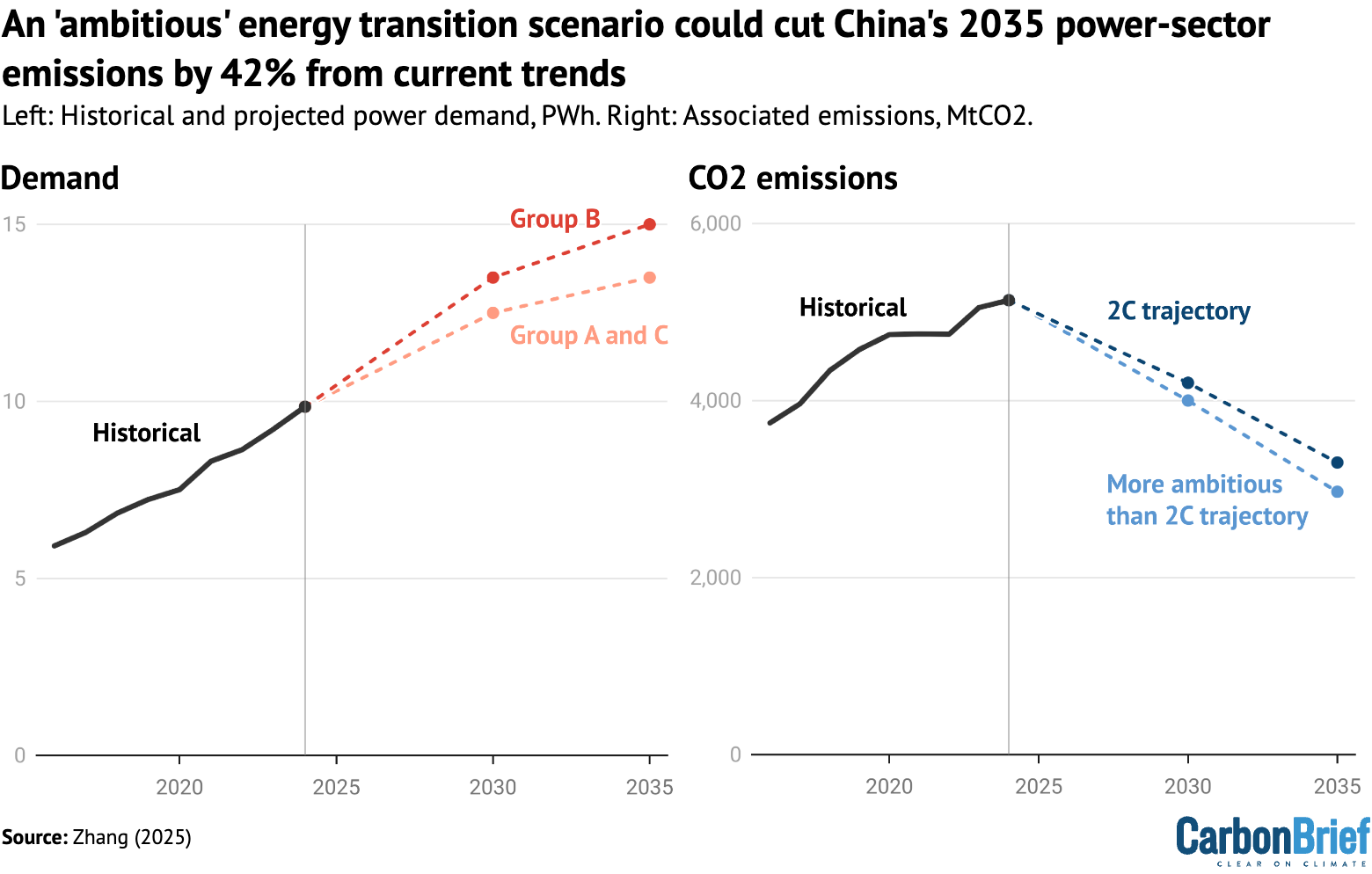

The basic 2C trajectory would see China’s power-sector emissions fall to 36% below 2024 levels by 2035, whereas the more ambitious 2C trajectory has a 42% decline.

The chart below shows recent electricity demand (left) and the carbon dioxide (CO2) emissions of China’s power sector (right), as well as how these might evolve under the different scenarios modelled for the paper.

The modelling accounts for recent trends suggesting that China’s electricity demand could reach 13.5PWh by 2035 (groups A and C). However, accommodating faster demand growth under a rapid electrification scenario (group B) would require China to deploy low-carbon energy even more rapidly, if it is to maintain pace with climate targets.

The modelling shows that wind and solar energy would need to supply around 40% of China’s electricity by 2030, if the country aims to remain on track for 2C of global warming. Solar and wind power generation would need to then rise to 50% by 2035 – up from 17.9% in 2024.

This growth would substantially reduce the system’s reliance on coal and other fossil fuels, which would decrease to 35% of generation in 2030 and 25% in 2035.

The more ambitious scenario, which targets limiting global warming since the pre-industrial period to between 1.5C and 2C, would lead to even higher wind and solar generation shares of 44% by 2030 and 54% by 2035.

Under the different scenarios, China’s wind and solar capacity would rise from around 1,700GW today to 2,350-2,780GW by 2030 and 2,910-3,800GW by 2035. Meeting this level of renewable deployment would require annual additions of 120-220GW.

Recent wind and solar additions have already exceeded this pace, but challenges with grid integration and supporting infrastructure could, nevertheless, slow future large-scale buildouts.

According to industry reports, 6.8% of wind and 6.1% of solar power generation were “curtailed” in the first four months of 2025, meaning the output could not be accommodated by the electricity grid and was wasted.

At the provincial level, wind and solar curtailment rates exceeded 10% in renewable-rich regions, such as Xinjiang, Gansu and Qinghai. To achieve the cost-efficient pathways modeled here, curtailment rates fall to 3-6%.

To achieve this level of integration, energy storage and transmission infrastructure will be necessary to shift renewable generation towards when and where it is needed.

Battery and grid capacity would need to rise by 6% and 5% per year from current levels out to 2035, respectively, in order to better integrate renewables into the grid.

Boosting wind and solar generation share

In order to explore the implications of uncertainty on China’s power system in 2030, the modelling includes three core scenarios (groups A-C).

Within these core groups, the modelling looks at the impact of further uncertainties on system outcomes by 2035, labelled A1, A2 and so on. This results in a “decision-tree” structure that outlines a range of possible futures.

The lines on the chart below show the share of China’s electricity that would be generated by wind and solar by 2030 and 2035, under each of these different futures. The coloured columns show the share of electricity generated by wind (red), solar (yellow), hydro (blue), nuclear (pink) and biomass (grey) in one specific scenario, namely, the “reference” case for renewable costs with moderate demand growth (A1).

The bands in the right-hand margin indicate the ranges of the 2035 results under all of the future scenarios, depending on variables such as the cost of renewables or batteries (cases two to four) and a larger rise in demand (case five).

At a minimum, for each of the 2C-compatible scenarios, wind and solar would take up around 50% of total generation by 2035.

Another consistent result across all scenarios is the need for more transmission capacity to shift generation from renewable-rich regions to those with high demand for power. By 2030, at least 225GW of new inter-provincial transmission capacity would be required, further enhancing electricity trading and grid reliability.

China is already expanding its “ultra-high-voltage” (UHV) transmission network at breakneck speed. As of the end of 2024, there were 42 UHV projects in operation, with a combined capacity exceeding 300GW.

Another assumption in the modelling is that electricity can flow freely and efficiently across regions, up to the transmission capacity limits. But, in reality, institutional and regulatory barriers complicate regional electricity trading.

China plans to establish a national unified power market by 2029. As such, deregulating the power sector is seen as an essential measure to enhance the power system’s operational efficiency and facilitate renewable energy integration.

Looking ahead to the NDC and beyond

Many experts have weighed in on China’s NDC target-setting, largely focusing on economy-wide emissions targets and non-CO2 greenhouse gases.

While these are indeed important elements of China’s next international climate pledge, our study seeks to identify robust power-sector targets that could support the country’s overall ambition and provide credible signals to energy planners.

Due to the rapidly evolving economic and geopolitical situation, there are good reasons to expect that China’s topline emissions number may be underwhelming.

On the other hand, there is an opportunity to emphasise and expand ambition within the power sector through additional sectoral targets. This would put a focus on quantifiable metrics that can guide investments and planning by state-owned enterprises and local governments.

While China has previously set a target for the absolute capacity of wind and solar, a goal for the share of electricity generation from these technologies, or for clean energy more broadly, would set a narrower range for future emissions from the power sector.

Given current uncertainties around the pace of power demand growth, for example, a target for clean energy share might provide greater confidence to policymakers than a capacity target alone.

Regardless of what targets are set, achieving the growth of clean energy modelled in our study would support China’s long-term climate commitments and demonstrate the nation’s intent to be a clean-energy powerhouse.

The post Guest post: What an ‘ambitious’ 2035 electricity target looks like for China appeared first on Carbon Brief.

Guest post: What an ‘ambitious’ 2035 electricity target looks like for China

Climate Change

A Tiny Caribbean Island Sued the Netherlands Over Climate Change, and Won

The case shows that climate change is a fundamental human rights violation—and the victory of Bonaire, a Dutch territory, could open the door for similar lawsuits globally.

From our collaborating partner Living on Earth, public radio’s environmental news magazine, an interview by Paloma Beltran with Greenpeace Netherlands campaigner Eefje de Kroon.

A Tiny Caribbean Island Sued the Netherlands Over Climate Change, and Won

Climate Change

Greenpeace organisations to appeal USD $345 million court judgment in Energy Transfer’s intimidation lawsuit

SYDNEY, Saturday 28 February 2026 — Greenpeace International and Greenpeace organisations in the US announce they will seek a new trial and, if necessary, appeal the decision with the North Dakota Supreme Court following a North Dakota District Court judgment today awarding Energy Transfer (ET) USD $345 million.

ET’s SLAPP suit remains a blatant attempt to silence free speech, erase Indigenous leadership of the Standing Rock movement, and punish solidarity with peaceful resistance to the Dakota Access Pipeline. Greenpeace International will also continue to seek damages for ET’s bullying lawsuits under EU anti-SLAPP legislation in the Netherlands.

Mads Christensen, Greenpeace International Executive Director said: “Energy Transfer’s attempts to silence us are failing. Greenpeace International will continue to resist intimidation tactics. We will not be silenced. We will only get louder, joining our voices to those of our allies all around the world against the corporate polluters and billionaire oligarchs who prioritise profits over people and the planet.

“With hard-won freedoms under threat and the climate crisis accelerating, the stakes of this legal fight couldn’t be higher. Through appeals in the US and Greenpeace International’s groundbreaking anti-SLAPP case in the Netherlands, we are exploring every option to hold Energy Transfer accountable for multiple abusive lawsuits and show all power-hungry bullies that their attacks will only result in a stronger people-powered movement.”

The Court’s final judgment today rejects some of the jury verdict delivered in March 2025, but still awards hundreds of millions of dollars to ET without a sound basis in law. The Greenpeace defendants will continue to press their arguments that the US Constitution does not allow liability here, that ET did not present evidence to support its claims, that the Court admitted inflammatory and irrelevant evidence at trial and excluded other evidence supporting the defense, and that the jury pool in Mandan could not be impartial.[1][2]

ET’s back-to-back lawsuits against Greenpeace International and the US organisations Greenpeace USA (Greenpeace Inc.) and Greenpeace Fund are clear-cut examples of SLAPPs — lawsuits attempting to bury nonprofits and activists in legal fees, push them towards bankruptcy and ultimately silence dissent.[3] Greenpeace International, which is based in the Netherlands, is pursuing justice in Europe, with a suit against ET under Dutch law and the European Union’s new anti-SLAPP directive, a landmark test of the new legislation which could help set a powerful precedent against corporate bullying.[4]

Kate Smolski, Program Director at Greenpeace Australia Pacific, said: “This is part of a worrying trend globally: fossil fuel corporations are increasingly using litigation to attack and silence ordinary people and groups using the law to challenge their polluting operations — and we’re not immune to these tactics here in Australia.

“Rulings like this have a chilling effect on democracy and public interest litigation — we must unite against these silencing tactics as bad for Australians and bad for our democracy. Our movement is stronger than any corporate bully, and grows even stronger when under attack.”

Energy Transfer’s SLAPPs are part of a wave of abusive lawsuits filed by Big Oil companies like Shell, Total, and ENI against Greenpeace entities in recent years.[3] A couple of these cases have been successfully stopped in their tracks. This includes Greenpeace France successfully defeating TotalEnergies’ SLAPP on 28 March 2024, and Greenpeace UK and Greenpeace International forcing Shell to back down from its SLAPP on 10 December 2024.

-ENDS-

Images available in Greenpeace Media Library

Notes:

[1] The judgment entered by North Dakota District Court Judge Gion follows a jury verdict finding Greenpeace entities liable for more than US$660 million on March 19, 2025. Judge Gion subsequently threw out several items from the jury’s verdict, reducing the total damages to approximately US$345 million.

[2] Public statements from the independent Trial Monitoring Committee

[3] Energy Transfer’s first lawsuit was filed in federal court in 2017 under the RICO Act – the Racketeer Influenced and Corrupt Organizations Act, a US federal statute designed to prosecute mob activity. The case was dismissed in 2019, with the judge stating the evidence fell “far short” of what was needed to establish a RICO enterprise. The federal court did not decide on Energy Transfer’s claims based on state law, so Energy Transfer promptly filed a new case in a North Dakota state court with these and other state law claims.

[4] Greenpeace International sent a Notice of Liability to Energy Transfer on 23 July 2024, informing the pipeline giant of Greenpeace International’s intention to bring an anti-SLAPP lawsuit against the company in a Dutch Court. After Energy Transfer declined to accept liability on multiple occasions (September 2024, December 2024), Greenpeace International initiated the first test of the European Union’s anti-SLAPP Directive on 11 February 2025 by filing a lawsuit in Dutch court against Energy Transfer. The case was officially registered in the docket of the Court of Amsterdam on 2 July, 2025. Greenpeace International seeks to recover all damages and costs it has suffered as a result of Energy Transfers’s back-to-back, abusive lawsuits demanding hundreds of millions of dollars from Greenpeace International and the Greenpeace organisations in the US. The next hearing in the Court of Amsterdam is scheduled for 16 April, 2026.

Media contact:

Kate O’Callaghan on 0406 231 892 or kate.ocallaghan@greenpeace.org

Climate Change

Former EPA Staff Detail Expanding Pollution Risks Under Trump

The Trump administration’s relentless rollback of public health and environmental protections has allowed widespread toxic exposures to flourish, warn experts who helped implement safeguards now under assault.

In a new report that outlines a dozen high-risk pollutants given new life thanks to weakened, delayed or rescinded regulations, the Environmental Protection Network, a nonprofit, nonpartisan group of hundreds of former Environmental Protection Agency staff, warns that the EPA under President Donald Trump has abandoned the agency’s core mission of protecting people and the environment from preventable toxic exposures.

Former EPA Staff Detail Expanding Pollution Risks Under Trump

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits