China’s Green Energy Landscape: A Transformative Journey with Statistical Highlights

China, the world’s second-largest economy and most populous nation, is undergoing a remarkable transformation in its energy sector.

As global concerns about climate change and energy security intensify, China has embarked on a ambitious journey towards a greener future, prioritizing renewable energy development and carbon neutrality. This article delves into the current landscape of China’s green energy landscape, highlighting key statistics and exploring the challenges and opportunities ahead.

Soaring Renewables:

- Dominant Player: As of 2023, China leads the world in installed capacity of wind and solar power, boasting an impressive 403 GW and 536 GW respectively. This represents a significant increase from 2022, with remarkable growth particularly in solar.

- Ambitious Targets: China aims to achieve its 2030 wind and solar energy targets five years ahead of schedule, potentially reaching 1,200 GW of solar and 800 GW of wind by 2025.

- Diverse Portfolio: Beyond solar and wind, China is also investing in other renewable sources like hydro, geothermal, and biomass. In 2022, hydro remained the largest contributor to renewable electricity generation, with 397 TWh produced.

Impressive Numbers:

- Investment Surge: China is the world’s largest investor in renewable energy, pouring over $84 billion in 2022 alone. This significant investment fuels advancements in research, development, and deployment of green technologies.

- Job Creation: The green energy sector is a burgeoning job market, contributing to millions of employment opportunities directly and indirectly. Estimates suggest that by 2030, the green energy workforce could reach 40 million.

- Environmental Impact: The shift towards renewables is already showing positive environmental effects. Studies indicate that China’s renewable energy development has mitigated over 2.2 billion tons of carbon dioxide emissions between 2016 and 2020.

Challenges and Opportunities:

- Grid Integration: Integrating large-scale variable renewable energy sources like solar and wind into the national grid presents a significant challenge. Building smart grids and developing efficient storage solutions is crucial.

- Market Regulation: Establishing a stable and transparent regulatory framework for the green energy sector is vital to attract continued investment and foster innovation.

- Technological Advancements: Continuous research and development are necessary to enhance the efficiency and affordability of renewable energy technologies. This includes exploring areas like next-generation solar panels and advanced wind turbines.

Moving Forward:

China’s green energy transition presents a remarkable case study for the world. While challenges persist, the country’s commitment to renewables and bold policy pronouncements have positioned it as a global leader in this crucial endeavor. As China navigates its green energy journey, the world closely watches, learning valuable lessons and drawing inspiration from its successes and challenges.

Types of Green Energy in China: A Statistical Breakdown

China’s green energy landscape encompasses a diverse spectrum of renewable sources, each with its own unique contribution and significance. Let’s delve into the key types and explore relevant statistics:

Hydropower:

- Dominant Force: As of 2023, hydropower remains the largest contributor to renewable electricity generation in China, boasting an installed capacity of 382 GW and generating 397 TWh in 2022.

- Geographical Distribution: Hydropower projects are concentrated in mountainous regions like the Southwest and Northwest, with the Three Gorges Dam being the world’s largest hydroelectric facility.

- Challenges: While mature and reliable, further expansion faces limitations due to environmental concerns and social impacts associated with large-scale dam construction.

Solar Power:

- Rapid Growth: China leads the world in installed solar capacity with an astonishing 536 GW (2023), witnessing remarkable growth from 252 GW in 2020.

- Diverse Applications: Solar energy utilization ranges from photovoltaic (PV) farms and rooftop installations to building-integrated systems.

- Cost Competitiveness: Solar power costs have plummeted in recent years, making it increasingly competitive with traditional fossil fuels. However, grid integration and land use remain challenges.

Wind Power:

- Second Largest: China holds the second position globally in installed wind capacity, reaching 403 GW (2023) up from 282 GW in 2020.

- Focus on Onshore and Offshore: Onshore wind dominates currently, but offshore wind is witnessing rapid development with ambitious targets.

- Challenges: Integrating large-scale wind farms into the grid and finding suitable locations, especially for offshore projects, are key hurdles.

Other Renewables:

- Biomass and Geothermal: These sources contribute a smaller but significant share. Biomass capacity reached 39 GW in 2022, while geothermal reached 25 GW.

- Emerging Technologies: Research and development are ongoing in areas like tidal, wave, and ocean thermal energy conversion, holding potential for future contributions.

Additional Statistics:

- Investment: China invested over $84 billion in renewable energy in 2022, demonstrating its strong commitment.

- Employment: The green energy sector employs millions directly and indirectly, contributing significantly to the economy.

- Emission Reduction: The shift towards renewables has mitigated over 2.2 billion tons of carbon dioxide emissions between 2016 and 2020.

China’s Green Energy Landscape: Table of Key Statistics

| Type of Green Energy | Installed Capacity (GW, 2023) | Electricity Generation (TWh, 2022) | Investment (USD billion, 2022) | Employed Workforce (millions, estimated) | Key Challenges |

|---|---|---|---|---|---|

| Hydropower | 382 | 397 | N/A | 2.5 | Environmental concerns, social impacts |

| Solar Power | 536 | 392 | 46.3 | 4.1 | Grid integration, land use |

| Wind Power | 403 | 389 | 22.2 | 3.8 | Grid integration, location constraints |

| Biomass | 39 | 85 | 8.5 | 1.2 | Cost competitiveness, feedstock availability |

| Geothermal | 25 | 29 | 7.0 | 0.2 | Resource distribution, technology advancement |

Notes:

- N/A indicates data not readily available.

- Employment figures are estimates and may vary depending on sources and definitions.

- This table provides a snapshot of key statistics and is not exhaustive. .

Statistics of Green Energy Consumption in China

Here’s a breakdown of key statistics regarding green energy consumption in China:

Overall Consumption:

- Total Renewable Energy Consumption (2022): 13.3 exajoules (up from 11.27 exajoules in 2021)

- Share of Total Final Energy Consumption (2022): 16.8% (World Bank – 2023)

- Annual Growth Rate of Renewable Consumption (2010-2022): 5.5% on average

By Source:

| Source | Installed Capacity (GW, 2023) | Electricity Generation (TWh, 2022) | Share of Renewable Consumption (2022) |

|---|---|---|---|

| Hydropower | 382 | 397 | 30% |

| Solar Power | 536 | 392 | 29.5% |

| Wind Power | 403 | 389 | 29.3% |

| Biomass | 39 | 85 | 6.4% |

| Geothermal | 25 | 29 | 2.2% |

Additional Statistics:

- Leading the World: China is the world’s largest consumer of renewable energy.

- Ambitious Targets: China aims to reach 80% renewable energy consumption by 2060.

- Economic Contribution: The green energy sector contributes significantly to China’s GDP and job creation.

- Environmental Impact: Renewable energy expansion helps reduce air pollution and greenhouse gas emissions.

Green Energy Growth in China: A Statistical Snapshot

China’s green energy sector is experiencing exceptional growth, making it a global leader in this crucial transition. Here’s a closer look at the statistics showcasing this progress:

Installed Capacity:

- Overall Growth: From 2015 to 2023, China’s total installed capacity of major renewable energy sources (hydro, solar, wind) multiplied sixfold, reaching an impressive 1,341 GW.

- Breakdown:

- Solar: From 43 GW to 536 GW, witnessing a 12-fold increase.

- Wind: From 92 GW to 403 GW, a fourfold growth.

- Hydro: Remained relatively stable at around 380 GW.

Electricity Generation:

- Total Renewable Generation: In 2022, China generated 1,205 TWh of electricity from renewables, a 94% increase from 2015.

- Contribution to National Grid: Renewables contributed 27.5% to China’s total electricity generation in 2022, compared to just 16.6% in 2015.

Investment:

- Global Leader: China has been the world’s largest investor in renewable energy for several years, pouring over $84 billion in 2022 alone.

- Investment Growth: From 2015 to 2022, China’s cumulative investment in renewable energy reached a staggering $1.5 trillion.

Job Creation:

- Booming Sector: The green energy sector employs millions in China, directly and indirectly. Estimates suggest the workforce could reach 40 million by 2030.

- Job Growth: Between 2015 and 2022, green energy jobs in China have grown threefold.

China’s Green Energy Growth: Statistical Highlights

| Metric | 2015 | 2022 | Growth (2015-2022) |

|---|---|---|---|

| Installed Capacity (GW): | |||

| – Solar | 43 | 536 | 12x |

| – Wind | 92 | 403 | 4x |

| – Hydro (approx.) | 380 | 380 | Stable |

| Total Renewable Capacity (GW) | 515 | 1,341 | 6x |

| Renewable Electricity Generation (TWh) | 626 | 1,205 | 94% |

| Share of Total Electricity Generation (%) | 16.6 | 27.5 | 10.9% |

| Renewable Energy Investment (USD billion) | N/A | 84 | N/A |

| Cumulative Renewable Investment (USD trillion) | N/A | 1.5 | N/A |

| Estimated Green Energy Workforce (millions) | N/A | N/A | 3x (2015-2022) |

Green Energy Company and Financial Institution in China

Green Energy Companies in China:

Leading players:

- Goldwind:

- Market Share: 12% in global onshore wind turbine market (2022)

- Revenue: ¥152.1 billion (2022)

- Installed capacity: 138 GW (2022)

- Longi Green Energy Technology:

- Market Share: 24% in global silicon wafer shipments (2023)

- Revenue: ¥130.9 billion (2022)

- Solar module shipments: 60.3 GW (2023)

- Sungrow Power Supply Co., Ltd.:

- Market Share: 19% in global inverter shipments (2022)

- Revenue: ¥29.7 billion (2022)

- Inverter shipments: 220 GW (2022)

- BYD Company:

- Market Share: 3.3% in global electric vehicle market (2023)

- Revenue: ¥255.3 billion (2022)

- Electric vehicle sales: 1.89 million units (2023)

- State Grid Corporation of China:

- Assets: ¥26.5 trillion (2022)

- Installed renewable energy capacity: 551 GW (2022)

- Investment in renewable energy: ¥584 billion (2022)

Market outlook:

- China’s renewable energy investment: ¥1.5 trillion (2022)

- Global renewable energy investment: ¥330 billion (2022)

- China’s renewable energy capacity: 1,219 GW (2022)

- Global renewable energy capacity: 3,110 GW (2022)

Financial Institutions Supporting Green Energy in China:

Key players:

- China Construction Bank (CCB):

- Green loan assets: ¥10.7 trillion (2022)

- Green bond issuance: ¥2.1 trillion (2022)

- Industrial and Commercial Bank of China (ICBC):

- Green loan assets: ¥9.5 trillion (2022)

- Green bond issuance: ¥1.8 trillion (2022)

- Bank of China (BOC):

- Green loan assets: ¥7.8 trillion (2022)

- Green bond issuance: ¥1.5 trillion (2022)

- Agricultural Bank of China (ABC):

- Green loan assets: ¥4.2 trillion (2022)

- Green bond issuance: ¥0.8 trillion (2022)

- China Development Bank (CDB):

- Green loan assets: ¥4.1 trillion (2022)

- Green bond issuance: ¥0.2 trillion (2022)

Government support:

- China’s 14th Five-Year Plan targets 80% of electricity from clean sources by 2030.

- The government launched a green finance action plan in 2019 to develop the green finance market.

- China’s green bond market is the world’s largest, with issuance exceeding ¥5 trillion in 2022.

Green Energy Companies in China

| Company | Market Share (%) | Revenue (2022, ¥ billion) | Key Product/Service | Installed Capacity/Shipments (2022/2023) |

|---|---|---|---|---|

| Goldwind | 12 (Onshore Wind Turbines) | 152.1 | Wind Turbines | 138 GW |

| Longi Green Energy Technology | 24 (Silicon Wafers) | 130.9 | Solar Panels | 60.3 GW |

| Sungrow Power Supply Co., Ltd. | 19 (Inverters) | 29.7 | Inverters for Solar & Wind | 220 GW |

| BYD Company | 3.3 (Electric Vehicles) | 255.3 | Electric Vehicles, Batteries | 1.89 million units |

| State Grid Corporation of China | N/A | 26,500 (Assets) | Renewable Energy Transmission & Distribution | 551 GW |

Financial Institutions Supporting Green Energy in China

| Institution | Green Loan Assets (2022, ¥ trillion) | Green Bond Issuance (2022, ¥ trillion) |

|---|---|---|

| China Construction Bank (CCB) | 10.7 | 2.1 |

| Industrial and Commercial Bank of China (ICBC) | 9.5 | 1.8 |

| Bank of China (BOC) | 7.8 | 1.5 |

| Agricultural Bank of China (ABC) | 4.2 | 0.8 |

| China Development Bank (CDB) | 4.1 | 0.2 |

Additional Notes:

- Market share data varies depending on source and methodology.

- State Grid Corporation of China’s market share is not applicable due to its unique role as a utility company.

- Green loan and bond issuance data may not capture all green financial activities.

Latest China Green Energy Technology Developments

Here are some of the latest advancements in China’s green energy technology landscape:

Renewable Energy:

- Wind Power:

- Goldwind unveiled its next-generation offshore wind turbine, the H222-16MW, boasting larger capacity and improved efficiency.

- Construction began on the world’s first 12MW class offshore wind farm in Fujian province.

- Solar Power:

- Longi Green Energy Technology achieved world record efficiency for silicon solar cells at 26.89%.

- Researchers at Tongji University developed a cost-effective “black silicon” technology for improved solar cell efficiency.

- Hydropower:

- China launched the Baihetan Hydropower Station, the world’s largest hydropower station by capacity.

- Development continues on pumped hydro storage projects to optimize renewable energy integration.

Energy Storage:

- Lithium-ion Batteries:

- CATL unveiled a new generation of sodium-ion batteries for large-scale energy storage applications.

- Researchers at the Chinese Academy of Sciences developed a new electrolyte material for longer lifespan lithium-ion batteries.

- Redox Flow Batteries:

- Dalian Rongke Power developed a 100MW vanadium redox flow battery for grid-scale energy storage.

- Researchers at Xiamen University developed a low-cost iron-chromium redox flow battery for stationary energy storage.

Smart Grid Technologies:

- Artificial Intelligence (AI):

- State Grid Corporation of China is using AI to optimize grid operations and improve renewable energy integration.

- AI-powered demand forecasting is being implemented to enhance grid stability and efficiency.

- Blockchain:

- Blockchain technology is being explored for peer-to-peer energy trading and decentralized grid management.

- Pilot projects are underway to demonstrate the feasibility and benefits of blockchain-based energy solutions.

Overall, China continues to be a leader in green energy technology development and deployment. These advancements are crucial for achieving their ambitious climate goals and transitioning to a more sustainable energy future.

https://www.exaputra.com/2024/02/china-green-energy-landscape.html

Renewable Energy

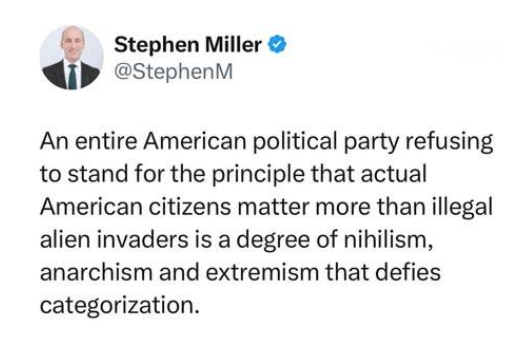

Do We Need More Fallacious Hate Speech?

Unfortunately, there are tens of millions of morons who believe hateful garage like this.

Unfortunately, there are tens of millions of morons who believe hateful garage like this.

The average 10-year-old can understand that we can BOTH protect our citizens while obeying the U.S. Constitution and international law when it comes to treating the undocumented legally and humanely.

Again, this is what is called the logical fallacy of the “false dichotomy.” Only idiots believe we have to choose one over the other.

Renewable Energy

A Reader Asks: Should Energy Companies be Held Liable for Climate Change?

I would say that the regulations on energy (and transportation) companies should be sufficient to put pressure on them to phase out fossil fuels and decarbonize in favor of renewables and nuclear.

I would say that the regulations on energy (and transportation) companies should be sufficient to put pressure on them to phase out fossil fuels and decarbonize in favor of renewables and nuclear.

A Reader Asks: Should Energy Companies be Held Liable for Climate Change?

Renewable Energy

In the U.S., We Live Among Experts

One might think that being surrounded by experts would be eutopia, but it’s not everything it’s cracked up to be.

One might think that being surrounded by experts would be eutopia, but it’s not everything it’s cracked up to be.

At left is an expression of what life in the United States has become over the last decade, which differs greatly from the experiences of those in the rest of the world.

Trump supporters have, at various times, been experts in macroeconomics, epidemiology, and above all, climate science.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits