Weather Guard Lightning Tech

Masdar Acquires Terna, Nissens Moves Production Out of EU, JSW Steel Upgrades Texas Facility

Masdar acquires Greece’s Terna Energy for 2.4 billion euros, eyeing further European renewable energy investments. Nissens Cooling Solutions relocates production from Europe to Eastern Europe and China due to economic pressures, highlighting EU industry challenges. JSW Steel USA invests $110 million in Texas facilities to support U.S. offshore wind development, leveraging Inflation Reduction Act incentives.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Allen Hall: I’m Allen Hall, president of Weather Guard Lightning Tech, and I’m here with the founder and CEO of Intel store, Phil Totaro. And the chief commercial officer of Weather Guard, Joel Saxum. And this is your News Flash. News Flash is brought to you by our friends at IntelStor. If you want market intelligence that generates revenue, then book a demonstration of IntelStor at IntelStor. com.

Masdar has announced plans to acquire Greece’s Tera Energy. The deal, valued at 2. 4 billion euros, marks the largest energy transaction on the Athens Stock Exchange. Master will initially acquire 67 percent of Terna Energy shares with the intention to reach 100 percent ownership through a subsequent all cash tender offer.

This acquisition is expected to significantly boost Greece’s renewable energy capacity and contribute to the EU’s net zero carbon footprint. By 2050 target. All right, Phil. Masdar’s back at it again.

Philip Totaro: Well, and this starts off a campaign of theirs to invest in properties in Europe. Terna Energy’s got wind a little bit of solar, a little bit of hydro, and a little bit of biomass. It’s about 1. 2 gigawatts worth of wind at this point, but a six gigawatt renewables portfolio that they actually want to install. So this is going to provide them with, the capital that they need to be able to pursue that. But Mazda looks like they’re not done. They’ve come out in the financial times and publicly stated that they’re looking for other investment vehicles in Europe.

And it sounds like there are some in. Germany and possibly Finland, Sweden maybe Holland as well, that, that they could they could gobble up here as, as they look to expand.

Allen Hall: Danish wind supplier Nissens Cooling Solutions has decided to move all its production abroad to reduce costs. The company, which produces cooling solutions for a major European wind turbine manufacturers, will relocate its production to existing facilities in Slovakia.

the Czech Republic and China throughout 2024. The decision comes in response to difficult market conditions, including geopolitical tensions affecting order timing and supply chains, as well as fluctuating material and energy costs. Phil, inflation is a big deal in Europe still, it is still causing major upset in the supply chain.

We’ve seen a couple of other companies move out of essentially Europe into Eastern Europe and into China because of similar issues. This is just continuing for months now. Is Nissens still on the leading edge of this movement, or are there more to come behind them?

Philip Totaro: It’s entirely possible there’s more to come, because, as you mentioned, inflation is part of it.

It’s really the lack of support that the industry’s been given by The EU government and then the individual countries themselves, Denmark can’t, step in and save every single company just like we see with Spain not being able to step in really and do anything for Siemens Gamesa either.

So this is a trend that is likely to continue happening as companies look to reduce their overhead and labor costs. That’s really the only reason you move to Eastern Europe and China especially. And it’s, it’s a pity because the, this has been talked about as an issue for a long time. And it feels like rather than addressing the substantive issue, the European Commission is trying to focus on these things in their, their, EU Green Deal that don’t have anything to do with addressing the, the financial viability of their domestic companies.

It’s all about, let’s keep Chinese companies out of Europe. And, and that’s not going to really solve the problem for profitability for These companies like Nissens that are going to continue to facing profit challenges where they’ve got high operating costs under the EU umbrella.

Joel Saxum: This is an interesting one as well, because this is what the EU has been like what they put forth for the EU wind power package back in October of 2023.

Those two initiatives is the European wind power action plan and communication and achieving their, some of the EU’s wind ambitions. Transcribed One of the goals of this is to keep as much manufacturing and control of that manufacturing within the EU. And this week you actually see a lot of executives over in the EU traveling for wind Europe board meetings.

And in their board meetings, this is one of the topics that was coming up. This is what they’re trying to make sure that they’re. Making as most moves on as they can. Right on the tail end of another company, another supplier for the wind industry moving operations. To the eastern part of Europe and to China.

That’s not a good look.

Allen Hall: JSW Steel USA, a subsidiary of India’s JSW Steel, has announced an investment of 110 million to upgrade its manufacturing facilities in Baytown, Texas. The investment will focus on steel plate mill modernization projects, aiming to facilitate goals and expand offshore wind energy technology.

To 30 gigawatts by 2030. The investment aligns with buy America requirements and will produce steel for offshore wind towers, platforms, and hydrocarbon pipelines. Joel, this is in your neck of the woods, 110 million into a steel factory in Texas is a major deal.

Joel Saxum: Yeah, Baytown is one of those old school, has been for a long time, oil and gas, chemical, industrial towns, right?

It’s, Baytown is, if you’re coming up from the Gulf and you’re heading up towards Houston, past Galveston and the Straits there, Baytown is right on the water. So they have the cape of the, one of the reasons that it’s a great spot for heavy industrial is you can offload and onload things from heavy trucks and from ships right there.

Right. So they can have little port facilities. One of the things that’s going on, like the offshore wind, yes, you have tubular monopiles and transition pieces and stuff, but the biggest part Piece that goes in the water in a wind farm is the offshore substation. Offshore substation expertise, Texas.

You’re looking at the Gulf coast, right? So all this, all this steel plate, this milling machinery, everything can be, is going to bolster that ability to use the steel for offshore wind as mills, as well as other things. This same materials can be used in shipbuilding like the Eco Edison that just set sail is a couple of hundred miles down the coast from there.

The substation for South Fork was built in Texas as well. So, as this trend continues, you’ll see more. It’s a good move on JSW steel.

Philip Totaro: And keep in mind, this is exactly what the IRA bill particularly the manufacturing tax credits, was meant to inspire, is foreign companies who, this company being JSW, being from India, would face import duties on any steel or fabricated products that they brought into the U.

S. So, by increasing the domestic production in the United States, they’re going to be able to avail themselves of the 45 X manufacturing tax credits. And they’re going to have this domestic content bonus for the project developers who are going to be using these foundations and potentially again, towers, transition pieces, anything that they’re going to be capable of making at this facility.

The other thing that it does is it gives us the opportunity to start getting more large capacity. Fabrication equipment in the U. S. Investments like this are going to be able to help with getting, these bigger turbines fabricated and making us less dependent on Europe or China to import a lot of that technology.

So, this is, again, exactly what the IRA Bill was, was meant to inspire.

https://weatherguardwind.com/masdar-terna-nissens-europe-jsw-steel-texas/

Renewable Energy

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

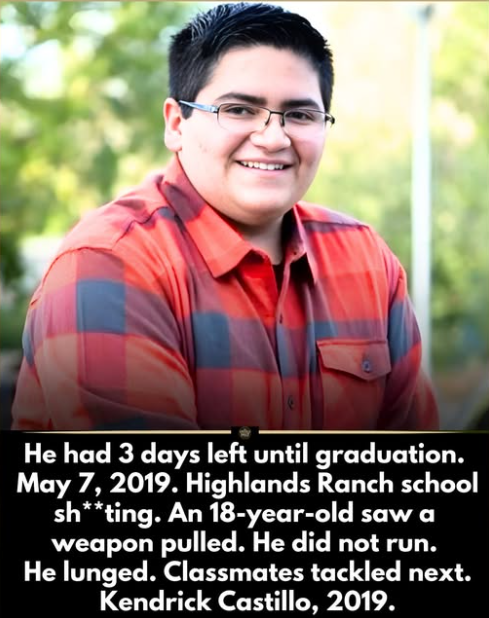

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

Renewable Energy

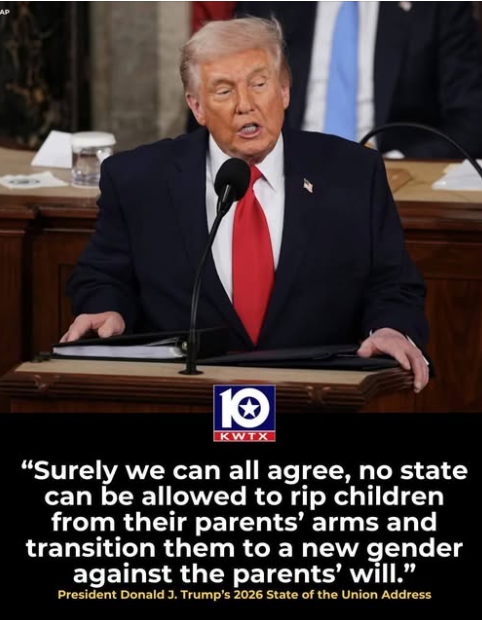

Forced Transgendering of America’s Little Kids

How often does this happen? How about never?

How often does this happen? How about never?

Trump loves to say that little boys go to school and come back home little girls.

He’s the most powerful person in the world for exactly one reason: We’re a nation of morons.

Renewable Energy

Illegal Aliens and U.S. Veterans

Two comments:

Two comments:

That the United States has homeless veterans is a national (and international) disgrace.

By definition, no one has the legal right to enter the U.S. illegally, but according to our constitution, everyone in America is entitled to due process.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits