Welcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

Tariffs and trade restrictions

US BAN: China has placed an export ban on shipments to the US of gallium, germanium and antimony, plus further restricted exports of certain types of graphite to the country, in a “rapid retaliation by Beijing against new export controls from Washington”, the Financial Times said. It added that “the immediate impact of the measures was unclear, given that the US had been diversifying its supply chains”. Analysis by Carbon Brief found that previous country-agnostic export controls on the minerals, all of which are used in low-carbon technologies, had a limited impact on supply chains, with Chinese exports either resuming after a short dip or remaining stable. Analysis by consultancy Trivium China stated that one of China’s motives with the ban could be to “warn the incoming Trump administration” against “ramping up economic and trade pressure”.

SOLAR TARIFFS: Meanwhile, the US has also imposed a “new round of tariffs on solar panel imports” from Malaysia, Cambodia, Vietnam and Thailand, following accusations by a US industry lobby of Chinese-owned factories in the four nations “dumping products into the [global] market”, Reuters reported. In response, China’s commerce ministry expressed its “concern over the US’ intention to politicise and weaponise trade investigations”, the state-run newspaper China Daily said. It cited a commerce ministry spokesperson saying that Chinese solar companies in southeast Asia have made “positive contributions to the local economic and social development”. Another Reuters article noted that Malaysia has “urged” Chinese companies not to use it “as a base to rebadge products to avoid US tariffs”.

-

Sign up to Carbon Brief’s free “China Briefing” email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

CHINA ‘HAWK’: On 6 December, president-elect Donald Trump nominated China “hawk” senator David Perdue for US ambassador to China, BBC News reported. Perdue wrote in the Washington Examiner in September 2024: “China continues to laugh at US attempts to partner with it on climate change…We should withdraw from the Paris climate agreement, as it commits the US to fund it primarily while giving China a free pass.”

CONTENT REQUIREMENTS: Meanwhile, according to Nikkei Asia, the EU is “adding restrictions to its [European Hydrogen Bank] subsidy program for ‘green’ hydrogen production that effectively lock out Chinese-made equipment” by stating that projects “will not be eligible if electrolyser stacks…sourced from China account for more than 25% of output capacity”. The Financial Times reported that the EU’s new €4.6bn tender for “technologies for decarbonisation” will only be accessible to Chinese companies that “agree to transfer intellectual property rights to the EU”, according to Teresa Ribera, the EU’s new executive vice president for a “clean, just and competitive transition”.

Carbon concentrations reporting

CLIMBING CO2: The amount of carbon dioxide (CO2) in the atmosphere above China’s land area rose in 2023, reaching approximately 421 parts per million (ppm), according to the country’s newly released greenhouse gas bulletin for 2023, reported the Communist party-affiliated newspaper People’s Daily. This rise of 2.3ppm was “slightly lower” than the average annual growth in concentrations of 2.4ppm over the past decade, the newspaper added. The 21st Century Herald, a business newspaper, also covered the bulletin’s launch, noting that the average concentrations of methane and nitrous oxide in 2023 rose year-on-year at a rate “lower than the global [average]”.

EXPERT WARNING: Separately, a new report found that, “while the civil sector has achieved significant synergistic emission reductions of CO2 and air pollutants”, the power and heating sectors are seeing “dual-growth” of carbon emissions and air pollution, while the emissions reductions of industry and transport “need to be further unleashed”, finance newspaper the Economic Daily reported. The study, released by the China Clean Air Policy Partnership – a consortium of leading universities, government-linked research institutes, industry associations and other stakeholders – assesses the “challenges China faces on the road to carbon neutrality and clean air synergy and proposes solutions”, current affairs news outlet China News said. It quoted professor He Kebin, dean of the Tsinghua University Institute for Carbon Neutrality, saying at the launch event that the upcoming shift from “dual-control of energy” to “dual-control of carbon” marks a “critical period” in China’s “green transformation”.

WEATHER IMPACT: Meanwhile, China “reported its warmest autumn this year since records began”, with average temperatures standing at “1.5C higher than the average year”, Agence-France Presse said. Scientists in China are searching for ways to develop climate-resilient potatoes – given the plants are “particularly vulnerable to heat” – in order to “protect [the country’s] food supplies”, Reuters reported. Also, “continued rains followed by extreme high temperatures” have severely damaged China’s kiwi harvest, according to Bloomberg.

Grid reform efforts continue

UNIFIED GRID: The China Electricity Council (CEC) launched a “blue book” – the term used for research reports or policy proposals issued by government departments or government-affiliated organisations – outlining a “strategic roadmap for future development” of a national unified power market, industry news outlet International Energy Net reported. It quoted a deputy director of the National Energy Administration (NEA) saying a unified power market is crucial for “deepening power sector reforms” and promoting the energy transition. Energy news outlet BJX News also covered the document’s release, which outlined a timetable for the plan: namely, that “preliminary construction [of a unified market] will be completed in 2025, full construction will be completed in 2029, and improvements and upgrading will be completed in 2035”. It added that key elements of the plan include “convergence” of provincial mechanisms, “participation” of large-scale renewable energy bases and “market adaptation” to the energy transition.

GREEN GRID: Separately, the CEC also reported that China’s electrification rate – the share of energy demand met by electricity – was “expected to reach 34% by 2030”, financial news outlet Yicai reported. Separately, China will “set another record” for solar capacity growth this year, with new installations expected to climb from last year’s 217 gigawatts (GW) to reach 230-260GW in 2024, according to an announcement by the China Photovoltaic Industry Association covered by Bloomberg. In addition, China’s installed wind capacity has exceeded 500 gigawatts (GW) and now accounts for 50% of the global total, state broadcaster CCTV reported.

STABLE GRID: The NEA released guiding opinions that aim to “clarify the scope of new businesses” in the energy sector and “facilitate [their] connection to the grid and operation”, following the rapid expansion of China’s renewable energy sector, an NEA official told International Energy Net. Finance newspaper Securities Times quoted Lin Boqiang, dean of the China Energy Policy Research Institute at Xiamen University, saying the new rules “aim to lessen pressure on the grid and ensure safe and stable operation of the power system”.

‘Green growth’ at the fore of key economic meeting

XI’S ‘KEY TASKS’: President Xi Jinping told policymakers that “synergistically promoting carbon reduction, pollution reduction and green growth” was one of nine “key tasks” for 2025 at the central economic work conference (CEWC), an annual high-level economic policy meeting that ended on 12 December, Xinhua reported. The state news agency added that Xi’s speech underscored the need to “step up the overall green transformation of economic and social development” and “deepen reform of the ecological civilisation system”, in part by creating a “healthy ecosystem” for low-carbon industries and “cultivating new growth points, such as green buildings”. It said the speech also mentioned that China will “establish a number of zero-carbon parks, promote the construction of a national carbon market, and establish a product carbon footprint management system and a carbon labelling certification system”. These themes had been raised in a meeting of the Politburo, the decision-making body of the Chinese communist party, a few days prior, according to China Daily.

GROWING PAINS: The CEWC meeting included “pledges to take a more proactive approach” in stimulating economic growth, “but gave no details on new stimulus measures”, the Associated Press reported, adding that China would “raise its fiscal deficit”, “stabilise the property market” and “boost consumer spending”. The International Energy Agency “lifted next year’s oil-demand estimates” in response to the anticipated “impact of China’s stimulus measures”, although it added “the pace of growth is expected to remain subdued”, the Wall Street Journal said. Reuters reported that “Chinese leaders signalled…they are ready to deploy whatever stimulus is needed to counter the impact of expected US trade tariffs on next year’s economic growth”, adding that the exact size of the stimulus will “depend on” the Trump administration’s tariffs and other policy measures against China.

HIGH-QUALITY GROWTH: China is “planning a fresh set of policies to propel growth in the equipment manufacturing sector, focusing on nurturing new growth engines such as new energy vehicles”, China Daily said, in tandem with calls from the CEWC and Politburo meetings to “nurture technological innovation”. A China Daily editorial argued that “Chinese policymakers are exercising tremendous prudence” to minimise risks and uncertainties while pursuing “new quality productive forces and innovation”.

Spotlight

How China’s renewables rollout boosts its ‘war on sand’

At the ongoing COP16 UN summit on desertification in Riyadh, Saudi Arabia, Carbon Brief hears from experts on the links between China’s rapidly expanding desert solar farms and Beijing’s decades-long efforts to keep sand in check.

China’s effort to build large solar power “bases” in and around the desert is a major part of its current renewable plan.

The initiative, which has expanded rapidly in the country’s arid north and northwest, is also part of its campaign to combat desertification, an issue increasingly exacerbated by climate change.

For more than four decades, Beijing has been trying to prevent sand from degrading its land with an afforestation programme called the “Three-North Shelterbelt” (三北防护林).

Over the past two years, the programme – described as China’s “war on sand” by the media – has been boosted by the development of large-scale solar bases in far-flung regions, such as Xinjiang and Inner Mongolia.

Installing solar panels in the desert can not only generate power, but also help prevent sand dunes from moving, according to Dr He Jijiang, executive deputy director of the Research Center for Energy Transition and Social Development at Tsinghua University, Beijing.

Energy companies’ investments also provide financial support to many regions’ sand-control campaigns – an apparent obstacle in the past – Dr He told Carbon Brief at a side event in the China pavilion at the ongoing COP16 talks.

Taming of the sand

China is one of the worst-hit countries by desertification, which essentially means land degradation in dry lands.

Nearly 18% of China’s landmass – roughly seven times the size of the UK – is affected by the issue, according to statistics reported by Guan Zhi’ou, director of China’s National Forestry and Grassland Administration and the head of the Chinese delegation to COP16, in November.

China’s effort to combat desertification has a strong link with its – and the world’s – climate actions.

Soil is the second largest natural carbon sink on Earth after oceans and stores a large amount of carbon. When land degrades, not only does it lose the ability to store as much carbon, it can also release carbon into the atmosphere, driving further climate change.

On the other hand, climate change accelerates land degradation and China is on the front line. The country has seen the largest total area shift from non-dryland into drylands over the past three decades, according to a major scientific report published by the UNCCD at COP16.

Since the introduction of the Three-North Shelterbelt programme in 1978, China has adopted a series of measures to fight desertification, from planting sand-blocking vegetation to laying straw on the ground in the shape of checkerboards to prevent its vast deserts from expanding.

Solar solution

China’s plan for renewable energy from 2021 to 2025 calls for the “large-scale development” of its sand-plus-solar anti-desertification method.

The concept centres around managing arid areas via building and maintaining solar farms. It stems from years of experience accumulated by Chinese solar developers, which have built solar farms in the desert for more than a decade – with varying degrees of success.

“Building solar farms needs a lot of space. China has vast deserts, so [companies] wanted to take advantage of it,” Dr He explained.

But to operate solar farms in such harsh conditions, these companies must first take various protective measures – and these measures helped combat desertification, too.

For example, companies need to put up fences around their solar farms to stop animals from entering, install anti-dust nets to prevent sand from gathering on equipment and make straw checkerboards around their bases to prevent nearby sand dunes from shifting, Dr He said.

Solar panels also bring benefits to the ground underneath. For example, they can reduce water evaporation by blocking out direct sunshine, according to Dr Chen Siyu, a professor at the college of atmospheric sciences at Lanzhou University in Lanzhou, a city situated on the edge of the Gobi desert in China.

Solar panels can “significantly increase” the soil moisture of dry regions and, therefore, help plants to grow, Dr Chen told Carbon Brief. A 2021 study conducted in northwest China projected that the soil moisture would increase by up to 113.6% when it is sheltered.

“Solar panels can also form a natural barrier, helping to shed wind speed and prevent dust storms from occurring and spreading,” she said.

Ramping up transition

The construction of solar farms also injects financial support to many regions’ sand-control campaigns, providing incentives for them to carry on, Dr He noted.

“In the past, planting trees only brought ecological benefits, not economic returns,” he said. “Now, if a company wants to build a solar power station, it needs to cover all related costs, from hiring equipment to growing plants.”

Ramping up the solar-plus-sand method can scale up China’s renewable deployment, as well as improving soil conditions by bringing greenery, vegetable plots and livestock to the desert and barren land. Because of this, dryland has become “a type of resource”, Dr He said.

This Spotlight is by freelance climate journalist Xiaoying You for Carbon Brief. A full-length version of the article is available on the Carbon Brief website.

Watch, read, listen

LOW-BALLING: Chinese climate envoy Liu Zhenmin, in a lengthy interview with China Newsweek, reflected on the “disappoint[ing]” $300bn finance goal and pushed back against questions of China “playing a stronger leadership role” in climate negotiations.

LOOKING AHEAD: The Asia Society Policy Institute wrote that, against the backdrop of an economic slowdown, China’s international climate pledge next year, coal trajectory and renewables buildout are “key things to watch” in a forecast for 2025.

PUTIN’S PIPELINE: State news agency Xinhua visited a hub of the recently completed China-Russia east-route gas pipeline to explore how it supplies Shanghai and other eastern provinces.

TRUMP EFFECT: A podcast by the Oxford Institute for Energy Studies discussed how the next Trump administration’s China policy could affect China’s own energy activities and climate action.

17%

The share of China’s greenhouse gas emissions produced by the steel industry, according to Reuters. The newswire added that China has published draft rules for comment on greenhouse gas emissions reporting for steel-makers, in preparation for the industry’s entry into the national emissions trading scheme.

New science

Global and Planetary Change

Compound drought and hot extremes (CDHEs) will increase across many regions of China over the coming century, especially in the eastern and central Songnen Plain and northern Sichuan Basin, a new study found. The authors evaluated changes in CDHEs across multiple croplands in China between 1961-2010 and 2031-80, using a large ensemble model, rainfall data and temperature data. “These results underscore the high risk of the spatial compounding of extremes at multiple croplands in China in the future,” the study said.

Impact of computing infrastructure on carbon emissions in China

Scientific Reports

A new paper found an upside-down “U” shaped relationship between carbon emission intensity – the emissions per unit of economic output – and computing infrastructure in Chinese cities, with emissions intensity initially increasing with a rise in computing infrastructure, before plateauing and then decreasing. The authors used data from 279 prefecture-level cities collected between 2008 to 2021. The findings are “particularly pronounced in central regions, hub cities and moderately digitally developed cities”, they said.

China Briefing is compiled by Wanyuan Song and Anika Patel. It is edited by Wanyuan Song and Dr Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 12 December 2024: Export controls; Carbon concentration figures; ‘War on sand’ appeared first on Carbon Brief.

China Briefing 12 December 2024: Export controls; Carbon concentration figures; ‘War on sand’

Climate Change

Cheniere Energy Received $370 Million IRS Windfall for Using LNG as ‘Alternative’ Fuel

The country’s largest exporter of liquefied natural gas benefited from what critics say is a questionable IRS interpretation of tax credits.

Cheniere Energy, the largest producer and exporter of U.S. liquefied natural gas, received $370 million from the IRS in the first quarter of 2026, a payout that shipping experts, tax specialists and a U.S. senator say the company never should have received.

Cheniere Energy Received $370 Million IRS Windfall for Using LNG as ‘Alternative’ Fuel

Climate Change

DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Absolute State of the Union

‘DRILL, BABY’: US president Donald Trump “doubled down on his ‘drill, baby, drill’ agenda” in his State of the Union (SOTU) address, said the Los Angeles Times. He “tout[ed] his support of the fossil-fuel industry and renew[ed] his focus on electricity affordability”, reported the Financial Times. Trump also attacked the “green new scam”, noted Carbon Brief’s SOTU tracker.

COAL REPRIEVE: Earlier in the week, the Trump administration had watered down limits on mercury pollution from coal-fired power plants, reported the Financial Times. It remains “unclear” if this will be enough to prevent the decline of coal power, said Bloomberg, in the face of lower-cost gas and renewables. Reuters noted that US coal plants are “ageing”.

OIL STAY: The US Supreme Court agreed to hear arguments brought by the oil industry in a “major lawsuit”, reported the New York Times. The newspaper said the firms are attempting to head off dozens of other lawsuits at state level, relating to their role in global warming.

SHIP-SHILLING: The Trump administration is working to “kill” a global carbon levy on shipping “permanently”, reported Politico, after succeeding in delaying the measure late last year. The Guardian said US “bullying” could be “paying off”, after Panama signalled it was reversing its support for the levy in a proposal submitted to the UN shipping body.

Around the world

- RARE EARTHS: The governments of Brazil and India signed a deal on rare earths, said the Times of India, as well as agreeing to collaborate on renewable energy.

- HEAT ROLLBACK: German homes will be allowed to continue installing gas and oil heating, under watered-down government plans covered by Clean Energy Wire.

- BRAZIL FLOODS: At least 53 people died in floods in the state of Minas Gerais, after some areas saw 170mm of rain in a few hours, reported CNN Brasil.

- ITALY’S ATTACK: Italy is calling for the EU to “suspend” its emissions trading system (ETS) ahead of a review later this year, said Politico.

- COOKSTOVE CREDITS: The first-ever carbon credits under the Paris Agreement have been issued to a cookstove project in Myanmar, said Climate Home News.

- SAUDI SOLAR: Turkey has signed a “major” solar deal that will see Saudi firm ACWA building 2 gigawatts in the country, according to Agence France-Presse.

$467 billion

The profits made by five major oil firms since prices spiked following Russia’s invasion of Ukraine four years ago, according to a report by Global Witness covered by BusinessGreen.

Latest climate research

- Claims about the “fingerprint” of human-caused climate change, made in a recent US Department of Energy report, are “factually incorrect” | AGU Advances

- Large lakes in the Congo Basin are releasing carbon dioxide into the atmosphere from “immense ancient stores” | Nature Geoscience

- Shared Socioeconomic Pathways – scenarios used regularly in climate modelling – underrepresent “narratives explicitly centring on democratic principles such as participation, accountability and justice” | npj Climate Action

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

The constituency of Richard Tice MP, the climate-sceptic deputy leader of Reform UK, is the second-largest recipient of flood defence spending in England, according to new Carbon Brief analysis. Overall, the funding is disproportionately targeted at coastal and urban areas, many of which have Conservative or Liberal Democrat MPs.

Spotlight

Is there really a UK ‘greenlash’?

This week, after a historic Green Party byelection win, Carbon Brief looks at whether there really is a “greenlash” against climate policy in the UK.

Over the past year, the UK’s political consensus on climate change has been shattered.

Yet despite a sharp turn against climate action among right-wing politicians and right-leaning media outlets, UK public support for climate action remains strong.

Prof Federica Genovese, who studies climate politics at the University of Oxford, told Carbon Brief:

“The current ‘war’ on green policy is mostly driven by media and political elites, not by the public.”

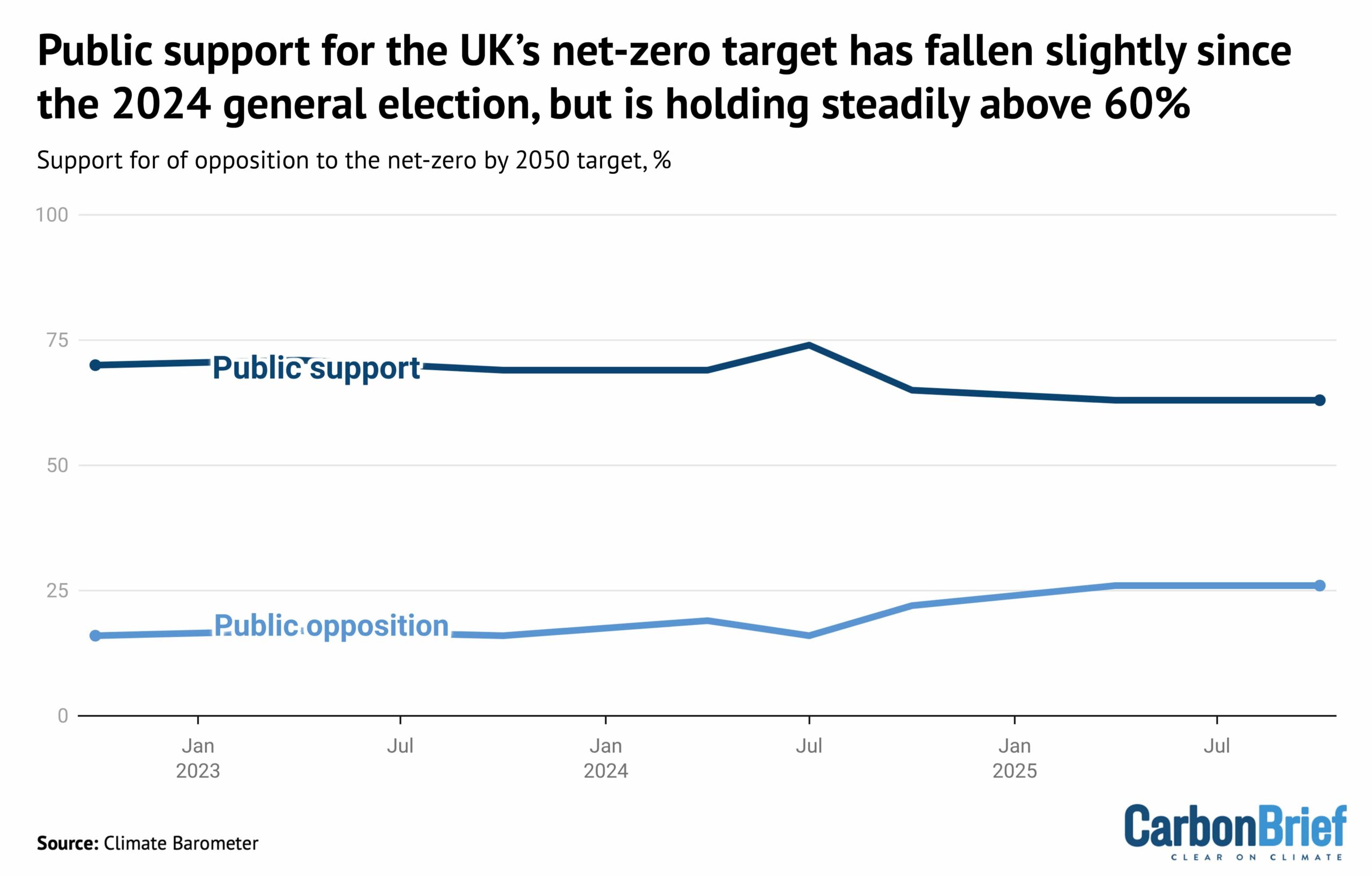

Indeed, there is still a greater than two-to-one majority among the UK public in favour of the country’s legally binding target to reach net-zero emissions by 2050, as shown below.

Steve Akehurst, director of public-opinion research initiative Persuasion UK, also noted the growing divide between the public and “elites”. He told Carbon Brief:

“The biggest movement is, without doubt, in media and elite opinion. There is a bit more polarisation and opposition [to climate action] among voters, but it’s typically no more than 20-25% and mostly confined within core Reform voters.”

Conservative gear shift

For decades, the UK had enjoyed strong, cross-party political support for climate action.

Lord Deben, the Conservative peer and former chair of the Climate Change Committee, told Carbon Brief that the UK’s landmark 2008 Climate Change Act had been born of this cross-party consensus, saying “all parties supported it”.

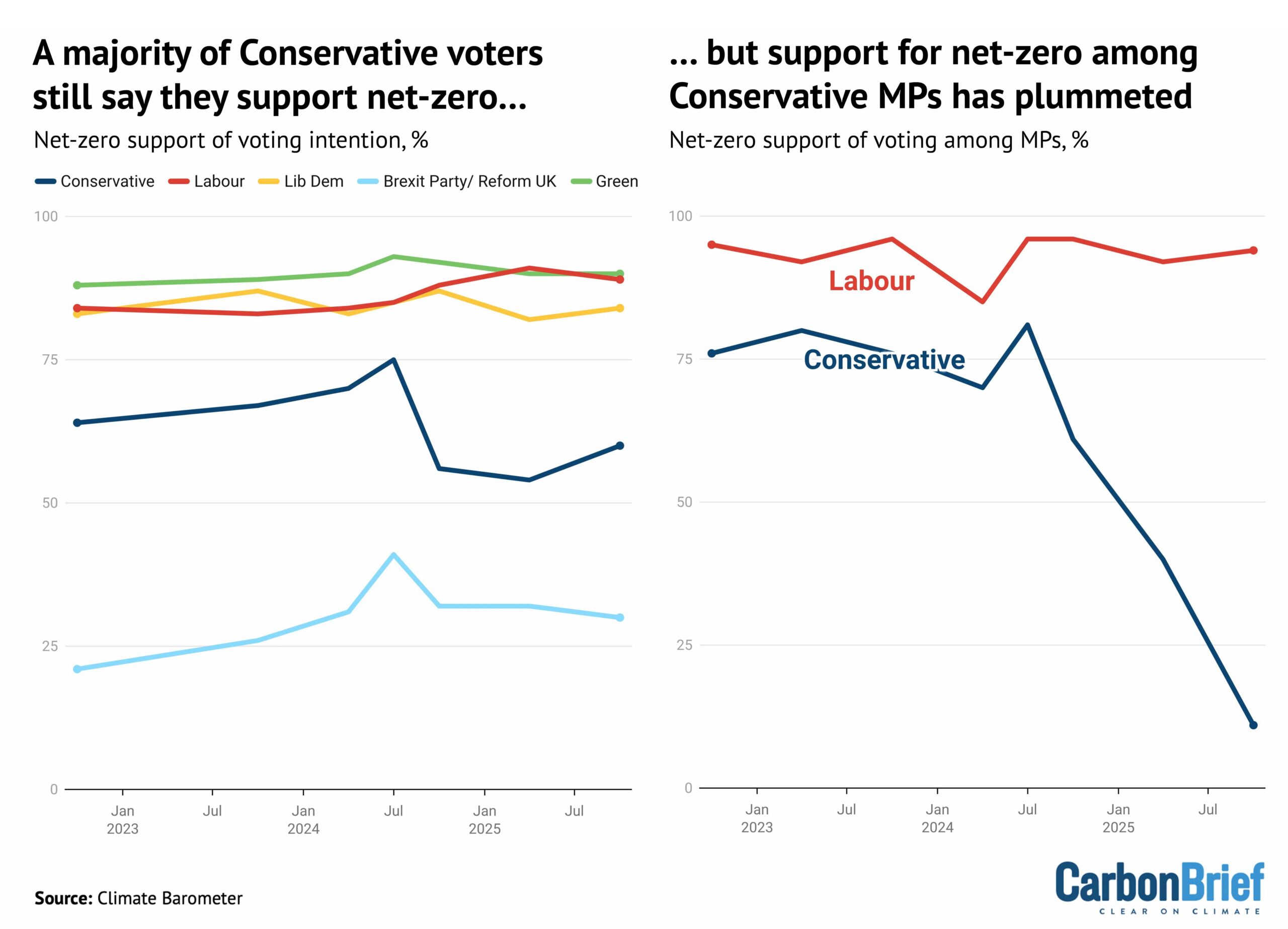

Since their landslide loss at the 2024 election, however, the Conservatives have turned against the UK’s target of net-zero emissions by 2050, which they legislated for in 2019.

Curiously, while opposition to net-zero has surged among Conservative MPs, there is majority support for the target among those that plan to vote for the party, as shown below.

Dr Adam Corner, advisor to the Climate Barometer initiative that tracks public opinion on climate change, told Carbon Brief that those who currently plan to vote Reform are the only segment who “tend to be more opposed to net-zero goals”. He said:

“Despite the rise in hostile media coverage and the collapse of the political consensus, we find that public support for the net-zero by 2050 target is plateauing – not plummeting.”

Reform, which rejects the scientific evidence on global warming and campaigns against net-zero, has been leading the polls for a year. (However, it was comfortably beaten by the Greens in yesterday’s Gorton and Denton byelection.)

Corner acknowledged that “some of the anti-net zero noise…[is] showing up in our data”, adding:

“We see rising concerns about the near-term costs of policies and an uptick in people [falsely] attributing high energy bills to climate initiatives.”

But Akehurst said that, rather than a big fall in public support, there had been a drop in the “salience” of climate action:

“So many other issues [are] competing for their attention.”

UK newspapers published more editorials opposing climate action than supporting it for the first time on record in 2025, according to Carbon Brief analysis.

Global ‘greenlash’?

All of this sits against a challenging global backdrop, in which US president Donald Trump has been repeating climate-sceptic talking points and rolling back related policy.

At the same time, prominent figures have been calling for a change in climate strategy, sold variously as a “reset”, a “pivot”, as “realism”, or as “pragmatism”.

Genovese said that “far-right leaders have succeeded in the past 10 years in capturing net-zero as a poster child of things they are ‘fighting against’”.

She added that “much of this is fodder for conservative media and this whole ecosystem is essentially driving what we call the ‘greenlash’”.

Corner said the “disconnect” between elite views and the wider public “can create problems” – for example, “MPs consistently underestimate support for renewables”. He added:

“There is clearly a risk that the public starts to disengage too, if not enough positive voices are countering the negative ones.”

Watch, read, listen

TRUMP’S ‘PETROSTATE’: The US is becoming a “petrostate” that will be “sicker and poorer”, wrote Financial Times associate editor Rana Forohaar.

RHETORIC VS REALITY: Despite a “political mood [that] has darkened”, there is “more green stuff being installed than ever”, said New York Times columnist David Wallace-Wells.

CHINA’S ‘REVOLUTION’: The BBC’s Climate Question podcast reported from China on the “green energy revolution” taking place in the country.

Coming up

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean, Brasília

- 3 March: UK spring statement

- 4-11 March: China’s “two sessions”

- 5 March: Nepal elections

Pick of the jobs

- The Guardian, senior reporter, climate justice | Salary: $123,000-$135,000. Location: New York or Washington DC

- China-Global South Project, non-resident fellow, climate change | Salary: Up to $1,000 a month. Location: Remote

- University of East Anglia, PhD in mobilising community-based climate action through co-designed sports and wellbeing interventions | Salary: Stipend (unknown amount). Location: Norwich, UK

- TABLE and the University of São Paulo, Brazil, postdoctoral researcher in food system narratives | Salary: Unknown. Location: Pirassununga, Brazil

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’? appeared first on Carbon Brief.

Climate Change

Pacific nations want higher emissions charges if shipping talks reopen

Seven Pacific island nations say they will demand heftier levies on global shipping emissions if opponents of a green deal for the industry succeed in reopening negotiations on the stalled accord.

The United States and Saudi Arabia persuaded countries not to grant final approval to the International Maritime Organization’s Net-Zero Framework (NZF) in October and they are now leading a drive for changes to the deal.

In a joint submission seen by Climate Home News, the seven climate-vulnerable Pacific countries said the framework was already a “fragile compromise”, and vowed to push for a universal levy on all ship emissions, as well as higher fees . The deal currently stipulates that fees will be charged when a vessel’s emissions exceed a certain level.

“For many countries, the NZF represents the absolute limit of what they can accept,” said the unpublished submission by Fiji, Kiribati, Vanuatu, Nauru, Palau, Tuvalu and the Solomon Islands.

The countries said a universal levy and higher charges on shipping would raise more funds to enable a “just and equitable transition leaving no country behind”. They added, however, that “despite its many shortcomings”, the framework should be adopted later this year.

US allies want exemption for ‘transition fuels’

The previous attempt to adopt the framework failed after governments narrowly voted to postpone it by a year. Ahead of the vote, the US threatened governments and their officials with sanctions, tariffs and visa restrictions – and President Donald Trump called the framework a “Green New Scam Tax on Shipping”.

Since then, Liberia – an African nation with a major low-tax shipping registry headquartered in the US state of Virginia – has proposed a new measure under which, rather than staying fixed under the NZF, ships’ emissions intensity targets change depending on “demonstrated uptake” of both “low-carbon and zero-carbon fuels”.

The proposal places stringent conditions on what fuels are taken into consideration when setting these targets, stressing that the low- and zero-carbon fuels should be “scalable”, not cost more than 15% more than standard marine fuels and should be available at “sufficient ports worldwide”.

This proposal would not “penalise transitional fuels” like natural gas and biofuels, they said. In the last decade, the US has built a host of large liquefied natural gas (LNG) export terminals, which the Trump administration is lobbying other countries to purchase from.

The draft motion, seen by Climate Home News, was co-sponsored by US ally Argentina and also by Panama, a shipping hub whose canal the US has threatened to annex. Both countries voted with the US to postpone the last vote on adopting the framework.

The IMO’s Panamanian head Arsenio Dominguez told reporters in January that changes to the framework were now possible.

“It is clear from what happened last year that we need to look into the concerns that have been expressed [and] … make sure that they are somehow addressed within the framework,” he said.

Patchwork of levies

While the European Union pushed firmly for the framework’s adoption, two of its shipping-reliant member states – Greece and Cyprus – abstained in October’s vote.

After a meeting between the Greek shipping minister and Saudi Arabia’s energy minister in January, Greece said a “common position” united Greece, Saudi Arabia and the US on the framework.

If the NZF or a similar instrument is not adopted, the IMO has warned that there will be a patchwork of differing regional levies on pollution – like the EU’s emissions trading system for ships visiting its ports – which will be complicated and expensive to comply with.

This would mean that only countries with their own levies and with lots of ships visiting their ports would raise funds, making it harder for other nations to fund green investments in their ports, seafarers and shipping companies. In contrast, under the NZF, revenues would be disbursed by the IMO to all nations based on set criteria.

Anais Rios, shipping policy officer from green campaign group Seas At Risk, told Climate Home News the proposal by the Pacific nations for a levy on all shipping emissions – not just those above a certain threshold – was “the most credible way to meet the IMO’s climate goals”.

“With geopolitics reframing climate policy, asking the IMO to reopen the discussion on the universal levy is the only way to decarbonise shipping whilst bringing revenue to manage impacts fairly,” Rios said.

“It is […] far stronger than the Net-Zero Framework that is currently on offer.”

The post Pacific nations want higher emissions charges if shipping talks reopen appeared first on Climate Home News.

Pacific nations want higher emissions charges if shipping talks reopen

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits