Welcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

New EU-China climate statement

CLIMATE STATEMENT: European Council president António Costa and European Commission president Ursula von der Leyen signed an EU-China agreement on climate with Chinese premier Li Qiang at today’s EU-China summit, following a meeting with President Xi Jinping. (The Chinese version calls the statement a “joint statement”, while in the EU version it is a “joint press statement”). In it, the two sides “agree to demonstrate leadership together to drive a global just transition” and promote “ambitious, equitable, balanced and inclusive outcomes” at COP30. The statement also highlighted an agreement to “facilitat[e] access to quality green technologies and products, so that they can be available, affordable and beneficial for all countries, including the developing countries”.

NO LANGUAGE ON COAL: According to a commission press release, the EU “reiterated its commitment to…enhance” climate cooperation with China, plus “encouraged China to propose an ambitious plan for its emission reductions up to 2035 and to step up its international finance contributions”. This echoed earlier comments to Reuters by EU climate commissioner Wopke Hoekstra that China must “take more of a leadership role” on climate action and “move out of the domain of coal”. However, the joint statement itself did not contain any language on coal. According to the statement, focuses for bilateral cooperation include the “energy transition, adaptation, methane emissions management and control, carbon markets and green and low-carbon technologies”, with the commission press release noting that the two sides had “intensive engagement” on emissions trading systems and the “circular economy” over the past 18 months.

CLEAN-TECH TENSIONS: The commission press release also noted that “current trade relations remain critically unbalanced”, with no further details on an expected agreement on electric vehicles. In an earlier meeting, according to state news agency Xinhua, Xi told his counterparts that “China and the EU should deepen green and digital partnerships and promote mutual investment cooperation”. It said he added: “It is hoped that the European side will keep trade and investment markets open, refrain from using restrictive economic and trade tools, and provide a favorable business environment for Chinese enterprises to invest and prosper in Europe.”

MEANS OF PRODUCTION: Earlier, China had issued “new restrictions” on technologies crucial to manufacturing electric vehicle (EV) batteries, reported the New York Times, with government licenses required for “any overseas transfer”. Cory Combs, head of supply chain research at consultancy Trivium China, told Carbon Brief: “My expectation is that Beijing will clear major Chinese producers to use their own tech in their own overseas facilities, but not to license to foreign competition”. He added that these restrictions were less likely to “impede climate cooperation” compared to the “massively disruptive” controls on exports of minerals and gallium metal extraction technologies.

Controversial ‘megadam’ launched

MEGADAM: Premier Li Qiang launched a “megadam” project, which is “expected to be the world’s largest hydroelectric facility”, on the Yarlung Tsangpo River in Tibet, reported the Hong Kong-based South China Morning Post (SCMP). It added that the project, which raised significant concerns when proposed earlier this year, could provide 300 terawatt-hours of electricity – “three times that of the Three Gorges dam” and roughly the same as the UK’s entire output. According to the Communist party-affiliated newspaper People’s Daily, Li “described [the dam] as a project of the century”, adding that “special emphasis must be placed on…prevent[ing] environmental damage”. The project could also help “bolster economic growth as current drivers show signs of faltering”, Reuters said. (See below.)

-

Sign up to Carbon Brief’s free “China Briefing” email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

POWER ‘TORRENT’: Elsewhere, China has completed a 4,000km power transmission project in the Taklaman desert that will “create a torrent of green power” from renewable-energy rich Xinjiang province, according to Xinhua. The new infrastructure, which took 15 years to build, will “double transmission distance and boost transmission capacity” to three gigawatts (GW), allowing “connections to other regional power grids for long-distance power transmission”, SCMP reported. Separately, nationwide installations of solar capacity in June reached 14GW, down 36% year-on-year and down from 93GW of new solar in May, BJX News said.

INTER-GRID TRADING: Regulators approved a proposal by China’s two major grid companies to develop “routine power-trading” between different operators in China, BJX News reported, with the aim of strengthening China’s power supply. Business news outlet Jiemian said that, according to the grid operators’ plan, regulators will focus on “listed trading” (挂牌交易) of low-carbon electricity between specific provinces. A government official told industry outlet International Energy Net that the move was partially driven by the need to manage the integration of large amounts of new renewable energy capacity into the grid.

Clean-tech a key growth driver

LEADING THE PACK: According to an official at China’s National Bureau of Statistics (NBS), China’s “new-three” industries “continue to maintain high growth rates”, China Environment News reported. The climate-related news outlet quoted an NBS official stating that China’s new-energy vehicle (NEV) industry grew 36% and the lithium-ion battery industry grew 53% in the first half of 2025, compared to overall economic growth of just over 5%. Meanwhile, the number of patents generated by clean-tech companies has “doubled” since 2020, with “53,000 invention patents granted” in 2024, according to the state-run newspaper China Daily.

‘GREEN FINANCE’: China has released a catalogue clarifying which projects can receive “green finance”, reported BJX News, noting that the list includes manufacturing of lithium-ion batteries and other “power-industry equipment projects”. The catalogue “serves as a reference for the future issuance of green loans and green bonds” and should “boost liquidity in the green finance market”, according to China Daily.

NEW PLAYBOOK: A high-level meeting on “urban work” attended by President Xi Jinping ended by pledging that the “focus [of China’s housing industry] will be directed toward building green, low-carbon and beautiful cities”, state news agency Xinhua reported. Reuters said that the meeting underscored that China is “abandoning [a strategy of] breakneck urban growth that once super-charged its economy”. Output of the heavily polluting steel, cement and glass industries fell in June, driven by China’s ongoing housing industry slump, according to Bloomberg, although it noted “hot weather” had limited construction activity.

Captured

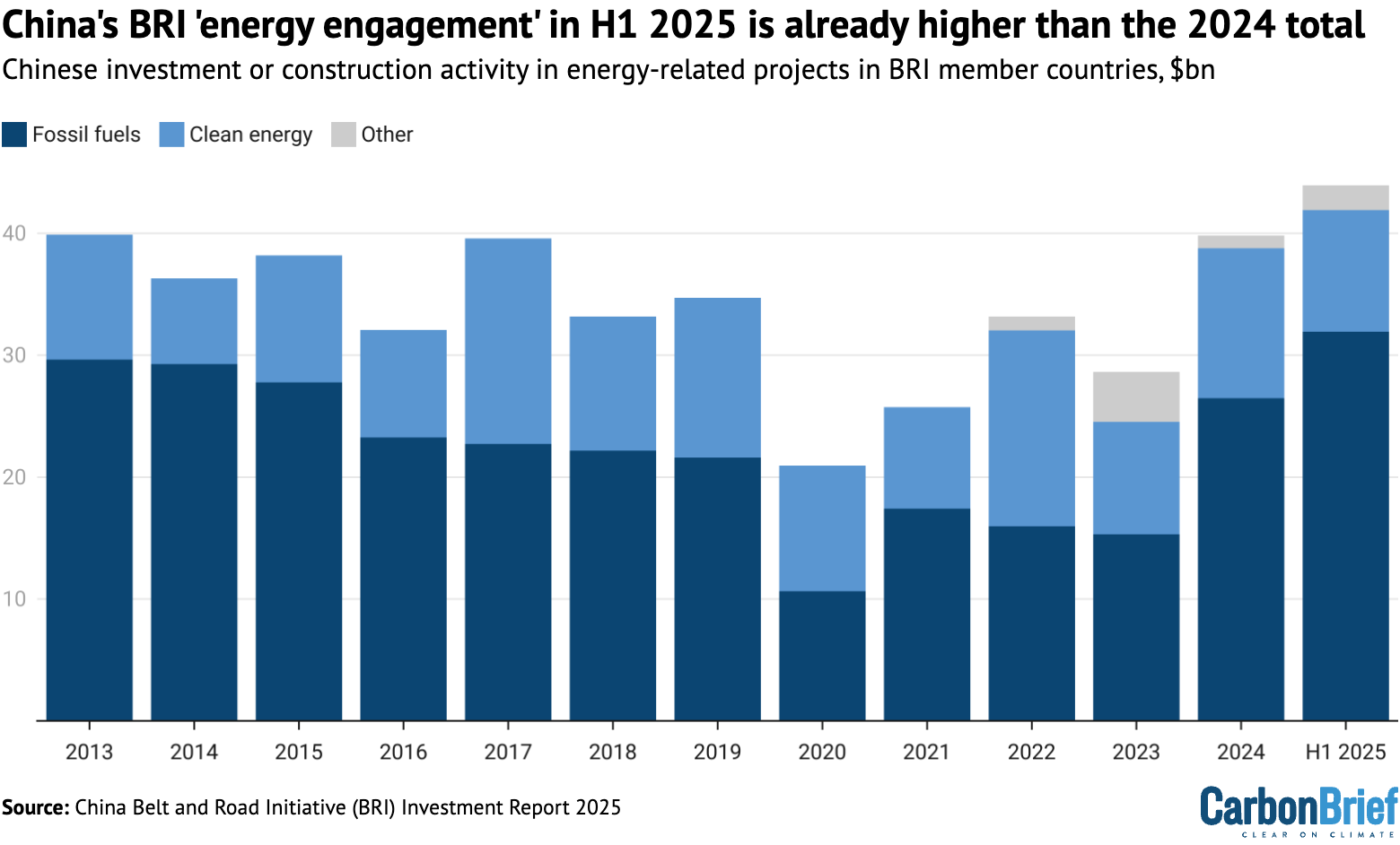

China’s energy-related investment and construction in “belt and road initiative” member states during the first half of 2025 (H1 2025) has already exceeded similar “engagement” in the whole of 2024, according to a new report. Clean-energy engagement in H1 2025 – particularly solar, wind and waste-to-energy – “reached new records” compared to the same period in previous years. Report author Prof Christoph Nedopil Wang told Carbon Brief that high oil and gas activity was “mostly explained by a single large gas-related construction project in Nigeria”, with clean-energy power outweighing fossil fuels in terms of newly added generation capacity.

Spotlight

Chinese clean-tech exports to cut emissions equal to Spain’s footprint

New analysis for Carbon Brief by Lauri Myllyvirta, senior fellow at the Asia Society Policy Institute, finds that the low-carbon technologies exported by China in 2024 alone could cut emissions overseas by 220m tonnes of carbon dioxide (MtCO2), roughly equivalent to Spain’s total annual CO2 output.

This issue features an abridged version of the analysis, which is available in full on Carbon Brief’s website.

China’s output of clean-energy technologies is enabling rapid deployment around the world, but their production is energy- and carbon-intensive.

Nevertheless, these clean-tech exports are having immediate global climate benefits – contradicting many commentaries linking China’s clean-tech boom to the sharp rise in its emissions.

Specifically, manufacturing clean-energy equipment for export resulted in an estimated 110MtCO2 of emissions in 2024, or just 1.1% of China’s CO2 from fossil fuels. Yet the solar panels, batteries, electric vehicles (EVs) and wind turbines exported in 2024 will avoid an estimated 220MtCO2 annually when put into operation overseas.

Moreover, these products will continue to generate emissions savings for as long as they continue operating, avoiding a cumulative total of 4bn tons of CO2 across their lifetime.

Looking beyond direct equipment exports, overseas clean-energy investments announced by Chinese companies in 2023-24, such as solar panel manufacturing plants, will generate another 90MtCO2 of avoided emissions per year, once the projects have been built.

In addition, overseas clean-power generation projects announced by Chinese investors in 2023-24 would save another 40MtCO2 per year.

Overseas footprint

China’s clean-energy footprint spans essentially the entire world, but in terms of resulting emission reductions, the largest destinations for China’s overseas clean-energy activity are south Asia and the Middle East and north Africa (MENA) region.

This reflects both the large volumes of Chinese clean-technology activity reaching these countries and their highly carbon-intensive power grids, which means that installing new solar panels offsets high-emissions generation, for example.

On the manufacturing side, Saudi Arabia is the main destination, with a major EV production facility, two solar factories and one for wind turbines. There are also a total of five battery manufacturing projects in Morocco and Oman.

OECD Europe is the largest destination for China’s exports and overseas manufacturing investments by value. However, relative to the volume of exports, the resulting CO2 savings are smaller than in other major destinations, due to lower carbon intensity of power generation.

Another way to look at China’s clean-energy exports and investments is to consider where they have the biggest emissions impact, relative to the total CO2 output in each region.

On a relative basis, sub-Saharan Africa stands out, in addition to MENA.

China’s clean-energy exports in 2024 alone, as well as 2023-24 investments, are set to cut annual emissions in sub-Saharan Africa by around 3% per year. This indicates a rapid uptake of solar power in the region, relative to the size of the region’s electricity systems.

Downstream opportunity

In 2024, clean-energy industries contributed more than 10% of China’s GDP for the first time, underscoring the country’s dominant role in the global manufacturing of certain low-carbon technologies and reinforcing its strategic interest in the continuation and acceleration of the global clean-energy transition.

On the surface, this dominance may suggest that other countries have limited economic opportunities in clean energy.

However, China’s involvement in global supply chains is still largely limited to exports and manufacturing, while most of the value is downstream – in project development, system integration, installation and end-user services.

For example, in 2024, China exported $177bn worth of solar panels, EVs, batteries and wind turbines.

By contrast, the downstream value of overseas clean-energy products and projects relying on Chinese components is an estimated $720bn annually, four times the value of the exported raw components.

Watch, read, listen

AIR-CON DEMAND: China’s “two new” programme could encourage more consumers to trade in their air conditioners for more energy-efficient units, reducing cooling demand by 4.1% this summer, according to a new report by thinktank Ember.

WINNING STRATEGY: Volt Rush discussed how China – and other countries – made solar energy “one of the cheapest sources of power on Earth”.

MERZ’S CHOICE: A comment by three policy experts for Dialogue Earth said Germany could become a “vital broker between Europe and China”, but must “step up” engagement with China on climate.

ENERGY SECURITY: Bashir Bayo Ojulari, head of the Nigerian National Petroleum Corporation, spoke with Xinhua about how other developing countries are “leveraging” China’s model of clean-energy growth coupled with a “reasonable mix of hydrocarbons”.

$7.6bn

The total economic losses caused by “natural disasters” in China in the first half of 2025, Reuters said, adding that “floods caused the most damage”. Regions across China have continued to suffer from extreme heat and deadly torrential rains over the past two weeks.

New science

Unveiling deployable rooftop solar potential across Chinese cities

Nature Cities

A new study on rooftop solar photovoltaics (RPV) in China found that “only 42% of the national technical potential is realistically deployable”. The paper assessed where RPV is deployable across 367 Chinese cities, considering factors including building type, “regional characteristics” and “policy limitations”. It found that, due to “regulatory factors”, deployable RPV is mainly found in urban public and industrial buildings, particularly in western, northern and central regions. They added that “to maximise value, initial deployment should prioritise public and industrial buildings in central and southern cities”.

Role of pumped hydro storage in China’s power system decarbonisation

The Electricity Journal

Developing 120GW of pumped hydro storage (PHS) – in line with China’s target for 2030 – will be “sufficient to balance electricity supply and demand by 2050” in the country, given expected growth in energy storage battery capacity, a new study said. The authors used a “high-resolution power system planning model” to assess the role of PHS in China’s power system. They argued that batteries are “emerging as a more economical solution” for energy storage compared to PHS, adding that “over-investment in PHS could lead to unnecessary electricity price inflation”.

China Briefing is compiled by Wanyuan Song and Anika Patel, with contributions from Ushika Kidd. It is edited by Wanyuan Song and Dr Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 24 July 2025: EU-China climate statement; World’s largest megadam; Clean-tech exports appeared first on Carbon Brief.

China Briefing 24 July 2025: EU-China climate statement; World’s largest megadam; Clean-tech exports

Climate Change

DeBriefed 6 February 2026: US secret climate panel ‘unlawful’ | China’s clean energy boon | Can humans reverse nature loss?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Secrets and layoffs

UNLAWFUL PANEL: A federal judge ruled that the US energy department “violated the law when secretary Chris Wright handpicked five researchers who rejected the scientific consensus on climate change to work in secret on a sweeping government report on global warming”, reported the New York Times. The newspaper explained that a 1972 law “does not allow agencies to recruit or rely on secret groups for the purposes of policymaking”. A Carbon Brief factcheck found more than 100 false or misleading claims in the report.

DARKNESS DESCENDS: The Washington Post reportedly sent layoff notices to “at least 14” of its climate journalists, as part of a wider move from the newspaper’s billionaire owner, Jeff Bezos, to eliminate 300 jobs at the publication, claimed Climate Colored Goggles. After the layoffs, the newspaper will have five journalists left on its award-winning climate desk, according to the substack run by a former climate reporter at the Los Angeles Times. It comes after CBS News laid off most of its climate team in October, it added.

WIND UNBLOCKED: Elsewhere, a separate federal ruling said that a wind project off the coast of New York state can continue, which now means that “all five offshore wind projects halted by the Trump administration in December can resume construction”, said Reuters. Bloomberg added that “Ørsted said it has spent $7bn on the development, which is 45% complete”.

Around the world

- CHANGING TIDES: The EU is “mulling a new strategy” in climate diplomacy after struggling to gather support for “faster, more ambitious action to cut planet-heating emissions” at last year’s UN climate summit COP30, reported Reuters.

- FINANCE ‘CUT’: The UK government is planning to cut climate finance by more than a fifth, from £11.6bn over the past five years to £9bn in the next five, according to the Guardian.

- BIG PLANS: India’s 2026 budget included a new $2.2bn funding push for carbon capture technologies, reported Carbon Brief. The budget also outlined support for renewables and the mining and processing of critical minerals.

- MOROCCO FLOODS: More than 140,000 people have been evacuated in Morocco as “heavy rainfall and water releases from overfilled dams led to flooding”, reported the Associated Press.

- CASHFLOW: “Flawed” economic models used by governments and financial bodies “ignor[e] shocks from extreme weather and climate tipping points”, posing the risk of a “global financial crash”, according to a Carbon Tracker report covered by the Guardian.

- HEATING UP: The International Olympic Committee is discussing options to hold future winter games earlier in the year “because of the effects of warmer temperatures”, said the Associated Press.

54%

The increase in new solar capacity installed in Africa over 2024-25 – the continent’s fastest growth on record, according to a Global Solar Council report covered by Bloomberg.

Latest climate research

- Arctic warming significantly postpones the retreat of the Afro-Asian summer monsoon, worsening autumn rainfall | Environmental Research Letters

- “Positive” images of heatwaves reduce the impact of messages about extreme heat, according to a survey of 4,000 US adults | Environmental Communication

- Greenland’s “peripheral” glaciers are projected to lose nearly one-fifth of their total area and almost one-third of their total volume by 2100 under a low-emissions scenario | The Cryosphere

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

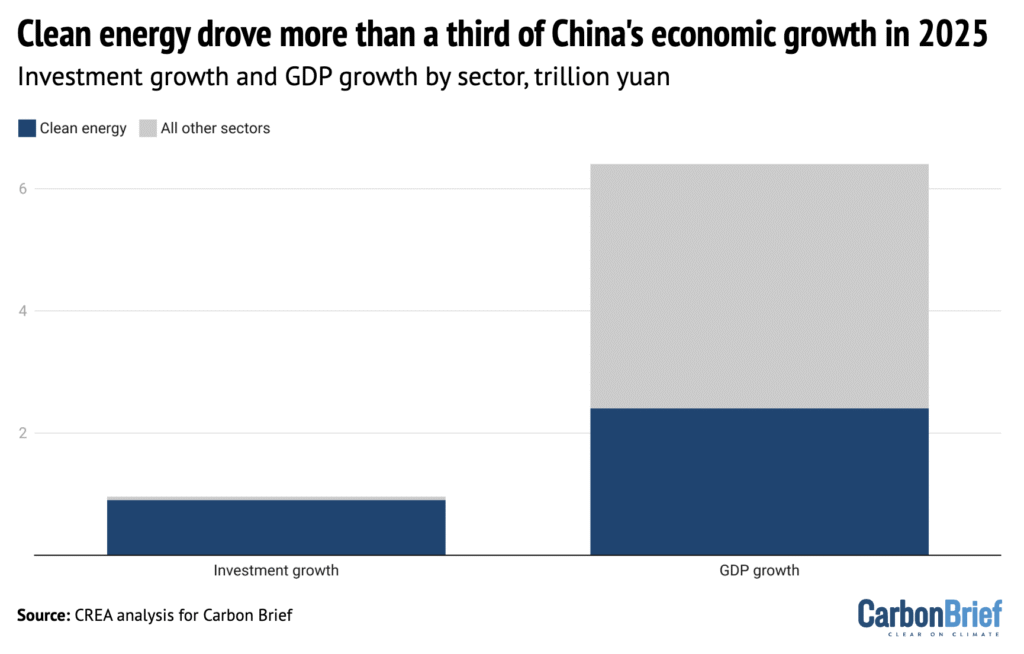

Solar power, electric vehicles and other clean-energy technologies drove more than a third of the growth in China’s economy in 2025 – and more than 90% of the rise in investment, according to new analysis for Carbon Brief (shown in blue above). Clean-energy sectors contributed a record 15.4tn yuan ($2.1tn) in 2025, some 11.4% of China’s gross domestic product (GDP) – comparable to the economies of Brazil or Canada, the analysis said.

Spotlight

Can humans reverse nature decline?

This week, Carbon Brief travelled to a UN event in Manchester, UK to speak to biodiversity scientists about the chances of reversing nature loss.

Officials from more than 150 countries arrived in Manchester this week to approve a new UN report on how nature underpins economic prosperity.

The meeting comes just four years before nations are due to meet a global target to halt and reverse biodiversity loss, agreed in 2022 under the landmark “Kunming-Montreal Global Biodiversity Framework” (GBF).

At the sidelines of the meeting, Carbon Brief spoke to a range of scientists about humanity’s chances of meeting the 2030 goal. Their answers have been edited for length and clarity.

Dr David Obura, ecologist and chair of Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES)

We can’t halt and reverse the decline of every ecosystem. But we can try to “bend the curve” or halt and reverse the drivers of decline. That’s the economic drivers, the indirect drivers and the values shifts we need to have. What the GBF aspires to do, in terms of halting and reversing biodiversity loss, we can put in place the enabling drivers for that by 2030, but we won’t be able to do it fast enough at this point to halt [the loss] of all ecosystems.

Dr Luthando Dziba, executive secretary of IPBES

Countries are due to report on progress by the end of February this year on their national strategies to the Convention on Biological Diversity [CBD]. Once we get that, coupled with a process that is ongoing within the CBD, which is called the global stocktake, I think that’s going to give insights on progress as to whether this is possible to achieve by 2030…Are we on the right trajectory? I think we are and hopefully we will continue to move towards the final destination of having halted biodiversity loss, but also of living in harmony with nature.

Prof Laura Pereira, scientist at the Global Change Institute at Wits University, South Africa

At the global level, I think it’s very unlikely that we’re going to achieve the overall goal of halting biodiversity loss by 2030. That being said, I think we will make substantial inroads towards achieving our longer term targets. There is a lot of hope, but we’ve also got to be very aware that we have not necessarily seen the transformative changes that are going to be needed to really reverse the impacts on biodiversity.

Dr David Cooper, chair of the UK’s Joint Nature Conservation Committee and former executive secretary of the Convention on Biological Diversity

It’s important to look at the GBF as a whole…I think it is possible to achieve those targets, or at least most of them, and to make substantial progress towards them. It is possible, still, to take action to put nature on a path to recovery. We’ll have to increasingly look at the drivers.

Prof Andrew Gonzalez, McGill University professor and co-chair of an IPBES biodiversity monitoring assessment

I think for many of the 23 targets across the GBF, it’s going to be challenging to hit those by 2030. I think we’re looking at a process that’s starting now in earnest as countries [implement steps and measure progress]…You have to align efforts for conserving nature, the economics of protecting nature [and] the social dimensions of that, and who benefits, whose rights are preserved and protected.

Neville Ash, director of the UN Environment Programme World Conservation Monitoring Centre

The ambitions in the 2030 targets are very high, so it’s going to be a stretch for many governments to make the actions necessary to achieve those targets, but even if we make all the actions in the next four years, it doesn’t mean we halt and reverse biodiversity loss by 2030. It means we put the action in place to enable that to happen in the future…The important thing at this stage is the urgent action to address the loss of biodiversity, with the result of that finding its way through by the ambition of 2050 of living in harmony with nature.

Prof Pam McElwee, Rutgers University professor and co-chair of an IPBES “nexus assessment” report

If you look at all of the available evidence, it’s pretty clear that we’re going to keep experiencing biodiversity decline. I mean, it’s fairly similar to the 1.5C climate target. We are not going to meet that either. But that doesn’t mean that you slow down the ambition…even though you recognise that we probably won’t meet that specific timebound target, that’s all the more reason to continue to do what we’re doing and, in fact, accelerate action.

Watch, read, listen

OIL IMPACTS: Gas flaring has risen in the Niger Delta since oil and gas major Shell sold its assets in the Nigerian “oil hub”, a Climate Home News investigation found.

LOW SNOW: The Washington Post explored how “climate change is making the Winter Olympics harder to host”.

CULTURE WARS: A Media Confidential podcast examined when climate coverage in the UK became “part of the culture wars”.

Coming up

- 2-8 February: 12th session of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES), Manchester, UK

- 8 February: Japanese general election

- 8 February: Portugal presidential election

- 11 February: Barbados general election

- 11-12 February: UN climate chief Simon Stiell due to speak in Istanbul, Turkey

Pick of the jobs

- UK Met Office, senior climate science communicator | Salary: £43,081-£46,728. Location: Exeter, UK

- Canadian Red Cross, programme officer, Indigenous operations – disaster risk reduction and climate change adaptation | Salary: $56,520-$60,053. Location: Manitoba, Canada

- Aldersgate Group, policy officer | Salary: £33,949-£39,253. Location: London (hybrid)

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 6 February 2026: US secret climate panel ‘unlawful’ | China’s clean energy boon | Can humans reverse nature loss? appeared first on Carbon Brief.

Climate Change

China Briefing 5 February 2026: Clean energy’s share of economy | Record renewables | Thawing relations with UK

Welcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

Solar and wind eclipsed coal

‘FIRST TIME IN HISTORY’: China’s total power capacity reached 3,890 gigawatts (GW) in 2025, according to a National Energy Administration (NEA) data release covered by industry news outlet International Energy Net. Of this, it said, solar capacity rose 35% to 1,200GW and wind capacity was up 23% to 640GW, while thermal capacity – which is mostly coal – grew 6% to just over 1,500GW. This marks the “first time in history” that wind and solar capacity has outranked coal capacity in China’s power mix, reported the state-run newspaper China Daily. China’s grid-related energy storage capacity exceeded 213GW in 2025, said state news agency Xinhua. Meanwhile, clean-energy industries “drove more than 90%” of investment growth and more than half of GDP growth last year, said the Guardian in its coverage of new analysis for Carbon Brief. (See more in the spotlight below.)

DAWN FOR SOLAR: Solar power capacity alone may outpace coal in 2026, according to projections by the China Electricity Council (CEC), reported business news outlet 21st Century Business Herald. It added that non-fossil sources could account for 63% of the power mix this year, with coal falling to 31%. Separately, the China Renewable Energy Society said that annual wind-power additions could grow by between 600-980GW over the next five years, with annual additions of 120GW expected until 2028, said industry news outlet China Energy Net. China Energy Net also published the full CEC report.

STATE MEDIA VOICE: Xinhua published several energy- and climate-related articles in a series on the 15th five-year plan. One said that becoming a low-carbon energy “powerhouse” will support decarbonisation efforts, strengthen industrial innovation and improve China’s “global competitive edge and standing”. Another stated that coal consumption is “expected” to peak around 2027, with continued “growth” in the power and chemicals sector, while oil has already peaked. A third noted that distributed energy systems better matched the “characteristics of renewable energy” than centralised ones, but warned against “blind” expansion and insufficient supporting infrastructure. Others in the series discussed biodiversity and environmental protection and recycling of clean-energy technology. Meanwhile, the communist party-affiliated People’s Daily said that oil will continue to play a “vital role” in China, even after demand peaks.

Starmer and Xi endorsed clean-energy cooperation

CLIMATE PARTNERSHIP: UK prime minister Keir Starmer and Chinese president Xi Jinping pledged in Beijing to deepen cooperation on “green energy”, reported finance news outlet Caixin. They also agreed to establish a “China-UK high-level climate and nature partnership”, said China Daily. Xi told Starmer that the two countries should “carry out joint research and industrial transformation” in new energy and low-carbon technologies, according to Xinhua. It also cited Xi as saying China “hopes” the UK will provide a “fair” business environment for Chinese companies.

-

Sign up to Carbon Brief’s free “China Briefing” email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

OCTOPUS OVERSEAS: During the visit, UK power-trading company Octopus Energy and Chinese energy services firm PCG Power announced they would be starting a new joint venture in China, named Bitong Energy, reported industry news outlet PV Magazine. The move “marks a notable direct entry” of a foreign company into China’s “tightly regulated electricity market”, said Caixin.

PUSH AND PULL: UK policymakers also visited Chinese clean-energy technology manufacturer Envision in Shanghai, reported finance news outlet Yicai. It quoted UK business secretary Peter Kyle emphasising that partnering with companies “like Envision” on sustainability is a “really important part of our future”, particularly in terms of job creation in the UK. Trade minister Chris Bryant told Radio Scotland Breakfast that the government will decide on Chinese wind turbine manufacturer Mingyang’s plans for a Scotland factory “soon”. Researchers at the thinktank Oxford Institute for Energy Studies wrote in a guest post for Carbon Brief that greater Chinese competition in Europe’s wind market could “help spur competition in Europe”, if localisation rules and “other guardrails” are applied.

More China news

- LIFE SUPPORT: China will update its coal capacity payment mechanism, which will raise thresholds for coal-fired power plants and expand to cover gas-fired power and pumped and new-energy storage, reported current affairs outlet China News.

- FRONTIER TECH: The world’s “largest compressed-air power storage plant” has begun operating in China, said Bloomberg.

- PARTNERSHIP A ‘MISTAKE’: The EU launched a “foreign subsidies” probe into Chinese wind turbine company Goldwind, said the Hong Kong-based South China Morning Post. EU climate chief Wopke Hoekstra said the bloc must resist China’s pull in clean technologies, according to Bloomberg.

- TRADE SPAT: The World Trade Organization “backed a complaint by China” that the US Inflation Reduction Act “discriminated against” Chinese cleantech exports, said Reuters.

- NEW RULES: China has set “new regulations” for the Waliguan Baseline Observatory, which provides “key scientific references for the United Nations Framework Convention on Climate Change”, said the People’s Daily.

Captured

New or reactivated proposals for coal-fired power plants in China totalled 161GW in 2025, according to a new report covered by Carbon Brief.

Spotlight

Clean energy drove China’s economic growth in 2025

New analysis for Carbon Brief finds that clean-energy sectors contributed the equivalent of $2.1tn to China’s economy last year, making it a key driver of growth. However, headwinds in 2026 could restrict growth going forward – especially for the solar sector.

Below is an excerpt from the article, which can be read in full on Carbon Brief’s website.

Solar power, electric vehicles (EVs) and other clean-energy technologies drove more than a third of the growth in China’s economy in 2025 – and more than 90% of the rise in investment.

Clean-energy sectors contributed a record 15.4tn yuan ($2.1tn) in 2025, some 11.4% of China’s gross domestic product (GDP)

Analysis shows that China’s clean-energy sectors nearly doubled in real value between 2022-25 and – if they were a country – would now be the 8th-largest economy in the world.

These investments in clean-energy manufacturing represent a large bet on the energy transition in China and overseas, creating an incentive for the government and enterprises to keep the boom going.

However, there is uncertainty about what will happen this year and beyond, particularly due to a new pricing system, worsening industrial “overcapacity” and trade tensions.

Outperforming the wider economy

China’s clean-energy economy continues to grow far more quickly than the wider economy, making an outsized contribution to annual growth.

Without these sectors, China’s GDP would have expanded by 3.5% in 2025 instead of the reported 5.0%, missing the target of “around 5%” growth by a wide margin.

Clean energy made a crucial contribution during a challenging year, when promoting economic growth was the foremost aim for policymakers.

In 2024, EVs and solar had been the largest growth drivers. In 2025, it was EVs and batteries, which delivered 44% of the economic impact and more than half of the growth of the clean-energy industries.

The next largest subsector was clean-power generation, transmission and storage, which made up 40% of the contribution to GDP and 30% of the growth in 2025.

Within the electricity sector, the largest drivers were growth in investment in wind and solar power generation capacity, along with growth in power output from solar and wind, followed by the exports of solar-power equipment and materials.

But investment in solar-panel supply chains, a major growth driver in 2022-23, continued to fall for the second year, as the government made efforts to rein in overcapacity and “irrational” price competition.

Headwinds for solar

Ongoing investment of hundreds of billions of dollars represents a gigantic bet on a continuing global energy transition.

However, developments next year and beyond are unclear, particularly for solar. A new pricing system for renewable power is creating uncertainty, while central government targets have been set far below current rates of clean-electricity additions.

Investment in solar-power generation and solar manufacturing declined in the second half of the year.

The reduction in the prices of clean-energy technology has been so dramatic that when the prices for GDP statistics are updated, the sectors’ contribution to real GDP – adjusted for inflation or, in this case deflation – will be revised down.

Nevertheless, the key economic role of the industry creates a strong motivation to keep the clean-energy boom going. A slowdown in the domestic market could also undermine efforts to stem overcapacity and inflame trade tensions by increasing pressure on exports to absorb supply.

Local governments and state-owned enterprises will also influence the outlook for the sector.

Provincial governments have a lot of leeway in implementing the new electricity markets and contracting systems for renewable power generation. The new five-year plans, to be published this year, will, therefore, be of major importance.

This spotlight was written for Carbon Brief by Lauri Myllyvirta, lead analyst at Centre for Research on Energy and Clean Air (CREA), and Belinda Schaepe, China policy analyst at CREA. CREA China analysts Qi Qin and Chengcheng Qiu contributed research.

Watch, read, listen

PROVINCE INFLUENCE: The Institute for Global Decarbonization Progress, a Beijing-based thinktank, published a report examining the climate-related statements in provincial recommendations for the 15th five-year plan.

‘PIVOT’?: The Outrage + Optimism podcast spoke with the University of Bath’s Dr Yixian Sun about whether China sees itself as a climate leader and what its role in climate negotiations could be going forward.

COOKING FOR CLEAN-TECH: Caixin covered rising demand for China’s “gutter oil” as companies “scramble” to decarbonise.

DON’T GO IT ALONE: China News broadcast the Chinese foreign ministry’s response to the withdrawal of the US from the Paris Agreement, with spokeswoman Mao Ning saying “no country can remain unaffected” by climate change.

$6.8tn

The current size of China’s green-finance economy, including loans, bonds and equity, according to Dr Ma Jun, the Institute of Finance and Sustainability’s president,in a report launch event attended by Carbon Brief. Dr Ma added that “green loans” make up 16% of all loans in China, with some areas seeing them take a 34% share.

New science

- China’s official emissions inventories have overestimated its hydrofluorocarbon emissions by an average of 117m tonnes of carbon dioxide equivalent (mtCO2e) every year since 2017 | Nature Geoscience

- “Intensified forest management efforts” in China from 2010 onwards have been linked to an acceleration in carbon absorption by plants and soils | Communications Earth and Environment

Recently published on WeChat

China Briefing is written by Anika Patel and edited by Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 5 February 2026: Clean energy’s share of economy | Record renewables | Thawing relations with UK appeared first on Carbon Brief.

Climate Change

Congress rescues aid budget from Trump’s “evisceration” but climate misses out

Under pressure from Congress, President Donald Trump quietly signed into law a funding package that provides billions of dollars more in foreign assistance spending than he had originally wanted to for the fiscal year between October 2025 and September 2026.

The legislation allocates $50 billion, $9 billion less than the level agreed the previous year under President Biden but $19 billion more than Trump proposed, restoring health and humanitarian aid spending to near pre-Trump levels.

Democratic Senator Patty Murray, vice-chair of the committee on appropriations, said that “while including some programmatic funding cuts, the bill rejects the Trump administration’s evisceration of US foreign assistance programmes”.

But, with climate a divisive issue in the US, spending on dedicated climate programmes was largely absent. Clarence Edwards, executive director of E3G’s US office, told Climate Home News that “the era of large US government investment in climate policy is over, at least for the foreseeable future”.

The package ruled out any support for the Climate Investment Funds’ Clean Technology Fund, which supports low-carbon technologies in developing countries and had received $150 million from the US in the previous fiscal year.

The US also made no pledge to the Africa Development Fund (ADF) – a mechanism run by the African Development Bank that provides grants and low-interest loans to the poorest African nations. A government spokesperson told Reuters that decision reflected concerns that “like too many other institutions, the ADF has adopted a disproportionate focus on climate change, gender, and social issues”.

GEF spared from cuts

Trump did, however, agree to Congress’s request to make $150 million – more than last year – available for the Global Environment Facility (GEF), which tackles environmental issues like biodiversity loss, land degradation and climate change.

Edwards said that GEF funding “survived due to Congressional pushback and a refocus on non-climate priorities like biodiversity, plastics and ocean ecosystems, per US Treasury guidance”.

Congress also pressured Trump into giving $54 million to the Rome-based International Fund for Agricultural Development. Its goals include helping small-scale farmers adapt to climate change and reduce emissions.

Without any pressure from Congress, Trump approved tens of millions of dollars each for multilateral development banks in Asia, Africa and Europe and just over a billion dollars for the World Bank’s International Development Association, which funds development projects in the world’s poorest countries.

As most of these banks have climate programmes and goals, much of this money is likely to be spent on climate action. The largest lender, the World Bank, aims to devote 45% of its finance to climate programmes, although, as Climate Home News has reported, its definition of climate spending is considered too loose by some analysts.

The bill also earmarks $830 million – nearly triple what Trump originally wanted – for the Millennium Challenge Corporation, a George W. Bush-era institution that has increasingly backed climate-focussed projects like transmission lines to bring clean hydropower to cities in Nepal.

No funding boost for DFC

While Congress largely increased spending, it rejected Trump’s call for nearly $4 billion for the Development Finance Corporation (DFC), granting just under $1 billion instead – similar to previous years.

Under Biden, there had been a push to get the DFC to support clean energy projects. But the Trump administration ended DFC’s support for projects like South Africa’s clean energy transition.

At a recent board meeting, the DFC’s board – now dominated by Trump administration officials – approved US financial support for Chevron Mediterranean Limited, the developers of an Israeli gas field.

Kate DeAngelis, deputy director at Friends of the Earth US told Climate Home News it was good for the climate that Trump had not been able to boost the DFC’s budget. “DFC seems set up to focus mainly on the dirtiest deals without any focus on development,” she said.

US Congressional elections in November could lead to Democrats retaking control of one or both houses of Congress. Edwards said that “Democratic gains might restore funding [in the next fiscal year], while Republican holds would likely extend cuts”.

But he warned that “budgetary pressures and a murky economic environment don’t hold promise of increases in US funding for foreign assistance and climate programs, regardless of which party controls Congress”.

The post Congress rescues aid budget from Trump’s “evisceration” but climate misses out appeared first on Climate Home News.

Congress rescues aid budget from Trump’s “evisceration” but climate misses out

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Renewable Energy2 years ago

GAF Energy Completes Construction of Second Manufacturing Facility