Welcome to Carbon Brief’s China Briefing.

Carbon Brief handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

China’s top climate negotiator interviewed

COAL STANCE: China News Weekly recently interviewed Su Wei, China’s lead climate negotiator, about China’s stance at COP28 and its energy transition. Su affirmed China’s position on fossil fuels, saying that it is “impossible to completely phase out fossil fuels, given limitations of the resources China possesses”. He argued that countries did not have to “be utterly opposed” to fossil fuels as long as the central question of emissions is solved, through technologies such as carbon capture, utilisation and storage (CCUS). Substituting fossil fuels with renewable energy should follow the principle of “establish [new rules] before breaking [old ones]”, he added. This means a “process” needs to be followed – namely, after “large-scale development” of renewable energy and non-fossil fuel energy, “coal power will be gradually reduced and the proportion of coal stock will also decline”.

DEVELOPED VS DEVELOPING: Su also highlighted the role of developed countries as a key debate at COP28. He described the current international environment as the “biggest challenge to realising the goal of tripling renewable energy capacity globally”, with some developed countries imposing tariffs on or launching investigations into Chinese products. He also criticised developed countries’ failure to provide the $100bn in climate finance they committed to in 2009, describing it as a “muddled account”.

US-CHINA OPTIMISM: Nevertheless, Su was relatively optimistic about the potential for US-China climate cooperation. He raised how US-China alignment at COP28 “made an important contribution” to its success, with the Sunnylands statement jointly released by the two countries allowing them to “propose wording for the text and help[ing] to unlock difficult issues in the negotiation”. Climate change, Su said, “remains one of the few positive elements that China and the US can mobilise to promote the stable development of their relationship”, allowing the two countries to “talk” despite other tensions. (In a recent issue of the Pekingnology newsletter, noted international relations scholar Da Wei concurred, saying the US and China “have some agreements on the climate change issue”. He added: “I believe that the two sides will declare more on climate change in the following months.”)

China ‘needs 324tn yuan’ to meet climate goals

‘ENORMOUS AMOUNT’: China needs to “spend about 324tn yuan” ($45.5tn), which is equal to 2.7 times its 2022 GDP, between 2021 and 2060 to achieve its goals of peaking carbon emissions by 2030 and reaching carbon neutrality by 2060, reported state-run newspaper the China Daily. The figures were included in China’s fourth national communication on climate change, which was submitted to the United Nations Framework Convention on Climate Change in December 2023. China “will need to spend far more to reach carbon neutrality than to achieve carbon peaking”, the document added. China’s previous national communication was submitted more than four years ago in 2019.

GROWING INVESTMENT: Meanwhile, China’s annual national economic work conference – held in December 2023 – announced “promotion of…green and low-carbon development” as one of nine key economic tasks in 2024, with “green” development becoming the “driving force for China’s high-quality development”, according to China News. The 2024 national energy work conference, also held in December, established that China aims to build 200 gigawatts (GW) of wind and solar capacity in 2024, as well as 5GW of nuclear energy, the newspaper added. China5E reported that China’s top economic planner, the national development and reform commission (NDRC) said in its first meeting of 2024 that it would develop “tangible policies” to attract private capital to invest in nuclear power and other major energy projects, as well as environmental protection schemes. Investment in renewable energy in China “seems increasingly to be driven by the profit motive”, a Financial Times editorial argued, adding that this trend is accelerated by increasing adoption of “cleantech” by China’s state-owned enterprises.

MARKET FORCES: China is also developing financial platforms to boost “green” and low-carbon investment in the new year. On 2 January, it launched a stock index to encourage “investment products that grant greater weightings for sectors such as renewables”, reported the Financial Times. Meanwhile, should China’s voluntary carbon market, the China Certified Emissions Reduction (CCER) program, relaunch this year, it could encourage finance to flow to projects that, together, could reduce carbon emissions by tens or even hundreds of millions of tonnes, Jiemian noted.

Updated industry guidelines to ‘encourage green tech’

INDUSTRY CATALOGUE: China’s top economic planner, the national development and reform commission (NDRC), released an updated 2024 version of its catalogue for guiding industry restructuring, designed to “promote high-end, intelligent and green manufacturing”, Xinhua reported. The catalogue divides industries into three categories: encouraged; restricted; and eliminated, reported China Environment. The “restricted” category refers to technologies, equipment and products that, among other things, “are not conducive to the realisation of the goals of carbon peaking and carbon neutrality”, it explained. The “eliminated” category contains technologies that “seriously waste resources, cause pollution…[or] impede the realisation of the goals of carbon peaking and carbon neutrality”, the outlet added. China Environment also reported that the catalogue said it would “encourage green technology innovation and the development of green environmental protection industry, promote energy saving…and resolutely curb the blind development of high-energy-consuming, high-emission and low-level projects”. (The phrase on curbing “blind development” has been in use for several years.)

NEW ADDITIONS: The “encouraged” category adds a “detailed explanation of carbon capture and application”, reported BJX News. The category also adds “green” hydrogen produced by electrolysis of water and synthesis of “green methanol” from carbon dioxide, as well as new solar materials for use in the construction industry, reported the news outlet. The “restricted” category has raised and added limitations for the power sector, such as new coal power units that cannot meet “ultra-low emission” requirements, said the report. Under the “elimination” category, thermal power plants will be phased out in accordance with the principle of “establish first, then modify” (先立后改) with plants eliminated “in an orderly manner, in accordance with an “annual phase-out plan”, added the report. The least efficient coal-fired boilers will be phased out in air pollution priority areas, the outlet added.

OFFICIAL REACTION: Officials from the NDRC told Jiemian that the new edition of the catalogue aims to promote “high-end, intelligent, and green manufacturing industry” in China, they added. The updated catalogue “will encourage green technology innovation and the development of green environmental protection industries, promote energy conservation, carbon reduction and green transformation in key areas”, they told the outlet.

BYD surpassed Tesla, claiming the top spot in EV sales

BYD VS TESLA: Chinese firm BYD’s sales of battery-only vehicles “outpaced” its US rival Tesla in the final quarter of 2023 for the first time, according to BBC News. BYD sold 526,000 units while Tesla delivered 484,000 units. However, for the whole of 2023, Tesla still sold more with 1.8m compared to nearly 1.6m for BYD, the broadcaster added.

SUCCESS STORY: CNN said that China’s fast transition to electric vehicles (EVs) is “thanks to strong government support”. The article quoted analysts from investment bank Natixis Asia saying “first-mover advantage and government support through infrastructure investment and subsidies have made it easy for Chinese EV makers to expand domestically and internationally”. (Consultant David Fishman noted on Twitter that domestic EV sales grew by 36% in 2023, “despite the end of the supporting subsidies”.) According to Bernstein research, “BYD batteries are among the lowest cost in the world”, reported the Financial Times. Michael Dunne, chief executive of Asia-focused car consultancy Dunne Insights, told the FT: “No one can match BYD on price. Period.” In his Bloomberg column, David Fickling attributed BYD’s edge to its in-house battery supply chain and cheaper cells. “More importantly”, he said, “on almost every financial metric, [BYD] is either advancing on, or overtaking [Tesla] — with its gaze already set on the wider car industry.”

FORECAST FOR 2024: Looking ahead to this year, S&P Global Mobility predicted battery electric vehicles (BEVs) sales would reach 13.3m units globally in 2024, accounting for 16.2% of total global passenger vehicle sales, with China’s BEV sales growing 28.6% year-on-year. BloombergNEF’s outlook forecast a milestone will be achieved by the end of 2024 – it will see the first quarter in which consumers buy more than five million electric or plug-in hybrid vehicles, with China being the main contributor.

Spotlight

What to watch in 2024

In 2023, several significant energy and climate stories came out of China. Global carbon dioxide (CO2) emissions rose, driven by increases in China, but analysis for Carbon Brief found that renewable energy growth could cause a “structural decline” of emissions from 2024. New coal “capacity payments” continue policy support for the fuel.

Meanwhile, the US and China issued the Sunnylands statement, which signalled a turning point in bilateral relations and played a part in theCOP28 outcome.

For the first China Briefing of 2024, Carbon Brief asks leading experts what they are watching for in China in the year ahead. Responses have been edited for length and clarity.

Joanna Lewis, provost’s distinguished associate professor of energy and environment, and director of the science, technology and international affairs program, Georgetown University:

The key thing I will be watching is the development of China’s new nationally determined contribution (NDC) and associated 2035 climate goals. Given the Sunnylands statement and COP28 decisions, we can expect that China’s next NDC will include the country’s first economy-wide target covering all greenhouse gases. As China’s emissions are slated to peak before 2030, it will also likely be China’s first absolute emissions target.

Beyond the NDC, I will also be watching China’s coal consumption. While consumption increased in 2023, many predict a slowing in 2024 and possible peaking by 2025 (or earlier). So watching trends over the coming year may signal what is to come. Also important to determining coal trends will be the rate of renewable energy growth. With an estimated 230GW of new wind and solar power installed in China last year – twice that of the US and Europe combined – and major advances in energy storage that are helping address the curtailment issue, China’s renewables sector is poised for continued rapid growth, which can help offset the demand for coal in the power sector.

David Fishman, senior manager, the Lantau Group:

China spent 2023 implementing incremental reforms to its power sector and energy policy – still trending in the right direction for power market decarbonisation and liberalisation, but taking smaller steps than in the previous few years. This is a return to normalcy for China, which has typically adopted a measured approach to policy reforms: preferring to make small changes and observe the outcomes of limited pilots, rather than big changes all at once.

I expect 2024 to be more of the same, with spot-trading in the power exchanges becoming more common and renewable consumption quotas expanding to more sectors. At the same time, the surging growth in renewable capacity, especially from desert mega-bases, should allow renewable generation growth to exceed power consumption growth. This will cap coal consumption in the power sector and send China’s carbon emissions into long-term structural decline from 2024 onward.

Ryna Cui, research director, Center for Global Sustainability, University of Maryland:

It is crucial to watch how coal plants will be utilised in the power system, whether as expected to back up an increasing share of intermittent renewables or to continue as “baseload” generation, where the emissions impact can be significant. It is also critical to watch whether and how China moves from a continued preference for coal to other solutions for grid stabilisation, such as cross-region grid balancing, demand-side management, battery and other storage technologies.

Methane is an emerging area that is finally receiving the policy attention it requires – both in China and globally. China’s methane action plan is the first published national policy targeting methane as a greenhouse gas (GHG). The document is brief, setting up overall guidelines and main task areas. So it is important to watch how more detailed policies and targets will continue to develop.

Internationally, the US-China Sunnylands statement set up the expectation for the next round of NDCs to cover all GHGs and all economic sectors. It will be exciting to watch how Sunnylands and the previous joint Glasgow declaration will be implemented.

Yan Qin, lead carbon analyst at the London Stock Exchange Group:

This will be an exciting year for China’s national carbon market and the newly relaunched offset market. The national emissions trading scheme (ETS) has just completed its second compliance period, with allowance prices rising to as high as 80 yuan per tonne ($11.25/t) due to tightening of benchmarks.

The scheme will see more progress this year, both on the regulatory side, with the newly released state council regulation on national carbon trading, and on the expansion to more industry sectors, with the first new batch possibly including the cement and aluminium sectors. We might also see more clarity on the role of the carbon market in China’s “dual carbon” targets against the backdrop of moving from energy dual control to carbon dual control. The revamped China Certified Emissions Reduction (CCER) offset market will also see issuance of new credits resume this year.

Tu Le, founder and managing director, Sino Auto Insights:

It was another record year for “new energy vehicle” (NEV, mainly electric vehicle) sales in China, largely on the back of a serious price war ignited by Tesla in January 2023. I’ll be watching to see whether the market can keep it up – and who will blink first this year. Will there continue to be foreign direct investment by Chinese electric vehicle and battery companies outside of China and, if so, where?

Chinese automakers exported a record number of vehicles in 2023, catching many observers’ attention. With the Inflation Reduction Act making the US market unattractive for now, the EU is the most attractive major market to Chinese EV firms. EU automakers will also begin shipping Chinese-built vehicles to their home markets. How the EU will ultimately react to this – and the growth of Chinese EV exports more widely – remains uncertain.

Watch, read, listen

BIG READ: China submitted its fourth national communication on climate change to the UNFCCC in December 2023 – the first since June 2019 – with sections on China’s greenhouse gas emissions by sector, “key objectives” and financial needs.

DE-RISKING RISKS: Henry Sanderson argued in Foreign Affairs that western countries must prioritise in order to compete with China on “clean energy” technologies.

WASTE UNREST: The New Books in East Asian Studies podcast interviewed Dr Jean Yen-chun Lin on research into environmental protests against waste incineration in Beijing.

CLIMATE ADAPTATION: China and Africa will “jointly promote climate resilience”, ministry of ecology and environment minister Huang Runqiu said in remarks, recently posted on YouTube, made at the September 2023 Africa Climate Summit.

New science

Hotter days, dirtier air: The impact of extreme heat on energy and pollution intensity in China

Energy Economics

Researchers have identified a “causal impact from ‘local temperature shocks’ on pollution intensity” in China between 2008 and 2017, finding that extreme heat increases energy demand, diminishes energy efficiency and increases consumption of coal, which leads to a rise in pollution intensity. The researchers said that this shows that extreme weather caused by climate change “will perpetuate an adverse impact on pollution intensity” across China.

Methane mitigation potentials and related costs of China’s coal mines

Fundamental Research

A new study estimated that “through continuous coal cuts and available…mitigation measures, China’s [coal mine methane] emissions can be reduced by 65%-78% [from 2021 levels] in 2060”. The study also found that methane emissions from abandoned coal mines “will far exceed those from coal mining under the 2060 carbon-neutral scenario, especially in northeastern China”. While coal mine methane mitigation may not currently be economically feasible, it added, it could become “the most cost-effective solution as [carbon dioxide] prices increase”.

Who is most affected by carbon tax? Evidence from Chinese residents in the context of ageing

Energy Policy

New research has discovered “significant differences” in the rate by which different age groups in China are affected by carbon taxation, with the “vulnerable elderly” being particularly affected. The results show that the “indirect carbon payment burden rate on the elderly…is 1.2 times that of the general population”, with low-income seniors facing a slightly higher than average rate at 1.4 times that of the general population.

China Briefing is compiled by Anika Patel and edited by Wanyuan Song and Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 11 January: Expectations for 2024; Top climate negotiator interviewed; NDRC promotes ‘green’ industry appeared first on Carbon Brief.

Climate Change

Analysis: Half of nations meet UN deadline for nature-loss reporting

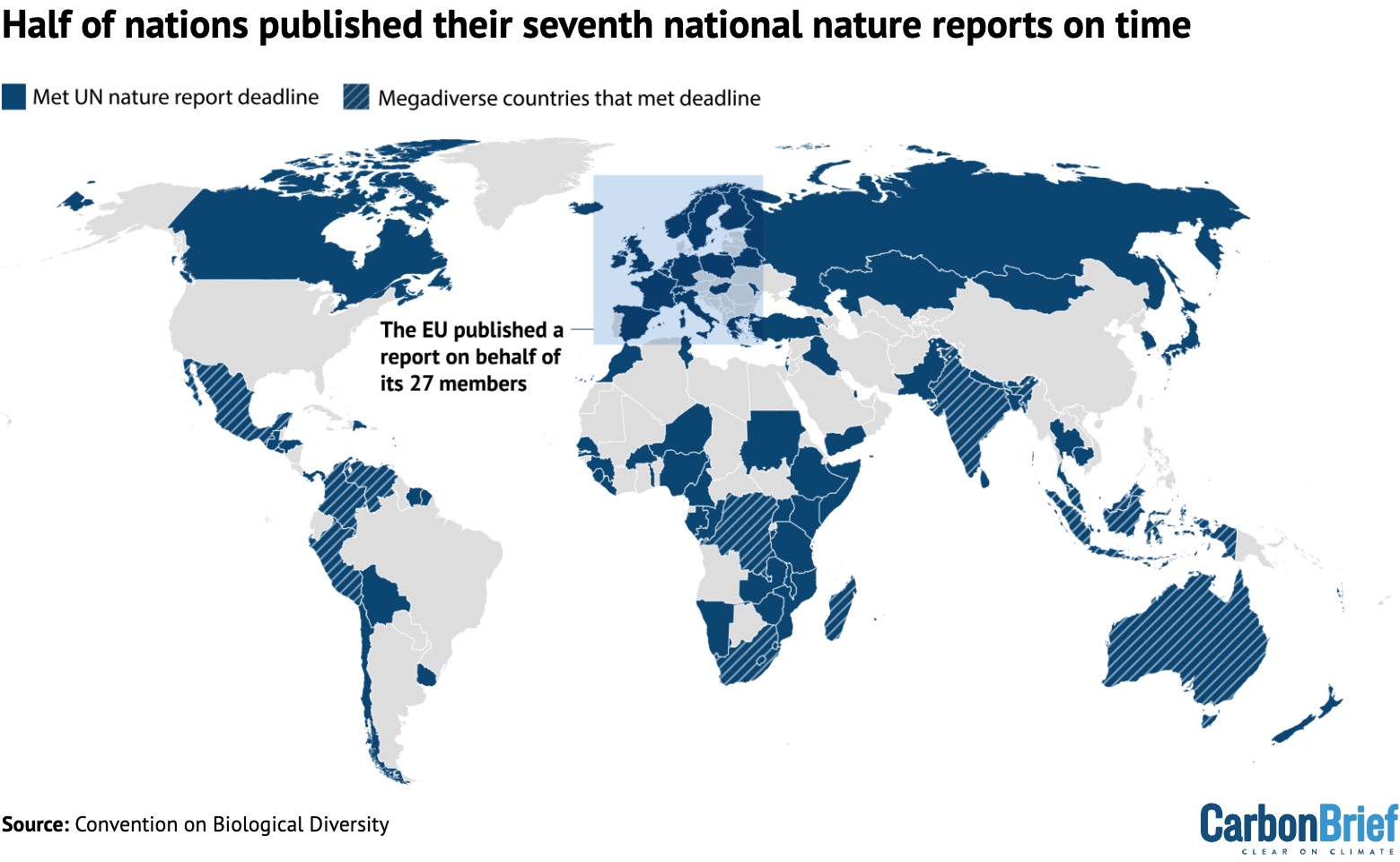

Half of nations have met a UN deadline to report on how they are tackling nature loss within their borders, Carbon Brief analysis shows.

This includes 11 of the 17 “megadiverse nations”, countries that account for 70% of Earth’s biodiversity.

It also includes all of the G7 nations apart from the US, which is not part of the world’s nature treaty.

All 196 countries that are part of the UN biodiversity treaty were due to submit their seventh “national reports” by 28 February, of which 98 have done so.

Their submissions are supposed to provide key information for an upcoming global report on actions to halt and reverse biodiversity loss by 2030, in addition to a global review of progress due to be conducted by countries at the COP17 nature summit in Armenia in October this year.

At biodiversity talks in Rome in February, UN officials said that national reports submitted late will not be included in the global report due to a lack of time, but could still be considered in the global review.

Tracking nature action

In 2022, nations signed a landmark deal to halt and reverse nature loss by 2030, known as the “Kunming-Montreal Global Biodiversity Framework” (GBF).

In an effort to make sure countries take action at the domestic level, the GBF included an “implementation schedule”, involving the publishing of new national plans in 2024 and new national reports in 2026.

The two sets of documents were to inform both a global report and a global review, to be conducted by countries at COP17 in Armenia later this year. (This schedule mirrors the one set out for tackling climate change under the Paris Agreement.)

The deadline for nations’ seventh national reports, which contain information on their progress towards meeting the 23 targets of the GBF based on a set of key indicators, was 28 February 2026.

According to Carbon Brief’s analysis of the UN Convention on Biological Diversity’s online reporting platform, 98 out of the 196 countries that are part of the nature convention (50%) submitted on time.

The map below shows countries that submitted their seventh national reports by the UN’s deadline.

This includes 11 of the 17 “megadiverse nations” that account for 70% of Earth’s biodiversity.

The megadiverse nations to meet the deadline were India, Venezuela, Indonesia, Madagascar, Peru, Malaysia, South Africa, Colombia, Mexico, the Democratic Republic of the Congo and Australia.

It also includes all of the G7 nations (France, Germany, the UK, Japan, Italy and Canada), excluding the US, which has never ratified the Convention on Biological Diversity.

The UK’s seventh national report shows that it is currently on track to meet just three of the GBF’s 23 targets.

This is according to a LinkedIn post from Dr David Cooper, former executive secretary of the CBD and current chair of the UK’s Joint Nature Conservation Committee, which coordinated the UK’s seventh national report,

The report shows the UK is not on track to meet one of the headline targets of the GBF, which is to protect 30% of land and sea for nature by 2030.

It reports that the proportion of land protected for nature is 7% in England, 18% in Scotland and 9% in Northern Ireland. (The figure is not given for Wales.)

National plans

In addition to the national reports, the upcoming global report and review will draw on countries’ national plans.

Countries were meant to have submitted their new national plans, known as “national biodiversity strategies and action plans” (NBSAPs), by the start of COP16 in October 2024.

A joint investigation by Carbon Brief and the Guardian found that only 15% of member countries met that deadline.

Since then, the percentage of countries that have submitted a new NBSAP has risen to 39%.

According to the GBF and its underlying documents, countries that were “not in a position” to meet the deadline to submit NBSAPs ahead of COP16 were requested to instead submit national targets. These submissions simply list biodiversity targets that countries will aim for, without an accompanying plan for how they will be achieved.

As of 2 March, 78% of nations had submitted national targets.

At biodiversity talks in Rome in February, UN officials said that national reports submitted late will not be included in the global report due to a lack of time, but could still be considered in the global review.

Funding ‘delays’

At the Rome talks, some countries raised that they had faced “difficulties in submitting [their national reports] on time”, according to the Earth Negotiations Bulletin.

Speaking on behalf of “many” countries, Fiji said that there had been “technical and financial constraints faced by parties” in the preparation of their seventh national reports.

In a statement to Carbon Brief, a spokesperson for the Global Environment Facility, the body in charge of providing financial and technical assistance to countries for the preparation of their national reports, said “delays in fund disbursement have occurred in some cases”, adding:

“In 2023, the GEF council approved support for the development of NBSAPs and the seventh national reports for all 139 eligible countries that requested assistance. This includes national grants of up to $450,000 per country and $6m in global technical assistance delivered through the UN Development Programme and UN Environment Programme.

“As of the end of January 2026, all 139 participating countries had benefited from technical assistance and 93% had accessed their national grants, with 11 countries yet to receive their funds. Delays in fund disbursement have occurred in some cases, compounded by procurement challenges and limited availability of technical expertise.”

The spokesperson added that the fund will “continue to engage closely with agencies and countries to support timely completion of NBSAPs and the seventh national reports”.

The post Analysis: Half of nations meet UN deadline for nature-loss reporting appeared first on Carbon Brief.

Analysis: Half of nations meet UN deadline for nature-loss reporting

Climate Change

Dow Asks Texas to Legalize Plastic Pollution from its Seadrift Complex

Facing multiple lawsuits, Dow requests an “unprecedented” permit amendment to authorize its discharge of polyethylene pellets into coastal waters.

Two weeks ago, when Texas sued a massive Dow petrochemical plant over water pollution, state environmental regulators were already considering a novel proposal from the company that would effectively legalize discharges of plastic material from the 4,700–acre complex into waters feeding San Antonio Bay and the Gulf of Mexico.

Dow Asks Texas to Legalize Plastic Pollution from its Seadrift Complex

Climate Change

Why Electricity Bills Are So High—and How the Blowback Could Hit Trump

As Democrats and climate activists seize on energy costs as a political issue, new data shows electricity rates rose 5 percent nationwide in 2025. The figures were much higher in some states.

COLUMBUS, Ohio—Protestors stood in the snow outside the offices of Ohio’s utility regulator in January to say they were fed up with rising electricity rates.

Why Electricity Bills Are So High—and How the Blowback Could Hit Trump

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits