Call to triple adaptation finance

At COP26 four years ago, governments agreed to “urge” developed countries to double finance for adapting to climate change up to around $40 billion a year by 2025.

That goal ends this year, although we will not know until 2027 if it has been met. But at a press conference in Bonn this afternoon, the Least Developed Countries group chair Evan Njewa called for a successor goal – tripling adaptation finance by 2030 on 2022 levels. “Adaptation is a lifeline,” he explained.

Other developing countries are likely to back this. Grupo Sur and the Like-Minded Developing countries have made the same call in different negotiating rooms and Njewa said he was sure that the small islands group AOSIS would back it too.

“We’re never going to say no to adaptation finance,” AOSIS finance negotiator Thibyan Ibrahim told Climate Home in Bonn. But he noted that even tripling “does little to close the adaptation finance gap”. The UN estimates that developing countries need $160-340 billion a year by 2030, whereas tripling on 2022 levels would bring in just under $100 billion.

Last year in Baku, developed governments would not agree to having a sub-goal on adaptation in the wider $300-billion-by-2035 finance goal and it’s not currently clear which negotiating track a new adaptation goal could be included in.

The doubling-by-2025 goal was in the COP26 cover decision – a stand-alone declaration all governments agree to – but the COP30 Presidency has said it does not want a cover decision.

It would fit in the Baku to Belem roadmap to $1.3 trillion or the Global Goal on Adaptation. But the roadmap is not an official negotiated UN agreement – so may not be followed up on – and developed-country governments have been resisting financial indicators in the Global Goal on Adaptation.

Meanwhile outside the world of UN climate talks, a recent CARE report showed that adaptation finance is likely to fall by 10% in 2026. France, Germany, the Netherlands and particularly the UK are set to make big cuts between 2025 and 2026.

The US is giving nothing in either 2025 or 2026. Commenting on US climate finance cuts generally, Njewa said he expects “someone somewhere to rise up and fill in the gap that that party has left”.

From Bonn to Nairobi?

Denouncing the visa problems faced by some developing country delegates heading to Bonn, more than 200 climate campaign groups made a joint call yesterday for governments to consider whether Germany should remain the default host for the mid-year climate talks.

Chanting “no borders, no nations, no visa applications”, a dozen campaigners gathered outside the conference centre on Tuesday morning, holding up a banner calling to move the annual talks to “visa-friendly countries”.

With many of those affected by the perennial issue unable to protest themselves, the demonstrators played a voice note from Roaa Alobeid, a young Sudanese climate activist who spoke movingly at COP28 about the war in her country.

She said she had gone to great lengths to get a visa for the Schengen area, which includes Germany, making an appointment, submitting 15 documents – including five letters of support and a bank statement – but was still rejected.

“I’m not there. I will never be there”, she said. “Why? I’m not worth it?” “We shouldn’t be left behind when we are the ones impacted.”

Cameroonian activist Zoneziwoh Mbondgulo-Wondieh did make it, but told the protest her one-year-old daughter had been refused a visa for being too young. She asked why Germany would implicitly tell a nursing mother they must stay at home and not work abroad.

When Climate Home questioned the German foreign office on this issue last year, a spokesperson said it was important to the government that all delegates could attend but there are legal requirements for getting a visa for the EU’s Schengen zone of free movement.

Rachitaa Gupta, head of the Global Campaign to Demand Climate Justice, said it would be better to hold the annual mid-year talks somewhere like Nairobi or Bangkok – where UN facilities already exist and visas are easier to obtain. Holding the meetings in the Global South would also be cheaper, Gupta added.

Climate finance on the rise – mostly for the rich

New figures out today paint a fairly positive picture of global climate finance, showing it climbed to a record $1.9 trillion in 2023, more than tripling over six years.

Climate Policy Initiative (CPI), which compiles the data, said that at the current rate of growth, the world could deliver $6 trillion in annual climate investment – the most conservative estimate of needs – by 2028.

Private-sector funding rose above $1 trillion for the first time in 2023, driven by household spending on electric vehicles, solar and energy-efficient housing – with clean energy in advanced economies and China receiving the bulk of the money.

While this suggests the long-touted need to “shift the trillions” towards green investment is underway, the headline numbers mask the fact that many of the poorest countries are still failing to receive anything like the amounts they need.

The CPI report shows that overall public climate finance fell by about 8% from 2022 to 2023, as government budgets were tight after the COVID-19 pandemic. It also warned that recently announced cuts to official development assistance, in countries such as the US and the UK, raise concern that money from this source could decline further.

International climate finance for emerging markets and developing countries reached $196 billion in 2023, with 78% of that from public sources. Yet while both climate-related development finance and private investment rose, CPI said the least-developed countries still face barriers to accessing affordable capital, and need more financial innovation and support.

In a separate report released on Monday, however, Oil Change International and 17 other NGOs warned that a widely used approach of using government money to lower investment risk and bring in more commercial cash – known as “blended finance” – is falling short of expectations.

The report found that every public dollar of concessional lending is bringing in 4-7 times less private investment than anticipated, leaving the Global South with massive shortfalls of cash for its energy transition. Most money, it said, is going to Global North countries and China, with the remaining 69% of the world’s population receiving just 15% of finance in 2023-2024.

“A just energy transition is dramatically more affordable than continued fossil fuel dependence. But unfortunately affordable doesn’t mean ‘attractive to banks and hedge funds’,” said Bronwen Tucker, global public finance lead at Oil Change. “It is clear from the data that private investors are not fit to lead the way to the fossil free future we need, and that governments must step in.”

Mineral justice for Africa

Efforts to revive the Lobito Corridor trade route in central Africa must prioritise local economic development over raw material exports, researchers at the International Institute for Environment and Development (IIED) said, as campaigners in Bonn call for justice for resource-rich countries and an end to the extractive injustices of the fossil fuel era.

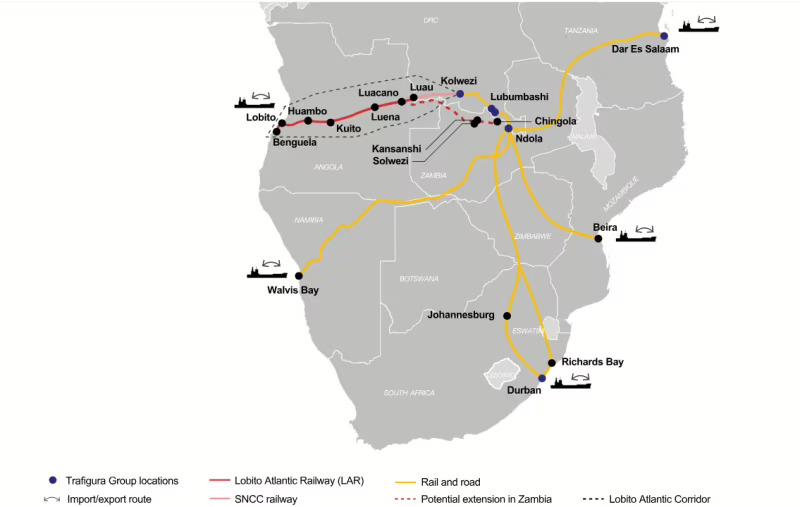

The US and the European Union are providing financial support to Angola, the Democratic Republic of Congo and Zambia to upgrade their infrastructure to aid transport of critical energy transition minerals like cobalt and copper through a rail system which terminates at the port of Lobito on Angola’s Atlantic coast.

In a policy brief issued this week, highlighting the Corridor’s opportunities and challenges for a just transition, the researchers questioned how the project’s development will benefit the wider economies of the countries involved, while protecting social benefits and human rights including being fair to the people whose land it might encroach upon and the artisanal miners who dig up many of the raw materials.

They said the involvement of the EU and the US has raised concerns in participating countries such as Zambia, where a parliamentary committee has said the Lobito Corridor project appears to focus on “mopping up critical raw materials” to respond to the energy security concerns of wealthy nations without adding value to the countries.

Lorenzo Cotula, IIED principal researcher, said if the EU and other prospective funders are interested in a genuine, long-term partnership with Angola, Congo and Zambia, they should support their efforts to promote economic development and improve the lives of their citizens.

“This project shouldn’t just be a means to export more raw materials more quickly to wealthier countries, or another chess piece in the great power game,” Cotula said.

“Millions of people in mineral-rich, lower-income countries are being sidelined in a global rush for materials to power electric cars, computers and even military technologies in richer nations,” he added.

Sharing similar concern, campaigners from Power Shift Africa and the Natural Resource Governance Institute (NRGI) convened a press conference at the ongoing talks in Bonn calling for the need for just minerals in the just transition, because one cannot exist without the other.

Anabella Rosemberg, senior advisor on just transition at Climate Action Network International (CAN-I), said the transition that is happening is not one that is needed for a climate-compatible world because the needs of resource-rich countries are being ignored.

Rosemberg said there is need for international cooperation to overturn the current competition over resources, adding that “we know that investment and trade deals are being arranged to secure the supply of these minerals, and in the end, we are reproducing all the mistakes that have been done in the past with the fossil-based economy”.

Samira Ally, project officer at Power Shift Africa, said Africa’s mineral wealth can accelerate a global shift to net zero when governed by justice and stability with necessary guardrails in place.

To do this, she asked governments to integrate language from the G20 and the UN panel on critical minerals into the climate talks and national climate plans so that they “reference sustainable supply chains and the right to development and industrialisation in the Global South”.

The post Bonn bulletin: Developing nations call for adaptation finance to triple by 2030 appeared first on Climate Home News.

Bonn bulletin: Developing nations call for adaptation finance to triple by 2030

Climate Change

Whale Entanglements in Fishing Gear Surge Off U.S. West Coast During Marine Heatwaves

New research finds that rising ocean temperatures are shrinking cool-water feeding grounds, pushing humpbacks into gear-heavy waters near shore. Scientists say ocean forecasting tool could help fisheries reduce the risk.

Each spring, humpback whales start to feed off the coast of California and Oregon on dense schools of anchovies, sardines and krill—prey sustained by cool, nutrient-rich water that seasonal winds draw up from the deep ocean.

Whale Entanglements in Fishing Gear Surge Off U.S. West Coast During Marine Heatwaves

Climate Change

Grasslands and Wetlands Are Being Gobbled Up By Agriculture, Mostly Livestock

A new study takes a first-of-its kind look at how farming converts non-forested areas and major carbon sinks into cropland and pasture.

Agriculture is widely known to be the biggest driver of forest destruction globally, especially in sprawling, high-profile ecosystems like the Amazon rainforest.

Grasslands and Wetlands Are Being Gobbled Up By Agriculture, Mostly Livestock

Climate Change

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

We handpick and explain the most important stories at the intersection of climate, land, food and nature over the past fortnight.

This is an online version of Carbon Brief’s fortnightly Cropped email newsletter.

Subscribe for free here.

Key developments

Food inflation on the rise

DELUGE STRIKES FOOD: Extreme rainfall and flooding across the Mediterranean and north Africa has “battered the winter growing regions that feed Europe…threatening food price rises”, reported the Financial Times. Western France has “endured more than 36 days of continuous rain”, while farmers’ associations in Spain’s Andalusia estimate that “20% of all production has been lost”, it added. Policy expert David Barmes told the paper that the “latest storms were part of a wider pattern of climate shocks feeding into food price inflation”.

-

Sign up to Carbon Brief’s free “Cropped” email newsletter. A fortnightly digest of food, land and nature news and views. Sent to your inbox every other Wednesday.

NO BEEF: The UK’s beef farmers, meanwhile, “face a double blow” from climate change as “relentless rain forces them to keep cows indoors”, while last summer’s drought hit hay supplies, said another Financial Times article. At the same time, indoor growers in south England described a 60% increase in electricity standing charges as a “ticking timebomb” that could “force them to raise their prices or stop production, which will further fuel food price inflation”, wrote the Guardian.

‘TINDERBOX’ AND TARIFFS: A study, covered by the Guardian, warned that major extreme weather and other “shocks” could “spark social unrest and even food riots in the UK”. Experts cited “chronic” vulnerabilities, including climate change, low incomes, poor farming policy and “fragile” supply chains that have made the UK’s food system a “tinderbox”. A New York Times explainer noted that while trade could once guard against food supply shocks, barriers such as tariffs and export controls – which are being “increasingly” used by politicians – “can shut off that safety valve”.

El Niño looms

NEW ENSO INDEX: Researchers have developed a new index for calculating El Niño, the large-scale climate pattern that influences global weather and causes “billions in damages by bringing floods to some regions and drought to others”, reported CNN. It added that climate change is making it more difficult for scientists to observe El Niño patterns by warming up the entire ocean. The outlet said that with the new metric, “scientists can now see it earlier and our long-range weather forecasts will be improved for it.”

WARMING WARNING: Meanwhile, the US Climate Prediction Center announced that there is a 60% chance of the current La Niña conditions shifting towards a neutral state over the next few months, with an El Niño likely to follow in late spring, according to Reuters. The Vibes, a Malaysian news outlet, quoted a climate scientist saying: “If the El Niño does materialise, it could possibly push 2026 or 2027 as the warmest year on record, replacing 2024.”

CROP IMPACTS: Reuters noted that neutral conditions lead to “more stable weather and potentially better crop yields”. However, the newswire added, an El Niño state would mean “worsening drought conditions and issues for the next growing season” to Australia. El Niño also “typically brings a poor south-west monsoon to India, including droughts”, reported the Hindu’s Business Line. A 2024 guest post for Carbon Brief explained that El Niño is linked to crop failure in south-eastern Africa and south-east Asia.

News and views

- DAM-AG-ES: Several South Korean farmers filed a lawsuit against the country’s state-owned utility company, “seek[ing] financial compensation for climate-related agricultural damages”, reported United Press International. Meanwhile, a national climate change assessment for the Philippines found that the country “lost up to $219bn in agricultural damages from typhoons, floods and droughts” over 2000-10, according to Eco-Business.

- SCORCHED GRASS: South Africa’s Western Cape province is experiencing “one of the worst droughts in living memory”, which is “scorching grass and killing livestock”, said Reuters. The newswire wrote: “In 2015, a drought almost dried up the taps in the city; farmers say this one has been even more brutal than a decade ago.”

- NOUVELLE VEG: New guidelines published under France’s national food, nutrition and climate strategy “urged” citizens to “limit” their meat consumption, reported Euronews. The delayed strategy comes a month after the US government “upended decades of recommendations by touting consumption of red meat and full-fat dairy”, it noted.

- COURTING DISASTER: India’s top green court accepted the findings of a committee that “found no flaws” in greenlighting the Great Nicobar project that “will lead to the felling of a million trees” and translocating corals, reported Mongabay. The court found “no good ground to interfere”, despite “threats to a globally unique biodiversity hotspot” and Indigenous tribes at risk of displacement by the project, wrote Frontline.

- FISH FALLING: A new study found that fish biomass is “falling by 7.2% from as little as 0.1C of warming per decade”, noted the Guardian. While experts also pointed to the role of overfishing in marine life loss, marine ecologist and study lead author Dr Shahar Chaikin told the outlet: “Our research proves exactly what that biological cost [of warming] looks like underwater.”

- TOO HOT FOR COFFEE: According to new analysis by Climate Central, countries where coffee beans are grown “are becoming too hot to cultivate them”, reported the Guardian. The world’s top five coffee-growing countries faced “57 additional days of coffee-harming heat” annually because of climate change, it added.

Spotlight

Nature talks inch forward

This week, Carbon Brief covers the latest round of negotiations under the UN Convention on Biological Diversity (CBD), which occurred in Rome over 16-19 February.

The penultimate set of biodiversity negotiations before October’s Conference of the Parties ended in Rome last week, leaving plenty of unfinished business.

The CBD’s subsidiary body on implementation (SBI) met in the Italian capital for four days to discuss a range of issues, including biodiversity finance and reviewing progress towards the nature targets agreed under the Kunming-Montreal Global Biodiversity Framework (GBF).

However, many of the major sticking points – particularly around finance – will have to wait until later this summer, leaving some observers worried about the capacity for delegates to get through a packed agenda at COP17.

The SBI, along with the subsidiary body on scientific, technical and technological advice (SBSTTA) will both meet in Nairobi, Kenya, later this summer for a final round of talks before COP17 kicks off in Yerevan, Armenia, on 19 October.

Money talks

Finance for nature has long been a sticking point at negotiations under the CBD.

Discussions on a new fund for biodiversity derailed biodiversity talks in Cali, Colombia, in autumn 2024, requiring resumed talks a few months later.

Despite this, finance was barely on the agenda at the SBI meetings in Rome. Delegates discussed three studies on the relationship between debt sustainability and implementation of nature plans, but the more substantive talks are set to take place at the next SBI meeting in Nairobi.

Several parties “highlighted concerns with the imbalance of work” on finance between these SBI talks and the next ones, reported Earth Negotiations Bulletin (ENB).

Lim Li Ching, senior researcher at Third World Network, noted that tensions around finance permeated every aspect of the talks. She told Carbon Brief:

“If you’re talking about the gender plan of action – if there’s little or no financial resources provided to actually put it into practice and implement it, then it’s [just] paper, right? Same with the reporting requirements and obligations.”

Monitoring and reporting

Closely linked to the issue of finance is the obligations of parties to report on their progress towards the goals and targets of the GBF.

Parties do so through the submission of national reports.

Several parties at the talks pointed to a lack of timely funding for driving delays in their reporting, according to ENB.

A note released by the CBD Secretariat in December said that no parties had submitted their national reports yet; by the time of the SBI meetings, only the EU had. It further noted that just 58 parties had submitted their national biodiversity plans, which were initially meant to be published by COP16, in October 2024.

Linda Krueger, director of biodiversity and infrastructure policy at the environmental not-for-profit Nature Conservancy, told Carbon Brief that despite the sparse submissions, parties are “very focused on the national report preparation”. She added:

“Everybody wants to be able to show that we’re on the path and that there still is a pathway to getting to 2030 that’s positive and largely in the right direction.”

Watch, read, listen

NET LOSS: Nigeria’s marine life is being “threatened” by “ghost gear” – nets and other fishing equipment discarded in the ocean – said Dialogue Earth.

COMEBACK CAUSALITY: A Vox long-read looked at whether Costa Rica’s “payments for ecosystem services” programme helped the country turn a corner on deforestation.

HOMEGROWN GOALS: A Straits Times podcast discussed whether import-dependent Singapore can afford to shelve its goal to produce 30% of its food locally by 2030.

‘RUSTING’ RIVERS: The Financial Times took a closer look at a “strange new force blighting the [Arctic] landscape”: rivers turning rust-orange due to global warming.

New science

- Lakes in the Congo Basin’s peatlands are releasing carbon that is thousands of years old | Nature Geoscience

- Natural non-forest ecosystems – such as grasslands and marshlands – were converted for agriculture at four times the rate of land with tree cover between 2005 and 2020 | Proceedings of the National Academy of Sciences

- Around one-quarter of global tree-cover loss over 2001-22 was driven by cropland expansion, pastures and forest plantations for commodity production | Nature Food

In the diary

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean | Brasília

- 5 March: Nepal general elections

- 9-20 March: First part of the thirty-first session of the International Seabed Authority (ISA) | Kingston, Jamaica

Cropped is researched and written by Dr Giuliana Viglione, Aruna Chandrasekhar, Daisy Dunne, Orla Dwyer and Yanine Quiroz.

Please send tips and feedback to cropped@carbonbrief.org

The post Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate appeared first on Carbon Brief.

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits