UK potatoes, South Korean cabbage and west African cocoa are just some of the foods that became markedly more expensive after extreme weather events in recent years, according to new research.

The study, published in Environmental Research Letters, analyses 16 examples of food price rises across the world that followed periods of extreme heat, drought or rainfall over 2022-24.

A “striking” example, according to the lead author, is the wide-ranging price impact following a 2024 heatwave in Asia, which saw cost increases from onions in India to rice in Japan.

Soaring food prices have been a major concern for consumers around the world since around 2021, with prices rising due to extreme weather fuelled by climate change, higher production costs and Russia’s invasion of Ukraine – among other factors.

The new findings act as a “stark reminder” of the “significant pressure” climate change is already having on crops, a researcher not involved in the study says.

Effects of weather extremes

Extreme weather has both immediate and long-lasting impacts on food production. It can destroy growing crops, impact yields and even weaken food supply chains.

One impact frequently tied to climate change is the rising cost of food. The price of everything from olive oil to eggs, and from chocolate to rice has fluctuated in many parts of the world in recent years.

The new study analyses 16 examples of increased food prices after a period of extreme weather over 2022-24. The researchers then assess how unusual the extreme heat, drought and rainfall events were compared to historical climate data.

These case studies are outlined in the map below. The shading indicates the percentage by which each weather extreme exceeded past climate data from that time period.

Many events, indicated by the darkest shading, “were so extreme as to completely exceed all historical precedent prior to 2020”, the study says.

The analysis is based on temperature data from Copernicus ERA5 spanning 1940-2024 and the Standardized Precipitation Evapotranspiration Index spanning 1901-2023, along with reporting from a range of news outlets and food price data from governments and industry groups.

(ERA5 is a reanalysis dataset that combines climate observations with model simulations.)

Dr Maximilian Kotz, a postdoctoral fellow at the Barcelona Supercomputing Center and the lead author of the new study, explains that some of the examples involve multiple types of extreme weather, such as intense heat and drought. But the researchers chose the extreme which occurred closest to the price rise for “simplicity of communication” on the map.

The research team selected “prominent” case studies, Kotz tells Carbon Brief, where the “effects are so obvious…that you don’t need a substantial, quantitative statistical analysis to see them. The people on the ground can see that this is what’s happening.”

The 2024 heatwave in Asia was a particularly “striking” example, he says, adding:

“What’s so interesting there is how widespread that exceptional heat was and also how ubiquitous these effects [on food prices] essentially were towards the end of last summer.

“India, China, South Korea, Japan, Vietnam – all of these countries that all experienced really exceptional heat…and all of them had documentation of these kinds of effects, to some extent.”

The study authors note that while the 2023-24 El Niño “likely played a role in amplifying a number of these extremes”, the increased intensity and frequency of the events is “in line with the expected and observed effects of climate change”.

(Other researchers have carried out rapid attribution analyses to assess the role of climate change in a number of the events included in the study, such as UK winter rainfall in 2023, Pakistan floods in 2022 and Ethiopian drought in 2022.)

In the UK, food price inflation is still rising as retailers partly blamed “hot weather hitting harvest yields”, the Guardian reported.

Cabbage, olive oil and rice

Government statistics indicate that extreme heat across east Asia in 2024 contributed to the cost of cabbage in South Korea rising 70% and rice in Japan increasing 48% from September 2023 to September 2024, the study says. The same heat also contributed to a 30% rise in the cost of vegetables in China between June and August 2024.

China, South Korea and Japan were among the many countries to experience their hottest year on record in 2024.

In the US, the researchers find that an “unprecedented” drought in California and Arizona across 2022 contributed to an 80% increase in vegetable prices between November 2021 and November 2022.

Droughts in southern Europe in 2022-23 drove a 50% price increase in olive oil across the EU from January 2023 to January 2024. Spain is the world’s largest producer of olive oil, followed by Italy – both of which were badly affected by the drought.

Cocoa was another commodity whose price has soared globally in the past couple of years. This was due to a number of factors, the study says, including extreme weather in Ghana and the Ivory Coast where more than 60% of the world’s cocoa is grown.

Many parts of the two west African countries experienced “unprecedented” temperatures of up to 50C in February 2024, following a “prolonged drought” in 2023.

The “dangerous”, humid February heat was made about 4C hotter due to climate change, according to analysis from the World Weather Attribution group.

The new study also looks at coffee price increases after extreme heat in Vietnam in 2024 and a 2023 drought in Brazil.

Kotz said the most notable examples of price rises were with commodities such as cocoa and coffee, which are available globally, but produced in concentrated areas – opening up the “possibility for greater volatility” in the event of weather extremes.

‘Knock-on’ effects

A 2024 study by Kotz and researchers at the European Central Bank found that high temperatures increased food inflation “persistently” for 12 months after the extremes in both high- and low-income countries.

Kotz says the new study is a “follow up” to this research. It discusses some of the other factors impacting the food prices in the study, such as high transport costs contributing to rising food prices in Ethiopia, as well as rising production costs and high tourist demand contributing to soaring rice prices in Japan.

The findings are a “stark reminder that climate change is already putting significant pressure on crop production globally”, says Dr Jasper Verschuur, an assistant professor of engineering and climate security at Delft University of Technology in the Netherlands.

Verschuur, who was not involved in the research, tells Carbon Brief:

“This study also stresses that the impacts of shocks to the agricultural sector can have cross-sectoral impacts – for instance, to health, political stability and monetary policy – which are rarely ever captured in modelling studies.”

He notes that while understanding of local impacts of extreme weather on crop yields and price has “improved”, the wider impacts and dual effects of climate and non-climate “shocks” are still less well-understood.

The researchers discuss some of the “knock-on societal risks” from rising food prices in the study, such as increasing economic inequality, malnutrition and an overall increase in inflation.

In a statement about the new research, Shona Goudie, the policy and advocacy manager at the Food Foundation, a UK charity whose executive director was involved in the study, says:

“Increasingly frequent price shocks due to climate change could see food insecurity and health inequalities deteriorate even further.”

The post Mapped: 16 times extreme weather drove higher food prices since 2022 appeared first on Carbon Brief.

Mapped: 16 times extreme weather drove higher food prices since 2022

Greenhouse Gases

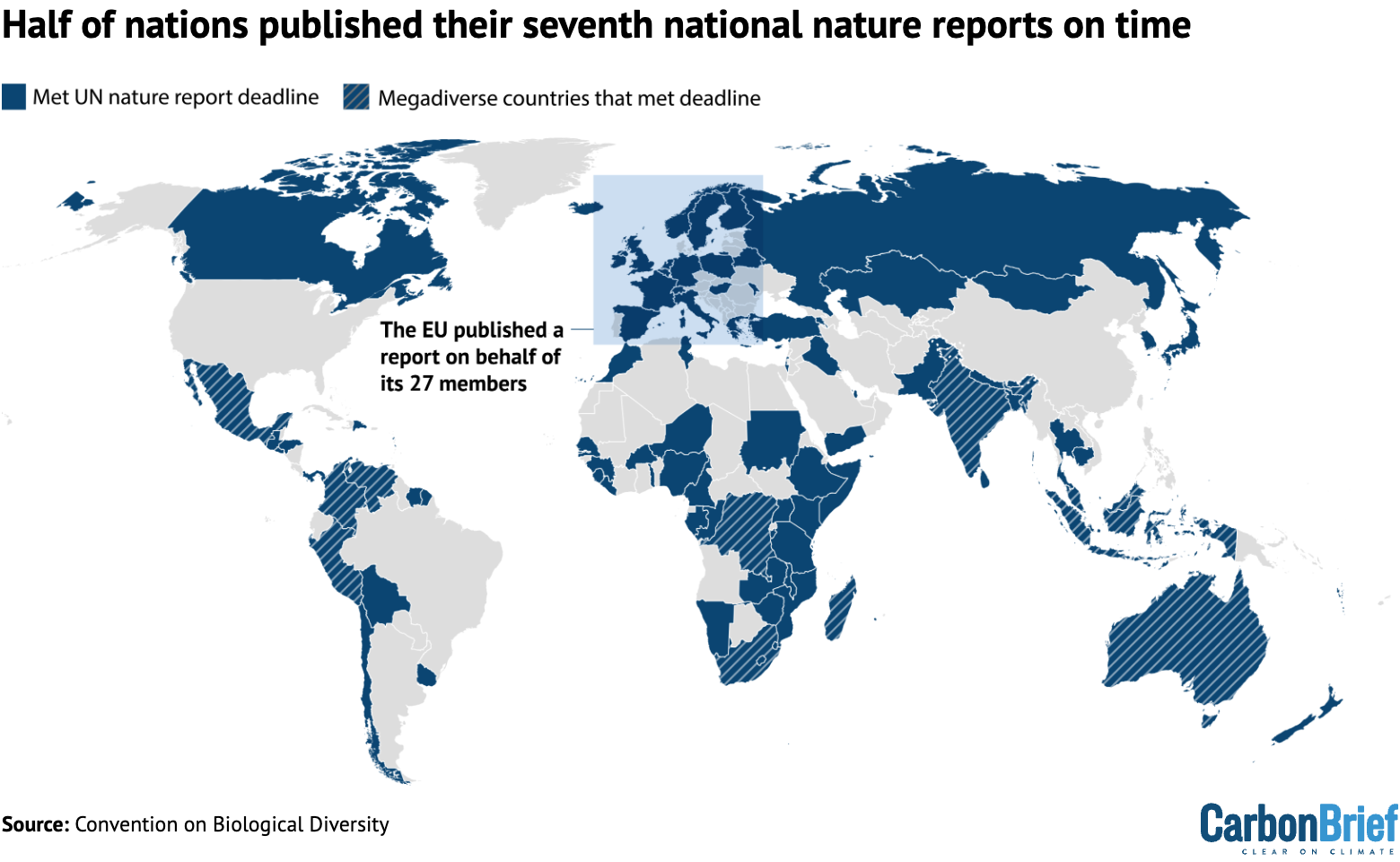

Analysis: Half of nations meet UN deadline for nature-loss reporting

Half of nations have met a UN deadline to report on how they are tackling nature loss within their borders, Carbon Brief analysis shows.

This includes 11 of the 17 “megadiverse nations”, countries that account for 70% of Earth’s biodiversity.

It also includes all of the G7 nations apart from the US, which is not part of the world’s nature treaty.

All 196 countries that are part of the UN biodiversity treaty were due to submit their seventh “national reports” by 28 February, of which 98 have done so.

Their submissions are supposed to provide key information for an upcoming global report on actions to halt and reverse biodiversity loss by 2030, in addition to a global review of progress due to be conducted by countries at the COP17 nature summit in Armenia in October this year.

At biodiversity talks in Rome in February, UN officials said that national reports submitted late will not be included in the global report due to a lack of time, but could still be considered in the global review.

Tracking nature action

In 2022, nations signed a landmark deal to halt and reverse nature loss by 2030, known as the “Kunming-Montreal Global Biodiversity Framework” (GBF).

In an effort to make sure countries take action at the domestic level, the GBF included an “implementation schedule”, involving the publishing of new national plans in 2024 and new national reports in 2026.

The two sets of documents were to inform both a global report and a global review, to be conducted by countries at COP17 in Armenia later this year. (This schedule mirrors the one set out for tackling climate change under the Paris Agreement.)

The deadline for nations’ seventh national reports, which contain information on their progress towards meeting the 23 targets of the GBF based on a set of key indicators, was 28 February 2026.

According to Carbon Brief’s analysis of the UN Convention on Biological Diversity’s online reporting platform, 98 out of the 196 countries that are part of the nature convention (50%) submitted on time.

The map below shows countries that submitted their seventh national reports by the UN’s deadline.

This includes 11 of the 17 “megadiverse nations” that account for 70% of Earth’s biodiversity.

The megadiverse nations to meet the deadline were India, Venezuela, Indonesia, Madagascar, Peru, Malaysia, South Africa, Colombia, Mexico, the Democratic Republic of the Congo and Australia.

It also includes all of the G7 nations (France, Germany, the UK, Japan, Italy and Canada), excluding the US, which has never ratified the Convention on Biological Diversity.

The UK’s seventh national report shows that it is currently on track to meet just three of the GBF’s 23 targets.

This is according to a LinkedIn post from Dr David Cooper, former executive secretary of the CBD and current chair of the UK’s Joint Nature Conservation Committee, which coordinated the UK’s seventh national report,

The report shows the UK is not on track to meet one of the headline targets of the GBF, which is to protect 30% of land and sea for nature by 2030.

It reports that the proportion of land protected for nature is 7% in England, 18% in Scotland and 9% in Northern Ireland. (The figure is not given for Wales.)

National plans

In addition to the national reports, the upcoming global report and review will draw on countries’ national plans.

Countries were meant to have submitted their new national plans, known as “national biodiversity strategies and action plans” (NBSAPs), by the start of COP16 in October 2024.

A joint investigation by Carbon Brief and the Guardian found that only 15% of member countries met that deadline.

Since then, the percentage of countries that have submitted a new NBSAP has risen to 39%.

According to the GBF and its underlying documents, countries that were “not in a position” to meet the deadline to submit NBSAPs ahead of COP16 were requested to instead submit national targets. These submissions simply list biodiversity targets that countries will aim for, without an accompanying plan for how they will be achieved.

As of 2 March, 78% of nations had submitted national targets.

At biodiversity talks in Rome in February, UN officials said that national reports submitted late will not be included in the global report due to a lack of time, but could still be considered in the global review.

Funding ‘delays’

At the Rome talks, some countries raised that they had faced “difficulties in submitting [their national reports] on time”, according to the Earth Negotiations Bulletin.

Speaking on behalf of “many” countries, Fiji said that there had been “technical and financial constraints faced by parties” in the preparation of their seventh national reports.

In a statement to Carbon Brief, a spokesperson for the Global Environment Facility, the body in charge of providing financial and technical assistance to countries for the preparation of their national reports, said “delays in fund disbursement have occurred in some cases”, adding:

“In 2023, the GEF council approved support for the development of NBSAPs and the seventh national reports for all 139 eligible countries that requested assistance. This includes national grants of up to $450,000 per country and $6m in global technical assistance delivered through the UN Development Programme and UN Environment Programme.

“As of the end of January 2026, all 139 participating countries had benefited from technical assistance and 93% had accessed their national grants, with 11 countries yet to receive their funds. Delays in fund disbursement have occurred in some cases, compounded by procurement challenges and limited availability of technical expertise.”

The spokesperson added that the fund will “continue to engage closely with agencies and countries to support timely completion of NBSAPs and the seventh national reports”.

The post Analysis: Half of nations meet UN deadline for nature-loss reporting appeared first on Carbon Brief.

Analysis: Half of nations meet UN deadline for nature-loss reporting

Greenhouse Gases

DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Absolute State of the Union

‘DRILL, BABY’: US president Donald Trump “doubled down on his ‘drill, baby, drill’ agenda” in his State of the Union (SOTU) address, said the Los Angeles Times. He “tout[ed] his support of the fossil-fuel industry and renew[ed] his focus on electricity affordability”, reported the Financial Times. Trump also attacked the “green new scam”, noted Carbon Brief’s SOTU tracker.

COAL REPRIEVE: Earlier in the week, the Trump administration had watered down limits on mercury pollution from coal-fired power plants, reported the Financial Times. It remains “unclear” if this will be enough to prevent the decline of coal power, said Bloomberg, in the face of lower-cost gas and renewables. Reuters noted that US coal plants are “ageing”.

OIL STAY: The US Supreme Court agreed to hear arguments brought by the oil industry in a “major lawsuit”, reported the New York Times. The newspaper said the firms are attempting to head off dozens of other lawsuits at state level, relating to their role in global warming.

SHIP-SHILLING: The Trump administration is working to “kill” a global carbon levy on shipping “permanently”, reported Politico, after succeeding in delaying the measure late last year. The Guardian said US “bullying” could be “paying off”, after Panama signalled it was reversing its support for the levy in a proposal submitted to the UN shipping body.

Around the world

- RARE EARTHS: The governments of Brazil and India signed a deal on rare earths, said the Times of India, as well as agreeing to collaborate on renewable energy.

- HEAT ROLLBACK: German homes will be allowed to continue installing gas and oil heating, under watered-down government plans covered by Clean Energy Wire.

- BRAZIL FLOODS: At least 53 people died in floods in the state of Minas Gerais, after some areas saw 170mm of rain in a few hours, reported CNN Brasil.

- ITALY’S ATTACK: Italy is calling for the EU to “suspend” its emissions trading system (ETS) ahead of a review later this year, said Politico.

- COOKSTOVE CREDITS: The first-ever carbon credits under the Paris Agreement have been issued to a cookstove project in Myanmar, said Climate Home News.

- SAUDI SOLAR: Turkey has signed a “major” solar deal that will see Saudi firm ACWA building 2 gigawatts in the country, according to Agence France-Presse.

$467 billion

The profits made by five major oil firms since prices spiked following Russia’s invasion of Ukraine four years ago, according to a report by Global Witness covered by BusinessGreen.

Latest climate research

- Claims about the “fingerprint” of human-caused climate change, made in a recent US Department of Energy report, are “factually incorrect” | AGU Advances

- Large lakes in the Congo Basin are releasing carbon dioxide into the atmosphere from “immense ancient stores” | Nature Geoscience

- Shared Socioeconomic Pathways – scenarios used regularly in climate modelling – underrepresent “narratives explicitly centring on democratic principles such as participation, accountability and justice” | npj Climate Action

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

The constituency of Richard Tice MP, the climate-sceptic deputy leader of Reform UK, is the second-largest recipient of flood defence spending in England, according to new Carbon Brief analysis. Overall, the funding is disproportionately targeted at coastal and urban areas, many of which have Conservative or Liberal Democrat MPs.

Spotlight

Is there really a UK ‘greenlash’?

This week, after a historic Green Party byelection win, Carbon Brief looks at whether there really is a “greenlash” against climate policy in the UK.

Over the past year, the UK’s political consensus on climate change has been shattered.

Yet despite a sharp turn against climate action among right-wing politicians and right-leaning media outlets, UK public support for climate action remains strong.

Prof Federica Genovese, who studies climate politics at the University of Oxford, told Carbon Brief:

“The current ‘war’ on green policy is mostly driven by media and political elites, not by the public.”

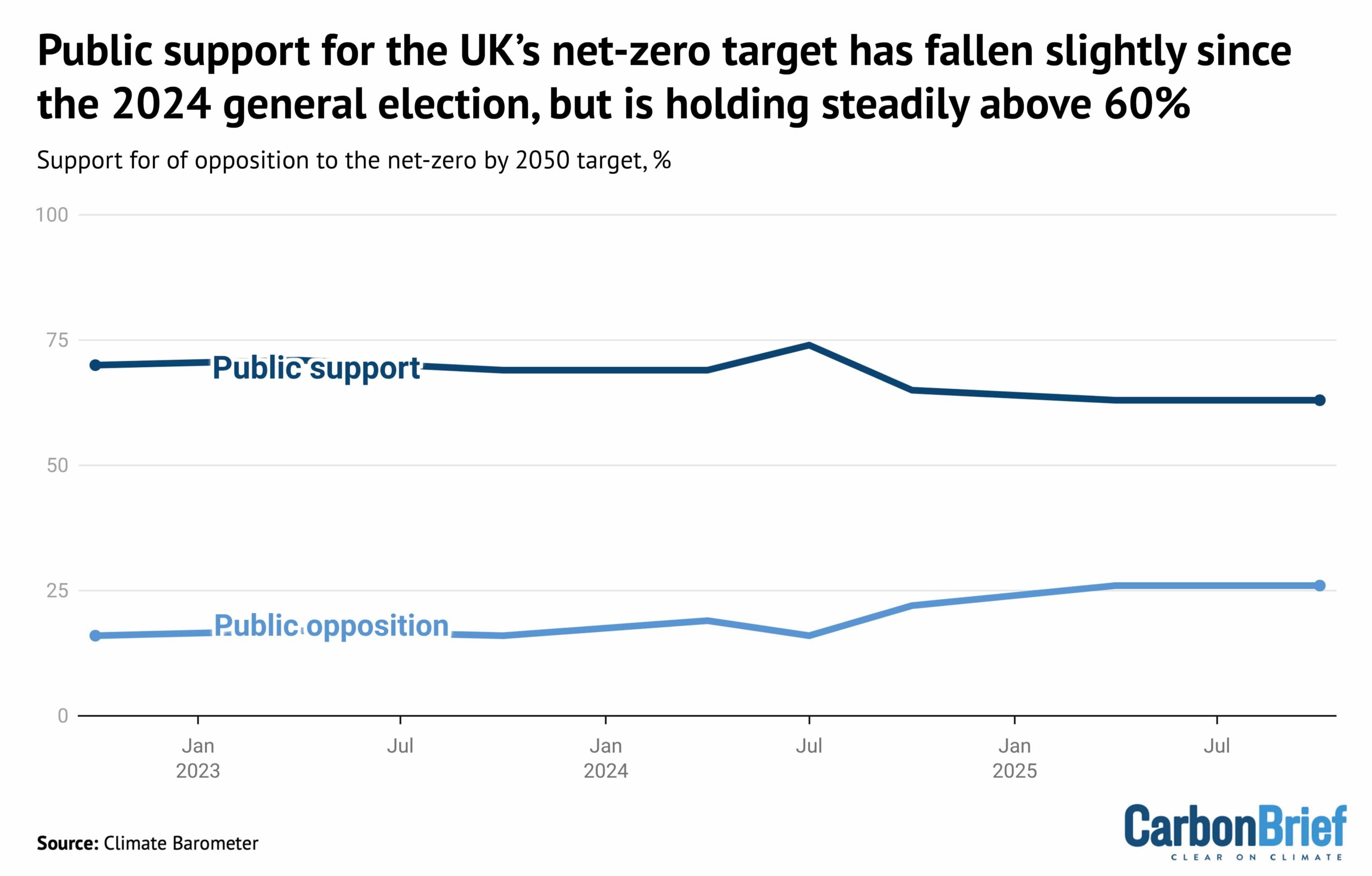

Indeed, there is still a greater than two-to-one majority among the UK public in favour of the country’s legally binding target to reach net-zero emissions by 2050, as shown below.

Steve Akehurst, director of public-opinion research initiative Persuasion UK, also noted the growing divide between the public and “elites”. He told Carbon Brief:

“The biggest movement is, without doubt, in media and elite opinion. There is a bit more polarisation and opposition [to climate action] among voters, but it’s typically no more than 20-25% and mostly confined within core Reform voters.”

Conservative gear shift

For decades, the UK had enjoyed strong, cross-party political support for climate action.

Lord Deben, the Conservative peer and former chair of the Climate Change Committee, told Carbon Brief that the UK’s landmark 2008 Climate Change Act had been born of this cross-party consensus, saying “all parties supported it”.

Since their landslide loss at the 2024 election, however, the Conservatives have turned against the UK’s target of net-zero emissions by 2050, which they legislated for in 2019.

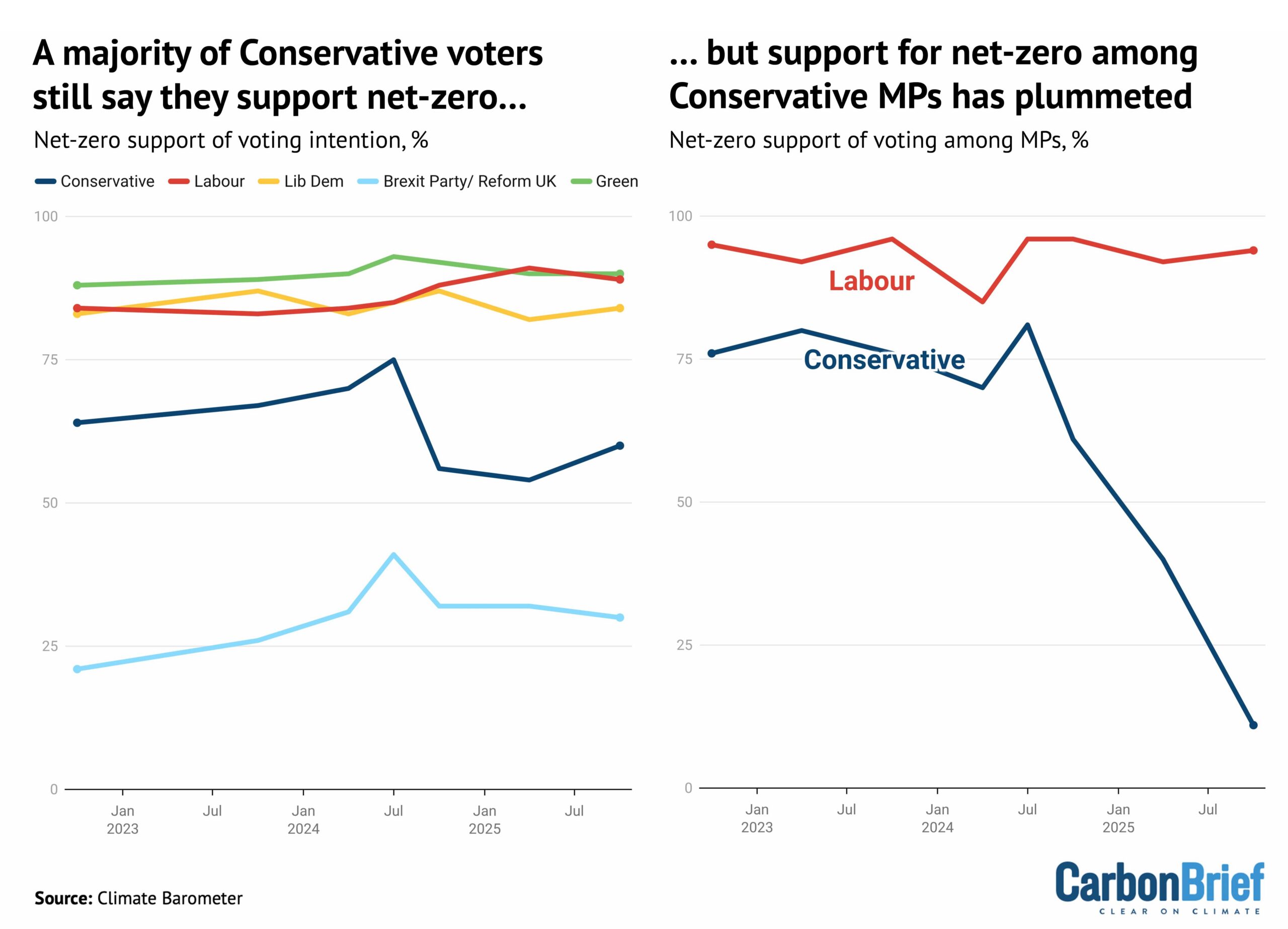

Curiously, while opposition to net-zero has surged among Conservative MPs, there is majority support for the target among those that plan to vote for the party, as shown below.

Dr Adam Corner, advisor to the Climate Barometer initiative that tracks public opinion on climate change, told Carbon Brief that those who currently plan to vote Reform are the only segment who “tend to be more opposed to net-zero goals”. He said:

“Despite the rise in hostile media coverage and the collapse of the political consensus, we find that public support for the net-zero by 2050 target is plateauing – not plummeting.”

Reform, which rejects the scientific evidence on global warming and campaigns against net-zero, has been leading the polls for a year. (However, it was comfortably beaten by the Greens in yesterday’s Gorton and Denton byelection.)

Corner acknowledged that “some of the anti-net zero noise…[is] showing up in our data”, adding:

“We see rising concerns about the near-term costs of policies and an uptick in people [falsely] attributing high energy bills to climate initiatives.”

But Akehurst said that, rather than a big fall in public support, there had been a drop in the “salience” of climate action:

“So many other issues [are] competing for their attention.”

UK newspapers published more editorials opposing climate action than supporting it for the first time on record in 2025, according to Carbon Brief analysis.

Global ‘greenlash’?

All of this sits against a challenging global backdrop, in which US president Donald Trump has been repeating climate-sceptic talking points and rolling back related policy.

At the same time, prominent figures have been calling for a change in climate strategy, sold variously as a “reset”, a “pivot”, as “realism”, or as “pragmatism”.

Genovese said that “far-right leaders have succeeded in the past 10 years in capturing net-zero as a poster child of things they are ‘fighting against’”.

She added that “much of this is fodder for conservative media and this whole ecosystem is essentially driving what we call the ‘greenlash’”.

Corner said the “disconnect” between elite views and the wider public “can create problems” – for example, “MPs consistently underestimate support for renewables”. He added:

“There is clearly a risk that the public starts to disengage too, if not enough positive voices are countering the negative ones.”

Watch, read, listen

TRUMP’S ‘PETROSTATE’: The US is becoming a “petrostate” that will be “sicker and poorer”, wrote Financial Times associate editor Rana Forohaar.

RHETORIC VS REALITY: Despite a “political mood [that] has darkened”, there is “more green stuff being installed than ever”, said New York Times columnist David Wallace-Wells.

CHINA’S ‘REVOLUTION’: The BBC’s Climate Question podcast reported from China on the “green energy revolution” taking place in the country.

Coming up

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean, Brasília

- 3 March: UK spring statement

- 4-11 March: China’s “two sessions”

- 5 March: Nepal elections

Pick of the jobs

- The Guardian, senior reporter, climate justice | Salary: $123,000-$135,000. Location: New York or Washington DC

- China-Global South Project, non-resident fellow, climate change | Salary: Up to $1,000 a month. Location: Remote

- University of East Anglia, PhD in mobilising community-based climate action through co-designed sports and wellbeing interventions | Salary: Stipend (unknown amount). Location: Norwich, UK

- TABLE and the University of São Paulo, Brazil, postdoctoral researcher in food system narratives | Salary: Unknown. Location: Pirassununga, Brazil

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’? appeared first on Carbon Brief.

Greenhouse Gases

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

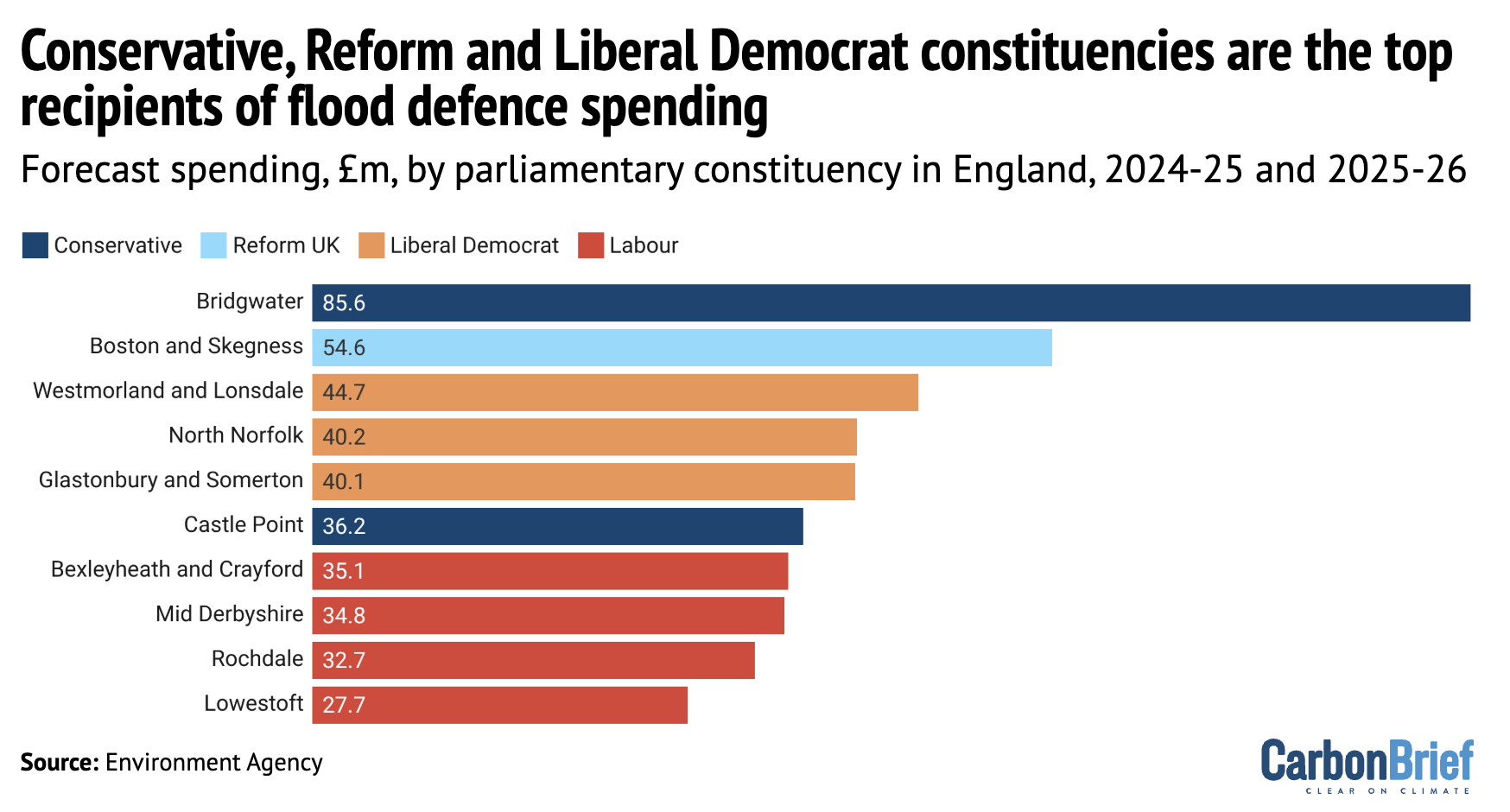

The Lincolnshire constituency held by Richard Tice, the climate-sceptic deputy leader of the hard-right Reform party, has been pledged at least £55m in government funding for flood defences since 2024.

This investment in Boston and Skegness is the second-largest sum for a single constituency from a £1.4bn flood-defence fund for England, Carbon Brief analysis shows.

Flooding is becoming more likely and more extreme in the UK due to climate change.

Yet, for years, governments have failed to spend enough on flood defences to protect people, properties and infrastructure.

The £1.4bn fund is part of the current Labour government’s wider pledge to invest a “record” £7.9bn over a decade on protecting hundreds of thousands of homes and businesses from flooding.

As MP for one of England’s most flood-prone regions, Tice has called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

He is also one of Reform’s most vocal opponents of climate action and what he calls “net stupid zero”. He denies the scientific consensus on climate change and has claimed, falsely and without evidence, that scientists are “lying”.

Flood defences

Last year, the government said it would invest £2.65bn on flood and coastal erosion risk management (FCERM) schemes in England between April 2024 and March 2026.

This money was intended to protect 66,500 properties from flooding. It is part of a decade-long Labour government plan to spend more than £7.9bn on flood defences.

There has been a consistent shortfall in maintaining England’s flood defences, with the Environment Agency expecting to protect fewer properties by 2027 than it had initially planned.

The Climate Change Committee (CCC) has attributed this to rising costs, backlogs from previous governments and a lack of capacity. It also points to the strain from “more frequent and severe” weather events, such as storms in recent years that have been amplified by climate change.

However, the CCC also said last year that, if the 2024-26 spending programme is delivered, it would be “slightly closer to the track” of the Environment Agency targets out to 2027.

The government has released constituency-level data on which schemes in England it plans to fund, covering £1.4bn of the 2024-26 investment. The other half of the FCERM spending covers additional measures, from repairing existing defences to advising local authorities.

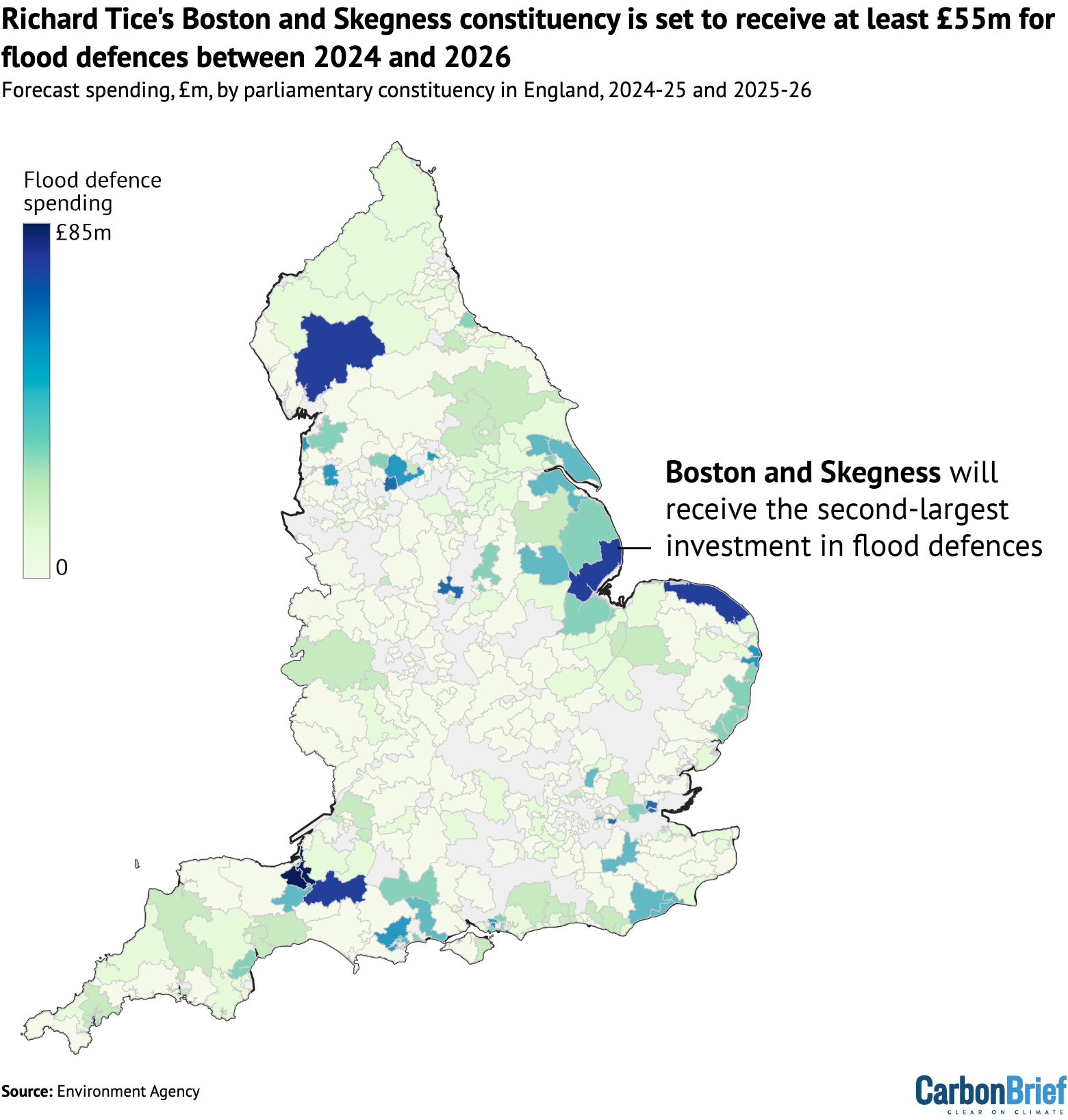

The map below shows the distribution of spending on FCERM schemes in England over the past two years, highlighting the constituency of Richard Tice.

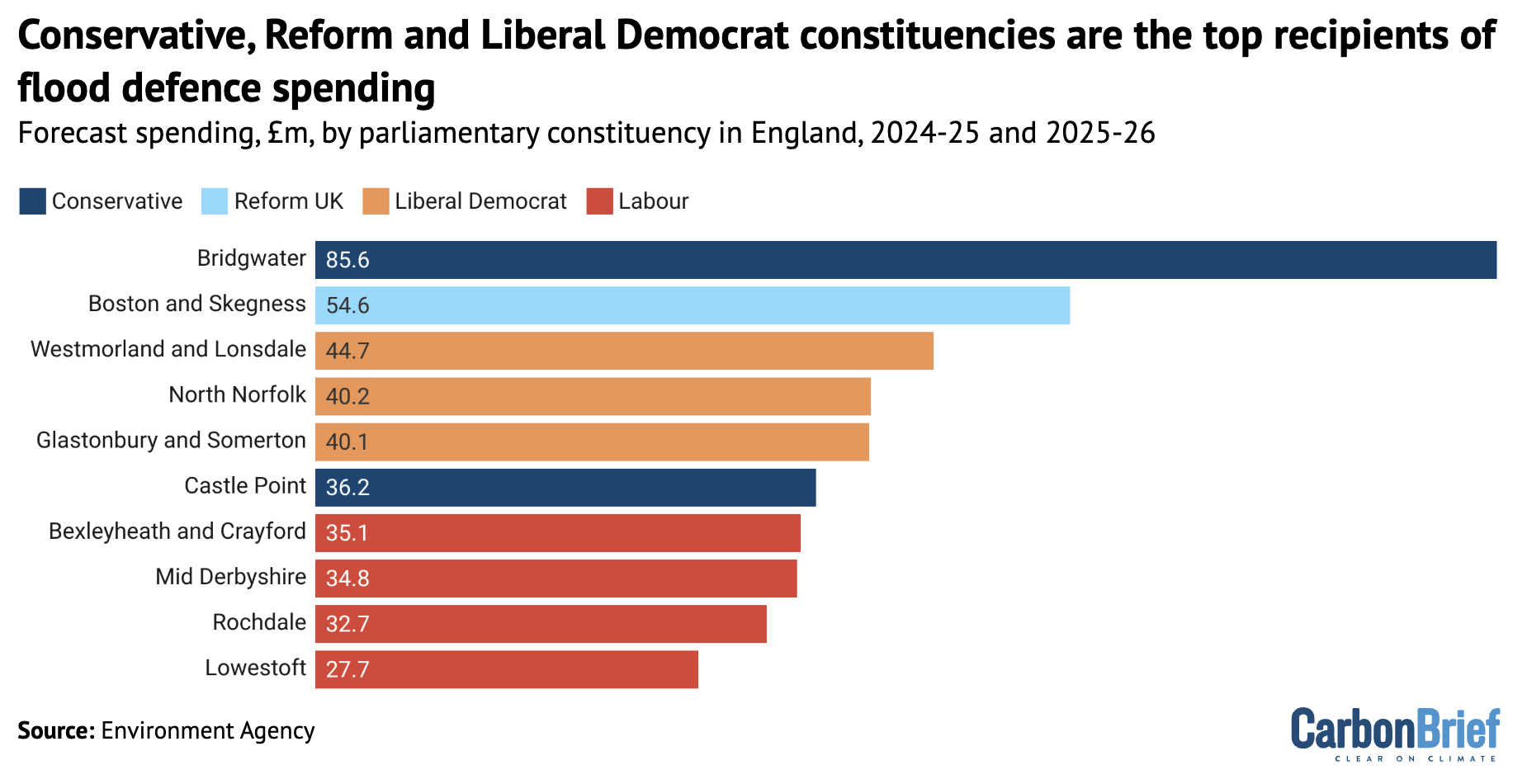

By far the largest sum of money – £85.6m in total – has been committed to a tidal barrier and various other defences in the Somerset constituency of Bridgwater, the seat of Conservative MP Ashley Fox.

Over the first months of 2026, the south-west region has faced significant flooding and Fox has called for more support from the government, citing “climate patterns shifting and rainfall intensifying”.

He has also backed his party’s position that “the 2050 net-zero target is impossible” and called for more fossil-fuel extraction in the North Sea.

Tice’s east-coast constituency of Boston and Skegness, which is highly vulnerable to flooding from both rivers and the sea, is set to receive £55m. Among the supported projects are beach defences from Saltfleet to Gibraltar Point and upgrades to pumping stations.

Overall, Boston and Skegness has the second-largest portion of flood-defence funding, as the chart below shows. Constituencies with Conservative and Liberal Democrat MPs occupied the other top positions.

Overall, despite Labour MPs occupying 347 out of England’s 543 constituencies – nearly two-thirds of the total – more than half of the flood-defence funding was distributed to constituencies with non-Labour MPs. This reflects the flood risk in coastal and rural areas that are not traditional Labour strongholds.

Reform funding

While Reform has just eight MPs, representing 1% of the population, its constituencies have been assigned 4% of the flood-defence funding for England.

Nearly all of this money was for Tice’s constituency, although party leader Nigel Farage’s coastal Clacton seat in Kent received £2m.

Reform UK is committed to “scrapping net-zero” and its leadership has expressed firmly climate-sceptic views.

Much has been made of the disconnect between the party’s climate policies and the threat climate change poses to its voters. Various analyses have shown the flood risk in Reform-dominated areas, particularly Lincolnshire.

Tice has rejected climate science, advocated for fossil-fuel production and criticised Environment Agency flood-defence activities. Yet, he has also called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

This may reflect Tice’s broader approach to climate change. In a 2024 interview with LBC, he said:

“Where you’ve got concerns about sea level defences and sea level rise, guess what? A bit of steel, a bit of cement, some aggregate…and you build some concrete sea level defences. That’s how you deal with rising sea levels.”

While climate adaptation is viewed as vital in a warming world, there are limits on how much societies can adapt and adaptation costs will continue to increase as emissions rise.

The post Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding appeared first on Carbon Brief.

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits