From mysterious white etching cracks to cutting-edge material innovations, Malloy Wind‘s expert Cory Mittleider reveals the complex world of gearbox bearing failures that plague wind turbines. Learn why traditional monitoring may not be enough and what operators need to know about the latest solutions to keep their gearboxes running reliably. Read the EPRI article Cory references: https://restservice.epri.com/publicdownload/000000003002021422/0/Product

Fill out our Uptime listener survey and enter to win an Uptime mug!

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Register for Wind Energy O&M Australia! https://www.windaustralia.com

Welcome to Uptime Spotlight, shining light on wind energy’s brightest innovators. This is the progress powering tomorrow.

Allen Hall: Welcome back to the Uptime Wind Energy Podcast Spotlight, where we tackle the technical challenges and innovations in wind energy. I’m your host, Allen Hall, joined by my co host, Joel Saxum.

We’re excited to welcome back one of our most popular guests, Cory Mittleider from Malloy Wind. In his previous appearance, Cory shared his expertise on main bearing failures. And many of you reached out asking for a deep dive into gearbox bearings. Today, Cory returns to do exactly that. As Malloy’s business unit manager, he and his team have diagnosed and solved countless gearbox bearing issues across different turbine platforms.

Having spent over 15 years in power transmission, Cory has become a specialist in understanding why these critical components fail and, more importantly, how to prevent those failures through better bearing selection and maintenance practices. Cory, welcome to the Uptime Wind Energy Podcast Spotlight.

Thanks for having me again. All right, so we’ve got a lot of requests to hear about gearbox, bearing, and what the issues are with those bearings. Gearboxes is something I know a little bit about. But you’re the expert. I hear a lot of complaining from the field. What is happening to gearbox bearings at the minute?

Cory Mittleider: Sure. Gearbox bearings has been an interesting one for me. So when I started in wind in 2011, it was generator bearings and gearbox bearings is where I started learning about this stuff. A lot of the generator stuff was electrical fluting damage. That’s pretty well figured out how to avoid that.

The gearbox one was a little more complex than that. And I don’t know if you’ve heard of. NREL’s Drivetrain Reliability Conference that’s happened for the last 12 plus years now. That’s a recurring topic for the last every single year, right? Is gearbox bearing failures. A lot of the conversation that started back in the day and is still going on is around what they call white etching cracking or white etching failures.

And back, in say, 11 and 12, A lot of the conversation was around was around that. It was around, the oils in the gearboxes. It was around coatings and bearing types and how they could affect the bearing itself to improve the life. And, specifically when it comes to gearbox bearings That was really hard back in the, the service providers and the operators themselves weren’t used to having to replace gearbox bearings.

They maybe weren’t even planning on having to replace gearbox bearings, right? But they started to see these problems. They started to get their head around the scope and how to identify them early and started to dig into it. There’s been a lot of investigations from bearing manufacturers, from third parties, from operators.

into those failures for over a decade now.

Allen Hall: I remember looking into some of the early gearbox issues and you’re talking about some of the failures I am actually familiar with. Those had a lot to do with just sort of basic fundamentals of like lubrication and loading, which were not obvious at the time.

Have we overcome some of those sort of basic bearing issues, or do they still exist out in the field?

Cory Mittleider: I started going to this drivetrain reliability conference in 2015. So I was a couple years later than the initials. But some of the earliest things I remember was slip occurring, right?

From typically I think the scenario that was presented on was high speed low load scenario. Yep. Such as bringing a turbine online, and I remember a chart very vividly from NREL’s outfitting of the high speed bearings on their test 1 5, right? The rollers should be rolling at 400 RPM, but their only roll, or the cajun roller assembly should have been going 400 RPM.

But it was only going 100 RPM meaning there was a ton of slip, a differential speed between the rollers and the inner ring raceway surface. There was some, oils that got fingers pointed at them for essentially being readily available to, to release hydrogen ions. And as we look back at wet etching cracking and the information that’s been collected over the years and investigated I think most people agree that hydrogen embrittlement is a big factor in that, um, there’s certainly components of material cleanliness that are involved in that conversation as well.

It’s a lot of investigation there. And to answer your question, is it still happening? I’ve got this report from an organization called EPRI. I found it on their website. It’s called Wind Turbine Gearbox Reliability Assessment. And they have listed what is it, seven points that lead to most of the gearbox related issues.

related failures and I’ll just read them off. It’s high contract stresses leading to pitting and spalling, bearing race slippage, macro pitting due to skidding and bearing slippage, wear due to inadequate lubrication, race cracking due to white etching formation, low quality materials and material defects or inclusions.

and improper bearing design leading to non uniform stresses or loads. And this was published December of 2021, right? So this is a couple years old, but it’s pretty, pretty recent from an accumulation of data, having time to digest and put out a report. This is pretty recent. And when I look at some other things in here that are really interesting 42 percent of gearbox related downtime is from high speed and intermediate bearings.

The other 58 percent is gearing related or maybe some of the other stages, but 42 percent are from high speed and intermediate bearings from those failure modes that I described. So the takeaway in my mind, as much as that’s something to be aware of and watch out for if it’s high speed and intermediate bearings, those often are replaced up tower.

So you can do that scopal work up tower. Another thing that’s also in the report they’re talking about that uptower scope of work costs somewhere between 15, 000 and 70, 000, right? So you can guess the sooner you catch that, you’re monitoring your CMS, you’re looking for inner ring defects or cracked inner ring or whatever, maybe sometimes outer rings falling as well.

If you can catch that sooner, get that replaced sooner, there’s less debris generated, there’s less additional ancillary components that need to be replaced or serviced. And that keeps it closer to that 15, 000 Scope of work,

Joel Saxum: of course, right? Let me ask you a question about that then. So to find that early enough, we’re usually always talking CMS, right?

And we know there’s a CMS usually from the factory. If it’s a Vesta, whatever they, if they’re doing an FSA, they’re monitoring that from afar. But there is aftermarket CMS for drivetrain monitoring that, like Onyx Insight comes to mind and there’s a couple of other brands out there, of course, would you recommend?

Cause this is a conversation we just had not too long ago with a bunch of people about blades and other reliability things. Would you recommend someone to shadow monitor a like a drivetrain CMS, even though they’re maybe they’re. Full service, agreement already has one. Do you think that’s smart?

Do you think that’s a good spend on money?

Cory Mittleider: Unfortunately what I’ve heard is it seems like no matter the application, gearbox, blade bearings, anything I’ve heard quite a few operators say that when they got to the end of warranty period or end of service agreement periods, they didn’t know what happened.

They didn’t know if X component had been replaced at all, or if it had been replaced five times. I guess I would certainly encourage operators to do everything they can to understand their own equipment. Is that making sure they get the reports from the people that are currently hired to service that?

Maybe it’s as simple as that. Maybe those are behind the wall, and they don’t get access to those. And there probably is some merit in understanding or maybe even say, shadow monitoring or double checking some things on their own to understand their asset. Ultimately it’s their asset.

And They’d be best off to know what’s going on with it. Yeah.

Joel Saxum: So let me ask you another question. With all of the, and this is monitoring inspection related. So to, to catch problems early. So CMS is one tool, right? Another tool is like an Uptower Borescope inspection. Of course, to me, end of warranty is an absolute must to have a third party come in and look at the, do a bore scope inspections, end of warranty.

Is there any other times that you recommend that, or do you recommend that to do every year like we do blade inspections, or what does that look like for you?

Cory Mittleider: The nice thing about gearbox bearings, especially in these high speed and intermediate positions that we’re talking about. The tried and true CMS tools really do a good job, is my understanding.

You can see those, the signatures are well developed they’re high speed enough to stand out. It’s not like main bearings where it’s tougher because it’s such a low speed, right? They blend into the floor on low speeds like that. So my understanding of what most operators do is they watch the CMS, they’ll look at other clues, they’ll look at temperature sometimes they have the the oil particle counting stuff to compliment that as well which the more ways you can monitor your equipment, the better, right?

So that makes sense. And usually what I understand is they’ll see some alarms, whether it’s any of that, or maybe the technician reporting noise, right? Those happen from time to time too. And then they’ll call in that bore scope. They’ll call in that physical inspection. The signature says it’s an inner ring on the high speed, but let’s look around.

It’s just double check and see if we’re, here. There’s a little more to it than just trust in that. Let’s get some eyes on it and figure it out, establish the scope of work. You might see some more stuff to be prepared for when you call in that crew to do a high speed

Joel Saxum: a high speed job. I remember talking to some people over in Denmark and they had an uptower kit that was like, they carried it up tower in a Pelican case.

And when they popped it open, it was a whole set of testing gear for testing oils. oils and lubes and greases and different things up tower where they could just take a small sample out of what was existing there and tell you the particulate levels and tell you if it’s been overheated or burnt up or what kind of life is left in it.

Does that service, have you heard of that service existing in the states? I’m

Cory Mittleider: not familiar with the, called the mobile oil lab type of thing. But it probably has some merit in spot checking. I think one of the things that’s been learned in the last decade, as we talked about WEC failures and gearbox.

Gearbox maintenance, essentially. I think there’s been a better job at paying attention at stuff like that. So I think there’s been an improvement, not just in the bearing technology and how they service it, but just staying on top of things, taking them seriously and doing it preventatively.

Allen Hall: From the design standpoint, Cory, the white edge cracking seems like something that could be designed out, but there maybe was a misunderstanding of how the lubrication, specific lubrication work with specific bearing sets and the loading that was there causing that slipping to occur.

And then which doesn’t seem obvious at first, but when you start thinking about it, like slippage is bad, it creates stress points in these bearings and then. Basically cracks them until they fail catastrophically. Are there more constraints on what the lubrication is and how often it needs to be checked if it becomes a critical piece to the success of a bearing?

Cory Mittleider: Oh we’ve had some conversations about lubrication on different bearing applications and ultimately confidence in lubrication is critical. To Perry Life. Absolutely. Debris can’t, minimize that water, minimize that presence of lubrication. The thing that makes wind turbines so difficult though is the environment and the variable load, right?

When we live in our industrial side of the business, you’ve got a processing plant, a production facility. A lot of times that gearbox, for example, is under more or less constant load. It’s probably in a building. That’s moderately environmentally controlled. Neither of which you have in a wind turbine, right?

You’ve got gusts. You’ve got, South Dakota, January last year, it was negative, 19 degrees, negative 44 wind chill. Now the turbines have a low limit cutoff, right? But even that’s pretty low, right? So you’ve got that and then we’ll get up to 110. And that’s the South Dakota environment.

You’ve got dry environments, you’ve got wet environments. There’s a lot of things that make it tough to have one thing work all the time, right? With that oil having to work for high speed bearings, low speed bearings. Ball bearings, roller type bearings, all inside one gearbox.

Allen Hall: I remember not long ago where additives were the thing.

There was a lot of sales of additives being sold. put into gearboxes to improve the lifetime of the gearbox. But it turns out from what I remember that some of those additives were actually causing some of the failures because it was not working the way that it in theory should have worked.

Cory Mittleider: Yeah, I think some of the early additive packages were pointed at as being more readily available to shed the hydrogen.

And generally, from a hydrogen embrittlement point of view for those that aren’t familiar essentially, you’re stripping off because you have the slipping and this kind of localized high pressure. It can generate localized high heat. It can essentially strip a hydrogen ion off of the chain of this additive, for example, and then coincidentally, when you take the two surfaces, a roller and a raceway, that’s that, that if lubrication isn’t present, separating them and they touch, the asperities touch and rub, that’ll create a negatively charged surface.

So you don’t have your positively charged hydrogen ion right next to your scar, your fresh surface that’s negatively charged. And then it attaches. And when that hydrogen ion attaches there, it weakens the bonds within that’s that steel structure, that alloy structure, and then your same stress cycles that Barry is built to last with it not being as strong, those bonds will break down sooner and sooner.

And essentially you end up with iron sand under the surface, these little pockets of copper. You know what I like to call iron sand under the surface. Now you have this discontinuity of material and it doesn’t carry the load and then it cracks and that’s A really short description of what leads to the white etching cracking phenomenon that’s been seen.

There’s some talk about even potentially electricity playing a contribution in the gearbox. Now an operator was telling me that about that maybe about a month ago. And then those hydrogen ions there’s also some observations that I’ve been seeing that they may want to collect, essentially.

near the impurities, near the inclusions within a steel alloy too, right? No steel is perfectly clean. There’s always something going on in there. Manufacturers do everything they can to minimize that and make them a rounded type instead of sharp edge type. But those are some of the factors that are currently still being talked about when it comes to WEC.

So to battle that, is there a specific oil that you recommend as being a bearing expert? We don’t deal a ton with the lubrication itself. Dealing with the bearings working with the manufacturers, we can tell you what characteristics we want the oil to have our viscosity at temperature, things like that.

But there’s a lot going on there. And I guess put it this way, I’m not well versed enough in oils. We could talk to the engineers at the bearing manufacturers to get some of those lists, but what we found in the last several years, specifically against this list of seven bullet points from this EPRI report, for example, is we’ve seen, we’re, like I said, this started in 2011 ish.

When I started to get involved. So your regular bearing that most items ship with, whether it’s your electric motor on your vacuum cleaner at home, the ball bearings in your wheel hub of your car, or wind turbines. They’re through hardened steel alloy. No coatings, no nothing on them typically.

That’s entry level. and they’re designed for raceway fatigue. And just like the other bearing applications we’ve talked about, all these things aren’t raceway raceway rolling contact fatigue. These are the other things that happen, right? So as the WEC thing started to come to life, one of the first responses from bearing manufacturers, from turbine OEMs, from gearbox OEMs was black oxide.

You guys are familiar with black oxide, I think, right? We even talked about it on our talked about main bearings a bit and Allen, I think it was you that brought up we call it a coating, but I don’t like that word as it pertains to black oxide specifically because it’s converted material, right?

It’s not applied afterwards. That’s what I would call a coating. Black oxide is actually converted material. steel alloy. The surface, again, that’s about two, three microns thick, really thin layer. And it’s exactly what it sounds like. It’s oxide. It’s oxidized steel, right? So it does have some benefits.

It essentially makes the the, surface of the raceways and the rollers fuzzier improving oil adhesion, trying to build up that, that oil layer, increasing your lambda to avoid the smearing, to avoid that contact, to avoid the the asperities touching leading to that scar, that negatively charged surface.

It can only do so much.

Allen Hall: But that’s so true though, because we, when we think of bearings, we think of everything being really smooth and rolling so easily. But when you talk about lubrication you need to have a surface to attach to, to provide that little thin layer of oil so that it does operate for a long period of time and removing that surface is going to be catastrophic in a lot of cases.

Cory Mittleider: And you’re right, you look at a ball bearing on your table, on your bench or something it looks, and they’re polished, they look incredibly smooth. But just like anything, you put it under a microscope and you start to see little peaks and valleys. I call them asperities, right? The roller has those asperities, the raceways have those asperities and it’s something that different bearing manufacturers control in different ways.

It’s something, it’s each manufacturer’s secret sauce on how they do those things a little bit, right? They put as Different effort into different places. But the whole goal with bearings and lubrication is to make sure those asperities don’t touch.

Allen Hall: Exactly. It’s much like a cylinder wall in a, in an engine.

When you watch them build an engine on these high end engines, everything’s so smooth and looks so great. Except for that cylinder wall, which they intentionally brush so that oil remains in that cylinder to lubricate that piston as it goes up and down. The same thing happens in a bearing. Just at a smaller level, it’s not as gross as scratching, but there is a surface there to hold oil properly and lubricant properly.

Losing that surface is really a delicate matter. I think people don’t understand that’s where the magic is. It’s right at that surface level because that white edge cracking was a result of slippage due to lubrication and the surfaces of the mating surfaces not being quite right. Boom.

Now we got a huge problem. And Cory, I think you’re right. A lot of the wind turbine world is so different than most bearing applications. You’re really putting a lot of stress on that. Are there more updated bearings that can handle the tough environment like South Dakota?

Cory Mittleider: Yeah. So something that progressed as the white etching cracking conversation progressed, and this isn’t unique to wind.

When you look at any bearing manufacturer has a catalog of different, uh, materials, heat treatments, coatings, things like that, that they can apply depending on the application. And one of the first upgrades often used for bearings in demanding applications is case carburizing, right? So instead of using a higher carbon content alloy, and through hardening it, Where it’s the same hardness throughout the cross section of the ring.

You use a low carbon alloy base material. And then you put it in a atmosphere with a high carbon atmosphere. You heat treat it for a period of time and you have a shell. Almost imagine cutting an M& M in half, right? You have a harder shell and a little bit of a kind of springy shock absorber type core.

Like a golf ball, yeah, so there’s that, and that’s, like I say, that’s pretty well known. That’s in a lot of different industries, a lot of different applications where our case hardened bearings are the next upgrade often. Something that in my experience going back to 2012, 2013 is there’s actually different versions of case hardening though.

So case carburized is the one that, that typically people are familiar with. It’s the. The standard case hardened version but one that we’ve had a lot of success with specifically in the last 10, 11, almost 12 years now is one that’s case carbon nitrided. So in addition to the carbon in the atmosphere being deposited in the part there’s also nitrogen that’s ends up getting added to the part.

And. Also, the, even the steel alloy is different. So now that’d be probably more what I’d call a medium carbon alloy steel. So it’s not the low carbon alloy steel. It’s not the high carbon alloy steel. It’s a little bit in the middle. Specifically there’s one manufacturer that we’ve worked with a lot on this and that’s NSK and they, what they call it is super tough.

They have a whole family of different materials, different alloys and heat treatments. And this is the one that’s found, we found to work really well in wind. Gearbox bearing applications and one of my my earliest example with a success story on the super tough bearings was actually the Getz.

I’m sure you’re familiar with the Getz gearbox. It had a little bit of a reputation for chewing up and spitting out planet bearings. The first one that I remember was I think it was late 2012. I got installed up tower in March of 2013 after the site was online for about three and a half, four years.

It had already failed a set of planet bearings, and that gets Gearbox. But they were able to do an uptower repair to replace that. And after doing that, the site, we talked about different monitoring methods. I don’t think that site had CMS on their Gearboxes. And never mind, planets are a little trickier because you can’t directly touch them right with the probe through the housing.

They’re floating around. One of the things that they did is they checked the filters. On a six month basis. Just look for some metal particles. That’s how they found it the first time. That’s how they probably find it again. So last update I got from them before they did some other work on the turbine, was that seven years later, so 2020 that when they looked at the Berry Raceways, they still looked brand new.

They still looked great. And the gets with its reputation was one that really stood out to me as successful. Now, between that seven year window we’ve sent a lot more to the field. We’ve done a lot more follow up and other things too, but that’s probably the longest and maybe biggest wow. Realization when it comes to the benefits of different materials, alloys, and heat treatments.

The other thing about bearing technology, ISO dictates that they have to have certain level of cleanliness and minimize particle size and count and type in the alloy. But again, that’s another thing that’s secret sauce on a per manufacturer basis per bearing manufacturer.

And what I’ve learned that NSK does in particular is they just publicized this maybe a year and a half ago now. They do what they call micro UT. So they’re essentially using a an in house developed ultrasonic testing on the bar stock. before the ring is even formed. So that allows them not to look at a sample and cut off a sample, polish it, put it under the microscope and say the sample was good.

So we qualify the whole bar or the sample was bad. So we scrapped the whole bar. They’re able to do that as a non destructive. type of test. So even if there is theoretically a bad spot in a bar, they can cut out this spot of the bar and then continue to keep using the rest as they make the forging.

So that’s another area that as we continue to have deeper and deeper conversations with operators right now that level of design intent and manufacturing diligence is really starting to be observed just now, in my opinion It was important the whole time. We’re just getting to that level.

We’re getting caught up to all the tiny little pieces, the less visible pieces, that can be impactful.

Allen Hall: Now, this is why we need you on the podcast, Cory, because you can explain all of this great bearing issue and resolutions to us, non bearing people. And I know we went across a lot of non bearing people out in the field that just need a little bit of advice.

And if you do need advice, you need to go to Molloy Wind. And check out their website. And Cory, how do they do that?

Cory Mittleider: Yeah, our our website’s at molloywind. com. One of the places that I like to point people is there is a I think it’s called resources tab with some tech articles that we’ve written largely around bearings there’s some gearbox bearing stuff main bearing, blade bearing stuff on there usually around what we’ve seen for failures in different applications.

And then when it comes to the gearbox bearing topic, there’s a couple pages with even the typical gearbox bearing configurations for high speed and intermediate. I have some pictures of on there showing how some use tapers and cylindricals, some use ball bearings and cylindricals in those high speed and intermediate positions.

Because they’re not all done the same. They’re not all implemented the same. Um, and then there’s also some pages as it comes to Gearbox Berries outlining the the, call them the coatings and conversion coatings materials information as well, black oxide and super tough, for example there’s some information there showing that.

Allen Hall: Yeah, so check out malloywind.com or you can reach out to Cory via LinkedIn. Cory, thank you so much for being with us again. I learned a tremendous amount. I’m almost, 10 percent of what your knowledge is. Boy the bearing information is so useful in the field. I really appreciate this.

Cory Mittleider: Yeah, thanks for your time.

https://weatherguardwind.com/malloy-wind-gearbox-bearing/

Renewable Energy

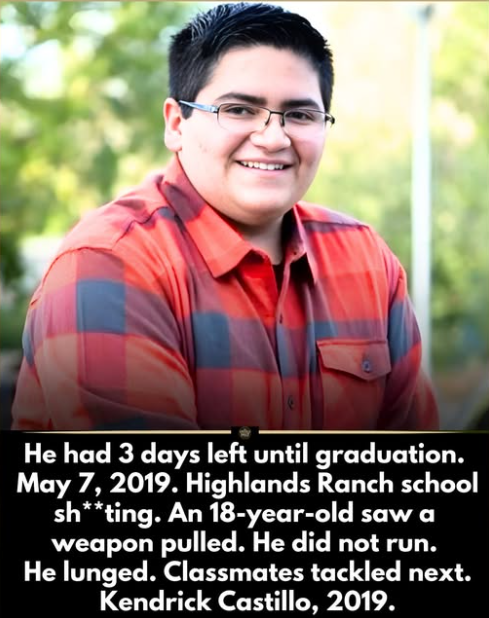

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

Renewable Energy

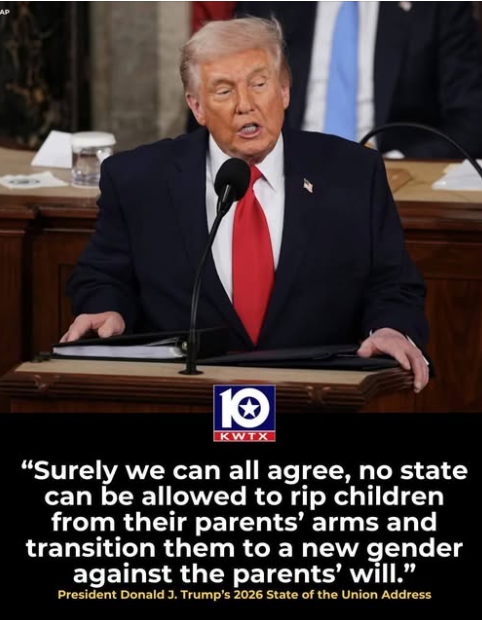

Forced Transgendering of America’s Little Kids

How often does this happen? How about never?

How often does this happen? How about never?

Trump loves to say that little boys go to school and come back home little girls.

He’s the most powerful person in the world for exactly one reason: We’re a nation of morons.

Renewable Energy

Illegal Aliens and U.S. Veterans

Two comments:

Two comments:

That the United States has homeless veterans is a national (and international) disgrace.

By definition, no one has the legal right to enter the U.S. illegally, but according to our constitution, everyone in America is entitled to due process.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits