Today’s climate crisis is already worse than scientists predicted, yet governments continue to pour billions of dollars of public funds into the single-biggest source of greenhouse gas emissions: fossil fuels. Activists have been protesting against this for years, and now we’re seeing the fight spill into courtrooms. In the face of climate breakdown, civil society is sending a clear message: governments that continue to use taxpayers’ money to fund fossil fuels should expect a lawsuit.

Litigation has the power to make or break fossil fuel expansion. With more than 2,000 cases filed across the globe since 2017, climate litigation has, so far, focused on the shortcomings of government or company policies, challenging inadequate emissions reduction targets or reparations linked to climate damages. Today, we’re seeing a new wave of climate litigation focused on institutions that channel public finance towards fossil fuels – with recent lawsuits in Australia, the UK, Mozambique, Brazil, South Korea and beyond.

These lawsuits allow citizens to take back control over their public finances and force public financial institutions – whose investments are notoriously opaque – to become more transparent. One critical step governments can take to avoid such lawsuits is to live up to their commitments and come to a global agreement on oil and gas export finance restrictions at an Organisation for Economic Cooperation and Development (OECD) meeting coming up in mid-March.

Clean, cheap or fair – which countries should pump the last oil and gas?

The UK, Canada and EU already tabled a proposal for such restrictions which, with sufficient support, can succeed in limiting public finance for fossil fuels. This would free up billions of dollars that can be reinvested in reliable, affordable and secure renewable energy, efficiency measures, and facilitating a just transition. To achieve this, getting the US on side is key, after which remaining OECD members will likely follow. If President Biden is serious about tackling climate change, it’s vital that he backs strong measures to stop international finance for fossil fuels.

Despite the US, as well as several G20 countries and major multilateral development banks (MDBs), committing to end international public finance for fossil fuel projects by the end of 2022, they continue to pour billions of dollars into international fossil fuel projects. Data also shows that far more public money goes into fossil fuels than renewables or energy efficiency measures. G20 governments and MDBs provided at least $55 billion for fossil fuels each year from 2019-2021, while allocating only $29 billion to renewables. Bankrolling these toxic industries is fundamentally incompatible with limiting global heating to 1.5C, which, according to the International Energy Agency, requires an immediate stop to investments in new coal, oil, gas and Liquefied Natural Gas (LNG) infrastructure.

State support for gas exports

A crucial part of this fight is holding Export Credit Agencies (ECAs) and similar development institutions accountable. ECAs are government-owned or controlled institutions that provide financing, often at subsidised rates, to large infrastructure projects around the world. ECAs are the world’s largest public financiers of fossil fuels, providing seven times more support for fossil fuels ($34 billion) than clean energy projects ($4.7 billion) between 2019 and 2021.

Without government-backed finance, these projects may not otherwise go ahead. This is especially true for the expansion of more than 80% of new LNG exports over the last decade. While President Biden’s recent announcement of a pause in approvals for new LNG export terminals in the US is welcome, we need to make much more rapid progress to stay within safe planetary limits. A crucial part of this fight is holding ECAs to account and governments to comply with international law.

Civil society groups are turning to the courts. The NGO Jubilee is suing Export Finance Australia and the Northern Australia Infrastructure Facility for failing to adequately report the environmental effects and climate impacts linked to their financing activities, which play a crucial role in determining how ECAs disclose relevant information.

Last year, Friends of the Earth UK took the UK’s ECA to court over its investment in a major LNG project in Mozambique. Friends of the Earth argued that the $1.15 billion in export finance support was unlawful, inconsistent with the latest science, and incompatible with the Paris Agreement. Although the court ruled in favour of the ECA, the case exerted enough pressure to stop funding for new overseas fossil fuel projects. Without the publicised court battle flagging the issue for the UK public and policymakers, this result may never have been achieved.

In Brazil, the human rights NGO Conectas sued the Brazilian Development Bank for failing to assess the negative climate impacts of its investments. Similarly, South Korean ECAs were challenged over the funding they provided for the Australian Barossa gas pipeline project, which would run through a protected marine park, forcing the financiers to review the necessity of LNG imports, as well as their environmental impacts.

Despite Cop28 pledge, France keeps fossil fuel subsidies for farmers

At COP26, 34 governments, including a majority of OECD members, signed up to the Clean Energy Transition Partnership (CETP), pledging to end international public finance for unabated fossil fuels by the end of 2022. Despite this, governments are failing to keep their promises and continue to fund international fossil fuel projects. The Jubilee case comes at a time when Australia announced its commitment to the CETP – we now need to see policies follow commitments. Put simply: when governments make promises, they need to keep them, or the courtroom awaits.

Maria Alejandra Vesga Correa is a legal officer in the global public finance team at Oil Change International. Leanne Govindsamy is programme head for corporate accountability and transparency at the Centre for Environmental Rights. Lorenzo Fiorilli is a lawyer working on public finance, energy markets and competition with ClientEarth.

The post When governments fund fossil fuels, it’s time to take them to court appeared first on Climate Home News.

When governments fund fossil fuels, it’s time to take them to court

Climate Change

On the Farm, the Hidden Climate Cost of America’s Broken Health Care System

American farmers are drowning in health insurance costs, while their German counterparts never worry about medical bills. The difference may help determine which country’s small farms are better prepared for a changing climate.

Samantha Kemnah looked out the foggy window of her home in New Berlin, New York, at the 150-acre dairy farm she and her husband, Chris, bought last year. This winter, an unprecedented cold front brought snowstorms and ice to the region.

On the Farm, the Hidden Climate Cost of the Broken U.S. Health Care System

Climate Change

A Little-Used Maneuver Could Mean More Drilling and Mining in Southern Utah’s Redrock Country

Two Utah Congress members have introduced a resolution that could end protections for Grand Staircase-Escalante National Monument. Conservation groups worry similar maneuvers on other federal lands will follow.

Lawmakers from Utah have commandeered an obscure law to unravel protections for the Grand Staircase-Escalante National Monument, potentially delivering on a Trump administration goal of undoing protections for public conservation lands across the country.

A Little-Used Maneuver Could Mean More Drilling and Mining in Southern Utah’s Redrock Country

Climate Change

Heatwaves driving recent ‘surge’ in compound drought and heat extremes

Drought and heatwaves occurring together – known as “compound” events – have “surged” across the world since the early 2000s, a new study shows.

Compound drought and heat events (CDHEs) can have devastating effects, creating the ideal conditions for intense wildfires, such as Australia’s “Black Summer” of 2019-20 where bushfires burned 24m hectares and killed 33 people.

The research, published in Science Advances, finds that the increase in CDHEs is predominantly being driven by events that start with a heatwave.

The global area affected by such “heatwave-led” compound events has more than doubled between 1980-2001 and 2002-23, the study says.

The rapid increase in these events over the last 23 years cannot be explained solely by global warming, the authors note.

Since the late 1990s, feedbacks between the land and the atmosphere have become stronger, making heatwaves more likely to trigger drought conditions, they explain.

One of the study authors tells Carbon Brief that societies must pay greater attention to compound events, which can “cause severe impacts on ecosystems, agriculture and society”.

Compound events

CDHEs are extreme weather events where drought and heatwave conditions occur simultaneously – or shortly after each other – in the same region.

These events are often triggered by large-scale weather patterns, such as “blocking” highs, which can produce “prolonged” hot and dry conditions, according to the study.

Prof Sang-Wook Yeh is one of the study authors and a professor at the Ewha Womans University in South Korea. He tells Carbon Brief:

“When heatwaves and droughts occur together, the two hazards reinforce each other through land-atmosphere interactions. This amplifies surface heating and soil moisture deficits, making compound events more intense and damaging than single hazards.”

CDHEs can begin with either a heatwave or a drought.

The sequence of these extremes is important, the study says, as they have different drivers and impacts.

For example, in a CDHE where the heatwave was the precursor, increased direct sunshine causes more moisture loss from soils and plants, leading to a drought.

Conversely, in an event where the drought was the precursor, the lack of soil moisture means that less of the sun’s energy goes into evaporation and more goes into warming the Earth’s surface. This produces favourable conditions for heatwaves.

The study shows that the majority of CDHEs globally start out as a drought.

In recent years, there has been increasing focus on these events due to the devastating impact they have on agriculture, ecosystems and public health.

In Russia in the summer of 2010, a compound drought-heatwave event – and the associated wildfires – caused the death of nearly 55,000 people, the study notes.

The record-breaking Pacific north-west “heat dome” in 2021 triggered extreme drought conditions that caused “significant declines” in wheat yields, as well as in barley, canola and fruit production in British Columbia and Alberta, Canada, says the study.

Increasing events

To assess how CDHEs are changing, the researchers use daily reanalysis data to identify droughts and heatwaves events. (Reanalysis data combines past observations with climate models to create a historical climate record.) Then, using an algorithm, they analyse how these events overlap in both time and space.

The study covers the period from 1980 to 2023 and the world’s land surface, excluding polar regions where CDHEs are rare.

The research finds that the area of land affected by CDHEs has “increased substantially” since the early 2000s.

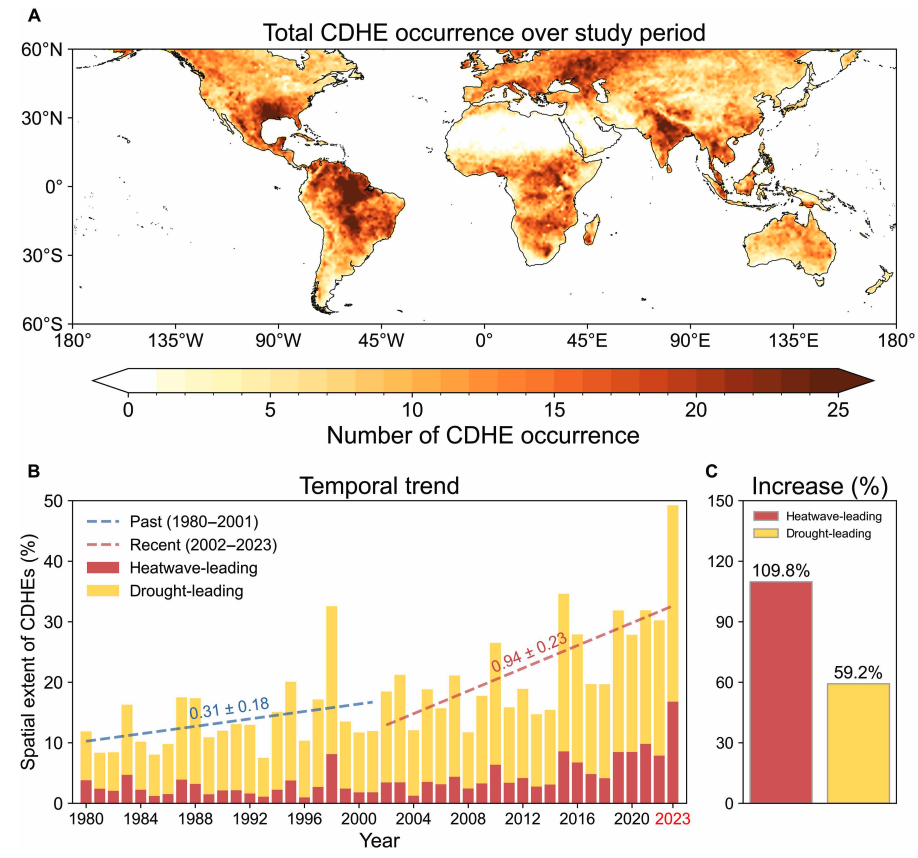

Heatwave-led events have been the main contributor to this increase, the study says, with their spatial extent rising 110% between 1980-2001 and 2002-23, compared to a 59% increase for drought-led events.

The map below shows the global distribution of CDHEs over 1980-2023. The charts show the percentage of the land surface affected by a heatwave-led CDHE (red) or a drought-led CDHE (yellow) in a given year (left) and relative increase in each CDHE type (right).

The study finds that CDHEs have occurred most frequently in northern South America, the southern US, eastern Europe, central Africa and south Asia.

Threshold passed

The authors explain that the increase in heatwave-led CDHEs is related to rising global temperatures, but that this does not tell the whole story.

In the earlier 22-year period of 1980-2001, the study finds that the spatial extent of heatwave-led CDHEs rises by 1.6% per 1C of global temperature rise. For the more-recent period of 2022-23, this increases “nearly eightfold” to 13.1%.

The change suggests that the rapid increase in the heatwave-led CDHEs occurred after the global average temperature “surpasse[d] a certain temperature threshold”, the paper says.

This threshold is an absolute global average temperature of 14.3C, the authors estimate (based on an 11-year average), which the world passed around the year 2000.

Investigating the recent surge in heatwave-leading CDHEs further, the researchers find a “regime shift” in land-atmosphere dynamics “toward a persistently intensified state after the late 1990s”.

In other words, the way that drier soils drive higher surface temperatures, and vice versa, is becoming stronger, resulting in more heatwave-led compound events.

Daily data

The research has some advantages over other previous studies, Yeh says. For instance, the new work uses daily estimations of CDHEs, compared to monthly data used in past research. This is “important for capturing the detailed occurrence” of these events, says Yeh.

He adds that another advantage of their study is that it distinguishes the sequence of droughts and heatwaves, which allows them to “better understand the differences” in the characteristics of CDHEs.

Dr Meryem Tanarhte is a climate scientist at the University Hassan II in Morocco, and Dr Ruth Cerezo Mota is a climatologist and a researcher at the National Autonomous University of Mexico. Both scientists, who were not involved in the study, agree that the daily estimations give a clearer picture of how CDHEs are changing.

Cerezo-Mota adds that another major contribution of the study is its global focus. She tells Carbon Brief that in some regions, such as Mexico and Africa, there is a lack of studies on CDHEs:

“Not because the events do not occur, but perhaps because [these regions] do not have all the data or the expertise to do so.”

However, she notes that the reanalysis data used by the study does have limitations with how it represents rainfall in some parts of the world.

Compound impacts

The study notes that if CDHEs continue to intensify – particularly events where heatwaves are the precursors – they could drive declining crop productivity, increased wildfire frequency and severe public health crises.

These impacts could be “much more rapid and severe as global warming continues”, Yeh tells Carbon Brief.

Tanarhte notes that these events can be forecasted up to 10 days ahead in many regions. Furthermore, she says, the strongest impacts can be prevented “through preparedness and adaptation”, including through “water management for agriculture, heatwave mitigation measures and wildfire mitigation”.

The study recommends reassessing current risk management strategies for these compound events. It also suggests incorporating the sequences of drought and heatwaves into compound event analysis frameworks “to enhance climate risk management”.

Cerezo-Mota says that it is clear that the world needs to be prepared for the increased occurrence of these events. She tells Carbon Brief:

“These [risk assessments and strategies] need to be carried out at the local level to understand the complexities of each region.”

The post Heatwaves driving recent ‘surge’ in compound drought and heat extremes appeared first on Carbon Brief.

Heatwaves driving recent ‘surge’ in compound drought and heat extremes

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits