FOR IMMEDIATE RELEASE

Citizens’ Climate Lobby joins broad coalition supporting bipartisan Fix Our Forests Act

September 9, 2025 – Citizens’ Climate Lobby (CCL) has joined American Forests, the Bipartisan Policy Center Action, the Federation of American Scientists, and a range of other organizations to express support for the Fix Our Forests Act.

This broad coalition of 22 organizations sent a joint letter to Senate leadership, urging the bill’s passage through the Senate Committee on Agriculture, Nutrition and Forestry and then through the full Senate.

The letter details the growing risks from wildfires and the need to mitigate those threats. “Congress has the opportunity to take bipartisan action now, proactively, before the next fire inevitably costs lives, livelihoods, and ways of life,” the letter states.

Visit American Forests’ website to see the full letter and complete list of co-signing organizations.

CCL is also mobilizing our volunteer base to build more support for this legislation. This week, CCL launched a new action tool to generate grassroots messages to lawmakers on the Senate Committee on Agriculture, Nutrition and Forestry.

CONTACT: Flannery Winchester, CCL Vice President of Communications, 615-337-3642, flannery@citizensclimate.org

###

Citizens’ Climate Lobby is a nonprofit, nonpartisan, grassroots advocacy organization focused on national policies to address climate change. Learn more at citizensclimatelobby.org.

The post CCL joins broad coalition supporting bipartisan Fix Our Forests Act appeared first on Citizens' Climate Lobby.

CCL joins broad coalition supporting bipartisan Fix Our Forests Act

Greenhouse Gases

Analysis: Record solar growth keeps China’s CO2 falling in first half of 2025

Clean-energy growth helped China’s carbon dioxide (CO2) emissions fall by 1% year-on-year in the first half of 2025, extending a declining trend that started in March 2024.

The CO2 output of the nation’s power sector – its dominant source of emissions – fell by 3% in the first half of the year, as growth in solar power alone matched the rise in electricity demand.

The new analysis for Carbon Brief shows that record solar capacity additions are putting China’s CO2 emissions on track to fall across 2025 as a whole.

Other key findings include:

- The growth in clean power generation, some 270 terawatt hours (TWh) excluding hydro, significantly outpaced demand growth of 170TWh in the first half of the year.

- Solar capacity additions set new records due to a rush before a June policy change, with 212 gigawatts (GW) added in the first half of the year.

- This rush means solar is likely to set an annual record for growth in 2025, becoming China’s single-largest source of clean power generation in the process.

- Coal-power capacity could surge by as much as 80-100GW this year, potentially setting a new annual record, even as coal-fired electricity generation declines.

- The use of coal to make synthetic fuels and and chemicals is growing rapidly, climbing 20% in the first half of the year and helping add 3% to China’s CO2 since 2020.

- The coal-chemical industry is planning further expansion, which could add another 2% to China’s CO2 by 2029, making the 2030 deadline for peaking harder to meet.

Even if its emissions fall in 2025 as expected, however, China is bound to miss multiple important climate targets this year.

This includes targets to reduce its carbon intensity – the emissions per unit of GDP – to strictly control coal consumption growth and new coal-power capacity, as well as to increase the share of cleaner electric-arc steelmaking in total steel output.

If policymakers want to make up for these shortfalls, then there will be additional pressure on China’s next “nationally determined contribution” (NDC, its international climate pledge for 2035) and its 15th five-year plan for 2026-30, both due to be finalised in the coming months.

The falling trend in CO2 emissions – and the clean-energy growth that is driving it – could give policymakers greater confidence that more ambitious targets are achievable.

Falling emissions from power, cement and steel

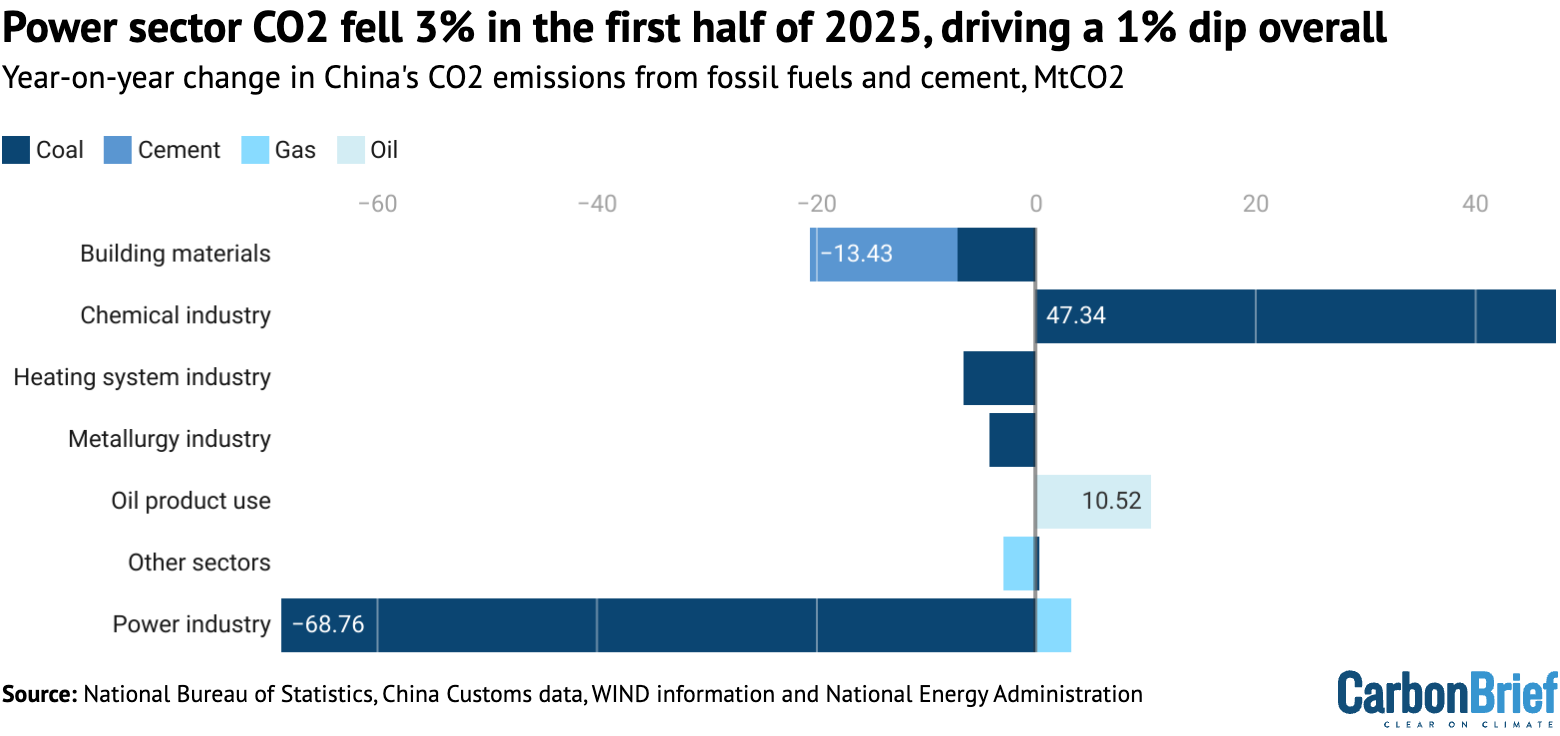

The reduction in emissions in the first half of 2025 was predominantly driven by the power sector, aided by the building materials, steel and heating industries.

Coal use in the power industry fell by 3.4% compared with the same period a year earlier, while gas use increased by 6%, resulting in a 3.2% drop in emissions for the sector overall.

The reduction in CO2 emissions from coal use in the power sector is shown at the bottom of the figure below, along with the small rise due to higher gas-fired electricity generation.

Other changes in CO2 emissions in the first half of 2025, compared with the same period in 2024, are broken down by source and sector in the rest of the figure.

Emissions from the building materials sector fell by 3% and from the metals industry by 1%, with cement falling 4% and steel output 3%. The reason for these reductions is the ongoing contraction in the construction sector, with real estate investment falling 11% and the floor area of new construction starts by 20%. Traditional targets of government infrastructure investment, such as transportation, also showed relatively slow growth.

CO2 reductions resulting from the drop in steel output were limited by a fall in the share of electric arc furnace (EAF) steelmaking, a much less emissions- and energy-intensive process than the coal-based production of primary steel.

The share of electric-arc output in total production fell from 10.2% in 2024 to 9.8% in the first half of 2025, despite a government target of 15% for this year.

Excess coal-based capacity and a lack of incentives for shifting production mean that electric arc steelmakers, rather than coal-based steel mills, tend to absorb reductions in output, as their operating costs are higher and costs of shutting down and starting up production lines are lower.

Shifting to EAF steel is one of the largest emission reduction opportunities in China over the next decade, according to an analysis by the Centre for Research on Energy and Clean Air.

Elsewhere, consumption of oil products increased by 1%. However, this growth did not come from transport fuel demand. The production of petrol, diesel and jet fuel all continued to fall, with electric vehicles eating into road-fuel demand. Instead, growth was driven by demand for naphtha from petrochemicals producers, including newly commissioned plants.

Gas use outside the power sector – mainly heating – dropped by 1%, after a fall in the first quarter due to mild winter temperatures and a smaller increase in the second quarter.

Solar boom covers power demand growth

The first half of 2025 saw a new record for the growth of clean power generation excluding hydro, made up of solar, wind, nuclear and biomass.

Clean power generation from solar, wind and nuclear power grew by 270 terawatt hours (TWh), substantially exceeding the 170TWh (3.7%) increase in electricity consumption. Hydropower generation fell by 3% (16TWh), moderating the fall in fossil fuel-fired power generation.

The rise in power generation from solar panels, on its own, covered all of the growth in electricity demand, increasing by 170TWh – equivalent to the national power output of Mexico or Turkey over the same period. Wind power output grew by 80TWh and nuclear by 20TWh.

As a result, the share of low-carbon sources reached 40% of the nation’s electricity generation overall in the first half of the year, up from 36% in the same period of 2024.

The figure below shows how clean-energy sources excluding hydro (columns) have started matching the recent increases in China’s electricity demand (solid line), as well as the average amount of growth in recent years (dashed line).

Strikingly, the record growth of solar and continued expansion of wind mean that both sources of electricity generation overtook hydropower for the first time in the first half of 2025, as shown in the figure below. Despite steady growth, nuclear power is a relatively distant fourth, at less than half of the power generation from each of the other three major non-fossil technologies.

The growth in solar power generation was driven by record capacity growth. China added 212GW of new solar capacity in the first half of the year, double the amount installed in the first half of 2024, which itself had been a new record.

For comparison, the world’s second-largest nation for solar capacity – the US – had only installed 178GW, in total, by the end of 2024, while third-ranked India had 98GW.

Some 93GW of new solar capacity was added to China’s grid in May alone, as the rush to install before a change in pricing policy culminated. This rate of installations translates to approximately 100 solar panels installed every second of the month.

The acceleration was due to a change in the policy on tariffs paid to new wind and solar generators, which started in June. Previously, new plants were guaranteed to receive the benchmark price for coal-fired power output in each province, for each unit of electricity they generate. Under the new policy, new generators have to secure contracts directly with electricity buyers, causing uncertainty and likely putting downward pressure on revenue.

The resulting surge in new capacity means that solar is poised to overtake wind this year – and hydro this year or next – to become the largest source of clean power generation in China.

This is despite solar capacity additions slowing down in June and projections diverging widely on how much growth to expect for the remainder of 2025 and into 2026, under the new policy.

The consensus among forecasters has been one of a sharp slowdown in installations.

After the new pricing policy was announced, the China Electricity Council (CEC) and China Photovoltaic Industry Association (CPIA) projected 210GW and 215-235GW for 2025 as a whole, respectively, implying plummeting additions in the second half of the year. In contrast, the State Grid Energy Research Institute expects 380GW to be added to the grid this year.

After data for May installations became available, the CEC upgraded its forecast for the whole year to 310GW and the CPIA to 270-300GW, implying that 60-100GW would be added in the second half of the year. This would still be a sharp deceleration compared with the second half of 2024, when 173GW was added.

For wind, the State Grid researchers expect 140GW and CEC 110GW, while 51GW was added in the first half of the year. Both numbers indicate larger capacity additions in the second half of 2025 and an increase for the full year compared with 2024.

The State Grid should have detailed knowledge of projects seeking to connect to the electricity grid, so its projections carry extra weight compared with others. If its expectations for wind and solar growth are realised, this would result in around 850TWh of annual clean power generation being added to the grid in 2025, as shown in the figure below.

This new clean power capacity would be more than enough to meet the entire electricity demand of Brazil (760TWh), or Germany and the UK combined (817TWh).

With the State Grid also projecting demand to grow by 400-640TWh (4.0-6.5%), clean-energy growth should push down CO2 from China’s power sector this year – and well into next year.

China’s top economic planner, the National Development and Reform Commission (NDRC), is also taking steps to spur demand for contracts with solar and wind producers.

A new policy – published in July – requires for the first time that steel, cement and polysilicon factories, as well as some new data centres, meet a certain percentage of their demand using renewable electricity.

Previously, such requirements were only applied to provinces, power distribution companies and the aluminum industry. Their mandated renewable energy shares have also now increased.

These changes boost demand for contracts with renewable electricity suppliers, just as new solar and wind plants are having to secure contracts directly with buyers, under their new pricing policy.

The increase in demand for renewable power resulting from these measures broadly matches the low end of the growth projected in solar and wind this year. The renewable quotas therefore offer a backstop of support for the continued growth of clean power, which will be required to meet China’s wider climate and energy targets.

The increase in solar power generation from rising installations could be even larger, but is being limited by issues around grid management and capacity.

The share of potential solar power output that was not utilised rose to 5.7% in the first half of 2025, from 3.2% a year earlier. While technical issues such as uncompleted grid connections could play a role amid the boom, this also implies a significant increase in curtailment.

The average utilisation rate of solar panels fell by 12% in the first quarter of this year, compared with the 2020–2023 average, according to China Electricity Council data accessed through Wind Information. This is a much larger reduction than indicated by the reported curtailment rates. The flipside of this dip in utilisation is that improvements to grid operation and infrastructure will unlock even more generation from existing solar capacity.

Coal power capacity is expected to surge this year, even as demand for power generation from coal contracts. The State Grid predicts 127GW of thermal power added. Some of this will be gas, but based on non-coal thermal power additions expected by the CEC, around 90-100GW is coal, while the CEC projects 80GW of coal power added.

Data from Global Energy Monitor shows 93-109GW of coal-power projects under construction that could be completed this year, assuming a 2.5 to 3-year lead time from issuance of permits to grid connection. The largest amount of coal-fired capacity China has ever connected to the grid in one year is 63GW in 2008, so 2025 seems likely to set a new record by a large margin.

A former senior official at one of China’s largest power firms stated in an interview in June 2025 that companies are building coal power capacity due to central government pressure.

There is little enthusiasm to invest and the target to expand coal-power capacity to 1,360GW in this five-year plan period, covering 2021-2025, is unlikely to be met. Operating coal-power capacity was 1,210GW at the end of June, up from 1,080GW at the end of 2020.

The influx of coal-fired capacity will result in falling utilisation and profitability.

However, oversupply of coal power could also weaken demand for contracts with solar and wind producers, undermining clean-energy growth. This makes measures that offer a backstop of demand for clean power, such as the sector quotas, all the more significant.

Coal chemicals shooting up

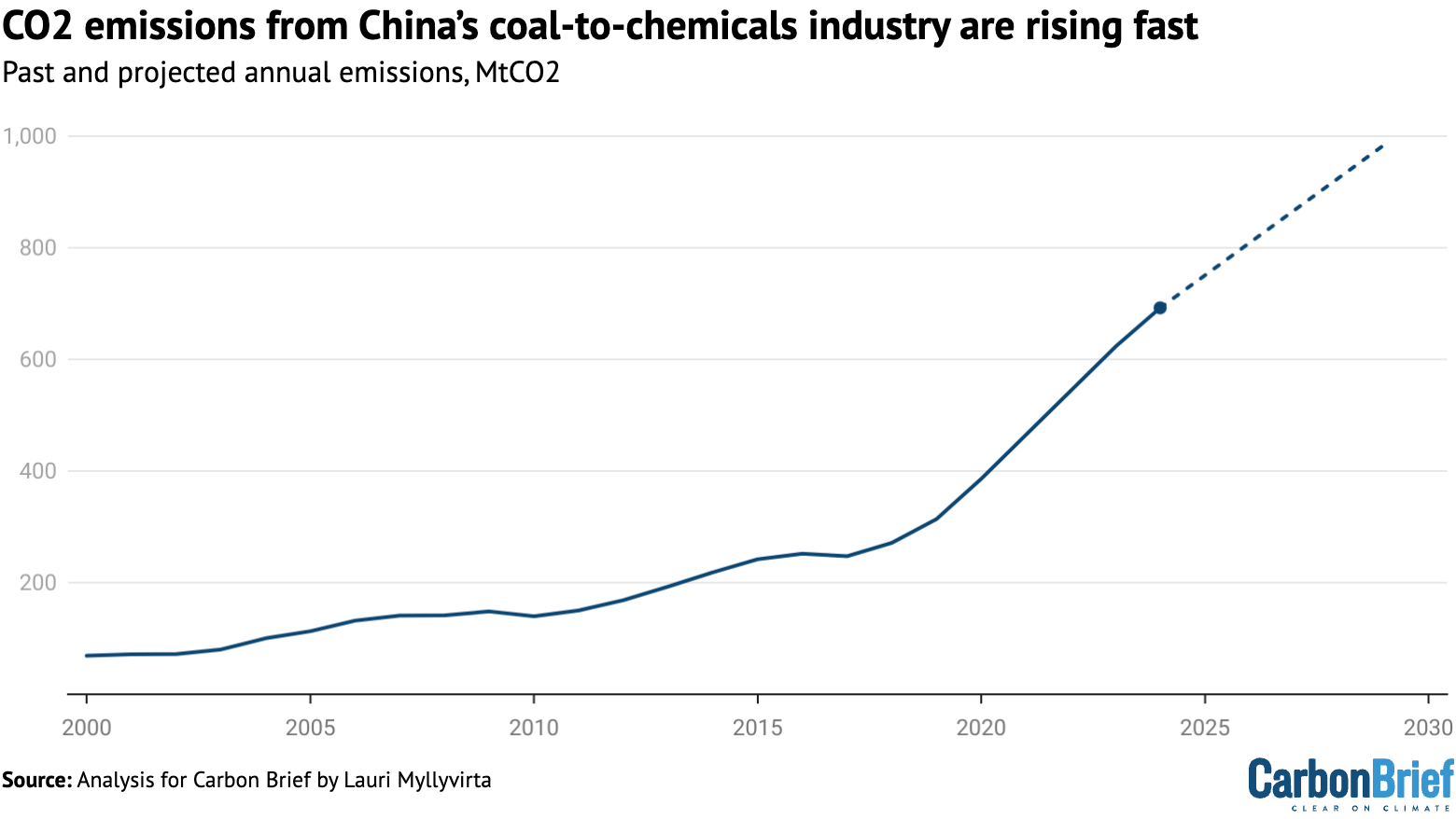

The only major sector that saw growth in emissions in the first half of the year was the chemicals sector. Coal use in the sector, both as a fuel and a feedstock, increased by a dramatic 20% year-on-year, on top of a 10% increase in 2024.

Oil use in the chemicals sector increased as well, as reflected in a 9% increase in total consumption of naptha – a key petrochemicals feedstock – estimated from OPEC data.

The growth is driven by the coal-to-chemicals industry, which turns coal into synthetic liquid and gaseous fuels, as well as petrochemical products. This is a sector that China has developed aggressively, to reduce reliance on imported oil and gas, as well as to promote the exploitation of coal resources in the country’s far west – particularly Xinjiang – where coal and coal power exports to the rest of China are limited by transportation capacity and costs.

The sector consumed approximately 390m tonnes of coal in 2024, resulting in an estimated 690m tonnes CO2 emissions (MtCO2), making it responsible for 6% of China’s fossil CO2 emissions and 9% of the country’s coal use in 2024.

Coal use and emissions increased 10% from 2023 while total coal conversion capacity increased only 5%, implying that the utilisation of existing capacity increased as well.

The coal-to-chemicals industry used 155m tonnes of standard coal in 2020 and CO2 emissions were estimated at 320MtCO2. The coal-to-chemicals industry therefore added around 3% to China’s total CO2 emissions from 2020 to 2024, making it one of the sectors responsible for the recent acceleration in the country’s CO2 emissions growth and its shortfall against targets to control increases in CO2 emissions and coal use.

Output from the sector reportedly replaced 100m tonnes of oil equivalent (Mtoe) of oil and gas in 2024, which implies 250-280MtCO2 emissions avoided from oil and gas use, depending on how the avoided demand breaks down between oil and gas.

The net effect of the industry on CO2 emissions was therefore an increase of around 410-440MtCO2, or 4% of China’s total CO2, highlighting that coal-based chemical production is much more carbon-intensive than its already carbon-intensive oil- and gas-based equivalent.

The sector’s growth in coal use and emissions reflects drastically improved profitability in most segments in recent years. Its profitability depends heavily on the oil price, so the sharp increase in oil prices from the 2015-2020 level in 2021-24 supported output growth, whereas the recent fall in oil prices could temper it.

The chemical industry association still expects the sector to expand capacity for another decade, until 2035, even under China’s CO2 peaking target.

Analysis by Tianfeng Securities touts the years 2025-2030 as the “peak period” for investment in coal to chemicals, claiming that potential annual investment over the next five years could reach three times the 2021-23 level and that half of this potential investment is in Xinjiang province.

Sinolink Securities projects that an average of at least 37m tonnes of coal conversion capacity will be added in the coal-to-chemicals industry each year from 2025 to 2029, with coal-to-oil-and-gas and coal-to-methanol dominating these capacity additions.

This would mean a 40% increase in the industry’s capacity from 2024 to 2029, with the potential to add over 250MtCO2 per year of emissions, increasing total CO2 emissions by over 2%.

The figure below illustrates this potential increase, which would continue recent trends.

If this further expansion takes place – and assuming new chemicals plants are used at the same rate as the existing fleet is being used today – then it would complicate China’s carbon peaking target and make the CO2 intensity target for 2030 even more challenging to meet.

However, this is not the first time that the industry has been predicted to boom. In 2014, the China Coal Association issued a prediction that the coal-to-chemicals industry would be using 750Mt of coal per year by 2020, converting to about 540Mt of “standard” coal.

In reality, less than a third of this demand was realised – in large part due to low oil prices – and the sector was still only using half of this amount by the end of 2024.

New targets on the horizon

Given the major increase in solar capacity in the first half, as well as expected additions of wind and nuclear throughout the year, China is on track for a fall in emissions in 2025.

This would continue a declining trend that began in early 2024 and leaves open the possibility that China’s emissions could have peaked already, years ahead of its “before 2030” target.

The recent slide in China’s total CO2 emissions is shown in the figure below, with the shallow decline illustrating the potential that this trend could be reversed.

Even if China’s emissions fall by a few percent this year, however, this is unlikely to be sufficient to meet the carbon intensity target for 2025 in the current five-year plan. Still, it would make the country’s 2030 carbon intensity commitment under the Paris Agreement easier to meet.

A continuing fall in emissions, extending the fall that began in early 2024, could also affect target-setting for the next five-year plan – which is being prepared for release in early 2026 – by showing that China could peak and reduce its emissions well ahead of the 2030 deadline.

Yet, despite rapid progress in 2024 and 2025, China is bound to miss multiple emissions-related targets in the 2021-2025 period, due to rapid CO2 rises during and after the Covid pandemic.

These targets include improvements in carbon intensity, “strict” controls of the growth in coal consumption and new coal-fired power plants, as well as the share of cleaner electric arc steelmaking in total steel output.

If China’s policymakers want to make up the shortfall against these 2025 targets and get on track for their 2030 goals, then they would need to set out higher ambitions in the 15th five-year plan, covering 2026-2030. For example, this could include reducing the carbon intensity of China’s economy by more than 20% over the next five years.

China’s new pledge (NDC) under the Paris Agreement, with targets for 2035, is due to be published in the next few months and will provide important indications of their intentions.

The new pricing policy for wind and solar has also increased the importance of target-setting, by making “contracts for difference” available for the amount of capacity needed to meet the central government’s clean-energy targets. An ambitious clean-energy target for 2035 would be a significant new backstop for clean-energy growth, with both climate and economic relevance.

Another major question is how the government will react to the influx of coal-fired capacity, even as power generation from coal recedes. It could either move to close down older coal plants – or to limit clean-energy additions.

With respect to coal power plants, the key point remains, however, that as long as clean power generation keeps growing faster than electricity demand, then increases in coal and gas fired capacity will result in falling utilisation, rather than increased CO2 emissions.

About the data

Data for the analysis was compiled from the National Bureau of Statistics of China, National Energy Administration of China, China Electricity Council and China Customs official data releases, and from WIND Information, an industry data provider.

Wind and solar output, and thermal power breakdown by fuel, was calculated by multiplying power generating capacity at the end of each month by monthly utilisation, using data reported by China Electricity Council through Wind Financial Terminal.

Total generation from thermal power and generation from hydropower and nuclear power was taken from National Bureau of Statistics monthly releases.

Monthly utilisation data was not available for biomass, so the annual average of 52% for 2023 was applied. Power sector coal consumption was estimated based on power generation from coal and the average heat rate of coal-fired power plants during each month, to avoid the issue with official coal consumption numbers affecting recent data.

CO2 emissions estimates are based on National Bureau of Statistics default calorific values of fuels and emissions factors from China’s latest national greenhouse gas emissions inventory, for the year 2021. Cement CO2 emissions factor is based on annual estimates up to 2024.

For oil consumption, apparent consumption is calculated from refinery throughput, with net exports of oil products subtracted.

The post Analysis: Record solar growth keeps China’s CO2 falling in first half of 2025 appeared first on Carbon Brief.

Analysis: Record solar growth keeps China’s CO2 falling in first half of 2025

Greenhouse Gases

China Briefing 21 August 2025: China’s CO2 decline; ‘Two mountains’; China’s cement challenge

Welcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

Emissions fell in first half

POWERING THE TRANSITION: China’s carbon dioxide (CO2) emissions fell 1% year-on-year in the first half of 2025, new analysis for Carbon Brief found, extending a decline that began in March 2024. Power sector emissions fell by 3% during this period, as growth in solar power alone matched the 170 terawatt-hour (TWh) rise in electricity demand, the analysis said. It noted that the sector’s coal use fell 3.4% year-on-year, while gas use increased by 6%. The analysis added that, even if China’s emissions fall in 2025, it will likely miss multiple climate targets this year, such as carbon intensity.

DEMAND UP, PRICES DOWN: Reuters reported that in July, which is not covered in the Carbon Brief analysis, China’s fossil-fuelled power generation “rose 4.3%…from a year earlier”, due to high cooling demand. Extreme heat continued to push power demand to new highs in early August, China Energy News said, with China seeing record demand continuously over 4-6 August. At one point demand reached 1,233 gigawatts, it added. Business news outlet Caixin reported that, despite this, power was “actually getting cheaper in some regions”, driven by the “growing share of renewables in the power mix”.

‘SHORT-TERM SHOCKS’: Extreme heat, heavy rains and floods “caused short-term shocks to economic operations”, Singapore-based outlet Lianhe Zaobao quoted a government official as saying. “Bad weather” specifically affected “steel and coal output”, according to Bloomberg, with the coal industry “also contending with government inspections”. The government will allocate 100bn yuan ($14bn) to “support businesses hit by natural disasters”, Reuters said.

PETROCHEMICALS RISING: The only major sector that saw growth in emissions during the first half of 2025 was the chemicals sector, the Carbon Brief analysis said, rising around 47% year-on-year. At least one segment of the industry is “set to expand by almost half between now and 2028”, Reuters cited a representative of oil giant Sinopec as saying. Meanwhile, state news agency Xinhua said Sinopec is “promoting the construction of a Beautiful China through the development of a beautiful petrochemical industry”.

Clean-tech exports stayed strong

OVERSEAS GROWTH: China’s exports of clean-energy technologies “rose further in July”, Caixin said, with Chinese lithium-ion battery and electric vehicle (EV) exports in the first seven months of 2025 rising around 26% year-on-year, by value. Solar cell exports also rose 54% in terms of volume over this period, it noted, although by value they “fell 23%”. Industry outlet PV Magazine said that China’s exports of solar cells and wafers had “increased significantly”, but that exports of panels declined. Meanwhile, the government has held its second meeting in two months with solar industry representatives on curbing overcapacity, Reuters said. Elsewhere, the Hong Kong-based South China Morning Post (SCMP) covered new research finding that, in 2024, Chinese EV companies invested more overseas than they did in China “for the first time”.

-

Sign up to Carbon Brief’s free “China Briefing” email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

‘PRAGMATIC’ ON CLIMATE: Chinese ambassador to the UK Zheng Zeguang argued China and the UK should work “more closely” to address climate change, in a Guardian commentary. (Zheng has also become China’s first permanent representative to the London-based International Maritime Organization, according to Xinhua.) In response to an article by UK government adviser Chris Stark saying that the UK should join China in becoming an “electrostate”, the Global Times published an editorial saying the UK’s energy transition “hinges on pragmatic cooperation” with China. Meanwhile, President Xi Jinping said China and Brazil should “ensure the success” of COP30, Xinhua reported.

CHINA’S SECURITY CONCERNS: China’s third-largest hydropower station has “fully transitioned away” from using western-made chips due to “national security and supply chain resilience concerns”, SCMP reported. The government also issued a notice on “strengthening” supervision of smart EVs, International Energy Net said, including software updates. China’s exports of permanent magnets and other rare-earth products “extended their recovery in July”, Bloomberg said, with export volumes rising 69% from a month earlier. The country is also warning foreign companies not to “stockpile rare earths and derived products such as magnets”, the Financial Times reported.

National ecology day

GREEN TO GOLD: China must “adopt green development approaches to grow our mountains of gold and silver”, Premier Li Qiang said, according to energy news outlet International Energy Net, at an event marking national ecology day. The event was also held on the 20th anniversary of President Xi Jinping’s speech in Zhejiang province, in which he emphasised that “lucid waters and lush mountains are invaluable assets”. [Read more on Xi’s “two mountains” theory in this analysis by Carbon Brief.] Li added that China must “steadily promote the green and low-carbon transformation of industries” and “collaborate with all parties to…address climate change”, it said.

OFFICIALS SPEAK: Speaking a few days earlier, Chinese climate envoy Liu Zhenmin told a conference that “green and low-carbon innovation… [is] the new engine driving global economic growth”, the state-run newspaper China Daily reported, adding that he “attributed much of [China’s energy] transformation to the ‘two mountains’ theory”. National Development and Reform Commission head Zheng Shanjie wrote an essay on the theory for the ideological journal Research on Xi Jinping Economic Thought, saying China must “coordinate efforts to reduce carbon emissions, mitigate pollution, expand green spaces and promote economic growth”. Environment minister Huang Runqiu also said this in a speech broadcasted by the Communist party-affiliated newspaper People’s Daily, adding that the tasks “may seem independent, but are actually closely interconnected”.

MEDIA REACTIONS: State media also issued commentaries on the theory, with the People’s Daily publishing a “Ren Ping” commentary – a byline indicating the article reflects party leaders’ views – saying it is a “beacon” for “global green development”. A People’s Daily commentary under the byline He Yin – which similarly signals that the article reflects party leaders’ views on international affairs – said the theory “contributes Chinese wisdom and solutions to building a clean and beautiful world”. An editorial in the state-supporting Global Times said: “Especially at a time when climate change is an urgent global challenge, [the theory] is timely, visionary and inspiring.”

Draft policies and pilot projects

COUNTING CARBON: The Ministry of Ecology and Environment (MEE) issued four more draft methodologies for China’s voluntary carbon market, three of which address “gas recovery and utilisation” from oil- and gas-fields, BJX News reported. The MEE also published a draft revision to guidelines for provincial greenhouse gas inventories that aims to “enhance the scientific rigour, standardisation and practicality” of compiling the documents, another BJX News article said. Meanwhile, China will also develop “national carbon measurement centres” to help support the development of carbon measurement capabilities, finance outlet EastMoney said.

‘GREEN FUELS’: Meanwhile, China has established nine pilot projects to develop “green fuels” including ammonia, methanol and ethanol, finance news outlet Yicai said, adding that many of the projects use “green hydrogen as a raw material to produce” the chemicals. Separately, China’s National Energy Administration (NEA) said in a statement that it placed “great importance on the development of green liquid fuels”, with co-firing in coal-fired power plants an “important pathway…to achieve low-carbon development”, BJX News reported. According to another BJX News article, the NEA also said it attached “great importance” to the gas-power industry and would continue to plan new “peak-shaving gas-fired power plants”.

OTHER POLICIES: Elsewhere, the NEA released draft guidelines for “assessing the capacity of power grids to accommodate distributed power sources”, BJX News said. Guangdong has become the first province in China to “recognise greenhouse gas emissions quotas as legal collateral for loans”, Yicai reported. Xinhua reported that the China Consumer Association has issued draft guidelines for “green consumption” that explore how “every green consumption choice can contribute to significant emission reduction effects”.

Spotlight

Guest spotlight: How China could decarbonise its cement industry

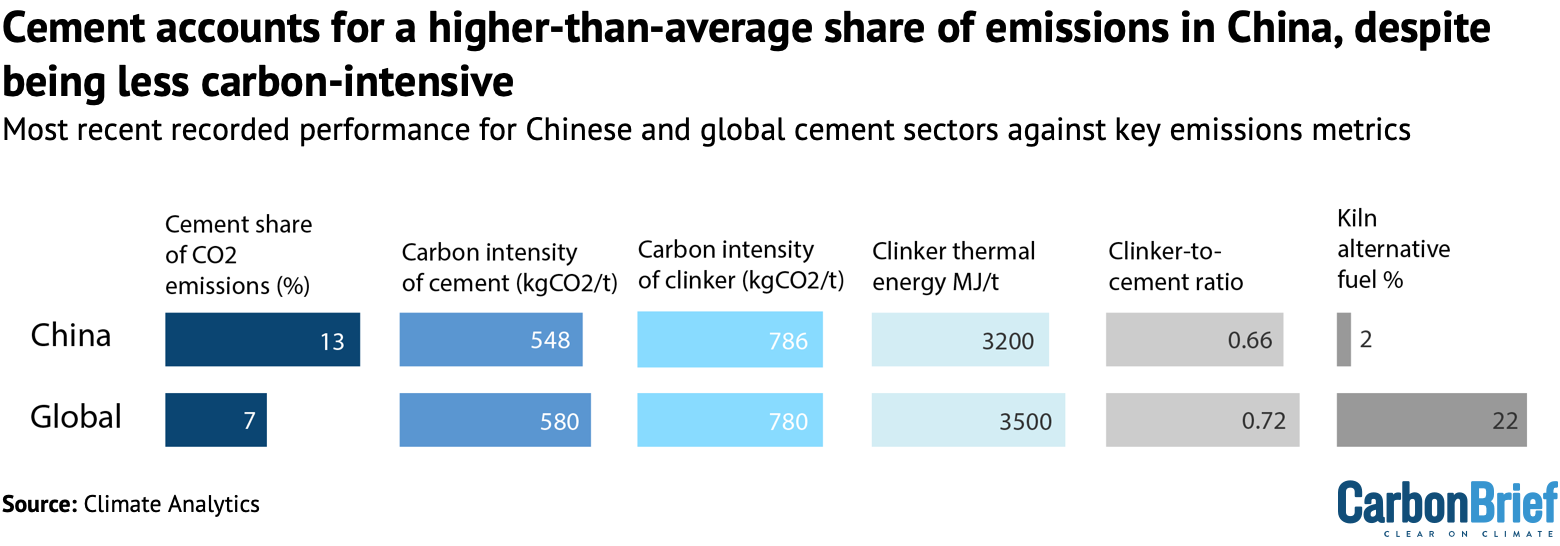

China could use a “whole-of-system” approach to decarbonise its cement industry, according to a report released today by thinktank Climate Analytics.

In this issue, report author James Bowen, Climate Analytics climate and energy policy analyst, examines how China could reduce the sector’s country-sized emissions.

China’s challenge in managing the carbon dioxide (CO2) emissions accompanying its economic rise is best illustrated by cement.

From about 200m tonnes (Mt) in 1990, Chinese cement production – almost all of which is domestically consumed – climbed to 2.5bn tonnes (Gt) in 2014 and has remained near this level for about a decade.

Its cement sector now emits more than the entire economies of all but three countries other than China itself – more than 1.2bn tonnes of CO2 (GtCO2) a year.

Cement decline significant but not enough for 1.5C

China’s main cement emissions challenge is that it continues to use far more cement and cement products per person than most countries.

Cement demand is now entering sustained decline as China’s economy restructures. Based on current trends, national production could drop below 1Gt by 2050.

But analysts have estimated that in addition to cutting demand – potentially even further than expected by 2050 – the emissions per unit of production would also need to fall, to align with the goals of the Paris Agreement.

Specifically, they estimate that emissions per unit would need to fall to around 360kg of CO2 per tonne by 2030 and 55-90kg by 2050. If each tonne of future Chinese cement continues to generate about 550kg of CO2, as at present, then the sector will remain well off this pace.

This task is formidable. Cement is an inexpensive, high-performance building material with widely available feedstocks.

About 90% of its emissions come from producing clinker – a key ingredient.

Unavoidable process emissions account for the majority of these emissions. But producers globally have also not yet managed to eliminate the remainder of clinker emissions, which result from heating cement kilns.

Cement’s emissions intensity in China has also rebounded since 2015, driven by new restrictions on cement with lower clinker content, due to quality concerns.

Many areas of past emissions-reduction success in China’s cement sector, such as energy efficiency, are approaching their technical limits.

These challenges help explain why carbon capture, utilisation and storage (CCUS) remains prominent in cement net-zero roadmaps globally.

But CCUS remains expensive and underperforming, given relatively little improvement in learning rates and related cost reductions. Plans to deploy CCUS therefore present a risk of diverting attention from cheaper and more effective abatement options – or failing to deliver as expected. This could sustain considerable mid-century residual emissions, jeopardising net-zero goals.

A ‘whole-of-system’ approach

An alternative “whole-of-system” approach could help China meet its cement emissions challenge more cheaply, without relying so heavily on the promise of CCUS.

This could include enhanced cement demand reduction, such as by extending building lifespans; optimising how concrete is designed and used; using alternative materials – such as timber – where appropriate; and reducing and reusing construction waste.

It could also include accelerating uptake of lower-carbon production technologies, such as alternative cement kiln fuels, electrified kiln heating, as well as low-clinker and alternative binder cements.

A wide range of policy support could advance this whole-of-system approach, including by ensuring a just transition for cement workers and impacted communities.

China has said it is working to include cement in the national emissions trading system (ETS) by 2027.

China could also incentivise companies to use less clinker by adopting a cement-based ETS benchmark, rather than a clinker benchmark, which has encouraged EU firms to continue using the carbon-intensive material under the region’s own ETS.

China could also displace coal from kiln heating, by adopting European-like measures to encourage the use of biomass or waste-derived fuels.

Meanwhile, reform in areas including industry standards, finance, market access and research and development could accelerate adoption of other low-emissions technologies and processes.

Watch, read, listen

WINNING ON STEEL?: China is gradually putting the conditions in place to become a world leader in developing low-carbon steel, according to Canary Media.

TRANSMISSION OMISSION: Jiemian explored how limited transmission capacity and “pricing discrepancies” is hampering China’s development of sending low-carbon power across provinces.

CHINA’S RISE: The Asia Society broadcasted a panel event from its summer summit discussing the factors behind China’s rise as a leader in new-energy and other technologies.

INDUSTRIAL DECARBONISATION: The Institute for Global Decarbonization Progress assessed key steps for improving China’s ability to tackle industrial emissions through zero-carbon industrial parks, informed by an expert dialogue.

15

The number of people who died during flooding in northern China’s Gansu province in early August, China Daily reported.

13

The death toll of flooding this week in Inner Mongolia, another northern province, according to Reuters.

New science

Increasing tropical cyclone residence time along the Chinese coastline driven by track rotation

npj Climate and Atmospheric Science

Tropical cyclones now spend “substantially” more time travelling along China’s coastal regions than they did in the 1980s, according to new research. The study found that tropical cyclones travelling along the coast of China have “become more parallel to the coastline since the 1980s” and the amount of time they spend travelling along the Chinese coast has increased by 2.5 hours per decade during this period. It added that these changes have “led to prolonged durations of heavy rainfall in the coastal regions”.

Resources, Conservation and Recycling

A new study estimated that the average carbon intensity of the electricity used in China fell from 983 grams of carbon dioxide per kilowatt-hour (gCO2/kwh) in 1997 to 545gCO2/kwh in 2022, “cumulatively avoiding 15.8bn tonnes of potential CO2 emissions”. The study used electric-generating unit level data and decomposition analysis to evaluate the effects of different decarbonisation policies on power plants. It found that changes to the fuel mix in China’s coal-fired power plants, reductions in the amount of heat energy needed to generate electricity and deployment of large-sized plants contributed most to reducing carbon emissions.

China Briefing is compiled by Wanyuan Song and Anika Patel. It is edited by Wanyuan Song and Dr Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 21 August 2025: China’s CO2 decline; ‘Two mountains’; China’s cement challenge appeared first on Carbon Brief.

China Briefing 21 August 2025: China’s CO2 decline; ‘Two mountains’; China’s cement challenge

Greenhouse Gases

Warming due to tropical deforestation linked to 28,000 ‘excess’ deaths per year

Warming driven by deforestation caused an extra 28,000 heat-related deaths per year across Africa, South America and Asia over 2001-20, new research finds.

The study, published in Nature Climate Change, is the first to look at human health impacts of warming caused specifically by tropical deforestation, as opposed to the burning of fossil fuels, its lead author tells Carbon Brief.

The authors find that deforestation alone drove, on average, 0.45C of warming in the tropics over 2001-20, accounting for 64% of the total warming in regions with tropical forest loss.

They also find that tropical deforestation over 2001-20 exposed 345 million people to “local warming”, in addition to the warming they were already facing due to global warming.

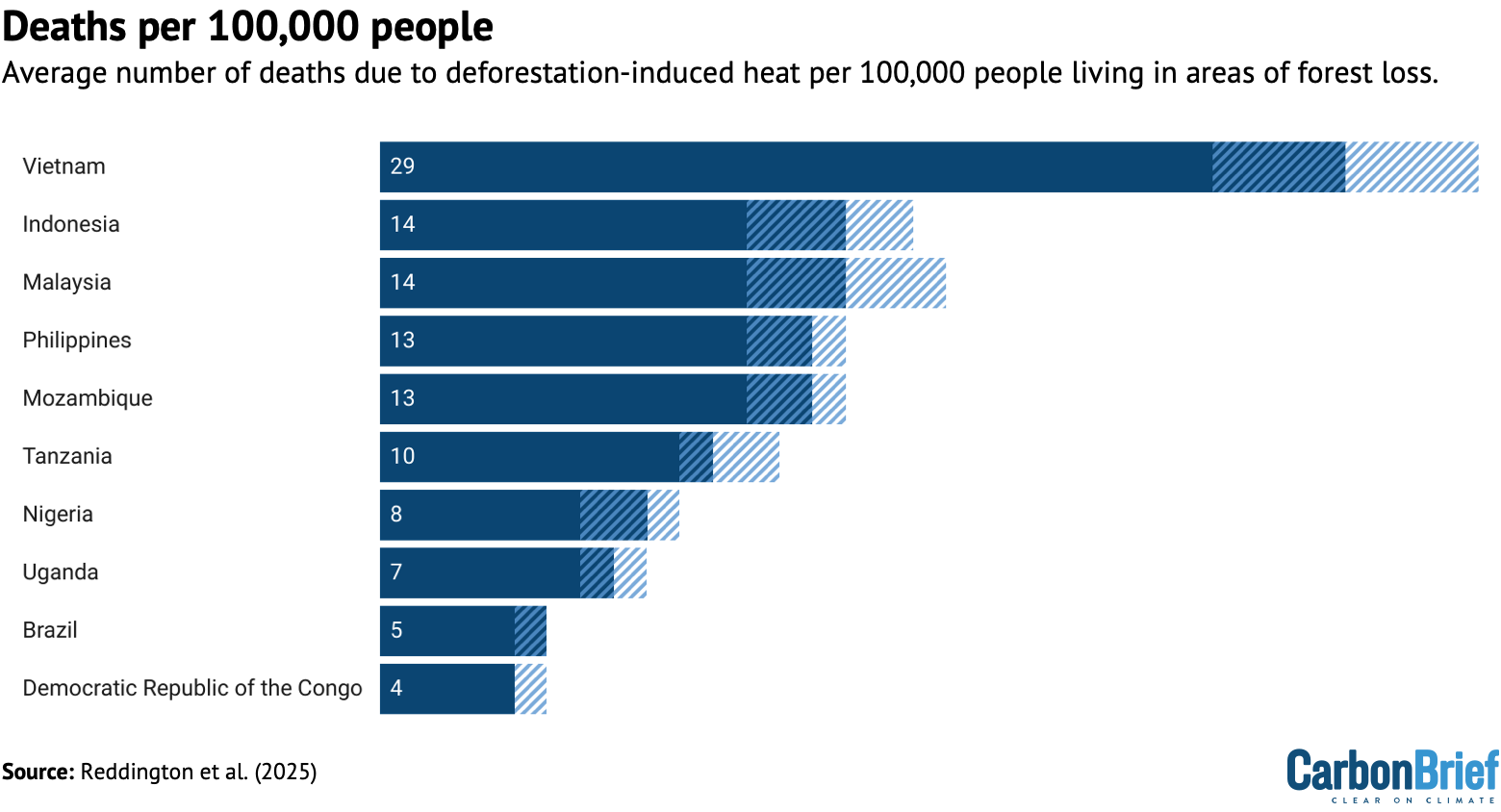

Six out of every 100,000 people living in deforested areas died as a result of deforestation-induced warming during this time, they warn.

This number is higher in south-east Asia, with Vietnam setting a record of, on average, 29 deaths per 100,000 people.

A researcher who was not involved with the study tells Carbon Brief that the “sobering” paper “reframes tropical deforestation as not only a carbon emissions and ecological issue, but also a critical public health concern”.

Tropical deforestation

Tropical forests, mainly distributed across South America, Africa and Asia, account for 45% of global forest cover.

These regions are well-known for their high biodiversity and the crucial ecosystem services that they provide, such as carbon storage.

However, tropical forest loss is on the rise.

A record 6.7m hectares of previously intact tropical forest was lost last year, mainly due to fires and land clearing for agriculture. As the planet warms, worsening heat and drought extremes are also causing trees to become less resilient to change, resulting in forest degradation.

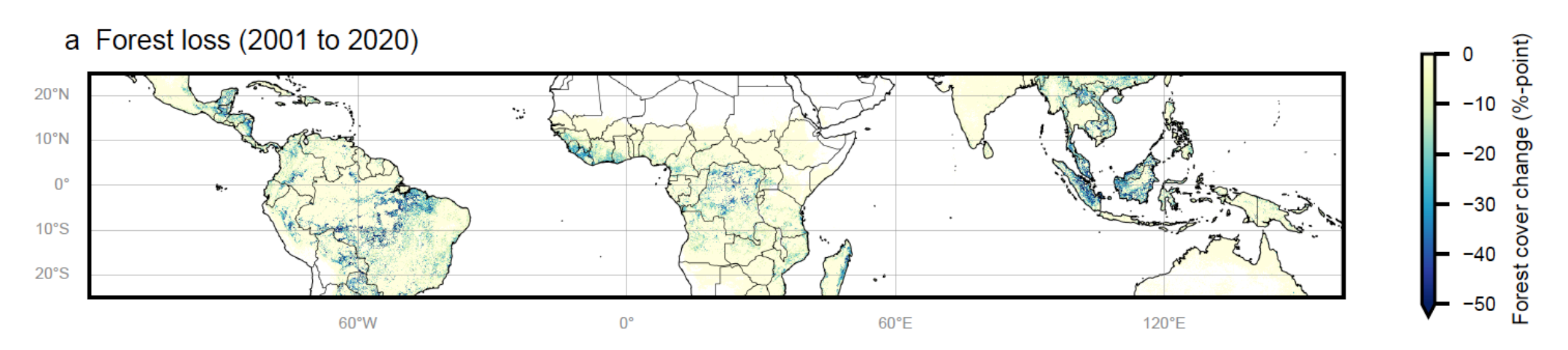

The new study uses data from the Global Land Analysis and Discovery laboratory at the University of Maryland to assess how tropical forest cover has changed year on year. The authors find that over 2001-20, a total of 1.6m square kilometres (160m hectares) of tropical forest was lost globally. This is shown on the map below, where blue indicates high forest loss and yellow indicates low loss.

The authors find the largest forest loss was in central and South America, but also highlight “extensive” loss in south-east Asia and tropical Africa.

Forest warming

Tropical deforestation has a wide range of negative consequences, including decreasing biodiversity, releasing carbon into the atmosphere and threatening the safety of Indigenous communities.

Loss of tree cover can also affect local temperatures by influencing the water cycle.

Water is constantly moving from the surface of the land into the atmosphere through a process called evapotranspiration. Plants play a crucial part in this process by moving water from the soil up through their roots and into their leaves, where it evaporates, cooling the air above. When trees are cut down, this cooling effect is reduced.

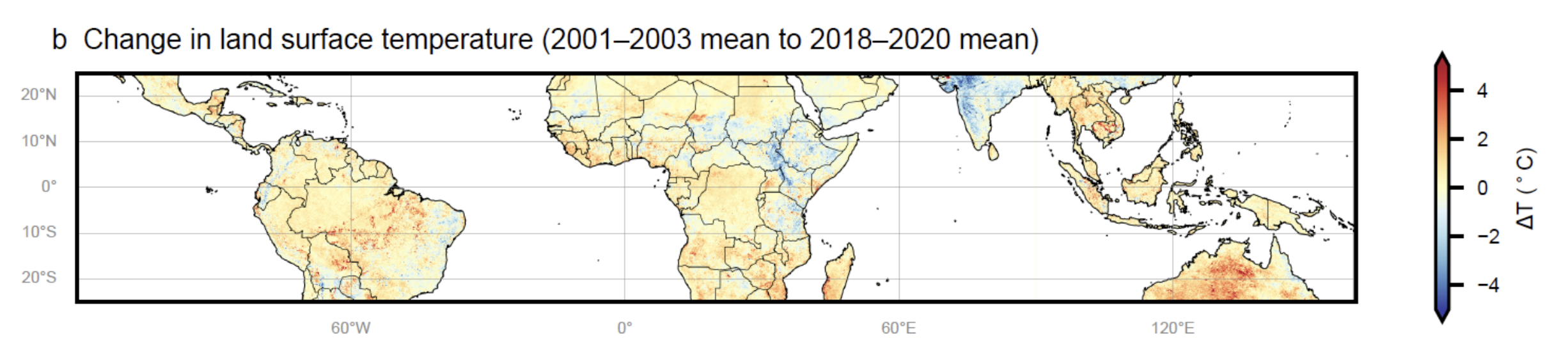

The authors use data of land surface temperatures from the NASA MODIS satellite to map warming in tropical regions over 2001-20. These results are shown in the map below, where red indicates warming and blue indicates cooling.

The authors find that between 2001-03 and 2018-20, surface temperatures increased by 0.34C in tropical central and South America, 0.1C in tropical Africa and 0.72C in south-east Asia. They add that “areas of forest loss coincide with areas of strong positive change in temperature across many regions of the tropics”.

By comparing their deforestation and surface warming maps, the authors find that deforested regions of the tropics saw an average of 0.7C warming over 2001-20, while areas that “maintained forest cover” saw an increase of only 0.2C.

By comparing the change in temperature in deforested regions with that in neighbouring locations without forest loss, they find that deforestation alone caused 0.45C of warming in the tropics over 2001-20 – accounting for 64% of total warming experienced over those regions.

Heat exposure

High temperatures can be deadly.

During periods of extreme heat, people can suffer from heat stroke and exhaustion – and even die. Those with underlying health conditions are at higher risk of fatal complications.

The authors use data from Oak Ridge National Laboratory’s LandScan to map where people live in the tropics. They estimate that 425 million people live in regions that were exposed to tropical deforestation over 2001-20, and just over three-quarters of them were exposed to warming as a result of the loss of forest cover.

Finally, the authors estimated “heat-related excess mortality” due to nearby tropical deforestation.

Using data from the 2019 Global Burden of Disease study, they determine the number of “non-accidental” deaths in each deforested tropical area. This excludes deaths from “external” causes, such as accidents and suicides, but includes “internal” causes, such as disease.

The researchers then used previously published “temperature-mortality” relationships for different countries. These relationships show the link between temperature and excess mortality rate, indicating the percentage increase in mortality for every degree of warming.

These relationships vary between countries, as people in hotter regions are generally better adapted to extreme heat.

By combining the data on local warming due to deforestation, temperature-mortality relationships and the non-accidental mortality data, the authors calculated how many non-accidental deaths would have been expected in deforested regions if they had not warmed due to the loss of forest cover.

By comparing the real and counterfactual mortality rates, the authors were able to calculate the total mortality burden due to tropical deforestation-induced warming.

Overall, the authors find that tropical deforestation drove an additional 28,300 deaths every year over 2001-20, accounting for 39% of the total heat-related mortality from global climate change and deforestation combined over locations of forest loss.

The study finds that, on average, six out of every 100,000 people living in deforested areas died as a result of deforestation-induced warming. However, these numbers vary by country.

The chart below shows the average annual deaths due to deforestation-induced heat per 100,000 people living in areas of forest loss.

Dr Carly Reddington is a research fellow at the University of Leeds and lead author of the study. She tells Carbon Brief that it is the “first study to look at human health impacts of tropical deforestation-induced warming”.

Dr Nicholas Wolff, a climate change scientist at the Nature Conservancy who was not involved with the study, tells Carbon Brief that the paper is “sobering”. He adds that it “reframes tropical deforestation as not only a carbon emissions and ecological issue, but also a critical public health concern”.

Data-scarce

The authors note that there are no country-specific heat vulnerability indices available for African countries. To develop their data for African countries, they used the average heat vulnerability index for South America.

Reddington tells Carbon Brief that Africa is the most “uncertain region” in the study and tells Carbon Brief that “more data is really crucial” to develop more accurate estimates.

Wolff tells Carbon Brief that extrapolating heat-mortality relationships “from data-rich regions to data-poor ones” is a “common practice in global-scale climate-health research”.

He praises the overall methodology as “innovative, transparent and scientifically sound, with appropriate caveats”.

Dr Luke Parsons, a climate modelling scientist at the Nature Conservancy, tells Carbon Brief that the conclusions are “robust”. However, he notes some “methodological issues” with the paper, such as the fact that all results are modelled, rather than measured.

He tells Carbon Brief that future work could assess “near-surface air temperature and humidity changes associated with deforestation, as well as study regional air temperature changes beyond deforested areas”.

While the new study focuses on warming within one square kilometre of forest loss, Reddington tells Carbon Brief that “deforestation is associated with warming up to 100km away”.

Furthermore, the study notes that the increase in deaths due to excess heat is likely to affect the most vulnerable members of society the most. It says:

“Vulnerable populations, particularly traditional and Indigenous communities, often live near deforested areas and face limited access to resources and infrastructure needed to cope with the combination of rising temperatures and environmental changes caused by deforestation and climate change.”

Wolff also stresses this disparity, adding that “many of these communities depend on forest clearing for agriculture, income and survival, and are forced to make difficult choices between short-term economic needs and long-term health and environmental stability”.

The authors also note that deforestation can drive a range of other interacting health problems, which were not considered in this study. For example, deforestation is linked to a rise in zoonotic diseases, such as malaria.

Dr Vikki Thompson, a climate scientist at the Royal Netherlands Meteorological Institute who was not involved in the study, says that the findings of the paper are “relevant to everyone”. She continues:

“We can reduce impacts of extreme heat by planting more trees and reducing deforestation everywhere, on both local and international scales.”

The post Warming due to tropical deforestation linked to 28,000 ‘excess’ deaths per year appeared first on Carbon Brief.

Warming due to tropical deforestation linked to 28,000 ‘excess’ deaths per year

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Greenhouse Gases1 year ago

Greenhouse Gases1 year ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change1 year ago

Climate Change1 year ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Carbon Footprint1 year ago

Carbon Footprint1 year agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits

-

Climate Change2 years ago

Why airlines are perfect targets for anti-greenwashing legal action

-

Climate Change1 month ago

Guest post: Why China is still building new coal – and when it might stop

-

Renewable Energy2 months ago

US Grid Strain, Possible Allete Sale