As countries come under growing pressure to tackle planet-heating methane emissions from the fossil fuel sector, oil and gas producers in COP host nations Brazil and Azerbaijan are struggling to prevent large leaks of methane, data shared with Climate Home News shows.

Satellite observations detected “super-emitting” methane plumes in the two countries this year that were visible from space and linked to state oil companies in both cases. Brazil presided over this year’s COP30 climate talks, while COP29 was in Azerbaijan.

Methane is a greenhouse gas that traps about 80 times more heat in the atmosphere than carbon dioxide but has a shorter life span. If global warming is to stay below 1.5C, the International Energy Agency (IEA) estimates that methane emissions from fossil fuels would need to fall by 75% by 2030.

At COP26 in 2021, a group of more than 100 countries announced their intention to cut methane emissions across all sectors by 30% from 2020 levels by the end of this decade. But a UN Environment Programme (UNEP) assessment shows they are instead set to rise 5% by 2030.

At COP30 this November, Brazil’s Environment Minister Marina Silva said that reducing methane emissions “gives us an opportunity to keep the planet’s average temperature [rise] within 1.5C, decreasing the frequency, intensity and impact of extreme weather events and protecting lives”.

And last year, Rovshan Najaf, president of Azerbaijan’s state oil company SOCAR, promised that the firm would achieve near-zero methane emissions in its oil and gas production by 2035.

However, the latest data available from Azerbaijan’s SOCAR shows that the company’s methane emissions more than tripled from 2023 to 2024, when the country hosted COP29. SOCAR identified about 200,000 tonnes of methane emissions from its business activities in 2024.

Brazilian state-oil company Petrobras, meanwhile, did manage to reduce its methane emissions by more than half between 2015 and 2022, but they have since stayed stagnant, at about a million tonnes of CO2-equivalent emitted per year, the company’s annual sustainability data shows.

“Reducing methane has significant impacts on a country’s ability to meet its climate commitments,” said Tengi George-Ikoli, a methane expert with the National Resource Governance Institute (NRGI).

“Countries like Brazil and Azerbaijan, who have hosted COPs, should be seen to commit to those efforts more so than others,” she emphasised.

In 2025, UNEP’s International Methane Emissions Observatory (IMEO) alerted countries globally – including Brazil and Azerbaijan – to around 2,200 instances linking their oil and gas production to super-emitting events.

Both Brazil and Azerbaijan have focal points that receive these IMEO alerts. But a recent report shows that 90% of the notifications did not even receive a response, and neither Brazil nor Azerbaijan are listed in the 25 successful cases that managed to reduce emissions thanks to this system.

Big plumes in Azerbaijan’s southern oil & gas hub

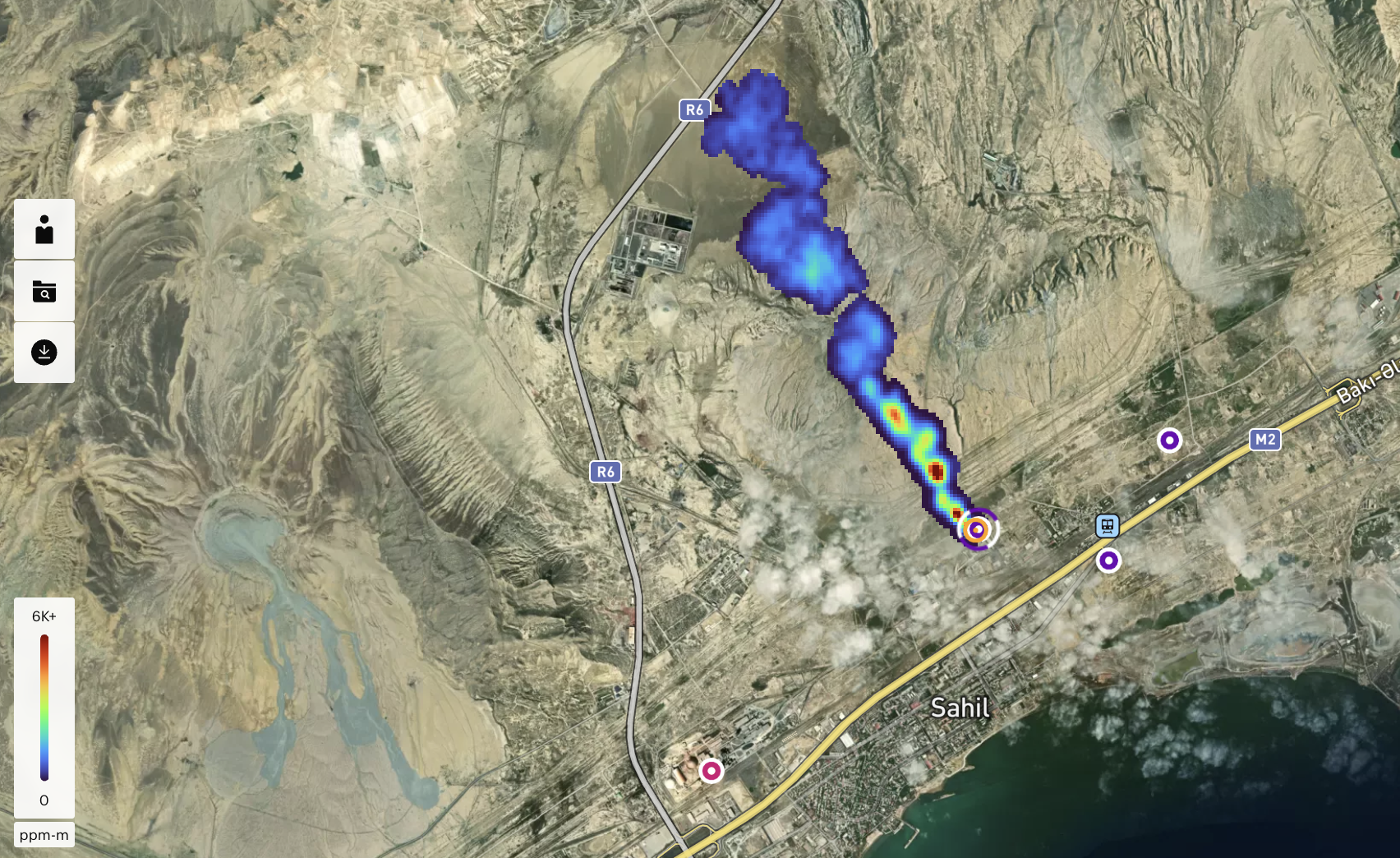

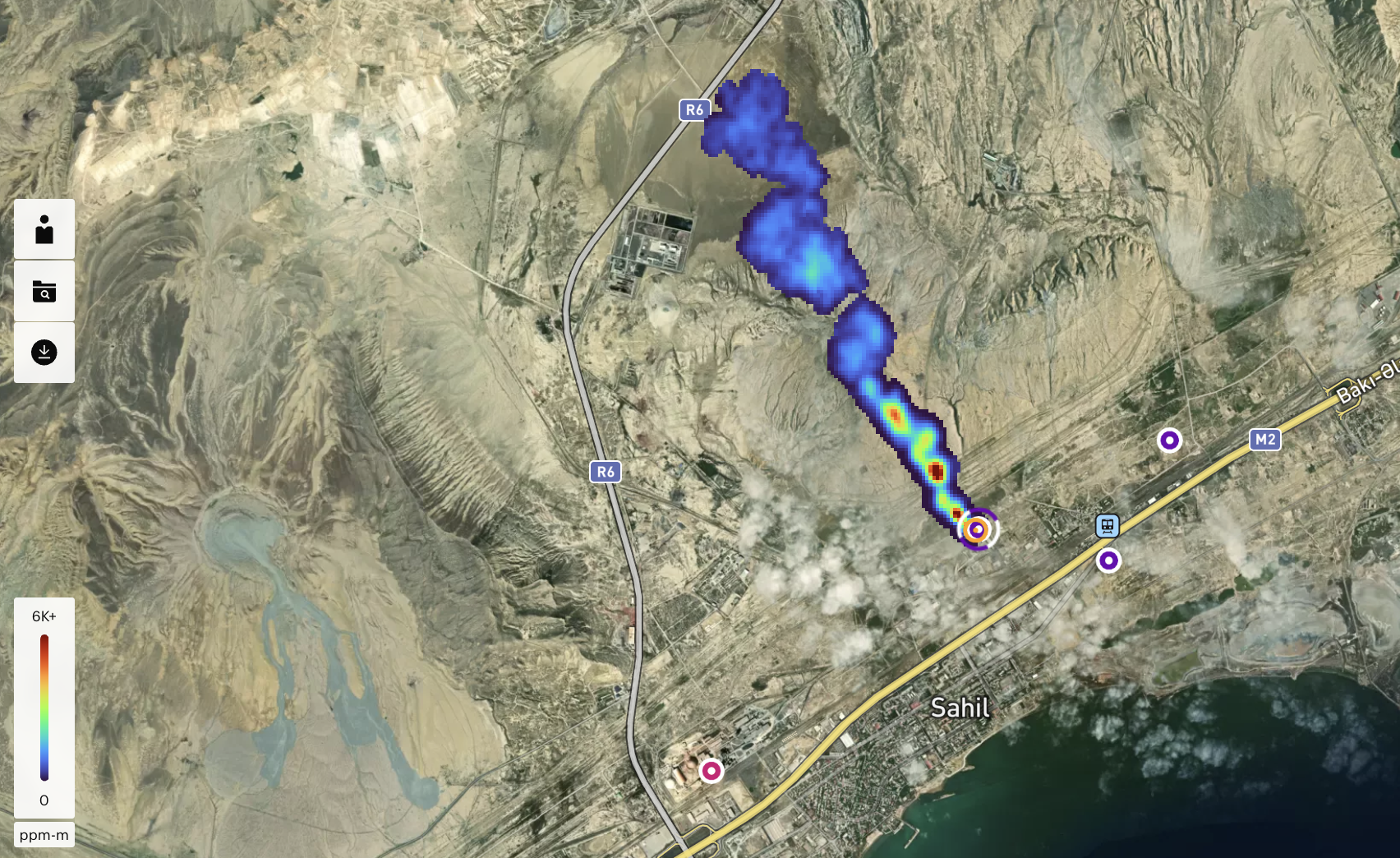

In Azerbaijan, persistent large-scale methane emissions have been detected over its southern coast – a hub for its oil and gas industry – during the past two years, according to satellite data from online monitoring platform Carbon Mapper.

When satellites passed over the region in mid-2024, as Azerbaijan prepared to host the COP29 climate summit, they spotted a handful of massive methane plumes, each releasing between 2,000 and 4,000 kilogrammes of methane per hour, dozens of times above the threshold for a “super-emitting” event.

According to Carbon Mapper’s data, methane emissions from the same locations still persisted a year later at comparable or even higher levels.

It is impossible to pinpoint precisely the source of those emissions without ground-level monitoring. But satellite data suggests that methane was released both from pipelines – which may be leaking – and compressor stations, which are facilities that help keep fossil gas flowing by boosting its pressure.

Throughout this year, large methane plumes have been observed by satellites emanating from a facility run by SOCAR in one of the world’s oldest oil fields, located just a few miles from Baku’s swanky waterfront boulevard.

In its 2025 sustainability report, SOCAR said it had expanded its methane emissions monitoring by using “leak detection AI tools”, drones and satellite technologies that “enabled more targeted, data-driven responses and supported the development of effective mitigation measures across operational sites”.

State oil firm in COP30 host nation linked to leaks

In Brazil, state-oil company Petrobras has been linked to three methane “super-emitting events” detected by satellites this year, which raises questions about emissions from its offshore oil and gas production facilities.

Three large methane plumes were detected in the Santos basin off the coast of Rio de Janeiro – which holds several of Brazil’s largest oil and gas fields – by Carbon Mapper on April 23.

Further analysis by environmental nonprofit SkyTruth, which specialises in satellite observations, revealed the plumes came from vessels in the Tupi field, which is majority-owned by Petrobras. Two of the vessels are operated by Dutch company SBM and the other by Petrobras.

The plumes in the Santos basin were large enough to be considered “super-emitting” methane events, on a scale similar to leaks in the same category detected in other parts of the world.

The US Environmental Protection Agency defines these as events with a rate of emissions of 100 kg of methane per hour. Two of the plumes detected in Brazil were above 300 and one was above 700 kg of methane per hour.

The events in Brazil are “particularly stunning” and could point to a more persistent issue, SkyTruth’s CEO John Amos told Climate Home, because the three plumes were detected during just one observation by a satellite orbiting the area.

“For one attempt to produce three positive plumes suggests that this could be a systematic problem offshore,” he said.

Petrobras says mitigation measures in place

Asked about these cases, Petrobras told Climate Home in a statement that the company is committed to reducing methane emissions as part of its decarbonisation strategy. It added that, because the plumes were detected by a single satellite observation, “the ability to draw broader conclusions about the consistency and magnitude of emissions over time is limited”.

The company also highlighted that its assets in the Santos basin perform “within the industry’s first quartile” for emissions per barrel of oil and noted that “initiatives such as recovering flare gas and performing leak detection and repair campaigns have helped to mitigate methane emissions”.

Petrobras also said that “during the period in question, operational conditions were under normal circumstances”.

Amos argued that if the sector considers such super-emitter plumes of methane – observable from space – “to be a consequence of ‘normal operating conditions’, then the offshore methane problem may be far worse than we anticipated”.

Just days before COP30, Petrobras executives co-chaired an offshore oil and gas conference in Rio de Janeiro. The discussions, the organisers wrote in a welcome letter, would focus on “traditional oil and gas technologies while highlighting the innovations essential for a more sustainable future” and would be “strategically positioned amid the ongoing energy transition”.

Barbados PM proposes binding methane pact

As global greenhouse gas emissions have continued to rise, with the United Nations admitting in November that an overshoot of the 1.5C warming limit is now inevitable, action on methane garnered growing attention at COP30.

New initiatives were launched at the climate summit in Belém to tackle methane emissions from the production of fossil fuels, which accounts for about a third of global emissions from this “super pollutant”, with other key sources being agriculture and waste management.

The UK launched a declaration to “drastically reduce” methane from the fossil fuel sector, which was endorsed by 11 countries including major oil and gas producers Canada, Norway and Kazakhstan. The actions it supports include more transparent monitoring, eliminating routine flaring and venting, and tracking progress towards near-zero methane emissions per unit of production.

The UK and Brazil also launched a three-year $25-million funding package to help developing countries tackle methane, among other “super pollutant” gases, which will benefit a first cohort of mostly fossil fuel-producing countries – among them Brazil, Kazakhstan, Mexico and Nigeria.

At last year’s COP29, the European Union championed an initiative that encouraged fossil fuel-producing countries to create roadmaps towards abating methane emissions from coal, oil and gas, including timelines, investment needs and the amount of emissions to be abated.

But, as a growing clutch of voluntary initiatives has failed to produce results at the scale and speed needed to rein in global warming in the short term, pressure is rising for a more accountable and comprehensive approach to the problem.

At COP30, Barbados’ Prime Minister Mia Mottley renewed her call for a legally binding methane pact to “pull the methane emergency brake” and “buy us some time”, starting with actions in the oil and gas industry.

NRGI’s George-Ikoli said the oil and gas sector could lead on cutting methane emissions because measures like zero flaring and venting, and eliminating leaks could bring in revenues for companies by enabling them to use or sell currently wasted gas.

Mottley wrote in an op-ed for The Guardian this month that the next step would be to convene heads of state from willing nations to develop “a roadmap in 2026 for binding measures for the oil and gas industry”. Negotiations could start by 2027, with a deal adopted “as soon as possible thereafter”, she proposed.

The post Recent COP hosts Brazil and Azerbaijan linked to “super-emitting” methane plumes appeared first on Climate Home News.

Recent COP hosts Brazil and Azerbaijan linked to “super-emitting” methane plumes

Climate Change

China Briefing 19 February 2026: CO2 emissions ‘flat or falling’ | First tariff lifted | Ma Jun on carbon data

Welcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

Carbon emissions on the decline

‘FLAT OR FALLING’: China’s carbon dioxide (CO2) emissions have been either “flat or falling” for almost two years, reported Agence France-Presse in coverage of new analysis for Carbon Brief by the Centre for Research on Energy and Clean Air (CREA). This marks the “first time” annual emissions may have fallen at a “time when energy demand was rising”, it added. Emissions fell 0.3% during the year, driven by a fall in emissions “across nearly all major sectors”, said Bloomberg – including the power sector. It said the chemicals sector was an exception, where emissions saw a “large jump from a surge of new plants using coal and oil” as feedstocks. The analysis has been covered around the world by outlets ranging from the New York Times, Bloomberg and BBC News through to Der Spiegel, CGTN and the Guardian.

TOP TASKS: President Xi Jinping listed “persisting in following the ‘dual-carbon’ goals” as one of eight “key” elements of economic work in 2026, according to a December speech just published in Qiushi, the Chinese Communist party’s leading journal for political theory. This included “deeply advancing” carbon reduction in key industries and “steadily promoting a peak in consumption of coal and oil”, according to the transcript. The National Energy Administration (NEA) also outlined a number of priority tasks for the department, including resolving “grid integration challenges” to encourage greater use of renewable energy and “boosting investment” in energy resources, said energy news outlet International Energy Net.

ETS EXPANSION: Meanwhile, the government has asked “heavy polluters” in several sectors not yet covered in China’s emissions trading scheme (ETS) to report their emissions for 2025, reported Bloomberg, in a “key step” for the further expansion of the carbon market. The affected industries are the “petrochemical, chemical, building materials (flat glass), nonferrous metals (copper smelting), paper and civil aviation industries”, according to the original notice posted by the Ministry of Ecology and Environment (MEE), as well as steel and cement companies not yet covered by the ETS.

State Council issued ‘unified’ power market guidance

POWER TRADE: China will aim for “market-based transactions” to account for 70% of total electricity consumption by 2030, according to new policy guidance released by China’s State Council and published by International Energy Net. The policy also called for greater “integration” of cross-regional trading and “fundamentally sound” market-based pricing mechanisms. On renewable power, the guidance urged officials to “expand the scale of green power consumption” and establish a “green certificate consumption system that combines mandatory and voluntary consumption”, as well as encourage “implementation of inter-provincial renewable energy priority dispatch plans”. It also calls for “roll[ing] out spot trade nationwide by 2027, up from just 4% of the total transactions today”, reported Bloomberg.

CLEAN-POWER PUSH: An official at China’s National Development and Reform Commission said in a Q&A published by BJX News that establishing a “unified” national power market is “crucial for constructing a new power system”. A separate analysis by Beijing-based power services firm Lambda reposted on BJX News argues that China’s unified power-market reforms – which have been “more than two decades” in the making – will allow for “widespread integration” of renewable energy, resolving the challenge of wind and solar “generating but being unable to transmit and integrate”. Business news outlet Jiemian quoted Xiamen University professor Lin Boqiang saying that, while power-market reform may present clean-energy companies with “growing pains” in the short term, it will “force the industry to develop healthily” in the long term.

EU tariffs lifted on first firm’s China-built EV imports

‘SOFTENED’ STANCE: The Chinese government has “softened its stance” on electric vehicle (EV) manufacturers who seek to independently negotiate with the EU on prices for their exports to the bloc, said Reuters, after it previously “urged the bloc not to engage in separate talks with Chinese manufacturers”. The move came as Volkswagen received an exemption from tariffs for one of its EVs that is made in China and imported to the EU, which it committed to sell above a specific price threshold, reported Bloomberg. It added that the company also pledged to follow an import quota and “invest in significant battery EV-related projects” in the EU.

-

Sign up to Carbon Brief’s free “China Briefing” email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

‘MADE IN EU’ MELTDOWN: Meanwhile, EU policymakers attempted to agree legislation that may force EV manufacturers to ensure “70% of the components in their cars are made in the EU” if they wish to receive subsidies, reported the Financial Times. A draft of the plan was ultimately rejected by nine European Commission leaders and commission president Ursula von der Leyen, Borderlex managing editor Rob Francis wrote on Bluesky.

BRAZIL BACKTRACKS: Brazil has “scrapped” a tariff exemption for Chinese EV manufacturers that allowed cars assembled in Brazil with parts imported from China to be sold at much lower prices than similar vehicles made from parts imported from other countries, reported the Hong Kong-based South China Morning Post. Separately, Bloomberg reported on the surge of tariff-free Chinese EVs that has enabled Ethiopia to ban the import of combustion-engine cars.

PRICE-WAR BAN: The Chinese government has “banned carmakers from pricing vehicles below cost”, reported Bloomberg, in an effort to clamp down on a “persistent price war” affecting the industry. China’s car industry, “particularly in the EV segment”, has seen “aggressive discounting, subsidies and bundled promotions” pushing down profitability for companies across the supply chain, said the state-run newspaper China Daily.

More China news

- POWERFUL WIND: China has connected a 20-megawatt offshore wind turbine – the “world’s most powerful” and “equivalent to a 58-story building” – to the grid, reported state news agency Xinhua.

- PROVINCIAL MOVES: Anhui has become the first Chinese province to release data on how much carbon different forms of power in the province emits per kilowatt-hour of power, according to power news outlet BJX News.

- RARE-EARTH RUNES: China may hold a “policy briefing” on export restrictions for rare earths and other critical minerals in March, according to Reuters.

- NO CHINA CREDITS: The US confirmed that clean-energy tax credits will not be available for companies that are “overly reliant on Chinese-made equipment”, said Reuters.

Spotlight

Ma Jun: ‘No business interest’ in Chinese coal power due to cheaper renewables

Carbon Brief spoke with Ma Jun, one of China’s most well-known environmentalists, about how open data can keep pressure on industry to decarbonise and boost interest in climate change.

Ma is director of the Beijing-based Institute of Public and Environmental Affairs (IPE), an organisation most well known for developing the Blue Map, China’s first public database for environment data.

Speaking to Carbon Brief during the first week of COP30 in Brazil last November, the discussion covered the importance of open data, key challenges for decarbonising industry, China’s climate commitments for 2035, cooperation with the EU and more.

Below are highlights from the conversation. The full interview can be found on the Carbon Brief website.

Open data is helping strengthen climate policy

- On how data transparency prevents environmental pollution in China: “From that moment [when the general public began flagging environmental violations on social media in 2014], it was no longer easy for mayors or [party] secretaries to try to interfere with the enforcement, because it’s being made so transparent, so public.”

- On encouraging the Chinese government to publish data: “The ministry felt that they had the backing from the people, basically, which helped them to gain confidence that data can be helpful and can be used in a responsible way.”

- On China’s new corporate disclosure rules: “We’re talking about what’s probably the largest scale of corporate measuring and disclosure now happening [anywhere in the world].”

- On the need for better emissions data: “It will be impossible to get started without proper, more comprehensive measuring and disclosure, and without having more credible data available.”

‘Green premium’ still challenging despite falling prices

- On the economics of coal: “There’s no business interest for the coal sector to carry on, because increasingly the market will trend towards using renewables, because it’s getting cheaper and cheaper”.

- On paying for low-carbon products: “When we engage with them and ask why they didn’t expand production, they say that producing these items will have a ‘green premium’, but no one wants to pay for that. Their users only want to buy tiny volumes for their sustainability reports.”

- On public perceptions in China of climate change: “It’s more abstract – [we’re talking about] the end of the century or the polar bears. People don’t feel that it’s linked with their own individual behaviour or consumption choices.”

Climate cooperation in a new era

- On criticism of China’s climate pledge: “In the west, the cultural tendency is that if you want to show that you’re serious, you need to set an ambitious target. Even if, at the end of the day, you fail, it doesn’t mean that you’re bad…But in China, the culture is that it is embarrassing if you set a target and you fail to fully honour that commitment.”

- On global climate cooperation: “The starting point could be transparency – that could be one of the ways to help bridge the gap.”

The role of civil society in China’s climate efforts

- On working in China as a climate NGO: “What we’re doing is based on these principles of transparency, the right to know. It’s based on the participation of the public. It’s based on the rule of law. We cherish that and we still have the space to work [on these issues].”

- On the climate consensus in China: “The environment – including climate – is the area with the biggest consensus view in [China]. It could be a test run for having more multi-stakeholder governance in our country.”

This interview was conducted by Anika Patel at COP30 in Belém on 13 November 2025.

Watch, read, listen

GREEN ALUMINIUM: Lantau Group principal David Fishman wrote on LinkedIn about why China’s aluminium smelters are seeking greater access to low-carbon power, following heated debate over a Financial Times article.

STRONGER THAN EVER: Isabel Hilton, chair of the Great Britain-China Centre, spoke on the Living on Earth podcast about China’s renewables push and exports of clean-energy technologies.

CUTTING CORNERS?: Business news outlet Caixin examined how a surge in turbine defects at one wind farm could be due to “aggressive cost-cutting and rapid installation waves”.

POLES APART: BBC News’ Global News Podcast examined the drivers behind China’s flatlining emissions, as revealed by Carbon Brief.

600

In gigawatts, China’s total capacity of coal plants that are “flexible” and – in theory – better able to balance the variability of renewables, according to a new report by the thinktank Ember.

New science

- China will see a 41% decline in in coal-mining jobs over the next decade under current climate policies | Environmental Research Letters

- During 2000-20, China’s per-person emissions of CO2 increased from 106kg to 539kg in urban households and from 35kg to 202kg in rural households, indicating that the inequality between urban and rural households is shrinking | Scientific Reports

Recently published on WeChat

China Briefing is written by Anika Patel and edited by Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 19 February 2026: CO2 emissions ‘flat or falling’ | First tariff lifted | Ma Jun on carbon data appeared first on Carbon Brief.

Climate Change

Ma Jun: ‘No business interest’ in Chinese coal power due to cheaper renewables

Open and transparent data can accelerate the decarbonisation of China’s industries and boost public interest in climate change, says Ma Jun.

Ma – one of China’s most recognisable environmental activists – says that early experiments with publishing real-time air quality data have paved the way for greater openness from the Chinese government towards publishing greenhouse gas emissions data.

However, he tells Carbon Brief in a wide-ranging interview, more needs to be done to encourage “multi-stakeholder” participation in climate efforts and to improve corporate emissions disclosure.

He also notes that China faces significant “challenges” in reducing emissions from “hard-to-abate” sectors, where companies struggle to find consumers willing to pay a “green premium” for low-carbon versions of their products.

Ma is the founder and director of the Institute of Public and Environmental Affairs (IPE), a Beijing-based NGO focused on environmental information disclosure and public participation.

The IPE is most well-known for developing the Blue Map, China’s first public database for environment data.

Ma has been a long-term advocate for environmental protection in China.

Prior to founding the IPE, he covered environmental pollution as an investigative reporter at the Hong Kong-based South China Morning Post.

He also authored China’s first book on the serious water pollution challenges facing the country.

Speaking to Carbon Brief during the first week of COP30 in Brazil last November, the discussion covered the importance of open data, key challenges for decarbonising industry, China’s climate commitments for 2035, cooperation with the EU and more.

- On how data transparency prevents environmental pollution in China: “From that moment [that the general public began flagging environmental violations on social media], it was no longer easy for mayors or [party] secretaries to try to interfere with the enforcement, because it’s being made so transparent, so public.”

- On encouraging the Chinese government to publish data: “The ministry felt that they had the backing from the people, basically, which helped them to gain confidence that data can be helpful and can be used in a responsible way.”

- On China’s new corporate disclosure rules: “We’re talking about what’s probably the largest scale of corporate measuring and disclosure now happening [anywhere in the world].”

- On air-pollution policies creating a template for climate action: “It started from the pollution control side and now we want to see that happen on the climate side.”

- On paying for low-carbon products: “When we engage with them and ask why they didn’t expand production, they say that producing these items will have a ‘green premium’, but no one wants to pay for that. Their users only want to buy tiny volumes for their sustainability reports.”

- On public perceptions of climate change: “It’s more abstract – [we’re talking about] the end of the century or the polar bears. People don’t feel that it’s linked with their own individual behaviour or consumption choices.”

- On the need for better emissions data: “It will be impossible to get started without proper, more comprehensive measuring and disclosure, and without having more credible data available.”

- On criticism of China’s climate pledge: “In the west, the cultural tendency is that if you want to show that you’re serious, you need to set an ambitious target. Even if, at the end of the day, you fail, it doesn’t mean that you’re bad…But in China, the culture is that it is embarrassing if you set a target and you fail to fully honour that commitment.”

- On global climate cooperation: “The starting point could be transparency – that could be one of the ways to help bridge the gap.”

- On the economics of coal: “There’s no business interest for the coal sector to carry on, because increasingly the market will trend towards using renewables, because it’s getting cheaper and cheaper”.

- On working in China as a climate NGO: “What we’re doing is based on these principles of transparency, the right to know. It’s based on the participation of the public. It’s based on the rule of law. We cherish that and we still have the space to work [on these issues].”

- On the climate consensus in China: “The environment – including climate – is the area with the biggest consensus view in [China]. It could be a test run for having more multi-stakeholder governance in our country.”

The transcript below has been edited for length and clarity.

Carbon Brief: You have been at the forefront of environmental issues in China for decades. How would you describe the changes in China’s approach to climate and environment issues over the time you’ve been observing them?

Ma Jun: I started paying attention to the issues when I got the chance to travel in different parts of China. I was struck by the environmental damage, particularly on the waterways, the rivers and lakes, which do not just have all these eco-impacts, but also expose hundreds of millions to health hazards.

That got me to start paying attention. So I authored a book called China’s Water Crisis and readers kept coming back to me to push for solutions. I delved deeper into the research and I realised that it’s quite complicated – not just that the magnitude [of the problem] is so big, but that the whole issue is quite complicated, because we copied rules, laws and regulations from the west but enforcement remained weak.

There are huge externalities, but companies would rather just cut corners to be more competitive, put simply. Behind that, there was a doctrine before of development at whatever cost. That was the starting point in China – not just for policymakers, even people in the street, if you asked them at that time, most likely [they] would say: “China’s still poor. Let’s develop before we even think about the environment.”

But that started changing, gradually. Unfortunately, it needed the “airpocalypse” in Beijing and the big surrounding regions to really motivate that change.

In 2011, Beijing suffered from very bad smog and millions upon millions of people made their voices heard – that they want clean air.

The government lent an ear to them and decided to start from transparency, monitoring and disclosing data to the public. So two years after it started and people were being given hourly air quality data [in 2011] – you realised how bad it was. In the first month [of 2013], the monthly average was over 150 micrograms. The WHO standard was 10 at the time – now it’s dropped to five. [Some news reports and studies, based on readings published at the time by the US embassy in Beijing, note significantly higher figures.]

We believe that it’s good to have that data – of course, it’s very helpful – but it’s not enough. Keeping children indoors or putting on face masks are not real solutions, we need to address the sources. So we launched a total transparency initiative with 24 other NGOs calling for real-time disclosure of corporate monitoring data.

To our surprise, the ministry made it happen. From 2014, tens of thousands of the largest emitters, every hour, needed to give people air [quality] data, and every two hours for water [quality].

We then launched an app to help visualise that for neighbourhoods. For the first time, people could realise which [companies] are not in compliance. Even super-large factories – every hour, if they were not in compliance, then they would turn from blue to red [in the app].

And so many people made complaints and petitioned openly – sharing that on social media, tagging the official [company] account. That triggered a chain reaction and changed that dynamic that I described.

From that moment, it was no longer easy for mayors or [party] secretaries to try to interfere with the enforcement, because it’s being made so transparent, so public. The [environmental protection] agencies got the backing from the people and knocked the door open – and pushed the companies to respond to the people.

Then, the data is also used to enable market-based solutions, such as green supply chains and green finance.

Starting first with major multinationals and then extending to local companies, companies compared their lists with our lists before they signed contracts. If any of their [supplier] companies were having problems, they could get a push notification to their inbox or cell [mobile] phone.

That motivates 36,000 [companies] to come to an NGO like us – to our platform – to make that disclosure about what went wrong and how we try to fix the problem, and after that measure and disclose more kinds of data, starting with local emission data and now extending to carbon data.

And for banking and green finance, an NGO like us now helps banks track the performance of three million corporations who want to borrow money from them, as part of the due diligence process. These are just tiny examples to try to demonstrate that there’s a real change.

Before, when I got started, the level of transparency was so limited. When we first looked at government data, at the beginning, there were only 2,000 records of enforcement. So we launched an index, assessed performance for 10 years across 120 cities.

During this process, [we also saw] consensus being made. In 2015, China’s amended Environmental Protection Law [came into effect] and created a special chapter – chapter five – titled [information] transparency and public participation. That was the first ever piece of legislation in China to have such a chapter on transparency.

CB: What motivated that? Was it because they’d already seen this big public backlash?

MJ: They started listening to people and the demand for change, for clean air. And then they started seeing how the data can be used – not to disrupt the society, but to help to mobilise people.

The ministry felt that they had the backing from the people, basically, which helped them to gain confidence that data can be helpful and can be used in a responsible way. Before, they were always concerned about the data, particularly on disruption of social stability, because our data is not that beautiful at the beginning, due to the very serious pollution problem.

When our organisation got started, nearly 20 years ago, 28% of the monitored waterways – nationally-monitored rivers – reported water that was good for no use. Basically, it is so polluted that it’s not good for any use. [Some] 300 million [people] were exposed to that in the countryside, it was very serious.

We’re talking about the government changing its mindset. Of course, the reality is that they found [the data] can be used the responsible way and can be helpful, so they decided to embrace that and to tolerate that, to gradually expand transparency.

Now, China is aligning its system with the International Sustainability Standards Board (ISSB). The environment ministry also created a disclosure scheme, with 90,000 of China’s largest [greenhouse gas] emitters on the list. We and our NGO partners tried to help implement that. We’re talking about billions of tonnes of carbon emissions.

It would have been hard to imagine before, but we’re talking about what’s probably the largest scale of corporate measuring and disclosure now happening [anywhere in the world].

Of course, it’s still not enough. Last year, we also helped the agency affiliated with the ministry to develop a guideline on voluntary carbon disclosure, targeting small and medium sized companies. We now have a new template on our platform – powered by AI – and a digital accounting tool that helps our users measure and disclose nearly 70m tonnes [of carbon dioxide equivalent] last year.

CB: Is there appetite on the industrial side to proactively get involved? Or is local regulation needed that mandates involvement?

MJ: At the beginning, no. If we have the dynamic that I described – at the beginning, whoever cut corners became more competitive. This caused a “race to the bottom” situation and even good companies find it quite difficult to stick to the rules.

But then the dynamic changed. Whoever’s not in compliance with the law will be kicked out of the game. Not only would they receive increasingly hefty penalties or fines, but the data will be put into use in supply chains. Many of our users – the brands – integrate that data into their sourcing, meaning that if [suppliers] don’t solve the problem they will lose contracts. And also banks could give them an unfavourable rating.

All this joint effort could create some sort of – of course, it’s [only a] chance – but some kind of a stick. But it’s also a kind of carrot, because those who decided to do better now benefit. If someone loses business [because they cannot help their consumer with compliance], then that business will [instead] go to those who want to go green.

This change in dynamic is very helpful. It started from the pollution control side and now we want to see that happen on the climate side. That’s why we decided to develop the blue map for zero carbon, to try to map out and further motivate the decarbonisation process – region by region, sector by sector.

You asked about corporations – this is extremely important. China is the factory of the world and 68% of carbon emissions still relate either to the direct manufacturing process or to energy consumption to power the industrial production. So it is very important to motivate them, to create both rules and stimulus – both stick and carrot.

But if you don’t have a stick, you can never make the carrot big enough. That is an externality problem, you never really solve that. We’ve now managed to solve the basic problem – non-compliance and outrageous violations. But that’s the first step. Deep decarbonisation – not just scope one and two, but extending further upstream to reach heavy industry, the hard-to-abate industries – now this is the challenge.

CB: What are your expectations for industrial decarbonisation more broadly, especially given the technology bottlenecks?

MJ: There are still bottlenecks, but we see, actually, some progress is being made. Now corporations in China understand that they need to go in [a low-carbon] direction and some of them are actually motivated to develop innovative solutions.

For example, several major steel manufacturers managed to be able to find ways to produce much lower-carbon steel products. In the aluminium [sector] they also tried and also batteries. Unfortunately, these remain as only pilot projects.

When we engage with them and ask why they didn’t expand production, they say that producing these items will have a “green premium”, but no one wants to pay for that. Their users only want to buy tiny volumes for their sustainability reports – for the rest, they just want the low-cost ones.

They said, the more we produce the green products, the bigger our losses. So we decided to leave these products in our warehouse.

Then we engaged with the brands – the real estate industry, the largest user of iron and steel – and the automobile industry, the second largest. They claimed that if they [purchase greener materials], they would pay a green premium, but their users and consumers have no idea about [green consumption]. They only want to buy the cheapest products – and the more [these manufacturers] produce, the more they suffer losses.

So this means we need a mechanism, with multi-stakeholder participation, to share the burden of that transition – to share that cost of the green transition.

That green premium can only be shared, not one single stakeholder can easily absorb all of this given all the breakneck competition in China – involution – it’s very, very serious and so companies are all stuck there.

What we’re trying to do is to help change that. We assessed the performance of 51 auto brands and tried to help all the stakeholders understand which ones could go low-carbon.

But it’s not enough just to score and rank them. We also need to engage with the public, to have them start gaining an understanding that their choice matters. So how – it’s more difficult, you know? Pollution is much easier. We told them: “Look, people are dumping all this waste.”

CB: It’s all visible.

MJ: Yeah, when people suffer so seriously from pollution – air, water and soil pollution – they feel strongly. They wrote letters to the brands, telling them that they like their products but they cannot accept this.

But on climate, it’s more abstract – [we’re talking about] the end of the century or the polar bears. People don’t feel that it’s linked with their own individual behaviour or consumption choices.

We decided to upgrade our green choice initiative to the 2.0 level. This new solution we developed is called product carbon scan. Basically, you take a picture of any product and services products and an AI [programme] will figure out what product that is and tell you the embodied carbon of that product.

Now, it’s getting particularly sophisticated with automobiles. The AI now – from this year – for most of the vehicles on the streets of China, can figure out not just which brand it is, but which model. We have all these models in our database – 700-800 models and 7,000-8,000 varieties of cars, all of which have specific carbon footprints.

CB: How do you account for all of the different variables? If something changes upstream, if a supplier changes – how do you account for that?

MJ: The idea is like this – now, this is mostly measured by third parties, our partners. We also have our emission factors database that we developed. So we know that, as you said, there are all these variables. For the past six months, we got our users to take pictures of 100,000 cars. We distributed them to 50 brands and [calculated] that the total carbon footprint was 4.2m tonnes, for the lifecycle of these 100,000 cars. Each brand got their own share of this.

So we wrote letters – and we’re still writing letters now, 10 NGOs in China, we’re writing letters now to the CEOs of these 50 brands – to tell them that this is happening. Our users, consumers of their products, are paying attention to this and are raising questions. We have two demands.

First, have you done your own measuring for the product you sell in China? Do you have plans to measure and disclose those specific details? Because if third parties can do it, so can they. It’s not space technology, they can do it and obviously they own all this data. They understand much better about the entire value chain and it’s much easier for them to get more accurate figures. With the “internet of things” and new technologies, for some products, they can get those details already, so the auto industry should be getting close to [achieving] that.

The second question is, you all have set targets for carbon reduction and carbon neutrality. We know that most of you are not on track. Even the best ones – Mercedes-Benz is at the top of our rankings – are seeing their carbon intensity going up. Not just the total volume [of emissions], but products’ carbon intensity is going up instead of going down. So, obviously, they haven’t really decarbonised their upstream – steel and aluminium. So [we ask them]: “What’s your plan? Can you give me an actionable, short- or mid-term plan on the decarbonisation of these upstream, hard-to-abate sectors?”

I think this is the way to try to tap into the success of pollution control and now extend that to cover carbon.

CB: It seems a challenge facing China’s climate action that policymakers often flag is MRV [monitoring, reporting and verification] and data in general. You’re the expert on this. Would you agree? Are there big challenges around MRV that China needs to address before it can progress further?

MJ: This is a prerequisite, in my view. To have [to] measure, disclose and allow access to data is a prerequisite for any meaningful multi-stakeholder effort. I wouldn’t underestimate the challenge in the follow-up process – the solutions, the innovations, the new technologies that need to be developed to decarbonise – but it will be impossible to get started without proper, more comprehensive measuring and disclosure, and without having more credible data available.

I take this as a starting point – a most important starting point. I’m so happy to see that there’s a growing consensus on that. In China, the government decided to embrace the concept of the ISSB, embrace the concept of ESG reporting, and to allow an NGO like us to try to help with the disclosure mechanism.

This is very powerful and very productive, and the reason that we could create that solution is because China pays so much attention to product carbon footprints, of course, motivated by the EU legislations, like the carbon border adjustment mechanism (CBAM) and others. In some ways, it’s quite interesting to see the EU set these very progressive rules, but then China responds and decides to create solutions and scale them up.

On the product carbon footprint alone, the Ministry of Ecology and Environment (MEE) coordinated 15 different ministries to work on it, with a very tight schedule – targets set for 2027 and then 2030 – [implying] very fast progress. We work together with our partners on a new book telling businesses – based on emission factors – how to handle it and how to proceed, in terms of practical solutions.

All this is just to say that, on the data and MRV side, China has already overcome its initial reluctance, or even resistance. Now [it] is in the process of not just making progress and expanding data transparency, but also trying to align that with international practice.

And at COP30, I actually launched a new report [titled the Global City Green and Low-Carbon Transparency Index]…The transparency index actually highlighted that, of course, developed cities are still doing better, but a whole group of Chinese cities are quickly catching up. Trailing behind are other global south cities.

When China decides to do something, it isn’t just individual businesses or even individual cities [that see action taken]. There will be more of a platform-based system – meaning there is an [underlying] national requirement, which can help to level the playing field, with regions or sectors possibly taking up stricter requirements, but not being able to compromise the national ones [by setting lower targets].

So, with MRV, I have some confidence. That doesn’t mean it’s easy. Particularly on the product carbon footprint, there are so many challenges. Trying to make emission factors more accurate is quite difficult, because products have so many components and the whole value chain can be very long and complicated. But with determination, with consensus, I’m still confident that China can deliver.

And in the meantime, what is now going on in China, increasingly, could become a contribution to global MRV practice.

CB: It’s interesting that you mentioned that. Talking to people at the COP30 China pavilion, people from global south countries see China as a climate leader and want to learn about what’s going on in China. By contrast, developed countries seem more focused on the level of ambition in China’s NDC [its climate pledge, known as a nationally determined contribution]. How would you view China’s role in climate action in the next five years?

MJ: On the NDC, my personal observation – I come from an NGO, so I don’t represent the government’s decision here – is that culturally, there’s some sort of differences, nuanced differences – or very obvious differences – here.

In the west, the cultural tendency is that if you want to show that you’re serious, you need to set an ambitious target. Even if, at the end of the day, you fail, it doesn’t mean that you’re bad, you still achieve more than if you’d set a lower target. That’s the mentality.

But in China, the culture is that it is embarrassing if you set a target and you fail to fully honour that commitment. So they tend to set targets in a slightly more conservative way.

I’m glad to see that [China’s] NDC is leaving space for flexibility – it said that China will try to achieve a higher target. This is the tone, and in my view it gives us the space and the legitimacy to try to motivate change and develop solutions to bend the curve faster. Even if the target is not that high, we know that we will try to beat that.

And then, there’s the renewables target for 1,200 gigawatts (GW) by 2030, a target that was achieved last year – six years early. Now we’ve set a target of 3,600GW – that means adding 180GW every year. But, as you know, over the past several years [China’s renewable additions] have been above 200GW.

So you can see that there’s a real opportunity there and we know that China will try to overdeliver. There’s no kind of a good or bad, or right or wrong, with these two different cultural [approaches].

But one thing I hope that we all focus more on is implementation – on action. Because we do see that, for some of the global targets that have already been set, no-one seems to be paying any real attention to them – such as the tripling of [global] renewable capacity.

We all witnessed that, in Dubai at COP28, a target was agreed and accepted by the international community. China’s on track, but what about the others? Most countries are not on track.

The global south, it’s not only for their climate targets – the [energy] transition is essential for their SDG [sustainable development goal] targets. But now they lag so far behind. That’s a pity, because now there’s enough capacity – and even bigger potential – to help them access all this much faster.

But geopolitical divides, resource competition, nationalism, protectionism – all of this is dividing us. It’s making global climate governance a lot more difficult and delaying the process to help [others in the] global transition. It’s very difficult to overcome these problems – probably it will get worse before it gets better.

But if we truly believe that climate change is an existential threat to our home planet, then we should try to find a way to collaborate a bit more. The starting point could be transparency – that could be one of the ways to help bridge the gap.

In China, we used to have a massive gap of distrust between different stakeholders. People hated polluting factories, but they also had suspicions around government agencies giving protection to those factories. So there’s all this distrust.

With transparency, it’s easier for trust to be built, gradually, and the government started gaining confidence [in sharing data] because they saw with their own eyes that people came together behind them. Before, [people] always suspected that [the government] were sheltering the polluters. But from that moment, they realised that the government was serious and so gave them a lot of support.

Globally – maybe I’m too negative – I do think that it would [improve the chances for us all to collaborate] if we had a global data infrastructure and a global data platform, that doesn’t just give [each country’s] national data but drills down – province by province, city by city, sector by sector and, eventually, to individual factories, facilities and mines. For each one of these, there would be a standardised reporting system, giving people the right to know. I think through this we could build trust and use it as a starting point for collaboration.

I sit on several international committees – on air, water, the Taskforce on Nature-related Financial Disclosures (TFND), transition minerals, and so on. In each of these, I often make suggestions on building global data infrastructure. Increasingly, I see more nodding heads, and some have started to make serious efforts. TNFD is one example. They already have a proposal to develop a global data facility on data. The International Chamber of Commerce also put forward a proposal on the global data infrastructure on minerals and other commodities.

Of course, in reality, there will be many difficulties – data security, for example. So maybe it cannot be totally centralised, we need to allow for decentralised regional systems, but you could also create catalogues to allow the users to [dig into] all this data.

CB: And that then inspires people to look into issues they care about?

MJ: Yes and through that process, we will create more consensus, create more trust and gradually formulate unified rules and standards.

And we need innovative solutions. In today’s world, security is something that’s not just paid attention to by China, in the west it’s a similar [story]. There are a lot of concerns about data security – growing concerns – so I think eventually there will be innovation to solve them. I’m still hopeful!

CB: Speaking of international cooperation, how has the withdrawal of the US from the Paris Agreement affected prospects for China-EU cooperation?

MJ: It will have a mixed impact, of course. Having the largest economy and second-largest emitter withdraw will have a big impact on global climate governance, and will in some way create negative pressure on other regions, because we’re all facing the question of: “If they don’t do it, why should we?” We also have those questions back home. I’m sure the EU is also facing this question.

But in the meantime, I hope that China and the EU realise that they have no choice but to work together – if they still, as they claim, truly believe in [the importance of] recognising the existential threat posed by climate change, then what choice do they have but to work together?

Fundamentally, we need a multilateral process to deal with this global challenge. The Paris Agreement, with all its challenges, still managed to help us avoid the worst of the worst. We still need this UNFCCC process and we need China and the EU to help maintain it.

At the last COP[29 in Azerbaijan], for the first time, it was not China and the US who saved the day. Before, it was always the US and China that made a deal and helped [shepherd] a global agreement. But last year, it was China and the EU that made the agreement and then helped to reach [a global deal] in Azerbaijan.

I do think that China and the EU have both the intention and the innovative capacity, as well as a very, very powerful business sector. I’m still hopeful that these two can come together at this COP [in Brazil].

CB: We’ve spoken a lot about heavy industry and industrial processes. Coal is a very big part of China’s emissions profile. In the short term, how do you see China’s coal use developing over the next five to 10 years?

This ties into that complicated issue of the geopolitical divide. The original plan was to use natural gas as the transition [fuel], which would make things much easier. But geopolitical tensions means gas is no longer considered safe and secure, because China has very little of this resource and has to depend on the other regions, including the US, for gas.

That, in some way, pushed towards authorising new coal power plants and, in some way, we are all suffering for that. In the west as well. We all have to create massive redundancies for so-called insecurity, we’re all bearing higher costs and we’re all facing the risk of stranded assets, because we have such a young coal-power fleet.

The only thing we can do is to try to make sure that these plants increasingly serve only as a backup and as a way to help absorb high penetration of renewables, because now this is a new challenge. Renewables have been expanding so fast that it’s very difficult – because of its intermittent nature – to integrate it into the power grid. New coal power can help absorb, but only if we can make [it] a backup and not use it unless there’s a need. Of course, that means we have to pay to cover the cost for those coal plants.

The funny thing is that there’s no business interest for the coal sector to carry on, because increasingly the market will trend towards using renewables, because it’s getting cheaper and cheaper. So the coal sector, for security and integration of renewables, will be kept. But it will play an increasingly smaller role. In the meantime, the coal sector can help balance the impact through making chemicals, rather than just energy.

In the meantime, [we need to] try to find ways to accelerate the whole energy transition and electrify our economy even faster. That’s a clear path towards both carbon peaking and carbon neutrality in China.

It’s already going on. Carbon Brief’s research already highlights some of the key issues, such as from March [2024] emissions are actually going down. That cannot happen without renewables, because our electricity demand is still going up significantly. In the meantime, the cost of electricity is declining.

This allows China to find its own logic to stick to the Paris Agreement, to stick to climate targets and even try to expand its climate action, because it can benefit the economy. It can benefit the people.

I think Europe probably could also learn from that, because Europe used to focus on climate for the climate’s sake. With [the Russia-Ukraine] war going on, that makes it even more difficult.

CB: You mean the green economy narrative?

MJ: Yes, the green economy narrative is not highlighted enough in Europe. Now, suddenly, it’s about affordability, it’s about competition, and suddenly they feel that they’re not in a very good position. But China actually focuses more on the green economy side. China and the EU could – hand-in-hand – try to pursue that.

CB: That leads perfectly to my last question. How important is the role of civil society now in developing climate and environmental policy in China?

MJ: We all trust in the importance of civil society. This is our logo, which we designed 20 years ago. Here are three segments: the government, business and civil society.

Civil society should be part of that. But we all, realistically, understand that the government is very powerful, businesses have all the resources, but civil society is still very limited in terms of its capacity to influence things.

But still, I’m glad to see that we have a civil society and NGOs like us continue to have the space in China to do what we’re doing. What we’re doing is based on these principles of transparency, the right to know. It’s based on the participation of the public. It’s based on the rule of law. We cherish that and we still have the space to work [on these issues].

We’re lucky, because the environment – including climate – is the area with the biggest consensus view in our society. It could be a test run for having more multi-stakeholder governance in our country. I hope that, increasingly, this can help build social trust between stakeholders and to see [climate action] benefit society in this way.

I know it’s not easy – there are still a lot of challenges [for NGOs] and not just in China. We work with partners in other regions – south-east Asia, south Asia, Africa and Latin America – and it’s hard to imagine the challenges they could face, such as serious challenges to their personal safety.

Now, even in the global north, NGOs are under pressure. So we have a common challenge. Back to the issue of transparency. I hope that transparency also can be a source of protection for NGOs.

When all of us need to [take action to address climate issues], whether that be taking samples of water, protesting on the ground – being face-to-face and on the front line – without some sort of multi-stakeholder governance, then it will be far more difficult for NGOs to participate.

If the government can provide environmental monitoring data to the public, if corporations can make self-disclosures, then it will help with this, to some extent. Because it’s not new – environmental blacklists in China are managed by the government, based on data, based on a legal framework. That can be a source of protection.

So I hope that NGO partners in other parts of the world can recognise that we should work together to promote transparency.

CB: Thank you.

The post Ma Jun: ‘No business interest’ in Chinese coal power due to cheaper renewables appeared first on Carbon Brief.

Ma Jun: ‘No business interest’ in Chinese coal power due to cheaper renewables

Climate Change

Uganda may see lower oil revenues than expected as costs rise and demand falls

Uganda’s plan to use future revenues from its emerging oil industry to drive economic development may not work as expected, because evidence so far shows that the government’s effort to extract and export its crude oil may not produce the returns it is counting on, analysts have warned.

A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) found that Uganda stands to benefit far less from oil production than previously projected, with revenues set to be half of earlier estimates if the world transitions away from fossil fuels on a path to reaching net zero emissions.

Uganda’s oil ambitions involve developing two oilfields on the shores of Lake Albert – Tilenga and Kingfisher – and constructing the 1,443-km East African Crude Oil Pipeline (EACOP), with the aim of transporting 230,000 barrels of crude per day to Tanzania’s Tanga port for export.

Gas flaring soars in Niger Delta post-Shell, afflicting communities

Led by oil major TotalEnergies and China National Offshore Oil Company (CNOOC), alongside the Uganda National Oil Company (UNOC) and Tanzania Petroleum Development Corporation, the project was given the financial go-ahead in 2022.

Will Scargill, one of the IEEFA report’s authors, told an online launch this week that oil may have seemed a historically attractive option for Uganda but the benefits it could yield are very sensitive to major risks, including cost overruns around the project and in the refining sector, which it also plans to enter.

“The EACOP project is expected to cost much more than the original expectations, so it’s a major project risk in Uganda as well,” he said.

The start of oil production and exports through the East Africa pipeline had been expected by 2025 – nearly 20 years after commercially viable oil was first discovered in the country – but has now been delayed until late 2026 or 2027.

Meanwhile, the cost of construction – particularly for the EACOP part of the project – has continued to rise, reaching around $5.6 billion, a 55% increase from the $3.6 billion projected shortly before it got financial approval, the report said.

US tariffs, China’s EV boom to curb oil revenues

Beyond delays and cost overruns, “there’s the risk the impact of the accelerating shift away from fossil fuels will have on the oil market,” Scargill said.

The report said the most significant factors for the Ugandan oil industry – which are beyond its control – have been the reduced outlook for international trade spurred by recently imposed US tariffs and the growing uptake of electric vehicles (EVs), particularly in China – which has led to a peak in transport fuel demand and an expected peak in overall oil consumption by 2027.

The 2025 oil outlook from the International Energy Agency (IEA) shows that growth in global oil demand will fall significantly by the end of the decade before entering a decline, driven mainly by electrification in transport which will displace 5.4 million barrels per day of global oil demand by the end of the decade.

In addition, structural changes in global energy markets, including oil supply growth outside the OPEC+ bloc – a group of major oil-producing countries including Saudi Arabia and Russia that sets production quotas – particularly in the US, Brazil and Guyana, are lowering prices.

“It’s a particularly bad time to be taking single big bets on particular sectors that are linked to external markets,” said Matthew Huxham, a co-author of the IEEFA report.

To make matters worse, Uganda’s public finances have been weakened in the past decade by external shocks including higher US interest rates and commodity prices, resulting in downgrades of the country’s sovereign credit rating, he added.

“What that means is, generally speaking, there is less fiscal resilience to shocks,” Huxham said.

Lower global demand for oil would likely see lower prices, profits and revenues for the Ugandan government, the report authors said. In addition, a global shift to renewable energy would mean Uganda selling even fewer barrels into international markets.

All of these factors suggest that investment in Uganda’s oil industry “would unlikely be as transformational as expected” for its development, Scargill said.

Climate Home News reached out to the Uganda National Oil Company and EACOP but had not received a response at the time of publication.

Foreign investors to recover costs while Uganda faces risks

Uganda has invested a significant amount of government funds not only in the oil pipeline but also in supporting infrastructure such as a planned refinery. The report authors raised concerns about revenue-sharing agreements under which foreign investors are entitled to recover their costs first, taking a larger share of oil revenues in the early years of production.

IEEFA estimates that while TotalEnergies’ and CNOOC’s returns could fall by 25-34% as the world uses less oil and moves from fossil fuels to clean energy, Uganda’s expected revenues could decline by up to 53%.

Explainer: What is the petrodollar and why is it under pressure?

Uganda is pursuing a $4.5-billion oil refinery project in Hoima District, with the country’s oil company UNOC due to take a 40% stake. To finance part of this investment and other oil-related infrastructure, UNOC has secured a loan facility of up to $2 billion from commodity trader Vitol.

Under the deal, Vitol gains priority access to oil revenues, placing it ahead of the Ugandan government when money starts flowing in, the report said. The IEEFA analysts warn that this will likely displace or defer planned use of the revenues for other government spending on things like health, education and climate adaptation, especially if oil production and the refinery construction are delayed or profits disappoint.

“Even if the refinery project is on time and on budget, the refinery and loan repayments could consume 40% of Uganda’s oil revenues through 2032,” Scargill noted.

Pointing to recent cost overruns at oil refinery projects in Africa, the report authors said Nigeria’s

Dangote refinery ended up costing more than twice the original estimate – jumping from $9 billion to over $18 billion.

Climate action is “weapon” for security in unstable world, UN climate chief says

They said analysis shows the Uganda refinery will cost 25% more than planned, on top of an expected overrun of over 50% on the EACOP project, cutting the annual return rate to 10%.

“This means there is a high chance the project, by itself, will not make any money,” the report added.

Responding to the report, the StopEACOP coalition said the analysis confirms that beyond causing ongoing environmental harm and displacing hundreds of thousands, the project “does not make economic sense, especially for the host countries”.

They called on financial institutions, including Standard Bank, KCB Uganda, Stanbic Uganda, Afreximbank, and the Islamic Corporation for the Development of the Private Sector, which are backing the “controversial” EACOP project, “to seriously engage with the findings of the IEEFA reports and reconsider their support”.

Prioritise climate-resilient investments instead

In another report released alongside the one on oil project finances, IEEFA argued that Uganda could achieve stronger and more effective development outcomes by redirecting its scarce public resources towards climate-resilient, electrified industrialisation rather than doubling down on oil.

Uganda is among the countries most vulnerable to climate change, yet ranks low in readiness to cope with its impacts. The report authors urged the government to apply stricter criteria when deciding how to spend public funds, focusing on things like improving access to modern energy services and climate adaptation.

The IEEFA report recommended investments in off-grid and mini-grid solar electrification, agro-processing, cold storage, crop irrigation and better roads as lower-risk alternatives to investing in fossil fuels.

Africa records fastest-ever solar growth, as installations jump in 2025

Investments that take climate risks into account could also attract concessional climate finance and align with Uganda’s fourth National Development Plan and Just Transition Framework, the report said.

“They also take less long to construct, are easy to deploy, pay back over a shorter period and they also put less pressure on the system,” Huxham added.

The post Uganda may see lower oil revenues than expected as costs rise and demand falls appeared first on Climate Home News.

Uganda may see lower oil revenues than expected as costs rise and demand falls

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits