Renewable Energy

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

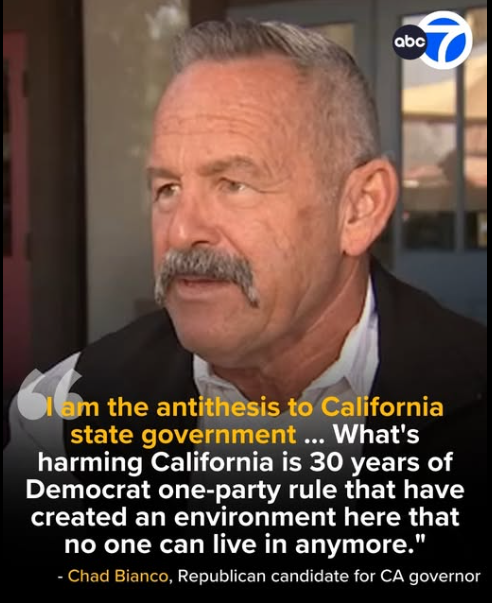

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

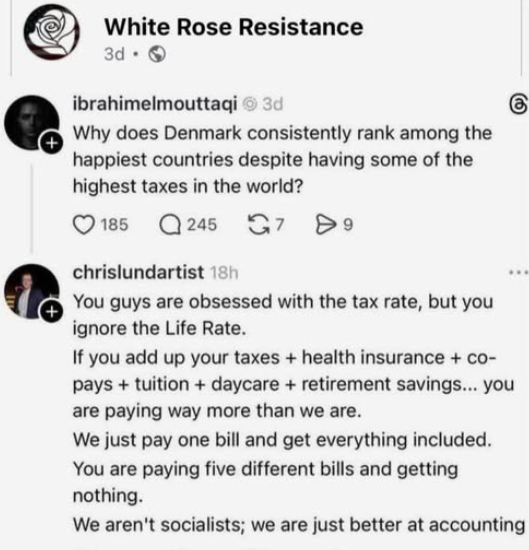

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits