Canada Poised to Lead: A Deep Dive into the Green Hydrogen Landscape

Canada, with its vast renewable resources and ambitious climate goals, is emerging as a global frontrunner in the green hydrogen revolution.

This clean fuel, produced using renewable energy sources like solar and wind, holds immense potential for decarbonizing various sectors, from transportation and industry to buildings and heating. Let’s explore the exciting developments and future prospects of green hydrogen in the Canadian landscape.

Fueled by Ambition:

The Canadian government unveiled its Hydrogen Strategy for Canada in 2020, outlining a roadmap to achieve net-zero emissions by 2050 and establish Canada as a global leader in clean hydrogen production and export. This strategy focuses on:

- Stimulating hydrogen production: Through financial support, incentives, and research & development initiatives.

- Building infrastructure: Investing in electrolyzer facilities, pipelines, and storage solutions.

- Developing demand: Encouraging hydrogen adoption in key sectors like transportation, industry, and heating.

Megaprojects on the Horizon:

Recent months have witnessed significant progress, with two major green hydrogen megaprojects announced:

- Hydrogen Quebec: A $1.2 billion project in Bécancour, Quebec, will produce clean hydrogen from hydropower for export and domestic use.

- BC Green Hydrogen Hub: A consortium led by Royal Dutch Shell plans to invest $1.35 billion in a green hydrogen production facility in Delta, British Columbia.

These projects showcase the growing investor confidence and potential for large-scale green hydrogen production in Canada.

Regional Initiatives:

Beyond national efforts, several provinces are taking proactive steps:

- Alberta: Leveraging its natural gas resources to produce blue hydrogen with carbon capture and storage, with plans to transition to green hydrogen over time.

- Ontario: Implementing its own hydrogen strategy focusing on clean transportation and industrial decarbonization.

- British Columbia: Aiming to be a global leader in clean hydrogen production and export, leveraging its abundant hydro and wind resources.

Green Hydrogen Statistics in Canada: A Snapshot

While green hydrogen is still an emerging sector in Canada, it’s experiencing rapid growth. Here are some key statistics to paint a picture:

Production:

- Current: As of 2023, green hydrogen production in Canada is minimal, accounting for less than 0.7% of the total hydrogen produced (around 3 million tonnes annually).

- Future Potential: Estimates suggest green hydrogen could contribute up to 30% of Canada’s end-use energy by 2050, highlighting its significant potential.

Projects:

- Number: Several green hydrogen projects are in various stages of development, with two major megaprojects recently announced:

- Hydrogen Quebec: $1.2 billion project to produce green hydrogen from hydropower.

- BC Green Hydrogen Hub: $1.35 billion project led by Royal Dutch Shell.

- Distribution: These projects are geographically diverse, showcasing potential across various regions.

Investment:

- Growing: Both public and private investments are increasing significantly, supporting project development and infrastructure creation.

- Example: The Canadian government has committed $1.5 billion to support hydrogen initiatives through its Hydrogen Strategy for Canada.

Technology:

- Focus: Development and deployment of efficient electrolyzer technologies to produce green hydrogen from renewable electricity are crucial.

- Advancements: Ongoing research and innovation aim to reduce costs and improve efficiency of these technologies.

Overall:

- While green hydrogen production in Canada is nascent, the statistics illustrate its rapid growth and immense potential.

- Overcoming challenges related to cost, infrastructure, and regulation will be critical to unlocking its full potential for a sustainable future.

Remember: These are just a few key statistics, and the landscape is constantly evolving. Stay updated on the latest developments and research for a more comprehensive understanding of green hydrogen in Canada.

Green Hydrogen Statistics in Canada: Table

| Category | Statistic | Year (if applicable) | Source |

|---|---|---|---|

| Production | Total Hydrogen Production | 2023 | Natural Resources Canada |

| Green Hydrogen Production | 2023 | Natural Resources Canada | |

| Green Hydrogen as % of Total Production | 2023 | Calculated from above | |

| Green Hydrogen Production Target (by 2050) | 2020 | Hydrogen Strategy for Canada | |

| Projects | Number of Green Hydrogen Projects | 2023 | Various news sources |

| Examples of Major Projects | – | See article for details | |

| Geographical Distribution of Projects | – | See article for details | |

| Investment | Total Government Investment | 2023 | Hydrogen Strategy for Canada |

| Examples of Private Investment | – | See article for details | |

| Technology | Focus Area | – | See article for details |

| Key Challenges | – | See article for details | |

| Challenges | Cost Comparison (Green vs. Traditional Fuels) | 2023 | Various industry reports |

| Infrastructure Needs | – | See article for details | |

| Regulatory Landscape | – | See article for details |

Challenges and Opportunities:

While the future looks promising, challenges remain:

- Cost competitiveness: Green hydrogen is currently more expensive than traditional fossil fuels. Continued technological advancements and policy support are crucial to bridge this gap.

- Infrastructure development: Building a robust hydrogen infrastructure requires significant investment and collaboration across various stakeholders.

- Standardization and regulations: Clear frameworks and standards are needed to ensure the safe and efficient development of the hydrogen industry.

Conclusion:

Canada’s green hydrogen landscape is brimming with potential. With clear government strategies, ongoing project development, and regional initiatives, the country is well-positioned to become a global leader in this clean energy revolution. Overcoming the challenges and capitalizing on the opportunities will be key to unlocking the full potential of green hydrogen for a sustainable future in Canada and beyond.

https://www.exaputra.com/2024/02/green-hydrogen-lansdcape-in-canada.html

Renewable Energy

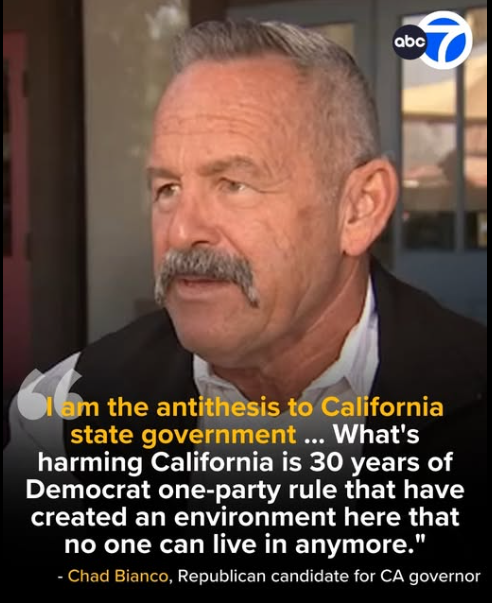

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

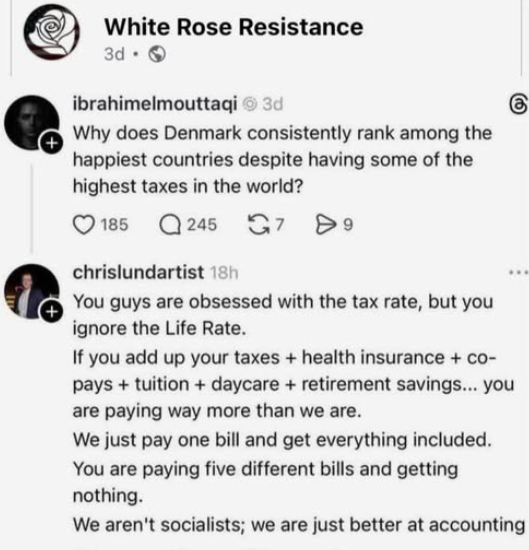

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

Renewable Energy

What Kids Need from Their Parents

Well, here’s a controversial statement.

Well, here’s a controversial statement.

Apparently, there are people who believe kids should be raised by dishonest imbeciles.

https://www.2greenenergy.com/2026/03/05/what-kids-need-from-their-parents/

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits