Agricultural Production by Region: A Focus on Rice and Wheat

Rice and wheat, the two undisputed champions of the cereal world, feed billions around the globe.

Let’s dive into the fascinating stats behind their regional production:

Rice and wheat, the titans of global agriculture, paint a nuanced picture of regional production with distinct narratives and intertwined challenges. Asia reigns supreme in rice, with China and India alone cultivating half the world’s harvest.

This dominance stems from fertile lands, intensive farming practices, and deep cultural dependence, weaving a tapestry of bountiful yields alongside concerns about sustainability. Yet, amidst Asian mastery, diverse flavors and traditions flourish, from Thai Jasmine’s fragrant allure to Japanese Koshihikari’s delicate touch. Meanwhile, wheat’s crown sits divided between Europe and Asia, with China and the European Union vying for top producer.

This global spread speaks to a diverse tapestry of farming systems, climates, and historical trade routes. Technology and mechanization hold sway in North America and parts of Europe, transforming wheat production with impressive yields but raising concerns about reliance on inputs and the fate of small farmers. Across both crops, climate change casts a long shadow, demanding adaptation through resilient varieties, water-saving practices, and diversified cropping systems.

Ultimately, rice and wheat remind us that agricultural production is a story of regional specializations, evolving practices, and a constant quest for sustainable yields to nourish billions. Understanding these narratives, with their triumphs and challenges, is key to ensuring a bountiful future for our global breadbasket.

Agricultural Production by Region: Rice

Rice: A Tale of Regional Dominance and Shifting Dynamics

Rice, the lifeblood of billions, paints a fascinating picture of agricultural production across the globe. Its narrative can be summarized in several key statements:

1. Asia Reigns Supreme: This continent holds the crown, with China and India alone churning out nearly half the world’s rice. Intensive farming practices, fertile land, and cultural dependence weave a tapestry of regional dominance.

2. Beyond Quantity, Diversity: While Asia leads in production, a multitude of countries across the continent cultivate unique rice varieties and traditions. Thai Jasmine, Japanese Koshihikari, and Indian Basmati are just a few examples of the diverse flavor profiles and cultural significance rice holds.

3. Challenges Amidst Abundance: Despite bountiful harvests, challenges lurk. Water scarcity, climate change, and soil degradation threaten long-term sustainability in some regions. Innovation and resource management are crucial for future rice production stability.

4. Shifting Trends and Emerging Players: While Asia remains the powerhouse, Africa and Latin America are witnessing growth in rice production. This trend, driven by population increases and changing dietary patterns, demands attention to infrastructure development and technology transfer.

5. Sustainability in the Spotlight: The future of rice production hinges on balancing high yields with environmental responsibility. Embracing organic farming practices, water conservation techniques, and pest management strategies are key to ensuring a sustainable future for rice, and thus, food security for billions.

Rce production reveals a complex interplay of regional dominance, cultural significance, and ecological concerns. Understanding these dynamics is crucial for ensuring a continued bountiful harvest that nourishes not just bodies, but also communities and traditions across the globe.

Rice, the lifeblood of billions, paints a fascinating picture of agricultural production across the globe. Its narrative can be summarized in several key statements:

1. Asia Reigns Supreme: This continent holds the crown, with China and India alone churning out nearly half the world’s rice. Intensive farming practices, fertile land, and cultural dependence weave a tapestry of regional dominance.

2. Beyond Quantity, Diversity: While Asia leads in production, a multitude of countries across the continent cultivate unique rice varieties and traditions. Thai Jasmine, Japanese Koshihikari, and Indian Basmati are just a few examples of the diverse flavor profiles and cultural significance rice holds.

3. Challenges Amidst Abundance: Despite bountiful harvests, challenges lurk. Water scarcity, climate change, and soil degradation threaten long-term sustainability in some regions. Innovation and resource management are crucial for future rice production stability.

4. Shifting Trends and Emerging Players: While Asia remains the powerhouse, Africa and Latin America are witnessing growth in rice production. This trend, driven by population increases and changing dietary patterns, demands attention to infrastructure development and technology transfer.

5. Sustainability in the Spotlight: The future of rice production hinges on balancing high yields with environmental responsibility. Embracing organic farming practices, water conservation techniques, and pest management strategies are key to ensuring a sustainable future for rice, and thus, food security for billions.

Rce production reveals a complex interplay of regional dominance, cultural significance, and ecological concerns. Understanding these dynamics is crucial for ensuring a continued bountiful harvest that nourishes not just bodies, but also communities and traditions across the globe.

Here is Rice Production Data by Region

- Asia reigns supreme: With over 90% of global rice production concentrated in Asia, it’s the undisputed king of the continent. China and India lead the pack, accounting for almost half the world’s rice output.

- Production powerhouse: China claims the top spot, churning out over 147 million metric tons annually, followed by India at 121 million metric tons. These figures dwarf other major rice producers like Indonesia, Bangladesh, and Vietnam.

- Consumption patterns: Asia also dominates rice consumption, with China and India again leading the charge. Over half the world’s rice is consumed in this region, highlighting its cultural and dietary significance.

- Yield variations: Yields per hectare vary significantly across Asia. China and Vietnam boast impressive yields due to intensive farming practices, while countries like Laos and Nepal have lower figures due to limitations in technology and infrastructure.

Global rice production by Country in 2023

Global Rice Production in 2023 (million metric tons, milled basis)

| Country | Production | Rank | Change From 2022 |

|---|---|---|---|

| China | 145.95 | 1 | -0.74 |

| India | 126.00 | 2 | 4.00 |

| Indonesia | 34.45 | 3 | 0.45 |

| Vietnam | 27.00 | 4 | 0.00 |

| Thailand | 20.20 | 5 | -0.50 |

| Burma | 12.50 | 6 | 0.70 |

| Philippines | 12.60 | 7 | -0.03 |

| Bangladesh | 12.00 | 8 | 2.00 |

| Pakistan | 9.00 | 9 | 3.50 |

| Japan | 7.45 | 10 | -0.03 |

| World Total | 520.90 | 17.84 |

Notes:

- Data based on projections from the United States Department of Agriculture (USDA) as of September 2023.

- Change column represents the difference in production compared to 2022 estimates.

- This table highlights the top ten rice-producing countries and the global total, but many other countries also contribute to rice production.

Agricultural Production by Region: Wheat

Wheat: A Global Staple Facing Winds of Change

Wheat, the golden grain that feeds nations, tells a story of regional variation, evolving practices, and ongoing challenges. Here are some key statements capturing its current landscape:

1. A Divided Throne: Unlike rice, wheat’s crown sits precariously balanced between Europe and Asia, with China and the European Union vying for top producer. This global distribution reflects diverse farming systems, climatic differences, and historical trade routes.

2. Beyond Breadbaskets: While major players like France, Ukraine, and the United States are known for their vast wheat fields, smaller nations like Switzerland and Denmark excel in quality bread-making wheat, showcasing the diverse spectrum of wheat production.

3. Modernization and Mechanization: Technological advancements in machinery, seeds, and precision agriculture are transforming wheat production, particularly in North America and parts of Europe. However, concerns arise regarding dependence on inputs, potential land consolidation, and the fate of small-scale farmers.

4. Climate Change casts a Shadow: Droughts, heat waves, and unpredictable weather patterns pose significant threats to wheat production worldwide. Adapting varieties, adopting water-saving practices, and diversifying cropping systems are crucial for climate resilience and long-term stability.

5. The Quest for Sustainable Yields: Balancing high yields with environmental sustainability is the challenge of our time. Utilizing eco-friendly fertilizers, promoting crop rotation, and adopting integrated pest management are critical steps towards sustainable wheat production for a hungry world.

Wheat’s story is one of global significance, evolving practices, and the constant need for adaptation. By understanding regional variations, addressing climate concerns, and pursuing sustainable practices, we can ensure that this golden grain continues to nourish humanity for generations to come.

Here is Wheat Production data by Region

- A more global game: Unlike rice, wheat cultivation is spread across continents. Europe, Asia, and North America are the dominant players, each contributing roughly 30% of global production.

- Top producers: The European Union reigns supreme, producing over 130 million metric tons annually. China follows closely behind at 134 million metric tons, showcasing its diverse agricultural prowess. Other significant producers include India, Russia, and the United States.

- Consumption trends: Wheat consumption is more evenly distributed than rice, with major consumers found in both developed and developing nations. China, India, and the United States are top consumers, illustrating its role as a staple food worldwide.

- Challenges and opportunities: Climate change, water scarcity, and soil degradation pose major challenges to wheat production in various regions. Technological advancements and innovative farming practices offer opportunities to improve yields and adapt to changing conditions.

Global Wheat Production by Country in 2023 (million metric tons)

| Country | Production | Rank | Change From 2022 |

|---|---|---|---|

| China | 137.00 | 1 | -2.00 |

| European Union | 134.00 | 2 | -2.00 |

| India | 113.50 | 3 | 3.50 |

| Russia | 85.00 | 4 | -5.00 |

| USA | 49.31 | 5 | -7.89 |

| Canada | 31.00 | 6 | -2.00 |

| Pakistan | 28.00 | 7 | 2.00 |

| Australia | 24.50 | 8 | -3.50 |

| Turkey | 24.00 | 9 | -0.50 |

| Ukraine | 22.00 | 10 | -7.00 |

| World Total | 783.43 | -28.09 |

Notes:

- Data based on projections from the United States Department of Agriculture (USDA) as of October 2023.

- Change column represents the difference in production compared to 2022 estimates.

- This table highlights the top ten wheat-producing countries and the global total, but many other countries also contribute to wheat production.

Comparing yields per hectare for rice and wheat across different countries can be quite insightful.

1. Region-specific comparisons:

- Asia:

- Rice: Vietnam’s impressive 5.7 tonnes/ha with Nepal’s modest 3.4 tonnes/ha.

- Wheat: Contrast China’s high yield of 4.8 tonnes/ha with Mongolia’s lower 2.2 tonnes/ha. Explore the role of climate and soil quality in these differences.

- Europe:

- Rice: France, with its 7.7 tonnes/ha, stands out. Compare this to Italy’s focus on quality over quantity, leading to yields closer to 5 tonnes/ha.

- Wheat: Germany’s 8 tonnes/ha and the UK’s 7.5 tonnes/ha showcase advanced European practices. Compare these to Ukraine’s 4.5 tonnes/ha, considering factors like post-conflict challenges.

2. Global leader comparisons:

- Rice: China maintains its top production position with a yield of 6.7 tonnes/ha, while India lags slightly behind at 5.2 tonnes/ha. Explore differences in farming practices and resource availability.

- Wheat: Compare the yield of France, the top European producer (8 tonnes/ha), with the US, the major North American player (6.6 tonnes/ha).

3. Yield trends over time:

- A country like Vietnam or Egypt, known for significant improvements in rice yields over the past decade. Identify key factors driving these increases, such as improved seed varieties and irrigation technology.

- Wheat yield changes in major producers like China or Russia. Analyze the impact of technological advancements, policy changes, and climate fluctuations on yield variability.

Comparing Rice and Wheat Yields by Country (Tonnes/Hectare)

| Country | Rice Yield | Wheat Yield | Notes |

|---|---|---|---|

| Asia | |||

| China | 6.7 | 4.8 | High production and mechanization |

| India | 5.2 | 3.2 | High production, lower yield than China |

| Vietnam | 5.7 | N/A | World’s leading rice exporter, high yields |

| Japan | 5.5 | 5.2 | Focus on quality grains, moderate yields |

| Nepal | 3.4 | 2.2 | Lower income, limited resources, lower yields |

| Europe | |||

| France | 7.7 | 8.0 | Top European rice producer, high yields |

| Italy | 5.0 | 5.7 | Focus on quality wheat, lower yields |

| Germany | N/A | 8.0 | Top European wheat producer, high yields |

| UK | N/A | 7.5 | High wheat yields, advanced farming practices |

| Ukraine | N/A | 4.5 | Lower yields due to conflict and economic challenges |

| Global Leaders | |||

| USA | N/A | 6.6 | Major North American producer, good wheat yields |

| Russia | N/A | 4.3 | Large wheat producer, lower yields than Europe or US |

Notes:

- N/A indicates data not readily available for that specific country and crop.

- This table provides a snapshot comparison and may not capture all regional variations within countries.

- Consider exploring online resources for more detailed data and interactive visualizations.

Beyond the numbers:

These statistics paint a picture of regional dominance and global importance for both rice and wheat. However, it’s crucial to remember that production volumes only tell part of the story. Factors like consumption patterns, local food security concerns, and the social and economic implications of these crops play equally important roles in understanding the intricate landscape of regional agriculture.

https://www.exaputra.com/2024/01/agricultural-production-by-region-rice.html

Renewable Energy

Sorry, Trump Couldn’t Care Less about Anyone but Himself

At first, I thought the meme at left was a joke, but upon further reflection, I realized that it was not.

At first, I thought the meme at left was a joke, but upon further reflection, I realized that it was not.

Renewable Energy

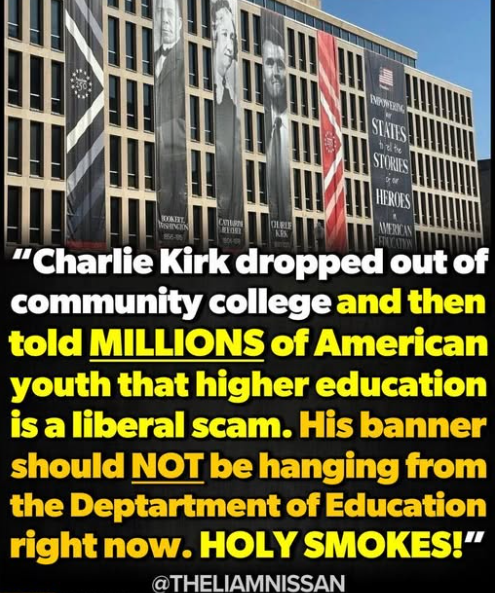

Spreading Propaganda against College Education

As we see all around us, the Trump administration is doing everything it can to minimize the percentage of voters with college degrees, for the obvious reason that educated people do not believe the utter crap coming out of the president’s mouth.

As we see all around us, the Trump administration is doing everything it can to minimize the percentage of voters with college degrees, for the obvious reason that educated people do not believe the utter crap coming out of the president’s mouth.

And to the imbecile who created the meme at left, uh, yeah, we understand that our society still needs tradespeople.

Renewable Energy

Dumbing Down America

There is only one way for Republicans to remain in power, and that is to make more MAGA idiots.

There is only one way for Republicans to remain in power, and that is to make more MAGA idiots.

Education is kryptonite to ignorance.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits