Welcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

Tasks for 2026

‘GREEN RESOLVE’: The Ministry of Ecology and Environment (MEE) said at its annual national conference that it is “essential” to “maintain strategic resolve” on building a “beautiful China”, reported energy news outlet BJX News. Officials called for “accelerating green transformation” and “strengthening driving forces” for the low-carbon transition in 2026, it added. The meeting also underscored the need for “continued reduction in total emissions of major pollutants”, it said, as well as for “advancing source control through carbon peaking and a low-carbon transition”. The MEE listed seven key tasks for 2026 at the meeting, said business news outlet 21st Century Business Herald, including promoting development of “green productive forces”, focusing on “regional strategies” to build “green development hubs” and “actively responding” to climate change.

CARBON ‘PRESSURE’: China’s carbon emissions reduction strategy will move from the “preparatory stages” into a phase of “substantive” efforts in 2026, reported Shanghai-based news outlet the Paper, with local governments beginning to “feel the pressure” due to facing “formal carbon assessments for the first time” this year. Business news outlet 36Kr said that an “increasing number of industry participants” will have to begin finalising decarbonisation plans this year. The entry into force of the EU’s carbon border adjustment mechanism means China’s steelmakers will face a “critical test of cost, data and compliance”, reported finance news outlet Caixin. Carbon Brief asked several experts, including the Asia Society Policy Institute’s Li Shuo, what energy and climate developments they will be watching in 2026.

COAL DECLINE: New data released by the National Bureau of Statistics (NBS) showed China’s “mostly coal-based thermal power generation fell in 2025” for the first time in a decade, reported Reuters, to 6,290 terawatt-hours (TWh). The data confirmed earlier analysis for Carbon Brief that “coal power generation fell in both China and India in 2025”, marking the first simultaneous drop in 50 years. Energy news outlet International Energy Net noted that wind generation rose 10% to 1,053TWh and solar by 24% to 1,573TWh.

EV agreement reached

‘NORMALISED COMPETITION’?: The EU will remove tariffs on imports of electric vehicles (EV) made in China if the manufacturers follow “guidelines on minimum pricing” issued by the bloc, reported the Associated Press. China’s commerce ministry stated that the new guidelines will “enable Chinese exporters to address the EU’s anti-subsidy case concerning Chinese EVs in a way that is more practical, targeted and consistent with [World Trade Organization] rules”, according to the state-run China Daily. An editorial by the state-supporting Global Times argued that the agreement symbolised a “new phase” in China-EU economic and trade relations in which “normalised competition” is stabilised by a “solid cooperative foundation”.

SOLAR REBATES: China will “eliminate” export rebates for solar products from April 2026 and phase rebates for batteries out by 2027, said Caixin. Solar news outlet Solar Headlines said that the removal of rebates would “directly test” solar companies’ profitability and “fundamentally reshape the entire industry’s growth logic”. Meanwhile, China imposed anti-dumping duties on imports of “solar-grade polysilicon” from the US and Korea, said state news agency Xinhua.

OVERCAPACITY MEETINGS: The Chinese government “warned several producers of polysilicon…about monopoly risks” and cautioned them not to “coordinate on production capacity, sales volume and prices”, said Bloomberg. Reuters and China Daily covered similar government meetings on “mitigat[ing] risks of overcapacity” with the battery and EV industries, respectively. A widely republished article in the state-run Economic Daily said that to counter overcapacity, companies would need to reverse their “misaligned development logic” and shift from competing on “price and scale” to competing on “technology”.

High prices undermined home coal-to-gas heating policy

SWITCHING SHOCK: A video commentary by Xinhua reporter Liu Chang covered “reports of soaring [home] heating costs following coal-to-gas switching [policies] in some rural areas of north China”. Liu added that switching from coal to gas “must lead not only to blue skies, but also to warmth”. Bloomberg said that the “issue isn’t a lack of gas”, but the “result of a complex series of factors including price regulations, global energy shocks and strained local finances”.

-

Sign up to Carbon Brief’s free “China Briefing” email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

HEATED DEBATE: Discussions of the story in China became a “domestically resonant – and politically awkward – debate”, noted the current affairs newsletter Pekingnology. It translated a report by Chinese outlet Economic Observer that many villagers in Hebei struggled with no access to affordable heating, with some turning back to coal. “Local authorities are steadily advancing energy supply,” People’s Daily said of the issue, noting that gas is “increasingly becoming a vital heating energy source” as part of China’s energy transition. Another People’s Daily article quoted one villager saying: “Coal-to-gas conversion is a beneficial initiative for both the nation and its people…Yet the heating costs are simply too high.”

DEJA-VU: This is not the first time coal-to-gas switching has encountered challenges, according to research by the Oxford Institute for Energy Studies, with nearby Shanxi province experiencing a similar situation. In Shanxi, a “lack of planning, poor coordination and hasty implementation” led to demand outstripping supply, while some households had their coal-based heating systems removed with no replacement secured. Others were “deterred” from using gas-based systems due to higher prices, it said.

More China news

- LOFTY WORDS: At Davos, vice-premier He Lifeng reaffirmed commitments to China’s “dual-carbon” goals and called for greater “global cooperation on climate change”, reported Caixin.

- NOT LOOKING: US president Donald Trump, also at Davos, said he was not “able to find any windfarms in China”, adding China sells them to “stupid” consumers, reported Euronews. China installed wind capacity has ranked first globally “for 15 years consecutively”, said a government official, according to CGTN.

- ‘GREEN’ FACTORIES: China issued “new guidelines to promote green [industrial] microgrids” including targets for on-site renewable use, said Xinhua. The country “pledged to advance zero-carbon factory development” from 2026, said another Xinhua report.

- JET-FUEL MERGER: A merger of oil giant Sinopec with the country’s main jet-fuel producer could “aid the aviation industry’s carbon reduction goals”, reported Yicai Global. However, Caixin noted that the move could “stifl[e] innovation” in the sustainable air fuel sector.

- NEW TARGETS: Chinese government investment funds will now be evaluated on the “annual carbon reduction rates” achieved by the enterprises or projects they support, reported BJX News.

- HOLIDAY CATCH-UP: Since the previous edition of China Briefing in December, Beijing released policies on provincial greenhouse gas inventories, the “two new” programme, clean coal benchmarks, corporate climate reporting, “green consumption” and hydrogen carbon credits. The National Energy Administration also held its annual work conference.

Spotlight

Why gas plays a minimal role in China’s climate strategy

While gas is seen in some countries as an important “bridging” fuel to move away from coal use, rapid electrification, uncompetitiveness and supply concerns have suppressed its share in China’s energy mix.

Carbon Brief explores the current role of gas in China and how this could change in the future. The full article is available on Carbon Brief’s website.

The current share of gas in China’s primary energy demand is small, at around 8-9%.

It also comprises 7% of China’s carbon dioxide (CO2) emissions from fuel combustion, adding 755m tonnes of CO2 in 2023 – twice the total CO2 emissions of the UK.

Gas consumption is continuing to grow in line with an overall uptick in total energy demand, but has slowed slightly from the 9% average annual rise in gas demand over the past decade – during which time consumption more than doubled.

The state-run oil and gas company China National Petroleum Corporation (CNPC) forecast in 2025 that demand growth for the year may slow further to just over 6%.

Chinese government officials frequently note that China is “rich in coal” and “short of gas”. Concerns of import dependence underpin China’s focus on coal for energy security.

However, Beijing sees electrification as a “clear energy security strategy” to both decarbonise and “reduce exposure to global fossil fuel markets”, said Michal Meidan, China energy research programme head at the Oxford Institute for Energy Studies.

A dim future?

Beijing initially aimed for gas to displace coal as part of a broader policy to tackle air pollution.

Its “blue-sky campaign” helped to accelerate gas use in the industrial and residential sectors. Several cities were mandated to curtail coal usage and switch to gas.

(January 2026 saw widespread reports of households choosing not to use gas heating installed during this campaign despite freezing temperatures, due to high prices.)

Industry remains the largest gas user in China, with “city gas” second. Power generation is a distant third.

The share of gas in power generation remains at 4%, while wind and solar’s share has soared to 22%, Yu Aiqun, research analyst at the thinktank Global Energy Monitor, told Carbon Brief. She added:

“With the rapid expansion of renewables and ongoing geopolitical uncertainties, I don’t foresee a bright future for gas power.”

However, gas capacity may still rise from 150 gigawatts (GW) in 2025 to 200GW by 2030. A government report noted that gas will continue to play a “critical role” in “peak shaving”.

But China’s current gas storage capacity is “insufficient”, according to CNPC, limiting its ability to meet peak-shaving demand.

Transport and industry

Gas instead may play a bigger role in the displacement of diesel in the transport sector, due to the higher cost competitiveness of LNG – particularly for trucking.

CNPC forecast that LNG displaced around 28-30m tonnes of diesel in the trucking sector in 2025, accounting for 15% of total diesel demand in China.

However, gas is not necessarily a better option for heavy-duty, long-haul transportation, due to poorer fuel efficiency compared with electric vehicles.

In fact, “new-energy vehicles” are displacing both LNG-fueled trucks and diesel heavy-duty vehicles (HDVs).

Meanwhile, gas could play a “more significant” role in industrial decarbonisation, Meidan told Carbon Brief, if prices fall substantially.

Growth in gas demand has been decelerating in some industries, but China may adopt policies more favourable to gas, she added.

An energy transition roadmap developed by a Chinese government thinktank found gas will only begin to play a greater role than coal in China by 2050 at the earliest.

Both will be significantly less important than clean-energy sources at that point.

This spotlight was written by freelance climate journalist Karen Teo for Carbon Brief.

Watch, read, listen

EV OUTLOOK: Tu Le, managing director of consultancy Sino Auto Insights, spoke on the High Capacity podcast about his outlook for China’s EV industry in 2026.

‘RUNAWAY TRAIN’: John Hopkins professor Jeremy Wallace argued in Wired that China’s strength in cleantech is due to a “runaway train of competition” that “no one – least of all [a monolithic ‘China’] – knows how to deal with”.

‘DIRTIEST AND GREENEST’: China’s energy engagement in the Belt and Road Initiative was simultaneously the “dirtiest and greenest” it has ever been in 2025, according to a new report by the Green Finance & Development Center.

INDUSTRY VOICE: Zhong Baoshen, chairman of solar manufacturer LONGi, spoke with Xinhua about how innovation, “supporting the strongest performers”, standards-setting and self-regulation could alleviate overcapacity in the industry.

$574bn

The amount of money State Grid, China’s main grid operator, plans to invest between 2026-30, according to Jiemian. The outlet adds that much of this investment will “support the development and transmission of clean energy” from large-scale clean-energy bases and hydropower plants.

New science

- The combination of long-term climate change and extremes in rainfall and heat have contributed to an increase in winter wheat yield of 1% in Xinjiang province between 1989-2023 | Climate Dynamics

- More than 70% of the “observed changes” in temperature extremes in China over 1901-2020 are “attributed to greenhouse gas forcing” | Environmental Research Letters

China Briefing is written by Anika Patel and edited by Simon Evans. Please send tips and feedback to china@carbonbrief.org

The post China Briefing 22 January 2026: 2026 priorities; EV agreement; How China uses gas appeared first on Carbon Brief.

China Briefing 22 January 2026: 2026 priorities; EV agreement; How China uses gas

Climate Change

Climate action is “weapon” for security in unstable world, UN climate chief says

In an increasingly unstable world of “strong arms and trade wars”, climate action is the “not-so-secret weapon” that can deliver security, the UN climate chief said in his first speech of the year.

Speaking in Istanbul alongside Turkiye’s COP31 president on Thursday, Simon Stiell warned that, while security is on most leaders’ lips at the moment, “many cling to a definition that is dangerously narrow”.

“For any leader who is serious about security, climate action is mission critical, as climate impacts wreak havoc on every population and economy,” he added. “Climate cooperation is an antidote to the chaos and coercion of this moment, and clean energy is the obvious solution to spiralling fossil fuel costs, both human and economic.”

Stiell’s remarks aim to reframe the global security debate at a time when climate change has slipped down the global political agenda.

Climate dropping down priority list

In much of the Western world, governments’ attention has shifted towards geopolitical tensions and spending redirected towards defence build-up following Russia’s invasion of Ukraine and, more recently, US President Donald Trump’s military action in Venezuela and renewed pursuit of Greenland.

Climate change has also fallen sharply in public risk perception among advanced economies, according to the Munich Security Conference’s annual survey on national threats, released ahead of the annual gathering of leaders – including those of most European nations – which starts on Friday.

In 2021, respondents in the G7 industrialised nations ranked climate change as the top risk facing their countries. This year, it has slipped to sixth place, overtaken by worries about cyberattacks, financial crises and disinformation.

By contrast, climate-related threats continue to dominate risk perceptions in major emerging economies. In China, India, Brazil and South Africa, respondents consistently rank climate change, extreme weather and forest fires among the most serious dangers facing their countries, the survey found.

“Antidote to the chaos”

The shift in sentiment comes as global temperatures are on course to breach the 1.5C warming threshold widely regarded as a critical guardrail. Scientists warn surpassing that limit would significantly increase the likelihood of more frequent and severe climate impacts worldwide, from droughts to floods and storms.

“Growing greenhouse gas pollution means escalating climate extremes fuelling famine, displacement and war,” said Stiell on Thursday, adding that “climate adaptation is the only path to securing billions of human lives, as climate impacts get rapidly worse”.

Clean energy, meanwhile, is the best way to protect energy supplies and communities from fossil fuels’ volatile costs, he added.

“The fact is renewables are the clearest, cheapest path to energy security and sovereignty – shielding countries and economies from shocks unleashed by wars, trade turmoil and the might-is-right politics that leave every nation poorer,” the UN climate chief said.

Gas flaring soars in Niger Delta post-Shell, afflicting communities

Ahead of the Munich Security Conference, energy analysts are warning that Europe should be wary of its reliance on US gas, which has become a growing energy source across the continent following restrictions on supplies from Russia after its invasion of Ukraine.

Chris Aylett, research fellow at Chatham House’s Environment and Society Centre, said Trump’s pursuit of geopolitical energy dominance seeks to lock countries, including EU member states, into long-term oil and gas dependencies.

“During peace, this vulnerability to an unreliable – if not actively hostile – supplier would be a major constraint on Europe’s strategic autonomy,” he added. “During war it would be catastrophic”.

What role for climate diplomacy?

UN climate head Stiell met this week with officials from the Turkish and Australian governments – co-hosts of this year’s COP31 summit in Antalya – as well as Brazil’s COP30 presidency to kick-start climate diplomacy efforts for the year ahead.

The ability of UN climate negotiations to keep up with the urgency of the climate crisis is coming under increasing question. The deepening divisions seen in Belém last November have stalled meaningful progress on key issues such as the transition away from fossil fuels and climate finance.

In his speech, Stiell acknowledged that climate cooperation is “under unprecedented threat” from those determined to use their power to increase dependency on polluting coal, oil and gas.

But climate action needs to enter a new “era of implementation” with the UN process moving closer to the real economy and countries deepening cooperation with businesses, investors and regional leaders, he added. Stiell noted he has convened experts to advise on this, and will say more about it in the months ahead.

Stiell’s remarks on the evolving UN climate regime echo the words of COP30 president André Aranha Corrêa do Lago. In a letter last month, he said climate multilateralism needs to “mature” and called for a shift to a two-speed system, where new coalitions lead fast, practical action alongside the slower, consensus-based decision-making of the annual COP climate summits.

The post Climate action is “weapon” for security in unstable world, UN climate chief says appeared first on Climate Home News.

Climate action is “weapon” for security in unstable world, UN climate chief says

Climate Change

Maryland Environmentalists Face Awkward Choice: Support Moore’s Budget Raid or Fight for Climate Goals

Budget pressures are forcing climate groups into uncomfortable compromises even as Maryland falls further behind on its climate targets.

Maryland environmental groups are backing Gov. Wes Moore’s plan to redirect more than $700 million from the state’s main clean energy fund while at the same time pushing for legislation to prevent similar raids in the future and secure hundreds of millions of dollars in guaranteed yearly climate spending going forward.

Climate Change

Analysis: Trump has overseen more coal retirements than any other US president

Donald Trump has overseen more retirements of coal-fired power stations than any other US president, according to Carbon Brief analysis.

His administration’s latest efforts to roll back US climate policy have been presented by interior secretary Doug Burgum as an opportunity to revive “clean, beautiful, American coal”.

The administration is in the process of attempting to repeal the 2009 “endangerment” finding, which is the legal underpinning of many federal climate regulations.

On 11 February, the White House issued an executive order on “America’s beautiful clean coal power generation fleet”, calling for government contracts and subsidies to keep plants open.

On the same day, Trump was presented with a trophy by coal-mining executives declaring him to be the “undisputed champion of beautiful clean coal”.

These words are in sharp contrast to Trump’s record in office, with more coal-fired power plants having retired under his leadership than any other president, as shown in the figure below.

This is because coal plants have been uneconomic to operate compared with cheaper gas and renewables – and because most of the US coal fleet is extremely old.

In total, some 57 gigawatts (GW) of coal capacity has already been retired during Trump’s first and second terms in office, compared with 48GW under Obama’s two full terms and 41GW under Biden’s single term.

Even in relative terms, the US has lost a larger proportion of its remaining coal fleet for each year of Trump’s presidencies than for either of his recent predecessors.

Trump’s record hints at the many practical and economic factors that have driven US coal closures, regardless of the preferences of the president of the day.

Indeed, Trump made variousefforts to prop up coal power during his first term in office. These were ultimatelyunsuccessful, as the figure below illustrates.

Coal plants have been retiring in large numbers over the past 20 years because they were uneconomic relative to cheaper sources of electricity, including renewables and gas.

These unfavourable market conditions, alongside air pollution regulations unrelated to climate change, have resulted in a steady parade of coal closures under successive presidents.

By 2024, wind and solar were generating more electricity in the US than coal.

More recently, analysis from the US Energy Information Administration shows that surging power prices have improved the economics of both coal and gas-fired power plants.

These rising prices have been driven by increasing demand, including from data centres, and by higher gas prices, due to increasing exports at liquefied natural gas (LNG) terminals.

These factors saw coal-power output increase by 13% year-on-year in 2025, only the second rise in a decade of steady decline for the fuel, according to the Rhodium Group.

Nevertheless, many utilities have still been looking to shutter their ageing coal-fired power plants.

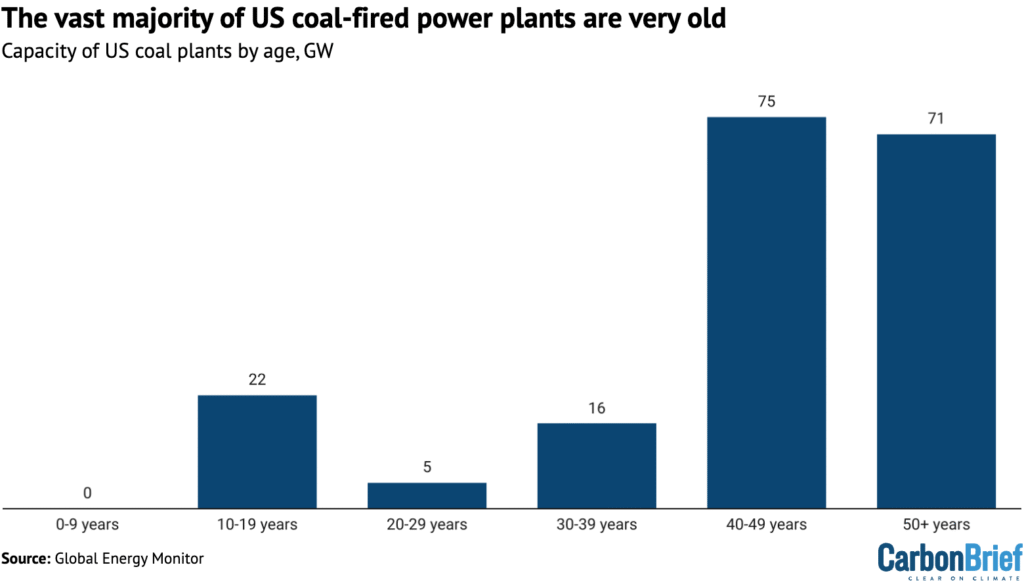

The vast majority of US coal plants are nearing retirement. Three-quarters of US coal capacity is more than four decades old and only 14% is less than 20 years old, as shown in the figure below.

In response, the Trump administration has recently invoked legislation designed for wartime emergencies to force a number of uneconomic coal plants to remain open.

Despite Trump’s efforts, clean energy made up 96% of the new electricity generation capacity added to the US grid in 2025. None of the new capacity came from coal power.

The post Analysis: Trump has overseen more coal retirements than any other US president appeared first on Carbon Brief.

Analysis: Trump has overseen more coal retirements than any other US president

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Renewable Energy2 years ago

GAF Energy Completes Construction of Second Manufacturing Facility