So-called “debt-for-nature swaps” have regained prominence in recent years as part of efforts to raise finance for conservation efforts across biodiverse developing countries.

These “swaps” are financial agreements in which a conservation organisation or government reduces, restructures or buys a developing country’s debt at a discount in exchange for investment in local conservation activities.

Despite a biodiversity “finance gap” estimated at $700bn per year, little finance has been forthcoming from developed countries to help debt-distressed lower-income countries meet their biodiversity and climate targets.

One expert, who helped Ecuador negotiate a debt conversion deal in 2023, tells Carbon Brief that these swaps are “a very tangible strategy that is starting to be proven”.

He adds that they are one of the “big sustainable financing tools that can help” support global-south countries in following through on international treaties.

However, critics are less optimistic about the feasibility of debt-for-nature swaps.

Another expert tells Carbon Brief that the swaps are “far too small to have any impact at all” on the debt of developing countries and that they are “not even marginal to a solution at the current level of their size”.

Additionally, she says, “there’s no evidence that they have worked for nature”.

In this Q&A, Carbon Brief examines how debt-for-nature swaps work, the criticism they have received and whether they can alleviate biodiversity loss and climate change in developing countries.

- Where did the idea of debt-for-nature swaps come from?

- How do debt-for-nature swaps work?

- How are they gaining traction in nature finance and conservation policy?

- What are some of the chief criticisms of debt-for-nature swaps?

- Can debt-for-nature swaps be done better?

Where did the idea of debt-for-nature swaps come from?

The idea of debt swaps emerged in response to the global debt crisis of 1982-83 brought on by multiple shocks to the world economy.

The 1979-80 “oil shock”, for example, more than doubled the real price of oil for the oil-importing developing countries, raising interest rates on debt and reducing how much foreign exchange they could raise to service their debts.

This mushrooming crisis led to the creation of a secondary market for developing country debt in 1982, where loans to developing countries could be traded at a market-determined price.

This paved the way for “swaps” of various kinds, where banks could trade their foreign debt at a discount and reduce their financial exposure to precarious loans, while private investors could gain a foothold in new markets that were otherwise closed off to them.

In 1984, ecologist Dr Thomas Lovejoy – then a vice president of science at WWF – wrote a column in the New York Times advocating for swaps where the local currency raised would go towards conservation.

Unlike previous debt swaps driven by a profit motive and giving multinationals “equity” in a country, debt-for-nature swaps were supposed to benefit the debtor country. Lovejoy’s column is widely recognised as one of the “catalysts” for debt-for-nature swaps.

Three years later, in 1987, US-based Conservation International entered into the first-ever debt-for-nature agreement with Bolivia.

In exchange for the Bolivian government’s commitment to grant maximum legal protection to nearly 4m hectares in the Amazon Basin, Conservation International bought $650,000 worth of debt from a swiss bank for $100,000. Bolivia also agreed to provide $250,000 in local currency for management activities in the Beni Reserve.

Even early proponents of debt-for-nature swaps acknowledged that they were “no panacea” for environmental issues in the least-developed countries. Nevertheless, they continued to be popular and have seen a resurgence in the post-Covid era.

How do debt-for-nature swaps work?

In its simplest sense, a debt-for-nature swap involves:

- An indebted, biodiverse developing country.

- A creditor or a group of creditors, such as other governments or private bondholders.

- International conservation organisations, to buy back the debt.

- Local conservation organisations, to implement the swap.

International conservation organisations or private foundations based in the global north have initiated or brokered most debt-for-nature swaps.

Other actors and intermediaries involved in swaps can include commercial banks, multilateral development banks, private finance institutions, insurance companies and legal and financial advisors.

Today, there are many different kinds of debt-for-nature deals in progress, but swaps can broadly be classified as “private”, involving commercial debt, or “public”, involving the debt between governments.

Private debt swaps

In private debt swaps, NGOs offer to buy back part of a government’s commercial debt from private creditors at a significant discount compared to the debt’s face value.

The indebted country then commits to repaying this debt – in whole or in part and generally in local currency. The amount generated by this payment – the difference between the price paid in local currency and the discounted price the NGO buys the debt for – is then put into an environmental protection fund administered by the conservation NGO.

While this was the model for most debt-for-nature swaps until 2008, arrangements have grown more complex in recent years.

The “buy-back” of debt claims by NGOs, for instance, has grown to take the form of various kinds of bonds – essentially, an IOU or loan issued by a government or company, whereby the issuer promises to pay back the face value of the loan on a set date, with regular interest.

For example, the Nature Conservancy set up a trust fund in 2015 which issued a $15.2m “blue bond” that private philanthropic funds paid into. This sum was then lent to the Seychelles government, which used it to buy back $21.6m of debt from the Paris Club of developed country creditors.

In exchange, Seychelles pledged to protect 30% of its marine area and 15% of high-biodiversity regions, along with upgrading its marine mapping and fisheries policies.

Despite a total debt reduction of only $1.4m, the island state committed to investing $5.6m in marine conservation and $3m towards an endowment trust fund.

Public debt swaps

Swaps of debt between countries in exchange for conservation commitments are known as “public debt-for-nature swaps”.

Here, the indebted, biodiverse country restructures or buys back debt from a lender country at a reduced price. The interest or a percentage of the buy-back price then goes toward environmental protection.

The first such swap took place in 1988 between Costa Rica and the Netherlands to finance a 4,000-hectare reforestation programme.

These bilateral debt-for-nature swaps have seen a resurgence in the past year or so.

In January 2023, for instance, Portugal signed an agreement to swap up to $140m of Cape Verde’s debt for investments in a special environmental and climate fund, with more debt relief determined by how its former colony meets key climate and nature goals.

In September last year, the US and Peru entered into a swap agreement covering more than $20m of Peru’s debt to the US. The money will go towards a conservation fund to protect three priority areas in the Amazon rainforest and provide grants to local communities and NGOs.

How are swaps gaining traction in nature finance and conservation policy?

Since the 1980s, 145 debt-for-nature swaps worldwide have written off $3.7bn from the face value of debt globally, according to a 2022 report by the African Development Bank (AfDB).

Most of the debt swaps – $2.4bn of the total – have occurred in Latin America and the Caribbean.

Carbon Brief has compiled a list of debt swaps that have taken place around the world. This is based on data from the African Development Bank report, along with reports from governments, conservation organisations and the media. It is not an exhaustive list.

The map below shows where swaps have taken place. The circles indicate the financial size of the debt involved in the swap, while the colours show the decade in which the swap was completed.

Debt-for-nature swap deals around the world over 1987-2023. The size of the circles corresponds to the face value of debt being swapped for conservation investments by countries, while the colour of the circles corresponds to the decade in which the swaps took place. Source: Carbon Brief analysis of African Development Bank (2022) and media and conservation organisations reports (2022), WWF Center for Conservation Finance (2003) and Eurodad (2023). Debt values not adjusted for inflation.

At the COP15 climate summit in Copenhagen in 2009, debt-for-nature swaps featured at the UN Framework Convention on Climate Change for the first time. They were included in the negotiating text after Indonesia introduced “external debt swap/relief” as a source of finance.

At COP27 in Sharm el-Sheikh in 2022, the Sustainable Debt Coalition Initiative was established with the support of 16 countries. It asked for debt swaps and other mechanisms to tackle both climate change and financial stability concerns.

At COP28 in Dubai last year, eight multilateral development banks, including the Green Climate Fund and the Global Environment Facility, announced a working group to boost the effectiveness, accessibility and scalability of sustainability-linked sovereign finance, including debt-for-nature swaps.

In the announcement, the development banks acknowledged that the burden of debt owed by the developing countries “greatly hinder[s] their ability to meet their global climate and nature commitments”.

The debt issue is also being addressed in other international meetings.

During the April 2024 World Bank and International Monetary Fund spring meetings, the Vulnerable Twenty Group (V20) – made up of 68 heavily indebted, climate-vulnerable countries – called for additional reforms to the international financial system. They proposed several measures, including increased representation in the global financial system and greater access to concessional finance, or finance provided at lower interest rates than commercial finance, including debt-for-nature swaps.

Eva Martínez, a human rights lawyer and programme officer at the Centre for Economic and Social Rights (CEDES) in Ecuador, tells Carbon Brief that swaps will also feature at this year’s G20 summit in Brazil. She explains:

“There is a working document on the new financial architecture…There are [also] references to [debt swaps] for food sovereignty, debt-for-health swaps. The spectrum is broadening.”

What are some of the chief criticisms of debt-for-nature swaps?

Since their inception, debt-for-nature swaps have attracted considerable concern over whether they are effective for either debt relief or conservation.

As with biodiversity offsets and nature-based solutions, debt-for-nature swaps have been criticised for putting a price on nature and “reducing” it to a financial commodity.

Another complication is that “biodiversity is really cheap”, Dr Rebecca Ray from Boston University’s Global Development Policy Center tells Carbon Brief. As a result, creating and maintaining new protected areas is often a small fraction of a country’s sovereign debt. She adds:

“This means a little bit of debt swapped goes a really long way to fund new natural protected areas, but it doesn’t go very far on the debt. And so it’s not the most efficient way to discharge debt, even though countries are particularly facing debt stress right now.

”Repaying debt is hard for countries all around the world due to problems that are not their fault.”

These countries need “immediate debt relief that is fast and large”, Ray points out, but biodiversity conservation projects “tend to cost a lot less money and take a lot more time”.

The following sections provide an overview of some of the other criticisms of debt-for-nature swaps.

Conditionality, sovereignty and additionality

The earliest controversy around debt-for-nature swaps was a perceived fear of foreign interference, sovereignty and a “return to the colonial system”.

The first swap in Bolivia in 1987, for instance, “unilaterally titled” the land to be protected in the Amazon before Indigenous communities could obtain land tenure claims. In 1989, Brazil’s then-president Jose Sarney rejected debt-for-nature swaps stating: “[The] Amazon is ours… [a]fter all, it is situated in our territory.”

Entering into a debt-swap agreement “immediately results in a loss of autonomy and sovereignty” over the resolution of public debt, argues Mae Buenaventura, senior programme manager on debt and green economy at the Asian Peoples’ Movement on Debt and Development (APMDD). She tells Carbon Brief:

“Lenders determine the terms of the swap, meaning that they can impose conditions on borrowing governments on how they should invest the freed-up funds and can work towards privileging the lender and private corporations.”

This, Mae and other critics say, gives lenders in the global north “more control” in a developing country than if the debt were to be cancelled outright.

They point out that debt-for-nature swaps also inherently come with conditions attached for conservation measures and can, thus, be described as conditional debt relief.

Others fear that swaps could open the door to “tied-aid” methods, where aid must be spent on services from the lending country, such as swaps being coupled with carbon credits.

However, Ray sees significant evolution in governments’ and creditors’ understanding of the need to put traditional communities that depend on biodiversity front and centre in the planning process.

She cites the success of the 2015 Seychelles debt-for-nature swap, where the Seychelles government undertook a multi-year “deep consultation” process to understand threats to the livelihoods of small fishing communities living on remote islands. Ray says:

“This was a way that got community buy-in, obviously, because this was protecting the livelihoods of those fishing communities, but also recognising that traditional communities frequently don’t just live off of biodiversity, but they have to help protect the biodiversity in order to survive.”

Another criticism of swaps is that they do not create new, “additional” biodiversity funds from the global north. They also run the risk of being “double counted”, if the original loan being restructured in a swap had already been counted towards meeting aid targets.

Frederic Hache, co-founder of the independent thinktank of the EU Green Finance Observatory, tells Carbon Brief:

“The reality is that no global-north country has any intention of dispersing significant amounts of new grant money…All you get is these conditional financial instruments designed to benefit primarily global private investors.”

Scale, fees and forgiveness

The biggest criticism of debt swaps from all the experts Carbon Brief spoke to is their size relative to the looming sovereign debt of biodiversity-rich countries.

The graphic below compares the size of debt swaps (small, dark blue circle) to the amount that indebted developing countries have paid to service their debts (large, light blue circle) over the past three decades.

Between 1987 and 2023, low- and middle-income countries paid more than US$7.6tn in debt service versus $8.4bn treated through debt-for-nature swaps. Source: World Bank International Debt Report (2023) and Eurodad calculations based on the data from the World Bank International Debt Statistics.

The Seychelles marine biodiversity swap, for instance, was considered “one of the largest in history at the time”, but only amounted to $23m. Ray says:

“That’s pennies, in comparison to the billions of dollars that countries like Sri Lanka are currently negotiating for debt restructuring…[Swaps] only make sense as part of a broader package of debt relief to meet the current crisis.”

According to Prof Jayati Ghosh, professor of economics at the University of Massachusetts at Amherst, while debt swaps imply debt reduction, they “are far too small to have any impact at all” on countries’ debt. Sometimes, she says, swaps are not even a reduction, but instead allow countries some leeway in rescheduling their debt payments. Ghosh adds:

“It’s not even rearranging the deck chairs on the Titanic. It’s pretending to rearrange the deck chairs on the Titanic, with big creditor countries refusing to really make the kinds of interventions that would make a difference in reducing the sovereign debt while pretending to do something about climate and conservation finance. And they’re not.”

According to Carbon Brief analysis, among all the debt-for-nature swaps that have taken place, Poland’s 1992 swap allocated the highest amount of resources to nature conservation, totalling over $500m. Ecuador’s 2023 swap, which saw the largest amount of debt swapped at $1.1bn, had the second-highest investment in conservation, allocating more than $400m for this purpose.

The chart below shows the 20 countries that have been the target of the largest debt swaps (light blue) and the amount of that money earmarked for conservation funds (dark blue).

High transaction costs, which are driven up by lengthy, complex, multilateral negotiations, the number of agents involved and intermediary fees, also eat into conservation savings.

Others point out that other real-world challenges, such as unstable exchange rates along with high inflation, can “erode and undermine the real value” of a country’s conservation commitments. For example, in Zambia, funds generated by a $2.2m debt swap in 1989 were exhausted in a year “due to the rapid devaluation” of the local currency.

Human rights

Sandra Guzmán, founder and general coordinator of the Climate Finance Group for Latin America and the Caribbean (GFLAC), tells Carbon Brief that it is not possible to generalise the impacts of debt-for-nature swaps. She adds:

“A swap with the World Bank, a swap with the IDB [Inter-American Development Bank] or a swap with a commercial bank is very different. Not all swaps are done in the same way because it depends on the institutions involved.”

The 2007 debt-for-nature swap between Costa Rica and the US is an example of a swap where public information on its activities in Indigenous and local communities is available.

This swap involved more than 200 rural communities. One of the projects in the KéköLdi Indigenous territory, in south-eastern Costa Rica, helped the community reintroduce native iguanas and transmit ancestral knowledge to youth. Guzmán tells Carbon Brief:

“It has been said to be one of the most effective [swaps] because of the size of the debt cut and the conservation programme that Costa Rica promoted.”

However, not all debt-for-nature swaps have been so clear about the impacts on Indigenous and local communities.

Martínez, of CEDES Ecuador, tells Carbon Brief that the Galapagos debt-for-nature swap – signed last year to cancel $1.1bn of Ecuador’s debt in exchange for investing $450m to protect Galapagos islands – did not undergo a consultation process with Indigenous peoples and local communities. This could impact the economic, social, cultural and environmental rights of these communities, Martínez said.

The Climate Bonds Initiative published a report in 2023 analysing debt-for-nature swaps in the Seychelles, Belize, Barbados and Ecuador.

Daniel Costa, senior sustainability debt analyst at Climate Bonds Initiative, tells Carbon Brief that most of the analysed swaps do not mention how they involve local communities. He adds:

“This is what we would like to see further as these transactions are developed.”

Governance

Other criticisms of debt-for-nature swaps are the inadequate governance conditions that debtor countries may have. Governance refers to how swaps are implemented in the countries, the institutions and stakeholders involved and the structure of negotiations.

For example, the 2023 Galapagos swap had “serious limitations” in monitoring and enforcement, lack of transparency and accountability and “little clarity on potential fiscal risks for Ecuador”, according to recent analysis by the Latin American Network for Economic and Social Justice (Latindadd) and other organisations.

The analysis also revealed a lack of public information on the conservation fund and whether these actions have contributed to capacity-building at the local level.

The decision on which conservation activities will be implemented with a debt-for-nature swap varies from transaction to transaction, notes Costa, of Climate Bonds Initiative. These activities are often managed by funds, whose members include conservation organisations in addition to the government, he adds.

Carola Mejía, climate justice, transitions and Amazon coordinator at Latindadd, tells Carbon Brief that while swaps may be potentially scalable, they need to be improved in many ways. She says swaps must be built on principles such as transparency, respect for sovereignty and fairness in negotiation.

Guzmán, of GFLAC, tells Carbon Brief:

“Not all countries will have the same capacities in terms of governance, structures, human, financial and institutional capacities. There are severely indebted countries that need [debt] cancellation; there are countries that can do swaps because they have economies that can move towards those scenarios; and there are countries with greater financial capacity that may not [need] swaps, but other types of financing.”

Greenwashing

Civil society organisations and researchers have also raised concerns about the potential for “greenwashing” in some debt-for-nature swaps.

Mejía says countries in the global north are not meeting their climate finance and biodiversity commitments, but are promoting swaps as “the big solution”. This carries the risk of greenwashing, Mejía adds, as rather than creating positive action for the environment, swaps are generating more loans and debt.

For example, the $30m swap between Indonesia and the US made in 2009 in exchange for conserving rainforests on the island of Sumatra had several shortcomings, according to a 2011 study. The swap did not free up additional resources for the Indonesian government and was “too insignificant to create indirect (positive) economic effects”, the study says.

In the 2023 Galapagos swap, although the IDB provided an $85m guarantee to support the debt agreement for 18.5 years, the Latindadd report found that “there have been no additional international commitments or disbursements so far”.

Debt-for-nature swaps have also been questioned for not directly benefiting citizens and for transferring power over the management of the funds and the implementation of conservation projects to creditors.

The Gabon Blue Conservation was created as part of the swap where Gabon received $500m in exchange for protecting 30% of its oceans. This foreign-owned conservation organisation receives a 20% administration fee, which “immediately reduces the savings for the country by a [fifth]”, a report by the Coalition for Fair Fisheries Arrangements says.

Moreover, the report adds, “it is hard to see evidence that” the marine spatial plan, mandated by the Nature Conservancy for this swap, empowers marginalised groups, including fishers, for decision-making around coastal management.

Hache tells Carbon Brief:

“From a geopolitical perspective, swaps are great. It’s a way to gain access and control to land resources that will prove possibly precious in the future. This is…diplomacy by other means.”

Can debt-for-nature swaps be more effective?

Debt-for-nature swaps are being reviewed for their effectiveness again at a time when biodiverse, developing countries struggling with debt payments are having to find the financial resources to meet biodiversity and climate targets.

According to the latest World Bank debt report, low- and middle-income countries owed their foreign lenders $9tn in 2022. The same year, these countries paid a record $443.5bn to pay down these debts, with these payments diverting government spending away from critical development priorities, as well as climate and nature spending.

A 2023 study found that 67 countries at risk of defaulting on their loans collectively host 22% of global “biodiversity priority areas”, such as relatively intact but vulnerable forests, grasslands, deserts and mangroves. For 35 of these countries, it estimated that all of their unprotected biodiversity priority areas could be protected for a fraction of their national debt.

Debt-for-nature swaps and debt-for-climate swaps could free up more than $100bn of debt in developing countries, according to a recent analysis by the International Institute for Environment and Development (IIED).

Ray, from Boston University, says that swaps can help create space for countries to make climate-adaptation plans that also help preserve livelihoods that depend on biodiversity, such as fishing or collecting forest produce.

She adds that this can “interrupt a vicious cycle between natural capital and volatile financial capital”, where economic crises and extreme weather events drastically reduce climate adaptation and biodiversity budgets.

But, in order to create this breathing room for biodiversity, swaps need to accomplish multiple things, she tells Carbon Brief:

“You need a lot of time. You need political capital and institutional capacity to centre the communities who have traditionally been the stewards of biodiversity and find a way to make sure that not only is their access to biodiversity uninterrupted, but that they are accountable for that job and rewarded for it. And a real commitment to accountability from everyone involved to make sure these projects actually help support biodiversity and communities.”

Ray points to the case of “blue bonds” for marine conservation, a label that multinational bank Barclays called “misleading” in 2023. According to Barclays, while “the point of a green bond is that 100% of the proceeds raised are spent on” marine projects, in blue bonds floated, each extra party “takes a cut from the proceeds”.

Other experts Carbon Brief spoke to had differing views, suggesting that debt-for-nature swaps would not just require improvements in governance, but in reforming the architecture of international finance.

Guzmán says:

“[Swaps] are initially going to open up your fiscal space, but are not going to solve the financing problem for countries. What we need to fundamentally change is the operation of financial institutions and the type of loans and the conditions they give for those loans, i.e., lower interest rates and much more appropriate treatment. That is really what is going to help sustainable financing.”

To Ghosh, creditors are often “unwilling to make very large commitments of debt reduction”. She adds:

“You have to do something about sovereign debt on its own, which means you have to be serious about the debt reductions. That’s independent of whether you’re linking this conditionality with nature, because without dealing with the sovereign debt, you are not going to generate a green transition in any of these countries. They simply can’t afford it.”

Ghosh suggests solutions that could change the “landscape of debt”, including a standstill on debt during debt negotiations – where the amount of debt stays the same instead of accruing interest while parties come to a resolution – and involving all creditors: private, public and multilateral.

To Hache, the “devil lies in the details” of debt-for-nature swaps. He says:

“It’s about the proportion of the budget allocated to conservation. It’s about the real amount of debt forgiveness compared to where the debt was trading, compared to its nominal value earlier…Ultimately, you also have to compare it to the real alternative, which is debt forgiveness, and you kill any chances of debt forgiveness, loss and damages by endorsing or accepting these deals.”

The post Q&A: Can debt-for-nature ‘swaps’ help tackle biodiversity loss and climate change? appeared first on Carbon Brief.

Q&A: Can debt-for-nature ‘swaps’ help tackle biodiversity loss and climate change?

Greenhouse Gases

Permitting reform: A major key to cutting climate pollution

Permitting reform: A major key to cutting climate pollution

By Dana Nuccitelli, CCL Research Coordinator

Permitting reform has emerged as the biggest and most important clean energy and climate policy area in the 119th Congress (2025-2026).

To make sure every CCL volunteer understands the opportunities and challenges ahead, CCL Vice President of Government Affairs Jennifer Tyler and I recently provided two trainings about the basics of permitting reform and understanding the permitting reform landscape.

These first introductory trainings set the stage for the rest of an ongoing series, which will delve into the details of several key permitting reform topics that CCL is engaging on. Read on for a recap of the first two trainings and a preview of coming attractions.

Permitting reform basics

Before diving into the permitting reform deep end, we need to first understand the fundamentals of the topic: what is “permitting”? What problems are we trying to solve with permitting reform? Why is it a key climate solution?

In short, a permit is a legal authorization issued by a government agency (federal and/or state and/or local) that allows a specific activity or project to proceed under certain defined conditions. The permitting process ensures that public health, safety, and the environment are protected during the construction and operation of the project.

But the permitting process can take a long time, and in some cases it’s taking so long that it’s unduly slowing down the clean energy transition. “Permitting reform” seeks to make the process more efficient while still ensuring that public health, safety, and the environment are protected.

There are a lot of factors involved in the permitting reform process, including environmental laws, limitations on lawsuits, and measures to expedite the building of electrical transmission lines that are key for expanding the capacity of America’s aging electrical grid in order to allow us to connect more clean energy and meet our energy affordability and security and climate needs.

But if we can succeed in passing a good, comprehensive permitting reform package through Congress, it could unlock enough climate pollution reductions to offset what we lost from this year’s rollback of the Inflation Reduction Act’s clean energy investments. Permitting reform is the big climate policy in the current session of Congress.

Understanding the permitting reform landscape

In the second training of this series, we sought to understand the players and the politics in the permitting reform space, learn about the challenges involved, and explore CCL’s framework and approach for weighing in on this policy topic.

Permitting reform has split some traditional alliances along two differing theories about how to best address climate change. Some groups with a theory of change relying on using permitting and lawsuits to slow and stop fossil fuel infrastructure are least likely to be supportive of a permitting reform effort. Groups like CCL that recognize the importance of quickly building lots of clean, affordable energy infrastructure are more supportive of permitting reform measures.

The subject has created some strange bedfellows, because clean energy and fossil fuel companies and organizations all want efficient permitting for their projects, and hence all tend to support permitting reform. For CCL, the key question is whether a comprehensive permitting reform package will be a net benefit to clean energy or the climate — and that’s what we’re working toward.

The two major political parties also have different priorities when it comes to permitting reform. Republicans tend to view it through a lens of reducing government red tape, ensuring that laws and regulations are only used for their intended purpose, and achieving energy affordability and security. Democrats prioritize building clean energy faster to slow climate change, addressing energy affordability, and protecting legacy environmental laws and community engagement.

As we discussed in the training, there are a number of key concepts that will require compromise from both sides of the aisle in order to reach a durable bipartisan permitting reform agreement. We’ll delve into the details of these in these upcoming trainings:

The Challenge of Energy Affordability and Security

First, with support from CCL’s Electrification Action Team, on February 5 I’ll examine what’s behind rising electricity rates and energy insecurity in the U.S. and how we can solve these problems. Electrification is a key climate solution in the transition to clean energy sources. But electricity rates are rising fast and face surging demand from artificial intelligence data centers. Permitting reform can play a key role in addressing these challenges.

Transmission Reform and Key Messages

Insufficient electrical transmission capacity is acting as a bottleneck slowing down the deployment of new clean energy sources in the U.S. Reforming cumbersome transmission permitting processes could unlock billions of tons of avoided climate pollution while improving America’s energy security and affordability. In this training on March 5, Jenn and I will dive into the details of the key clean energy and climate solution that is transmission reform, and the key messages to use when lobbying our members of Congress.

Clean energy projects often encounter long, complex permitting steps that slow construction and raise costs. Practical permitting reforms can help ensure that good projects move forward faster while upholding environmental and community protections. In this training on March 19, Jenn and I will examine permitting reforms to build energy infrastructure faster, some associated tensions and compromises that they may involve, and key messages for congressional offices.

Presidents from both political parties have taken steps to interfere with the permitting of certain types of energy infrastructure that they oppose. These executive actions create uncertainty that inhibits the development of new energy sources in the United States. For this reason, ensuring fair permitting certainty is a key aspect of permitting reform that enjoys bipartisan support. In this training on April 2, Jenn and I will discuss how Congress can ensure certainty in a permitting reform package, and key messages for congressional offices.

Community Engagement and Key Messages

It’s important for energy project developers to engage local communities in order to address any local concerns and adverse impacts that may arise from new infrastructure projects. But it’s also important to strike a careful balance such that community input can be heard and addressed in a timely manner without excessively slowing new clean energy project timelines. In this training on May 7, Jenn and I will examine how community engagement may be addressed in the permitting reform process, and key messages for congressional offices.

We look forward to nerding out with you in these upcoming advanced and important permitting reform trainings!

Want to take action now? Use our online action tool to call Congress and encourage them to work together on comprehensive permitting reform.

The post Permitting reform: A major key to cutting climate pollution appeared first on Citizens' Climate Lobby.

Greenhouse Gases

DeBriefed 30 January 2026: Fire and ice; US formally exits Paris; Climate image faux pas

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Fire and ice

OZ HEAT: The ongoing heatwave in Australia reached record-high temperatures of almost 50C earlier this week, while authorities “urged caution as three forest fires burned out of control”, reported the Associated Press. Bloomberg said the Australian Open tennis tournament “rescheduled matches and activated extreme-heat protocols”. The Guardian reported that “the climate crisis has increased the frequency and severity of extreme weather events, including heatwaves and bushfires”.

WINTER STORM: Meanwhile, a severe winter storm swept across the south and east of the US and parts of Canada, causing “mass power outages and the cancellation of thousands of flights”, reported the Financial Times. More than 870,000 people across the country were without power and at least seven people died, according to BBC News.

COLD QUESTIONED: As the storm approached, climate-sceptic US president Donald Trump took to social media to ask facetiously: “Whatever happened to global warming???”, according to the Associated Press. There is currently significant debate among scientists about whether human-caused climate change is driving record cold extremes, as Carbon Brief has previously explained.

Around the world

- US EXIT: The US has formally left the Paris Agreement for the second time, one year after Trump announced the intention to exit, according to the Guardian. The New York Times reported that the US is “the only country in the world to abandon the international commitment to slow global warming”.

- WEAK PROPOSAL: Trump officials have delayed the repeal of the “endangerment finding” – a legal opinion that underpins federal climate rules in the US – due to “concerns the proposal is too weak to withstand a court challenge”, according to the Washington Post.

- DISCRIMINATION: A court in the Hague has ruled that the Dutch government “discriminated against people in one of its most vulnerable territories” by not helping them to adapt to climate change, reported the Guardian. The court ordered the Dutch government to set binding targets within 18 months to cut greenhouse gas emissions in line with the Paris Agreement, according to the Associated Press.

- WIND PACT: 10 European countries have agreed a “landmark pact” to “accelerate the rollout of offshore windfarms in the 2030s and build a power grid in the North Sea”, according to the Guardian.

- TRADE DEAL: India and the EU have agreed on the “mother of all trade deals”, which will save up to €4bn in import duty, reported the Hindustan Times. Reuters quoted EU officials saying that the landmark trade deal “will not trigger any changes” to the bloc’s carbon border adjustment mechanism.

- ‘TWO-TIER SYSTEM’: COP30 president André Corrêa do Lago believes that global cooperation should move to a “two-speed system, where new coalitions lead fast, practical action alongside the slower, consensus-based decision-making of the UN process”, according to a letter published on Tuesday, reported Climate Home News.

$2.3tn

The amount invested in “green tech” globally in 2025, marking a new record high, according to Bloomberg.

Latest climate research

- Including carbon emissions from permafrost thaw and fires reduces the remaining carbon budget for limiting warming to 1.5C by 25% | Communications Earth & Environment

- The global population exposed to extreme heat conditions is projected to nearly double if temperatures reach 2C | Nature Sustainability

- Polar bears in Svalbard – the fastest-warming region on Earth – are in better condition than they were a generation ago, as melting sea ice makes seal pups easier to reach | Scientific Reports

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

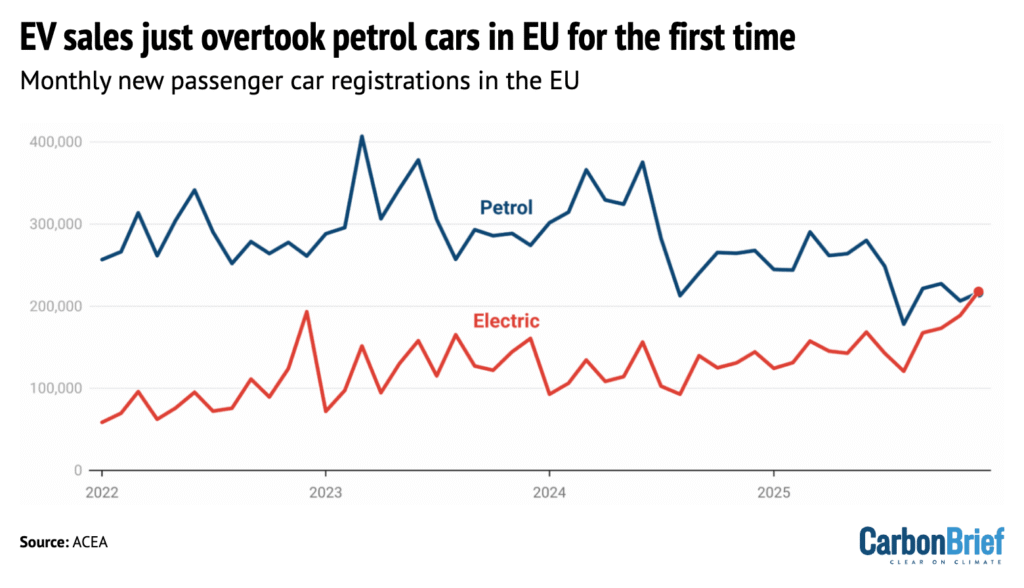

Sales of electric vehicles (EVs) overtook standard petrol cars in the EU for the first time in December 2025, according to new figures released by the European Automobile Manufacturers’ Association (ACEA) and covered by Carbon Brief. Registrations of “pure” battery EVs reached 217,898 – up 51% year-on-year from December 2024. Meanwhile, sales of standard petrol cars in the bloc fell 19% year-on-year, from 267,834 in December 2024 to 216,492 in December 2025, according to the analysis.

Spotlight

Looking at climate visuals

Carbon Brief’s Ayesha Tandon recently chaired a panel discussion at the launch of a new book focused on the impact of images used by the media to depict climate change.

When asked to describe an image that represents climate change, many people think of polar bears on melting ice or devastating droughts.

But do these common images – often repeated in the media – risk making climate change feel like a far-away problem from people in the global north? And could they perpetuate harmful stereotypes?

These are some of the questions addressed in a new book by Prof Saffron O’Neill, who researches the visual communication of climate change at the University of Exeter.

“The Visual Life of Climate Change” examines the impact of common images used to depict climate change – and how the use of different visuals might help to effect change.

At a launch event for her book in London, a panel of experts – moderated by Carbon Brief’s Ayesha Tandon – discussed some of the takeaways from the book and the “dos and don’ts” of climate imagery.

Power of an image

“This book is about what kind of work images are doing in the world, who has the power and whose voices are being marginalised,” O’Neill told the gathering of journalists and scientists assembled at the Frontline Club in central London for the launch event.

O’Neill opened by presenting a series of climate imagery case studies from her book. This included several examples of images that could be viewed as “disempowering”.

For example, to visualise climate change in small island nations, such as Tuvalu or Fiji, O’Neill said that photographers often “fly in” to capture images of “small children being vulnerable”. She lamented that this narrative “misses the stories about countries like Tuvalu that are really international leaders in climate policy”.

Similarly, images of power-plant smoke stacks, often used in online climate media articles, almost always omit the people that live alongside them, “breathing their pollution”, she said.

During the panel discussion that followed, panellist Dr James Painter – a research associate at the Reuters Institute for the Study of Journalism and senior teaching associate at the University of Oxford’s Environmental Change Institute – highlighted his work on heatwave imagery in the media.

Painter said that “the UK was egregious for its ‘fun in the sun’ imagery” during dangerous heatwaves.

He highlighted a series of images in the Daily Mail in July 2019 depicting people enjoying themselves on beaches or in fountains during an intense heatwave – even as the text of the piece spoke to the negative health impacts of the heatwave.

In contrast, he said his analysis of Indian media revealed “not one single image of ‘fun in the sun’”.

Meanwhile, climate journalist Katherine Dunn asked: “Are we still using and abusing the polar bear?”. O’Neill suggested that polar bear images “are distant in time and space to many people”, but can still be “super engaging” to others – for example, younger audiences.

Panellist Dr Rebecca Swift – senior vice president of creative at Getty images – identified AI-generated images as “the biggest threat that we, in this space, are all having to fight against now”. She expressed concern that we may need to “prove” that images are “actually real”.

However, she argued that AI will not “win” because, “in the end, authentic images, real stories and real people are what we react to”.

When asked if we expect too much from images, O’Neill argued “we can never pin down a social change to one image, but what we can say is that images both shape and reflect the societies that we live in”. She added:

“I don’t think we can ask photos to do the work that we need to do as a society, but they certainly both shape and show us where the future may lie.”

Watch, read, listen

UNSTOPPABLE WILDFIRES: “Funding cuts, conspiracy theories and ‘powder keg’ pine plantations” are making Patagonia’s wildfires “almost impossible to stop”, said the Guardian.

AUDIO SURVEY: Sverige Radio has published “the world’s, probably, longest audio survey” – a six-hour podcast featuring more than 200 people sharing their questions around climate change.

UNDERSTAND CBAM: European thinktank Bruegel released a podcast “all about” the EU’s carbon adjustment border mechanism, which came into force on 1 January.

Coming up

- 1 February: Costa Rican general election

- 3 February: UN Environment Programme Adaptation Fund Climate Innovation Accelerator report launch, Online

- 2-8 February: Intergovernmental Platform on Biodiversity and Ecosystem Services (IPBES) 12th plenary, Manchester, UK

Pick of the jobs

- Climate Central, climate data scientist | Salary: $85,000-$92,000. Location: Remote (US)

- UN office to the African Union, environmental affairs officer | Salary: Unknown. Location: Addis Ababa, Ethiopia

- Google Deepmind, research scientist in biosphere models | Salary: Unknown. Location: Zurich, Switzerland

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 30 January 2026: Fire and ice; US formally exits Paris; Climate image faux pas appeared first on Carbon Brief.

DeBriefed 30 January 2026: Fire and ice; US formally exits Paris; Climate image faux pas

Greenhouse Gases

Factcheck: What it really costs to heat a home in the UK with a heat pump

Electric heat pumps are set to play a key role in the UK’s climate strategy, as well as cutting the nation’s reliance on imported fossil fuels.

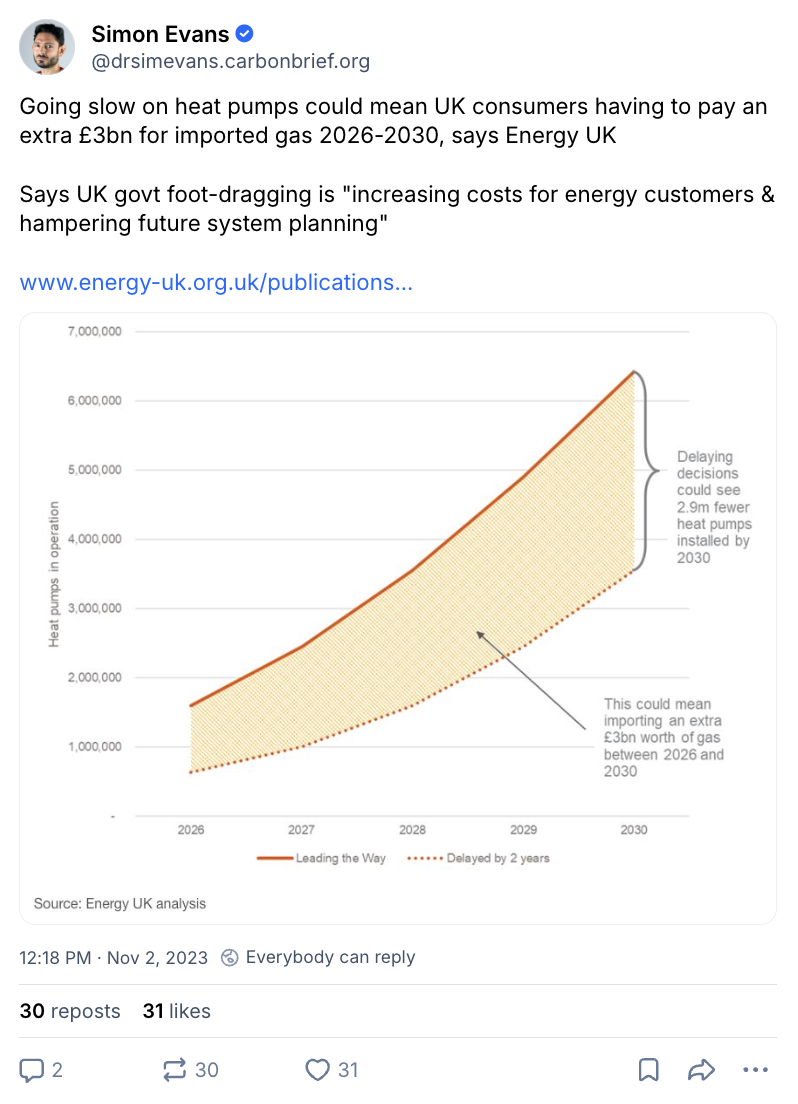

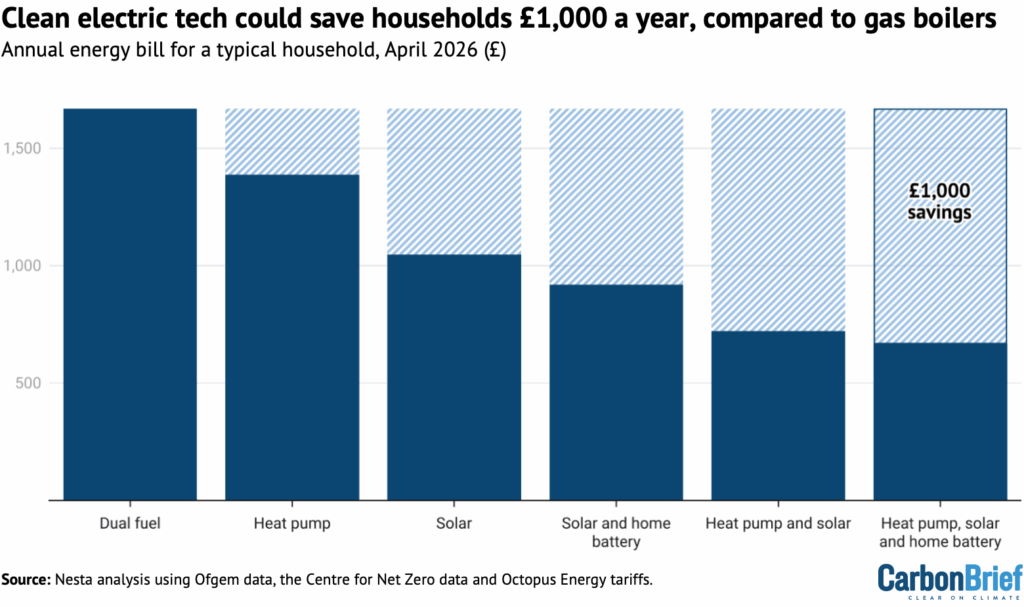

Heat pumps took centre-stage in the UK government’s recent “warm homes plan”, which said that they could also help cut household energy bills by “hundreds of pounds” a year.

Similarly, innovation agency Nesta estimates that typical households could cut their annual energy bills nearly £300 a year, by switching from a gas boiler to a heat pump.

Yet there has been widespread media coverage in the Times, Sunday Times, Daily Express, Daily Telegraph and elsewhere of a report claiming that heat pumps are “more expensive” to run.

The report is from the Green Britain Foundation set up by Dale Vince, owner of energy firm Ecotricity, who campaigns against heat pumps and invests in “green gas” as an alternative.

One expert tells Carbon Brief that Vince’s report is based on “flimsy data”, while another says that it “combines a series of worst-case assumptions to present an unduly pessimistic picture”.

This factcheck explains how heat pumps can cut bills, what the latest data shows about potential savings and how this information was left out of the report from Vince’s foundation.

How heat pumps can cut bills

Heat pumps use electricity to move heat – most commonly from outside air – to the inside of a building, in a process that is similar to the way that a fridge keeps its contents cold.

This means that they are highly efficient, adding three or four units of heat to the house for each unit of electricity used. In contrast, a gas boiler will always supply less than one unit of heat from each unit of gas that it burns, because some of the energy is lost during combustion.

This means that heat pumps can keep buildings warm while using three, four or even five times less energy than a gas boiler. This cuts fossil-fuel imports, reducing demand for gas by at least two-fifths, even in the unlikely scenario that all of the electricity they need is gas-fired.

Since UK electricity supplies are now the cleanest they have ever been, heat pumps also cut the carbon emissions associated with staying warm by around 85%, relative to a gas boiler.

Heat pumps are, therefore, the “central” technology for cutting carbon emissions from buildings.

While heat pumps cost more to install than gas boilers, the UK government’s recent “warm homes plan” says that they can help cut energy bills by “hundreds of pounds” per year.

Similarly, Nesta published analysis showing that a typical home could cut its annual energy bill by £280, if it replaces a gas boiler with a heat pump, as shown in the figure below.

Nesta and the government plan say that significantly larger savings are possible if heat pumps are combined with other clean-energy technologies, such as solar and batteries.

Both the government and Nesta’s estimates of bill savings from switching to a heat pump rely on relatively conservative assumptions.

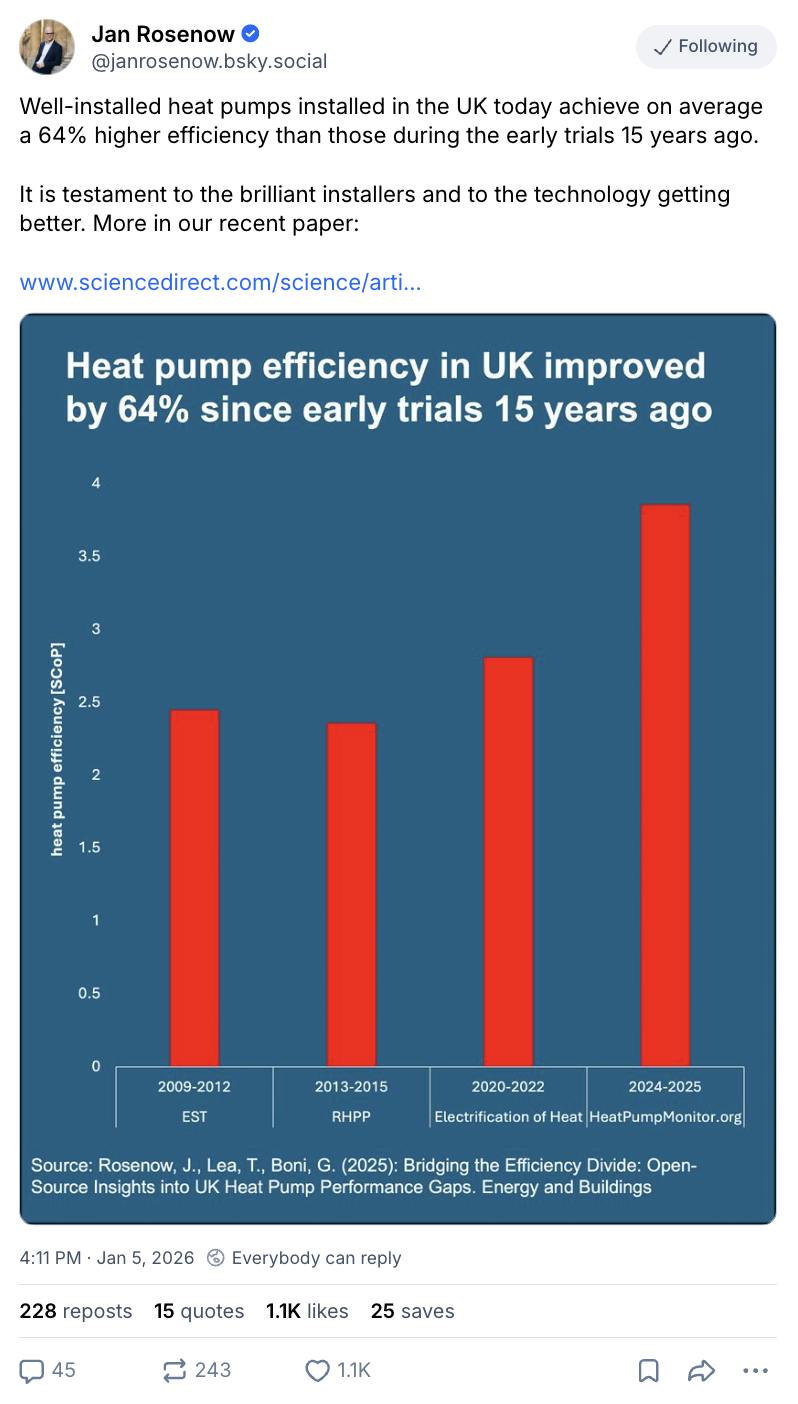

Specifically, the government assumes that a heat pump will deliver 2.8 units of heat for each unit of electricity, on average. This is known as the “seasonal coefficient of performance” (SCoP).

This figure is taken from the government-backed “electrification of heat” trial, which ran during 2020-2022 and showed that heat pumps are suitable for all building types in the UK.

(The Green Britain Foundation report and Vince’s quotes in related coverage repeat a number of heat pump myths, such as the idea that they do not perform well in older properties and require high levels of insulation.)

Nesta assumes a slightly higher SCoP of 3.0, says Madeleine Gabriel, the organisation’s director of sustainable future. (See below for more on what the latest data says about SCoP in recent installations.)

Both the government and Nesta assume that a home with a heat pump would disconnect from the gas grid, meaning that it would no longer need to pay the daily “standing charge” for gas. This currently amounts to a saving of around £130 per year.

Finally, they both consider the impact of a home with a heat pump using a “smart tariff”, where the price of electricity varies according to the time of day.

Such tariffs are now widely available from a variety of energy suppliers and many have been designed specifically for homes that have a heat pump.

Such tariffs significantly reduce the average price for a unit of electricity. Government survey data suggests that around half of heat-pump owners already use such tariffs.

This is important because on the standard rates under the price cap set by energy regulator Ofgem, each unit of electricity costs more than four times as much as a unit of gas.

The ratio between electricity and gas prices is a key determinant of the size and potential for running-cost savings with a heat pump. Countries with a lower electricity-to-gas price ratio consistently see much higher rates of heat-pump adoption.

(Decisions taken by the UK government in its 2025 budget mean that the electricity-to-gas ratio will fall from April, but current forecasts suggest it will remain above four-to-one.)

In contrast, Vince’s report assumes that gas boilers are 90% efficient, whereas data from real homes suggests 85% is more typical. It also assumes that homes with heat pumps remain on the gas grid, paying the standing charge, as well as using only a standard electricity tariff.

Prof Jan Rosenow, energy programme leader at the University of Oxford’s Environmental Change Institute, tells Carbon Brief that Vince’s report uses “worst-case assumptions”. He says:

“This report cherry-picks assumptions to reach a predetermined conclusion. Most notably, it assumes a gas boiler efficiency of 90%, which is significantly higher than real-world performance…Taken together, the analysis combines a series of worst-case assumptions to present an unduly pessimistic picture.”

Similarly, Gabriel tells Carbon Brief that Vince’s report is based on “flimsy data”. She explains:

“Dale Vince has drawn some very strong conclusions about heat pumps from quite flimsy data. Like Dale, we’d also like to see electricity prices come down relative to gas, but we estimate that, from April, even a moderately efficient heat pump on a standard tariff will be cheaper to run than a gas boiler. Paired with a time-of-use tariff, a heat pump could save £280 versus a boiler and adding solar panels and a battery could triple those savings.”

What the latest data shows about bill savings

The efficiency of heat-pump installations is another key factor in the potential bill savings they can deliver and, here, both the government and Vince’s report take a conservative approach.

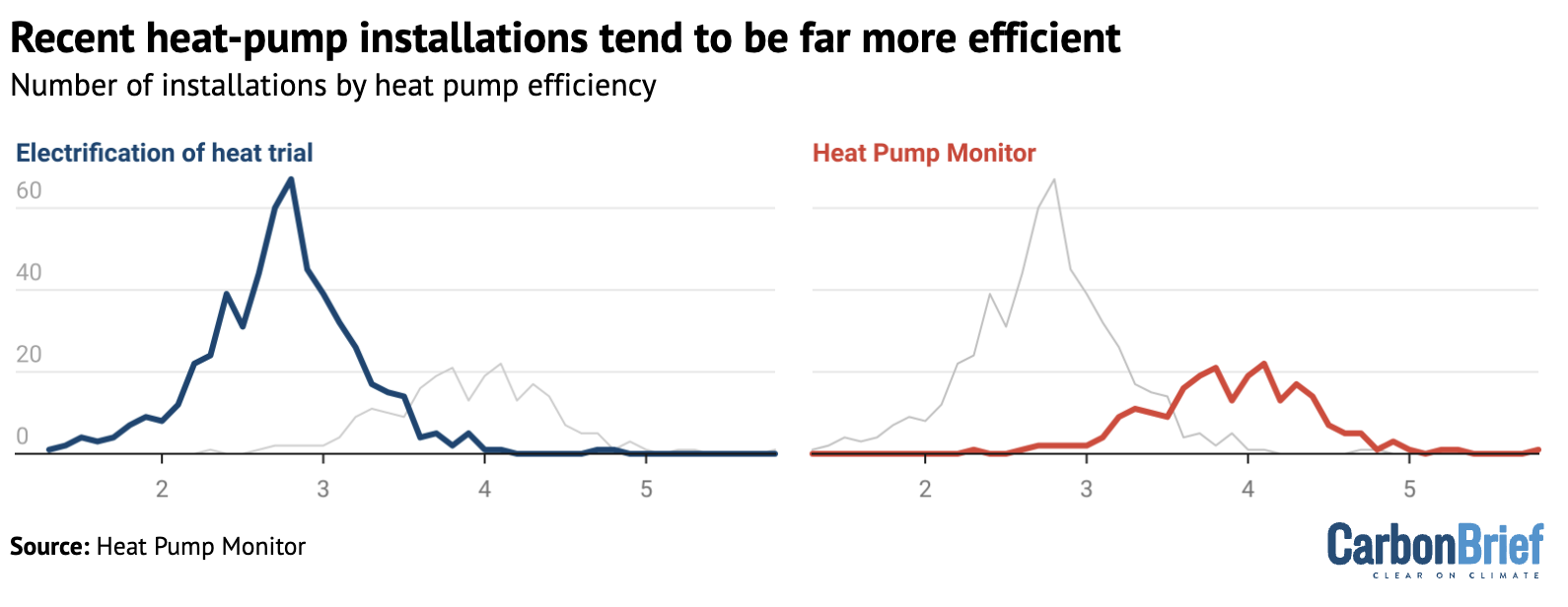

They rely on the “electrification of heat” trial data to use an efficiency (SCoP) of 2.8 for heat pumps. However, Rosenow says that recent evidence shows that “substantially higher efficiencies are routinely available”, as shown in the figure below.

Detailed, real-time data on hundreds of heat pump systems around the UK is available via the website Heat Pump Monitor, where the average efficiency – a SCoP of 3.9 – is much higher.

Homes with such efficient heat-pump installations would see even larger bill savings than suggested by the government and Nesta estimates.

Academic research suggests that there are simple and easy-to-implement reasons why these systems achieve much higher efficiency levels than in the electrification of heat trial.

Specifically, it shows that many of the systems in the trial have poor software settings, which means they do not operate as efficiently as their heat pump hardware is capable of doing.

The research suggests that heat pump installations in the UK have been getting more and more efficient over time, as engineers become increasingly familiar with the technology.

It indicates that recently installed heat pumps are 64% more efficient than those in early trials.

Notably, the Green Britain Foundation report only refers to the trial data from the electrification of heat study carried out in 2020-22 and the even earlier “renewable heat premium package” (RHPP). This makes a huge difference to the estimated running costs of a heat pump.

Carbon Brief analysis suggests that a typical household could cut its annual energy bills by nearly £200 with a heat pump – even on a standard electricity tariff – if the system has a SCoP of 3.9.

The savings would be even larger on a smart heat-pump tariff.

In contrast, based on the oldest efficiency figures mentioned in the Green Britain Foundation report, a heat pump could increase annual household bills by as much as £200 on a standard tariff.

To support its conclusions, the report also includes the results of a survey of 1,001 heat pump owners, which, among other things, is at odds with government survey data. The report says “66% of respondents report that their homes are more expensive to heat than the previous system”.

There are several reasons to treat these findings with caution. The survey was carried out in July 2025 and some 45% of the heat pumps involved were installed between 2021-23.

This is a period during which energy prices surged as a result of Russia’s invasion of Ukraine and the resulting global energy crisis. Energy bills remain elevated as a result of high gas prices.

The wording of the survey question asks if homes are “more or less expensive to heat than with your previous system” – but makes no mention of these price rises.

The question does not ask homeowners if their bills are higher today, with a heat pump, than they would have been with the household’s previous heating system.

If respondents interpreted the question as asking whether their bills have gone up or down since their heat pump was installed, then their answers will be confounded by the rise in prices overall.

There are a number of other seemingly contradictory aspects of the survey that raise questions about its findings and the strong conclusions in the media coverage of the report.

For example, while only 15% of respondents say it is cheaper to heat their home with a heat pump, 49% say that one of the top three advantages of the system is saving money on energy bills.

In addition, 57% of respondents say they still have a boiler, even though 67% say they received government subsidies for their heat-pump installation. It is a requirement of the government’s boiler upgrade scheme (BUS) grants that homeowners completely remove their boiler.

The government’s own survey of BUS recipients finds that only 13% of respondents say their bills have gone up, whereas 37% say their bills have gone down, another 13% say they have stayed the same and 8% thought that it was too early to say.

The post Factcheck: What it really costs to heat a home in the UK with a heat pump appeared first on Carbon Brief.

Factcheck: What it really costs to heat a home in the UK with a heat pump

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits