Modern Agriculture: Rise of the Robot Farmers

The fields of our future might look a lot different than the ones we see today. Gone are the days of backbreaking manual labor and dependence on unpredictable weather patterns.

Modern agriculture is embracing a new era of automation, where robots are steadily replacing human hands in tending to our crops.

Planting the Seeds of Change

Imagine a fleet of autonomous tractors gliding across vast fields, meticulously planting seeds at precise intervals. This is no longer science fiction, but a reality rapidly transforming the agricultural landscape. Robotic planting machines equipped with GPS and AI can map fields, determine soil conditions, and plant seeds with optimal spacing and depth, leading to higher yields and reduced waste.

Weeding Out the Inefficiencies

One of the most tedious and time-consuming tasks in agriculture is weeding. But robots are coming to the rescue, armed with sophisticated computer vision and dexterous manipulators. These weed-seeking machines can identify and remove unwanted plants with laser precision, minimizing the need for herbicides and protecting the environment.

Harvesting the Rewards of Precision

The robots don’t stop at planting and weeding; they’re also revolutionizing harvesting. Imagine robotic arms, programmed with delicate movements, gently picking delicate fruits or meticulously selecting vegetables based on color and ripeness. This level of precision minimizes damage and ensures only the highest quality produce reaches our tables.

Beyond the Brawn: The Brains of the Operation

The rise of agricultural robots is not just about replacing muscle power; it’s about harnessing the power of data and artificial intelligence. These robots are equipped with a network of sensors that collect real-time data on soil moisture, temperature, and even plant health. This information is then fed into AI algorithms that analyze the data and make informed decisions about irrigation, fertilization, and pest control.

The Benefits of a Robotic Revolution

The integration of robots into agriculture promises a multitude of benefits:

- Increased Productivity and Efficiency: Robots can work tirelessly 24/7, significantly boosting productivity and efficiency compared to traditional manual labor.

- Reduced Labor Costs and Shortages: The aging farm workforce and the exodus from rural areas can be addressed by robots, alleviating labor shortages and reducing labor costs.

- Improved Sustainability: Precision agriculture enabled by robots minimizes resource waste, reduces reliance on harmful chemicals, and promotes more sustainable farming practices.

- Enhanced Food Security: By optimizing yields and reducing losses, robots can contribute to improved food security and stability, especially in areas facing challenges like climate change.

Challenges and Concerns

Despite the exciting possibilities, the rise of agricultural robots also raises concerns:

- High Initial Investment Costs: The upfront cost of purchasing and maintaining robots can be a significant barrier for small-scale farmers.

- Job Displacement: While robots create new opportunities, they may also lead to job losses in traditional agricultural roles.

- Ethical Considerations: Questions arise about the ethical implications of relying on machines to manage our food production systems.

The Future of Farming: Humans and Robots in Harmony

The future of agriculture is not about robots replacing humans; it’s about humans and robots working together in harmony. Farmers will remain crucial for their knowledge, expertise, and ability to adapt to changing conditions. Robots will serve as powerful tools, augmenting human capabilities and enabling farmers to make data-driven decisions for optimal crop production.

As we embrace this new era of agricultural robotics, it’s essential to address the challenges and ensure that this technological advancement benefits both farmers and consumers, promoting a sustainable and food-secure future for all.

Agricultural Robots: Statistics and Data Shaping the Future of Farming

The rise of agricultural robots is transforming the farming landscape, promising increased efficiency, sustainability, and food security. Let’s delve into the data and statistics that paint a picture of this burgeoning industry:

Market Growth:

- The global agricultural robots market is estimated to reach USD 30.5 billion by 2028, growing at a CAGR of 17.7% from 2022 to 2028. (Source: Future Market Insights)

- North America currently dominates the market, accounting for 38.9% of the global revenue share in 2022. (Source: Future Market Insights)

- The Asia Pacific region is expected to witness the fastest growth in the coming years, driven by factors like rising labor costs and government initiatives promoting automation. (Source: Mordor Intelligence)

Robot Types and Applications:

-

The market is segmented into various robot types, including:

- Field robots for planting, weeding, and harvesting.

- Livestock robots for milking, feeding, and monitoring animal health.

- Indoor farming robots for managing vertical farms and controlled environments.

-

Field robots currently hold the largest market share, followed by livestock robots and indoor farming robots. (Source: MarketsandMarkets)

-

Fruit and vegetable harvesting is the leading application for agricultural robots, followed by planting and weeding. (Source: Mordor Intelligence)

Impact and Benefits:

- Agricultural robots can increase yields by up to 20% through precision planting, weed control, and optimized irrigation. (Source: World Economic Forum)

- They can reduce labor costs by up to 50%, addressing labor shortages and increasing farm profitability. (Source: ABI Research)

- These robots can minimize pesticide and herbicide use by targeting specific weeds and pests, promoting environmental sustainability. (Source: The Guardian)

Challenges and Concerns:

- The high initial investment cost of robots can be a barrier for small-scale farmers.

- Job displacement due to automation is a concern that needs to be addressed through reskilling and training programs.

- Ethical considerations regarding the use of robots in food production need to be carefully evaluated and addressed.

The Future of Agricultural Robots:

- Advancements in artificial intelligence, sensor technology, and machine learning will lead to more sophisticated and adaptable robots.

- Increased collaboration between robotics companies, farmers, and policymakers is crucial for developing and implementing sustainable solutions.

- The focus will shift towards human-robot partnerships, where robots augment human capabilities and enable data-driven decision-making for optimal crop production.

As the data suggests, agricultural robots are not just a futuristic trend; they are rapidly becoming a reality with the potential to revolutionize the way we grow food. By addressing the challenges and capitalizing on the opportunities, we can harness the power of these machines to build a more sustainable and food-secure future for all.

Table of Agricultural Robots: Statistics

| Statistic | Dat | Source | |

|---|---|---|---|

| Global Market Value (2028) | USD 30.5 billion | Future Market Insights | |

| CAGR (2023-2028) | 17.7% | Future Market Insights | |

| Dominant Region (2022) | North America (38.9% share) | Future Market Insights | |

| Fastest Growing Region | Asia Pacific | Mordor Intelligence | |

| Market Segments | Field robots, Livestock robots, Indoor farming robots | MarketsandMarkets | |

| Leading Market Share | Field robots | Mordor Intelligence | |

| Leading Application | Fruit and vegetable harvesting | Mordor Intelligence | |

| Yield Increase Potential | Up to 20% | World Economic Forum | |

| Labor Cost Reduction Potential | Up to 50% | ABI Research | |

| Pesticide/Herbicide Use Reduction Potential | Significant reduction | The Guardian | |

| Main Challenge | High initial investment cost | ||

| Other Challenges | Job displacement, Ethical considerations | ||

| Future Trend | Advancements in AI, sensor technology, and machine learning | ||

| Future Focus | Human-robot partnerships |

Note: This table is not exhaustive and can be further expanded based on your specific interests. If you have any particular data points or statistics you’d like to see included, please let me know!

Agricultural Robots: The Companies Leading the Automation Revolution

The fields of the future are teeming with metallic life. Gone are the days of backbreaking manual labor; agriculture is entering a new era where robots are reshaping how we grow food. From planting and weeding to harvesting and data analysis, these tireless machines are transforming the industry, promising increased efficiency, sustainability, and food security. Let’s delve into the world of agricultural robots and meet some of the companies leading the charge:

1. Naïo Technologies (Japan)

Naïo Technologies is a pioneer in autonomous field robots, developing machines that navigate fields with precision and perform various tasks. Their flagship robot, the Scout™, is a weed-killing marvel that uses cameras and lasers to identify and eliminate unwanted plants, reducing herbicide use and protecting the environment.

2. Iron Ox (United States)

Iron Ox is redefining farming by bringing it indoors. Their robotic farms are controlled environments where AI-powered robots tend to crops with utmost precision. This vertical farming approach minimizes water and resource usage, making it ideal for urban areas and reducing reliance on unpredictable weather conditions.

3. Blue River Technology (United States)

Blue River Technology tackles the problem of weeds not in the field, but during harvest. Their LettuceBot™ is a marvel of engineering, gently guiding romaine lettuce heads through a vision system that identifies weeds and removes them with targeted bursts of air, ensuring pristine harvests without damaging delicate produce.

4. Abundant Robotics (United States)

Abundant Robotics is focused on automating the apple-picking process, a notoriously labor-intensive task. Their robots, affectionately called “ARMies,” use advanced perception systems and gentle grippers to navigate orchard trees and pick apples with remarkable dexterity, minimizing bruising and maximizing fruit quality.

5. Ecorobotix (Switzerland)

Ecorobotix focuses on developing robots for smaller farms and vineyards. Their Rosalie™ robot is a multi-talented assistant, capable of weeding, mowing, and even spraying, making it a versatile tool for organic farmers who prioritize sustainability and precision agriculture.

These are just a few examples of the many companies pushing the boundaries of agricultural robotics. With constant advancements in technology and AI, the future of farming promises even more sophisticated robots capable of performing complex tasks and adapting to diverse agricultural needs. As these innovations take root, the fields of tomorrow may not just be greener, but also filled with the whirring hum of robotic helpers, ensuring a bountiful harvest for generations to come.

Remember, the rise of agricultural robots is not about replacing farmers; it’s about empowering them with powerful tools to work smarter, not harder. The human touch and expertise will always be crucial in managing and adapting to changing conditions. The future of agriculture lies in a harmonious collaboration between humans and robots, working together to cultivate a sustainable and food-secure future for all.

https://www.exaputra.com/2024/01/modern-agriculture-rise-of-agricultural.html

Renewable Energy

BladeBUG Tackles Serial Blade Defects with Robotics

Weather Guard Lightning Tech

BladeBUG Tackles Serial Blade Defects with Robotics

Chris Cieslak, CEO of BladeBug, joins the show to discuss how their walking robot is making ultrasonic blade inspections faster and more accessible. They cover new horizontal scanning capabilities for lay down yards, blade root inspections for bushing defects, and plans to expand into North America in 2026.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining Light on Wind. Energy’s brightest innovators. This is the Progress Powering Tomorrow.

Allen Hall: Chris, welcome back to the show.

Chris Cieslak: It’s great to be back. Thank you very much for having me on again.

Allen Hall: It’s great to see you in person, and a lot has been happening at Blade Bugs since the last time I saw Blade Bug in person. Yeah, the robot. It looks a lot different and it has really new capabilities.

Chris Cieslak: So we’ve continued to develop our ultrasonic, non-destructive testing capabilities of the blade bug robot.

Um, but what we’ve now added to its capabilities is to do horizontal blade scans as well. So we’re able to do blades that are in lay down yards or blades that have come down for inspections as well as up tower. So we can do up tower, down tower inspections. We’re trying to capture. I guess the opportunity to inspect blades after transportation when they get delivered to site, to look [00:01:00] for any transport damage or anything that might have been missed in the factory inspections.

And then we can do subsequent installation inspections as well to make sure there’s no mishandling damage on those blades. So yeah, we’ve been just refining what we can do with the NDT side of things and improving its capabilities

Joel Saxum: was that need driven from like market response and people say, Hey, we need, we need.

We like the blade blood product. We like what you’re doing, but we need it here. Or do you guys just say like, Hey, this is the next, this is the next thing we can do. Why not?

Chris Cieslak: It was very much market response. We had a lot of inquiries this year from, um, OEMs, blade manufacturers across the board with issues within their blades that need to be inspected on the ground, up the tap, any which way they can.

There there was no, um, rhyme or reason, which was better, but the fact that he wanted to improve the ability of it horizontally has led the. Sort of modifications that you’ve seen and now we’re doing like down tower, right? Blade scans. Yeah. A really fast breed. So

Joel Saxum: I think the, the important thing there is too is that because of the way the robot is built [00:02:00] now, when you see NDT in a factory, it’s this robot rolls along this perfectly flat concrete floor and it does this and it does that.

But the way the robot is built, if a blade is sitting in a chair trailing edge up, or if it’s flap wise, any which way the robot can adapt to, right? And the idea is. We, we looked at it today and kind of the new cage and the new things you have around it with all the different encoders and for the heads and everything is you can collect data however is needed.

If it’s rasterized, if there’s a vector, if there’s a line, if we go down a bond line, if we need to scan a two foot wide path down the middle of the top of the spa cap, we can do all those different things and all kinds of orientations. That’s a fantastic capability.

Chris Cieslak: Yeah, absolutely. And it, that’s again for the market needs.

So we are able to scan maybe a meter wide in one sort of cord wise. Pass of that probe whilst walking in the span-wise direction. So we’re able to do that raster scan at various spacing. So if you’ve got a defect that you wanna find that maximum 20 mil, we’ll just have a 20 mil step [00:03:00] size between each scan.

If you’ve got a bigger tolerance, we can have 50 mil, a hundred mil it, it’s so tuneable and it removes any of the variability that you get from a human to human operator doing that scanning. And this is all about. Repeatable, consistent high quality data that you can then use to make real informed decisions about the state of those blades and act upon it.

So this is not about, um, an alternative to humans. It’s just a better, it’s just an evolution of how humans do it. We can just do it really quick and it’s probably, we, we say it’s like six times faster than a human, but actually we’re 10 times faster. We don’t need to do any of the mapping out of the blade, but it’s all encoded all that data.

We know where the robot is as we walk. That’s all captured. And then you end up with really. Consistent data. It doesn’t matter who’s operating a robot, the robot will have those settings preset and you just walk down the blade, get that data, and then our subject matter experts, they’re offline, you know, they are in their offices, warm, cozy offices, reviewing data from multiple sources of robots.

And it’s about, you know, improving that [00:04:00] efficiency of getting that report out to the customer and letting ’em know what’s wrong with their blades, actually,

Allen Hall: because that’s always been the drawback of, with NDT. Is that I think the engineers have always wanted to go do it. There’s been crush core transportation damage, which is sometimes hard to see.

You can maybe see a little bit of a wobble on the blade service, but you’re not sure what’s underneath. Bond line’s always an issue for engineering, but the cost to take a person, fly them out to look at a spot on a blade is really expensive, especially someone who is qualified. Yeah, so the, the difference now with play bug is you can have the technology to do the scan.

Much faster and do a lot of blades, which is what the de market demand is right now to do a lot of blades simultaneously and get the same level of data by the review, by the same expert just sitting somewhere else.

Chris Cieslak: Absolutely.

Joel Saxum: I think that the quality of data is a, it’s something to touch on here because when you send someone out to the field, it’s like if, if, if I go, if I go to the wall here and you go to the wall here and we both take a paintbrush, we paint a little bit [00:05:00] different, you’re probably gonna be better.

You’re gonna be able to reach higher spots than I can.

Allen Hall: This is true.

Joel Saxum: That’s true. It’s the same thing with like an NDT process. Now you’re taking the variability of the technician out of it as well. So the data quality collection at the source, that’s what played bug ducts.

Allen Hall: Yeah,

Joel Saxum: that’s the robotic processes.

That is making sure that if I scan this, whatever it may be, LM 48.7 and I do another one and another one and another one, I’m gonna get a consistent set of quality data and then it’s goes to analysis. We can make real decisions off.

Allen Hall: Well, I, I think in today’s world now, especially with transportation damage and warranties, that they’re trying to pick up a lot of things at two years in that they could have picked up free installation.

Yeah. Or lifting of the blades. That world is changing very rapidly. I think a lot of operators are getting smarter about this, but they haven’t thought about where do we go find the tool.

Speaker: Yeah.

Allen Hall: And, and I know Joel knows that, Hey, it, it’s Chris at Blade Bug. You need to call him and get to the technology.

But I think for a lot of [00:06:00] operators around the world, they haven’t thought about the cost They’re paying the warranty costs, they’re paying the insurance costs they’re paying because they don’t have the set of data. And it’s not tremendously expensive to go do. But now the capability is here. What is the market saying?

Is it, is it coming back to you now and saying, okay, let’s go. We gotta, we gotta mobilize. We need 10 of these blade bugs out here to go, go take a scan. Where, where, where are we at today?

Chris Cieslak: We’ve hads. Validation this year that this is needed. And it’s a case of we just need to be around for when they come back round for that because the, the issues that we’re looking for, you know, it solves the problem of these new big 80 a hundred meter plus blades that have issues, which shouldn’t.

Frankly exist like process manufacturer issues, but they are there. They need to be investigated. If you’re an asset only, you wanna know that. Do I have a blade that’s likely to fail compared to one which is, which is okay? And sort of focus on that and not essentially remove any uncertainty or worry that you have about your assets.

’cause you can see other [00:07:00] turbine blades falling. Um, so we are trying to solve that problem. But at the same time, end of warranty claims, if you’re gonna be taken over these blades and doing the maintenance yourself, you wanna know that what you are being given. It hasn’t gotten any nasties lurking inside that’s gonna bite you.

Joel Saxum: Yeah.

Chris Cieslak: Very expensively in a few years down the line. And so you wanna be able to, you know, tick a box, go, actually these are fine. Well actually these are problems. I, you need to give me some money so I can perform remedial work on these blades. And then you end of life, you know, how hard have they lived?

Can you do an assessment to go, actually you can sweat these assets for longer. So we, we kind of see ourselves being, you know, useful right now for the new blades, but actually throughout the value chain of a life of a blade. People need to start seeing that NDT ultrasonic being one of them. We are working on other forms of NDT as well, but there are ways of using it to just really remove a lot of uncertainty and potential risk for that.

You’re gonna end up paying through the, you know, through the, the roof wall because you’ve underestimated something or you’ve missed something, which you could have captured with a, with a quick inspection.

Joel Saxum: To [00:08:00] me, NDT has been floating around there, but it just hasn’t been as accessible or easy. The knowledge hasn’t been there about it, but the what it can do for an operator.

In de-risking their fleet is amazing. They just need to understand it and know it. But you guys with the robotic technology to me, are bringing NDT to the masses

Chris Cieslak: Yeah.

Joel Saxum: In a way that hasn’t been able to be done, done before

Chris Cieslak: that. And that that’s, we, we are trying to really just be able to roll it out at a way that you’re not limited to those limited experts in the composite NDT world.

So we wanna work with them, with the C-N-C-C-I-C NDTs of this world because they are the expertise in composite. So being able to interpret those, those scams. Is not a quick thing to become proficient at. So we are like, okay, let’s work with these people, but let’s give them the best quality data, consistent data that we possibly can and let’s remove those barriers of those limited people so we can roll it out to the masses.

Yeah, and we are that sort of next level of information where it isn’t just seen as like a nice to have, it’s like an essential to have, but just how [00:09:00] we see it now. It’s not NDT is no longer like, it’s the last thing that we would look at. It should be just part of the drones. It should inspection, be part of the internal crawlers regimes.

Yeah, it’s just part of it. ’cause there isn’t one type of inspection that ticks all the boxes. There isn’t silver bullet of NDT. And so it’s just making sure that you use the right system for the right inspection type. And so it’s complementary to drones, it’s complimentary to the internal drones, uh, crawlers.

It’s just the next level to give you certainty. Remove any, you know, if you see something indicated on a a on a photograph. That doesn’t tell you the true picture of what’s going on with the structure. So this is really about, okay, I’ve got an indication of something there. Let’s find out what that really is.

And then with that information you can go, right, I know a repair schedule is gonna take this long. The downtime of that turbine’s gonna be this long and you can plan it in. ’cause everyone’s already got limited budgets, which I think why NDT hasn’t taken off as it should have done because nobody’s got money for more inspections.

Right. Even though there is a money saving to be had long term, everyone is fighting [00:10:00] fires and you know, they’ve really got a limited inspection budget. Drone prices or drone inspections have come down. It’s sort, sort of rise to the bottom. But with that next value add to really add certainty to what you’re trying to inspect without, you know, you go to do a day repair and it ends up being three months or something like, well

Allen Hall: that’s the lightning,

Joel Saxum: right?

Allen Hall: Yeah. Lightning is the, the one case where every time you start to scarf. The exterior of the blade, you’re not sure how deep that’s going and how expensive it is. Yeah, and it always amazes me when we talk to a customer and they’re started like, well, you know, it’s gonna be a foot wide scarf, and now we’re into 10 meters and now we’re on the inside.

Yeah. And the outside. Why did you not do an NDT? It seems like money well spent Yeah. To do, especially if you have a, a quantity of them. And I think the quantity is a key now because in the US there’s 75,000 turbines worldwide, several hundred thousand turbines. The number of turbines is there. The number of problems is there.

It makes more financial sense today than ever because drone [00:11:00]information has come down on cost. And the internal rovers though expensive has also come down on cost. NDT has also come down where it’s now available to the masses. Yeah. But it has been such a mental barrier. That barrier has to go away. If we’re going going to keep blades in operation for 25, 30 years, I

Joel Saxum: mean, we’re seeing no

Allen Hall: way you can do it

Joel Saxum: otherwise.

We’re seeing serial defects. But the only way that you can inspect and or control them is with NDT now.

Allen Hall: Sure.

Joel Saxum: And if we would’ve been on this years ago, we wouldn’t have so many, what is our term? Blade liberations liberating

Chris Cieslak: blades.

Joel Saxum: Right, right.

Allen Hall: What about blade route? Can the robot get around the blade route and see for the bushings and the insert issues?

Chris Cieslak: Yeah, so the robot can, we can walk circumferentially around that blade route and we can look for issues which are affecting thousands of blades. Especially in North America. Yeah.

Allen Hall: Oh yeah.

Chris Cieslak: So that is an area that is. You know, we are lucky that we’ve got, um, a warehouse full of blade samples or route down to tip, and we were able to sort of calibrate, verify, prove everything in our facility to [00:12:00] then take out to the field because that is just, you know, NDT of bushings is great, whether it’s ultrasonic or whether we’re using like CMS, uh, type systems as well.

But we can really just say, okay, this is the area where the problem is. This needs to be resolved. And then, you know, we go to some of the companies that can resolve those issues with it. And this is really about played by being part of a group of technologies working together to give overall solutions

Allen Hall: because the robot’s not that big.

It could be taken up tower relatively easily, put on the root of the blade, told to walk around it. You gotta scan now, you know. It’s a lot easier than trying to put a technician on ropes out there for sure.

Chris Cieslak: Yeah.

Allen Hall: And the speed up it.

Joel Saxum: So let’s talk about execution then for a second. When that goes to the field from you, someone says, Chris needs some help, what does it look like?

How does it work?

Chris Cieslak: Once we get a call out, um, we’ll do a site assessment. We’ve got all our rams, everything in place. You know, we’ve been on turbines. We know the process of getting out there. We’re all GWO qualified and go to site and do their work. Um, for us, we can [00:13:00] turn up on site, unload the van, the robot is on a blade in less than an hour.

Ready to inspect? Yep. Typically half an hour. You know, if we’ve been on that same turbine a number of times, it’s somewhere just like clockwork. You know, muscle memory comes in, you’ve got all those processes down, um, and then it’s just scanning. Our robot operator just presses a button and we just watch it perform scans.

And as I said, you know, we are not necessarily the NDT experts. We obviously are very mindful of NDT and know what scans look like. But if there’s any issues, we have a styling, we dial in remote to our supplement expert, they can actually remotely take control, change the settings, parameters.

Allen Hall: Wow.

Chris Cieslak: And so they’re virtually present and that’s one of the beauties, you know, you don’t need to have people on site.

You can have our general, um, robot techs to do the work, but you still have that comfort of knowing that the data is being overlooked if need be by those experts.

Joel Saxum: The next level, um, commercial evolution would be being able to lease the kit to someone and or have ISPs do it for [00:14:00] you guys kinda globally, or what is the thought

Chris Cieslak: there?

Absolutely. So. Yeah, so we to, to really roll this out, we just wanna have people operate in the robots as if it’s like a drone. So drone inspection companies are a classic company that we see perfectly aligned with. You’ve got the sky specs of this world, you know, you’ve got drone operator, they do a scan, they can find something, put the robot up there and get that next level of information always straight away and feed that into their systems to give that insight into that customer.

Um, you know, be it an OEM who’s got a small service team, they can all be trained up. You’ve got general turbine technicians. They’ve all got G We working at height. That’s all you need to operate the bay by road, but you don’t need to have the RAA level qualified people, which are in short supply anyway.

Let them do the jobs that we are not gonna solve. They can do the big repairs we are taking away, you know, another problem for them, but giving them insights that make their job easier and more successful by removing any of those surprises when they’re gonna do that work.

Allen Hall: So what’s the plans for 2026 then?

Chris Cieslak: 2026 for us is to pick up where 2025 should have ended. [00:15:00] So we were, we were meant to be in the States. Yeah. On some projects that got postponed until 26. So it’s really, for us North America is, um, what we’re really, as you said, there’s seven, 5,000 turbines there, but there’s also a lot of, um, turbines with known issues that we can help determine which blades are affected.

And that involves blades on the ground, that involves blades, uh, that are flying. So. For us, we wanna get out to the states as soon as possible, so we’re working with some of the OEMs and, and essentially some of the asset owners.

Allen Hall: Chris, it’s so great to meet you in person and talk about the latest that’s happening.

Thank you. With Blade Bug, if people need to get ahold of you or Blade Bug, how do they do that?

Chris Cieslak: I, I would say LinkedIn is probably the best place to find myself and also Blade Bug and contact us, um, through that.

Allen Hall: Alright, great. Thanks Chris for joining us and we will see you at the next. So hopefully in America, come to America sometime.

We’d love to see you there.

Chris Cieslak: Thank you very [00:16:00] much.

Renewable Energy

Understanding the U.S. Constitution

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Here’s their quiz, which should be called the “Constitutional Trivia Quiz.”, whose purpose is obviously to convince Americans of their ignorance.

When I teach, I’m going for understanding of the topic, not the memorization of useless information.

Renewable Energy

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

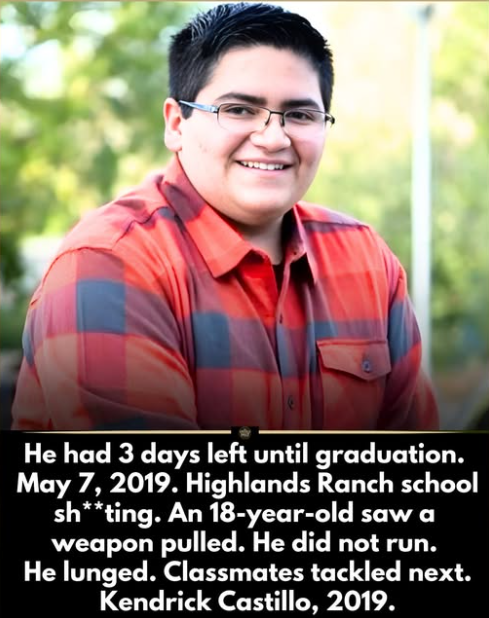

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits