Re: Shell Oil, Mother Jones reports:

Re: Shell Oil, Mother Jones reports:

Shell’s profits have climbed to $14 billion for the first half of 2024 after its decision to focus on fossil fuels over low-carbon energy delivered stronger than expected earnings for a second consecutive quarter.

Europe’s biggest oil and gas company rewarded its shareholders with a further $3.5 billion in share buybacks after reporting adjusted earnings of $6.3 billion in the three months to the end of June.

The latest results, which have taken the company’s total profits for the first half of the year to $14 billion and its share buybacks to $7 billion, have angered climate campaigners as Shell continues to grow its global gas business and pull back on investment in low-carbon energy.

At least these people are being honest. They openly admit that they’re destroying the planet in order to make huge profits.

That’s a hell of a lot more than ExxonMobil can say with their enormous PR campaigns designed to convince us that they’re transitioning to hydrogen, biofuels, our whatever their latest round of bullshit is focused on.

As suggested in the photo above, this whole situation would evaporate the moment that Big Oil had to pay even a tiny portion of the costs that our civilization is suffering in terms of environmental damage.

From Mother Jones: Shell Is Doubling Down on Fossil Fuels. We’re Paying the Price

Renewable Energy

US Offshore Wind Restarts After Court Injunctions

Weather Guard Lightning Tech

US Offshore Wind Restarts After Court Injunctions

Allen covers four US offshore wind projects winning injunctions to resume construction, including major updates from Dominion Energy’s Coastal Virginia project. Plus Ming Yang’s proposed UK manufacturing facility faces security review delays, Seaway 7 lands the Gennaker contract in Germany, and Taiwan’s Fengmiao project hits a milestone.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Happy Monday everyone!

Four offshore wind projects have secured preliminary injunctions blocking the Trump administration’s stop-work order.

Dominion Energy’s Coastal Virginia Offshore Wind.

Avangrid’s Vineyard Wind 1.

Equinor’s Empire Wind.

And Ørsted’s Revolution Wind.

All four argued they were at critical stages of construction.

The courts agreed.

Work has resumed.

A fifth project… Ørsted’s Sunrise Wind… has a hearing scheduled for today.

Now… within days of getting back to work… milestones are being reached.

Dominion Energy reported seventy-one percent completion on Coastal Virginia.

The first turbine… installed in January.

The Charybdis… America’s only U.S.-flagged wind turbine installation vessel… is finally at work. Fifty-four towers, thirty nacelles, and twenty-six blade sets now staged at Portsmouth Marine Terminal. The third offshore substation has arrived.

But here is where the numbers tell the real story.

The month-long delay fighting the Bureau of Ocean Energy Management?

Two hundred twenty-eight million dollars.

New tariffs?

Another five hundred eighty million.

The project budget now stands at eleven-point-five billion dollars.

Nine-point-three billion already invested by end of 2025.

Dominion and partner Stonepeak are sharing the cost.

Dominion insists offshore wind remains the fastest and most economical way to deliver nearly three gigawatts to Virginia’s grid.

A grid that powers military installations… naval shipbuilding… and America’s growing AI and cyber capabilities.

First power expected this quarter.

Full completion… now pushed to early 2027.

Up in New England… Vineyard Wind 1 also resumed work.

The sixty-second and final turbine tower shipped from New Bedford this week.

Ten blade sets remain at the staging site.

The installation vessel is scheduled to depart by end of March.

The turbines are going up.

But eight hundred eight million dollars in delays and tariffs…

That is a price the entire industry is watching.

═══ Scotland Waits on Ming Yang Decision ═══

In Scotland… a decision that could reshape European supply chains… hangs in the balance.

Chinese manufacturer Ming Yang wants to build the UK’s largest wind turbine manufacturing facility.

The site… Ardersier… near Inverness. The investment… one-point-five billion pounds.

The jobs… fifteen hundred.

Trade Minister Chris Bryant says the government must weigh security.

Critical national infrastructure must be safe and secure.

Scotland’s First Minister John Swinney is losing patience.

He told reporters this week the decision has taken too long.

He called it pivotal to Scotland’s renewable energy potential…

and a crucial component of the nation’s just transition.

Meanwhile… Prime Minister Keir Starmer met with President Xi Jinping in Beijing this week.

He spoke of building a more sophisticated relationship between the two nations.

Whisky tariffs… halved to five percent.

Wind turbine factories?

Still under review.

Bryant says they want a steady, eyes-wide-open relationship with China.

Drive up trade where possible.

Challenge where necessary.

But no flip-flopping.

For now… Scotland waits.

And so does the UK supply chain.

═══ Seaway 7 Lands Gennaker Contract ═══

In the German Baltic Sea… a major contract award.

Seaway 7, part of the Subsea 7 Group, will transport and install sixty-three monopiles and transition pieces for the Gennaker offshore wind farm.

The contract value… one hundred fifty to three hundred million dollars.

Subsea 7 calls it substantial.

The client is Skyborn Renewables… a portfolio company of BlackRock’s Global Infrastructure Partners.

Nine hundred seventy-six megawatts of capacity.

Sixty-three Siemens Gamesa turbines.

Four terawatt-hours of annual generation.

Enough to power roughly one million German homes.

Seaway 7’s work begins next year.

═══ Taiwan’s Fengmiao Hits Milestone ═══

In Taiwan… Copenhagen Infrastructure Partners completed the first batch of jacket foundations for the Fengmiao offshore wind farm.

Five hundred megawatts.

On schedule for late 2027 completion.

Offshore installation begins later this year.

The jackets were built by Century Wind Power… a local Taiwanese supplier.

CIP called it a sign of strong execution capabilities and proof they can deliver large-scale, complex energy projects.

But they are not stopping there.

Fengmiao 2… six hundred megawatts… is already in development.

Taiwan is aiming for a major boost in large-scale renewable energy by 2030.

And that is the state of the wind industry for February 2, 2026

Join us tomorrow for the Uptime Wind Energy Podcast.

Renewable Energy

How Is U.S. Insanity Affecting Tourism?

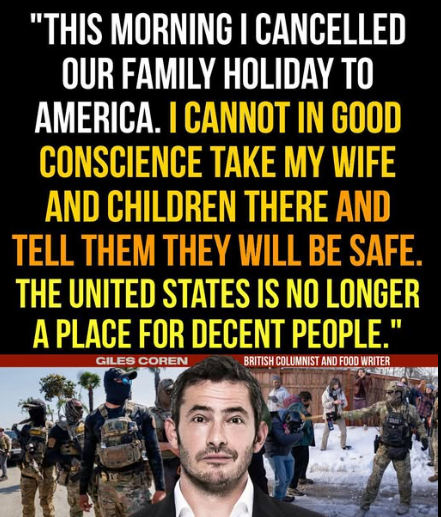

It’s probably a bit too soon to have useable statistics on this subject, but it’s certainly not too early to apply some common sense.

It’s probably a bit too soon to have useable statistics on this subject, but it’s certainly not too early to apply some common sense.

There are at two factors at play here:

1) America is broadly regarded as a rogue country. Do you want to visit North Korea? Do Canadians want to spend money in a country that wants to annex them?

2) America is now understood to be unsafe. Do you want to visit Palestine? Ukraine? Iran?

Renewable Energy

Commercial Solar Solutions: Real Case Studies by Cyanergy

The post Commercial Solar Solutions: Real Case Studies by Cyanergy appeared first on Cyanergy.

https://cyanergy.com.au/blog/commercial-solar-solutions-real-case-studies-by-cyanergy/

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits