From Africa to Southeast Asia, the Trump administration is cancelling US support for projects designed to replace coal, oil and gas with clean energy, pushing instead for the use of American taxpayers’ money to support planet-heating fossil fuels.

Since Donald Trump took office in January, he has scrapped energy transition partnerships with South Africa, Indonesia and Vietnam and is trying to halt US backing for the African Development Bank (AfDB) and multilateral Climate Investment Funds.

At the same time, his administration has ordered the US Export-Import Bank (EXIM) to start supporting coal power projects abroad and, seemingly with some success, is putting pressure on the World Bank to fund more fossil fuels.

Climate campaigners said these changes would foster dependence on coal, oil and gas in developing countries, worsening climate change and holding back economic development.

At energy security talks, US pushes gas and derides renewables

US cuts to South Africa’s JETP

Since 2021, a group of wealthy countries including the US have teamed up with the coal-reliant emerging economies of South Africa, Indonesia and Vietnam on Just Energy Transition Partnership (JETP) plans to swap coal for clean energy in a way that is fair to workers and communities.

But Trump’s administration has pulled out of these deals. In March, the rest of the rich nations involved issued a statement saying the US’s withdrawal from the South African partnership was “regrettable”.

It meant the US would no longer provide $56 million in grants, and the US International Development Finance Corporation (DFC) would not provide $1 billion in loans on commercial terms or equity investment to South African projects. Even projects already being implemented were cancelled, according to a South African foreign ministry spokesperson.

Coal-reliant South African provinces falling behind on just transition

Projects funded by other countries in the coal-reliant province of Mpumalanga include developing green hydrogen, energy-efficient homes, better electricity transmission and mapping areas suitable for wind turbines.Coal-reliant South African provinces falling behind on just transition

US contributions represented just under 10% of the total grants provided and a similar share of the total pledges. The other countries said they remain “fully committed” to the programme and “some partners are exploring possibilities for supporting work previously being carried out by the US”.

CIF coal transition programme on hold

As well as ending direct support, the US is also throwing a spanner in the works of $500 million due to be provided by the CIF, which works through multilateral development banks, and its Accelerating Coal Transition (ACT) programme for South Africa.

In 2022, South Africa asked the CIF for $450 million in loans and $50 million in grants under this programme to repurpose three aging coal-fired power plants in Mpumalanga, replace the electricity they generated with renewables, fund community projects in the province and make its buildings more energy-efficient.

The plan – approved that year by governments on the CIF committee that oversees this programme, including the US – was for this money to unlock around $2.1 billion more, mainly from development banks and the private sector.

But in July 2024, following elections and a change of environment minister in Pretoria, South Africa tried to change the investment plan to reflect state-owned utility Eskom’s decision to keep the three coal plants running – albeit below their full capacity – until 2030.

With the nation having suffered frequent planned blackouts due to a shortage of electricity supply, the government cited “energy security concerns” for the proposed change. Altering the plan meant it had to seek approval from this committee – the Clean Technology Fund’s Trust Fund – again.

By the time of the committee meeting in February 2025, with Trump now in the White House, the plan had still not been signed off by governments. The co-chair’s meeting summary shows that South Africa urged governments to give it the greenlight.

But in early March, the US prevented those funds from being approved, according to a Bloomberg news report. Two sources with knowledge of the discussions also told Climate Home that the US was holding back funding.

While the US under Trump has become hostile to phasing out fossil fuels in general, it has a particularly bad relationship with South Africa’s government, cancelling all “aid and assistance” in February due to Pretoria’s criticism of US ally Israel and US allegations of discrimination against South Africa’s white minority.

First carbon credit scheme for early coal plant closures unveiled

The CIF committee next meets on June 11 in Washington, where the updated South African energy investment plan is due to be discussed, according to Bloomberg. A CIF spokesperson told Climate Home the agenda is “currently being finalised” and that deliberations related to the South African investment plan are “ongoing and not public”.

“A delay in funding means a delay in decarbonising the South African power sector,” said Tracy Ledger, head of just transition at the Johannesburg-based Public Affairs Research Institute.

Trump budget cuts to harm development

In the proposed US budget for 2026 – which has to be negotiated with Congress – the White House has proposed cutting $275 million of spending allocated to the CIF and the Global Environment Facility together, as well as taking $555 million away from the AfDB’s fund for Africa’s least developed countries because it is “not currently aligned to Administration priorities”.

Samuel Maimbo, a World Bank vice president who is bidding to lead the AfDB, said US cuts to the African Development Fund would have a “huge impact on Africa’s development”.

Even as it seeks to take money away from clean energy, the Trump administration has said it is willing to spend more public money supporting fossil fuel projects abroad – and has pressured international lenders like the World Bank to do the same, with some success.

EXIM backs coal projects

On the day he was inaugurated, Trump issued an executive order announcing he would withdraw from the Paris climate agreement and “revoked and rescinded immediately” former President Joe Biden’s international climate finance plan. He instructed the EXIM president at the time, Reta Jo Lewis, to report back in 30 days on how she had complied with this order.

On May 1, the board of directors of the bank – which provides loans and other support to US businesses to help them export their products – voted unanimously to reverse a ban on funding coal-fired power projects.

Solar squeeze: US tariffs threaten panel production and jobs in Thailand

According to Kate DeAngelis, deputy director of economic policy at Friends of the Earth US, who monitored the meeting online, the board’s acting chair James Cruse told those present that this move put EXIM in line with Trump’s executive order and that Cruse had supported it all along.

A bank spokesperson told Climate Home that the entire board agreed that these changes “put the Bank in alignment with charter and administration priorities”.

Asked whether, as DeAngelis claimed, the bank was quicker to heed Trump’s order to fund coal than Biden’s previous order to phase out support for fossil fuels, the spokesperson said that “as an independent agency, EXIM always works to align with the priorities of the current administration”, adding that it “is most wholly focused on ensuring [our] mission and charter mandates are upheld”.

Funding foreign coal makes the US an outlier internationally. In recent years, almost all major nations – including China – have promised to stop funding coal-fired power plants abroad, although some exceptions persist.

Oil Change International campaigner Laurie van der Burg said public funding was crucial for coal plant developers as these projects are now deemed too risky by private banks. She added that EXIM’s move was “concerning” but unlikely to reverse the global trend of coal finance dropping.

Push for World Bank to back gas

In April, meanwhile, US Treasury Secretary Scott Bessent said that the World Bank – which provides cheap loans and grants to developing countries – “must be tech neutral and prioritise affordability in energy investment”. “In most cases, this means investing in gas and other fossil fuel-based energy production,” he said.

Shortly before Bessent’s speech, World Bank President Ajay Banga told reporters he would seek approval from the bank’s board to enable more gas projects, which are currently only supported in limited circumstances. Customarily, the head of the World Bank is effectively chosen by the US president, with Bessent saying in April that Banga needed to earn the Trump administration’s trust.

Trump’s first 100 days: US walks away from global climate action

Fran Witt, who attended the bank’s spring meetings as part of her work with the NGO Recourse, told Climate Home that the bank should spend taxpayers’ money on playing “a leadership role in helping [energy] transition rather than fostering dependence on gas”.

She said that, while the World Bank top leadership will push hard for gas, it would be a “pretty thorny discussion”, with “more progressive executive directors probably trying to hold fire”.

Voting power is proportionate to the shares each government holds and, while the US has the most at 16%, other nations like Japan, China and European countries also have substantial sway.

If the bank does start backing gas infrastructure like pipelines and ports, Witt said she expects a lot of developing countries will be keen to access that funding – particularly in Asia where “there’s a massive dash for gas”.

The post Trump shifts US funds from shutting down foreign fossil fuels to expanding them appeared first on Climate Home News.

Trump shifts US funds from shutting down foreign fossil fuels to expanding them

Climate Change

On the Farm, the Hidden Climate Cost of America’s Broken Health Care System

American farmers are drowning in health insurance costs, while their German counterparts never worry about medical bills. The difference may help determine which country’s small farms are better prepared for a changing climate.

Samantha Kemnah looked out the foggy window of her home in New Berlin, New York, at the 150-acre dairy farm she and her husband, Chris, bought last year. This winter, an unprecedented cold front brought snowstorms and ice to the region.

On the Farm, the Hidden Climate Cost of the Broken U.S. Health Care System

Climate Change

A Little-Used Maneuver Could Mean More Drilling and Mining in Southern Utah’s Redrock Country

Two Utah Congress members have introduced a resolution that could end protections for Grand Staircase-Escalante National Monument. Conservation groups worry similar maneuvers on other federal lands will follow.

Lawmakers from Utah have commandeered an obscure law to unravel protections for the Grand Staircase-Escalante National Monument, potentially delivering on a Trump administration goal of undoing protections for public conservation lands across the country.

A Little-Used Maneuver Could Mean More Drilling and Mining in Southern Utah’s Redrock Country

Climate Change

Heatwaves driving recent ‘surge’ in compound drought and heat extremes

Drought and heatwaves occurring together – known as “compound” events – have “surged” across the world since the early 2000s, a new study shows.

Compound drought and heat events (CDHEs) can have devastating effects, creating the ideal conditions for intense wildfires, such as Australia’s “Black Summer” of 2019-20 where bushfires burned 24m hectares and killed 33 people.

The research, published in Science Advances, finds that the increase in CDHEs is predominantly being driven by events that start with a heatwave.

The global area affected by such “heatwave-led” compound events has more than doubled between 1980-2001 and 2002-23, the study says.

The rapid increase in these events over the last 23 years cannot be explained solely by global warming, the authors note.

Since the late 1990s, feedbacks between the land and the atmosphere have become stronger, making heatwaves more likely to trigger drought conditions, they explain.

One of the study authors tells Carbon Brief that societies must pay greater attention to compound events, which can “cause severe impacts on ecosystems, agriculture and society”.

Compound events

CDHEs are extreme weather events where drought and heatwave conditions occur simultaneously – or shortly after each other – in the same region.

These events are often triggered by large-scale weather patterns, such as “blocking” highs, which can produce “prolonged” hot and dry conditions, according to the study.

Prof Sang-Wook Yeh is one of the study authors and a professor at the Ewha Womans University in South Korea. He tells Carbon Brief:

“When heatwaves and droughts occur together, the two hazards reinforce each other through land-atmosphere interactions. This amplifies surface heating and soil moisture deficits, making compound events more intense and damaging than single hazards.”

CDHEs can begin with either a heatwave or a drought.

The sequence of these extremes is important, the study says, as they have different drivers and impacts.

For example, in a CDHE where the heatwave was the precursor, increased direct sunshine causes more moisture loss from soils and plants, leading to a drought.

Conversely, in an event where the drought was the precursor, the lack of soil moisture means that less of the sun’s energy goes into evaporation and more goes into warming the Earth’s surface. This produces favourable conditions for heatwaves.

The study shows that the majority of CDHEs globally start out as a drought.

In recent years, there has been increasing focus on these events due to the devastating impact they have on agriculture, ecosystems and public health.

In Russia in the summer of 2010, a compound drought-heatwave event – and the associated wildfires – caused the death of nearly 55,000 people, the study notes.

The record-breaking Pacific north-west “heat dome” in 2021 triggered extreme drought conditions that caused “significant declines” in wheat yields, as well as in barley, canola and fruit production in British Columbia and Alberta, Canada, says the study.

Increasing events

To assess how CDHEs are changing, the researchers use daily reanalysis data to identify droughts and heatwaves events. (Reanalysis data combines past observations with climate models to create a historical climate record.) Then, using an algorithm, they analyse how these events overlap in both time and space.

The study covers the period from 1980 to 2023 and the world’s land surface, excluding polar regions where CDHEs are rare.

The research finds that the area of land affected by CDHEs has “increased substantially” since the early 2000s.

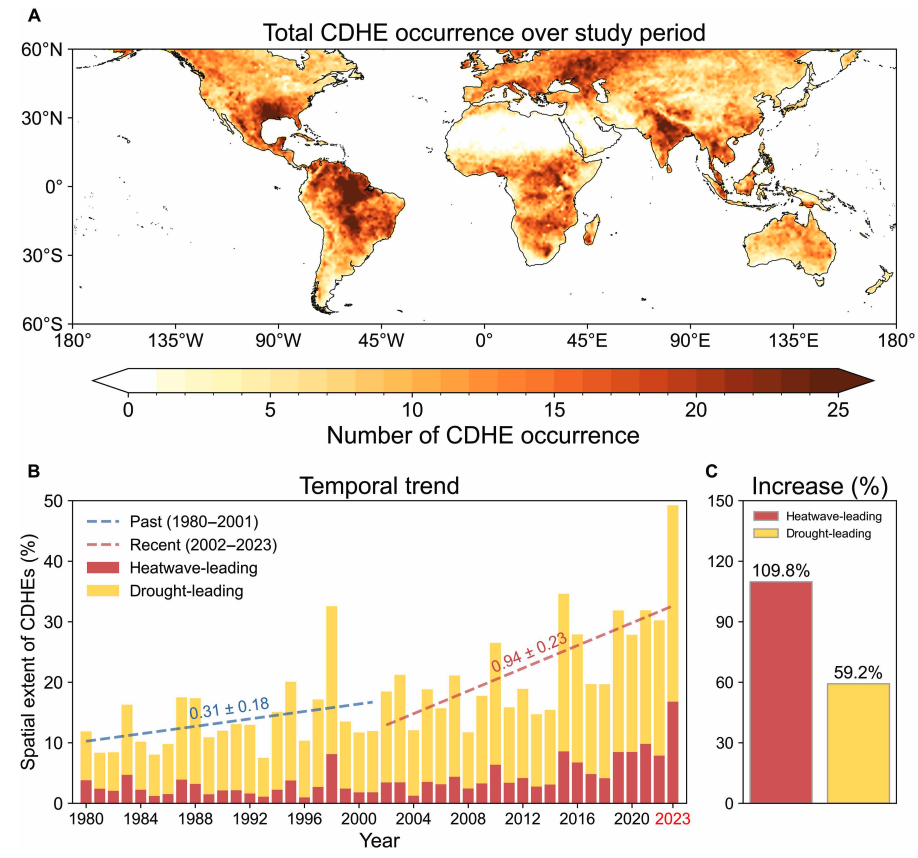

Heatwave-led events have been the main contributor to this increase, the study says, with their spatial extent rising 110% between 1980-2001 and 2002-23, compared to a 59% increase for drought-led events.

The map below shows the global distribution of CDHEs over 1980-2023. The charts show the percentage of the land surface affected by a heatwave-led CDHE (red) or a drought-led CDHE (yellow) in a given year (left) and relative increase in each CDHE type (right).

The study finds that CDHEs have occurred most frequently in northern South America, the southern US, eastern Europe, central Africa and south Asia.

Threshold passed

The authors explain that the increase in heatwave-led CDHEs is related to rising global temperatures, but that this does not tell the whole story.

In the earlier 22-year period of 1980-2001, the study finds that the spatial extent of heatwave-led CDHEs rises by 1.6% per 1C of global temperature rise. For the more-recent period of 2022-23, this increases “nearly eightfold” to 13.1%.

The change suggests that the rapid increase in the heatwave-led CDHEs occurred after the global average temperature “surpasse[d] a certain temperature threshold”, the paper says.

This threshold is an absolute global average temperature of 14.3C, the authors estimate (based on an 11-year average), which the world passed around the year 2000.

Investigating the recent surge in heatwave-leading CDHEs further, the researchers find a “regime shift” in land-atmosphere dynamics “toward a persistently intensified state after the late 1990s”.

In other words, the way that drier soils drive higher surface temperatures, and vice versa, is becoming stronger, resulting in more heatwave-led compound events.

Daily data

The research has some advantages over other previous studies, Yeh says. For instance, the new work uses daily estimations of CDHEs, compared to monthly data used in past research. This is “important for capturing the detailed occurrence” of these events, says Yeh.

He adds that another advantage of their study is that it distinguishes the sequence of droughts and heatwaves, which allows them to “better understand the differences” in the characteristics of CDHEs.

Dr Meryem Tanarhte is a climate scientist at the University Hassan II in Morocco, and Dr Ruth Cerezo Mota is a climatologist and a researcher at the National Autonomous University of Mexico. Both scientists, who were not involved in the study, agree that the daily estimations give a clearer picture of how CDHEs are changing.

Cerezo-Mota adds that another major contribution of the study is its global focus. She tells Carbon Brief that in some regions, such as Mexico and Africa, there is a lack of studies on CDHEs:

“Not because the events do not occur, but perhaps because [these regions] do not have all the data or the expertise to do so.”

However, she notes that the reanalysis data used by the study does have limitations with how it represents rainfall in some parts of the world.

Compound impacts

The study notes that if CDHEs continue to intensify – particularly events where heatwaves are the precursors – they could drive declining crop productivity, increased wildfire frequency and severe public health crises.

These impacts could be “much more rapid and severe as global warming continues”, Yeh tells Carbon Brief.

Tanarhte notes that these events can be forecasted up to 10 days ahead in many regions. Furthermore, she says, the strongest impacts can be prevented “through preparedness and adaptation”, including through “water management for agriculture, heatwave mitigation measures and wildfire mitigation”.

The study recommends reassessing current risk management strategies for these compound events. It also suggests incorporating the sequences of drought and heatwaves into compound event analysis frameworks “to enhance climate risk management”.

Cerezo-Mota says that it is clear that the world needs to be prepared for the increased occurrence of these events. She tells Carbon Brief:

“These [risk assessments and strategies] need to be carried out at the local level to understand the complexities of each region.”

The post Heatwaves driving recent ‘surge’ in compound drought and heat extremes appeared first on Carbon Brief.

Heatwaves driving recent ‘surge’ in compound drought and heat extremes

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits