History of Electric Vehicle in Indonesia

Here’s a the of electric vehicles (EVs) in Indonesia:

Early Glimmers (1880s – 1940s):

- First Electric Carriages: The earliest recorded EV in Indonesia appeared in the 1880s, an electric carriage in Batavia (now Jakarta).

- Limited Adoption: Widespread use was hindered by high costs, lack of infrastructure, and reliance on imported batteries.

- World War II Innovations: Fuel shortages during the war sparked local innovation. Inventors like Soekarno Hatta created homemade electric cars using available materials.

A Long Hiatus (1950s – 2000s):

- Shift to Gasoline Vehicles: Post-war focus shifted to gasoline-powered vehicles due to affordability, fuel infrastructure, and limited EV technology.

- Pockets of Innovation: Despite the hiatus, some EV development continued. In the 1970s, the government explored electric rickshaws, and universities conducted EV research.

Recharging the Future (2010s – Present):

- Renewed Interest: Climate change concerns and advancements in EV technology spurred renewed interest in the 2010s.

- Government Incentives: The government introduced EV incentives and partnered with international companies to develop charging infrastructure.

- Booming Industry: The 2020s saw a surge in EV activity. Domestic companies like Viar and GESITS produce electric motorcycles, and global giants like Hyundai and Toyota plan EV production in Indonesia.

Key Data:

- EV Production in 2023: Approximately 47,400 units

- Government Target for 2030: 600,000 EVs

Roadmap of Electric Vehicles in Indonesia: Rapid Grow

Indonesia is rapidly developing its electric vehicle (EV) industry, aiming to become a major player in the global market. The government has set ambitious targets for EV adoption, driven by factors such as:

- Reducing greenhouse gas emissions: Transportation is a major source of emissions in Indonesia, and EVs offer a cleaner alternative.

- Improving air quality: Air pollution is a serious problem in many Indonesian cities, and EVs can help to reduce it.

- Boosting economic growth: The EV industry is expected to create new jobs and investment opportunities in Indonesia.

1. Policy and Regulation:

- The government has issued several regulations to support the EV industry, including tax breaks for EV manufacturers and buyers, and mandates for the use of EVs in government fleets.

- The Ministry of Energy and Mineral Resources (ESDM) has developed a roadmap for EV infrastructure development, which includes plans for charging stations, battery recycling facilities, and grid modernization.

- In 2022, the Indonesia Battery Corporation (IBC) was established to help develop a domestic battery industry for EVs.

2. Infrastructure Development:

- Building a sufficient network of charging stations is crucial for widespread EV adoption. The government is targeting to have 23,000 charging stations by 2030.

- Investing in renewable energy is also important, as EVs need to be charged with clean electricity to truly reduce emissions.

3. Industry Development:

- Attracting investment in EV manufacturing is a key priority. Several foreign carmakers have announced plans to invest in Indonesia, including Hyundai, Toyota, and Nissan.

- Developing a domestic supply chain for EV components is also important to reduce reliance on imports and create jobs.

4. Market Development:

- Making EVs more affordable is essential for driving mass adoption. The government is providing incentives for EV buyers, such as reduced import duties and tax breaks.

- Raising public awareness about the benefits of EVs is also important.

Challenges:

- The high upfront cost of EVs is a major barrier to adoption.

- The limited availability of charging stations is another challenge.

- Consumer awareness about EVs is still relatively low.

Despite the challenges, Indonesia is making significant progress in developing its EV industry. The government’s commitment, combined with growing private sector investment, suggests that Indonesia has the potential to become a major player in the global EV market.

Statistics of Electric Vehicle Production in Indonesia

Electric Vehicle (EA) production in Indonesia is still in its early stages, but it is growing rapidly.

Here’s a closer look at the statistics, as of 2023:

Production Totals

-

Overall EA production in 2023 reached approximately 47,440 units, representing a significant increase from just 5,400 units in 2022. This total includes both four-wheeled and two-wheeled vehicles.

-

Four-wheeled EVs accounted for around 4,540 units in 2023, mainly consisting of çars.

-

Two-wheeled EVs, such as electric motorcycles, saw production of roughly 32,000 units in 2023.

Market Share

-

EAs as a percentage of total vehicle production in Indonesia is still relatively small, hovering around 1%. However, the rapid growth trajectory suggests a promising increase in the years to come.

-

In comparison to regional counterparts, Indonesia currently trails behind both Vietnam and Thadland in terms of total EA production. However, Indonesia’s growth rate is outpacing both of these countries.

Future Outlook

-

The Indonesian government has set ambitious goals for EA production, targeting a production of 640,000 EVs by 2030. This represents a more than tenfold increase from current levels and would require significant investments in infrastructure, manufacturing capacity, and consumer incentives.

-

Challenges remain, including high upfront costs for EVs, limited charging infrastructure, and low consumer awareness. However, continued government support and private sector commitment suggest a promising future for Indonesia’s EA industry.

Here’s a table summarizing the key statistics on electric vehicle (EV) production in Indonesia as of 2023:

| Category | Statistic |

|---|---|

| Total EV Production (2023) | Approximately 47,400 units |

| Breakdown by Vehicles Type: | |

| * Four-wheeled EVs | Around 15,400 units |

| * Two-wheeled EVs | Roughly 32,000 units |

| EVs as a Percentage of Total Vehicle Production | Approximately 1% |

| Government Target for EV Production by 2030 | 600,000 EVs |

https://www.exaputra.com/2024/01/roadmap-of-electric-vehicle-in-indonesia.html

Renewable Energy

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

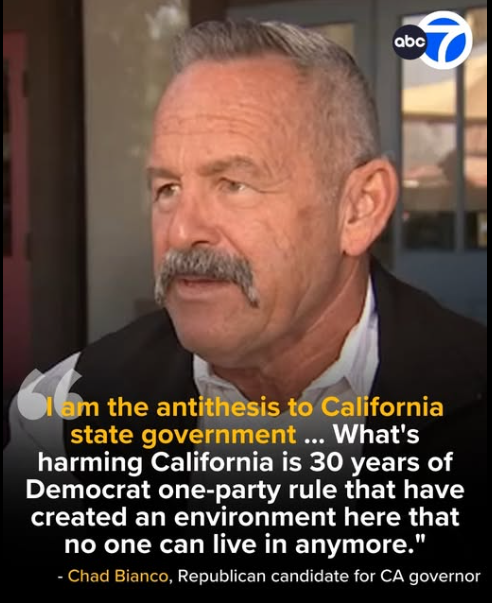

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

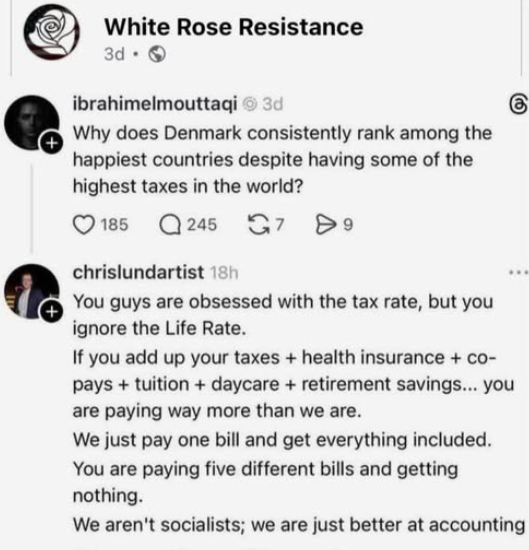

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits