Reaching net-zero will be much cheaper for the UK government than previously expected – and the economic damages of unmitigated climate change far more severe.

These are two key conclusions from the latest report on risks to the government finances from the independent Office for Budget Responsibility (OBR), which includes a chapter on climate change.

The new OBR report shows very clearly that the cost of cutting emissions to net-zero is significantly smaller than the economic damages of failing to act.

Here are four key charts from the OBR report.

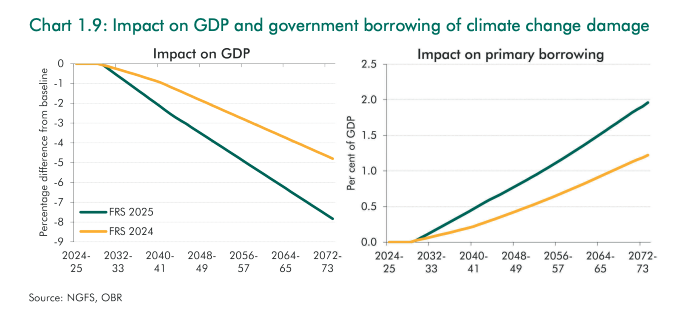

Climate damages could reach 8% of GDP by 2070s

The UK could take an 8% hit to its economy by the early 2070s, if the world warms by 3C this century, according to the new OBR report.

(This aspect of the OBR report has been picked up in a Reuters headline: “Global 3C warming would hurt UK economy much more than previously predicted, OBR says.”)

Its latest estimate (blue line) of the impact of “climate-related damages” by the 2070s is three percentage points (60%) higher than thought just last year (yellow), as shown in the figure below.

The OBR says that the increase in its estimate of climate damages is due to using a “more comprehensive and up-to-date analysis”.

(The world is currently on track to warm by only slightly less than 3C this century.)

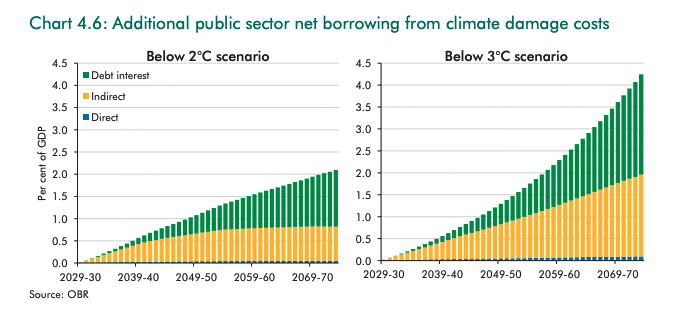

Unchecked damages could double hit to borrowing

The impact of climate damages on government borrowing would be nearly twice as high by the 2070s, if global warming goes unchecked and reaches 3C, according to the OBR report.

This is shown in the figure below, which compares additional government borrowing each year, as a share of GDP, if warming is limited to less than 2C this century (left) or if it climbs to 3C (right).

The OBR explains that the largest impact of climate damages on government borrowing is “lower productivity and employment and, therefore, lower tax receipts”.

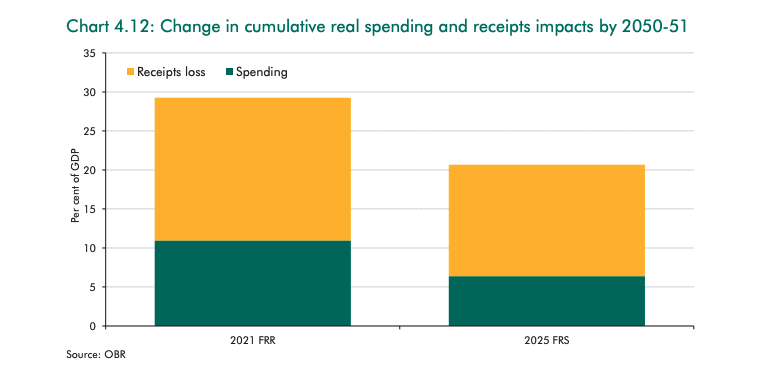

Cost of net-zero halved

When it comes to cutting UK emissions, the OBR says the government will only need to invest just over half as much on reaching net-zero, compared with what it expected four years earlier.

This is shown in the figure below, with the latest 2025 estimate (right) showing a cumulative government investment of 6% of GDP across the 25 years to 2050, down from 11% (left).

(Note that the large majority of “lost government receipts”, shown in yellow in the figure below, are due to fuel duty evaporating as drivers shift to electric vehicles. As the OBR notes, the government could choose to recoup these losses via other types of motoring taxes.)

The OBR takes its estimates of the costs and benefits of cutting emissions to net-zero from the government’s Climate Change Committee (CCC). The CCC recently issued significantly lower estimates for net-zero investment costs, due to more rapidly falling clean-technology costs.

Acknowledging this shift, the OBR says the latest CCC estimates on the cost of reaching net-zero are “significantly lower” than earlier figures.

It notes that the net cost to the economy of reaching net-zero emissions by 2050 is now put at £116bn over 25 years, some £204bn lower than previously expected.

In very rough terms, this figure – which excludes health co-benefits due to cutting emissions and avoided climate damages – is equivalent to less than £70 per person per year.

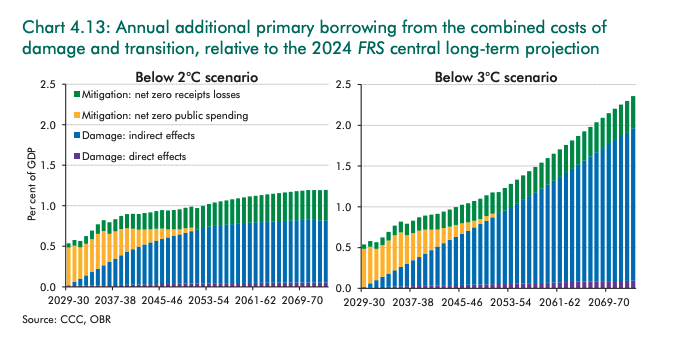

Cost of action far lower than cost of inaction

Taken together, the OBR findings show more clearly than ever before that the cost of taking action to tackle climate change would be far lower than the cost of unchecked warming.

For the first time, its latest report combines the estimated cost of cutting emissions with the expected damages due to rising temperatures in a single figure, shown below.

The comparison illustrates that climate damages (blue bars in the chart) are set to impose severe costs on the UK public finances, even if warming is limited to less than 2C this century (left).

The OBR also shows how the cost of government investment in cutting emissions (yellow) is both temporary and relatively small in comparison to climate damages.

Moreover, it highlights how unchecked warming of 3C this century (right) would impose far higher climate damages on the UK government’s finances than if global temperatures are kept in check.

Specifically, global action to limit warming to 2C instead of 3C could prevent more than 1 percentage point of climate damages being added to annual government borrowing by the 2070s.

In contrast, the combined estimated cost to government of action to cut emissions never exceeds 0.6 percentage points – even if lost receipts due to fuel duty are not replaced (green).

Beyond these new numbers, the OBR acknowledges that it still does not include the cost of adapting to climate change, or the impact this could have on reducing damages.

Nor does it consider the potential for accelerated transitions towards clean energy, technological advances that make this shift cheaper or the risk of tipping points, which could cause “large and irreversible changes” to the global climate.

The post OBR: Net-zero is much cheaper than thought for UK – and unchecked global warming far more costly appeared first on Carbon Brief.

OBR: Net-zero is much cheaper than thought for UK – and unchecked global warming far more costly

Climate Change

Dow Asks Texas to Legalize Plastic Pollution from its Seadrift Complex

Facing multiple lawsuits, Dow requests an “unprecedented” permit amendment to authorize its discharge of polyethylene pellets into coastal waters.

Two weeks ago, when Texas sued a massive Dow petrochemical plant over water pollution, state environmental regulators were already considering a novel proposal from the company that would effectively legalize discharges of plastic material from the 4,700–acre complex into waters feeding San Antonio Bay and the Gulf of Mexico.

Dow Asks Texas to Legalize Plastic Pollution from its Seadrift Complex

Climate Change

Why Electricity Bills Are So High—and How the Blowback Could Hit Trump

As Democrats and climate activists seize on energy costs as a political issue, new data shows electricity rates rose 5 percent nationwide in 2025. The figures were much higher in some states.

COLUMBUS, Ohio—Protestors stood in the snow outside the offices of Ohio’s utility regulator in January to say they were fed up with rising electricity rates.

Why Electricity Bills Are So High—and How the Blowback Could Hit Trump

Climate Change

Africa’s mineral wealth can make it an architect of a more just energy transition

Mohamed Okash is the Founding Director of the Institute of Climate and Environment at SIMAD University in Somalia.

A recent report by the African Finance Corp. suggests that Africa holds an approximate $29.5 trillion in mineral wealth. It is little wonder then that the continent is once again being courted for what lies beneath its soil.

For Africa, this moment feels both familiar — and fraught. Indeed, the stakes are not only about minerals; they are about whether a continent with the world’s youngest population will be shaped by decisions made elsewhere, or finally assert control over how its future is built.

It is time for African policymakers, political leaders, and regional institutions to treat minerals not merely as export commodities, but as strategic bargaining tools.

From cobalt and lithium to the rare earth minerals powering electric vehicles, renewable energy systems, and modern defence technologies, global powers are racing to secure the resources they believe will define the next century.

In this context, Africa has a strategic advantage. The continent holds an estimated 30% of the world’s critical mineral reserves, including over 55% of global cobalt, around 44% of global manganese, significant shares of platinum-group metals, and fast-growing lithium discoveries in countries such as the Democratic Republic of Congo, Zimbabwe, Ghana and others. Despite this endowment, Africa only captures less than 1% of global mineral value addition.

A regional approach to value addition

To turn this tide, African policymakers, political leaders, and regional institutions must be intentional about the terms under which these resources leave the continent.

One practical step would be adopting common beneficiation thresholds, requiring that certain minerals not be exported in raw form, but only after reaching a defined level of domestic processing, such as concentration, refining, or precursor production. Instead of shipping unprocessed lithium ore or cobalt concentrate abroad, for example, governments could require some level of upgrading at home.

A handful of African nations have already taken such measures.

In 2023, Namibia banned exports of unprocessed lithium and other critical minerals to encourage local beneficiation. That same year, Ghana announced a lithium agreement that also included provisions for local value addition and state participation, signalling that raw mineral exports will not define its long-term strategy. And just last week, Zimbabwe suspended exports of lithium concentrates and all raw minerals. The government framed the move as a way to compel domestic processing and downstream investment rather than continued raw export dependency.

In addition, the African Union has been pushing toward a more coordinated regional approach to minerals through its African Mining Vision. Fully implementing such an approach would not only strengthen the continent’s bargaining power but prevent companies from simply shifting operations to the country offering the weakest standards.

Mineral revenues can help fund climate plans

Of course, export restrictions alone are not a silver bullet. They work best when backed by clear regulation, reliable energy supply, infrastructure investment, and regional coordination.

Aligning mineral policy with energy, climate, and industrial strategies is equally important. That means linking mining licenses to renewable energy investment consistent with the Paris Agreement, directing mineral revenues into long-term industrial or green transformation funds rather than short-term budget fixes, and using frameworks such as the African Continental Free Trade Area (AfCFTA) to build cross-border value chains. Strong transparency standards under the Extractive Industries Transparency Initiative (EITI) can further strengthen public trust and fiscal stability.

Critical minerals give Africa a real chance to move beyond aid-dependent development and invest in growth driven from within. Managed well, they can help finance locally led transformation, creating jobs, building industries, and strengthening economic resilience.

A different model with young people at the table

This debate cannot be confined to boardrooms and foreign capitals, however. Africa has one of the youngest populations on Earth, yet for many young people, the future is not guaranteed, shaped by persistent poverty, inequality, conflict, and accelerating climate shocks that erode livelihoods and public trust.

Young people must have a seat at the table. And they are already making their voices heard; speaking boldly about the future they want, sparking public conversation through entrepreneurship, organising, research, art, and policy advocacy. Indeed, the mineral agreements signed today will determine whether this generation inherits jobs and dignity, or deeper vulnerability and unfinished promises.

Africa’s future should not be secured by the goodwill of external partners, nor by repeating extractive bargains dressed up as development. It should be shaped by African leaders who choose value creation over raw export, and long-term sovereignty over short-term gain.

In a world marked by climate change and growing geopolitical rivalry, Africa has something few others possess: the resources, the market, and the moral claim to insist on a different model.

If that mineral wealth is governed with the right policies, transparency, and foresight, it can anchor green industrialisation, expand opportunity for a rising generation, and reposition Africa not as a prize in a new scramble, but as a decisive architect of a more just and sustainable global order.

The post Africa’s mineral wealth can make it an architect of a more just energy transition appeared first on Climate Home News.

Africa’s mineral wealth can make it an architect of a more just energy transition

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits