Weather Guard Lightning Tech

Masdar’s Offshore Wind Buy, Statkraft’s Renewables Investment, Siemens Secures Credit Line

Masdar acquires stake in Dogger Bank South wind farm, Statkraft invests in Norwegian renewables, Siemens Energy secures credit line to support wind turbine subsidiary.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Allen Hall: I’m Allen Hall, president of Weather Guard Lightning Tech. And I’m here with the founder and CEO of IntelStor, Phil Totaro, and the chief commercial officer of Weather Guard, Joel Saxum. And this is your News Flash. News Flash is brought to you by our friends at IntelStor. If you need actionable information about renewable projects or technologies, check out IntelStor at intelstor.com.

Masdar, an Abu Dhabi based renewable energy company, has completed its acquisition of a 49 percent stake in the 3 gigawatt Dogger Bank South offshore wind project in the UK. The project, located more than 100 kilometers off the northeastern coast of England, will be one of the world’s largest offshore wind farms.

Masdar and RWE signed an agreement to collaborate the 11 billion pound project at COP 28 in the UAE last December, that the two companies will work together to develop and operate the wind farm with construction potentially starting at the end of 2025. The first 800 megawatts of electricity are expected to come online in 2029 with full commissioning by the end of 2031.

Now, Phil, this is becoming more routine. where the large operators like RWE are selling off a significant portion, almost 50 percent of these projects to raise revenue for the next project. Masdar, on the other hand, seems to be becoming very aggressive in the renewable space.

Philip Totaro: Yes, and actually what was interesting is you mentioned that this was announced back at COP28.

One of the things that we never got a chance to talk about on the show before Is the fact that Masdar at that time announced something like close to a hundred billion dollars worth of investment that they were going to be making in, multiple projects in, I, I want to say something like 21 different countries including, far flung places like Uzbekistan and wherever, but this is part of a deliberate strategy on their part to start putting more money behind renewable projects because they’re seeing returns that are good enough, especially on, an RWE built and operated project.

This is the sort of thing that good operators can do is they can attract capital to come in and help them, provide that mechanism to invest in new greenfield or repowering projects. So it’s a great business model. And again the clever operators and the operators who have a robust and healthy portfolio projects, they are the ones that are able to attract that investment.

Joel Saxum: Yeah. Masdar, it’s a good move. And in my opinion, you start to see, like we’ve been talking a lot of this big infrastructure, big money investing in infrastructure, specifically energy infrastructure, a lot different than some of that other Middle Eastern big money spent like Saudi Arabia, buying golf leagues, building cities and things like that in the desert.

But Masdar they are in, even in the United States onshore, they own parts of four different wind farms all of them in Texas. So they’re spreading their money around, Globally.

Allen Hall: Statkraft, the Norwegian state owned energy company, plans to invest up to 6. 3 billion in Norwegian hydro and wind power projects.

The company’s annual report for 2023 showed a decrease in revenue and profits compared to the previous year largely due to lower power prices following the European energy crisis. But despite that drop, Statkraft signed a record number of long term agreements with Norwegian industrial companies and entered into several power purchase agreements in other markets, including its first long term power contract in the United States.

Boy Statkraft is doing all right for itself. I know they’ve been hiring bunches of people on the wind side. They are really stepping up the effort in renewables, Phil.

Philip Totaro: Yeah. And what’s interesting is this is, again, all part of a global strategy. Keep in mind that they’re also now building a lot of projects in wind and some solar projects down in Brazil.

They’re looking at a lot of different foreign markets at the moment and they will probably come out with some announcements soon, but an additional, 6 billion in or 6. 3 in investment is going to go a pretty long way for them.

Joel Saxum: Yeah. You can think to understand about Norway as well and their power production is there.

They run on mostly all renewables already, a lot of hydro up there. So they do have the Nord link from Norway to Germany is the HVDC line that connects basically Norway to the EU. And they also have the North Sea link, which connects Norway to the UK. And both of those high voltage DC lines will be part of that export mechanism coming out of Norway.

They’re going to put a bunch of, they have great hydro resources, great wind resources. They’re going to be at the point. Where they are at the point now, but they’ll be continuing to build to the point where they’re being a net exporter of renewable energy to other places in Europe.

Philip Totaro: And keep in mind too, that Statkraft also because they had acquired some projects in Spain from Siemens Gamesa, they’re actually starting to build their first projects now in Spain.

So they’re going to be deploying that capital all over the place and it’s going to be a good thing for the industry.

Allen Hall: In a significant financial move, Siemens Energy has secured a new 4 billion credit line to refinance existing debts, including those of a struggling wind turbine subsidiary, Siemens Gamesa Renewable Energy.

The five year revolving facility is supported by 26 international banks, replaces the company’s previous 3 billion credit line and Siemens Gamesa’s 2 billion facility. This strategic financial restructuring is seen as a key step in stabilizing Gamesa’s operation. And setting a solid foundation for future growth.

Phil, I’m a little amazed how easily Siemens Energy had this facility brought to it or able to acquire it. I would think that Siemens Energy would have trouble getting 26 banks to loan them. Money or provide a credit line with the problems at Gamesa at the minute. Evidently they see the other parts of Siemens Energy being very profitable and sustainable.

Is this the future for Siemens Energy? They can secure themselves financially with these financial instruments and make the move forward?

Philip Totaro: It would seem so, but keep in mind as well that there, there was a part of that deal to salvage Siemens Gamesa that involved, the German government stepping in and saying, okay, we’re going to backstop up to a point, but we’re going to, provide a mechanism whereby everybody can get some certainty.

So the fact that Siemens Energy without Siemens Gamesa as a part of it is highly profitable. Combined with the fact that the German government had stepped in, I think provides everybody the confidence to just, and keep in mind, like you said, this is just a refinancing of two prior, prior kind of credit facilities or debt facilities that were available to the company and its subsidiaries.

I don’t see this as being hugely revolutionary in terms of the fact that they were able to get a deal, but it is important for them to be able to securitize what they have with Siemens Gamesa moving forward. It’s, depending on what the outcome of Siemens Gamesis troubles is going to be at least it sounds like it’s not going to get any worse.

And this new 4 billion euro credit facility should cover most of what Siemens Gamesas’s issues are going to be.

Masdar’s Offshore Wind Buy, Statkraft’s Renewables Investment, Siemens Secures Credit Line

Renewable Energy

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

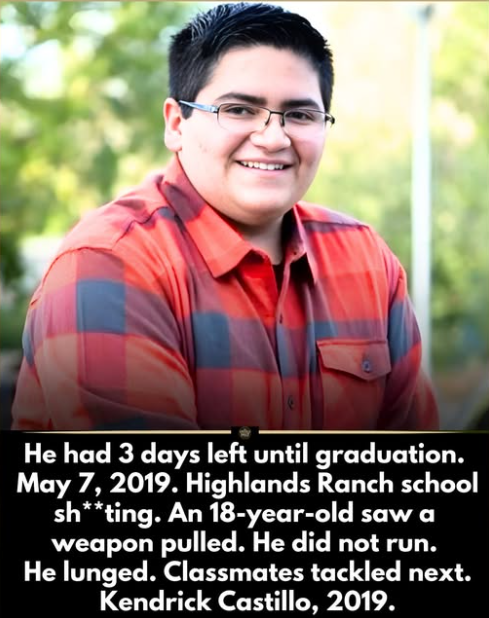

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

Renewable Energy

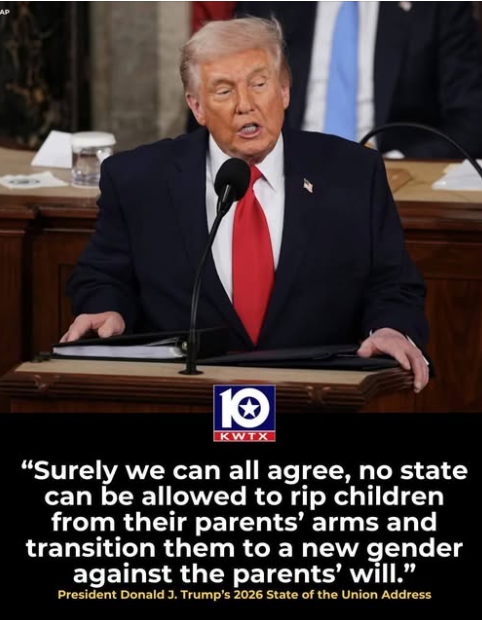

Forced Transgendering of America’s Little Kids

How often does this happen? How about never?

How often does this happen? How about never?

Trump loves to say that little boys go to school and come back home little girls.

He’s the most powerful person in the world for exactly one reason: We’re a nation of morons.

Renewable Energy

Illegal Aliens and U.S. Veterans

Two comments:

Two comments:

That the United States has homeless veterans is a national (and international) disgrace.

By definition, no one has the legal right to enter the U.S. illegally, but according to our constitution, everyone in America is entitled to due process.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits