Definition MSCI ESG Ratings Assessment

Definition for MSCI ESG Ratings

MSCI ESG Ratings refer to the evaluation and scoring system provided by MSCI Inc., a leading provider of investment decision support tools and services.

MSCI ESG Ratings assess the environmental, social, and governance (ESG) performance of companies and provide investors with a standardized measure of their sustainability practices.

Outlook MSCI ESG Ratings Assessment

MSCI ESG Ratings are designed to help investors understand the ESG risks and opportunities associated with their investment portfolios. The ratings provide a comprehensive assessment of companies’ ESG practices, considering factors such as carbon emissions, energy efficiency, labor standards, board composition, and business ethics, among others.

The ratings are based on a robust methodology that incorporates a wide range of data sources, including company disclosures, regulatory filings, and third-party information. MSCI analyzes this data to generate scores and assign ratings to companies on a scale from AAA (highest) to CCC (lowest), with intermediate grades reflecting different levels of ESG performance.

The MSCI ESG Ratings enable investors to compare companies within an industry or across sectors, identify leaders and laggards in terms of ESG performance, and integrate ESG considerations into their investment decision-making processes. The ratings are widely used by institutional investors, asset managers, and other stakeholders seeking to incorporate sustainability and ESG factors into their investment strategies.

It’s important to note that the specific criteria and indicators used in the MSCI ESG Ratings may evolve over time to reflect emerging trends, regulatory changes, and market demands.

MSCI ESG Ratings is a framework that assesses the environmental, social, and governance (ESG) performance of companies. While the specific Key Performance Indicators (KPIs) used in the MSCI ESG Ratings are proprietary and can evolve over time.

Key Aspect MSCI ESG Ratings Assessment

Here are some key areas and indicators that are typically considered:

1. Environmental Performance

– Carbon emissions: KPIs can include greenhouse gas emissions, carbon intensity, and emissions reduction targets.

– Energy efficiency: KPIs may measure energy consumption, energy intensity, and renewable energy usage.

– Water management: KPIs can assess water usage, water efficiency, and water risk management practices.

– Waste management: KPIs may measure waste generation, recycling rates, and waste reduction efforts.

2. Social Impact

– Labor standards: KPIs can include metrics related to labor rights, employee diversity and inclusion, health and safety performance, and fair employment practices.

– Human rights: KPIs may assess human rights policies, supply chain labor practices, and engagement with stakeholders on human rights issues.

– Product safety and quality: KPIs can evaluate product safety standards, quality control measures, and responsible marketing practices.

3. Governance and Ethics

– Board composition and independence: KPIs may assess board diversity, independence of directors, and the presence of independent committees.

– Executive compensation: KPIs can evaluate the alignment of executive pay with company performance and long-term sustainability goals.

– Anti-corruption and ethics: KPIs may measure the implementation of anti-corruption policies, adherence to ethical standards, and transparency in lobbying and political contributions.

4. Innovation and Resource Efficiency

– Research and development (R&D) investment: KPIs can assess the level of investment in sustainable technologies, innovation projects, and product development.

– Resource efficiency: KPIs may measure resource consumption, efficiency improvements, and efforts to promote circular economy principles.

– Supply chain management: KPIs can evaluate supply chain transparency, responsible sourcing, and supplier assessment practices.

These KPIs are used by MSCI to evaluate companies’ ESG performance and assign ratings based on the results.

The specific indicators and weightings used in the MSCI ESG Ratings are determined by MSCI’s methodology and may vary depending on industry-specific factors and regional considerations. The ratings are widely used by investors to assess companies’ ESG risks and opportunities and to make informed investment decisions.

https://www.exaputra.com/2023/06/kpi-for-msci-esg-ratings-assessment.html

Renewable Energy

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

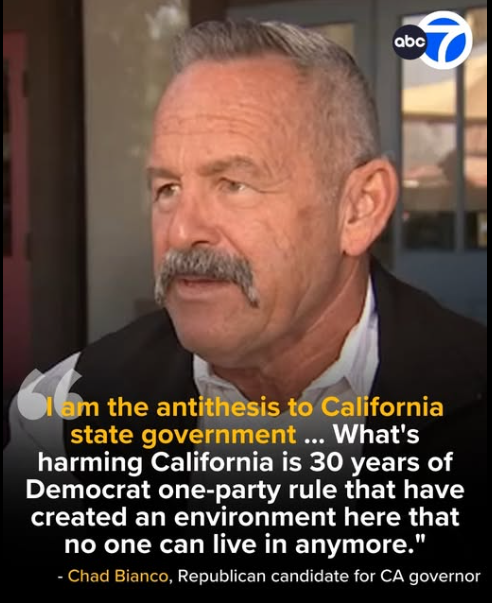

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

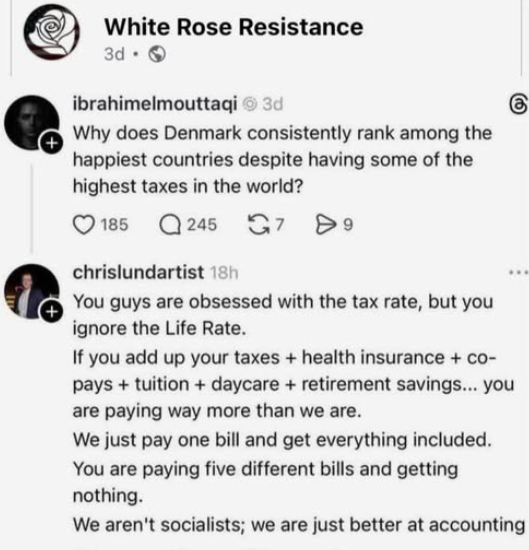

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits