Electric vehicles (EVs) now account for more than one-in-four car sales around the world, but the next phase is likely to depend on government action – not just technological change.

That is the conclusion of a new report from the Centre for Net Zero, the Rocky Mountain Institute and the University of Oxford’s Environmental Change Institute.

Our report shows that falling battery costs, expanding supply chains and targeted policy will continue to play important roles in shifting EVs into the mass market.

However, these are incremental changes and EV adoption could stall without efforts to ensure they are affordable to buy, to boost charging infrastructure and to integrate them into power grids.

Moreover, emerging tax and regulatory changes could actively discourage the shift to EVs, despite their benefits for carbon dioxide (CO2) emissions, air quality and running costs.

This article sets out the key findings of the new report, including a proposed policy framework that could keep the EV transition on track.

A global tipping point

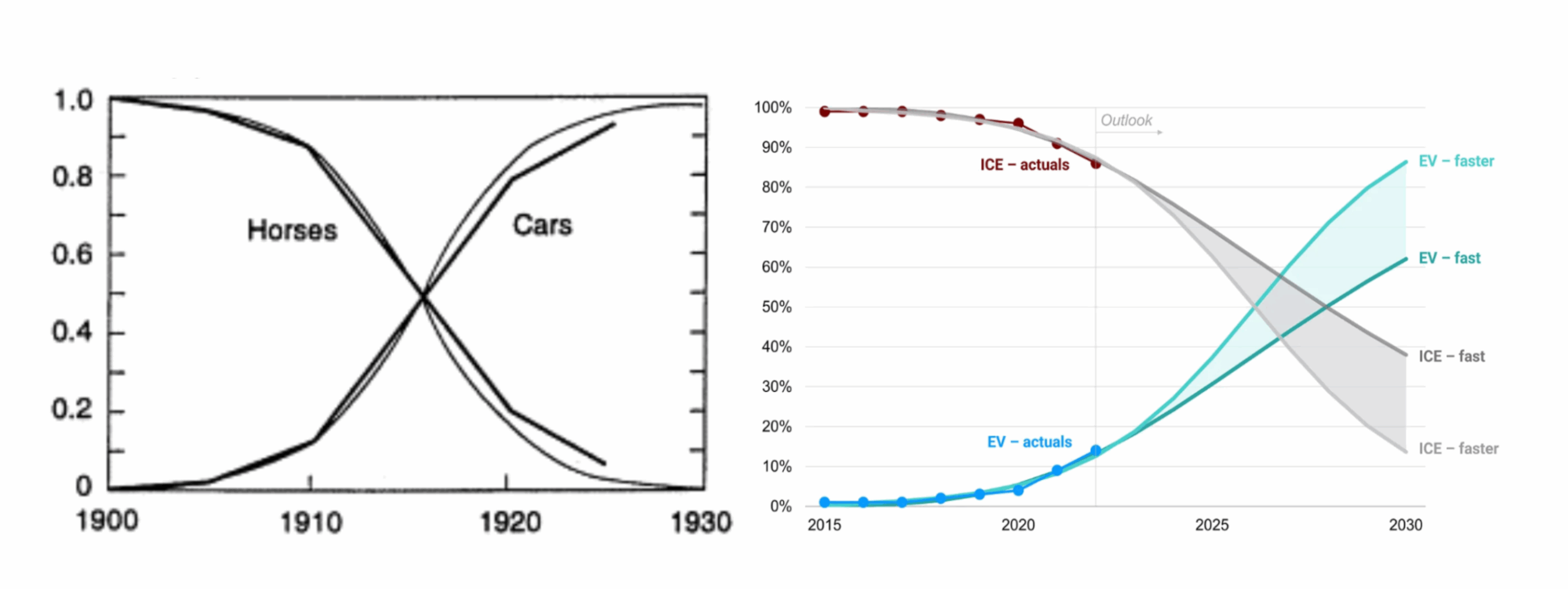

Technology transformations are rarely linear, as small changes in cost, infrastructure or policy can lead to outsized progress – or equally large reversals.

The adoption of new technologies tends to follow a similar pathway, often described by an “S-curve”. This is divided into distinct phases, from early uptake, with rapid growth from very low levels, through to mass adoption and, ultimately, market saturation.

However, technologies that depend on infrastructure display powerful “path-dependency”, meaning decisions and processes made early within the rollout can lock in rapid growth, but equally, stagnation can also become entrenched, too.

EVs are now moving beyond the early-adopter phase and beginning to enter mass diffusion. There are nearly 60m on the road today, according to the International Energy Agency, up from just 1.2m a decade ago.

Technological shifts of this scale can unfold faster than expected. Early in the last century in the US, for example, millions of horses and mules virtually disappeared from roads in under three decades, as shown in the chart below left.

Yet the pace of these shifts is not fixed and depends on the underlying technology, economics, societal norms and the extent of government support for change. Faster or slower pathways for EV adoption are illustrated in the chart below right.

Internal combustion engine (ICE) vehicles did not prevail in becoming the dominant mode of transport through technical superiority alone. They were backed by massive public investment in roads, city planning, zoning and highway expansion funded by fuel taxes.

Meanwhile, they faced few penalties for pollution and externalities, benefitting from implicit subsidies over cleaner alternatives. Standardisation, industrial policy and wartime procurement further entrenched the ICE.

EVs are well-positioned to follow a faster trajectory, as they directly substitute ICE vehicles while being cleaner, cheaper and quieter to run.

Past transitions show that like-for-like replacements – such as black-and-white to colour TVs – tend to diffuse faster than entirely novel products.

Late adopters also benefit from cost reductions and established norms. For example, car ownership took 60 years to diffuse across the US, but just 20 years in parts of Latin America and Japan.

In today’s globalised economy, knowledge, capital and supply chains travel faster still. Our research suggests that the global EV shift could be achieved within decades, not half a century.

Yet without decisive policy, investment and coordination, feedback loops could slow, locking in fossil-fuel dependence.

Our research suggests that further supporting the widespread deployment of EVs hangs on three interlinked actions: supporting adoption; integrating with clean electricity systems; and ensuring sustainability across supply chains and new mobility systems.

Closing the cost gap

EVs have long offered lower running costs than ICE vehicles, but upfront costs – while now cost-competitive in China, parts of Europe and in growing second-hand markets – remain a major barrier to adoption in most regions.

While battery costs have fallen sharply – lithium-ion battery packs fell by 20% in 2024 alone – this has not fully translated into lower retail vehicle prices for consumers.

In China, a 30% fall in battery prices in 2024 translated into a 10% decline in electric SUV prices. However, in Germany, EV retail prices rose slightly in 2024 despite a 20% drop in battery costs.

These discrepancies reflect market structures rather than cost fundamentals. Our report suggests that a competitive EV market, supported by transparent pricing and a strong second-hand sector, can help unlock cost parity in more markets.

Beyond the sale of EVs, government policy around running costs, such as fuel duty, has the potential to disincentivse EV adoption.

For example, New Zealand’s introduction of road-pricing for EVs contributed to a collapse in registrations from nearly 19% of sales in December 2023 to around 4% in January 2024.

EV-specific fees have also been introduced in a number of US states. Last month, the UK also announced a per-mile charge for EVs – but not ICEs – from 2028.

Addressing the loss of fuel-duty revenue as EVs replace ICE vehicles is a headache for any government seeking to electrify mobility.

However, to avoid slowing diffusion, new revenues could be used to build out new charging infrastructure, just as road-building was funded as the ICE vehicle was scaling up.

While subsidies to support upfront costs can help enable EV adoption, the best approach to encouraging uptake is likely to shift once the sector moves into a phase of mass diffusion.

Targeted support, alongside innovative financing models to broaden access, from blended finance to pay-as-you-drive schemes, could play a greater role in ensuring lower-income drivers and second-hand buyers are not left behind.

Mandates as engines of scale

Zero-emission vehicle (ZEV) mandates and ICE phase-out deadlines can reduce costs more effectively than alternatives by guaranteeing market scale, our research finds, reducing uncertainty for automakers and pushing learning rates forward through faster production.

California’s ZEV mandate was one of the first in the 1990s, a policy that has since been adopted by ten other US states and the UK.

China’s NEV quota system has produced the world’s fastest-growing EV market, while, in Norway, clear targets and consistent incentives mean EVs now account for nearly all of new car sales. These “technology-forcing” policies have proved highly effective.

Analyses consistently show that the long-run societal benefits of sales mandates for EVs far outweigh their compliance costs.

For example, the UK’s ZEV mandate has an estimated social net present value of £39bn, according to the government, driven largely by emissions reductions and lower running costs for consumers.

Benefits can also extend beyond national borders. For example, California’s “advanced clean cars II” regulations – adopted by a number of US states and an influence on other countries – have been instrumental in compelling US automakers to develop and commercialise EVs, which can, in turn, trigger innovation and scale to reduce costs worldwide.

Research suggests that, where possible, combining mandates and incentives creates further synergies: mandates alleviate supply-side constraints, making subsidies more effective on the demand side.

Public charging: a critical bottleneck

Public charging is one of the most significant impediments to EV adoption today.

Whereas EVs charged at home are substantially cheaper to run than ICE vehicles, higher public charging costs can erase this benefit – in the UK, this can be up to times the home equivalent.

While most homes in the UK, for example, do have access to off-street parking, there are large swathes of low-income and urban households without access to private driveways. For these households, a lack of cheap public charging has been described as a de facto “pavement tax”, which is disincentivising EV adoption and resulting in an inequitable transition.

Our research shows that a dual-track charging strategy could help resolve the situation. Expanding access to private charging – through cross-pavement cabling, “right-to-charge” legislation for renters and planning mandates for new developments could be combined with strategic investment in public charging, to overcome the “chicken-and-egg” problem for investors uncertain about future EV demand.

Meanwhile, “smart charging” in public settings – where EV demand is matched with cheaper electricity supply – can also help close the affordability gap, by delivering cheap off-peak charging that is already available to those charging at home.

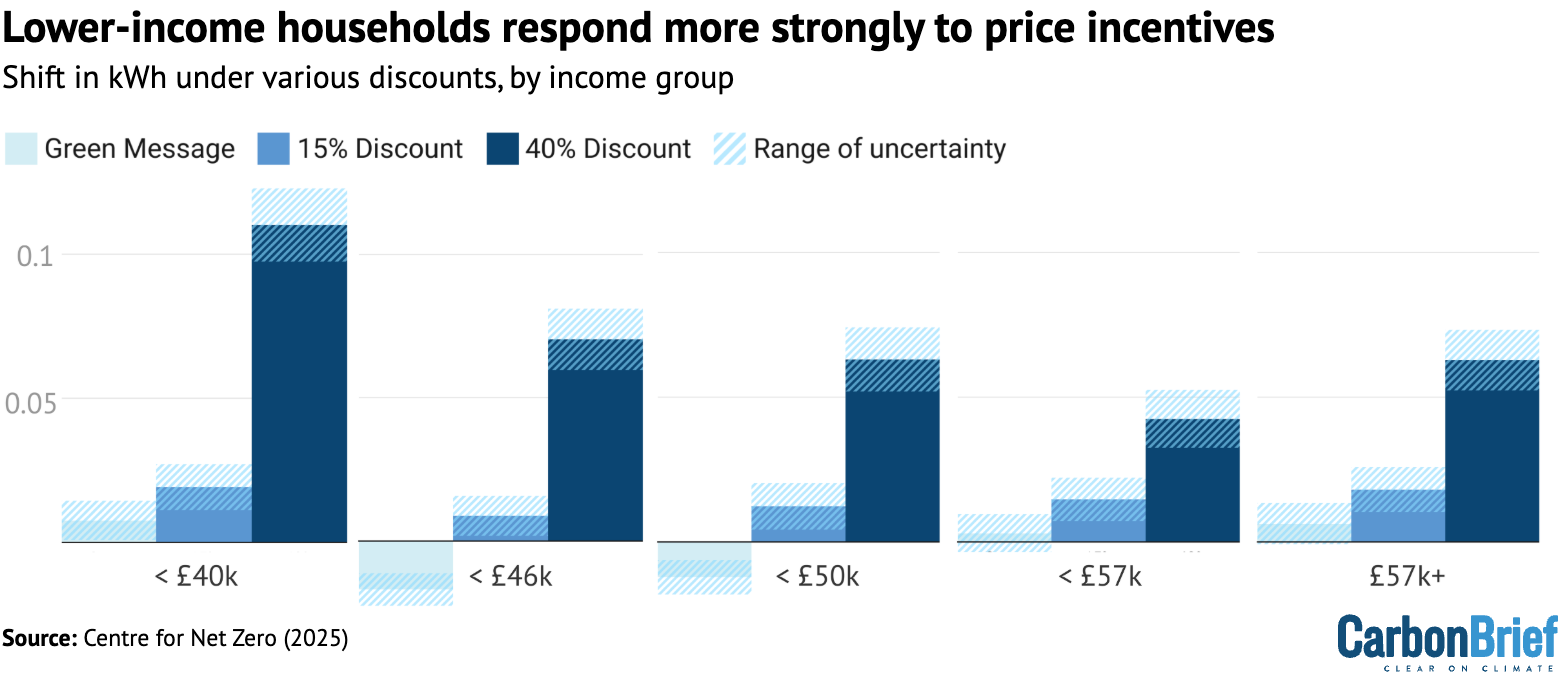

The Centre for Net Zero’s research shows that drivers respond to dynamic pricing outside of the convenience of their homes, which reduces EV running costs below those of petrol cars.

The figure below shows that, while the level of discount being offered had the strongest impact, lower-income areas showed the largest behavioural response, indicating that they may stand to gain the most from a rollout of such incentives.

Our research suggests that policymakers could encourage this type of commercial offering by creating electricity markets with strong price signals and mandating that these prices are transparent to consumers.

Integrating with clean electricity grids

Electrification is central to decarbonising the world’s economies, meaning that sufficient capacity on electricity networks is becoming a key focus.

For the rollout of EVs, pressure will be felt most on low-voltage “distribution” networks, where charging is dispersed and tends to follow existing peaks and troughs in domestic demand.

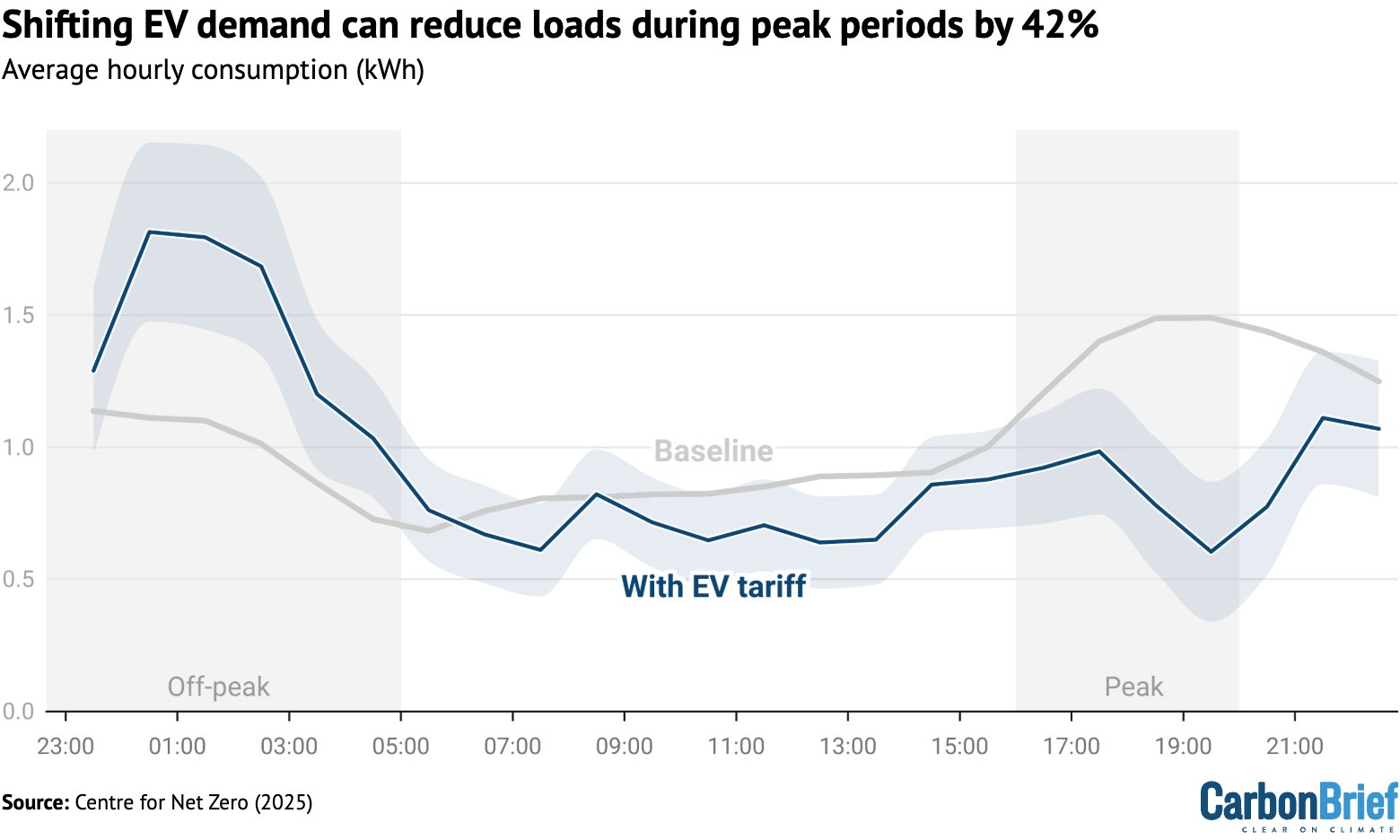

Rather than responding to this challenge by just building out the grid – with the corresponding economic and political implications – making smart charging the norm could help mitigate pressure on the network.

Evidence from the Centre for Net Zero’s trials shows that AI-managed charging can shift EV demand off-peak, reducing residential peak load by 42%, as shown in the chart below.

Additionally, the amount of time when EVs are plugged in but not moving is often substantial, giving networks hours each day in which they can shift charging, targeting periods of low demand or high renewable output.

The system value of this flexible charging is significant. In the UK, managed charging could absorb 15 terrawatt hours (TWh) of renewable electricity that would otherwise be curtailed by 2030 – equivalent to Slovenia’s entire annual consumption.

For these benefits to be realised, our research suggests that global policymakers may need to mandate interoperability across vehicles, chargers and platforms, introduce dynamic network charges that reflect local grid stress and support AI-enabled automation.

Bi-directional charging – which allows EVs to export electricity to the grid, becoming decentralised, mobile storage units – remains underexploited. This could allow EVs to contribute to the capacity of the grid, helping with frequency and providing voltage support at both local and system levels.

The nascency of such vehicle-to-grid (V2G) technology means that penetration is currently limited, but there are some markets that are further ahead.

For example, Utrecht is an early leader in real-world V2G deployment in a context of significant grid congestion, while Japan is exploring the use of V2G for system resilience, providing backup power during outages. China is also exploring V2G systems.

Our research shows that if just 25% of vehicles across six major European nations had V2G functionality, then the theoretical total capacity of the connected vehicles would exceed each of those country’s fossil-fuel power fleet.

Mandating V2G readiness at new chargepoints, aligning the value of exports with the value to the system and allowing aggregators to pool capacity from multiple EVs, could all help take V2G from theory to reality.

A sustainable EV system

It is important to note that electrification alone does not guarantee sustainability.

According to Rocky Mountain Institute (RMI) analysis, the total weight of ore needed to electrify the world’s road transport system is around 1,410mtonnes (Mt). This is 40% less than the 2,150Mt of oil extracted every year to fuel a combustion-based system. EVs concentrate resource use upfront, rather than locking in fossil-fuel extraction.

Moreover, several strategies can reduce reliance on virgin minerals, including recycling, new chemistries and improved efficiency.

Recycling, in particular, is progressing rapidly. Some 90% of lithium-ion batteries could now be recycled in some regions, according to RMI research. Under an accelerated scenario, nearly all demand could be met through recycling before 2050.

Finally, while our report focuses largely on EVs, it is important to highlight that they are not a “silver bullet” for decarbonising mobility.

Cities such as Seoul and New York have demonstrated that micromobility, public transport and street redesign can cut congestion, improve health and reduce the number of overall vehicles required.

Better system design reduces mineral demand, lowers network strain and broadens access.

The ‘decision decade’ ahead

Policy decisions made today will determine whether EVs accelerate into exponential growth or stall.

Our research suggests that governments intent on capturing the economic and environmental dividends of electrified mobility are likely to need coherent, cross-cutting policy frameworks that push the market up the steep climb of the EV S-curve.

The post Guest post: How to steer EVs towards the road of ‘mass adoption’ appeared first on Carbon Brief.

Guest post: How to steer EVs towards the road of ‘mass adoption’

Climate Change

Uganda may see lower oil revenues than expected as costs rise and demand falls

Uganda’s plan to use future revenues from its emerging oil industry to drive economic development may not work as expected, because evidence so far shows that the government’s effort to extract and export its crude oil may not produce the returns it is counting on, analysts have warned.

A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) found that Uganda stands to benefit far less from oil production than previously projected, with revenues set to be half of earlier estimates if the world transitions away from fossil fuels on a path to reaching net zero emissions.

Uganda’s oil ambitions involve developing two oilfields on the shores of Lake Albert – Tilenga and Kingfisher – and constructing the 1,443-km East African Crude Oil Pipeline (EACOP), with the aim of transporting 230,000 barrels of crude per day to Tanzania’s Tanga port for export.

Gas flaring soars in Niger Delta post-Shell, afflicting communities

Led by oil major TotalEnergies and China National Offshore Oil Company (CNOOC), alongside the Uganda National Oil Company (UNOC) and Tanzania Petroleum Development Corporation, the project was given the financial go-ahead in 2022.

Will Scargill, one of the IEEFA report’s authors, told an online launch this week that oil may have seemed a historically attractive option for Uganda but the benefits it could yield are very sensitive to major risks, including cost overruns around the project and in the refining sector, which it also plans to enter.

“The EACOP project is expected to cost much more than the original expectations, so it’s a major project risk in Uganda as well,” he said.

The start of oil production and exports through the East Africa pipeline had been expected by 2025 – nearly 20 years after commercially viable oil was first discovered in the country – but has now been delayed until late 2026 or 2027.

Meanwhile, the cost of construction – particularly for the EACOP part of the project – has continued to rise, reaching around $5.6 billion, a 55% increase from the $3.6 billion projected shortly before it got financial approval, the report said.

US tariffs, China’s EV boom to curb oil revenues

Beyond delays and cost overruns, “there’s the risk the impact of the accelerating shift away from fossil fuels will have on the oil market,” Scargill said.

The report said the most significant factors for the Ugandan oil industry – which are beyond its control – have been the reduced outlook for international trade spurred by recently imposed US tariffs and the growing uptake of electric vehicles (EVs), particularly in China – which has led to a peak in transport fuel demand and an expected peak in overall oil consumption by 2027.

The 2025 oil outlook from the International Energy Agency (IEA) shows that growth in global oil demand will fall significantly by the end of the decade before entering a decline, driven mainly by electrification in transport which will displace 5.4 million barrels per day of global oil demand by the end of the decade.

In addition, structural changes in global energy markets, including oil supply growth outside the OPEC+ bloc – a group of major oil-producing countries including Saudi Arabia and Russia that sets production quotas – particularly in the US, Brazil and Guyana, are lowering prices.

“It’s a particularly bad time to be taking single big bets on particular sectors that are linked to external markets,” said Matthew Huxham, a co-author of the IEEFA report.

To make matters worse, Uganda’s public finances have been weakened in the past decade by external shocks including higher US interest rates and commodity prices, resulting in downgrades of the country’s sovereign credit rating, he added.

“What that means is, generally speaking, there is less fiscal resilience to shocks,” Huxham said.

Lower global demand for oil would likely see lower prices, profits and revenues for the Ugandan government, the report authors said. In addition, a global shift to renewable energy would mean Uganda selling even fewer barrels into international markets.

All of these factors suggest that investment in Uganda’s oil industry “would unlikely be as transformational as expected” for its development, Scargill said.

Climate Home News reached out to the Uganda National Oil Company and EACOP but had not received a response at the time of publication.

Foreign investors to recover costs while Uganda faces risks

Uganda has invested a significant amount of government funds not only in the oil pipeline but also in supporting infrastructure such as a planned refinery. The report authors raised concerns about revenue-sharing agreements under which foreign investors are entitled to recover their costs first, taking a larger share of oil revenues in the early years of production.

IEEFA estimates that while TotalEnergies’ and CNOOC’s returns could fall by 25-34% as the world uses less oil and moves from fossil fuels to clean energy, Uganda’s expected revenues could decline by up to 53%.

Explainer: What is the petrodollar and why is it under pressure?

Uganda is pursuing a $4.5-billion oil refinery project in Hoima District, with the country’s oil company UNOC due to take a 40% stake. To finance part of this investment and other oil-related infrastructure, UNOC has secured a loan facility of up to $2 billion from commodity trader Vitol.

Under the deal, Vitol gains priority access to oil revenues, placing it ahead of the Ugandan government when money starts flowing in, the report said. The IEEFA analysts warn that this will likely displace or defer planned use of the revenues for other government spending on things like health, education and climate adaptation, especially if oil production and the refinery construction are delayed or profits disappoint.

“Even if the refinery project is on time and on budget, the refinery and loan repayments could consume 40% of Uganda’s oil revenues through 2032,” Scargill noted.

Pointing to recent cost overruns at oil refinery projects in Africa, the report authors said Nigeria’s

Dangote refinery ended up costing more than twice the original estimate – jumping from $9 billion to over $18 billion.

Climate action is “weapon” for security in unstable world, UN climate chief says

They said analysis shows the Uganda refinery will cost 25% more than planned, on top of an expected overrun of over 50% on the EACOP project, cutting the annual return rate to 10%.

“This means there is a high chance the project, by itself, will not make any money,” the report added.

Responding to the report, the StopEACOP coalition said the analysis confirms that beyond causing ongoing environmental harm and displacing hundreds of thousands, the project “does not make economic sense, especially for the host countries”.

They called on financial institutions, including Standard Bank, KCB Uganda, Stanbic Uganda, Afreximbank, and the Islamic Corporation for the Development of the Private Sector, which are backing the “controversial” EACOP project, “to seriously engage with the findings of the IEEFA reports and reconsider their support”.

Prioritise climate-resilient investments instead

In another report released alongside the one on oil project finances, IEEFA argued that Uganda could achieve stronger and more effective development outcomes by redirecting its scarce public resources towards climate-resilient, electrified industrialisation rather than doubling down on oil.

Uganda is among the countries most vulnerable to climate change, yet ranks low in readiness to cope with its impacts. The report authors urged the government to apply stricter criteria when deciding how to spend public funds, focusing on things like improving access to modern energy services and climate adaptation.

The IEEFA report recommended investments in off-grid and mini-grid solar electrification, agro-processing, cold storage, crop irrigation and better roads as lower-risk alternatives to investing in fossil fuels.

Africa records fastest-ever solar growth, as installations jump in 2025

Investments that take climate risks into account could also attract concessional climate finance and align with Uganda’s fourth National Development Plan and Just Transition Framework, the report said.

“They also take less long to construct, are easy to deploy, pay back over a shorter period and they also put less pressure on the system,” Huxham added.

The post Uganda may see lower oil revenues than expected as costs rise and demand falls appeared first on Climate Home News.

Uganda may see lower oil revenues than expected as costs rise and demand falls

Climate Change

Ugandans living near new oil pipeline let down by compensation programmes

Most Ugandans whose land and livelihoods were affected by the construction of the East African Crude Oil Pipeline (EACOP) are dissatisfied with training programmes provided by developers which were designed to stop them being left worse off, a survey has found.

The Africa Institute for Energy Governance (AFIEGO) asked 246 people in seven communities affected by the project for their views on the developers Resettlement Action Plan (RAP).

It found that while most affected households have received some form of support, most were dissatisfied with the quality of food security programmes and training on alternative vocations and financial literacy.

Dickens Kamugisha, AFIEGO’s CEO, said that while the Ugandan government claims it is developing the oil sector to create lasting value for everyone, this study shows that this is not the case especially for the people that were displaced for the project.

“They lost their land, were under-compensated and now an inadequate livelihood restoration programme is being implemented. Instead of creating lasting value for the project-affected people, the government and the EACOP company could create lasting poverty for the people”, he added.

EACOP is being built by a coalition led by the French company Total, along with China’s National Offshore Oil Corporation and Uganda and Tanzania’s state-owned oil companies.

The 1,400 km pipeline will take oil from Uganda’s Tilenga and Kingfisher oil fields through Tanzania to the East African coast, where the oil can be put on ships and exported.

Inadequate training

Nearly four-in-five of those surveyed described vocational training programmes, designed to give displaced people new professions like bakers, welders and soap makers, as inadequate. They cited short training periods, absentee trainers and limited hands-on learning.

One participant said he was trained in catering for four months in 2024. “I did not understand what I was taught. We were not learning most of the time”, he said.

The young man said that he only cooked once in the four months and that trainers told them that they would be sent home if they complained.

The financial literacy programme, aimed at training people to use their compensation wisely, was also described as inadequate by nearly four-fifths.

They said the training was only one day and was conducted by a commercial bank, which pushed them to open bank accounts rather than improving their money management practices.

“They were interested in business, and not in people learning”, one woman said, “no wonder when people got money, some married more women. The compensation was also too little!”

Not enough food

Those who were physically displaced by the pipeline or who lost more than a fifth of their land to it were supposed to be entitled to food assistance for up to a year or more.

While three-quarters of respondents received some food assistance, just a third said it was adequate. They complained that they did not understand why some people were getting food and others not.

There were also complaints about the quantity of beans, rice, cooking oil and salt provided, particularly from those with big families. One woman said her family of 30 used up the 4 kg of rice and beans in one meal.

An agricultural recovery programme aimed to help people transition but, while many confirmed receiving seeds, seedlings or fertilisers, they complained that the seeds were poor quality and distributed too late – after the rains – for crops to grow.

In Kyotera District, one participant recounted receiving 70 coffee seedlings, of which only 20 survived. “We were given very young coffee seedlings. They were also poor quality with some having no roots,” the participant said. “I watered those coffee seedlings, but they did not grow. They were poor quality!”

Some of the affected communities also complained about not getting the livelihood options they wanted, adding that those who wanted livestock were given seeds instead because they did not have a building to house the livestock.

On the other hand, the survey found that about two-thirds of affected people were satisfied with the distance between their homes and the pipeline. The third who were not satisfied said they feared accidents like oil spills and noise and dust pollution as the pipeline is built.

“I fear for my life,” said one man in Hoima, “the pipeline can burst, spill and affect us. We have also been told that the pipeline will be heated. The heat from the pipeline could affect our soils”.

The post Ugandans living near new oil pipeline let down by compensation programmes appeared first on Climate Home News.

Ugandans living near new oil pipeline let down by compensation programmes

Climate Change

Virginia House Passes Data Center Tax Exemption, With Conditions

New and existing data centers could continue receiving a break on the state’s retail sales and use tax, as long as they moved away from fossil fuels and tried to reduce energy usage.

RICHMOND, Va.—The Virginia House of Delegates on Tuesday passed legislation continuing billions of dollars in state tax exemptions for all qualifying new and existing data centers as long as they take a series of steps to move away from fossil fuels and transition to renewable energy.

Virginia House Passes Data Center Tax Exemption, With Conditions

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits