The green hydrogen industry in France

The green hydrogen industry in France is rapidly evolving and holds much promise for the country’s decarbonization goals. Here’s a breakdown of the current landscape:

Ambitious targets:

- National Strategy: France aims for 6.5 GW of installed electrolyzer capacity by 2030, producing 20-40% of its industrial hydrogen from renewables. The EU target is even higher, at 10 million mt/year by 2030.

- Investment: €7 billion has been allocated for green hydrogen development until 2030, with €700 million dedicated to supporting production in 2024. A recent €4 billion plan focuses on deploying 1 GW of electrolysis within three years.

Key priorities:

- Domestic production: France wants to become a leader in green hydrogen production and supply, focusing on renewable energy sources like wind and solar for electrolysis.

- Industry decarbonization: Green hydrogen is seen as a crucial tool to reduce emissions in hard-to-abate sectors like steel, chemicals, and refining.

- Mobility: France targets 20,000-50,000 light-duty fuel cell vehicles, 800-2,000 heavy-duty vehicles, and 400-1,000 hydrogen refuelling stations by 2030.

Industry structure:

- Public support: The government provides grants, tax breaks, and other incentives to attract investments and foster innovation.

- Private players: Major French companies like Air Liquide, Engie, and McPhy are actively involved in developing electrolyzers, fuel cell technologies, and infrastructure.

- Regional dynamics: Regional initiatives and collaborations contribute to a diverse and growing industry landscape.

Challenges and opportunities:

- High initial costs: Electrolyzers and hydrogen infrastructure are still expensive, requiring continued government support and cost reduction efforts.

- Public awareness: Building public understanding and acceptance of hydrogen technologies is crucial for wider adoption.

- International competition: France faces competition from other European countries and global players in developing a thriving green hydrogen economy.

The green hydrogen industry in France is full of potential, backed by ambitious government plans, strong private investments, and regional initiatives. Overcoming the challenges and capitalizing on the opportunities will be key to France’s success in achieving its decarbonization goals and establishing itself as a leader in the global green hydrogen market.

Statistics of Green Hydrogen Industry Lansdcape in France

Green Hydrogen Industry Statistics in France (2024):

Production:

- Current annual hydrogen production: 900,000 tons (mostly “gray” from fossil fuels)

- Annual green hydrogen production (2022): 45 kilotons (5% of industrial hydrogen)

- Target green hydrogen production by 2030: 20-40% of industrial hydrogen (roughly 180,000 – 360,000 tons)

- National electrolyzer capacity target by 2030: 6.5 GW

Demand:

- Projected carbon-free hydrogen demand by 2030:

- 70% for industry (ferrous metallurgy leading)

- 7% for energy sector

- Remaining for transportation (light and heavy vehicles, maritime, trains)

Investment:

- €7 billion allocated for green hydrogen development until 2030

- €4 billion plan for deploying 1 GW of electrolysis within 3 years

- €700 million dedicated to supporting production in 2024

Jobs:

- Potential for 50,000 – 150,000 jobs by 2030

International Perspective:

- EU target for annual green hydrogen production by 2030: 10 million metric tons

- France aims to become a major exporter of green hydrogen

Challenges:

- High initial costs for electrolyzers and infrastructure

- Public awareness and acceptance of hydrogen technologies

- International competition

Opportunities:

- Significant government support and funding

- Strong private sector involvement

- Growing regional initiatives and collaborations

Table: Green Hydrogen Industry Statistics in France (2024)

| Category | Statistic |

|---|---|

| Production | |

| Current annual hydrogen production | 900,000 tons (mostly gray) |

| Annual green hydrogen production (2022) | 45 kilotons (5% of industrial hydrogen) |

| Target green hydrogen production by 2030 | 20-40% of industrial hydrogen (180,000-360,000 tons) |

| National electrolyzer capacity target by 2030 | 6.5 GW |

| Demand | |

| Projected carbon-free hydrogen demand by 2030 (by sector) | 70% industry, 7% energy, remaining for transport |

| Investment | |

| Total allocated for green hydrogen development until 2030 | €7 billion |

| Plan for deploying 1 GW of electrolysis within 3 years | €4 billion |

| Dedicated to supporting production in 2024 | €700 million |

| Jobs | |

| Potential jobs created by 2030 | 50,000-150,000 |

| International Perspective | |

| EU target for annual green hydrogen production by 2030 | 10 million metric tons |

| France’s export ambition | Major exporter of green hydrogen |

Note: These statistics are based on publicly available information, and estimates may vary slightly depending on the source.

Conclusion of Green Hydrogen Industry Lansdcape in France

The green hydrogen industry in France is at a pivotal juncture, brimming with immense potential but also facing significant challenges. Here’s a summary of its key takeaways:

Positively bullish:

- Ambitious national targets: France’s aggressive goals for green hydrogen production and electrolyzer capacity by 2030 demonstrate a strong commitment to decarbonization.

- Significant investments: Substantial government funding and private sector involvement provide a solid foundation for industry growth.

- Diverse application potential: Green hydrogen’s applicability across various sectors, from industry and energy to mobility, paints a picture of a transformative fuel source.

- Job creation potential: The burgeoning industry holds the promise of generating countless jobs, boosting the economy and local communities.

- European leadership aspirations: France’s aim to become a major exporter of green hydrogen positions it as a potential pioneer in the global market.

Challenges to overcome:

- Cost reductions: Bringing down the high initial costs of electrolyzers and infrastructure is crucial for wider adoption and scalability.

- Public perception: Building public awareness and acceptance of hydrogen technologies will be necessary for full-fledged societal embrace.

- International competition: France faces stiff competition from other European and global players aiming to dominate the green hydrogen market.

- Technological advancements: Continuous research and development are essential to improve efficiency, safety, and affordability of hydrogen production and utilization.

The future of the French green hydrogen industry is promising, albeit demanding. Successfully navigating the challenges while capitalizing on the opportunities will determine its success in achieving its ambitious decarbonization goals and establishing France as a frontrunner in the global green hydrogen race.

This conclusion concisely summarizes the key points of the French green hydrogen landscape, highlighting both its promise and the hurdles it needs to overcome.

https://www.exaputra.com/2024/01/green-hydrogen-industry-lansdcape-in.html

Renewable Energy

Homeschooling

Decent and intelligent people respect the rights of parents to homeschool their children, but there are two reasons for concern: a) socialization, failure to expose children to their peers, so that they may make friends and come to understand the norms of society, and b) the quality of the education itself.

Almost all homeschooling in the United States is conducted on the basis of a radical rightwing viewpoint, normally a blend of evangelical Christianity and Trumpism.

Renewable Energy

The Positive Effects We’ve Had on Others Are Profound, Whether We Know It or Not

There’s a theory that most people underestimate the positive effects they’ve had on other people.

There’s a theory that most people underestimate the positive effects they’ve had on other people.

Yes, that’s the theme of “It’s a Wonderful Life,” but it’s also the core of the 1995 film “Mr. Holland’s Opus,” in which a music teacher who deemed that his life had been a failure because he never completed writing a great symphony, is gently and beautifully corrected. Please see below.

The Positive Effects We’ve Had on Others Are Profound, Whether We Know It or Not

Renewable Energy

Renewable Energy Concepts Can’t Violate the Laws of Physics

In the early days of 2GreenEnergy, my people and I were vigorously engaged in finding solid ideas in cleantech that needed funding in order to move forward.

In the early days of 2GreenEnergy, my people and I were vigorously engaged in finding solid ideas in cleantech that needed funding in order to move forward.

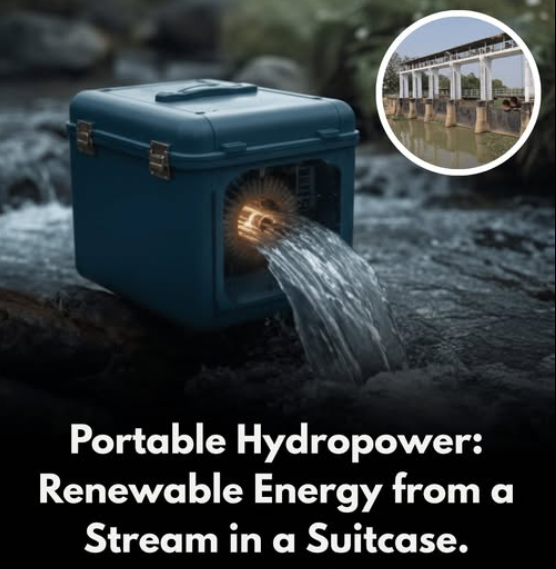

I vividly remember a conversation with a guy in Maryland who was trying to explain the (ostensible) breakthrough that he and his team had made in hydrokinetics. When I was having trouble visualizing what we was talking about, he asked me to “think of it as a river in a box.”

“Oh!” I exclaimed. “You mean you take a box full of standing water, add energy to it get it moving, then extract that energy, leaving you with more energy that you added to it.”

“Exactly.”

I politely explained that the laws of physics, specifically the first and second laws of thermodynamics, make this impossible.

He wasn’t through, however, and insisted that, in his office, his people had constructed a “working model.”

Here’s where my tone descended into something less than 100% polite. I told him that he may think he has a working model, but he’s wrong; if he believes this, he’s ignorant; if he doesn’t, but is conducting this conversation anyway, he’s a fraud.

“But don’t you want to come see it?” he implored.

“No. Not only would not fly across the country to see whatever it is you claim to have built, I wouldn’t walk across the street to a “working model” of something that is theoretically impossible.”

—

I tell this story because the claim made at the upper left is essentially identical. You’re pumping water up out of a stream, and then claiming to extract more energy when the water flows back into the stream.

Of course, social media today is rife with complete crap like this. We’ve devolved to a point where defrauding money out of idiots is rapidly replacing baseball as our national pastime.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits