Introduction Enapter Company Profiles Reviews

Enapter is a company that specializes in green hydrogen technology. They are known for developing innovative electrolyzer systems that produce hydrogen from renewable energy sources, such as wind and solar power.

Enapter’s mission is to accelerate the transition to a sustainable energy future by providing cost-effective and scalable solutions for hydrogen production. Their products are designed to support various applications, including energy storage, fuel cells, and decarbonization efforts across industries.

Enapter Company History

Enapter, founded in 2014, has a relatively short but impactful history in the field of green hydrogen technology.

Here’s a brief overview of their key milestones:

Foundation (2014)

Enapter was established in Pisa, Italy, by Sebastian-Justus Schmidt and Vaitea Cowan. The company’s vision was to make green hydrogen production more accessible and sustainable.

Prototyping and Research (2014-2017)

During its early years, Enapter focused on research and development, creating prototypes and conducting extensive R&D to refine their AEM (Anion Exchange Membrane) electrolysis technology.

Commercialization (2017-2018)

Enapter transitioned from the development phase to commercialization, making their AEM electrolyzers available to a wider market. These electrolyzers are compact, efficient, and capable of producing green hydrogen on-site.

Global Expansion (2018-Present)

Enapter expanded its operations and presence internationally. They established subsidiaries in Germany and Thailand, which allowed them to tap into a broader range of markets and collaborate with partners and customers worldwide.

Awards and Recognition

Over the years, Enapter has received recognition for its innovative green hydrogen solutions. They have won awards such as the Solar Impulse Efficient Solution Label, which highlights sustainable and efficient technologies.

Growing Product Portfolio

Enapter’s product portfolio has continued to expand, offering various electrolyzer models to cater to different needs, from small-scale residential units to larger industrial systems.

Contributing to the Hydrogen Economy

The company actively contributes to the development of the green hydrogen economy by enabling clean energy solutions, energy storage, and decarbonization efforts in industries like transportation, agriculture, and energy production.

Enapter’s history is marked by its commitment to advancing green hydrogen technology and playing a vital role in the transition to a more sustainable and eco-friendly energy landscape.

Enapter Company Profiles

Here is general description of what you might find in a company profile for Enapter:

Company Name: Enapter

Founded: 2014

Founders: Sebastian-Justus Schmidt and Vaitea Cowan

Headquarters: Pisa, Italy

Key People: You can list the current CEO, key executives, and notable team members.

Industry: Green Hydrogen Technology

Products/Services

Describe their main products and services, such as AEM electrolyzer systems for green hydrogen production.

Mission

Highlight the company’s mission and goals, which often involve advancing sustainable energy solutions and the hydrogen economy.

Partnerships and Collaborations

List significant partnerships with other companies, research institutions, or organizations.

Technological Innovation

Emphasize any unique technologies or innovations that set Enapter apart in the green hydrogen sector.

Sustainability Initiatives

Highlight any sustainability and environmental efforts the company is involved in.

Customer Base

Mention the industries and sectors that benefit from Enapter’s products and services.

Enapter Company: Manufacturer’s

Enapter is a green hydrogen technology company that specializes in the development and manufacturing of AEM (Anion Exchange Membrane) electrolyzer systems for hydrogen production.

Enapter is known for producing its own electrolyzer systems. They design and manufacture these systems in-house to ensure quality control and efficiency in green hydrogen production.

Product of Enapter Company

Enapter specializes in the production of AEM (Anion Exchange Membrane) electrolyzer systems for green hydrogen production. These electrolyzer systems are designed to be efficient, compact, and suitable for various applications.

Some of Enapter’s key products include:

1. EL 2.1: This is a small-scale AEM electrolyzer designed for residential and commercial use. It’s suitable for on-site hydrogen production to support energy storage, fuel cells, and decarbonization efforts.

2. EL 4.0: The EL 4.0 is a larger electrolyzer system, ideal for industrial and commercial applications. It can produce a higher volume of green hydrogen and is commonly used in sectors such as transportation and energy production.

3. EL 2.1 for Backup Power: This product is a version of the EL 2.1 designed for backup power solutions. It’s often used in conjunction with renewable energy sources to ensure a reliable power supply.

Enapter’s products are known for their modularity, scalability, and compatibility with renewable energy sources, making them valuable in the transition to a more sustainable energy future. For the most current information about their product offerings, you should visit Enapter’s official website or contact them directly.

Development of Enapter Company

Enapter has experienced significant development and growth since its founding in 2014.

Here’s an overview of the company’s development:

1. Founding and Early Years (2014-2017): Enapter was established in Pisa, Italy, by co-founders Sebastian-Justus Schmidt and Vaitea Cowan. The company’s early years were dedicated to research and development, focusing on perfecting their AEM (Anion Exchange Membrane) electrolyzer technology.

2. Commercialization (2017-2018): Enapter transitioned from the research phase to commercialization, making their AEM electrolyzers available to the market. These systems were designed to produce green hydrogen from renewable energy sources, such as solar and wind power.

3. Global Expansion (2018-Present): Enapter expanded its global presence by establishing subsidiaries in Germany and Thailand. This expansion allowed them to tap into broader markets and work with partners and customers worldwide.

4. Product Portfolio Growth: Enapter’s product portfolio has continued to evolve, offering various electrolyzer models to cater to different needs, from small-scale residential units to larger industrial systems. They have been at the forefront of developing innovative electrolyzer technology.

5. Awards and Recognition: The company has received recognition for its contributions to sustainable energy solutions, including the Solar Impulse Efficient Solution Label, which highlights eco-friendly and efficient technologies.

6. Hydrogen Economy Advancement: Enapter has actively contributed to the development of the green hydrogen economy by supporting clean energy solutions, energy storage, and decarbonization initiatives in various industries.

Enapter’s development has been marked by its dedication to advancing green hydrogen technology and playing a crucial role in the global transition to more sustainable and environmentally friendly energy solutions.

Future of Enapter Company

Predicting the future of a company involves some level of uncertainty, but based on Enapter’s mission, industry trends, and their historical development, we can make some educated guesses about their future:

1. Further Expansion: Enapter is likely to continue expanding its global presence. They may establish more subsidiaries and partnerships in key regions to meet the growing demand for green hydrogen solutions.

2. Technological Advancements: The company is likely to invest in research and development to further enhance the efficiency and performance of their AEM electrolyzer technology. This may lead to the development of even more advanced and cost-effective systems.

3. Diversification of Product Portfolio: Enapter may expand its product offerings to address a wider range of applications and industries, such as transportation, agriculture, and industrial processes.

4. Scaling up Production: As the demand for green hydrogen increases, Enapter may scale up its manufacturing capabilities to produce more electrolyzer units to meet market needs.

5. Environmental and Sustainability Initiatives: Enapter will likely continue to support and engage in sustainability initiatives, contributing to the reduction of greenhouse gas emissions and the adoption of cleaner energy solutions.

6. Regulatory and Policy Impact: The company’s growth and direction could be influenced by changing government regulations and policies related to hydrogen production and green technologies.

7. Market Adoption: Enapter’s success will depend on the broader adoption of green hydrogen technology. As the hydrogen economy continues to evolve, Enapter is poised to play a significant role in this transition.

While these are some potential aspects of Enapter’s future, it’s important to remember that the company’s specific path will be shaped by a variety of factors, including market dynamics, technological advancements, and global efforts to combat climate change.

Conclusion of Enapter Company Profiles Reviews

Enapter is a forward-thinking company in the field of green hydrogen technology. Founded in 2014, the company has evolved significantly, transitioning from research and development to commercialization and expanding its global presence with subsidiaries in Germany and Thailand.

Enapter is known for its AEM electrolyzer systems, which offer efficient and scalable solutions for green hydrogen production. They have received recognition for their efforts in promoting sustainable and efficient energy solutions.

The company’s future appears promising, with a focus on further expansion, technological advancements, and diversification of its product portfolio. Enapter is expected to continue playing a pivotal role in the development of the green hydrogen economy and supporting sustainability initiatives worldwide.

https://www.exaputra.com/2023/11/enapter-company-profiles-reviews.html

Renewable Energy

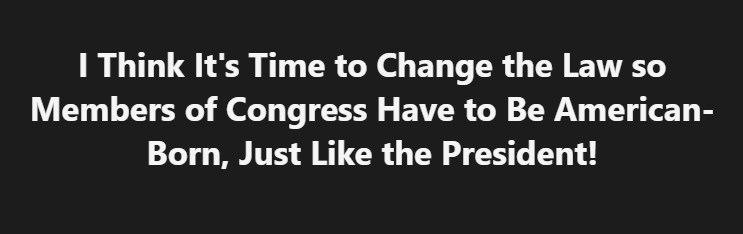

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

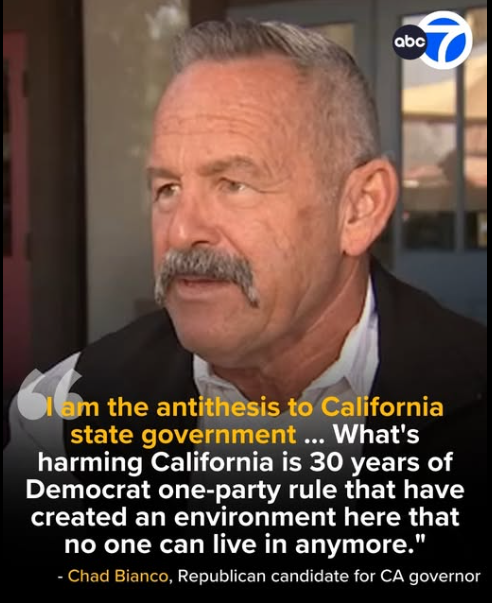

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

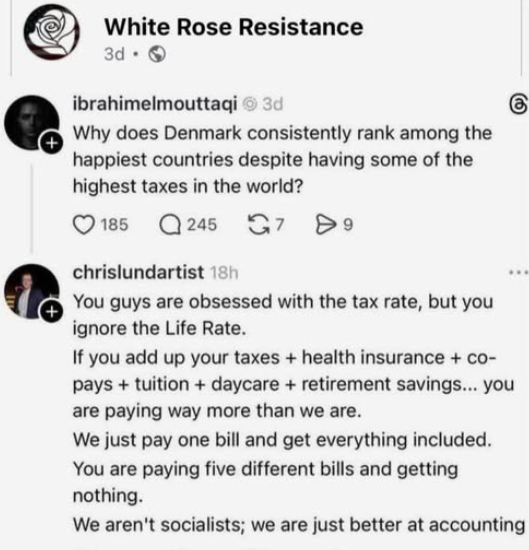

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits