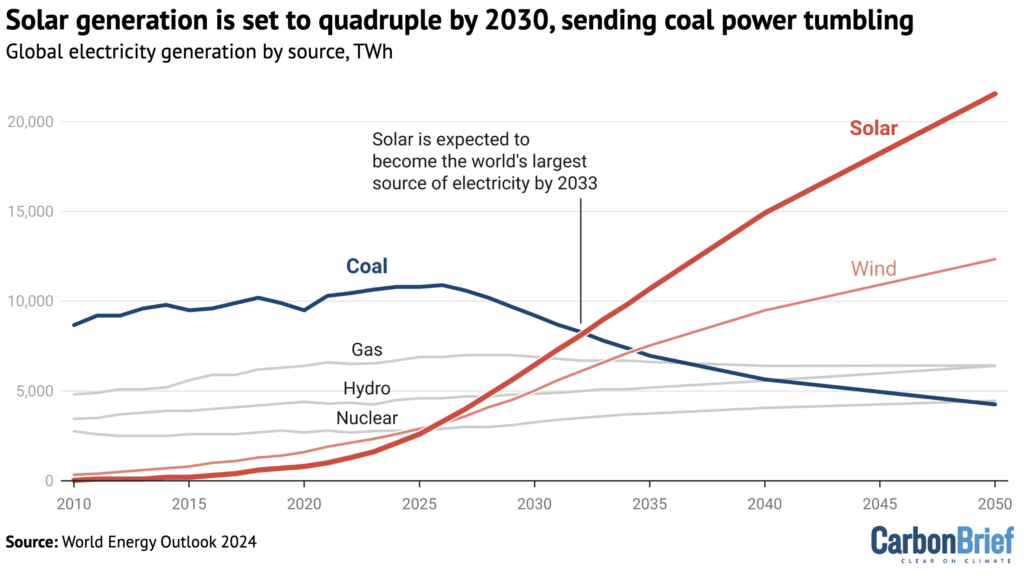

Global electricity generation from solar will quadruple by 2030 and help to push coal power into reverse, according to Carbon Brief analysis of data from the International Energy Agency (IEA).

The IEA’s latest World Energy Outlook 2024 shows solar overtaking nuclear, wind, hydro, gas and, finally, coal, to become the world’s single-largest source of electricity by 2033.

This solar surge will help kickstart the “age of electricity”, the agency says, where rapidly expanding clean electricity and “inherently” greater efficiency will push fossil fuels into decline.

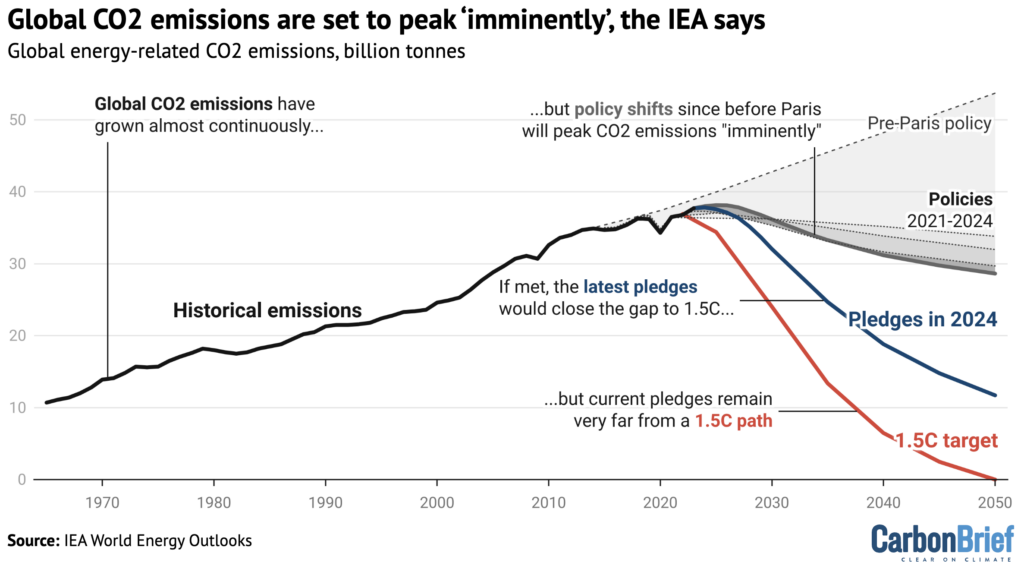

As a result, the world’s energy-related carbon dioxide (CO2) emissions will reach a peak “imminently”, the IEA says, with its data indicating a turning point in 2025.

Other highlights from Carbon Brief’s in-depth examination of the IEA’s latest outlook include:

- Renewables will grow 2.7-fold by 2030, short of the “tripling” goal set at COP28.

- Still, clean energy is growing at an “unprecedented rate”, and will overtake coal, gas and then oil, to become the world’s largest source of energy “in the mid-2030s”.

- Low-carbon energy, including renewables and nuclear, will grow 44% by 2030, adding 48 exajoules (EJ) to global energy supplies.

- Global energy demand will only rise by 34EJ (5%) over the same period.

- This means clean energy will push each of the fossil fuels past their peak by 2030.

- Electric vehicles (EVs) are now expected to displace 6m barrels of oil per day (mb/d) by 2030, up from a figure of 4mb/d by 2030 in last year’s outlook.

Despite these changes, the world is on track to cut CO2 emissions to just 4% below 2023 levels by 2030, the agency warns, resulting in warming of 2.4C above pre-industrial temperatures.

It says there is an “increasingly narrow, but still achievable” path to staying below 1.5C, which would need more clean electricity, faster electrification and a 33% cut in emissions by 2030.

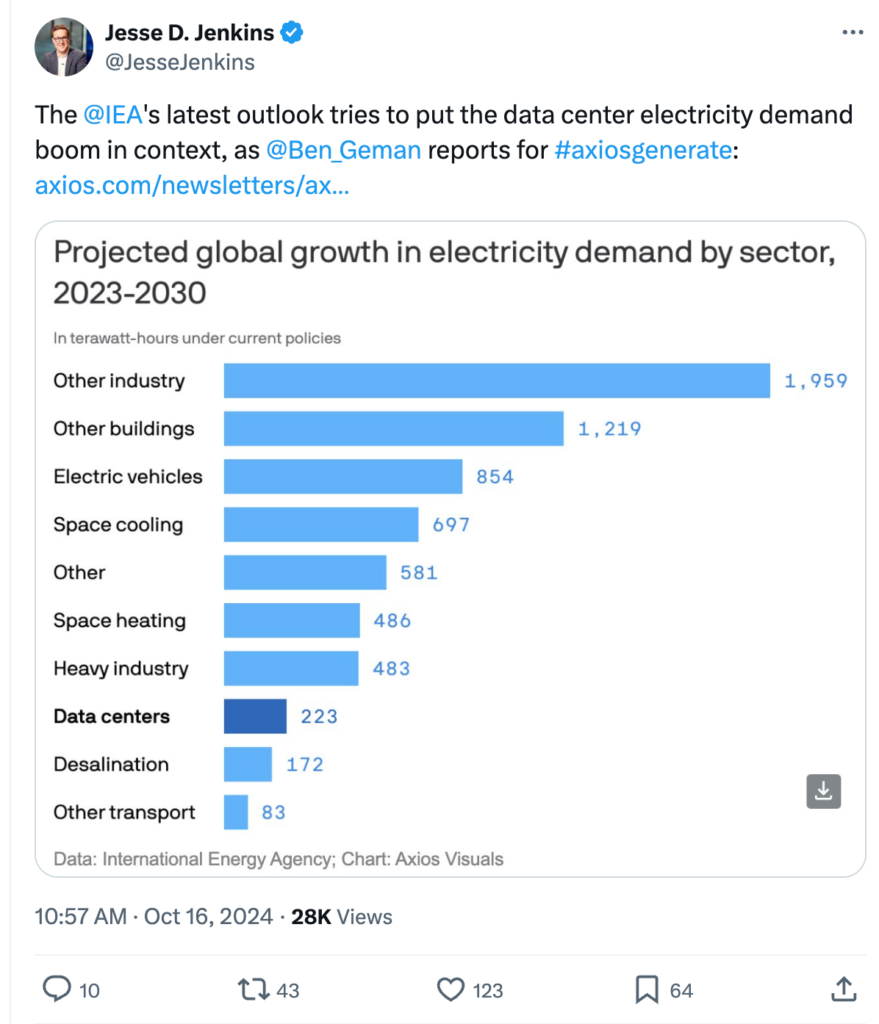

This year, in light of heightened geopolitical risks and uncertainties, the IEA explores “sensitivities” around its core outlook. These include slower (or faster) uptake of electric vehicles (EVs), as well as faster growth in data-centre loads and more heatwave-driven demand for air conditioning.

The agency maintains that, even when these sensitivities are combined, global demand for coal, oil and gas – as well as CO2 emissions – would peak no more than a few years later than expected.

(See Carbon Brief’s coverage of previous IEA world energy outlooks from 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016 and 2015.)

World energy outlook

The IEA’s annual World Energy Outlook (WEO) is published every autumn. It is widely regarded as one of the most influential annual contributions to the understanding of climate and energy trends.

The outlook explores a range of scenarios, representing different possible futures for the global energy system. These are developed using the IEA’s “Global Energy and Climate Model”.

The 1.5C-compatible “net-zero emissions by 2050” (NZE) scenario was introduced in 2021 and updated in September 2023. The NZE is revised again in the WEO 2024 to reflect the fact that global CO2 emissions reached another record high last year, rather than falling.

The report says that the path to 1.5C is “increasingly narrow, but still achievable”. However, it adds:

“Every year in which global emissions rise and actions fall short of what is needed for the future makes this pathway steeper and harder to climb.”

Alongside the NZE is the “announced pledges scenario” (APS), in which governments are given the benefit of the doubt and assumed to meet all of their climate goals on time and in full.

Finally, the “stated policies scenario” (STEPS) represents “the prevailing direction of travel for the energy system, based on a detailed assessment of current policy settings”. Here, the IEA looks not at what governments are saying, but what they are actually doing.

Annex B of the report breaks down the policies and targets included in each scenario. In effect, the IEA is judging the seriousness of each target and whether it will be followed through.

For example, the provisions of the European Green Deal are included in the STEPS. But the EU target to cut emissions to 55% below 1990 levels by 2030 is only met under the APS.

Since last year’s report, some 38 countries responsible for a third of global energy-related CO2 emissions have introduced new clean-energy measures, the IEA says.

It mentions South Korea’s 11th electricity plan, which “includes a significant expansion of nuclear, wind and solar”, and the new UK government “lift[ing] the de-facto ban on new onshore wind”.

(It says there have also been “some rollbacks” of climate policy over the past year, such as Javier Milei’s reforms in Argentina, but the global impact of these is “relatively small”.)

The report emphasises that “none of the scenarios should be viewed as a forecast”. It adds:

“Our scenario analysis is designed to inform decisionmakers as they consider options, not to predict how they will act.”

Earlier this year, some US politicians and analysts criticised the IEA’s work, in particular, its suggestion in WEO 2023 that demand for oil, coal and gas would each peak before 2030. They also argued that the IEA was straying from its core focus on energy security.

At the time, the agency defended its approach in a response to Senate Republicans.

This year’s edition goes on to reiterate the IEA’s view that fossil fuels will peak this decade – and pushes back on the idea that climate change and clean energy are outside its mission.

It says that “more efficient, cleaner energy systems can reduce energy security risks” and that a “comprehensive approach to energy security…needs to extend beyond traditional fuels”.

In his foreword to the report, IEA executive director Fatih Birol adds:

“The concept of energy security goes well beyond safeguarding against traditional risks to oil and natural gas supplies, as important as that remains for the global economy.”

He says that, in addition to those issues, energy security includes access to affordable energy supplies, secure supply chains for clean-energy technologies and dealing with the rising threat of extreme weather disruption to energy systems. Birol’s foreword continues:

“The analysis in this year’s outlook reinforces my long-held conviction that energy security and climate action go hand-in-hand…This is because deploying cost-competitive clean energy technologies represents a lasting solution not only for bringing down emissions, but also for reducing reliance on fuels that have been prone to volatility and disruption.”

Discussing the controversy over fossil-fuel peaking in a press briefing to launch this year’s report, Birol said that the latest data – and the outlooks of several major international oil and gas companies – had “confirmed and reconfirmed” the IEA’s position on oil demand.

Birol said press reports had described the latest data as “vindication” for the IEA’s forecast of minimal growth in oil demand this year. But he added: “It’s not a vindication of the IEA, it’s a vindication of numbers and objective analysis.”

Nevertheless, this year’s outlook puts extra emphasis on the uncertainty surrounding its scenarios. It devotes an entire chapter to exploring “sensitivities”, such as slower growth in EV sales or a more rapid escalation of heatwaves driving demand for air conditioning.

Even when these sensitivities are combined in ways that would slow climate action, however, the IEA says that oil demand still peaks and begins to decline by 2035. Similarly, global CO2 emissions would be less than 2% higher in 2030 and 1% in 2035 than in the core outlook.

‘Age of electricity’

A central theme of this year’s outlook is the idea that the global energy system is entering a new era, defined by rapid growth in electricity demand and a surge in clean electricity supplies.

In a press release accompanying the report, Birol calls this new era the “age of electricity”, in contrast to the earlier “age of coal” and “age of oil”. (The “golden age of gas”, predicted by the IEA in 2012, was prematurely brought to an end by the global energy crisis, driven by high gas prices.)

Birol says “the future of the energy system is electric” and that it is “moving at speed” towards “increasingly be[ing] based on clean sources of electricity”. In the report foreword he adds:

“The latest outlook also confirms that the contours of a new, more electrified energy system are becoming increasingly evident, with major implications on how we meet rising demand for energy services. Clean electricity is the future, and one of the striking findings of this outlook is how fast demand for electricity is set to rise, with the equivalent of the electricity use of the world’s ten largest cities being added to global demand each year.”

The IEA says that electricity demand is set to rise six times faster than global energy demand overall, in the years out to 2035, having only been twice as fast since 2010.

Moreover, despite a rapid acceleration in recent years, clean electricity has not yet grown fast enough to meet rising demand, leaving space for fossil-fueled power to continue expanding.

Global solar capacity is now 40-times larger than it was in 2010 and wind six times larger, the outlook notes, and a record 560 gigawatts (GW) of renewables were added in 2023.

Yet growth in clean electricity supplies has still fallen short of rising demand, meaning coal power has climbed 23% since 2010 and gas by 36%, raising emissions in the sector by 20%.

This is now set to change. The report says:

“It is now cheaper to build onshore wind and solar power projects than new fossil-fuel plants almost everywhere around the world, and the economic arguments remain strong even when considering the accompanying investment required to cope with their variability of generation.”

Renewables are only on track to expand 2.7-fold from 2022 to 2030 – short of the tripling target set at COP28 – but clean electricity will still outstrip rising demand, out to 2030 and beyond.

The IEA data shows that the amount of electricity generated from solar power alone is set to quadruple from 2023 levels by 2030 – and to climb more than nine-fold by 2050.

This means that solar will overtake nuclear, hydro and wind in 2026, gas in 2031 – and then coal by 2033 – to become the world’s largest source of electricity, as shown in the figure below.

Along with a doubling of wind generation and more modest gains for nuclear and hydro by 2030, clean electricity will push coal power into reverse, declining 13% by 2030 and 34% by 2035.

(The outlook sees modest growth of 6% by 2030 for gas power, but most of this would be erased by 2035 as clean electricity supplies continue to expand.)

The IEA says that China was responsible for 60% of worldwide renewable installations last year – and will add 60% of new capacity out to 2030. This means that by the early 2030s, solar generation in China alone is set to exceed the US’ current total electricity demand.

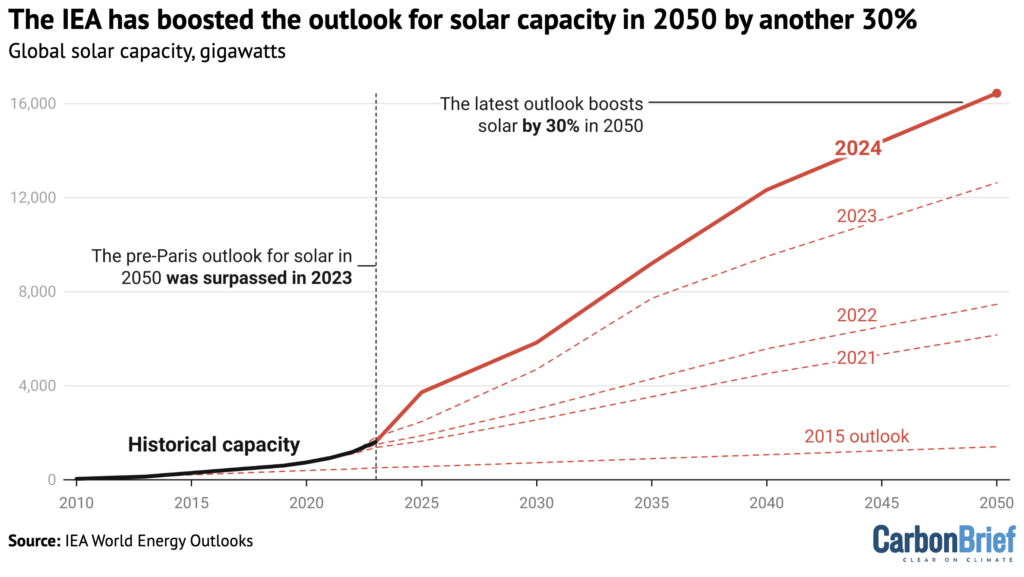

Notably, this year’s report includes another significant boost to the outlook for solar under current policy settings.

The IEA now sees global solar capacity exceeding 16,000GW by 2050, some 30% higher than expected last year and nearly 11-times higher than it thought in 2015, as shown in the figure below.

By 2023, the world had already installed 1,610GW of solar capacity. This comfortably exceeded the 1,405GW of capacity that the IEA had expected in 2050, under prevailing policy settings in its 2015 world energy outlook, released before the Paris Agreement later that year.

Similarly, this year’s outlook says battery storage capacity will reach 1,630GW by 2030. Only two years ago, it had said battery capacity would reach just 1,296GW by 2050.

In addition to raising the outlook for solar and storage, however, this year’s report also includes significantly higher global electricity demand, which has been revised upwards by 5% in 2030.

This 1,700 terawatt-hour (TWh) revision to global demand in 2030 – nearly equivalent to current electricity use in India – is much larger than the 1,000TWh adjustment for solar.

As a result, the IEA has also raised its outlook for coal power in 2030 by nearly 900TWh.

The IEA says that higher electricity demand is “mainly” down to “increased light industry activity, notably in China, much of it associated with a rapid rise in clean-technology manufacturing”.

Other factors include faster-than-expected adoption of EVs, more rapid electrification in industry in developing countries and the rise of data centres.

(The IEA, nevertheless, pours cold water on over-hyped reporting of AI-driven growth in data-centre electricity demand, which it sees accounting for barely 3% of growth to 2030, overall.)

Alongside growth in wind and solar, the report stresses the need for “a wide set of dispatchable low-emissions sources, including hydropower, bioenergy and nuclear power”.

It also emphasises the need for rising investment in electricity grids and storage. Spending in these areas is currently only two-thirds of investment in renewables, whereas parity will be needed to facilitate clean electricity expansion and ensure resilience to extreme weather and cyberattacks.

Fossil fuels peak by 2030

The “age of electricity” will have important implications for the current fossil-fuelled energy system, the report says. These include a reduction in the rate of global energy demand growth, even as demand for “energy services” – such as heat and mobility – rises rapidly in the developing world.

Explaining this apparent paradox, the IEA says that much of the energy released by burning fossil fuels is lost as waste heat. In contrast, a “more electrified, renewables-rich system is inherently more efficient”. This means less energy will be required to deliver the same energy services.

For example, electric technologies such as EVs and heat pumps deliver mobility and heat much more efficiently than internal combustion engines or fossil fuel boilers, the report says.

As the “age of electricity” gains pace, sources of energy demand across all sectors of the economy will be increasingly electrified, including heating, cooling, mobility and industrial processes.

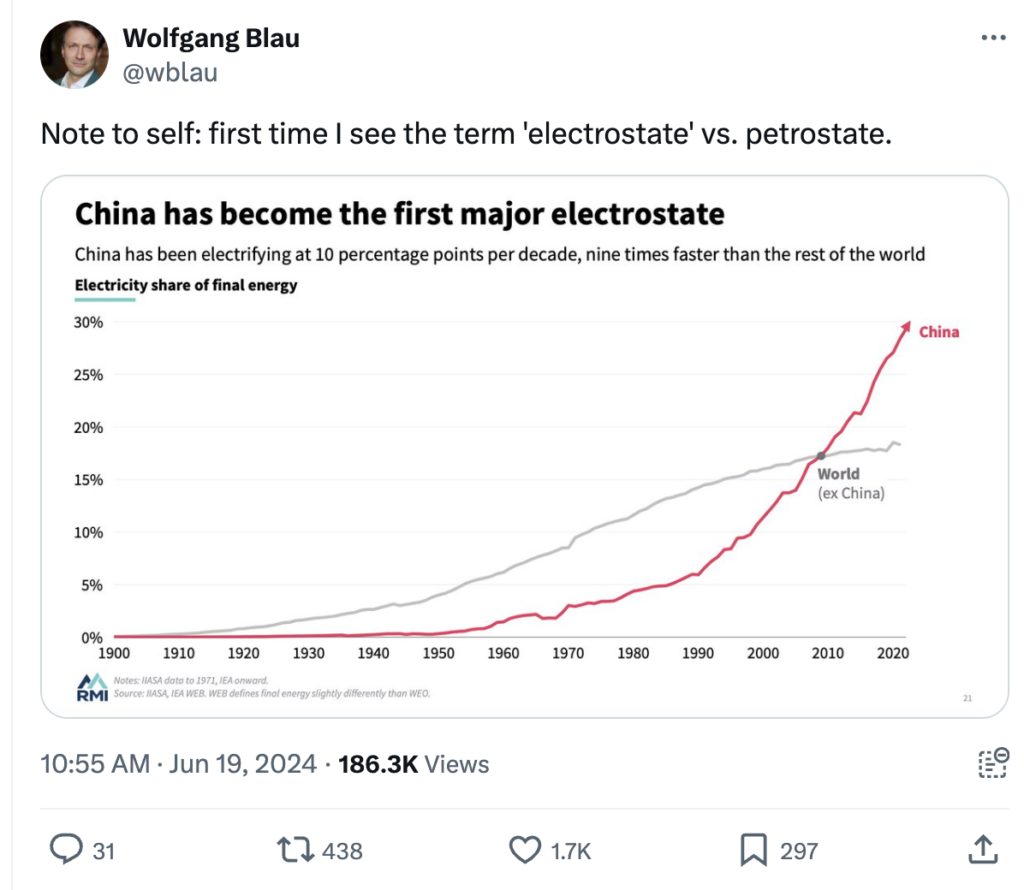

This means the share of final energy consumption met by electricity will rise from 17% in 2010 and 20% in 2023 to 24% by 2030 and 32% by 2050, the outlook says – a more than 50% rise on current levels of electrification.

(Earlier this year, the Rocky Mountain Institute said China had “leapfrogged” other major countries in terms of rapid electrification, becoming what it termed the “first major electrostate”. Electricity already accounts for 26% of its energy consumption and will reach nearly 45% by 2050.)

Notably, the IEA has also been edging up its outlook for electrification, reflecting repeated boosts to its view on the deployment of electric technologies such as EVs and heat pumps. In 2015, it only expected electricity to meet 26% of final demand in 2050.

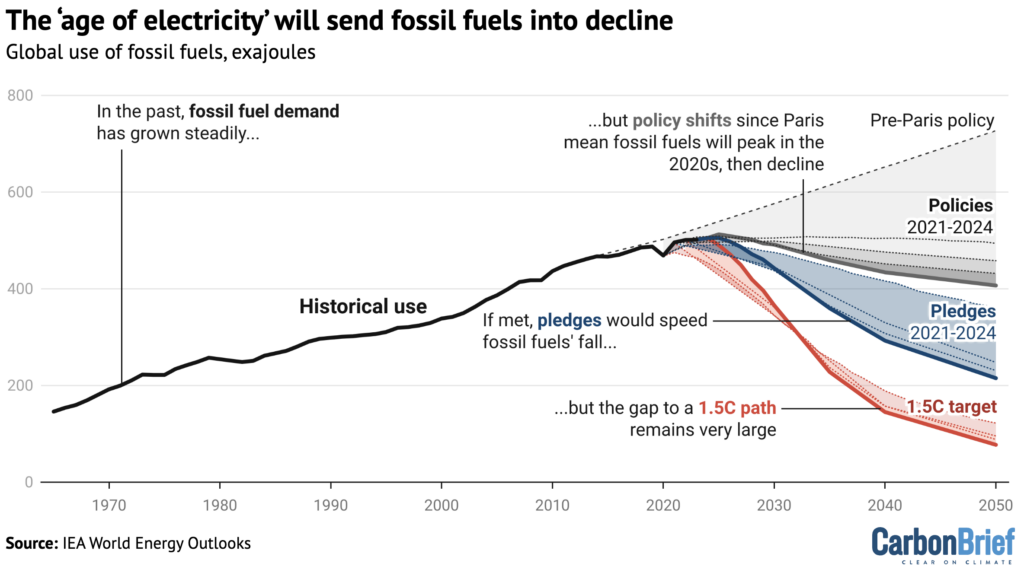

The rise of electrification, fed by expanding clean electricity sources, is now on the cusp of sending fossil fuels into decline, the outlook shows. As noted above, this year’s report reiterates the agency’s view that coal, oil and gas will each reach a peak this decade. It says:

“In the STEPS, coal demand begins to decline around 2025, while oil and natural gas demand both peak towards the end of the decade.”

Indeed, the outlook data shows global energy supply growing 34EJ (5%) by 2030, with this growth easily outpaced by clean-energy expansion of 48EJ (44%). As a result, fossil fuels in aggregate will be pushed into decline, as shown in the figure below.

The chart above shows how shifts in the global policy and technology landscape since the 2015 Paris Agreement have transformed the outlook for fossil-fuel growth.

Instead of the continuation of historical growth rates expected before Paris, the IEA has in recent years shifted its outlook, to a peak and increasingly steep decline in fossil-fuel demand.

Indeed, this year’s report points to fossil-fuel demand under current policy settings declining at a rate that is nearly in line with the climate pledges countries had made in 2021.

For example, the report says that China’s rapid uptake of EVs is spurring a “major slowdown” in oil demand growth globally, which is “wrong-footing oil producers”. It explains:

“China has been the engine of oil-market growth in recent decades, but that engine is now switching over to electricity.”

Indeed, the rise of electric mobility around the world is set to displace 6mb/d of oil demand by 2030, the outlook says, up from the 4mb/d it expected last year.

It notes that despite negative reporting, global EV sales were up 25% in the first half of 2024, with China accounting for 80% of the increase, but the rest of the world’s market also up 10%.

Nevertheless, the chart above illustrates the large gap between the current trajectory of the global energy system and what would be needed to meet existing national climate pledges, let alone the Paris Agreement target of limiting warming to “well-below” 2C or 1.5C.

Insufficient progress on emissions

This year’s outlook puts the gap between climate ambition and the world’s current trajectory into stark relief, saying that prevailing policy settings would likely see warming reach 2.4C this century.

Reflecting the marginally higher outlook for coal use in the short term, but more rapid fossil fuel declines in the medium and longer terms, this 2.4C assessment is the same as last year’s report.

This combination of changes is illustrated in the figure below, showing how the outlook for global energy-related CO2 emissions (grey line) has changed since 2015 (dashes). The IEA now says CO2 emissions will peak “imminently”, with its data pointing towards a peak in 2025.

(Last year, the outlook said emissions would peak by 2025 at the latest.)

The chart above illustrates how new policies and technological progress since the Paris Agreement are bending the curve of global CO2 emissions away from the 3.5C of warming expected in 2015.

Still, it also shows the massive gap that would need to be bridged in order to meet national climate pledges for 2030 and for reaching net-zero emissions by mid-century (blue line). And it shows the huge scale of the gap to the “increasingly narrow, but still achievable” path to 1.5C.

While current policy settings would cut global CO2 emissions to 4% below 2023 levels by 2030, according to the IEA, a far larger 33% reduction would be needed for 1.5C.

A separate report from the IEA, published last month, shows how countries could close most of this gap “by fully implementing the 2030 goals they agreed at COP28”.

These goals included doubling the rate of energy efficiency improvements and tripling global renewable capacity by 2030. Together, these two elements “could provide larger emissions reductions by 2030 than anything else”, the outlook says.

It reinforces the key changes that would be needed to get on track for current climate pledges – which would limit warming in 2100 to around 1.7C – or to limit warming to 1.5C.

In broad terms, this would mean even faster electrification and deployment of clean-energy technologies, as well as taking rapid action to cut methane emissions from the oil and gas industry.

(Instead of electricity’s share of final energy use increasing from 20% to 32% by 2050, as under current policy settings, electrification rates would double to 42% by 2050, if climate pledges are met, and would nearly triple to 55%, if the world gets on track for 1.5C.)

More specifically, the IEA points to “seven key clean-energy technologies”: solar; wind; nuclear; EVs; heat pumps; low-emissions hydrogen; and carbon capture and storage.

The report says the world has “the need and the capacity to go much faster” in these areas, which – unlike the current trajectory – would bring global emissions into a “meaningful decline”.

Spotlighting the need for a positive outcome in upcoming climate-finance discussions at the COP29 UN summit in November in Baku, Azerbaijan, the IEA says that high financing costs and project risks are limiting the spread of these clean-energy technologies in developing countries.

Concluding his report foreword, the IEA’s Birol emphasises the choices facing governments, investors and consumers. He writes:

“This WEO highlights, once again, the choices that can move the energy system in a safer and more sustainable direction. I urge decision makers around the world to use this analysis to understand how the energy landscape is changing, and how to accelerate this clean energy transformation in ways that benefit people’s lives and future prosperity.”

The outlook warns that decisionmakers “too often entrench the flaws in today’s energy system, rather than pushing it towards a cleaner and safer path”. It adds: “[L]ocking in fossil fuel use has consequences…the costs of climate inaction…grow higher by the day.”

The post Analysis: Solar surge will send coal power tumbling by 2030, IEA data reveals appeared first on Carbon Brief.

Analysis: Solar surge will send coal power tumbling by 2030, IEA data reveals

Greenhouse Gases

DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Absolute State of the Union

‘DRILL, BABY’: US president Donald Trump “doubled down on his ‘drill, baby, drill’ agenda” in his State of the Union (SOTU) address, said the Los Angeles Times. He “tout[ed] his support of the fossil-fuel industry and renew[ed] his focus on electricity affordability”, reported the Financial Times. Trump also attacked the “green new scam”, noted Carbon Brief’s SOTU tracker.

COAL REPRIEVE: Earlier in the week, the Trump administration had watered down limits on mercury pollution from coal-fired power plants, reported the Financial Times. It remains “unclear” if this will be enough to prevent the decline of coal power, said Bloomberg, in the face of lower-cost gas and renewables. Reuters noted that US coal plants are “ageing”.

OIL STAY: The US Supreme Court agreed to hear arguments brought by the oil industry in a “major lawsuit”, reported the New York Times. The newspaper said the firms are attempting to head off dozens of other lawsuits at state level, relating to their role in global warming.

SHIP-SHILLING: The Trump administration is working to “kill” a global carbon levy on shipping “permanently”, reported Politico, after succeeding in delaying the measure late last year. The Guardian said US “bullying” could be “paying off”, after Panama signalled it was reversing its support for the levy in a proposal submitted to the UN shipping body.

Around the world

- RARE EARTHS: The governments of Brazil and India signed a deal on rare earths, said the Times of India, as well as agreeing to collaborate on renewable energy.

- HEAT ROLLBACK: German homes will be allowed to continue installing gas and oil heating, under watered-down government plans covered by Clean Energy Wire.

- BRAZIL FLOODS: At least 53 people died in floods in the state of Minas Gerais, after some areas saw 170mm of rain in a few hours, reported CNN Brasil.

- ITALY’S ATTACK: Italy is calling for the EU to “suspend” its emissions trading system (ETS) ahead of a review later this year, said Politico.

- COOKSTOVE CREDITS: The first-ever carbon credits under the Paris Agreement have been issued to a cookstove project in Myanmar, said Climate Home News.

- SAUDI SOLAR: Turkey has signed a “major” solar deal that will see Saudi firm ACWA building 2 gigawatts in the country, according to Agence France-Presse.

$467 billion

The profits made by five major oil firms since prices spiked following Russia’s invasion of Ukraine four years ago, according to a report by Global Witness covered by BusinessGreen.

Latest climate research

- Claims about the “fingerprint” of human-caused climate change, made in a recent US Department of Energy report, are “factually incorrect” | AGU Advances

- Large lakes in the Congo Basin are releasing carbon dioxide into the atmosphere from “immense ancient stores” | Nature Geoscience

- Shared Socioeconomic Pathways – scenarios used regularly in climate modelling – underrepresent “narratives explicitly centring on democratic principles such as participation, accountability and justice” | npj Climate Action

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

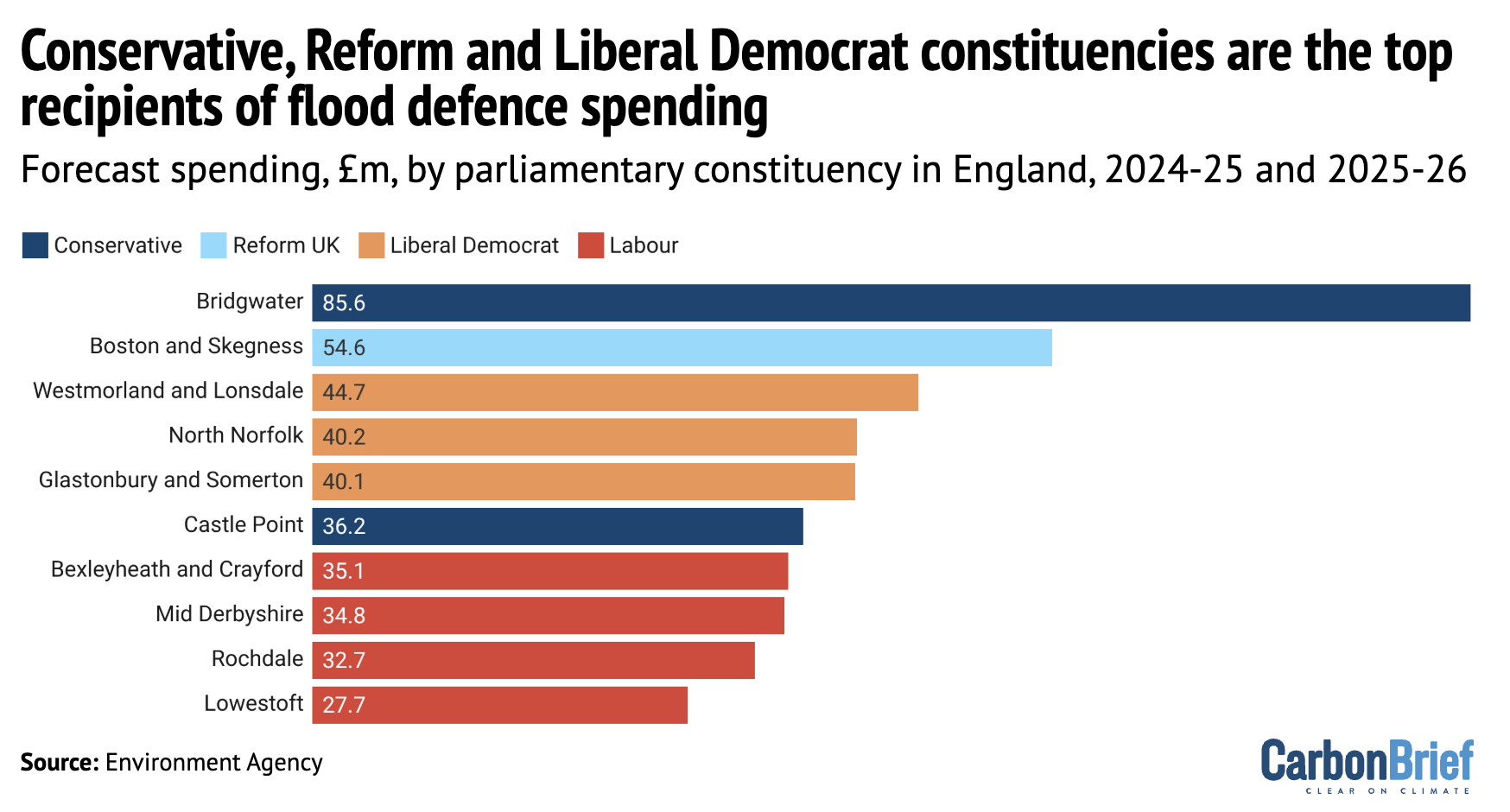

The constituency of Richard Tice MP, the climate-sceptic deputy leader of Reform UK, is the second-largest recipient of flood defence spending in England, according to new Carbon Brief analysis. Overall, the funding is disproportionately targeted at coastal and urban areas, many of which have Conservative or Liberal Democrat MPs.

Spotlight

Is there really a UK ‘greenlash’?

This week, after a historic Green Party byelection win, Carbon Brief looks at whether there really is a “greenlash” against climate policy in the UK.

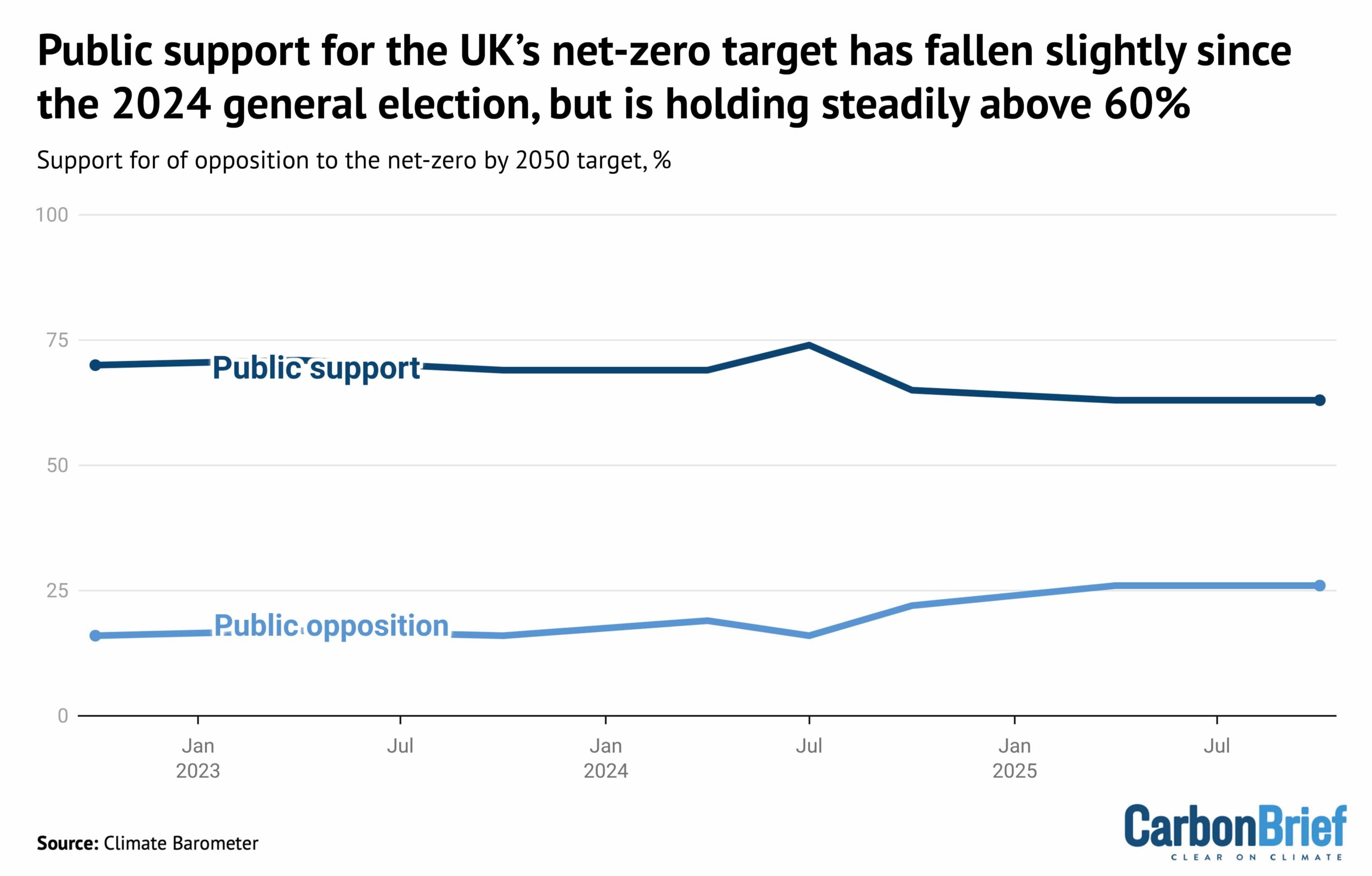

Over the past year, the UK’s political consensus on climate change has been shattered.

Yet despite a sharp turn against climate action among right-wing politicians and right-leaning media outlets, UK public support for climate action remains strong.

Prof Federica Genovese, who studies climate politics at the University of Oxford, told Carbon Brief:

“The current ‘war’ on green policy is mostly driven by media and political elites, not by the public.”

Indeed, there is still a greater than two-to-one majority among the UK public in favour of the country’s legally binding target to reach net-zero emissions by 2050, as shown below.

Steve Akehurst, director of public-opinion research initiative Persuasion UK, also noted the growing divide between the public and “elites”. He told Carbon Brief:

“The biggest movement is, without doubt, in media and elite opinion. There is a bit more polarisation and opposition [to climate action] among voters, but it’s typically no more than 20-25% and mostly confined within core Reform voters.”

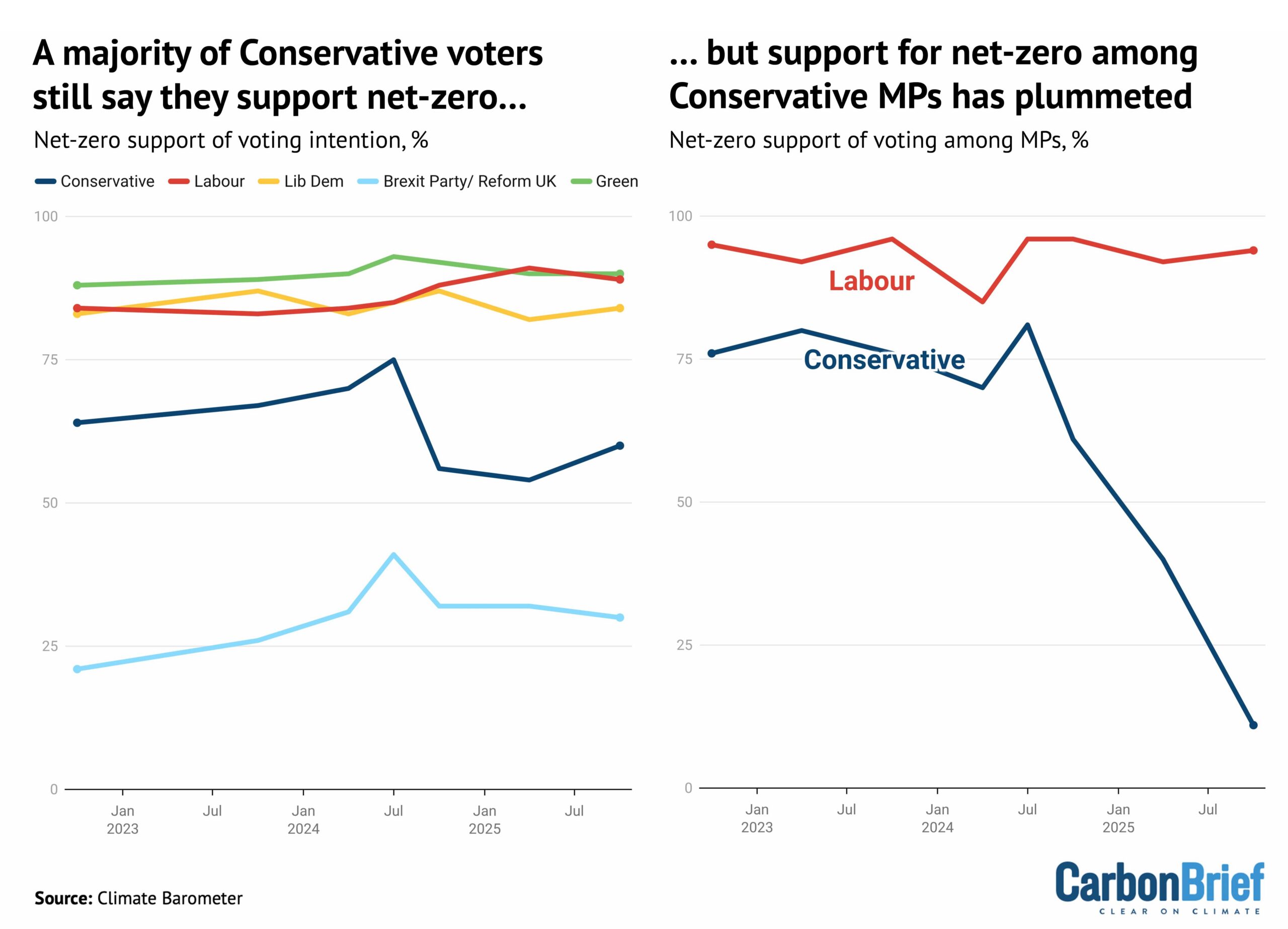

Conservative gear shift

For decades, the UK had enjoyed strong, cross-party political support for climate action.

Lord Deben, the Conservative peer and former chair of the Climate Change Committee, told Carbon Brief that the UK’s landmark 2008 Climate Change Act had been born of this cross-party consensus, saying “all parties supported it”.

Since their landslide loss at the 2024 election, however, the Conservatives have turned against the UK’s target of net-zero emissions by 2050, which they legislated for in 2019.

Curiously, while opposition to net-zero has surged among Conservative MPs, there is majority support for the target among those that plan to vote for the party, as shown below.

Dr Adam Corner, advisor to the Climate Barometer initiative that tracks public opinion on climate change, told Carbon Brief that those who currently plan to vote Reform are the only segment who “tend to be more opposed to net-zero goals”. He said:

“Despite the rise in hostile media coverage and the collapse of the political consensus, we find that public support for the net-zero by 2050 target is plateauing – not plummeting.”

Reform, which rejects the scientific evidence on global warming and campaigns against net-zero, has been leading the polls for a year. (However, it was comfortably beaten by the Greens in yesterday’s Gorton and Denton byelection.)

Corner acknowledged that “some of the anti-net zero noise…[is] showing up in our data”, adding:

“We see rising concerns about the near-term costs of policies and an uptick in people [falsely] attributing high energy bills to climate initiatives.”

But Akehurst said that, rather than a big fall in public support, there had been a drop in the “salience” of climate action:

“So many other issues [are] competing for their attention.”

UK newspapers published more editorials opposing climate action than supporting it for the first time on record in 2025, according to Carbon Brief analysis.

Global ‘greenlash’?

All of this sits against a challenging global backdrop, in which US president Donald Trump has been repeating climate-sceptic talking points and rolling back related policy.

At the same time, prominent figures have been calling for a change in climate strategy, sold variously as a “reset”, a “pivot”, as “realism”, or as “pragmatism”.

Genovese said that “far-right leaders have succeeded in the past 10 years in capturing net-zero as a poster child of things they are ‘fighting against’”.

She added that “much of this is fodder for conservative media and this whole ecosystem is essentially driving what we call the ‘greenlash’”.

Corner said the “disconnect” between elite views and the wider public “can create problems” – for example, “MPs consistently underestimate support for renewables”. He added:

“There is clearly a risk that the public starts to disengage too, if not enough positive voices are countering the negative ones.”

Watch, read, listen

TRUMP’S ‘PETROSTATE’: The US is becoming a “petrostate” that will be “sicker and poorer”, wrote Financial Times associate editor Rana Forohaar.

RHETORIC VS REALITY: Despite a “political mood [that] has darkened”, there is “more green stuff being installed than ever”, said New York Times columnist David Wallace-Wells.

CHINA’S ‘REVOLUTION’: The BBC’s Climate Question podcast reported from China on the “green energy revolution” taking place in the country.

Coming up

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean, Brasília

- 3 March: UK spring statement

- 4-11 March: China’s “two sessions”

- 5 March: Nepal elections

Pick of the jobs

- The Guardian, senior reporter, climate justice | Salary: $123,000-$135,000. Location: New York or Washington DC

- China-Global South Project, non-resident fellow, climate change | Salary: Up to $1,000 a month. Location: Remote

- University of East Anglia, PhD in mobilising community-based climate action through co-designed sports and wellbeing interventions | Salary: Stipend (unknown amount). Location: Norwich, UK

- TABLE and the University of São Paulo, Brazil, postdoctoral researcher in food system narratives | Salary: Unknown. Location: Pirassununga, Brazil

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’? appeared first on Carbon Brief.

Greenhouse Gases

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

The Lincolnshire constituency held by Richard Tice, the climate-sceptic deputy leader of the hard-right Reform party, has been pledged at least £55m in government funding for flood defences since 2024.

This investment in Boston and Skegness is the second-largest sum for a single constituency from a £1.4bn flood-defence fund for England, Carbon Brief analysis shows.

Flooding is becoming more likely and more extreme in the UK due to climate change.

Yet, for years, governments have failed to spend enough on flood defences to protect people, properties and infrastructure.

The £1.4bn fund is part of the current Labour government’s wider pledge to invest a “record” £7.9bn over a decade on protecting hundreds of thousands of homes and businesses from flooding.

As MP for one of England’s most flood-prone regions, Tice has called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

He is also one of Reform’s most vocal opponents of climate action and what he calls “net stupid zero”. He denies the scientific consensus on climate change and has claimed, falsely and without evidence, that scientists are “lying”.

Flood defences

Last year, the government said it would invest £2.65bn on flood and coastal erosion risk management (FCERM) schemes in England between April 2024 and March 2026.

This money was intended to protect 66,500 properties from flooding. It is part of a decade-long Labour government plan to spend more than £7.9bn on flood defences.

There has been a consistent shortfall in maintaining England’s flood defences, with the Environment Agency expecting to protect fewer properties by 2027 than it had initially planned.

The Climate Change Committee (CCC) has attributed this to rising costs, backlogs from previous governments and a lack of capacity. It also points to the strain from “more frequent and severe” weather events, such as storms in recent years that have been amplified by climate change.

However, the CCC also said last year that, if the 2024-26 spending programme is delivered, it would be “slightly closer to the track” of the Environment Agency targets out to 2027.

The government has released constituency-level data on which schemes in England it plans to fund, covering £1.4bn of the 2024-26 investment. The other half of the FCERM spending covers additional measures, from repairing existing defences to advising local authorities.

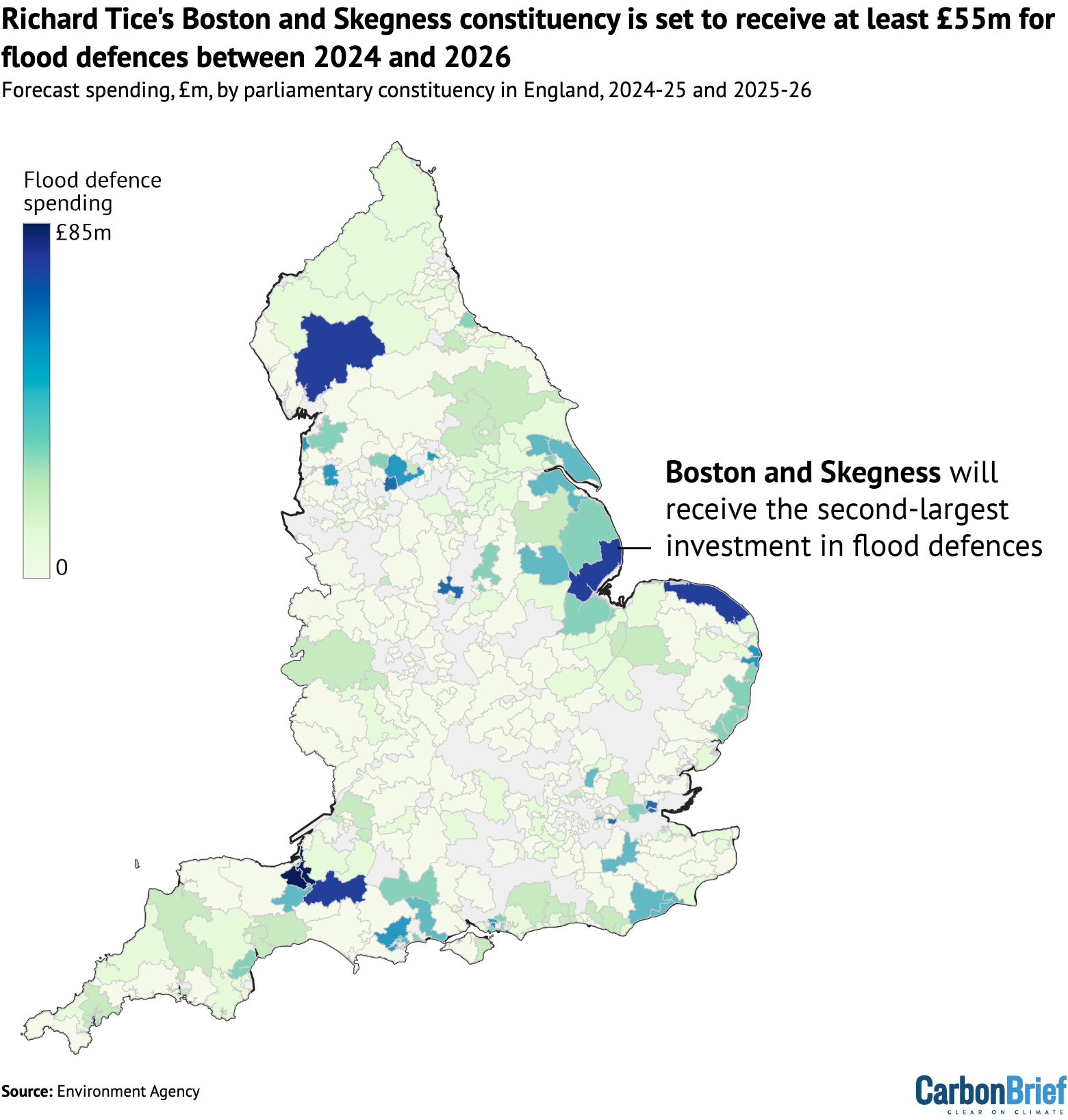

The map below shows the distribution of spending on FCERM schemes in England over the past two years, highlighting the constituency of Richard Tice.

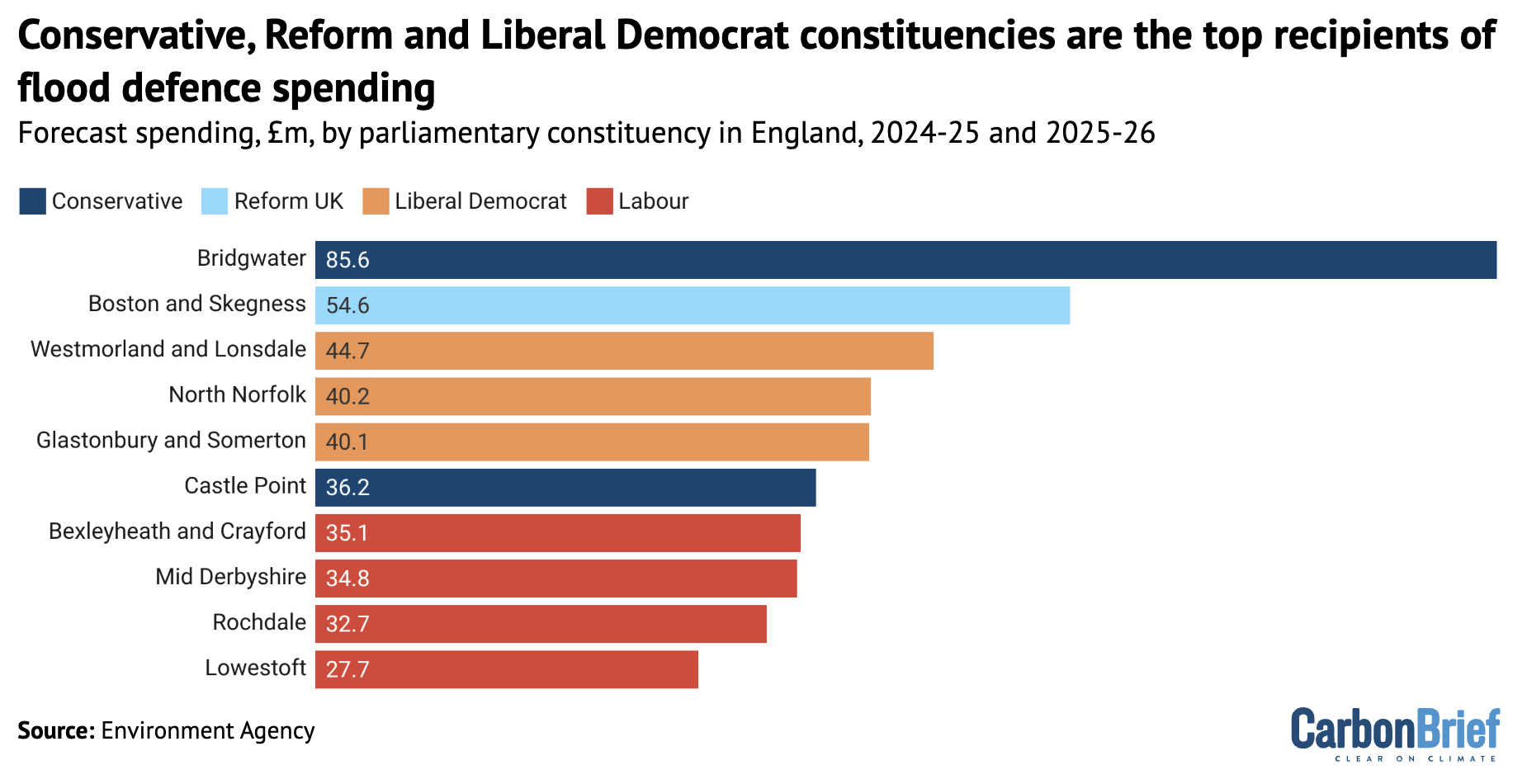

By far the largest sum of money – £85.6m in total – has been committed to a tidal barrier and various other defences in the Somerset constituency of Bridgwater, the seat of Conservative MP Ashley Fox.

Over the first months of 2026, the south-west region has faced significant flooding and Fox has called for more support from the government, citing “climate patterns shifting and rainfall intensifying”.

He has also backed his party’s position that “the 2050 net-zero target is impossible” and called for more fossil-fuel extraction in the North Sea.

Tice’s east-coast constituency of Boston and Skegness, which is highly vulnerable to flooding from both rivers and the sea, is set to receive £55m. Among the supported projects are beach defences from Saltfleet to Gibraltar Point and upgrades to pumping stations.

Overall, Boston and Skegness has the second-largest portion of flood-defence funding, as the chart below shows. Constituencies with Conservative and Liberal Democrat MPs occupied the other top positions.

Overall, despite Labour MPs occupying 347 out of England’s 543 constituencies – nearly two-thirds of the total – more than half of the flood-defence funding was distributed to constituencies with non-Labour MPs. This reflects the flood risk in coastal and rural areas that are not traditional Labour strongholds.

Reform funding

While Reform has just eight MPs, representing 1% of the population, its constituencies have been assigned 4% of the flood-defence funding for England.

Nearly all of this money was for Tice’s constituency, although party leader Nigel Farage’s coastal Clacton seat in Kent received £2m.

Reform UK is committed to “scrapping net-zero” and its leadership has expressed firmly climate-sceptic views.

Much has been made of the disconnect between the party’s climate policies and the threat climate change poses to its voters. Various analyses have shown the flood risk in Reform-dominated areas, particularly Lincolnshire.

Tice has rejected climate science, advocated for fossil-fuel production and criticised Environment Agency flood-defence activities. Yet, he has also called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

This may reflect Tice’s broader approach to climate change. In a 2024 interview with LBC, he said:

“Where you’ve got concerns about sea level defences and sea level rise, guess what? A bit of steel, a bit of cement, some aggregate…and you build some concrete sea level defences. That’s how you deal with rising sea levels.”

While climate adaptation is viewed as vital in a warming world, there are limits on how much societies can adapt and adaptation costs will continue to increase as emissions rise.

The post Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding appeared first on Carbon Brief.

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

Greenhouse Gases

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

We handpick and explain the most important stories at the intersection of climate, land, food and nature over the past fortnight.

This is an online version of Carbon Brief’s fortnightly Cropped email newsletter.

Subscribe for free here.

Key developments

Food inflation on the rise

DELUGE STRIKES FOOD: Extreme rainfall and flooding across the Mediterranean and north Africa has “battered the winter growing regions that feed Europe…threatening food price rises”, reported the Financial Times. Western France has “endured more than 36 days of continuous rain”, while farmers’ associations in Spain’s Andalusia estimate that “20% of all production has been lost”, it added. Policy expert David Barmes told the paper that the “latest storms were part of a wider pattern of climate shocks feeding into food price inflation”.

-

Sign up to Carbon Brief’s free “Cropped” email newsletter. A fortnightly digest of food, land and nature news and views. Sent to your inbox every other Wednesday.

NO BEEF: The UK’s beef farmers, meanwhile, “face a double blow” from climate change as “relentless rain forces them to keep cows indoors”, while last summer’s drought hit hay supplies, said another Financial Times article. At the same time, indoor growers in south England described a 60% increase in electricity standing charges as a “ticking timebomb” that could “force them to raise their prices or stop production, which will further fuel food price inflation”, wrote the Guardian.

‘TINDERBOX’ AND TARIFFS: A study, covered by the Guardian, warned that major extreme weather and other “shocks” could “spark social unrest and even food riots in the UK”. Experts cited “chronic” vulnerabilities, including climate change, low incomes, poor farming policy and “fragile” supply chains that have made the UK’s food system a “tinderbox”. A New York Times explainer noted that while trade could once guard against food supply shocks, barriers such as tariffs and export controls – which are being “increasingly” used by politicians – “can shut off that safety valve”.

El Niño looms

NEW ENSO INDEX: Researchers have developed a new index for calculating El Niño, the large-scale climate pattern that influences global weather and causes “billions in damages by bringing floods to some regions and drought to others”, reported CNN. It added that climate change is making it more difficult for scientists to observe El Niño patterns by warming up the entire ocean. The outlet said that with the new metric, “scientists can now see it earlier and our long-range weather forecasts will be improved for it.”

WARMING WARNING: Meanwhile, the US Climate Prediction Center announced that there is a 60% chance of the current La Niña conditions shifting towards a neutral state over the next few months, with an El Niño likely to follow in late spring, according to Reuters. The Vibes, a Malaysian news outlet, quoted a climate scientist saying: “If the El Niño does materialise, it could possibly push 2026 or 2027 as the warmest year on record, replacing 2024.”

CROP IMPACTS: Reuters noted that neutral conditions lead to “more stable weather and potentially better crop yields”. However, the newswire added, an El Niño state would mean “worsening drought conditions and issues for the next growing season” to Australia. El Niño also “typically brings a poor south-west monsoon to India, including droughts”, reported the Hindu’s Business Line. A 2024 guest post for Carbon Brief explained that El Niño is linked to crop failure in south-eastern Africa and south-east Asia.

News and views

- DAM-AG-ES: Several South Korean farmers filed a lawsuit against the country’s state-owned utility company, “seek[ing] financial compensation for climate-related agricultural damages”, reported United Press International. Meanwhile, a national climate change assessment for the Philippines found that the country “lost up to $219bn in agricultural damages from typhoons, floods and droughts” over 2000-10, according to Eco-Business.

- SCORCHED GRASS: South Africa’s Western Cape province is experiencing “one of the worst droughts in living memory”, which is “scorching grass and killing livestock”, said Reuters. The newswire wrote: “In 2015, a drought almost dried up the taps in the city; farmers say this one has been even more brutal than a decade ago.”

- NOUVELLE VEG: New guidelines published under France’s national food, nutrition and climate strategy “urged” citizens to “limit” their meat consumption, reported Euronews. The delayed strategy comes a month after the US government “upended decades of recommendations by touting consumption of red meat and full-fat dairy”, it noted.

- COURTING DISASTER: India’s top green court accepted the findings of a committee that “found no flaws” in greenlighting the Great Nicobar project that “will lead to the felling of a million trees” and translocating corals, reported Mongabay. The court found “no good ground to interfere”, despite “threats to a globally unique biodiversity hotspot” and Indigenous tribes at risk of displacement by the project, wrote Frontline.

- FISH FALLING: A new study found that fish biomass is “falling by 7.2% from as little as 0.1C of warming per decade”, noted the Guardian. While experts also pointed to the role of overfishing in marine life loss, marine ecologist and study lead author Dr Shahar Chaikin told the outlet: “Our research proves exactly what that biological cost [of warming] looks like underwater.”

- TOO HOT FOR COFFEE: According to new analysis by Climate Central, countries where coffee beans are grown “are becoming too hot to cultivate them”, reported the Guardian. The world’s top five coffee-growing countries faced “57 additional days of coffee-harming heat” annually because of climate change, it added.

Spotlight

Nature talks inch forward

This week, Carbon Brief covers the latest round of negotiations under the UN Convention on Biological Diversity (CBD), which occurred in Rome over 16-19 February.

The penultimate set of biodiversity negotiations before October’s Conference of the Parties ended in Rome last week, leaving plenty of unfinished business.

The CBD’s subsidiary body on implementation (SBI) met in the Italian capital for four days to discuss a range of issues, including biodiversity finance and reviewing progress towards the nature targets agreed under the Kunming-Montreal Global Biodiversity Framework (GBF).

However, many of the major sticking points – particularly around finance – will have to wait until later this summer, leaving some observers worried about the capacity for delegates to get through a packed agenda at COP17.

The SBI, along with the subsidiary body on scientific, technical and technological advice (SBSTTA) will both meet in Nairobi, Kenya, later this summer for a final round of talks before COP17 kicks off in Yerevan, Armenia, on 19 October.

Money talks

Finance for nature has long been a sticking point at negotiations under the CBD.

Discussions on a new fund for biodiversity derailed biodiversity talks in Cali, Colombia, in autumn 2024, requiring resumed talks a few months later.

Despite this, finance was barely on the agenda at the SBI meetings in Rome. Delegates discussed three studies on the relationship between debt sustainability and implementation of nature plans, but the more substantive talks are set to take place at the next SBI meeting in Nairobi.

Several parties “highlighted concerns with the imbalance of work” on finance between these SBI talks and the next ones, reported Earth Negotiations Bulletin (ENB).

Lim Li Ching, senior researcher at Third World Network, noted that tensions around finance permeated every aspect of the talks. She told Carbon Brief:

“If you’re talking about the gender plan of action – if there’s little or no financial resources provided to actually put it into practice and implement it, then it’s [just] paper, right? Same with the reporting requirements and obligations.”

Monitoring and reporting

Closely linked to the issue of finance is the obligations of parties to report on their progress towards the goals and targets of the GBF.

Parties do so through the submission of national reports.

Several parties at the talks pointed to a lack of timely funding for driving delays in their reporting, according to ENB.

A note released by the CBD Secretariat in December said that no parties had submitted their national reports yet; by the time of the SBI meetings, only the EU had. It further noted that just 58 parties had submitted their national biodiversity plans, which were initially meant to be published by COP16, in October 2024.

Linda Krueger, director of biodiversity and infrastructure policy at the environmental not-for-profit Nature Conservancy, told Carbon Brief that despite the sparse submissions, parties are “very focused on the national report preparation”. She added:

“Everybody wants to be able to show that we’re on the path and that there still is a pathway to getting to 2030 that’s positive and largely in the right direction.”

Watch, read, listen

NET LOSS: Nigeria’s marine life is being “threatened” by “ghost gear” – nets and other fishing equipment discarded in the ocean – said Dialogue Earth.

COMEBACK CAUSALITY: A Vox long-read looked at whether Costa Rica’s “payments for ecosystem services” programme helped the country turn a corner on deforestation.

HOMEGROWN GOALS: A Straits Times podcast discussed whether import-dependent Singapore can afford to shelve its goal to produce 30% of its food locally by 2030.

‘RUSTING’ RIVERS: The Financial Times took a closer look at a “strange new force blighting the [Arctic] landscape”: rivers turning rust-orange due to global warming.

New science

- Lakes in the Congo Basin’s peatlands are releasing carbon that is thousands of years old | Nature Geoscience

- Natural non-forest ecosystems – such as grasslands and marshlands – were converted for agriculture at four times the rate of land with tree cover between 2005 and 2020 | Proceedings of the National Academy of Sciences

- Around one-quarter of global tree-cover loss over 2001-22 was driven by cropland expansion, pastures and forest plantations for commodity production | Nature Food

In the diary

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean | Brasília

- 5 March: Nepal general elections

- 9-20 March: First part of the thirty-first session of the International Seabed Authority (ISA) | Kingston, Jamaica

Cropped is researched and written by Dr Giuliana Viglione, Aruna Chandrasekhar, Daisy Dunne, Orla Dwyer and Yanine Quiroz.

Please send tips and feedback to cropped@carbonbrief.org

The post Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate appeared first on Carbon Brief.

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits