The post How Businesses Can Profit from Installing EV Chargers in 2026 appeared first on Cyanergy.

https://cyanergy.com.au/blog/how-businesses-can-profit-from-installing-ev-chargers-in-2026/

Renewable Energy

North Sea Summit, Vineyard Wind Back to Work

Weather Guard Lightning Tech

North Sea Summit, Vineyard Wind Back to Work

Allen, Joel, and Yolanda discuss the North Sea Summit where nine European countries committed to 100 gigawatts of offshore wind capacity and the massive economic impact that comes with it. They also break down the federal court ruling that allows Vineyard Wind to resume construction with a tight 45-day window before installation vessels leave. Plus GE Vernova’s Q4 results show $600 million in wind losses and Wind Power Lab CEO Lene Helstern raises concerns about blade quality across the industry.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

The Uptime Wind Energy Podcast brought to you by Strike Tape, protecting thousands of wind turbines from lightning damage worldwide. Visit strike tape.com. And now your hosts, Allen Hall, Rosemary Barnes, Joel Saxum, and Yolanda Padron.

Speaker 2: Welcome to the Uptime Wind Energy Podcast. I’m your host, Alln Hall. I’m here with Yolanda Padron and Joel Saxum.

Rosemary Barnes is snorkeling at the Greek Barrier Reef this week, uh, big news out of Northern Europe. Uh, the Northeast Summit, which happened in Hamburg, uh, about a week or so ago, nine European countries are. Making a huge commitment for offshore wind. So it’s the, the countries involved are Britain, Belgium, Denmark, France, Germany, Iceland, question Mark Ireland, Luxembourg, Netherlands, and Norway.

That together they want to develop [00:01:00] 100 gigawatts of offshore wind capacity in shared waters. Uh, that’s enough to power about. 85 million households and the PAC comes as Europe is trying to wean itself from natural gas from where they had it previously and the United States. Uh, so they, they would become electricity in independent.

Uh, and this is one way to do it. Two big happy, uh, companies. At the moment, Vattenfall who develops s lot offshore and Siemens gaa of course, are really excited by the news. If you run the numbers and you, you, you have a hundred gigawatts out in the water and you’re using 20 megawatt turbines, then you’re talking about 5,000 turbines in the water total.

That is a huge offshore wind order, and I, I think this would be great news for. Obviously Vestas and [00:02:00] Siemens cesa. Uh, the, the question is there’s a lot of political maneuvering that is happening. It looks like Belgium, uh, as a country is not super active and offshore and is rethinking it and trying to figure out where they want to go.

But I think the big names will stay, right? France and Germany, all in on offshore. Denmark will be Britain already is. So the question really is at the moment then. Can Siemens get back into the win game and start making money because they have projected themselves to be very profitable coming this year, into this year.

This may be the, the stepping stone, Joel.

Joel Saxum: Well, I think that, yeah, we talked about last week their 21 megawatt, or 21 and a half megawatt. I believe it is. Big new flagship going to be ready to roll, uh, with the big auctions happening like AR seven in the uk. Uh, and you know, that’s eight gigawatts, 8.4 gigawatts there.

People are gonna be, the, the order book’s gonna start to fill up, like [00:03:00]Siemens is, this is a possibility of a big turnaround. And to put some of these numbers in perspective, um, a hundred gigawatts of offshore wind. So what does that really mean? Right? Um, what it means is if you, if you take the, if you take two of the industrial big industrial powerhouses that are a part of this pact, the UK and Germany combine their total demand.

That’s a hundred gigawatt. That’s what they, that’s what their demand is basically on a, you know, today. Right? So that’s gonna continue to grow, right? As, uh, we electrify a lot of things. And the indus, you know, the, the next, the Industrial Revolution 4.0 or whatever we’re calling it now is happening. Um, that’s, that’s a possibility, right?

So this a hundred gigawatts of offshore wind. Is gonna drive jobs all up all over Europe. Right. This isn’t just a jobs at the port in Rotterdam or wherever it may be. Right? This is, this is manufacturing jobs, supply chain jobs, the same stuff we’ve been talking about on the podcast for a while here with [00:04:00] what the UK is doing with OWGP and the, or e Catapult and all the kind of the monies that the, the, the Crown and, and other, uh, private entities are putting in there.

They’re starting to really, they’re, or this a hundred gigawatts is really gonna look like building out that local supply chain. Jobs, all these different things. ’cause Alan, like you, you mentioned off air. If you look at a hundred gigawatts of offshore wind, that’s $200 billion or was to put it in Euros, 175 billion euros, 170 billion euros, just in turbine orders.

Right. That doesn’t mean, or that doesn’t cover ships, lodging, food, like, you know, everything around the ports like tools, PPE, all of the stuff that’s needed by this industry. I mean, there’s a, there’s a trillion dollar impact here.

Speaker 2: Oh, it’s close. Yeah. It’s at least 500 billion, I would say. And Yolanda, from the asset management side, have we seen anything of this scale to manage?

It does seem like there’d be a lot of [00:05:00] turbines in the water. A whole bunch of moving pieces, ships, turbines, cables, transformers, substations, going different directions. How, what kind of infrastructure is that going to take?

Yolanda Padron: You know, a lot of the teams that are there, they’re used to doing this on a grand scale, but globally, right?

And so having this be all at once in the UK is definitely gonna be interesting. It’ll be a good opportunity for everybody to take all of the lessons learned to, to just try to make sure that they don’t come across any issues that they might have seen in the past, in other sites, in other countries. They just bring everything back home to their countries and then just make sure that everything’s fine.

Um, from like development, construction, and, and operations.

Joel Saxum: I was thinking about that. Just thinking about development, construction, operations, right? So some of [00:06:00] these sites we’re thinking about like how, you know, that, that, that map of offshore wind in, in the Northern Atlantic, right? So if this is gonna go and we’re talking about the countries involved here, Norway, Germany, Denmark, France, Belgium, you’re gonna have it all over.

So into the Baltic Sea. Around Denmark, into the Norwegian waters, uk, Ireland all the way over, and Iceland is there. I don’t think there’s gonna be any development there. I think maybe they’re just there as a, as cheerleaders. Um, offtake, possibly, yes. Some cables running over there. But you’re going to need to repurpose some of the existing infrastructure, or you’re not, not, you’re going to need to, you’re going to get the opportunity to, and this hasn’t happened in offshore wind yet, right?

So. Basically repowering offshore wind, and you’re going to be able to look at, you know, you’re not doing, um, greenfield geotechnical work and greenfield, um, sub c mapping. Like, some of those things are done right, or most of those things are done. So there, I know there’s a lot of, like, there’s a, there’s two and [00:07:00] three and six and seven megawatt turbines all over the North Atlantic, so we’re gonna be able to pop some of those up.

Put some 15 and 20 megawatt machines in place there. I mean, of course you’re not gonna be able to reuse the same mono piles, but when it comes to Yolanda, like you said, the lessons learned, Hey, the vessel plans for this area are done. The how, how, how we change crews out here, the CTVs and now and SOVs into port and that stuff, that those learnings are done.

How do we maintain export cables and inter array cables with the geotechnic here, you’re not in a green field, you’re in a brown field. That, that, that work. A lot of those lessons learned. They’re done, right? You’ve, you’ve stumbled through them, you’ve made those mistakes. You’ve had to learn on the fly and go ahead here.

But when you go to the next phase of Repowering, an offshore wind farm, the the Dev X cost is gonna go way down, in my opinion. Now, someone, someone may fight back on that and say, well, we have to go do some demolition or something of that sort. I’m not sure, but [00:08:00]

Yolanda Padron: yeah. But I think, you know. We like to complain sometimes in the US about how some of the studies just aren’t catered toward us, right?

And so we’ve seen it a lot and it’s a lot of the studies that are made are just made in Europe where, where this is all taking place. So it’s gonna be really, really interesting to see such a massive growth where everything’s being developed and where the studies are localized from where. You have this very niche area and they can, they’ve studied it.

They know exactly what’s going on there. And to your point, they’ve seen a lot of, they’ve minimized the risk, like the environmental risks as much as they could. Right. And so it’s, it’s going to be really, really interesting to have them

Joel Saxum: ensuring and financing these projects should be way easier

Speaker 2: when Europe is saying that the industry has pledged to cut costs by 30% between.

20, 25 and 2040. So you would think that the turbine [00:09:00] costs and the installation costs would have to be really cost conscious on the supply chain and, uh, taking lessons learned from the previous generations of offshore wind. I think that makes sense. 30% is still a lot, and I, I think the, the feeling I’m getting from this is, Hey, we’re making a hundred gigawatt commitment to this industry.

You have to work really hard to deliver a efficient product, get the cost down so it’s not costing as much as, you know. Could do if we, if we did it today, and we’re kind of in from an offshore standpoint over in Europe, what a generation are we in, in terms of turbines three? Are we going into four? A lot of lessons learned.

Joel Saxum: Yeah. The, the new Siemens one’s probably generation four. Yeah. I would say generation four in the new, because you went from like the two and three megawatt machines. Like there’s like Vesta three megawatts all over the place, and then you went into the directive [00:10:00] machines. You got into that seven and eight megawatt class, and then you got into the, where we’re at now, the 15, the 12 and 15 megawatt units, the Docker bank style stuff, and then I would say generation four is the, yeah, the Siemens 21 and a half machine.

Um, that’s a good way to look at it. Alan four we’re on the fourth generation of offshore wind and, and so it’s Generation one is about ready to start being cycled. There’s some, and some of these are easier, they’re nearer to shore. We’ll see what, uh, who starts to take those projects on. ’cause that’s gonna be an undertaking too.

Question on the 30%, uh, wind Europe says industry has pledged to cut cost by 30% by 20. Is that. LCOE or is it devex costs or is it operational costs or did they, were they specific on it or they just kinda like cut cutting costs?

Speaker 2: My recollection when that first came about, which was six months ago, maybe a little longer, it was LCOE, [00:11:00] right?

So they’re, they’re trying to drive down the, uh, dollars per, or euros per megawatt hour output, but that the capital costs, if the governments can help with the capital costs. On the interest rates, just posting bonds and keeping that down, keeping the interest rates low for these projects by funding them somehow or financing them, that will help a tremendous amount.

’cause if. Interest rates remain high. I know Europe is much lower than it is in the United States at the minute, but if they interest rates start to creep up, these projects will not happen. They’re marginal

Joel Saxum: because you have your central in, in, in Europe, you have your central bank interest rates, but even like the f the, the Indi Individual nation states will subsidize that.

Right? Like if you go to buy a house in Denmark right now, you pay like 1.2%. Interest

Speaker 2: compared to what, six and a half right now in the states? Yeah, it’s low.

Speaker 4: Australia’s wind farms are [00:12:00] growing fast. But are your operations keeping up? Join us February 17th and 18th at Melbourne’s Pullman on the park for Wind energy o and M Australia 2026, where you’ll connect with the experts solving real problems in maintenance asset management.

And OEM relations. Walk away with practical strategies to cut costs and boost uptime that you can use the moment you’re back on site. Register now at WMA 2020 six.com. Wind Energy o and m Australia is created by wind professionals for wind professionals because this industry needs solutions, not speeches,

Speaker 2: as we all know.

On December 22nd, the federal government issued a stop work order. On all offshore winds that included vineyard wind up off the coast of Massachusetts, that’s a 62 turbine, $4.5 billion wind farm. Uh, that’s being powered by some GE turbines. Uh, the government [00:13:00] has, uh, cited national security concerns, but vineyard went to court and Federal Judge Brian Murphy rolled the, the administration failed to adequately explain or justify the decision to shut it down.

Uh, the judge issued a stay, which it is allowing Vineyard went to immediately resume work on the project now. They’re close to being finished at a vineyard. There are 44 turbines that are up and running right now and creating power and delivering power on shore. There are 17 that are partially installed.

Uh, when the stop order came. The biggest issue at the moment, if they can’t get rolling again, there are 10 towers with Noels on them, what they call hammerheads. That don’t have blades. And, uh, the vineyard wind. Last week as we were recording this, said you really don’t want hammerheads out in the water because they become a risk.

They’re not assembled, completed [00:14:00] items. So lightning strikes and other things could happen, and you really don’t want them to be that way. You want to finish those turbines, so now they have an opportunity to do it. The window’s gonna be short. And Yolanda listening to some GE discussions, they were announcing their Q4 results from last year.

The ships are available till about the end of March, and then the ships are gonna finally go away and go work on another project. So they have about 45 days to get these turbines done. I guess my question is, can they get it done work-wise? And I, I, I guess the, the issue is they gotta get the turbines running and if they do maintenance on it, that’s gonna be okay.

So I’m wondering what they do with blade sets. Do they have a, a set of blades that are, maybe they pass QC but they would like them to be better? Do they install ’em just to get a turbine operational even temporarily to get this project quote unquote completed so they can get paid?

Yolanda Padron: Yeah. If, if the risk is low, low [00:15:00] enough, it, it should be.

I mean a little bit tight, but what, what else can you do? Right? I mean, the vessel, like you might have a shot of getting the vessel back eventually, or being able to get something in so you can do some of the blade repairs. And the blade repairs of tower would require a different vessel than like bringing in a whole blade, right?

And so just. You have a very limited time scope to be able to do everything. So I don’t know that I would risk just not being able to pull this off altogether and just risk the, you know, the rest of the tower by not having a complete, you know, LPS and everything on there just because not everything’s a hundred percent perfect.

Joel Saxum: There’s a weird mix in technical and commercial risk here, right? Because. Technically, we have these hammerheads out there, right? There’s a million things that can happen with those. Like I, I’ve [00:16:00] personally done RCAs where, um, you have a hammerhead on this was onshore, right? But they, they will get, um, what’s called, uh, Viv, uh, vortex induced vibration.

So when they don’t have the full components out there, wind will go by and they’ll start to shake these things. I’ve seen it where they shook them so much because they’re not designed to be up there like that. They shook them so much that like the bolts started loosening and concrete started cracking in the foundations and like it destroyed the cable systems inside the tower ’cause they sat there and vibrated so violently.

So like that kind of stuff is a possibility if you don’t have the right, you know. Viv protection on and those kind of things, let alone lightning risk and some other things. So you have this technical risk of them sitting out there like that. But you also have the commercial risk, right? Because the, the banks, the financiers, the insurance companies, there’s the construction policies and there’s, there’s, you gotta hit these certain timelines or it’s just like if you’re building a house, right?

You’re building a house, you have to go by the loan that the bank gives you in, you know, in micro [00:17:00] terms to kind of think about that. That’s the same thing that happens with this project, except for this project’s four and a half billion dollars and probably has. It’s 6, 8, 10 banks involved in it. Right? So you have a lot of, there’s a lot of commercial risk.

If you don’t, if you don’t move forward when you have the opportunity to, they won’t, they’ll frown on that. Right? But then you have to balance the technical side. So, so looking at the project as a whole, you’ve got 62 turbines, 44 or fully operational. So that leaves us with 18 that are not. Of those 18, you said Alan?

10 needed blades.

Speaker 2: 10 need blades, and one still needs to be erected.

Joel Saxum: Okay, so what’s the other seven?

Speaker 2: They’re partially installed, so they, they haven’t completed the turbine, so everything’s put together, but they haven’t powered them up yet.

Joel Saxum: I was told that. Basically with the kit that they have out of vineyard wind, that they can do one turbine a day blades.

Speaker 2: That would be, yeah, that would make sense to me.

Joel Saxum: But, but you also have to, you have 45 days of vessel time left. You said they’re gonna leave in March, but you also gotta think it’s fricking winter in. The, [00:18:00] in the Atlantic

Speaker 2: they are using jackass. However, there’s big snow storms and, and low uh, pressure storms that are rolling through just that area.

’cause they, they’ve kind of come to the Midwest and then shoot up the east coast. That’s where you see New York City with a lot of snow. Boston had a lot of snow just recently. They’re supposed to get another storm like that. And then once it hits Boston, it kind of hits the water, which is where vineyard is.

So turbulent water for sure. Super cold this time of year out there,

Joel Saxum: but wind, you can’t sling blades in, in probably more than what, six meters per second’s? Probably your cutoff.

Speaker 2: Yeah. This is not the best time of year to be putting blade sets up offshore us.

Joel Saxum: Technically, if you had blue skies, yeah, this thing can get done and we can move.

But with weather risk added in you, you’ve got, there’s some wild cards there.

Speaker 2: I It’s gonna be close.

Joel Saxum: Yeah. If we looked at the, the weather, it looks like even, I think this coming weekend now we’re recording in January here, and [00:19:00] this weekend’s, first week in February coming, there’s supposed to be another storm rolling up through there too.

Speaker 2: It was pretty typical having lived in Massachusetts almost 25 years. It will be stormy until April. So we’re talking about the time span of which GE and Vineyard want to be done. That’s a rough period for snow. And as historically, uh, that timeframe is also when nor’easters happened, where the storms just sit there and cyclone off the shore around vineyard and then dump the snow back on land.

Those storms are really violent and there’s no way they’re gonna be hanging. Anything out in the water, so I think it’s gonna be close. They’re gonna have to hope for good weather. Don’t let blade damage catch you off guard. OGs, ping sensors detect issues before they become expensive, time consuming problems from ice buildup and lightning strikes to pitch misalignment and internal blade cracks.

OGs Ping has you covered The cutting edge sensors are easy to install, giving you [00:20:00] the power to stop damage before it’s too late. Visit eLog ping.com and take control of your turbine’s health today. So while GE Ver Nova celebrated strong results in its Q4 report, in both its energy and electrification business, the company’s wind division told a different story.

In the fourth quarter of 2025, wind revenue fell 24% to $2.37 billion. Uh, driven primarily by offshore wind struggles, vineyard, wind, uh. The company recorded approximately $600 million in win losses for the full year up from earlier expectations of about $400 million. That’s what I remember from last summer.

Uh, the, the culprit was. All vineyard wind, they gotta get this project done. And with this work stoppages, it just keeps dragging it on and on and on. And I know GE has really wanted to wrap that up as [00:21:00] fast as they can. Uh, CEO Scott Straza has said the company delivered strong financial results, which they clearly have because they’re gas turbine business is taking orders out to roughly 2035, and I think the number on the back order was gonna be somewhere in the realm of 150 billion.

Dollars, which is an astronomical number for back orders. And because they had the back orders that far out, they’re raising prices which improves margins, which makes everybody on the stock market happy. You would think, Joel? Except after the, the Q4 results today, GE Renovo stock is really flat,

Joel Saxum: which is an odd thing, right?

I talk about it all the time. Um, I’m always thinking they’re gonna drop and they go up and they go up and they go up. But today was just kind of like a, I don’t know how to take it. Yeah. And I don’t know if it’s a, a broader sentiment across what the market was doing today because there was some other tech earnings and things of that sort, but it’s always something to watch, right?

So. Uh, there, [00:22:00] there’s some interesting stuff going on on in the GE world, but one thing I want to touch on here, we’re talking like vineyard wind caused them this, these delays right there is a, a, a larger call to understand why there was these delays and because it’s causing. Havoc across the industry.

Right. But even the, like, a lot of like, uh, conservative lawmakers, like there were some senators and stuff coming out saying like, we need more transparency to understand these 90 day halts because of what it’s doing to the industry, right? Because to date there hasn’t been really any explanation and the judges have been just kind of throwing ’em out.

Um, but you can see what it’s done here to ge. Recording $600 million in win losses. I mean, and that is mostly all vineyard wind, right? But there’s a little bit of Dogger bank stuff in there. I would imagine

Speaker 2: a tiny bit. Really? ’cause Dogger has been a lot less stressful to ge.

Joel Saxum: But it is, yeah. The, the uncertainty of the market.

And that’s why we kind of said a little bit, I said a little bit ago, like when this thing is done, when Vineyard [00:23:00] Point is like, and when you can put the final nail in the coffin of construction on that, it is gonna be agh sigh of relief over at GEs offices For sure.

Speaker 2: Our friend Alina, Hal Stern appeared in Energy Watch this week and she’s spent a long time in the wind industry.

She’s been in it 25 years, and, uh, she commented that she’s seeing some troubling things. Uh, she’s also the new CEO of Wind Power Lab over in Denmark, and they’re a consultancy firm on wind turbines and particularly blades. Uh, Lena says that she’s watched some. Really significant manufacturing errors in operational defects and wind turbine blades become more frequent.

And in 2025 alone, Windpower lab analyzed and provided repair recommendations for over 700 blades globally. And I assume, or Blade Whisperer Morton Hamburg was involved in a number of those. Uh, the problem she says is that the market eagerly, uh, [00:24:00] demanded cheap turbines, which is true. And, uh. Everything had to be done faster and with lower costs, and you end up with a product that reflects that.

Uh, we’ve had Lena on a podcast a couple of times, super smart. Uh, she’s great to talk to, get offline and understand what’s happening behind the scenes. And, uh, in some of these conference rooms between asset managers, operators, and OEMs, those are sometimes tough. Discussions, but I, I think Lena’s pointing out something that I, the industry has been trying to deal with and she’s raising it up sort of to a higher level because she has that weight to do that.

We have some issues with blades that we need to figure out pretty quickly. And Yolanda, you ran, uh, a large, uh, operator in the United States. We’re dealing with more than a thousand turbines. How locked in is Lena, uh, to [00:25:00]some of these issues? And are they purely driven just by the push to lower the cost of the blades or was it more of a speed issue that they making a longer blades in the same amount of time?

Where’s that balance and, and what are we going to do about it going forward as we continue to make larger turbines?

Yolanda Padron: She’s great with, with her point, and I think it’s. A little bit about the, or equally about the OEMs maybe not being aware of these issues as much, or not having the, the bandwidth to take care of these issues with limited staff and just a lot of the people who are charge of developing and constructing these projects at a very short amount of time, or at least with having to wear so many hats that they.

Don’t necessarily have the, the bandwidth to do a deep dive on what the potential risks could be in [00:26:00] operations. And so I think the way I’ve, I’ve seen it, I’ve experienced it. It’s almost like everybody’s running a marathon. Their shoe laces untied, so they trip and then they just kind of keep on running ’cause you’re behind, ’cause you tripped.

And so it just keeps on, it’s, it’s, it’s a vicious cycle. Um. But, uh, we’ve also seen just, just in our time together and everything, that there’s a lot of people that are noticing this and that are taking the time to just pause, you know, tie those releases and just talk to each other a little bit more of, Hey, I’m the one engineer doing this for so many turbines.

You have these turbines too. Are you seeing this issue? Yes. No. Are, how are you tackling it? How have you tackled it in the past? How can we work together to, to use the data we have? Right? That, I mean, if you’re not going to get a really great answer from your OEMs or if you’re not going to get a lot of [00:27:00] easily available answers just from the dataset that you’re seeing from your turbine, it’s really easy now to to reach out to other people within the industry and to be able to talk it over, which I think is something that Lena.

Is definitely encouraging here.

Joel Saxum: Yeah. Yeah. It’s, I mean, she, she makes a statement about owners needing to be technically mature, ensure you have inspections, get your TSAs right. So these are, again, it’s lessons learned. It’s sharing knowledge within the market because at the end of the day, this is a new, not a new reality.

This is the reality we’re living in. Right. It’s not new. Um, but, but we’re getting better at it. I think that’s the, the important thing here, right? From a, from a. If we take a, the collective group of operators in the world and say like, you know, where were you two, three years ago and where are you today? I think we’re in a much better place, and that’s from knowledge sharing and, and understanding these issues.

And, you know, we’re, we’re at the behest of, uh, good, fast, cheap pick. [00:28:00] Right. And so that’s got us where we are today. But now we’re, we’re starting to get best practices, lessons learned, fix things for the next go around. And you’re seeing efforts at the OEM level as well to, uh, and some, some of these consultants coming out, um, to, to try to fix some of these manufacturing issues.

You know, Alan, you and I have talked with DFS composites with Gulf Wind Technology. Like there, there’s things here that we could possibly fix. You’re starting to see operators do. Internal inspections to the blades on the ground before they fly them. That’s huge. Right? That’s been the Wind Power lab has been talking about that since 2021.

Right. But the message is finally getting out to the industry of this is what you should be doing as a best practice to, you know, de-risk. ’cause that’s the whole thing. You de-risk, de-risk, de-risk. Uh, so I think. Lena’s spot on, right? We know that this, these things are happening. We’re working with the OEMs to do them, but it takes them a technically mature operator.

And if you’re, if you don’t have the staff to be technically mature, go grab a consultant, [00:29:00] go grab someone that is to help you out. I think that’s a, that’s an important, uh, thing to take from this as well. Those people are out there, those groups are out there, so go and go in, enlist that to make sure you’re de-risking this thing, because at the end of the day, if we’re de-risking turbines.

It’s better for the whole industry.

Speaker 2: Yeah. You want to grab somebody that has seen a lot of blades, not a sole consultant on a particular turbine mine. You’re talking about at this point in the development of the wind industry, you’re talking about wind power labs, sky specs kind of companies that have seen thousands of turbines and have a broad reach where they’ve done things globally, just not in Scandinavia or the US or Australia or somewhere else.

They’ve, they’ve seen problems worldwide. Those people exist, and I, I don’t think we as an industry use them as much as we could, but it would get to the solutions faster because having seen so many global [00:30:00] issues with the St turbine, the solution set does vary depending on where you are. But it’s been proven out already.

So even though you as an asset manager. May have never heard of this technique to make your performance better. You make your blades last longer. It’s probably been done at this point, unless it’s a brand new turbine. So a lot of the two x machines and three X machines, and now we’re talking about six X machines.

There’s answers out there, but you’re gonna have to reach out to somebody who has a global reach. We’ve grown too big to do it small anymore,

Yolanda Padron: which really should be a relief to. All of the asset managers and operations people and everything out there, right? Like. You don’t have to use your turbines as Guinea pigs anymore.

You don’t have to struggle with this.

Speaker 2: That wraps up another episode of the Uptime Wind Energy Podcast, and if today’s discussion sparked any questions or ideas, we’d love to hear from you. Reach out to us on LinkedIn and don’t forget to subscribe so you never miss an episode. [00:31:00] And if you found value in today’s conversation, please leave us a review.

It really helps other wind energy professionals discover the show for Rosie, Yolanda and Joel. I am Alan Hall, and we’ll see you here next week on the Uptime Wind Energy Podcast.

Renewable Energy

US Offshore Wind Restarts After Court Injunctions

Weather Guard Lightning Tech

US Offshore Wind Restarts After Court Injunctions

Allen covers four US offshore wind projects winning injunctions to resume construction, including major updates from Dominion Energy’s Coastal Virginia project. Plus Ming Yang’s proposed UK manufacturing facility faces security review delays, Seaway 7 lands the Gennaker contract in Germany, and Taiwan’s Fengmiao project hits a milestone.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Happy Monday everyone!

Four offshore wind projects have secured preliminary injunctions blocking the Trump administration’s stop-work order.

Dominion Energy’s Coastal Virginia Offshore Wind.

Avangrid’s Vineyard Wind 1.

Equinor’s Empire Wind.

And Ørsted’s Revolution Wind.

All four argued they were at critical stages of construction.

The courts agreed.

Work has resumed.

A fifth project… Ørsted’s Sunrise Wind… has a hearing scheduled for today.

Now… within days of getting back to work… milestones are being reached.

Dominion Energy reported seventy-one percent completion on Coastal Virginia.

The first turbine… installed in January.

The Charybdis… America’s only U.S.-flagged wind turbine installation vessel… is finally at work. Fifty-four towers, thirty nacelles, and twenty-six blade sets now staged at Portsmouth Marine Terminal. The third offshore substation has arrived.

But here is where the numbers tell the real story.

The month-long delay fighting the Bureau of Ocean Energy Management?

Two hundred twenty-eight million dollars.

New tariffs?

Another five hundred eighty million.

The project budget now stands at eleven-point-five billion dollars.

Nine-point-three billion already invested by end of 2025.

Dominion and partner Stonepeak are sharing the cost.

Dominion insists offshore wind remains the fastest and most economical way to deliver nearly three gigawatts to Virginia’s grid.

A grid that powers military installations… naval shipbuilding… and America’s growing AI and cyber capabilities.

First power expected this quarter.

Full completion… now pushed to early 2027.

Up in New England… Vineyard Wind 1 also resumed work.

The sixty-second and final turbine tower shipped from New Bedford this week.

Ten blade sets remain at the staging site.

The installation vessel is scheduled to depart by end of March.

The turbines are going up.

But eight hundred eight million dollars in delays and tariffs…

That is a price the entire industry is watching.

═══ Scotland Waits on Ming Yang Decision ═══

In Scotland… a decision that could reshape European supply chains… hangs in the balance.

Chinese manufacturer Ming Yang wants to build the UK’s largest wind turbine manufacturing facility.

The site… Ardersier… near Inverness. The investment… one-point-five billion pounds.

The jobs… fifteen hundred.

Trade Minister Chris Bryant says the government must weigh security.

Critical national infrastructure must be safe and secure.

Scotland’s First Minister John Swinney is losing patience.

He told reporters this week the decision has taken too long.

He called it pivotal to Scotland’s renewable energy potential…

and a crucial component of the nation’s just transition.

Meanwhile… Prime Minister Keir Starmer met with President Xi Jinping in Beijing this week.

He spoke of building a more sophisticated relationship between the two nations.

Whisky tariffs… halved to five percent.

Wind turbine factories?

Still under review.

Bryant says they want a steady, eyes-wide-open relationship with China.

Drive up trade where possible.

Challenge where necessary.

But no flip-flopping.

For now… Scotland waits.

And so does the UK supply chain.

═══ Seaway 7 Lands Gennaker Contract ═══

In the German Baltic Sea… a major contract award.

Seaway 7, part of the Subsea 7 Group, will transport and install sixty-three monopiles and transition pieces for the Gennaker offshore wind farm.

The contract value… one hundred fifty to three hundred million dollars.

Subsea 7 calls it substantial.

The client is Skyborn Renewables… a portfolio company of BlackRock’s Global Infrastructure Partners.

Nine hundred seventy-six megawatts of capacity.

Sixty-three Siemens Gamesa turbines.

Four terawatt-hours of annual generation.

Enough to power roughly one million German homes.

Seaway 7’s work begins next year.

═══ Taiwan’s Fengmiao Hits Milestone ═══

In Taiwan… Copenhagen Infrastructure Partners completed the first batch of jacket foundations for the Fengmiao offshore wind farm.

Five hundred megawatts.

On schedule for late 2027 completion.

Offshore installation begins later this year.

The jackets were built by Century Wind Power… a local Taiwanese supplier.

CIP called it a sign of strong execution capabilities and proof they can deliver large-scale, complex energy projects.

But they are not stopping there.

Fengmiao 2… six hundred megawatts… is already in development.

Taiwan is aiming for a major boost in large-scale renewable energy by 2030.

And that is the state of the wind industry for February 2, 2026

Join us tomorrow for the Uptime Wind Energy Podcast.

Renewable Energy

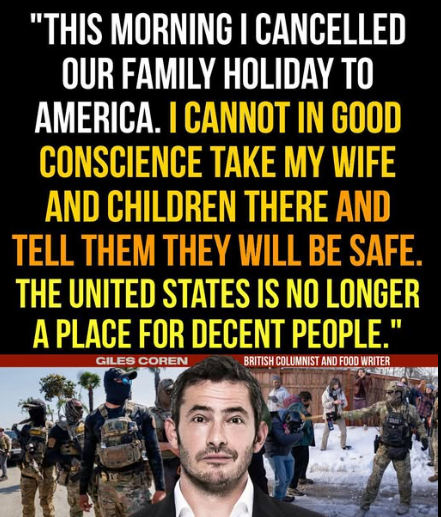

How Is U.S. Insanity Affecting Tourism?

It’s probably a bit too soon to have useable statistics on this subject, but it’s certainly not too early to apply some common sense.

It’s probably a bit too soon to have useable statistics on this subject, but it’s certainly not too early to apply some common sense.

There are at two factors at play here:

1) America is broadly regarded as a rogue country. Do you want to visit North Korea? Do Canadians want to spend money in a country that wants to annex them?

2) America is now understood to be unsafe. Do you want to visit Palestine? Ukraine? Iran?

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits