Lawmakers in Ghana are weighing up whether to greenlight one of Africa’s largest lithium mines after civil society groups urged them to do more to ensure that the project benefits the country and supports green development.

Ghana granted Australian miner Atlantic Lithium a lease to open the country’s first lithium mine in the hope of capitalising on the EV-driven boom for the silvery metal, which is used to manufacture batteries for electric cars and other clean tech products.

But as the deal awaited ratification by parliament in December, the government withdrew the agreement after campaigners and analysts in Ghana warned that the terms risked shortchanging the West African nation at a time when it is seeking to benefit from the scramble for battery minerals.

Atlantic Lithium, which had earlier raised concerns that falling lithium prices were affecting the viability of the project, has since put forward a revised agreement. This new deal would see it pay higher royalties to the government when lithium prices rise, as they have since the start of this year. Lawmakers are expected to review the new terms of the contract for the much-delayed project this month.

Like other resource-rich African nations, Ghana, the continent’s largest gold producer, is seeking a bigger share of mining revenues to spur development and benefit local people.

Experts told Climate Home News the negotiations with Atlantic Lithium highlighted the difficulties for governments to negotiate preferential terms with mining companies, on which they depend for revenues and expertise.

“Lithium is Ghana’s first green mineral and will set the benchmark for future critical mineral agreements,” opposition lawmaker Kwaku Ampratwum-Sarpong, a member of the committee on lands and natural resources, told local media in December. “Weak deals now risk setting a poor precedent for the country.”

Ghana’s lithium potential

Atlantic Lithium says the Ewoyaa project could produce 3.6 million tonnes of lithium spodumene concentrates over the mine’s 12-year lifespan – turning Ghana into one of Africa’s top lithium producers and a significant new supply source for the EV battery industry outside of established producers in Australia, Chile and China.

The lithium is expected to be exported to the US and further refined for use in EV batteries. Atlantic Lithium financed the exploration of the mining site by forward-selling Ghana’s lithium resources to Elevra, a North American lithium producer which has a supply agreement with Tesla.

Atlantic Lithium previously obtained a concession to cut the royalty rate it would pay Ghana from the mandated 10% to 5%. The company argued that the adjustment was necessary to make the project viable after lithium prices had plummeted by more than 80% since 2023.

The company’s move sparked a public outcry. Policy think-tanks that analysed the agreement described it as “colonial” and warned that parliament risked “repeating history’s mistakes” if it approved the deal. The Natural Resource Governance Institute challenged Atlantic Lithium’s claims about its revised profitability and urged the government to scrutinise the assumptions made by the company.

In light of the criticism, the government withdrew the deal in December.

“When governments depend on mining projects to project a sense of economic progress, they stop negotiating for value and start negotiating out of fear,” Bright Simons, of the Accra-based IMANI Centre for Policy and Education, told Climate Home News.

A balancing act

Atlantic Lithium has since put forward a revised agreement based on a proposal by the minister for lands and natural resources, Emmanuel Armah-Kofi Buah, to establish a sliding scale for royalty rates based on lithium prices.

The scale would start at 5% when lithium spodumene prices are below $1,500 per tonne and rise to 12% when prices exceed $3,000 per tonne. Lithium prices are currently at a two-year high and climbed above $2,000 at the start of the year, as analysts forecast stronger demand growth.

Henry Wilkinson, Atlantic Lithium’s communications manager, told Climate Home News the revised agreement was aligned with current legislation and would “ensure that value is generated for Ghana and Ghanaians”.

The government, he said, should find “the appropriate balance” between attracting foreign investment and retaining value from its nascent lithium industry.

“If the government sets fiscal terms that are deemed unattractive for companies looking to advance projects in Ghana, the country risks missing out on securing a position within the value chain; particularly with other countries, such as Mali, Zimbabwe, Nigeria and South Africa all moving ahead with their lithium production ambitions,” he added.

Fear of missing out

But this new approach hasn’t convinced everyone. For Simons, of the IMANI think-tank, the revised agreement still falls short of Ghana’s interests.

“African youth are tired of being told all the time that Africa is rich underground when the signs of destitution are so stark above ground,” he told Climate Home News.

“The narrative that the critical minerals rush is about building the next phase of the global economy has created a massive new wave of anxiety that the continent will miss out yet again. It feels like [a] determined betrayal.”

Atlantic Lithium will allocate 1% of the project’s revenues to a community fund that will finance development projects in the local area. But the protracted negotiations have left people living near the mining site in limbo.

Farming communities say Atlantic Lithium told them to stop planting crops three years ago because they would need to be resettled ahead of the mine opening. While they await a decision on the mine, no one has yet received compensation for the loss of earnings, the Ghanaian NGO Friends of the Nation told Climate Home News. The community representatives in the negotiations with Atlantic Lithium receive stipends from the company, the NGO added, which it says poses a conflict of interest.

Atlantic Lithium said that the delays have been “beyond the company’s control”.

Unequal bargaining power

For Marisa Lourenço, a South Africa-based risk consultant, African governments are too reliant on foreign expertise for extracting their mineral resources and this often limits their bargaining power.

“The broad absence of local beneficiation means that African governments can do very little with their resources and this keeps them reliant on the terms put forward by foreign mining companies,” she said.

In Ghana, the mining industry is the largest tax-paying sector in the country. And the initial agreement to develop the Ewoyaa mine was based on a feasibility study carried out by Atlantic Lithium, said Patrick Stephenson, Ghana country manager at the Natural Resource Governance Institute.

Stephenson told Climate Home News that delays to the ratification of the project’s mining lease show that the government needs to rely on its own data and analysis to inform decisions “rather than on company-determined interests and priorities”.

That could include the creation of a state‑led minerals analytical unit capable of conducting its own profitability modelling, price benchmarking, feasibility studies and project valuation, he added.

The post West Africa’s first lithium mine awaits go-ahead as Ghana seeks better deal appeared first on Climate Home News.

West Africa’s first lithium mine awaits go-ahead as Ghana seeks better deal

Climate Change

UK government faces legal challenge over deep sea mining permits to “opaque” firm

The UK government may have broken the law by approving the transfer of two deep-sea mining licences for exploration of mineral-rich seabed in the Pacific Ocean to an “opaque” company with ties to a US lobby group, according to Greenpeace.

The campaign group has taken the first step to kick-start a legal challenge over the government’s decision to facilitate the transfer of the permits it sponsors in the Clarion Clipperton Zone to Glomar Minerals following the bankruptcy of their previous holder, a Norwegian firm called Loke Marine Minerals.

The licences, overseen by the International Seabed Authority (ISA), a UN body, grant exclusive rights to explore an area of the ocean larger than England for potato-sized polymetallic nodules. These nodules contain minerals such as copper, cobalt and nickel, which are used in both clean energy technologies and defence applications.

No extraction can take place in the Clarion Clipperton Zone until countries agree on a mining code under drawn-out and increasingly contentious ISA negotiations.

Polarised debate

The debate over the nascent industry has grown increasingly polarised since US President Donald Trump issued an executive order to fast-track deep sea mining, including in international waters – a move widely seen as an unilateral measure aimed at circumventing the ISA’s authority.

Marine scientists argue that mining the seabed could cause severe, and likely irreversible, damage to ecosystems by destroying habitats, releasing toxic plumes and creating noise pollution. Over a dozen countries, including the UK, have called for a moratorium on deep sea mining until there is enough scientific evidence to assess its impact.

Greenpeace said the UK government’s sponsorship of the exploration licences now held by Glomar Minerals “flies in the face” of its public position on the practice.

In a letter warning Britain’s business secretary of upcoming legal action if its decision is not reviewed, the environmental group said the government had acted unlawfully by failing to consider cancelling the licences. It argued that Glomar Minerals is effectively controlled by foreign states or nationals, which it claims breaches ISA rules.

The ISA regulations say activities in a license area should be carried out by people or companies that possess the nationality of the country sponsoring the contract, or are effectively controlled by them or their nationals, without giving more specific details. If entities from different states are involved, then each state needs to sponsor the license, according to the rules.

Ties to DC lobby group

Glomar Minerals assumed control of the licences last year after acquiring Loke’s British subsidiary, UK Seabed Resources, which first secured the contracts in 2013 when it was owned by US weapons manufacturer Lockheed Martin.

Although Glomar Minerals is headquartered in the UK, the company appears to be largely managed by executives and investors based overseas. Its chief executive is Walter Sognnes, a Norwegian energy executive who also led Loke at the time the company filed for bankruptcy.

One of Glomar’s listed directors and principal controllers is Washington-based Raphael Diamond, the founder and executive chairman of Securing America’s Future Energy (SAFE), a US lobby group that brings together military and business leaders. SAFE advocates reducing reliance on foreign supply chains, including for critical minerals, on national security grounds.

In April 2025, SAFE publicly welcomed Trump’s executive order on deep sea mining, saying “we must make sure we don’t cede access [of seabed nodules] to our adversaries”. In a recent report, the group argued that “the United States should out-compete China to be the first nation in the world to commercialise deep-seabed minerals”.

The US is not a full member of the ISA as it never ratified the UN convention that underpins it and therefore cannot directly sponsor ISA contracts.

“Opaque” ownership

Greenpeace has raised concerns about what it describes as Glomar’s “opaque” corporate structure and funding arrangements. Incorporation documents list the company’s majority shareholder as a firm based in Delaware, a US state known for corporate secrecy laws that do not require public disclosure of owners or directors.

Company filings show that in June last year, Glomar entered into a loan agreement for an undisclosed sum with another Delaware-registered entity, MHG Funding. Under the terms of the agreement, the lender could gain sweeping control of Glomar’s assets, including “all licences”, in the event of a default.

The lender is listed as Louis Mayberg, an American financial investor and philanthropist. A donor to the Democratic Party, Mayberg funded SAFE and served on the group’s board until at least the end of 2024, according to the most recent available records.

Climate Home News had not received a response to questions sent to Glomar, SAFE and Louis Mayberg at the time of publication.

In a December press release announcing the UK government’s decision, Glomar said its priority “remains closing knowledge gaps and contributing to a robust scientific understanding of the deep sea environment”.

US permitting process fast-tracked

As governments vie to secure access to critical minerals, the race to mine the ocean seabed has been heating up, spurred on by the Trump administration and efforts by countries to break their dependence on China.

Japan said this week it had conducted the first test mission to lift seabed mud within its national waters that is rich in rare earths to a scientific ship, soon after China cut off exports to its Asian rival amid a diplomatic row.

Last month, The Metals Company (TMC) – another deep-sea mining hopeful that holds exploration licences under the ISA, which it obtained via Nauru – became the first company to seek approval to collect nodules in the Clarion Clipperton Zone from the US authorities under an accelerated process run by the National Oceanic and Atmospheric Administration (NOAA).

The company’s CEO Gerard Barron told Reuters he hopes to obtain the permit by the end of the year.

The ISA has repeatedly said it has an exclusive mandate to oversee activities in the Pacific Ocean area and any unilateral action would violate international law and undermine ocean governance.

Greenpeace worries that licences ending up in “the wrong hands” could open the door to “destructive deep sea mining that could harm marine wildlife”.

Erica Finnie, oceans campaigner at Greenpeace UK, said the “opaque structure” of Glomar makes it hard for the UK government to have full oversight of the exploration licences and the individuals involved.

“The licences should be held by independent scientific bodies with a genuine interest in doing research, as they are in other countries, instead of companies seeking to profit from mining the seabed,” she added.

A spokesperson for the UK’s Department for Business and Trade said it would not comment on ongoing legal proceedings.

The post UK government faces legal challenge over deep sea mining permits to “opaque” firm appeared first on Climate Home News.

UK government faces legal challenge over deep sea mining permits to “opaque” firm

Climate Change

‘Rush’ for new coal in China hits record high in 2025 as climate deadline looms

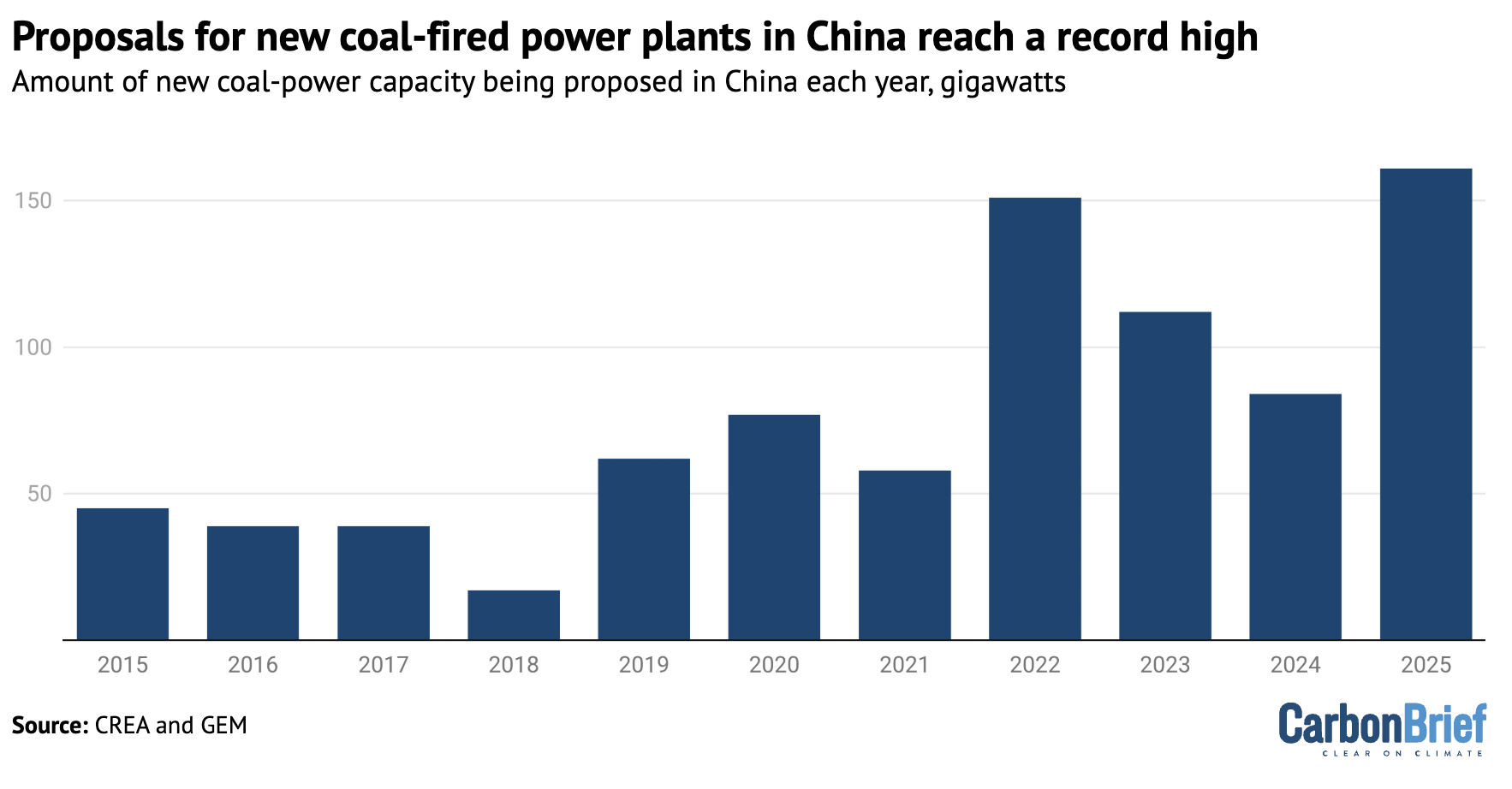

Proposals to build coal-fired plants in China reached a record high in 2025, finds a new study.

The report, released by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM), says that, in 2025, developers submitted new or reactivated proposals to build a total of 161 gigawatts (GW) of new coal-fired power plants.

The new proposals come even as China’s buildout of renewable energy pushed down coal-power generation and carbon dioxide (CO2) emissions in 2025, meaning many coal plants are already running at just half of their maximum capacity.

The co-authors argue that while clean-energy growth may limit emissions from coal power in the short term, the surge in proposals could lock in new coal assets, “weaken…incentives” for power-system reform and help keep coal capacity online in spite of China’s climate goals.

The high rate of new proposals, the study says, likely reflects a “rush by the coal industry stakeholders” to develop projects before an expected tightening of climate policy in the next five years.

In addition, “misaligned” payment mechanisms are encouraging developers to propose large-scale coal units, which – if developed – could impact the transition of the coal sector from playing the central role in electricity generation to flexibly supporting a system built on clean power.

Significant additions pushing down running hours

The report finds that the amount of new coal-fired power proposals by Chinese developers, including reactivated applications, hit a new peak in 2025, at 161GW. This is equal to 13% of the coal capacity currently online in China.

The country is continuing to add significant coal-power capacity, with a record 95GW added to the grid last year and another 291GW in the pipeline – meaning units that have been proposed, are actively under construction or have already been permitted.

Moreover, around two-thirds of coal-power capacity proposed in China since 2014 has either been commissioned – meaning it has been completed and started operating – or remains in the pipeline, Christine Shearer, report co-author and research analyst at thinktank Global Energy Monitor, tells Carbon Brief.

She adds that this is the “reverse of what we see outside China, where roughly two-thirds of proposed coal capacity never makes it to construction”.

Coal remains a significant part of China’s power mix, making the nation’s electricity sector one of the world’s largest emitters. Indeed, the power sector emitted more than 5.6bn tonnes of carbon dioxide (GtCO2) in 2024 – meaning that if it were its own country, it would have the highest emissions of any country except China itself.

But emissions from the power sector have been flat or falling since March 2024, according to analysis for Carbon Brief by CREA lead analyst Lauri Myllyvirta.

This is largely due to China’s rapid installation of renewable power, which is covering nearly all of new electricity demand and pushing coal generation into decline in 2025.

Some parts of the coal-power pipeline are reflecting this shift. In 2025, construction began on 83GW of new coal capacity – down from 98GW in 2024.

In addition, new permitting fell to a four-year low, at 45GW, which could point to tighter controls on coal-plant approvals in the future, says the report.

The chart below shows the amount of new coal-power capacity being proposed in China each year, in GW.

The shift from new power demand being met by coal to being met by renewable energy means any “additional coal power capacity would face structurally low utilisation”, the report says, referring to the number of hours that plants are able to operate each year.

This reduces coal-plant earnings needed to cover the cost of investment and makes instances of “stranded [coal] assets and compensation pressures” more likely.

A previous analysis for Carbon Brief finds that “larger additions of coal capacity are often followed by falling utilisation” – meaning that the construction of new coal plants does not necessarily increase emissions.

Utilisation rates for coal-fired power plants have hovered around 51% since 2025, according to the CREA and GEM report.

Shearer argues that while low utilisation rates would “dampen the immediate impact on annual CO2 emissions”, in the long-term the buildout “locks capital into fossil fuels” and “weakens incentives to build the cleaner forms of flexibility” needed for a renewables-centred system.

Low utilisation has also not led to coal plant capacity being retired in any notable way, the report notes, with generators instead supported by the coal “capacity payment” mechanism and extending the life of older units.

Delayed retirement of older coal plants causes “persistent overcapacity” and adds to calls for further compensation and policy support, the report says.

Coal generation has “no room to expand” under China’s international climate pledge for 2030, it adds, with utilisation rates for coal units likely to fall to 42% if renewables continue to meet all additional demand and if all of the plants currently under construction or permitted are brought online.

Crunch-time for coal

The surge in new proposals reflects a “rush” by the coal industry to ensure their projects are approved before the policy environment tightens, according to the report.

China is expected to introduce absolute emissions targets over the next five years. While these are expected to be aspirational for the first five years – alongside binding targets for carbon intensity, the emissions per unit of GDP – from 2030 they will be binding.

The current five-year period until 2030 will also likely see most of China’s energy-intensive industries pulled into the scope of its national carbon market.

In the power sector, government officials have said that coal is expected to shift from playing a major role in power supply to supporting “flexibility” operations.

This would require coal plants to shift between varying load levels and respond quickly to changes in demand and other system needs.

However, the report finds, the approvals for coal power “continue to reflect expectations of high operating hours”, instead of flexible operations.

For many of these proposals, planned annual utilisation was stated to be more than 4,800 hours, or 55% of hours in the year. This is greater than the 4,685 utilisation hours (53%) logged in 2023, the year in which the most coal power was generated over the past decade, according to data shared by the report authors with Carbon Brief.

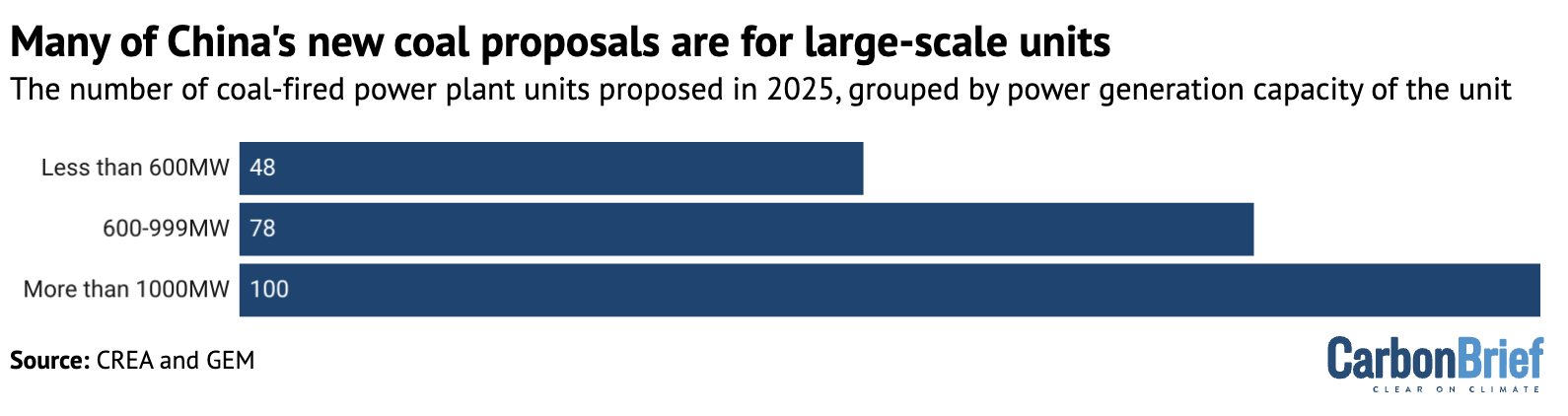

In addition, the report says that many of the new coal-power proposals in 2025 were for “large-scale units”, each representing at least 1GW of power, as shown in the figure below.

These larger units are designed for “stable, continuous operation” and are “poorly suited to the type of flexibility increasingly required in a power system dominated by wind and solar”, says the report.

This suggests that “project developers still anticipated base-load style operation”, it adds, “sitting uneasily” with the fact of higher clean-energy generation and falling coal plant utilisation.

Reliance on sales and subsidies

This persistence in developing large-scale units could be explained by the financial incentives that govern the coal-power industry.

Coal power plants are cheap to build but risk low profits and high costs, with many current operators already facing losses at recent utilisation rates.

In 2024, the government established a capacity payment mechanism for coal-fired power plants. This mechanism rewards developers for adding “seldom-utilised, backup” capacity to the grid.

These capacity payments, as well as regulated pricing and implicit government backing “can make plants viable on paper even if utilisation and operating margins are weak”, Shearer tells Carbon Brief, which may explain the continued appetite for new coal from developers.

More than 100bn yuan ($14bn) in capacity payments were made to coal plants in 2024, although it has not yet had a discernable impact on utilisation.

Large-scale units, the report says, are “particularly well positioned” to benefit from the policy, as it rewards maximising capacity and does not favour plants that are more suited for flexible operations.

(The Chinese government recently announced plans to adjust the mechanism, confirming that in some cases capacity payments could be more than the initial expected threshold of 50% of a benchmark coal plant’s total fixed costs.)

Meanwhile, the report adds that coal-fired power plants continue to earn most of their revenue from selling electricity, with only 5% of total income coming from capacity payments.

As such, these “misaligned incentives” encourage producing power and installing significant new capacity, despite the government’s aim to shift coal to a supporting role in the system.

Shearer tells Carbon Brief that a better approach to flexibility would be to “adopt technology-neutral flexibility standards”, rather than focusing on “flexible coal”, which would mean coal would have to “compete directly with storage, demand response, grid upgrades and other clean options”. She adds:

“The risk of coal-specific flexibility policies is that they lock in capacity rather than solve the underlying system need.”

The post ‘Rush’ for new coal in China hits record high in 2025 as climate deadline looms appeared first on Carbon Brief.

‘Rush’ for new coal in China hits record high in 2025 as climate deadline looms

Climate Change

The EU should partner with Global South to protect carbon-storing wetlands

Fred Pearce is a freelance author and journalist writing on behalf of Wetlands International Europe.

Everybody knows that saving the Amazon rainforest is critical to our planet’s future. But the Pantanal? Most people have never heard of Brazil’s other ecological treasure, the world’s largest tropical wetland – let alone understood its importance, as home to the highest concentration of wildlife in the Americas, while keeping a billion tonnes of carbon out of the atmosphere, and protecting millions of people downstream from flooding.

Hundreds of millions of euros are spent every year on protecting and restoring the world’s forests. Wetlands are just as important, yet don’t get anything like the same recognition or investment. That, scientists insist, has to change. And Europe can lead the way.

For forests, the EU already provides financial and technical assistance for a series of Forest Partnerships with non-EU countries, as part of its Global Gateway strategy for investing globally in environmentally and socially sustainable infrastructure. Such partnerships operate in Guyana, the Democratic Republic of the Congo, Mongolia and elsewhere.

I believe the time is now right to establish a parallel EU Wetland Partnerships, framing wetlands as a strategic, cost-effective investment offering high financial, environmental and social returns.

Wetlands store a third of global soil carbon

Wetlands come in many shapes and sizes: freshwater peatlands, lakes and river floodplains, as well as coastal salt marshes, mangroves and seagrass beds. They are vital natural infrastructure, maintaining river flows that buffer against extreme weather events such as floods and drought, as well as protecting biodiversity, and providing jobs and economic opportunities, often for the most vulnerable nature-dependent communities.

Wetlands cover just six percent of the land surface, but store a third of global soil carbon – twice the amount in all the world’s forests. Yet they have been disappearing three times faster than forests, with 35 percent lost in the past half century.

Their loss adds to climate change, causes species extinction, triggers mass exoduses of fishers and other people whose livelihoods disappear, and depletes both surface and underground water reserves. Continued wetlands destruction is estimated to contribute five percent of global CO2 emissions – more than aviation and shipping combined.

EU Wetland Partnerships can be critical to unlocking finance to stem the losses and realise the benefits by promoting nature-based economic development, such as sustainable aquaculture, eco-tourism, and forms of wetlands agriculture known as paludiculture, while contributing to climate adaptation by improving the resilience of water resources.

Pantanal faces multiple threats

The Pantanal would be a prime candidate for a flagship project. The vast seasonal floodplain stretching from Brazil into Paraguay and Bolivia, is home to abundant populations of cayman, capybaras, jaguars and more than 600 species of birds. It is vital also for preventing flooding on the River Paraguay for some 2000 kilometres downstream to the Atlantic Ocean.

The Pantanal faces multiple threats, from droughts due to upstream water diversions and climate change, invasions by farmers setting fires and a megaproject to dredge the river and create a shipping corridor through the wetland.

But EU investment to achieve partnership targets agreed with Brazil on restoration, conservation and sustainable management could reinvigorate traditional sustainable land use – including cattle ranching that helps sustain the Pantanal’s open flooded grasslands.

Accounting for wetlands carbon in national emissions targets

Africa, a main focus of the Global Gateway, has abundant potential for early partnership initiatives. They include the Inner Niger Delta in Mali, which sustains some three million inhabitants, but is threatened by upstream dams and conflicts over resources between farmers and herders.

Another is the Sango Bay-Minziro wetland, a region of swamp forests, flooded grasslands and papyrus swamp straddling the border between Uganda and Tanzania on the shores of Lake Victoria, Africa’s largest lake.

The two countries have agreed to cooperate in pushing back against illegal logging, papyrus extraction and farming, and Wetlands International has been working with local governments to encourage community-based initiatives. But an EU partnership could dramatically expand this work, helping sustain the wider ecology of Lake Victoria and the Nile Basin.

Deep in the Amazon, forest protection cash must vie with glitter of illegal gold

National pledges to bring wetlands to the fore of environmental action are proliferating rapidly, especially since the 2023 global climate stocktake at COP28 in the UAE emphasised the importance of accounting for wetlands carbon in national emissions targets.

Since then, more than 50 countries have signed up to the 2023 Freshwater Challenge to protect freshwater ecosystems; more than 40 governments with 40 percent of the world’s mangroves have endorsed the 2022 Mangrove Breakthrough that aims to protect and restore 15 million hectares by 2030; and the newly established Peatland Breakthrough aims at rewetting at least 30 million hectares and halting the loss of undrained peatland by 2030.

Such ambition will almost certainly be endorsed at the 2026 UN Water Conference to be hosted by the UAE and Senegal in December this year. But the key to turning targets into reality on the ground lies in finding the billions of Euros needed to deliver on the ambition. EU Wetlands Partnerships could help seal the deal.

The post The EU should partner with Global South to protect carbon-storing wetlands appeared first on Climate Home News.

The EU should partner with Global South to protect carbon-storing wetlands

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits