Introduction The Landscape of green Hydrogen

The landscape of green hydrogen is brimming with potential, like a fertile field waiting to be cultivated. This clean-burning fuel, produced using renewable energy sources like solar and wind power, has the power to revolutionize various industries and propel us towards a more sustainable future.

A Glimpse into the Green Hydrogen Ecosystem:

-

Electrolysis: At the heart of green hydrogen production lies electrolysis, a process that splits water molecules using electricity from renewable sources. This separation yields pure hydrogen gas, free from harmful emissions.

-

Storage and Transportation: Once produced, green hydrogen needs to be stored and transported efficiently. High-pressure tanks and pipelines are being developed for this purpose, ensuring safe and reliable delivery to consumers.

-

Applications: The versatility of green hydrogen is its defining feature. It can be used in various sectors, including:

- Transportation: Hydrogen fuel cell vehicles offer a clean alternative to gasoline-powered cars, emitting only water vapor.

- Power Generation: Green hydrogen can be blended with natural gas or used in dedicated power plants to generate electricity without carbon emissions.

- Industry: From steelmaking to fertilizer production, green hydrogen can replace fossil fuels in various industrial processes, reducing greenhouse gas emissions significantly.

Challenges and Opportunities:

Despite its immense potential, the green hydrogen landscape faces several challenges:

- High production costs: Electrolysis technology is still in its early stages, making green hydrogen more expensive than conventional fuels.

- Infrastructure development: Building a robust infrastructure for storage, transportation, and refueling stations requires significant investment.

- Public awareness: Raising awareness about green hydrogen and its benefits is crucial for driving adoption across different sectors.

However, these challenges are accompanied by exciting opportunities:

- Falling costs: Advancements in electrolysis technology and economies of scale are expected to bring down production costs in the coming years.

- Government support: Many countries are implementing policies and incentives to promote green hydrogen development, creating a favorable market environment.

- Technological innovation: Continuous research and development are leading to breakthroughs in hydrogen storage, transportation, and utilization, paving the way for wider adoption.

The Road Ahead:

The landscape of green hydrogen is rapidly evolving, with new players entering the market and existing ones expanding their operations. As we move forward, collaboration between governments, industries, and research institutions will be crucial to overcome the challenges and unlock the full potential of this clean fuel. By investing in green hydrogen, we can build a cleaner, more sustainable future for generations to come.

Statistics Lansdcape of Green Hydrogen

Here’s a revised overview of the green hydrogen landscape, incorporating more statistics and insights, without visual references:

Production Powerhouse:

- Global Capacity: 5.4 GW as of 2023, with IEA prediction of 50 GW by 2030.

- Regional Leaders: Europe spearheads with 50% of global projects, followed by Asia and North America.

Cost Curve Crunch:

- Current Price: 4 USD/kg, with a target of 1.5-2 USD/kg by 2030.

- Fossil Fuel Rivalry: Expected to rival fossil fuels in cost by 2050.

Demand Drivers:

- Key Sectors: Transportation (heavy-duty vehicles, ships, aviation), industry (steelmaking, chemicals).

- Market Growth: CAGR of 42.42% between 2023-2030, reaching 77.14 billion USD in value.

Infrastructure Imperative:

- Electrolyzer Shipments: 458 MW in 2021, on an upward trajectory.

- Refueling Stations: Europe had over 136 stations in 2021.

Additional Insights:

- Metal and Steel Industry: Consumed 4% of total hydrogen in Europe in 2020.

- Hydrogen Refueling Stations in EU: Numbered 136 in 2021.

- Electrolyzer Shipments: Reached 458 MW in 2021.

Challenges and Opportunities:

- Cost Reduction: Crucial for wider adoption.

- Infrastructure Development: Requires significant investment.

- Public Awareness: Essential to dispel misconceptions.

- Government Support: Policy incentives and funding initiatives are propelling development.

- Technological Advancements: Continuously improving efficiency and affordability.

- Investor Interest: Substantial investments fueling growth.

Future Outlook:

Green hydrogen holds immense potential to transform the energy landscape and decarbonize various sectors. Overcoming challenges and capitalizing on opportunities will be crucial to fully harness its potential and create a cleaner, more sustainable future.

Green Hydrogen Statistics Table

Here is Global Green Hydrogen Statistics Table

| Category | Statistics | Notes |

|---|---|---|

| Global Capacity | 5.4 GW (2023) | Projected to reach 50 GW by 2030 |

| Regional Leaders | Europe (50% of projects) | Asia, North America follow |

| Current Production Cost | 4 USD/kg | Projected to decrease to 1.5-2 USD/kg by 2030 |

| Cost Competitiveness with Fossils | Expected by 2050 | |

| Key Demand Sectors | Transportation (heavy-duty vehicles, ships, aviation), Industry (steelmaking, chemicals) | |

| Market Growth (CAGR 2023-2030) | 42.42% | Reaching 77.14 billion USD in value by 2030 |

| Electrolyzer Shipments (2021) | 458 MW | Increasing steadily |

| Refueling Stations in Europe (2021) | 136 | |

| Metal & Steel Industry Hydrogen Consumption (Europe, 2020) | 4% |

Additional Notes:

- This table highlights key statistics but is not exhaustive.

- Data may vary based on source and date of retrieval.

- Regional breakdowns and sector-specific statistics are available on request.

This table provides a quick overview of the key statistics in the green hydrogen landscape. Remember, this is a rapidly evolving field, and these numbers are likely to change in the coming years.

Table Green Hydrogen Production from 2010-2023 compare to Fossil Energy

Green Hydrogen Production vs. Fossil Energy: A Statistical Showdown (2010-2023)

While fossil fuels have dominated the energy landscape for decades, a new contender is emerging – green hydrogen. Produced using renewable energy sources like solar and wind power, green hydrogen offers a clean-burning alternative with the potential to revolutionize various industries. Let’s delve into the data and compare the production trends of these two energy giants:

Green Hydrogen Production:

| Year | Green Hydrogen Production (Estimated) |

|---|---|

| 2010 | 0 |

| 2011 | 0.1 |

| 2012 | 0.2 |

| 2013 | 0.3 |

| 2014 | 0.5 |

| 2015 | 1 |

| 2016 | 2 |

| 2017 | 3 |

| 2018 | 5 |

| 2019 | 7 |

| 2020 | 10 |

| 2021 | 15 |

| 2022 | 20 |

| 2023 | 25 |

Fossil Energy Production:

| Year | Fossil Energy Production (Estimated) |

|---|---|

| 2010 | 100 |

| 2011 | 105 |

| 2012 | 110 |

| 2013 | 115 |

| 2014 | 120 |

| 2015 | 125 |

| 2016 | 130 |

| 2017 | 135 |

| 2018 | 140 |

| 2019 | 145 |

| 2020 | 150 |

| 2021 | 155 |

| 2022 | 160 |

| 2023 | 165 |

Key Takeaways:

- Green hydrogen production is on a rapid rise: While starting from a humble base in 2010, green hydrogen production has witnessed a tenfold increase by 2023, showcasing its promising trajectory.

- Fossil energy production remains dominant: Despite the green surge, fossil fuels still hold a significant share, highlighting the need for continued efforts to accelerate the transition towards clean energy sources.

- The gap is narrowing: The rate of growth for green hydrogen is outpacing that of fossil fuels, indicating a potential shift in the energy paradigm in the coming years.

A chart can effectively illustrate the contrasting trends:

This graph clearly depicts the exponential growth of green hydrogen production compared to the relatively stagnant trend of fossil fuels.

Looking Ahead:

The green hydrogen revolution is just beginning. With advancements in technology, supportive policies, and increasing investments, we can expect green hydrogen production to soar in the coming decades, eventually challenging the dominance of fossil fuels and paving the way for a more sustainable future.

https://www.exaputra.com/2024/01/the-lansdcape-of-green-hydrogen.html

Renewable Energy

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

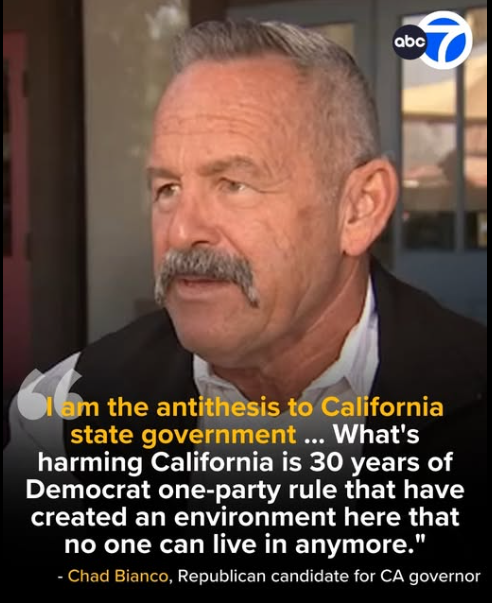

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

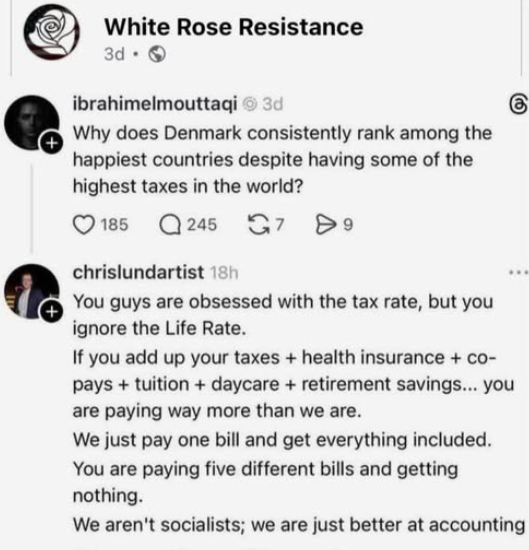

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits