History of Renewable Energy Development in Austria: A Journey of Commitment and Innovation

Austria boasts a remarkable journey in developing its renewable energy sector, transforming itself into a global leader. Let’s explore the key milestones and factors contributing to this success:

Early Beginnings (Pre-1970s):

- Hydropower Pioneer: Blessed with abundant rivers and mountainous terrain, Austria embraced hydropower from the late 19th century. By the 1950s, it dominated the country’s electricity generation.

Anti-Nuclear Stance and Renewables Rise (1970s-1990s):

- Public Rejects Nuclear: In 1978, a historic public vote overwhelmingly denied the construction of Austria’s sole nuclear plant, solidifying its commitment to renewables.

- Diversification with Wind and Biomass: Subsequent decades saw investments in wind and biomass, with government support through feed-in tariffs and incentives.

Rapid Expansion and EU Leadership (2000s-Present):

- Soaring Renewable Share: By 2010, Austria’s renewable share in electricity generation skyrocketed to 68%, placing it among the EU’s frontrunners.

- Ambitious Goals and Continued Progress: With ambitious targets of 100% renewable electricity by 2030 and carbon neutrality by 2040, Austria continues to invest in solar, geothermal, and other technologies.

Key Factors for Success:

- Strong Policy Support: Long-term policies, financial incentives, and research funding from the government played a pivotal role.

- Public Acceptance: Widespread public support for renewables fostered a conducive environment for development.

- Favorable Geography: Natural resources like hydropower potential and wind energy corridors proved advantageous.

Challenges and Future Prospects:

- Grid Integration: Integrating variable renewable sources like wind and solar into the grid presents a significant challenge.

- Social Acceptance: While general support exists, specific projects might face local opposition.

- Cost-Effectiveness: Ensuring the cost-effectiveness of renewable deployment remains crucial for continued expansion.

Despite these challenges, Austria’s commitment to innovation and public support set a strong foundation for its future. It serves as a model for other countries aiming to transition to a sustainable energy future.

Renewable Energy Consumption in Austria

Austria is a global leader in renewable energy consumption, boasting impressive statistics and ambitious goals. Here’s a breakdown:

Current Status:

- Share of Renewables: As of 2022, 79% of Austria’s electricity comes from renewable sources, placing it among the top in the world.

- Breakdown by Source:

- Hydropower: 67% (dominant source, leveraging abundant rivers and mountainous terrain)

- Wind Power: 19%

- Solar Power: 14%

- Bioenergy: 3%

- Geothermal Energy: 1%

- Total Renewable Energy Consumption: Over 82 Terajoules (TJ) in 2020, distributed across electricity, heating, and cooling sectors.

Goals and Targets:

- 100% Renewable Electricity: Austria aims to achieve 100% renewable electricity by 2030, implying an additional 22-27 Terawatt hours (TWh) of renewable electricity generation.

- Carbon Neutrality: The country has set an ambitious target of achieving carbon neutrality by 2040, further solidifying its commitment to sustainability.

Challenges and Opportunities:

- Grid Integration: Integrating increasing amounts of variable renewable sources like wind and solar into the grid poses a challenge.

- Social Acceptance: While there is general support for renewables, some specific projects may face local opposition.

- Cost-Effectiveness: Ensuring the cost-effectiveness of renewable energy deployment will be crucial for its continued expansion.

Austria’s impressive renewable energy consumption, ambitious goals, and ongoing efforts to address challenges position it as a global leader and an inspiration for other countries seeking a sustainable energy future.

Renewable Energy Growth in Austria: A Story of Steady Progress and Ambitious Goals

Austria is a world leader in renewable energy growth, experiencing consistent expansion and setting ambitious targets for the future. Let’s delve into the specifics:

Recent Growth:

- Electricity Generation: Between 2010 and 2022, the share of renewables in Austria’s electricity generation rose from 68% to 79%, representing a significant increase.

- Installed Capacity: Wind power capacity tripled from 2014 to 2022, reaching over 3.2 GW, while solar photovoltaic capacity grew tenfold to over 3.4 GW in the same period.

- Investment: Austria invested €4.8 billion in renewable energy in 2022, highlighting its dedication to continued growth.

Factors Driving Growth:

- Favorable Policy Environment: Austria’s “Renewables Expansion Law” (EAG) of 2021 supports investments in solar, wind, and biomass through grants and subsidies.

- Public Support: Public opinion in Austria strongly favors renewable energy, creating a positive environment for development.

- Technological Advancements: Cost reductions in wind and solar power technologies have made them more competitive with fossil fuels.

Future Growth Projections:

- Target: Austria aims to achieve 100% renewable electricity by 2030, requiring an additional 27 TWh of generation capacity.

- Focus Areas: Expansion in wind and solar power is expected to play a dominant role, supplemented by growth in geothermal and biomass.

- Challenges: Grid integration of variable renewable sources, social acceptance of specific projects, and cost-effectiveness remain key challenges to overcome.

International Recognition:

- Austria consistently ranks among the top countries in global renewable energy rankings, including those by IRENA and the World Bank.

- The country serves as a model for other nations aiming to transition towards a sustainable energy future.

Beyond Electricity:

While the focus is often on electricity, Austria is also expanding renewable energy use in the heating and cooling sectors, aiming for increased integration and overall decarbonization.

Austria’s remarkable renewable energy growth is a testament to its policy framework, public support, and commitment to innovation. Looking ahead, the country’s ambitious goals and ongoing efforts position it as a leader in shaping a more sustainable future.

.

Statistic Data of Renewable Energy Patterns in Austria

Here’s a breakdown of key renewable energy statistics in Austria:

Electricity Generation:

- Share of Renewables:

- 2022: 79%

- 2010: 68%

- Breakdown by source:

- Hydropower: 67% (dominant)

- Wind Power: 19%

- Solar Power: 14%

- Bioenergy: 3%

- Geothermal: 1%

- Total Renewable Consumption:

- 2020: 82 Terajoules (TJ)

- Distributed across electricity, heating, and cooling sectors.

Growth:

- Electricity Generation: Increase from 68% to 79% in renewable share between 2010 and 2022.

- Installed Capacity:

- Wind: Triplication from 2014 to 2022 (over 3.2 GW).

- Solar PV: Tenfold growth from 2014 to 2022 (over 3.4 GW).

- Investment: €4.8 billion in renewable energy in 2022.

Hydropower in Austria: A Leading Light in Renewable Energy

Hydropower dominates the renewable energy landscape in Austria, playing a crucial role in the country’s energy independence and sustainability efforts. Let’s delve into its significance:

Current Status:

- Dominant Contributor: As of 2022, hydropower accounts for an impressive 67% of Austria’s electricity generation, making it the leading source of renewable energy.

- Installed Capacity: Over 12 GW of installed hydropower capacity, spread across roughly 1,300 hydropower plants.

- Type Breakdown:

- Run-of-river: Majority type, utilizing flowing water without needing large dams.

- Pumped storage: Provides flexibility and grid balancing capabilities.

Significance and Benefits:

- Reliable and Baseload Power: Hydropower offers reliable and continuous electricity generation, serving as a stable baseload for the grid.

- High Efficiency: Conversion of water potential energy into electricity boasts high efficiency, minimizing energy losses.

- Clean and Sustainable: Generates electricity without greenhouse gas emissions or air pollution, contributing to climate change mitigation.

- Flexibility: Pumped storage plants offer flexibility, storing excess energy during low demand periods and releasing it during high demand.

Future Outlook:

- Continued Role: While growth might not be significant due to limited untapped potential, hydropower will likely remain the cornerstone of Austria’s renewable energy mix.

- Modernization and Efficiency: Focus on modernization and efficiency improvements of existing plants to maximize output and sustainability.

- Integration with Other Renewables: Integrating hydropower with other renewable sources like wind and solar for a more resilient and flexible energy system.

Challenges and Considerations:

- Environmental Impact: Hydropower development can impact river ecosystems and biodiversity, requiring careful planning and mitigation measures.

- Public Acceptance: New projects might face local opposition due to potential environmental and social impacts.

- Sedimentation: Managing sedimentation buildup in reservoirs is crucial for long-term sustainability.

Hydropower is a cornerstone of Austria’s renewable energy success story. While there are challenges to address, its continued responsible development and integration with other renewables will be vital for securing a sustainable energy future.

Wind Energy in Austria: A Story of Steady Growth and Future Potential

While not currently as dominant as hydropower, wind energy plays a significant role in Austria’s renewable energy mix and has experienced substantial growth in recent years. Here’s a closer look:

Current Status:

- Contribution: As of 2022, wind power accounts for 19% of Austria’s electricity generation, ranking second behind hydropower.

- Installed Capacity: Over 3.2 GW of installed wind power capacity across approximately 800 wind turbines.

- Growth: Triplication of installed capacity from 2014 to 2022, showcasing significant expansion.

- Location: Wind farms primarily concentrated in eastern and northeastern regions with favorable wind conditions.

Significance and Benefits:

- Renewable and Clean: Generates electricity without harmful emissions, contributing to climate change mitigation efforts.

- Cost-Effective: Technology advancements have made wind power increasingly cost-competitive with fossil fuels.

- Job Creation: Development and maintenance of wind farms create employment opportunities in rural areas.

- Land Use: Requires less land compared to some other renewable sources like solar.

Future Outlook:

- Ambitious Targets: Austria aims to significantly increase wind power capacity by 2030, playing a crucial role in achieving 100% renewable electricity.

- Technological Advancements: Continued advancements in turbine technology are expected to further increase efficiency and reduce costs.

- Offshore Potential: Exploring the potential of offshore wind farms in the Baltic Sea for additional capacity.

Challenges and Considerations:

- Grid Integration: Integrating variable wind energy into the grid requires smart grid technologies and storage solutions.

- Social Acceptance: Public concerns about visual impact and noise pollution from wind farms can be challenges.

- Environmental Impact: Careful planning and mitigation measures are needed to minimize impact on wildlife and habitats.

Wind energy is a key player in Austria’s renewable energy transition. Overcoming challenges and harnessing future potential will be crucial for achieving ambitious renewable energy goals and a sustainable future.

Solar Energy in Austria: Key Data Points

Current Status:

- Electricity from Renewables in 2021: 71% (leader in Europe)

- Solar Power Capacity (end of 2022): 3.8 GW

- Electricity from Solar Power in 2022: 4.2%

- Market Growth CAGR (2024-2029): 17.47%

Ambitious Goals:

- 100% Renewable Electricity by 2030: Aiming for complete transition

- 1 Million Homes with Solar Panels by 2030: Significant expansion planned

- Additional 11 TWh Photovoltaics Needed by 2030: Substantial increase required

Driving Forces:

- Government Support: Feed-in tariffs, grants, tax breaks

- Public Support: Strong preference for clean and reliable energy

- Falling Costs: Solar panels becoming more affordable

- Favorable Climate: Austria has ample sunshine for generation

The future of solar energy in Austria appears promising. With strong government and public support, falling costs, and a suitable climate, the country is well-positioned to achieve its ambitious goals and become a leader in solar power generation.

Biomass Energy in Austria: A Leading Renewable Contributor

Biomass occupies a prominent position in Austria’s renewable energy landscape, holding the title of most relevant renewable source:

- Overall Share: 57% of total renewable energy (as of 2022)

- Electricity Production: 6.5% (mostly through combined heat and power plants)

- Heat Production: 30% of total heat energy mix

- Most Popular Source for Residential Heating: 40% share in dwellings

Key Features:

- Dominant Heat Market: Biomass primarily contributes to heat generation, accounting for 81% of its production in 2016.

- District Heating Leader: 50% of district heating relies on biomass, with significant expansion through biomass-based plants in the past decade.

- Growth Potential: The Austrian Biomass Association estimates the potential to nearly double biomass energy use.

Drivers of Success:

- Established Infrastructure: Austria has a well-developed infrastructure for utilizing biomass, including numerous wood pellet boilers and biogas plants.

- Sustainable Forestry Practices: Emphasis on responsible forest management ensures a reliable supply of wood-based biomass.

- Supportive Policies: Government incentives like feed-in tariffs and tax breaks encourage investment in biomass technologies.

Challenges:

- Emission Concerns: While considered renewable, biomass combustion can still generate emissions, requiring careful management to minimize environmental impact.

- Competition with Food Production: Balancing land use between energy production and food security remains a critical consideration.

- Cost Fluctuations: Biomass prices can be volatile, impacting project economics.

Future Outlook:

With its established infrastructure, sustainable practices, and supportive policies, biomass is expected to continue playing a vital role in Austria’s energy mix. However, addressing emission concerns, competition with food production, and cost fluctuations will be crucial for sustained and responsible growth.

Geothermal Energy in Austria: Tapping into Earth’s Heat

While not yet a major player in Austria’s energy landscape, geothermal energy holds potential for future growth, thanks to its:

Renewable and Sustainable Nature: Like other renewables, geothermal heat utilizes Earth’s internal heat, minimizing resource depletion and emissions.

Reliable Baseload Supply: Geothermal energy delivers continuous, dependable power, balancing intermittent sources like solar and wind.

Diverse Applications: Suitable for heating buildings, producing electricity, and supporting industrial processes.

Current Status:

- Installed Capacity: Around 111 MW (as of 2022), primarily serving district heating networks.

- Electricity Production: Negligible contribution to national electricity generation.

- Heat Production: Provides heating for approximately 40,000 households and various public buildings.

Challenges:

- Limited Geothermal Resource Potential: Geothermal potential varies across Austria, with most promising areas concentrated in Vienna Basin and Pannonian Basin.

- High Exploration and Drilling Costs: Initial investment for accessing geothermal resources can be substantial.

- Regulatory Uncertainty: Lack of a dedicated regulatory framework for deep geothermal projects can hinder development.

Recent Developments:

- Vienna Geothermal Project: A joint venture formed by Wien Energie and OMV aims to develop the first deep geothermal plant in Vienna by 2026.

- Upper Austria’s First Geothermal Greenhouse: Utilizing geothermal heat for sustainable vegetable production.

- Growing Public and Institutional Interest: Increased awareness and support for exploring geothermal potential.

Future Outlook:

While challenges exist, growing interest and recent developments suggest potential for geothermal energy to expand in Austria. Government support, technological advancements, and successful pilot projects could unlock its potential as a valuable contributor to the country’s clean energy future.

Additional Data:

- Geothermal Heat Pump Installations: Over 90,000 operating in Austria, contributing significantly to space heating.

- Market Growth Potential: Experts estimate geothermal could provide up to 10% of Austria’s heat demand by 2050.

Geothermal energy in Austria is at an early stage but holds promise for future growth, contributing to a diverse and sustainable energy mix.

Austria: Renewable Energy Technology by Category (as of 2023)

Hydropower:

- Type: Primarily large-scale run-of-river and pumped storage hydropower plants.

- Installed capacity: 16.7 GW

- Electricity generation: 60% of total, 40 TWh annually

- Strengths: Mature technology, reliable baseload power, efficient energy storage through pumped storage.

- Weaknesses: Limited potential for expansion, environmental concerns regarding river ecosystems.

Wind Power:

- Type: Primarily onshore wind farms, with growing offshore potential.

- Installed capacity: 3.7 GW

- Electricity generation: 15% of total, 10 TWh annually

- Strengths: Rapidly growing technology, cost-effective, good wind resource potential.

- Weaknesses: Intermittency requires grid balancing solutions, visual impact concerns.

Solar Power:

- Type: Mixture of rooftop photovoltaic (PV) systems and ground-mounted solar farms.

- Installed capacity: 2.6 GW

- Electricity generation: 10% of total, 7 TWh annually

- Strengths: Decentralized generation, versatile applications, falling costs.

- Weaknesses: Intermittency, limited land availability for large-scale farms.

Biomass Power:

- Type: Primarily wood pellet combustion plants with some biogas facilities.

- Installed capacity: 0.7 GW

- Electricity generation: 3% of total, 2 TWh annually

- Strengths: Domestic fuel source, dispatchable power, carbon neutrality potential.

- Weaknesses: Emissions concerns, competition for land and forest resources.

Emerging Technologies:

- Geothermal energy: Limited potential in Austria, but several small-scale projects exist.

- Heat pumps: Growing popularity for residential and commercial heating.

- District heating: Well-developed infrastructure, utilizing various renewable sources like biomass and waste heat.

Policy and incentives:

- Strong government support through feed-in tariffs, investment grants, and tax breaks.

- Focus on innovation and research for further development of renewable technologies.

Key Takeaways:

- Austria is a global leader in renewable energy, with hydropower forming the backbone and wind, solar, and biomass playing increasingly important roles.

- Diversification of technology portfolio is crucial for achieving 100% renewable electricity by 2030.

- Balancing environmental concerns, social acceptance, and cost-effectiveness remains a challenge.

Please note: This information is a general overview. Specific details and data may vary depending on the source.

Largest Renewable Energy Power Plant in Austria

Unfortunately, defining “largest” in the context of renewable energy power plants in Austria can be tricky due to the different technologies involved. Each technology has its own way of measuring capacity and output, making direct comparisons a bit apples-to-oranges.

However, here are some ways to tackle your question:

Based on Installed Capacity:

- Hydropower: The largest hydropower plant in Austria is Limberg II with an installed capacity of 1,000 MW. However, remember that hydropower often involves multiple smaller plants generating collectively, so this might not be the “biggest” in terms of physical scale.

- Wind power: Wind farms are typically scattered across an area, making a single “largest” difficult to pinpoint. However, the Puch Wind Farm boasts the most turbines (41) with a combined capacity of 163 MW.

- Solar power: The largest solar farm in Austria is the Vienna Airport PV Park with a capacity of 24 MW. Again, the decentralized nature of solar power makes “biggest” a complex term.

- Biomass power: The largest biomass power plant is Dürnrohr Thermal Power Station with a capacity of 200 MW.

Based on Annual Electricity Generation:

- Hydropower: This remains the same as above, with Limberg II generating the most electricity annually.

- Wind power: While Puch Wind Farm has the most turbines, the Wolfsberg Wind Farm actually generates more electricity (around 230 GWh annually).

- Solar power: While Vienna Airport PV Park has the largest capacity, the ECOwinds Grafenworth Solar PV Park generates more electricity (around 30 GWh annually).

- Biomass power: Again, Dürnrohr Thermal Power Station remains the highest generator of electricity amongst biomass plants.

Final Thoughts:

Instead of a single “largest” plant, Austria prioritizes diversifying its renewable energy portfolio. Therefore, focusing on the strengths and weaknesses of each technology and their contribution to the bigger picture might be more relevant than identifying a single winner.

Top 10 Renewable Energy Companies in Austria (2024)

Defining the “top 10” in renewable energy involves various factors like revenue, installed capacity, innovation, or market share. Here are 10 notable companies leading the charge in Austria, highlighting their key areas of focus:

1. VERBUND AG:

- Leading international electricity company, headquartered in Vienna.

- Core business: Hydropower generation, transmission, and trading (98% of generation).

- Operates over 120 hydropower plants across Austria, Germany, and Europe.

- Growing portfolio of wind and solar farms.

2. Wien Energie GmbH:

- Largest municipal energy company in Austria, supplying Vienna with various utilities.

- Strong focus on renewables (60% electricity from biomass & waste-to-energy).

- Operates hydropower, biomass, and wind farms.

- Investing heavily in solar power and district heating expansion.

3. Energie Burgenland AG:

- Main energy supplier in Burgenland, Austria.

- Diverse renewable energy portfolio: Hydropower, wind, biomass, and solar.

- Operates over 100 hydropower plants and several wind & solar parks.

- Committed to achieving 100% renewable energy supply by 2030.

4. Andritz AG:

- Global leader in pulp & paper, hydropower, and metals industries.

- Significant role in developing and supplying hydropower equipment.

- Offers solutions for all segments of the hydropower value chain.

5. GreenTech Cluster Styria GmbH:

- Non-profit organization promoting green technologies in Styria, Austria.

- Over 200 member companies in renewable energy, energy efficiency, and environmental technologies.

- Provides networking, market intelligence, and project development support.

6. Austrian Energy Group:

- Formed by the merger of EVN AG and VERBUND AG’s thermal power assets.

- Operates gas-fired power plants and district heating networks in Austria.

- Crucial role in grid stability and integrating renewable energy sources.

7. ENGIE SA:

- French multinational energy and utility company with a presence in Austria.

- Operates gas-fired power plants and district heating networks.

- Invests in renewable energy projects (wind & solar) across Europe.

8. Scheuch GmbH:

- Leading manufacturer of biomass boilers and other bioenergy technology.

- Provides solutions for residential, commercial, and industrial applications.

- Contributes to the growth of biomass power, a vital component of Austria’s mix.

9. SolarFocus GmbH:

- Developer, manufacturer, and distributor of innovative solar thermal systems.

- Offers products for domestic hot water, heating, and pool heating applications.

- Promotes solar thermal energy, complementary to solar PV.

10. IQX Group GmbH:

- Developer and manufacturer of microCHP (combined heat and power) systems.

- Provides efficient and sustainable energy solutions for buildings.

- Contributes to reducing reliance on fossil fuels and increasing energy independence.

Remember, this is not an exhaustive list. The landscape of renewable energy companies in Austria is constantly evolving. These companies represent a diverse range of technologies and approaches, all contributing to Austria’s impressive achievements in the renewable energy sector.

Future of Renewable Energy Development in Austria

Austria, already a leader in renewable energy with ambitious goals to achieve 100% renewable electricity by 2030, is set for an exciting future in clean energy development. Here are some key aspects to consider:

Growth Drivers:

- Continued political commitment: The strong national focus on renewables, reflected in policies and incentives, is expected to persist.

- Technological advancements: Innovations in areas like energy storage, grid integration, and emerging technologies like geothermal and hydrogen will enhance potential and efficiency.

- Public support: Growing societal awareness and demand for sustainability will likely continue to fuel public support for renewable energy projects.

Key Areas of Development:

- Expansion of existing technologies: Hydropower will remain a vital base, while wind and solar are expected to see significant growth, including offshore wind potential.

- Integration of diverse sources: Optimizing grid management and storage solutions will be crucial to accommodate the increasing mix of renewable sources.

- Decentralization: Increased deployment of rooftop solar and community-based projects will empower local communities and contribute energy independence.

- Focus on green hydrogen: Investments in hydrogen production from renewable sources are expected to gain momentum, offering energy storage and fuel options.

Challenges and Opportunities:

- Balancing environmental and social impacts: Careful planning and stakeholder engagement are needed to mitigate potential impacts on landscapes and communities.

- Grid infrastructure upgrades: Investments in grid modernization and expansion will be necessary to handle the increasing share of variable renewable energy.

- Cost considerations: Continued cost reductions in renewable technologies and their efficient integration will be key to maintaining affordability.

The future of renewable energy development in Austria appears bright. With continued political will, technological advancements, and innovative approaches, Austria is well-positioned to solidify its leadership in the clean energy transition and set an example for other nations.

https://www.exaputra.com/2024/02/renewable-energy-landscape-in-austria.html

Renewable Energy

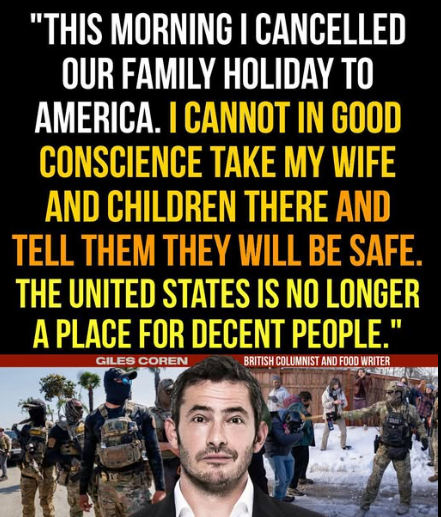

How Is U.S. Insanity Affecting Tourism?

It’s probably a bit too soon to have useable statistics on this subject, but it’s certainly not too early to apply some common sense.

It’s probably a bit too soon to have useable statistics on this subject, but it’s certainly not too early to apply some common sense.

There are at two factors at play here:

1) America is broadly regarded as a rogue country. Do you want to visit North Korea? Do Canadians want to spend money in a country that wants to annex them?

2) America is now understood to be unsafe. Do you want to visit Palestine? Ukraine? Iran?

Renewable Energy

Commercial Solar Solutions: Real Case Studies by Cyanergy

The post Commercial Solar Solutions: Real Case Studies by Cyanergy appeared first on Cyanergy.

https://cyanergy.com.au/blog/commercial-solar-solutions-real-case-studies-by-cyanergy/

Renewable Energy

Inside ATT and SSE’s Faskally Safety Leadership Centre

Weather Guard Lightning Tech

Inside ATT and SSE’s Faskally Safety Leadership Centre

Allen visits the Faskally Safety Leadership Centre with Mark Patterson, Director of Safety, Health, and Environment at SSE, and Dermot Kerrigan, Director and Co-Founder of Active Training Team. They discuss how SSE has put over 9,000 employees and 2,000 contract partners through ATT’s innovative training program, which uses actors and realistic scenarios to create lasting behavioral change across the entire workforce chain, from executives to technicians. Reach out to SSE and ATT to learn more!

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining Light on Wind. Energy’s brightest innovators. This is the Progress Powering tomorrow.

Allen Hall: Mark and Turnt. Welcome to the show. Thank you.

Mark Patterson: Thank you.

Allen Hall: We’re in Scotland, present Scotland and per Scotland, which is a place most people probably haven’t ventured to in the United States, but it is quite lovely, although chilly and rainy. It’s Scotland. We’re in December. Uh, and we’re here to take a look at the SSE Training Center.

And the remarkable things that active training team is doing here, because we had seen this in Boston in a smaller format, uh, about a year ago almost now.

Dermot Kerrigan: Just Yeah,

Allen Hall: yeah. Six months

Dermot Kerrigan: ago.

Allen Hall: Yeah. Yeah. It hasn’t been that long ago. Uh, but IC was on me to say, you gotta come over. You gotta come over. You gotta see the, the whole, uh, environment where we put you into the police room and some of the things we wanna talk about, uh, because it, [00:01:00] it does play different.

And you’re right, it does play different. It is very impactful. And it, and maybe we should start off first of Mark, you’re the head of basically health and safety and environment for SSE here in Perth. This is a remarkable facility. It is unlike anything I have seen in the States by far. And SSE has made the commitment to do this sort of training for.

Everybody in your employment and outside of your employment, even contractors.

Mark Patterson: We have been looking at some quite basic things in safety as everybody does. And there’s a fundamental thing we want to do is get everybody home safe. And uh, it’s easier said than done because you’ve gotta get it right for every single task, every single day.

And that’s a massive challenge. And we have like 15,000. 15,000 people in SSE, we probably work with about 50,000 contract [00:02:00] partners and we’re heavily dependent, uh, on get our contract partners to get our activities done. And they’re crucial.

Speaker: Mm-hmm.

Mark Patterson: And in that it’s one community and we need to make sure everybody there gets home safe.

And that’s what drove us to think about adding more rules isn’t gonna do it. Um, you need to give people that sense of a feeling, uh, when a really serious sense of cars and then equip them with tools to, to deal with it. So. We’ve all probably seen training that gives that sense of doom and dread when something goes badly wrong, but actually that needs to be.

Coupled with something which is quite powerful, is what are the tools that help people have the conversations that gets everybody home safe. So kind of trying to do two things.

Allen Hall: Well, SSC is involved in a number of large projects. You have three offshore wind farms, about a more than a thousand turbines right now.

Wind turbines onshore, offshore, and those offshore projects are not easy. There’s a lot of complexity to them.

Mark Patterson: Absolutely. So look, I I think [00:03:00] that’s, that’s something that. You’ve gotta partner with the right people. If you wanna be successful, you need to make it easy for people to do the right thing. Yeah, as best you possibly can.

You need to partner with the right people, and you need to get people that you need to have a sense that you need to keep checking that as you’re growing your business. The chinks in your armor don’t grow too. But fundamentally there’s something else, which is a sense of community. When people come together to, to do a task, there is a sense of community and people work, put a lot of discretionary effort into to get, uh, big projects done.

And in that, um, it’s a sense of community and you wanna make sure everybody there gets home safe to their friends and family. ’cause if we’re all being honest about it, you know, SSE is a brilliant company. What we do is absolutely worth doing. I love SC. But I love my family a fair amount more. And if you bought into that, you probably bought into the strategy that we’re trying to adopt in terms of safety.

Uh, it’s really simple messaging. Um,

Allen Hall: yeah. That, that is very clear. Yeah. And it should be [00:04:00]well communicated outside of SSEI hope because it is a tremendous, uh, value to SSE to do that. And I’m sure the employees appreciate it because you have a culture of safety. What. Trigger that. How long ago was that trigger?

Is this, this is not something you thought up yesterday for sure.

Mark Patterson: No, look, this, the, the, what we’ve done in the immersive training center, um, really reinforces a lot of things that we’ve had in place for a while, and it, it takes it to the, the next level. So we’ve been working probably more than 10 years, but, uh, certainly the.

Seven years we’ve been talking very much about our safety family, that’s the community and SSE with our contract partners and what we need to do. And part of that is really clear language about getting people home safe. Uh, a sense that you’ve, everybody in it that works with us has a safety license. And that license is, if it’s not safe, we don’t do it.

It’s not a rural based thing. It’s how we roll. It’s part of the culture. We’d, we, uh, have a culture where, and certainly trying to instill for everybody a culture. Where [00:05:00] they’ve got that license. If, if they think something’s not right, we’ll stop the job and get it right. And even if they’re wrong, we’ll still listen to them because ultimately we need to work our way through, right?

So we’ve been, we’ve thought hard about the language we wanted to use to reinforce that. So the importance of plan, scan and adapt. So planning our work well, thinking through what we need to do. Not just stopping there though, keeping scanning for what could go wrong. That sense that you can’t remember everything.

So you need to have immediate corrective actions and that immediate sort of see it, sort of report it. If you see something that isn’t right, do something about it. And that sense of community caring for the community that you work with. And those are the essence of our, our language on safety and the immersive training.

Uh, is not trying to shove that language down everybody’s throats again, particularly our contract partners, but it’s, it’s helping people see some really clear things. One is if a [00:06:00] really serious incident occurs at what, what it feels like here. And I’ve spent a lot of time in various industries and people are different when they’ve been on a site or involved when there’s been a really serious incident and you need to do something to.

Get that sense of a feeling of what it feels like and actually make people feel slightly uncomfortable in the process. ’cause that’s part of it,

Allen Hall: right? Yes.

Mark Patterson: Because you know,

Allen Hall: you remember that.

Mark Patterson: You remember that. Yeah. We’ve had, you know, we’ve had people say, well, I felt very uncomfortable in that bit of the training.

It was okay. But was, I felt very uncomfortable. And you know, we’ve talked about that a lot.

Allen Hall: Yeah.

Mark Patterson: We know you kinda should because if there’s something wrong with you, if you don’t feel uncomfortable about that. But what’s super powerful on the guys in at TT do brilliantly. Is have facilitators that allow you to have that conversation and understand what do you need to do differently?

How do you influence somebody who’s more senior? How do you, how do you bring people with you so that they’re gonna [00:07:00] do what you want ’em to do after you’ve left the building? And. Just pointing the finger at people and shouting at them. Never does that. Right? Uh, rarely does that. You’ve gotta get that sense of how do you get people to have a common belief?

And,

Allen Hall: and I think that’s important in the way that SSE addresses that, is that you’re not just addressing technicians, it’s the whole chain. It’s everybody is involved in this action. And you can break the link anywhere in there. I wanna get through the description of why that. Process went through ATTs head to go.

We need to broaden the scope a little bit. We need to think about the full chain from the lowest entry worker just getting started to the career senior executive. Why chain them all together? Why put them in the same room together? Yeah. Why do you do that?

Dermot Kerrigan: Well, behavioral safety or behavioral base safety kind of got a bad rep because it was all about.

If we could just [00:08:00] make those guys at the front line behave themselves,

Allen Hall: then everything’s fine,

Dermot Kerrigan: then everything’s fine.

Allen Hall: Yes.

Dermot Kerrigan: But actually that’s kind of a, the wrong way of thinking. It didn’t work. I, I think,

Allen Hall: yeah, it didn’t work.

Dermot Kerrigan: What the mess, the central message we’re trying to get across is that actually operational safety is not just the business of operational people.

It’s everybody’s business.

Allen Hall: Right.

Dermot Kerrigan: You know? Um, and. Yeah, everybody has a role to p play in that, you know? Right. So site based teams, back office support functions, everybody has a role to play. And, you know, there’s a strand in, in this scenario where, uh, an incident takes place because people haven’t been issued with the right piece of equipment.

Which is a lifting cage.

Allen Hall: Yes.

Dermot Kerrigan: And there’s a whole story about that, which goes through a procurement decision made somewhere where somebody hit a computer and a computer said no because they’d asked for too many lifting cages when they, somebody could have said, you’ve asked for five lifting cages, it’s takes you over the procurement cap.

Would four do it? [00:09:00] Yes, that would be fine. That would be fine. Yeah. As it is, they come to a crucial piece of operation. This incr this, you know, this crucial piece of kit simply isn’t there. So in order to hit the deadline and try and make people happy, two ordinary guys, two technicians, put two and two together, make five, and, and one of them gets killed, you know?

Yeah. So it’s, we’re, we’re trying to show that, that this isn’t just operational people. It’s everybody’s business.

Mark Patterson: Well, that’s why we worked with you in this, because, um, we saw. Why you got it in terms of that chain? Um, so in, in the scenario, it’s very clear there’s a senior exec talking to the client and actually as SSE.

We’re sometimes that client, we’ve got big principal contractors that are doing our big construction activities. We’ve got a lot in renewables and onshore and offshore wind obviously, but, and the transmission business and in thermal, so, uh, and distribution. So I’ll list all our businesses and including customer’s business, but we’ve got some big project activities where we’re the client sometime we’re the principal contractor [00:10:00] ourselves.

And we need to recognize that in each chain, each link in that chain, there’s a risk that we say the wrong thing, put the wrong pressure on. And I think what’s really helpful is we have in the center that sort of philosophy here that we get everybody in together mixed up. Probably at least half of our board have done this.

Our executive team have all done this. Um, people are committed to it at that level, and they’re here like everybody else sitting, waiting for this thing to start. Not being quite sure what they’re gonna go through in the day. Um, and it’s actually really important you’ve got a chief exec sitting with somebody who’s, um, a scaffolder.

That’s really important. ’cause the scaffolder is probably the more likely person to get hurt rather than chief exec. So actually everybody seeing what it’s like and the pressures that are under at each level is really important.

Allen Hall: SSC is such a good example for the industry. I watched you from outside in America for a long time and you just watch the things that happened.

[00:11:00] Here you go. Wow. Okay. SSC is organized. They know what they’re doing, they understand what the project is, they’re going about it. Mm-hmm. Nothing is perfect, but I, I think when we watch from the United States, we see, oh, there’s order to it. There’s a reason they’re doing these things. They’re, they’re measuring what is happening.

And I think that’s one of the things about at t is the results. Have been remarkable, not just here, but in several different sites, because a TT touches a lot of massive infrastructure projects in the uk and the success rate has been tremendous. Remember? You wanna just briefly talk about that?

Dermot Kerrigan: Yeah. But we, we run a number of centers.

We also run mobile programs, which you got from having seen us in the States. Um, but the first, uh, center that we, we, we opened was, was called. Epic, which stood for Employers Project Induction Center, and that was the Thames Tideway Tunnel Project, which is now more or less finished. It’s completed. And that was a 10 year project, 5 billion pounds.

Allen Hall: Wow.

Dermot Kerrigan: Um, [00:12:00] and you know, unfortunately the fact is on, on that kind of project, you would normally expect to hurt a number of people, sometimes fatally. That would be the expectation.

Allen Hall: Right. It’s a complicated

Dermot Kerrigan: project, statistic underground. So, you know, we, and, and of course Tide, we are very, very. Very pleased that, uh, in that 10 year span, they didn’t even have one, uh, serious life-changing injury, uh, let alone a fatality.

Um, so you know that that’s, and I’m I’m not saying that what ATTs work, uh, what we do is, is, is, is directly responsible for that, but certainly Epic, they would say Tideway was the cornerstone for the safety practices, very good safety practices that they, they put out. Uh, on that project, again, as a cultural piece to do with great facilities, great leadership on the part of the, of the, of the executive teams, et cetera, and stability.

It was the same ex executive team throughout that whole project, which is quite unusual.

Allen Hall: No.

Dermot Kerrigan: Yeah. [00:13:00] Um, so yeah, it, it, it seems to work, you know, uh, always in safety that the, the, the, the tricky thing is trying to prove something works because it hasn’t happened. You know?

Allen Hall: Right, right. Uh, prove the negative.

Dermot Kerrigan: Yeah. Um,

Allen Hall: but in safety, that’s what you want to have happen. You, you do know, not want an outcome.

Dermot Kerrigan: No, absolutely not.

Allen Hall: No reports, nothing.

Dermot Kerrigan: No. So, you know, you have to give credit to, to organizations. Organizations like SSE. Oh, absolutely. And projects like Tideway and Sted, uh, on their horn projects. Who, who have gone down this, frankly, very left field, uh, route.

We we’re, you know, it is only in the last 10 years that we’ve been doing this kind of thing, and it hasn’t, I mean, you know, Tideway certainly is now showing some results. Sure. But, you know, it’s, it’s, it, it wasn’t by any means a proven way of, of, of dealing with safety. So

Mark Patterson: I don’t think you could ever prove it.

Dermot Kerrigan: No.

Mark Patterson: And actually there’s, there’s something [00:14:00]fundamentally of. It, it kind of puts a stamp on the culture that you want, either you talked about the projects in SSE, we’ve, we’ve done it for all of our operational activities, so we’ve had about 9,000 people through it for SSE and so far about 2000 contract partners.

Um, we’re absolutely shifting our focus now. We’ve got probably 80% of our operational teams have been through this in each one of our businesses, and, uh, we. We probably are kind of closing the gaps at the moment, so I was in Ireland with. I here guys last week, um, doing a, a mobile session because logistically it was kind of hard to come to Perth or to one of the other centers, but we’re, we’re gradually getting up to that 80%, uh, for SSE colleagues and our focus is shifting a bit more to contract partners and making sure they get through.

And look, they are super positive about this. Some of them have done that themselves and worked with a TT in the past, so they’re. Really keen to, to use the center that we have [00:15:00] here in Perth, uh, for their activities. So when, when they’re working with us, we kind of work together to, to make that happen. Um, but they can book that separately with you guys.

Yeah. Uh, in, in the, uh, Fastly Center too.

Allen Hall: I think we should describe the room that we’re in right now and why this was built. This is one of three different scenes that, that each of the. Students will go through to put some realism to the scenario and the scenario, uh, a worker gets killed. This is that worker’s home?

Dermot Kerrigan: Yeah. So each of the spaces that we have here that, that they denote antecedents or consequences, and this is very much consequences. Um, so the, the, the participants will be shown in here, uh, as they go around the center, uh, and there’s a scene that takes place where they meet the grown up daughter of the young fella who’s been right, who’s been, who’s been tragically killed.

Uh, and she basically asks him, uh, asks [00:16:00] them what happened. And kind of crucially this as a subtext, why didn’t you do something about it?

Allen Hall: Mm-hmm.

Dermot Kerrigan: Because you were there,

Allen Hall: you saw it, why it was played out in front of you. You saw, you

Dermot Kerrigan: saw what happened. You saw this guy who was obviously fast asleep in the canteen.

He was exhausted. Probably not fit for work. Um, and yet being instructed to go back out there and finish the job, um, with all the tragic consequences that happen,

Allen Hall: right?

Dermot Kerrigan: But it’s important to say, as Mark says, that. It’s not all doom and gloom. The first part of the day is all about showing them consequences.

Allen Hall: Sure. It’s

Dermot Kerrigan: saying it’s a,

Allen Hall: it’s a Greek tragedy

Dermot Kerrigan: in

Allen Hall: some

Dermot Kerrigan: ways, but then saying this doesn’t have to happen. If you just very subtly influence other people’s behavior, it’s

Allen Hall: slight

Dermot Kerrigan: by thinking about how you behave and sure adapting your behavior accordingly, you can completely change the outcome. Uh, so long as I can figure out where you are coming from and where that behavior is coming from, I might be able to influence it,

Allen Hall: right.

Dermot Kerrigan: And if I can, then I can stop that [00:17:00] hap from happening. And sure enough, at the end of the day, um, the last scene is that the, the, the daughter that we see in here growing up and then going back into this tragic, uh, ending, uh. She’s with her dad, then it turned out he was the one behind the camera all along.

So he’s 45 years old, she’s just passed the driving test and nobody got her 21 years ago. You know,

Mark Patterson: I think there, there is, there’s a journey that you’ve gotta take people through to get to believe that. And kind of part of that journey is as, as we look around this room, um, no matter who it is, and we’ve talked to a lot of people, they’ll be looking at things in this room and think, well, yeah, I’ve got a cup like that.

And yes. Yeah. When my kids were, we, we had. That play toy for the kids. Yes. So there is something that immediately hooks people and children hook

Allen Hall: people.

Mark Patterson: Absolutely. And

Allen Hall: yes,

Mark Patterson: they get to see that and understand that this is, this is, this is, could be a real thing. And also in the work site, uh, view, there’s kind of a work site, there’s a kind of a boardroom type thing [00:18:00] and you can actually see, yeah, that’s what it kind of feels like.

The work sites a little bit. You know, there’s scuffs in the, on the line, on the floor because that’s what happens in work sites and there’s a sense of realism for all of this, uh, is really important.

Allen Hall: The realism is all the way down to the outfits that everybody’s worn, so they’re not clean safety gear.

It’s. Dirty, worn safety gear, which is what it should be. ’cause if you’re working, that’s what it should look like. And it feels immediately real that the, the whole stage is set in a, in the canteen, I’ll call it, I don’t know, what do you call the welfare area? Yeah. Okay.

Dermot Kerrigan: Yeah.

Allen Hall: Okay. Uh, wanna use the right language here.

But, uh, in the states we call it a, a break room. Uh, so you’re sitting in the break room just minding your own business and boom. An actor walks in, in full safety gear, uh, speaking Scottish very quickly, foreign American. But it’s real.

Mark Patterson: I think

Allen Hall: it feels real because you, you, I’ve been in those situations, I’ve seen that that break the,

Mark Patterson: the language is real and, uh, [00:19:00] perhaps not all, uh, completely podcast suitable.

Um, but when you look at it, the feedback we’ve got from, from people who are closer to the tools and at all levels, in fact is, yeah. This feels real. It’s a credible scenario and uh, you get people who. I do not want to be in a safety training for an entire day. Um, and they’re saying arms folded at the start of the day and within a very short period of time, they are absolutely watching what the heck’s going on here.

Yes. To understand what’s happening, what’s going on. I don’t understand. And actually it’s exactly as you say, those subtle things that you, not just giving people that experience, but the subtle things you can nudge people on to. There’s some great examples of how do you nudge people, how do you give feedback?

And we had some real examples where people have come back to us and said even things to do with their home life. We were down in London one day, um, and I was sitting in on the training and one of the guys said, God, you’ve just taught me something about how I can give feedback to people in a really impactful [00:20:00] way.

So you, so you explain the behavior you see, which is just the truth of what the behavior is. This is what I saw you do, this is what happened, but actually the impact that that has. How that individual feels about it. And the example that they used was, it was something to do with their son and how their son was behaving and interacting.

And he said, do you know what? I’ve struggled to get my son to toe the line to, to look after his mom in the right way. I’m gonna stop on the way home and I’m gonna have a conversation with him. And I think if I. Keep yourself cool and calm and go through those steps. I think I can have a completely different conversation.

And that was a great example. Nothing to do with work, but it made a big difference to that guy. But all those work conversations where you could just subtly change your tone. Wind yourself back, stay cool and calm and do something slightly different. And I think that those, those things absolutely make a difference,

Allen Hall: which is hard to do in the moment.

I think that’s what the a TT training does make you think of the re the first reaction, [00:21:00] which is the impulsive reaction. We gotta get this job done. This has gotta be done. Now I don’t have the right safety gear. We’ll, we’ll just do it anyway to, alright, slow. Just take a breather for a second. Think about what the consequences of this is.

And is it worth it at the end of the day? Is it worth it? And I think that’s the, the reaction you want to draw out of people. But it’s hard to do that in a video presentation or

Dermot Kerrigan: Yeah.

Allen Hall: Those things just

Dermot Kerrigan: don’t need to practice.

Allen Hall: Yeah. It doesn’t stick in your brain.

Dermot Kerrigan: You need to give it a go And to see, right.

To see how to see it happen. And, and the actors are very good. They’re good if they, you know. What, whatever you give them, they will react to.

Mark Patterson: They do. That’s one of the really powerful things. You’ve got the incident itself, then you’ve got the UNP of what happened, and then you’ve got specific, uh, tools and techniques and what’s really good is.

Even people who are not wildly enthusiastic at the start of the day of getting, being interactive in, in, in a session, they do throw themselves into it ’cause they recognize they’ve been through [00:22:00] something. It’s a common sense of community in the room.

Dermot Kerrigan: Right.

Mark Patterson: And they have a bit of fun with it. And it is fun.

Yeah. You know, people say they enjoy the day. Um, they, they, they recognize that it’s challenged them a little bit and they kinda like that, but they also get the opportunity to test themselves. And that testing is really important in terms of, sure. Well, how do you challenge somebody you don’t know and you just walking past and you see something?

How do you have that conversation in a way that just gets to that adult To adult communication? Yeah. And actually gets the results that you need. And being high handed about it and saying, well, those are the rules, or, I’m really important, just do it. That doesn’t give us a sustained improvement.

Dermot Kerrigan: PE people are frightened of failure, you know?

Sure. They’re frightened of getting things wrong, so give ’em a space where they, where actually just fall flat in your face. Come back up again and try again. You know, give it a go. And, because no one’s, this is a safe space, you know, unlike in the real world,

Allen Hall: right?

Dermot Kerrigan: This is as near to the real world as you want to get.

It’s pretty real. It’s safe, you know, uh, it’s that Samuel Beckett thing, you know, fail again, [00:23:00] fail better,

Allen Hall: right?

Mark Patterson: But there’s, there’s a really good thing actually because people, when they practice that they realize. Yeah, it’s not straightforward going up and having a conversation with somebody about something they’re doing that could be done better.

And actually that helps in a way because it probably makes people a little bit more generous when somebody challenges them on how they’re approaching something. Even if somebody challenges you in a bit of a cat handed way, um, then you can just probably take a breath and think this. This, this guy’s probably just trying to have a conversation with me,

Allen Hall: right.

Mark Patterson: So that I get home to my family.

Allen Hall: Right.

Mark Patterson: It’s hard to get annoyed when you get that mindset. Mindset

Allen Hall: someone’s looking after you just a little bit. Yeah. It does feel nice.

Mark Patterson: And, and even if they’re not doing it in the best way, you need to be generous with it. So there’s, there’s good learnings actually from both sides of the, the, the interaction.

Allen Hall: So what’s next for SSE and at t? You’ve put so many people through this project in, in the program and it has. Drawn great results.

Mark Patterson: Yeah.

Allen Hall: [00:24:00] How do you, what do you think of next?

Mark Patterson: So what’s next? Yeah, I guess, uh, probably the best is next to come. Next to come. We, I think there’s a lot more that we can do with this.

So part of what we’ve done here is establish with a big community of people, a common sense of what we’re doing. And I think we’ve got an opportunity to continue with that. We’ve got, um, fortunate to be in a position where we’ve got a good level of growth in the business.

Allen Hall: Yes,

Mark Patterson: we do. Um, there’s a lot going on and so there’s always a flow of new people into an organization, and if people, you know, the theory of this stuff better than I do, would say that you need to maintain a, a sense of community that’s kind of more than 80%.

If you want a certain group of people to act in a certain way, you need about 80% of the people plus to act in that way, and then it’ll sustain. But if it starts. To drift so that only 20% of people are acting a certain way, then that is gonna ex extinguish that elements of the culture. So we need to keep topping up our Sure, okay.

Our, our [00:25:00] immersive training with people, and we’re also then thinking about the contract partners that we have and also leaving a bit of a legacy. For the communities in Scotland, because we’ve got a center that we’re gonna be using a little bit less because we’ve fortunate to get the bulk of our people in SSE through, uh, we’re working with contract partners.

They probably want to use it for. For their own purposes and also other community groups. So we’ve had all kinds of people from all these different companies here. We’ve had the Scottish first Minister here, we’ve had loads of people who’ve been really quite interested to see what we’re doing. And as a result of that, they’ve started to, uh, to, to step their way through doing something different themselves.

So,

Allen Hall: so that may change the, the future of at t also. And in terms of the slight approach, the scenarios they’re in. The culture changes, right? Yeah. Everybody changes. You don’t wanna be stuck in time.

Dermot Kerrigan: No, absolutely.

Allen Hall: That’s one thing at t is not,

Dermot Kerrigan: no, it’s not

Allen Hall: stuck in time.

Dermot Kerrigan: But, uh, I mean, you know, we first started out with the centers, uh, accommodating project.

Yeah. So this would [00:26:00] be an induction space. You might have guys who were gonna work on a project for two weeks, other guys who were gonna work on it for six months. They wanted to put them through the same experience. Mm. So that when they weren’t on site. That they could say, refer back to the, the, the, the induction and say, well, why ask me to do that?

You know, we, we, we both have that experience, so I’m gonna challenge you and you’re gonna accept challenge, et cetera. So it was always gonna be a short, sharp shock. But actually, if you’re working with an organization, you don’t necessarily have to take that approach. You could put people through a little bit of, of, of, of the training, give ’em a chance to practice, give ’em a chance to reflect, and then go on to the next stage.

Um. So it, it becomes more of a, a journey rather than a single hard, a single event experience. Yeah. You don’t learn to drive in a day really, do you? You know, you have to, well, I do transfer it to your right brain and practice, you know?

Allen Hall: Right. The more times you see an experience that the more it’s memorable and especially with the, the training on how to work with others.[00:27:00]

A refresh of that is always good.

Dermot Kerrigan: Yeah.

Allen Hall: Pressure changes people and I think it’s always time to reflect and go back to what the culture is of SSE That’s important. So this, this has been fantastic and I, I have to. Thank SSC and a TT for allowing us to be here today. It was quite the journey to get here, but it’s been really enlightening.

Uh, and I, I think we’ve been an advocate of a TT and the training techniques that SSC uses. For well over a year. And everybody we run into, and in organizations, particularly in win, we say, you, you gotta call a TT, you gotta reach out because they’re doing things right. They’re gonna change your safety culture, they’re gonna change the way you work as an organization.

That takes time. That message takes time. But I do think they need to be reaching out and dermo. How do they do that? How do, how do they reach att?

Dermot Kerrigan: Uh, they contact me or they contact att. So info at Active Trading Team, us.

Allen Hall: Us. [00:28:00] There you go.

Dermot Kerrigan: or.co uk. There you go. If you’re on the other side of the pond. Yeah.

Allen Hall: Yes. And Mark, because you just established such a successful safety program, I’m sure people want to reach out and ask, and hopefully a lot of our US and Australian and Canadian to listen to this podcast. We’ll reach out and, and talk to you about how, what you have set up here, how do they get ahold of you?

Mark Patterson: I’ll give you a link that you can access in the podcast, if that. Great. And uh, look. The, the risk of putting yourself out there and talking about this sort of thing is you sometimes give the impression you’ve got everything sorted and we certainly don’t in SSE. And if the second you think you’ve got everything nailed in terms of safety in your approach, then, then you don’t.

Um, so we’ve got a lot left to do. Um, but I think this particular thing has made a difference to our colleagues and, and contract partners and just getting them home safe.

Allen Hall: Yes. Yes, so thank you. Just both of you. Mark Dermott, thank you so much for being on the podcast. We appreciate both [00:29:00] of you and yeah, I’d love to attend this again, this is.

Excellent, excellent training. Thanks, Alan. Thanks.

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits