A scenario that meets the “net-zero by 2050” goal would be the “cheapest” option for the UK, according to modelling by the National Energy System Operator (NESO).

In a new report, the organisation that manages the UK’s energy infrastructure says its “holistic transition” scenario would have the lowest cost over the next 25 years, saving £36bn a year – some 1% of GDP – compared to an alternative scenario that slows climate action.

These savings are from lower fuel costs and reduced climate damages, relative to a scenario where the UK fails to meet its climate goals, known as “falling behind”.

The UK will need to make significant investments to reach net-zero, NESO says, but this would cut fossil-fuel imports, support jobs and boost health, as well as contributing to a safer climate.

Slowing down these efforts would reduce the scale of investments needed, but overall costs would be higher unless the damages from worsening climate change are “ignored”, the report says.

In an illusory world where climate damages do not exist, slowing the UK’s efforts to cut emissions would generate “savings” of £14bn per year on average – some 0.4% of GDP.

NESO says that much of this £14bn could be avoided by reaching net-zero more cheaply and that it includes costs unrelated to climate action, such as a faster rollout of data centres.

Notably, the report appears to include efforts to avoid the widespread misreporting of a previous edition, including in the election manifesto of the hard-right, climate-sceptic Reform UK party.

Overall, NESO warns that, as well as ignoring climate damages, the £14bn figure “does not represent the cost of achieving net-zero” and cannot be compared with comprehensive estimates of this, such as the 0.2% of GDP total from the UK’s Climate Change Committee (CCC).

Net-zero is the ‘cheapest option’

Every year, NESO publishes its “future energy scenarios”, a set of four pathways designed to explore how the nation’s energy system might change over the coming decades.

(Technically the scenarios apply to the island of Great Britain, rather than the whole UK, as Northern Ireland’s electricity system is part of a separate network covering the island of Ireland.)

Published in July, the scenarios test a series of questions, such as what it would mean for the UK to meet its climate goals, whether it is possible to do so while relying heavily on hydrogen and what would happen if the nation was to slow down its efforts to cut emissions.

The scenarios have a broad focus and do not only consider the UK’s climate goals. In addition, they also explore the implications of a rapid growth in electricity demand from data centres, the potential for autonomous driving and many other issues.

With so many questions to explore, the scenarios are not designed to keep costs to a minimum. In fact, NESO does not publish related cost estimates in most years.

This year, however, NESO has published an “economics annex” to the future energy scenarios. It last published a similar exercise in 2020, with the results being widely misreported.

In the new annex, NESO says that the UK currently spends around 10% of GDP on its energy system. This includes investments in new infrastructure and equipment – such as cars, boilers or power plants – as well as fuel, running and maintenance costs.

This figure is expected to decline to around 5% of GDP by 2050 under all four scenarios, NESO says, whether they meet the UK’s net-zero target or not.

For each scenario, the annex adds up the total of all investments and ongoing costs in every year out to 2050. It then adds an estimate of the economic damages from the greenhouse gas emissions that primarily come from burning fossil fuels, using the Treasury’s “green book”.

When all of these costs are taken into account, NESO says that the “cheapest” option is a pathway that meets the UK’s climate goals, including all of the targets on the way to net-zero by 2050.

It says this pathway, known as “holistic transition”, would bring average savings of £36bn per year out to 2050, relative to a pathway where the UK slows its efforts on climate change.

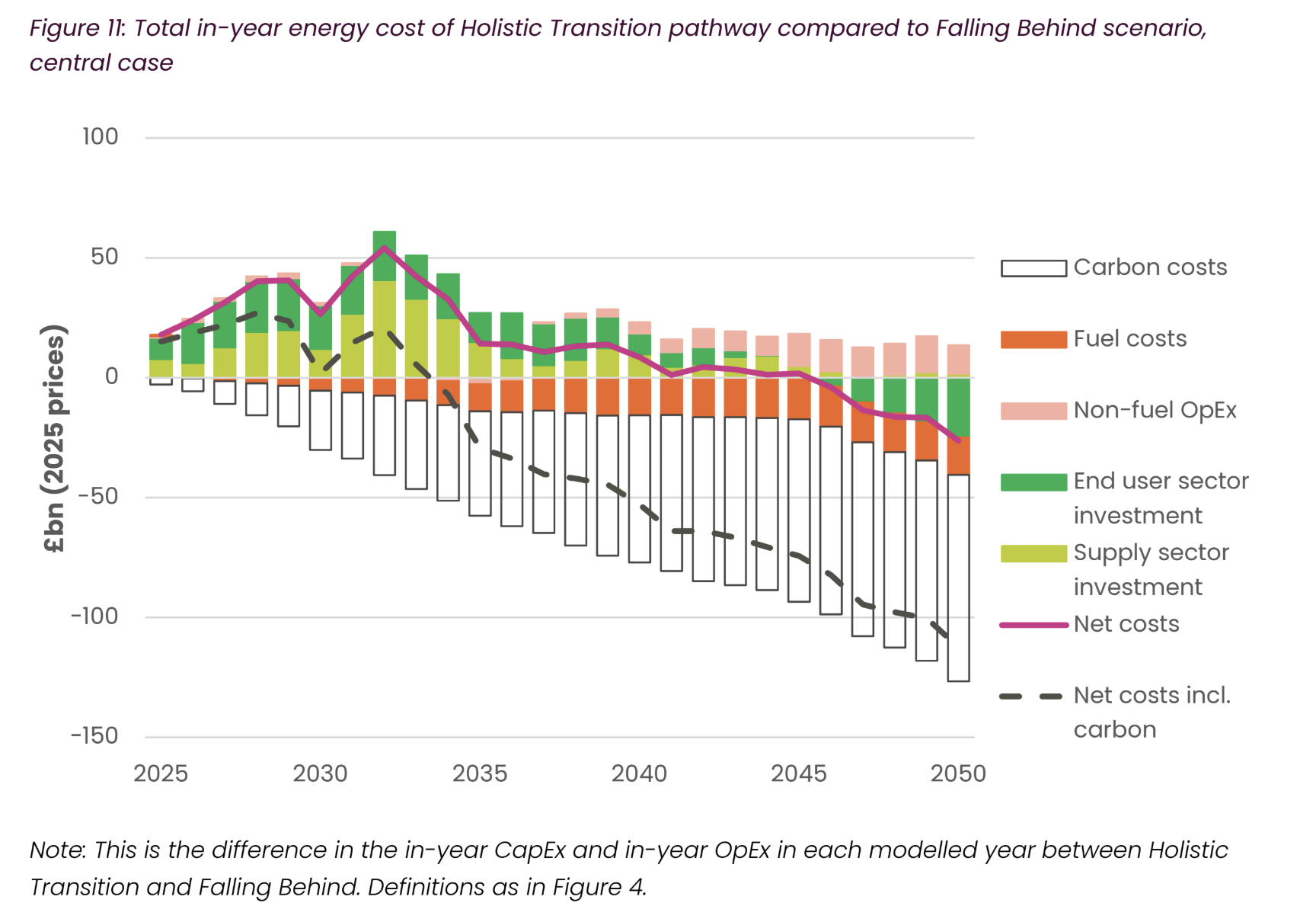

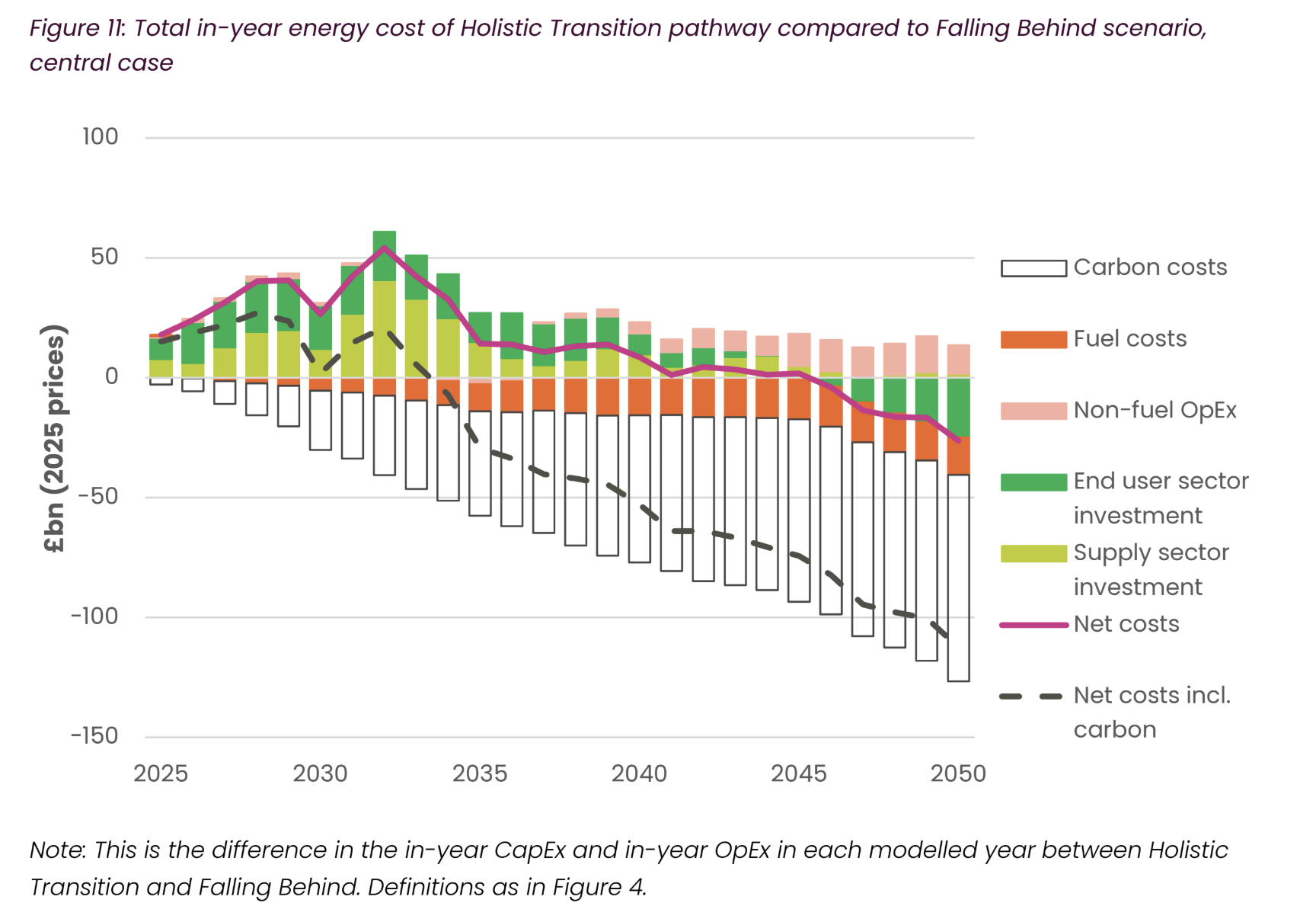

The overall savings, illustrated by the dashed line in the figure below, stem primarily from lower fuel costs (orange bars) and reduced climate damages (white bars).

Note that the carbon pricing that is already applied to power plants and other heavy industry under the UK’s emissions trading system (ETS) is excluded from running costs in the annex, appearing instead within the wider “carbon costs” category.

This makes the running costs of fossil-fuel energy sources seem cheaper than they really are, when including the ETS price.

Net-zero requires significant investment

While NESO says that its net-zero compliant “holistic transition” pathway is the cheapest option for the UK, it does require significant upfront investments.

The scale of the additional investments needed to stay on track for the UK’s climate goals, beyond a pathway where those targets are not met, is illustrated in the figure below.

This shows that the largest extra investments would need to be made in the power sector, such as by building new windfarms (shown by the dark yellow bars). This is followed by investment needs for homes, such as to install electric heat pumps instead of gas boilers (dark red bars).

These additional investments would amount to around £30bn per year out to 2050, but with a peak of as much as £60bn over the next decade.

These investments would be offset by lower fuel bills, including reduced gas use in homes (pale red) and lower oil use in transport (mid green).

Notably, NESO says it expects EVs to be cheaper to buy than petrol cars from 2027, meaning there are also significant savings in transport capital expenditure (“CapEx”, dark green).

Again, the biggest savings in “holistic transition” relative to “falling behind” would come from avoided climate damages – described by NESO as “carbon costs”.

Net-zero cuts fossil-fuel imports

In addition to avoided climate damages, NESO says that reaching the UK’s net-zero target would bring wider benefits to the economy, including lower fuel imports.

Specifically, it says that climate efforts would “materially reduce” the UK’s dependency on overseas gas, with imports falling to 78% below current levels by 2050 in “holistic transition”. Under the “falling behind” scenario, imports rise by 35%”, despite higher domestic production.

This finding, shown in the figure below, is the opposite of what has been argued by many of those that oppose the UK’s net-zero target.

NESO goes on to argue that the shift to net-zero would have wider economic benefits. These include a shift from buying imported fossil fuels to investing money domestically instead, which “could bring local economic benefits and support future employment”.

The operator says that there is the “potential for more jobs to be created than lost in the transition to net-zero” and that there would be risks to UK trade if it fails to cut emissions, given exports to the EU – the UK’s main trading partner – would be subject to the bloc’s new carbon border tax.

Beyond the economy, NESO points to studies finding that the transition to net-zero would have other benefits, including for human health and the environment.

It does not attempt to quantify these benefits, but points to analysis from the CCC finding that health benefits alone could be worth £2.4-8.2bn per year by 2050.

Investment is higher for net-zero than for ‘not-zero’

It is clear from the NESO annex that its net-zero compliant “holistic transition” pathway would entail significantly more upfront investment than if climate action is slowed under “falling behind”.

This idea, in effect, is the launchpad for politicians arguing that the UK should walk away from its climate commitments and stop building new low-carbon infrastructure.

As already noted, the NESO analysis shows that this would increase costs to the UK overall.

Still, NESO’s new report adds that “falling behind” would “save” £14bn a year – relative to meeting the UK’s net-zero target – as long as carbon costs are “ignored”.

Specifically, it says that ignoring carbon costs, “holistic transition” would cost an average of £14bn a year more out to 2050 than “falling behind”, which misses the net-zero target. This is equivalent to 0.4% of the UK’s GDP and is illustrated by the solid pink line in the figure below.

Some politicians are indeed now willing to ignore the problem of climate change and the damages caused by ongoing greenhouse gas emissions. These politicians may therefore be tempted to argue that the UK could “save” £14bn a year by scrapping net-zero.

However, NESO’s report cautions against this, stating explicitly that the “costs discussed here do not represent the cost of achieving net-zero emissions”. It says:

“Our pathways cannot provide firm conclusions over the relative costs attached to the choices between pathways…We reiterate that the costs discussed here do not represent the cost of achieving net-zero emissions.”

It says that the scenarios have not been designed to minimise costs and that it would be possible to reach net-zero more cheaply, for example by focusing more heavily on EVs and renewables instead of hydrogen and nuclear.

Moreover, it says that some of the difference in costs between “holistic transitions” and “falling behind” is unrelated to climate action. Specifically, it says that electricity demand from data centres is around twice as high in “holistic transitions”, adding some £5bn a year in costs in 2050.

In addition, NESO says that most of the “saving” in “falling behind” would be wiped out if fossil fuel prices are higher than expected – falling from £14bn per year to just £5bn a year – even before considering climate damages and wider benefits, such as for health.

Finally, NESO says that failing to make the transition to net-zero would leave the UK more exposed to fossil-fuel price shocks, such as the global energy crisis that added 1.8% to the nation’s energy costs in 2022. It says a similar shock would only cost 0.3% of GDP in 2050 if the country has reached net-zero – as in “holistic transition” – whereas costs would remain high in “falling behind”.

The post Net-zero scenario is ‘cheapest option’ for UK, says energy system operator appeared first on Carbon Brief.

Net-zero scenario is ‘cheapest option’ for UK, says energy system operator

Climate Change

Uganda may see lower oil revenues than expected as costs rise and demand falls

Uganda’s plan to use future revenues from its emerging oil industry to drive economic development may not work as expected, because evidence so far shows that the government’s effort to extract and export its crude oil may not produce the returns it is counting on, analysts have warned.

A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) found that Uganda stands to benefit far less from oil production than previously projected, with revenues set to be half of earlier estimates if the world transitions away from fossil fuels on a path to reaching net zero emissions.

Uganda’s oil ambitions involve developing two oilfields on the shores of Lake Albert – Tilenga and Kingfisher – and constructing the 1,443-km East African Crude Oil Pipeline (EACOP), with the aim of transporting 230,000 barrels of crude per day to Tanzania’s Tanga port for export.

Gas flaring soars in Niger Delta post-Shell, afflicting communities

Led by oil major TotalEnergies and China National Offshore Oil Company (CNOOC), alongside the Uganda National Oil Company (UNOC) and Tanzania Petroleum Development Corporation, the project was given the financial go-ahead in 2022.

Will Scargill, one of the IEEFA report’s authors, told an online launch this week that oil may have seemed a historically attractive option for Uganda but the benefits it could yield are very sensitive to major risks, including cost overruns around the project and in the refining sector, which it also plans to enter.

“The EACOP project is expected to cost much more than the original expectations, so it’s a major project risk in Uganda as well,” he said.

The start of oil production and exports through the East Africa pipeline had been expected by 2025 – nearly 20 years after commercially viable oil was first discovered in the country – but has now been delayed until late 2026 or 2027.

Meanwhile, the cost of construction – particularly for the EACOP part of the project – has continued to rise, reaching around $5.6 billion, a 55% increase from the $3.6 billion projected shortly before it got financial approval, the report said.

US tariffs, China’s EV boom to curb oil revenues

Beyond delays and cost overruns, “there’s the risk the impact of the accelerating shift away from fossil fuels will have on the oil market,” Scargill said.

The report said the most significant factors for the Ugandan oil industry – which are beyond its control – have been the reduced outlook for international trade spurred by recently imposed US tariffs and the growing uptake of electric vehicles (EVs), particularly in China – which has led to a peak in transport fuel demand and an expected peak in overall oil consumption by 2027.

The 2025 oil outlook from the International Energy Agency (IEA) shows that growth in global oil demand will fall significantly by the end of the decade before entering a decline, driven mainly by electrification in transport which will displace 5.4 million barrels per day of global oil demand by the end of the decade.

In addition, structural changes in global energy markets, including oil supply growth outside the OPEC+ bloc – a group of major oil-producing countries including Saudi Arabia and Russia that sets production quotas – particularly in the US, Brazil and Guyana, are lowering prices.

“It’s a particularly bad time to be taking single big bets on particular sectors that are linked to external markets,” said Matthew Huxham, a co-author of the IEEFA report.

To make matters worse, Uganda’s public finances have been weakened in the past decade by external shocks including higher US interest rates and commodity prices, resulting in downgrades of the country’s sovereign credit rating, he added.

“What that means is, generally speaking, there is less fiscal resilience to shocks,” Huxham said.

Lower global demand for oil would likely see lower prices, profits and revenues for the Ugandan government, the report authors said. In addition, a global shift to renewable energy would mean Uganda selling even fewer barrels into international markets.

All of these factors suggest that investment in Uganda’s oil industry “would unlikely be as transformational as expected” for its development, Scargill said.

Climate Home News reached out to the Uganda National Oil Company and EACOP but had not received a response at the time of publication.

Foreign investors to recover costs while Uganda faces risks

Uganda has invested a significant amount of government funds not only in the oil pipeline but also in supporting infrastructure such as a planned refinery. The report authors raised concerns about revenue-sharing agreements under which foreign investors are entitled to recover their costs first, taking a larger share of oil revenues in the early years of production.

IEEFA estimates that while TotalEnergies’ and CNOOC’s returns could fall by 25-34% as the world uses less oil and moves from fossil fuels to clean energy, Uganda’s expected revenues could decline by up to 53%.

Explainer: What is the petrodollar and why is it under pressure?

Uganda is pursuing a $4.5-billion oil refinery project in Hoima District, with the country’s oil company UNOC due to take a 40% stake. To finance part of this investment and other oil-related infrastructure, UNOC has secured a loan facility of up to $2 billion from commodity trader Vitol.

Under the deal, Vitol gains priority access to oil revenues, placing it ahead of the Ugandan government when money starts flowing in, the report said. The IEEFA analysts warn that this will likely displace or defer planned use of the revenues for other government spending on things like health, education and climate adaptation, especially if oil production and the refinery construction are delayed or profits disappoint.

“Even if the refinery project is on time and on budget, the refinery and loan repayments could consume 40% of Uganda’s oil revenues through 2032,” Scargill noted.

Pointing to recent cost overruns at oil refinery projects in Africa, the report authors said Nigeria’s

Dangote refinery ended up costing more than twice the original estimate – jumping from $9 billion to over $18 billion.

Climate action is “weapon” for security in unstable world, UN climate chief says

They said analysis shows the Uganda refinery will cost 25% more than planned, on top of an expected overrun of over 50% on the EACOP project, cutting the annual return rate to 10%.

“This means there is a high chance the project, by itself, will not make any money,” the report added.

Responding to the report, the StopEACOP coalition said the analysis confirms that beyond causing ongoing environmental harm and displacing hundreds of thousands, the project “does not make economic sense, especially for the host countries”.

They called on financial institutions, including Standard Bank, KCB Uganda, Stanbic Uganda, Afreximbank, and the Islamic Corporation for the Development of the Private Sector, which are backing the “controversial” EACOP project, “to seriously engage with the findings of the IEEFA reports and reconsider their support”.

Prioritise climate-resilient investments instead

In another report released alongside the one on oil project finances, IEEFA argued that Uganda could achieve stronger and more effective development outcomes by redirecting its scarce public resources towards climate-resilient, electrified industrialisation rather than doubling down on oil.

Uganda is among the countries most vulnerable to climate change, yet ranks low in readiness to cope with its impacts. The report authors urged the government to apply stricter criteria when deciding how to spend public funds, focusing on things like improving access to modern energy services and climate adaptation.

The IEEFA report recommended investments in off-grid and mini-grid solar electrification, agro-processing, cold storage, crop irrigation and better roads as lower-risk alternatives to investing in fossil fuels.

Africa records fastest-ever solar growth, as installations jump in 2025

Investments that take climate risks into account could also attract concessional climate finance and align with Uganda’s fourth National Development Plan and Just Transition Framework, the report said.

“They also take less long to construct, are easy to deploy, pay back over a shorter period and they also put less pressure on the system,” Huxham added.

The post Uganda may see lower oil revenues than expected as costs rise and demand falls appeared first on Climate Home News.

Uganda may see lower oil revenues than expected as costs rise and demand falls

Climate Change

Ugandans living near new oil pipeline let down by compensation programmes

Most Ugandans whose land and livelihoods were affected by the construction of the East African Crude Oil Pipeline (EACOP) are dissatisfied with training programmes provided by developers which were designed to stop them being left worse off, a survey has found.

The Africa Institute for Energy Governance (AFIEGO) asked 246 people in seven communities affected by the project for their views on the developers Resettlement Action Plan (RAP).

It found that while most affected households have received some form of support, most were dissatisfied with the quality of food security programmes and training on alternative vocations and financial literacy.

Dickens Kamugisha, AFIEGO’s CEO, said that while the Ugandan government claims it is developing the oil sector to create lasting value for everyone, this study shows that this is not the case especially for the people that were displaced for the project.

“They lost their land, were under-compensated and now an inadequate livelihood restoration programme is being implemented. Instead of creating lasting value for the project-affected people, the government and the EACOP company could create lasting poverty for the people”, he added.

EACOP is being built by a coalition led by the French company Total, along with China’s National Offshore Oil Corporation and Uganda and Tanzania’s state-owned oil companies.

The 1,400 km pipeline will take oil from Uganda’s Tilenga and Kingfisher oil fields through Tanzania to the East African coast, where the oil can be put on ships and exported.

Inadequate training

Nearly four-in-five of those surveyed described vocational training programmes, designed to give displaced people new professions like bakers, welders and soap makers, as inadequate. They cited short training periods, absentee trainers and limited hands-on learning.

One participant said he was trained in catering for four months in 2024. “I did not understand what I was taught. We were not learning most of the time”, he said.

The young man said that he only cooked once in the four months and that trainers told them that they would be sent home if they complained.

The financial literacy programme, aimed at training people to use their compensation wisely, was also described as inadequate by nearly four-fifths.

They said the training was only one day and was conducted by a commercial bank, which pushed them to open bank accounts rather than improving their money management practices.

“They were interested in business, and not in people learning”, one woman said, “no wonder when people got money, some married more women. The compensation was also too little!”

Not enough food

Those who were physically displaced by the pipeline or who lost more than a fifth of their land to it were supposed to be entitled to food assistance for up to a year or more.

While three-quarters of respondents received some food assistance, just a third said it was adequate. They complained that they did not understand why some people were getting food and others not.

There were also complaints about the quantity of beans, rice, cooking oil and salt provided, particularly from those with big families. One woman said her family of 30 used up the 4 kg of rice and beans in one meal.

An agricultural recovery programme aimed to help people transition but, while many confirmed receiving seeds, seedlings or fertilisers, they complained that the seeds were poor quality and distributed too late – after the rains – for crops to grow.

In Kyotera District, one participant recounted receiving 70 coffee seedlings, of which only 20 survived. “We were given very young coffee seedlings. They were also poor quality with some having no roots,” the participant said. “I watered those coffee seedlings, but they did not grow. They were poor quality!”

Some of the affected communities also complained about not getting the livelihood options they wanted, adding that those who wanted livestock were given seeds instead because they did not have a building to house the livestock.

On the other hand, the survey found that about two-thirds of affected people were satisfied with the distance between their homes and the pipeline. The third who were not satisfied said they feared accidents like oil spills and noise and dust pollution as the pipeline is built.

“I fear for my life,” said one man in Hoima, “the pipeline can burst, spill and affect us. We have also been told that the pipeline will be heated. The heat from the pipeline could affect our soils”.

The post Ugandans living near new oil pipeline let down by compensation programmes appeared first on Climate Home News.

Ugandans living near new oil pipeline let down by compensation programmes

Climate Change

Virginia House Passes Data Center Tax Exemption, With Conditions

New and existing data centers could continue receiving a break on the state’s retail sales and use tax, as long as they moved away from fossil fuels and tried to reduce energy usage.

RICHMOND, Va.—The Virginia House of Delegates on Tuesday passed legislation continuing billions of dollars in state tax exemptions for all qualifying new and existing data centers as long as they take a series of steps to move away from fossil fuels and transition to renewable energy.

Virginia House Passes Data Center Tax Exemption, With Conditions

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits