We discuss the rapid rise of skills-based hiring in wind energy, with 81% of employers now prioritizing competency over degrees. Delaware strikes a major $128 million offshore wind agreement. We tackle the idea of “clean” natural gas. And mounting cybersecurity concerns arise as Chinese manufacturers gain control of critical supply chains.

Fill out our Uptime listener survey and enter to win an Uptime mug! Register for Wind Energy O&M Australia! https://www.windaustralia.com

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Allen Hall: Skills based hiring shakes up wind energy recruitment, while Delaware strikes a 128 million offshore wind deal. Plus, what’s really behind those clean, natural gas claims? This is the Uptime Wind Energy Podcast.

You’re listening to the Uptime Wind Energy Podcast, brought to you by BuildTurbines. com. Learn, train, and be a part of the clean energy revolution.

Visit BuildTurbines. com today. Now, here’s your hosts. Alan Hall, Joel Saxom, Phil Totaro, and Rosemary Barnes. Hey,

Allen Hall: Uptime family. We’ve got something awesome brewing just for you. Want to help make your favorite wind energy podcast even better? Well, here’s your chance. And yes, there’s something special in it for you.

We’ve created a quick five minute survey to learn what gets you excited about our show and what topics you’d love us to dive into. The best part, everyone who completes a survey and drops their email Will be entered to win one of our coveted Uptime Podcast mugs and they’re so coveted I don’t have one.

It’ll go along with your morning coffee while catching up on the latest wind energy news And your input means everything to us whether you’ve been with us since day one or just discovered us last week We want to hear your thoughts and our Wind energy O& M Australia event is on in a big way. We’re all gonna be down there February 11th and 12th Bill, you want to give us the latest and greatest on sponsors and on the events at the conference?

Phil Totaro: Yeah, so we just had two, uh, very big name companies, uh, sign up to sponsor corporate roundtables. One is GE Vernova, and the other one is Winergy. And at this event, we’re going to have topics covering lightning protection and damage, leading into erosion, Condition monitoring technology, uh, noise and nuisance, uh, drive chain refurbishment, insurance, you name it.

We’ve got it covered. Uh, so please register today if you haven’t already.

Allen Hall: And you can do that at windaustralia. com. So register now.

Unlock your wind farm’s best performance at Wind Energy O& M Australia. February 11th to 12th in sunny Melbourne. Join industry leaders as they share practical solutions for maintenance, OEM relations and asset management.

Discover strategies to cut costs, keep your assets running smoothly and drive long term success in today’s competitive market. Register today and explore sponsorships at www. windaustralia. com.

Allen Hall: Well, the U. S. Department of Labor published a Skills First Hiring Starter Kit last fall, and this has touched off a broader discussion about worker qualifications. And in 2024, 81 percent of employers Uh, practice skills based hiring up from 73 percent in 2023 and just 56 percent in 2022, according to some research.

So it’s up by 30%, almost 30 percent right now since 2022. Now, an analysis by Indeed, which is a job site, found the number of job postings requiring at least a four year degree fell to 17. 8 percent in January of 2024 compared to about 20 percent in 2019. So the number of employers who are requiring degrees to even apply for a job has dropped and there are more employers looking for skills.

Rather than diplomas, which is an interesting trend. And Joel was mentioning before we started today that Elon Musk put out a Twitter post or I guess it’s an ex post now. about this particular topic.

Joel Saxum: Yeah. Today he’s, he put a post out. It says, if you’re a hardcore software engineer and want to build the everything app, please join us by sending your best work to code at X.

com. That’s not the important part. The important part here is what he states is we don’t care where you went to school or even whether you went to a school or what big name company you worked at. Just show us your code. And to me, I think that’s amazing because I guess there’s, it’s a pendulum swing. My whole life as a young person in the United States, it was, you got to get a good job.

You got to get a degree. You got to get a degree. You got to get a degree. And then you see that being beat into the culture. And then the cost of these degrees just going crazy over here, right now. I mean, an average four year degree, you’re paying 80, 100, a hundred thousand dollars plus just to get over or more, right?

Yeah. Alan’s, Alan’s giving me the thumbs up way more. So, so, you know, if, if I, if I I’m in Texas right here in Austin, if I want to go to UT Austin. It’s going to cost me like 40 to 45, 000 a year for your degree. That’s 180, 000 degree that like, that’s so, uh, like it’s so much of a hurdle to employment and to growing, uh, growing employment as a society and in good jobs, and I think that like, from my standpoint, I’ve always.

Try to lean on this. If you’re a hard worker, if you’ve got some skills, I don’t care where you’ve worked in the past, I don’t care what school you went to, or even if you went to one, if you can do the job, let’s do the damn job. And that’s my take on it.

Rosemary Barnes: Uh, so one thing that I think has changed recently is that in the past, like the reason why you would say you want X degree is because you want someone that has the knowledge that you would learn in that degree.

Um, but these days there’s like nothing that you can’t learn well on the internet, just as well as in a degree. It’s kind of insane the way that now that we have the internet available, it’s insane to keep on doing it in the same way. So I think now, yeah, like we can still have the same requirement that we used to have in terms of knowledge.

But it doesn’t need to be so gatekept by the universities. But that said, I do think that there’s some kinds of engineering, like a lot of what people call engineering, I don’t think needs a degree, you know, um, and especially the things that need engineering sign off. Like it’s really rare that you actually need to use your engineering judgment for something like that.

It’s much more often, you need to just check what’s being done, check what the design standard says, and make sure that it fits within that. I don’t think you need a degree for that. Where I think you need engineers is where something comes outside of the design standard so that an engineer can make sure that, you know, everything has been considered that should have and, um, you know, do the analyses that are required and just, you know, use their professional experience and education to make sure that, You’re not inadvertently doing something unsafe.

Joel Saxum: I think when, when engineering, when you talk engineering this way, the gap for me would be when liability rolls into place. So if you’re designing a bridge, I would like someone to sign off on that, that can demonstrate, demonstrate from. whatever training and these things that they’ve, they’ve achieved a certain level of being an engineer to, and in the States, that would be a structural engineer with a SCE stamp.

And that makes sense to me.

Rosemary Barnes: The higher the stakes, the less that you should be needing someone that has any sort of judgment applied to it. You know, it should be a really rigorous standard that was definitely developed by engineers. Um, make sure that that standard, you know, covers everything that it needs to.

And then the person signing off should just be saying that it, It has done what the standard says it should do. I don’t think that there is, or should be, a lot of individual judgment in place about, will this bridge fall down? Will this aeroplane fall out of the sky? Will this, uh, I don’t know, um, petrol station explode?

You know, like that shouldn’t be somebody’s like individual call on whether a valve is big enough or a bolt is replaced frequently enough. There shouldn’t be any judgment calls there. It should just be kind of, you know, do it as, um, as the design standard says. And that design standard is really rigorous and performed by engineers.

Phil Totaro: Let’s put it this way. As we’re talking about engineering, you know, I think skills based hiring is potentially more applicable than it would be, say, in like the medical field, for example. Like, I don’t want somebody who’s just watched a bunch of YouTube videos on surgery to perform brain surgery on me.

So, you know, there’s, I think there’s a difference. Uh, maybe we can, you know, there’s a bit more margin you can get away with. Uh, doing this sort of thing for engineering as, as society evolves and all that. But, uh, yeah, I, I don’t know if it’s applicable everywhere.

Rosemary Barnes: I think that sometimes like in Australia, I’ve never heard that term skills based hiring and until today, but I have noticed, you know, early in my career, people cared that I had my accredited engineering degree and was eligible to be a member of Engineers Australia.

I don’t know. It’s been decade, decades, more than one decade, probably since anybody cared about that for me. So I think it gets less important as you progress in your career. But one weird place where I have noticed that people really want an engineering degree is, uh, my project management roles for, um, construction of new wind farms, new solar farms and stuff.

And that strikes me as a place where you don’t need an engineering degree at all. That, that should be pretty easy. like work experience, you know, um, build, building up to it. I know heaps of people that would be excellent at that sort of role, um, that aren’t engineers. And there’s, you do need to understand, you know, what the regulations are technically and make sure that, you know, things are happening correctly.

So it’s not like it’s a non technical role, but it’s not one of those kind of creative engineering roles where you have to, you know, be. I don’t know, coming up with a lot of solutions on your, on your own. Um, so I think that that’s unnecessarily restricting something to, we don’t have that many engineers in Australia.

I think that, you know, there’s a lot of people that could do that role that don’t have an engineering degree.

Joel Saxum: And I think that that’s the basis of this report that came out from the department of labor in the U S here is you’re trying to, they’re trying to make the labor market less restrictive. Cause if you’re just going to put a thing in there and it says, you’ve got to have a degree for this.

You’ve got to have a degree for that. You got to, some of them don’t even make sense. Like I. Anecdotally, here’s one from the state of Wisconsin. You can be a substitute teacher in the state of Wisconsin, but only if you have a degree, a four year degree, but that four year degree does not have to be in teaching.

The four year degree can be in whatever you want. It can be from Rose Hulman University as an engineer. And, but you need that degree to go and sit in the math class for a day to make sure the students don’t revolt. That’s a weird one to me.

Lightning is an act of God, but lightning damage is not actually, is very predictable and very preventable.

Strike tape is a lightning protection system upgrade for wind turbines made by weather guard. It dramatically improves the effectiveness of the factory LPS so you can stop worrying about lightning damage. Visit weather guard wind.com to learn more. Read a case study and schedule a call today.

Allen Hall: Delaware has signed a major agreement with U.

S. Wind worth 128 million dollars, marking a key development in offshore wind infrastructure along the east coast. The deal enables installation of transmission cables through Delaware waters and the state park land to connect two Maryland offshore wind projects to the grid. Now, there’s a couple of interesting pieces to this agreement.

$200 million is gonna be allocated for electrical grid upgrades within Delaware, and that’s gonna be focused on improving reliability and capacity. $12 million is for the cable right of way, which is pretty typical. Uh, $76 million, uh, of renewable ener energy credits are gonna be transferred to the state.

Which, um, Phil will know a lot about that. And then there’s 40 million going to the community for coastal dredging projects, clean energy workforce training, scholarship initiatives, and state park improvement. So the thing that raises my awareness of these kind of transactions, having seen something similar happen up in New Jersey, is that every time there’s an offshore wind project off the coast of one of these East Coast states.

They seem to extract hundreds of millions of dollars from the developers for state projects that may or may not have anything to do with the electrical grid. But raise the price of offshore wind, it has to raise the prices.

Phil Totaro: Absolutely. Um, you know, everything’s got to be accounted for in, in the budget and, and anytime you start stuffing these, you know, political pork projects into, you know, some kind of budget allocation, it’s necessarily going You know, end up being paid for by the project developer, but then ultimately it gets passed on to us as rate payers, because how do you think the developer makes money?

They want to be able to sell the power to somebody, and that means they also have to increase the power purchase contract price that they ask. Um, what’s interesting about this is, okay, so this is a deal in Delaware. New York actually also just announced that they’re going to do another allocation round, but only for the power generation because they have, um, you know, all the electrical infrastructure already being built and paid for by the preexisting projects.

So they’ve got a, you know, spare capacity in the substations to be able to do the power offtake. So the industry is cheering and everybody’s assuming that it’s going to lower the prices for this, you know, sixth round in, in the state of New York. Um, Um, except when everybody still comes to the realization that we haven’t done anything about inflation in a meaningful way.

Interest rates have come down a tad. I’m sure that, especially in a state like New York, they’re always going to find ways to start plumping up the price of things.

Allen Hall: What was the Orsted agreement with New Jersey for a while? Was it 400 million, 500 million? 300. 300 million? Okay. And that was the federal money that was going to come to Orstead for developing the project, right?

And then the state of New Jersey wanted to take that as a lump sum,

Phil Totaro: or take all of it. And, and that’s, that’s exactly, you know, a good, a good example where, you know, it was, the whole, Reason that there was this federal allocation of funds to the project developer was said that it could offset some of the capex cost to the developer.

And when the states see that somebody is, you know, getting 300 million dollars to go. do something to the benefit and of their state. They all start getting dollar signs in their eyes and saying, well, why aren’t we getting some of that federal money? Uh, and they devise clever ways and say, Oh, well, we’re not going to sign the power purchase agreement with you, or, uh, allow you to go build or hook into this substation over here, unless you give us some of that money.

Uh, that, that’s basically what this amounts to.

Allen Hall: but isn’t in The interest of the state to put offshore wind in it. Like Delaware is not the easiest place to get to for power generation. Right. And it’s, it’s a, it’s a little tiny state. It’s like 2000 square miles. Uh, there’s not a lot of power plants on it.

They’ve closed down some of them. That’s how they get in the power on shore from us. Wind is a going right where an old coal generation factory was because the grid infrastructure, so it’s going to plug into it there. So the whole situation for Delaware is weird in that it’s relatively simple to hook up the wind turbines to the existing grid in Delaware.

But now U. S. Wind is basically paying, what, 100, 000 per square mile to upgrade the electrical grid in Delaware? That seems like a lot of money to me.

Joel Saxum: I think Phil was spot on when he said political pork projects, right? Because to me, these are all, it’s all like earmarks. When you listen, when you watch a bill go through in D.

C. or at the state level, wherever, the bill may be about, you know, How many chicken wings we can eat this week, whatever it is. And, and, and then there’s an, there’s things earmarked. And you want the chicken wing bill passed? Well, you’re also going to give me 10 million bucks for this racetrack over here.

And then I’m also going to get this, this thing passed in the same, the same breath. If you want that, you’re going to get this. And what it ends up doing is, is it’s shooting these. These people, these states, they’re gonna, they shot themselves in the foot multiple times. We saw it in New Jersey, right? Like, Dorstad took the right down, backed off, and said, like, we’re not doing this anymore.

And we’ve seen this play out, this, this, I guess this, this concept is in my head right now, this pendulum swinging, right? Like, you’ve seen I’ve seen energy projects or watched the history of energy projects around the world where local geographies, local governments got taken advantage of, and they got resources pulled from them.

That happens. And then the pendulum swings the other way, and they put so many regulations and so much stuff in there like this. Like, this, if you add these up, they signed a 128 million dollar bill. Agreement. Great. But then there’s going to be a 200 million electrical grid, 12 million for cable right away, 76 here, 40 here.

You’re stacking this thing up to a 300 plus million extra tab just to develop a wind farm. You’re going to shoot yourself in the foot because the pendulum is that then the pendulum is swung too far the other way and you’re using up, uh, monies that Could be used for other things that in, in, in the development process.

Phil Totaro: And let’s go back to Alan’s question, which is why would they not want to build offshore wind? I mean, the answer is, well, guess what? If you like creating jobs, particularly jobs in the new economy, if you like tax revenue, if you like providing clean electricity, et cetera, I mean, these are, these are things that You do want to get reelected.

I’m talking to the politicians now. You know, you do want to get reelected. This is the way to do it is to ensure that you’re creating opportunity within the state. Um, you know, they’re, they’re taking advantage of opportunity by getting the cash, but then it’s not necessarily going to the benefit of everybody in the state because where do you think that cash came from in the first place?

It’s all the tax revenue from all of us. Collectively, in the first place, whether it’s the federal government or the state government tax coffers that it comes out of, so we’re the ones paying for it. And yet we don’t actually have, you know, a say in how, you know, like Joel’s talking about these, these horse trades and deals that end up happening when somebody is trying to pass a bill.

We have no say in how. That haggling happens. We elect somebody and we expect that they’re going to do a job for us, but I don’t necessarily always agree with the job that’s being done by the politicians that have been elected. I may not have even voted for them, and yet they’re deciding my fate.

Joel Saxum: I think it, Phil, if we could do, let’s look at a model that has worked in the past that didn’t require a bunch of this stuff.

If you know anything about the state of Alaska and the permanent fund dividend, right? The oil and gas companies are pulling oil and gas. Very, they’ve been doing it since the seventies. They’ve been pulling a lot of value in oil and gas out of the, out of the ground up there. So what they do is they have to do a, use a portion of those proceeds to fund a fund that goes back to the state.

Okay. So that is a, that is an, uh, an after development cost. So you build that into your operating model. Instead of saying upfront, you got to pay us 300 million to do this. How about we work together? And maybe we get a couple cents for every kilowatt hour produced or something off of these offshore wind farms, like the state of Louisiana is doing.

That’s where these things should go, in my opinion.

Phil Totaro: And not for nothing, but Louisiana is also making these reinvestments into, you know, developing things around coastal erosion and, and protecting the, the natural resources that they’ve got there, which I think is actually important and necessary for them to be able to do.

But that’s a decision that they made. And, and structured it in a way where it’s not impacting the CapEx cost of developing the project in the first place. And that’s the key thing here.

Allen Hall: As wind energy professionals, staying informed is crucial, and let’s face it, difficult. That’s why the Uptime Podcast recommends PES Wind magazine.

PES Wind offers a diverse range of in depth articles and expert insights that dive into the most pressing issues facing our energy future. Whether you’re an industry veteran or new to wind, PES Wind has the high quality content you need. Don’t miss out. Visit PESWind. com today. Well Rosemary, I’m getting a little tired of hearing the term clean natural gas and that it is so much less expensive to use clean natural gas instead of renewable solar.

Wind, hydro, uh, that, uh, it makes no sense. We have to tear down all the wind turbines, all the solar panels should go away because clean natural gas is a better, uh, energy source. And I think that’s a very US perspective.

Rosemary Barnes: Can I just have two problems with that? Clean, natural gas. In that the only word that’s unproblematic is gas.

We can all agree that it’s a gas, but, um, clean. I mean, I don’t even know what they mean. Uh, natural, it’s a, it’s a fossil gas, like a natural, we don’t say natural coal, natural oil, um, you know, it’s fossil gas, it’s methane, right? Like that, that’s, that’s what it is. Uh, it’s incredibly good. Marketing that, I don’t know, the term, um, came about well before we cared about climate change.

So it wasn’t for that, but natural, natural gas makes it sound much nicer than what it is, which is fossil, fossil methane. How are they calling it clean? What’s their, what’s their definition or just that it’s cleaner than coal?

Allen Hall: They’ve dropped the er part from cleaner than coal. And it is cleaner than coal, and I will give them that.

Rosemary Barnes: I think even that’s debatable because, um, with methane, there’s losses, you know, like, because methane is like 84 times as strong a, um, a greenhouse gas than carbon dioxide is. It really matters small amounts getting leaked, and there’s always leakage, especially from, yeah, where it’s extracted, but. in the pipelines all along.

And I know that, you know, I’ve been following a little bit the research that’s been done on this area. And especially now that we can monitor with satellites, we find more and more and more leaks and the carbon or the, you know, greenhouse gas intensity of, um, fossil gas is increasing and increasing and increasing the more that we know.

And I have seen some studies try and say that in a lot of situations, it’s actually, um, overall worse for the climate than, than coal. That’s not the mainstream view and it’s not true on every. Every type of project, you know, some countries are better at extracting it cleanly, more cleanly than others, but, um, yeah, I don’t know.

How can they get away with that clean, clean natural gas? Come on.

Allen Hall: Well, the comparison of the cost of clean natural gas to other energy sources, particularly renewables, is very U. S. focused. They’ll say, well, in the U. S., uh, wind is a lot more expensive, particularly offshore wind is a lot more expensive than putting a gas, uh, electrification plant in.

True. For right now. True. But the rest of the world is not that way. Because the U. S. is full of natural gas. Pretty much Joel can walk around his backyard in Texas, drop in a pole, and get natural gas to come out of it. It’s not that hard. But if you look at the rest of the world, it’s much harder to find natural gas and the prices are widely variable.

So this is why the U. S. can make this claim. The U. S. right now is paying about 4 per million BTU. Alright, not bad. The U. K. right now is 14. per million BTU. And Germany is about 1350, right? So they’re three times more expensive, almost four times more expensive than the United States. That changes the whole economics of natural gas versus renewables.

So we are seeing renewable energy go in big time in France and in Germany, in the UK, and a lot of other places, but maybe not as much in the United States, uh, at the moment because natural gas is so low. So, Rosemary, do you see the same thing that this U. S. argument is being using globally?

Rosemary Barnes: Well, I mean, it’s an argument about, uh, cost that ignores the climate impact, right?

So, I think you first, we need to start with this only argument only works if we don’t care about the climate at all, which a lot of countries do. Um, Yeah, I mean, to a greater or lesser extent, and obviously it’s easier to care about the climate if the cost difference isn’t so great. Uh, I do think it’s a very, a very US thing, but, um, even, I mean, it’s relevant everywhere and I’ve heard the term called the, um, the spark gap, like how different the cost is between, you know, creating some sort of energy service by electricity versus with, um, natural gas.

So, you know, it might be comparing, um, A electric heat pump for heating your home versus a gas boiler. Um, what’s the cost difference for, you know, getting your house to the temperature that you want it. And, you know, some places in the world it’s cheaper to do it with electricity. In more places it’s cheaper to do it with gas.

I think that the US is like one end of a big continuum of the whole world dealing with that exact issue, but it’s definitely at, at the end, I think.

Allen Hall: But every country needs to think about it for themselves, right? The economics in the United States are totally different than the economics in Germany, the UK, France, India, South America, Brazil.

They’re just totally different, and I think we’re getting caught up, at least in the United States, that globally, wind is not an answer. Globally, solar is not an answer. Globally, hydro is not an answer. That the only answer is LNG. Which is just a complete distortion of what the reality is. For the time being, the natural gas is easy in the United States.

Rosemary Barnes: It’s also, in terms of energy security, like, you’ve got the gas there, so you’re fine. Europe wants to get off gas regardless of how much it costs. I mean, that’s, that makes it extra, an extra incentive that is expensive. But they don’t have it, so they have to import it. So they would prefer to have energy security by, you know, having their own wind farms.

Peace. Um, so I think that the US fails to see that as well, that there’s an energy security like for most countries, having your own renewables is, um, more better energy security than having to buy that, you know, your gas and your oil in from other countries.

Allen Hall: Dealing with damaged blades? Don’t let slower pairs keep your turbines down.

Blade platforms get you back up and running fast. Blade Platform’s truck mounted platforms reach up to 100 meters, allowing for a quick setup, improved safety, and efficient repairs. Book soon to secure your spot and experience a difference in blade access, speed, and efficiency. Visit bladeplatforms. com and get started today.

Well, a stark warning has been coming from Europe about wind energy’s supply chain growing dependence upon Chinese manufacturers and a Dutch government backed report report. Along with comments from former MI6 chief, Sir Richard Dearlove highlights concerns about cybersecurity risks and strategic vulnerabilities in the offshore wind sector.

Now the background on the Chinese manufacturers, I think it’s pretty well known to people in wind, but there’s six of the top 10 wind turbine manufacturers in the world are now based in China. And a lot of Chinese firms control the critical supply chain. Uh, it’s particularly for rare earth magnets, right?

And there is a significant risk and concern among Intel officials like MI6 and my guess is the CIA, Joel, and others that, uh, putting Chinese manufactured assets into your grid makes them vulnerable, uh, which I, I think has been proven out time and time again from other different sectors of manufacturer from.

As we learned, Wi Fi routers to cell phones and a variety of other things. It’s not inconsequential, but there does seem to be a big conflict coming among Europeans because there are developers that are really going after Chinese manufacturers, or at least talking to it. Is that going to stop now that the governments and the Intel officials are basically saying, don’t do it.

We’re just not going to even consider

Joel Saxum: it. I think that depends on how much control the grid operator has over these decisions, right? Like in the United States, you can, do your permitting, do everything, but at the end of the day, FERC has to sign off on your wind farm and they have the ultimate control from a federal level.

Um, so the operators may have some, some sway and some pull, but not at the end of the day, it’s not their choice whether this happens to them or not, or whether they get to install these, these turbines or not. But I think it, it’s a viable concern. In my opinion, if we’re looking on the world stage of who, Foreseeable future we may have a conflict with.

We don’t want the ability for someone that we’re in a conflict with to shut our energy supply down. Whether you’re in the UK and you’re Part of MI6 or were part of MI6. I guess you’re probably always a part of MI6 if you were a part of MI6. Does that make sense? Um, but you know, you don’t want the, a foreign operator or a foreign, you know, at that point in time, that could be an adversary to be able to have control over of what you’ve got going on.

Uh, power generation wise, because it’s, I mean, that’s, that’s a, it’s a matter of national security and that’s my take on it.

Phil Totaro: Well, and let’s, let’s also give some context to this because the developers in Europe were initially saying, Oh, we’re going to go talk to the Chinese to try and get commercial negotiating leverage against the Western OEMs saying, Hey, Hey, you guys are trying to pass on all these cost increases to us as project developers.

We don’t want to pay more, so we’re going to go talk to the Chinese and maybe we get some of their turbines. Now, fast forward five years, we just had a tender in France for offshore where even Western, you know, hardcore Western project development companies, and I’m talking like NG, EDF, they were all quoting their, their project proposals with, you know, 20 plus megawatt Chinese wind turbines.

The Chinese turbines have become more of an attractive option to developers that I believe are making bad decisions about whether or not they should be considering Chinese turbines in the first place. I don’t really think that’s They’re taking total cost of ownership into account. You know, the developer is the one making the decision on something that has profound impact to everybody that is downstream from a very early upstage, you know, development decision about what equipment to use.

And how is that going to be maintained? How much does it cost, et cetera, et cetera. And security almost doesn’t even come into the equation, uh, at all. For this week’s wind

Joel Saxum: farm of the week. We’re heading up to New York state, uh, by Allen there. Um, so the wind farm of the week is eight point wind. It’s a next era site in Steuben County, New York.

And we’re focusing on this one because it is a big one. Big wind farm, not in number of turbines, but in megawatts per turbine. Uh, this is one of the first tur, uh, wind farms in the United States to install the GE 5.5 megawatt 1 58, uh, meter rotor machine. Uh, cool thing about it is eight point wind.com that NextEra put together has a comprehensive safety plan.

a public involvement plan, and various fact sheets about partners, and what NextEra does, and how Steuben County is a leader in in the renewable energy space. So they’ve tried to, you know, be a little bit more forward and open with the residents around there about what’s going on with these big turbines being installed.

So this wind farm also has a 16 and a half mile transmission line that was put in. As a part of it to, uh, uh, connect to the grid managed by the New York ISO. Uh, and it’s also producing enough clean, renewable energy, uh, to power more than 46, 000 New York homes. Uh, it’s expected to, uh, provide more than 40 million in revenue to local governments to support schools, infrastructure, and vital services, such as fire departments, which is a hot topic these days.

Um, the payments to landowners are also estimated to be around 25 million over 30 year expected life of the project. So the Eight Point Wind Energy Center, uh, up in Steuben County, New York, you are the wind farm of the week.

Allen Hall: Well, that’s going to do it for this week’s Uptime Wind Energy podcast. Thanks for listening.

And please give us a five star rating on your podcast platform and subscribe in the show notes below to Uptime Tech News, our weekly sub stack, did I mention sub stack? Newsletter. And Uptime Wind Energy podcast.

https://weatherguardwind.com/natural-gas-delaware-offshore/

Renewable Energy

Should We Appease MAGA by Rewriting the Constitution?

Do you think this will change American lives for the better? If so, how?

Do you think this will change American lives for the better? If so, how?

Rewriting the U.S. Constitution will take some work, as I’m sure you’re aware.

Renewable Energy

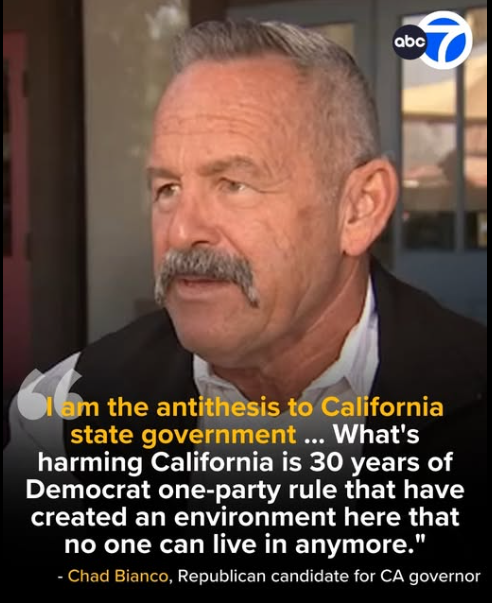

California’s Next Governor?

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

What does the most affluent state in America need in its next governor? I’m pretty sure it not a Trump supporter.

Yes, we have traffic, which we hate. But that’s because everybody and his dog wants to be here for our economic opportunities and our natural beauty.

In general, we reject racism, ignorance, corruption, and environmental destruction.

Renewable Energy

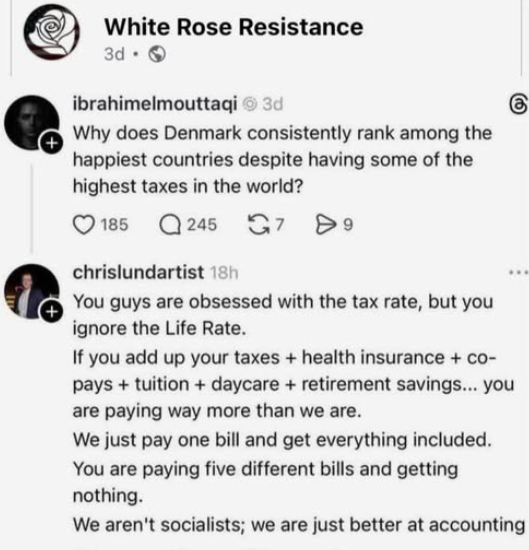

Understanding Social Democracy

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

I can’t swear that the content of the meme here is accurate; in fact, most affluent Scandinavians I run across admit that they pay higher taxes than Americans.

They claim that the attraction is that they aren’t forced to live among uneducated slobs where people are dying of treatable diseases with masses of impoverished people living on the streets.

Isn’t there something to be said for that?

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits