The UK’s greenhouse gas emissions fell by 5.7% in 2023 to their lowest level since 1879, according to new Carbon Brief analysis.

The last time UK emissions were this low, Queen Victoria was on the throne, Benjamin Disraeli was prime minister, Mosley Street in Newcastle became the first road in the world with electric lighting and 59 people died in the Tay Bridge disaster in Dundee.

Carbon Brief’s analysis, based on preliminary government energy data, shows emissions fell to just 383m tonnes of carbon dioxide equivalent (MtCO2e) in 2023. This is the first time they have dropped below 400MtCO2e since Victorian times.

Other key findings from the analysis include:

- The UK’s emissions are now 53% below 1990 levels, while GDP has grown by 82%.

- The drop in emissions in 2023 was largely due to an 11% fall in gas demand. This was due to higher electricity imports after the French nuclear fleet recovered, above-average temperatures and weak underlying demand driven by high prices.

- Gas demand would have fallen even faster, but for a 15% fall in UK nuclear output.

- Coal use fell by 23% in 2023 to its lowest level since the 1730s, as all but one of the UK’s remaining coal-fired power stations closed down.

- Transport was the single-largest sector in terms of emissions, followed by buildings industry, agriculture and electricity generation. The electricity sector likely dropped below agriculture for the first time.

While the 23MtCO2e reduction in 2023 was faster than the 14MtCO2e per year average needed to reach net-zero by 2050, it was mostly unrelated to deliberate climate action. The UK will need to address emissions from buildings, transport, industry and agriculture to reach its 2050 target.

The analysis is the latest in a long-running series of annual estimates from Carbon Brief, covering emissions during 2022, 2020, 2019, 2018, 2017, 2016, 2015 and 2014.

Lowest since 1879

The UK’s territorial greenhouse gas emissions – those that occur within the country’s borders – have now fallen in 25 of the 34 years since 1990.

(Consumption-based emissions, including CO2 embedded in imported goods and services, were increasing until 2007, but have since fallen at a similar rate to territorial emissions.)

Apart from brief rebounds after the global financial crisis and the Covid-19 lockdowns, UK emissions have fallen during every year for the past two decades.

The latest 23MtCO2e (5.7%) reduction in 2023 takes UK emissions down to 383MtCO2e, according to Carbon Brief’s new analysis.

This is the lowest since 1879 – outside the 1926 general strike – as shown in the figure below.

Having dropped to a then-record low for the modern era of 404MtCO2e during the height of Covid in 2020, UK emissions bounced back in 2021 as the economy reopened.

While emissions declined in 2022, they remained above 2020 levels. In 2023, however, emissions fell below the lows seen during Covid lockdowns, to levels not seen since Victorian times.

Accidental action

The biggest contributor to the drop in UK greenhouse gas emissions in 2023 was an 11% reduction in gas demand, which accounted for around two-thirds of last year’s overall decline. This took the UK’s gas demand to its lowest level since the 1980s.

However, the drop in 2023 was not primarily due to deliberate climate action.

The figure below shows the estimated actual drop in emissions in red, followed by contributions from a series of factors that decreased emissions, in blue, and other factors in grey.

The most significant factor was the UK returning to its long-term position as a net electricity importer in 2023, reducing demand for domestically generated power from gas by more than 20%.

This followed an anomalous year in 2022, when the UK was a net exporter for the first time ever, as a result of widespread outages in the French nuclear fleet.

Lower demand for gas power accounted for more than two-thirds of the fall in gas use overall.

Next, above-average temperatures reduced the need for heating, while continuing very high prices since Russia’s invasion of Ukraine caused weak underlying demand for gas.

Reflecting both of these factors, there was a 6% drop in domestic demand in 2023, accounting for a fifth of the overall decline in gas consumption. A similar 7% drop in commercial demand for gas accounted for another tenth of the total, with a 5% drop in industrial demand the remainder.

Finally, the figure shows that there was a small reduction in gas demand and associated CO2 emissions as a result of increased wind and solar generation.

The impact of rising wind and solar capacity in 2023 was muted by average windspeeds being below average and the average number of sun hours falling sharply compared with 2022.

The UK’s emissions would have fallen even further in 2023 if not for a 15% decline in the output of the nation’s nuclear fleet. This followed the closure in 2022, of the Hunterston B station in Scotland and the Hinkley Point B plant in Somerset, as well as maintenance outages.

The decline in 2023 means UK nuclear output fell to the lowest level since the early 1980s. Following the site closures in 2022, the UK only has five operational nuclear power plants remaining, all but one of which – Sizewell B in Suffolk – are due to close this decade.

Out of coal

After gas, the next-largest driver of falling UK emissions in 2023 was coal, accounting for around 14% of the overall drop in emissions.

The decline of coal use in the UK – for homes, railways, factories and power stations – is a major part of the long-term reduction in greenhouse gas emissions over the past 30 years.

Factors in this long-term decline include controls on domestic coal burning to limit air pollution, the end of steam railways, the shift from coal-based “town gas” to “natural” gas from the North Sea, the deindustrialisation of the 1970s and the “dash for gas” of the 1990s.

More recently, coal demand has dropped precipitously as the rapid build-out of renewable sources of electricity has combined with falling demand and carbon pricing that favours gas.

The figure below shows how UK coal demand surged during the industrial revolution before levelling off through the 20th century, barring general strikes in 1921 and 1926.

Coal demand has been falling steadily since the passage of the Clean Air Act in 1956, in response to London’s “great smog” of 1952. In 2023, UK coal demand fell by another 23% to the lowest level since the 1730s, when George II was on the throne and Robert Walpole was prime minister.

The recent reduction of coal demand is largely down to the demise of coal power, which made up around 40% of the UK’s electricity generation as recently as 2012. Coal power output has fallen by 97% over the past decade, accounting for 87% of the fall in UK coal demand overall.

In 2023, only 1% of the UK’s electricity came from coal, with three coal-fired plants closing down: the coal units at Drax in Yorkshire; Kilroot in Northern Ireland; and West Burton A in Lincolnshire.

As of the start of October 2023, only one coal plant remains – the Ratcliffe-on-Soar site in Nottinghamshire. Operator Uniper plans to close Ratcliffe in September 2024, ahead of the government’s deadline to end coal power by October 2024.

Sectoral shifts

The reductions in gas use for power and building heat, as well as the fall in coal use for power, further cemented the transport sector as the largest contributor to UK emissions in 2023.

This is shown in the figure below, which highlights how transport emissions have barely changed over the past several decades as more efficient cars have been offset by increased traffic.

The power sector was the largest contributor to the UK’s emissions until 2014. In 2023, it was likely only the fifth-largest below transport, buildings, industry and – for the first time – also agriculture.

As of 2023, transport emissions were only around 10% below 1990 levels and made up nearly a third of the UK’s overall total. There are now more than a million electric vehicles (EVs) on the UK’s road, which will have avoided around 2MtCO2e of annual emissions.

However, the government has also frozen or cut fuel duty every year since 2010, rather than increasing it in line with inflation, adding up to around 20MtCO2e to the UK’s total.

Emissions from buildings – chiefly for heating and cooling – are the second-largest contributor to the UK’s emissions, accounting for around a fifth of the total.

They were around one-third lower than 1990 levels in 2023, with improved insulation and boiler regulations making the UK’s buildings more efficient to heat.

Efficiency improvements dried up around a decade ago and the fall in building emissions since 2021 has been driven by high prices suppressing demand, rather than deliberate policy choices.

Industrial emissions made up an estimated tenth of the UK’s total in 2023, having fallen by two-thirds since 1990 and by a quarter in the past decade.

In common with many other developed economies, the UK shifted from heavy industry towards advanced manufacturing and services from the 1970s onwards. However, industrial energy efficiency improvements and a shift to lower-carbon fuels are also part of the picture.

Agricultural emissions have barely changed for decades, making up just over a tenth of the UK’s total in 2023 and having fallen just 12% since 1990 as livestock herds have shrunk.

There was a small decrease in farm emissions in 2022 as the energy crisis filtered through into surging prices for fertilisers. For the figure above, Carbon Brief assumes the reduced fertiliser use in 2022 continued in 2023, as fertiliser prices only eased in summer 2023.

Decoupling emissions

The drop in UK emissions in 2023 came as the economy flatlined, growing by just 0.4% on 2022 levels. The UK’s emissions are now 53% below 1990 levels while the economy has grown 82%.

This “decoupling” of emissions from economic growth is shown in the figure below. As noted above, this analysis is based on territorial emissions within the UK’s borders.

Consumption-based emissions including imported goods and services were climbing in the early part of this century. However, emissions cuts over the past two decades have been very largely driven by sectors that cannot easily be “outsourced”, particularly power and building heat.

The UK is now in a mild recession and the economy is only expected to grow by around 1% in 2024. Recent trends in the “emissions intensity” of the UK economy – the emissions per unit of GDP – and weak economic growth suggests that emissions could continue to fall in 2024.

On the other hand, gas and oil prices are easing to pre-crisis levels, while above-average temperatures may not continue for another year. Petrol demand rose by nearly 5% in 2023 as traffic continued to rebound from the pandemic – and jet fuel use similarly climbed by 16%.

Moreover, the one-off impact of the UK returning to net electricity imports has now unwound. As such, further emissions cuts in 2024 are far from guaranteed.

Target practise

While the UK has made rapid progress in cutting its territorial emissions since 1990, it remains only around halfway to reaching its net-zero target for 2050, as the chart figure shows.

Emissions fell by 23MtCO2e in 2023, according to Carbon Brief’s analysis. This is faster than the 14MtCO2e reduction needed every year for the next quarter-century to reach net-zero by 2050.

However, with only one coal-fired power station remaining and the power sector overall now likely only the fifth-largest contributor to UK emissions, the country will need to start cutting into gas power and looking to other sectors, if it is to continue making progress towards its targets.

This will mean expanding wind and solar capacity to reduce gas use, while retaining gas-fired power stations for periods of low wind and starting to build low-carbon alternatives, such as gas with carbon capture and storage, long-term energy storage or hydrogen-fired turbines.

Emissions from road transport and buildings will be key areas if the UK is to progress, which is why changes to government plans around electric vehicles and heat pumps could be problematic.

Similarly, a government decision to “carry forward” the “surplus” emissions cuts from earlier years – largely due to external events such as Covid – would severely weaken UK targets at a time when continued ambition is needed, to stay on track for medium- and long-term climate goals.

Methodology

The starting point for Carbon Brief’s analysis of UK greenhouse gas emissions is preliminary government estimates of energy use by fuel. These are published quarterly, with the final quarter of each year appearing in figures published at the end of the following February. The same approach has accurately estimated year-to-year changes in emissions in previous years (see table, below).

One large source of uncertainty is the provisional energy use data, which is revised at the end of March each year and often again later on. Emissions data is also subject to revision in light of improvements in data collection and the methodology used, with major revisions in 2021.

The table above applies Carbon Brief’s emissions calculations to the comparable energy use and emissions figures, which may differ from those published previously.

Another source of uncertainty is the fact that Carbon Brief’s approach to estimating the annual change in emissions differs from the methodology used for the government’s own provisional estimates. The government has access to more granular data not available for public use.

Carbon Brief’s analysis takes figures on the amount of energy sourced from coal, oil and gas reported in Energy Trends 1.2. These figures are combined with conversion factors for the CO2 emissions per unit of energy, published annually by the UK government. Conversion factors are available for each fuel type, for example, petrol, diesel, gas, coal for electricity generation.

For oil, the analysis also draws on Energy Trends 3.13, which further breaks down demand according to the subtype of oil, for example, petrol, jet fuel and so on. Similarly, for coal, the analysis draws on Energy Trends 2.6, which breaks down solid fuel use by subtype.

Emissions from each fuel are then estimated from the energy use multiplied by the conversion factor, weighted by the relative proportions for each fuel subtype.

For example, the UK uses roughly 50m tonnes of oil equivalent (Mtoe) in the form of oil products, around half of which is from road diesel. So half the total energy use from oil is combined with the conversion factor for road diesel, another one-fifth for petrol and so on.

Energy use from each fossil fuel subtype is mapped onto the appropriate emissions conversion factor. In some cases, there is no direct read-across, in which case the nearest appropriate substitute is used. For example, energy use listed as “bitumen” is mapped to “processed fuel oils – residual oil”. Similarly, solid fuel used by “other conversion industries” is mapped to “petroleum coke”, and “other” solid fuel use is mapped to “coal (domestic)”.

The energy use figures are calculated on an inland consumption basis, meaning they include bunkers consumed in the UK for international transport by air and sea. In contrast, national emissions inventories exclude international aviation and shipping.

The analysis, therefore, estimates and removes the part of oil use that is due to the UK’s share of international aviation. It draws on the UK’s final greenhouse gas emissions inventory, which breaks emissions down by sector and reports the total for domestic aviation.

This domestic emissions figure is compared with the estimated emissions due to jet fuel use overall, based on the appropriate conversion factor. The analysis assumes that domestic aviation’s share of emissions is equivalent to its share of jet fuel energy use.

In addition to estimating CO2 emissions from fossil fuel use, Carbon Brief assumes that CO2 emissions from non-fuel sources, such as land-use change and forestry, are the same as a year earlier. Remaining greenhouse gas emissions are assumed to change in line with the latest government energy and emissions projections.

These assumptions are based on the UK government’s own methodology for preliminary greenhouse gas emissions estimates, published in 2019.

Note that the figures in this article are for emissions within the UK measured according to international guidelines. This means they exclude emissions associated with imported goods, including imported biomass, as well as the UK’s share of international aviation and shipping.

The Office for National Statistics (ONS) has published detailed comparisons between various different approaches to calculating UK emissions, on a territorial, consumption, environmental accounts or international accounting basis.

The UK’s consumption-based CO2 emissions increased between 1990 and 2007. Since then, however, they have fallen by a similar number of tonnes as emissions within the UK.

Bioenergy is a significant source of renewable energy in the UK and its climate benefits are disputed. Contrary to public perception, however, only around one quarter of bioenergy is imported.

International aviation is considered part of the UK’s carbon budgets and faces the prospect of tighter limits on its CO2 emissions. The international shipping sector has a target to at least halve its emissions by 2050, relative to 2008 levels.

The post Analysis: UK emissions in 2023 fell to lowest level since 1879 appeared first on Carbon Brief.

Analysis: UK emissions in 2023 fell to lowest level since 1879

Climate Change

Cheniere Energy Received $370 Million IRS Windfall for Using LNG as ‘Alternative’ Fuel

The country’s largest exporter of liquefied natural gas benefited from what critics say is a questionable IRS interpretation of tax credits.

Cheniere Energy, the largest producer and exporter of U.S. liquefied natural gas, received $370 million from the IRS in the first quarter of 2026, a payout that shipping experts, tax specialists and a U.S. senator say the company never should have received.

Cheniere Energy Received $370 Million IRS Windfall for Using LNG as ‘Alternative’ Fuel

Climate Change

DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Absolute State of the Union

‘DRILL, BABY’: US president Donald Trump “doubled down on his ‘drill, baby, drill’ agenda” in his State of the Union (SOTU) address, said the Los Angeles Times. He “tout[ed] his support of the fossil-fuel industry and renew[ed] his focus on electricity affordability”, reported the Financial Times. Trump also attacked the “green new scam”, noted Carbon Brief’s SOTU tracker.

COAL REPRIEVE: Earlier in the week, the Trump administration had watered down limits on mercury pollution from coal-fired power plants, reported the Financial Times. It remains “unclear” if this will be enough to prevent the decline of coal power, said Bloomberg, in the face of lower-cost gas and renewables. Reuters noted that US coal plants are “ageing”.

OIL STAY: The US Supreme Court agreed to hear arguments brought by the oil industry in a “major lawsuit”, reported the New York Times. The newspaper said the firms are attempting to head off dozens of other lawsuits at state level, relating to their role in global warming.

SHIP-SHILLING: The Trump administration is working to “kill” a global carbon levy on shipping “permanently”, reported Politico, after succeeding in delaying the measure late last year. The Guardian said US “bullying” could be “paying off”, after Panama signalled it was reversing its support for the levy in a proposal submitted to the UN shipping body.

Around the world

- RARE EARTHS: The governments of Brazil and India signed a deal on rare earths, said the Times of India, as well as agreeing to collaborate on renewable energy.

- HEAT ROLLBACK: German homes will be allowed to continue installing gas and oil heating, under watered-down government plans covered by Clean Energy Wire.

- BRAZIL FLOODS: At least 53 people died in floods in the state of Minas Gerais, after some areas saw 170mm of rain in a few hours, reported CNN Brasil.

- ITALY’S ATTACK: Italy is calling for the EU to “suspend” its emissions trading system (ETS) ahead of a review later this year, said Politico.

- COOKSTOVE CREDITS: The first-ever carbon credits under the Paris Agreement have been issued to a cookstove project in Myanmar, said Climate Home News.

- SAUDI SOLAR: Turkey has signed a “major” solar deal that will see Saudi firm ACWA building 2 gigawatts in the country, according to Agence France-Presse.

$467 billion

The profits made by five major oil firms since prices spiked following Russia’s invasion of Ukraine four years ago, according to a report by Global Witness covered by BusinessGreen.

Latest climate research

- Claims about the “fingerprint” of human-caused climate change, made in a recent US Department of Energy report, are “factually incorrect” | AGU Advances

- Large lakes in the Congo Basin are releasing carbon dioxide into the atmosphere from “immense ancient stores” | Nature Geoscience

- Shared Socioeconomic Pathways – scenarios used regularly in climate modelling – underrepresent “narratives explicitly centring on democratic principles such as participation, accountability and justice” | npj Climate Action

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

The constituency of Richard Tice MP, the climate-sceptic deputy leader of Reform UK, is the second-largest recipient of flood defence spending in England, according to new Carbon Brief analysis. Overall, the funding is disproportionately targeted at coastal and urban areas, many of which have Conservative or Liberal Democrat MPs.

Spotlight

Is there really a UK ‘greenlash’?

This week, after a historic Green Party byelection win, Carbon Brief looks at whether there really is a “greenlash” against climate policy in the UK.

Over the past year, the UK’s political consensus on climate change has been shattered.

Yet despite a sharp turn against climate action among right-wing politicians and right-leaning media outlets, UK public support for climate action remains strong.

Prof Federica Genovese, who studies climate politics at the University of Oxford, told Carbon Brief:

“The current ‘war’ on green policy is mostly driven by media and political elites, not by the public.”

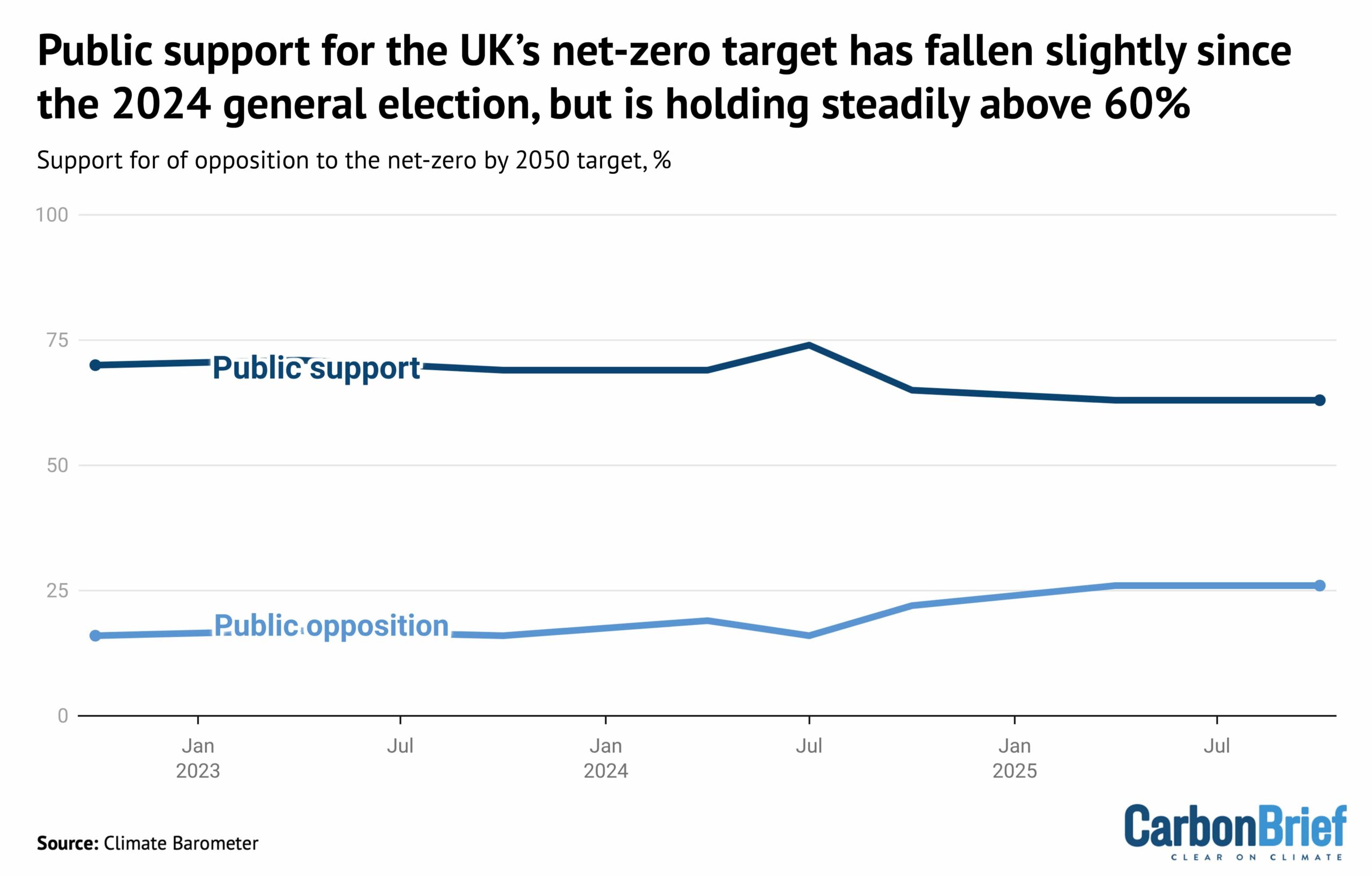

Indeed, there is still a greater than two-to-one majority among the UK public in favour of the country’s legally binding target to reach net-zero emissions by 2050, as shown below.

Steve Akehurst, director of public-opinion research initiative Persuasion UK, also noted the growing divide between the public and “elites”. He told Carbon Brief:

“The biggest movement is, without doubt, in media and elite opinion. There is a bit more polarisation and opposition [to climate action] among voters, but it’s typically no more than 20-25% and mostly confined within core Reform voters.”

Conservative gear shift

For decades, the UK had enjoyed strong, cross-party political support for climate action.

Lord Deben, the Conservative peer and former chair of the Climate Change Committee, told Carbon Brief that the UK’s landmark 2008 Climate Change Act had been born of this cross-party consensus, saying “all parties supported it”.

Since their landslide loss at the 2024 election, however, the Conservatives have turned against the UK’s target of net-zero emissions by 2050, which they legislated for in 2019.

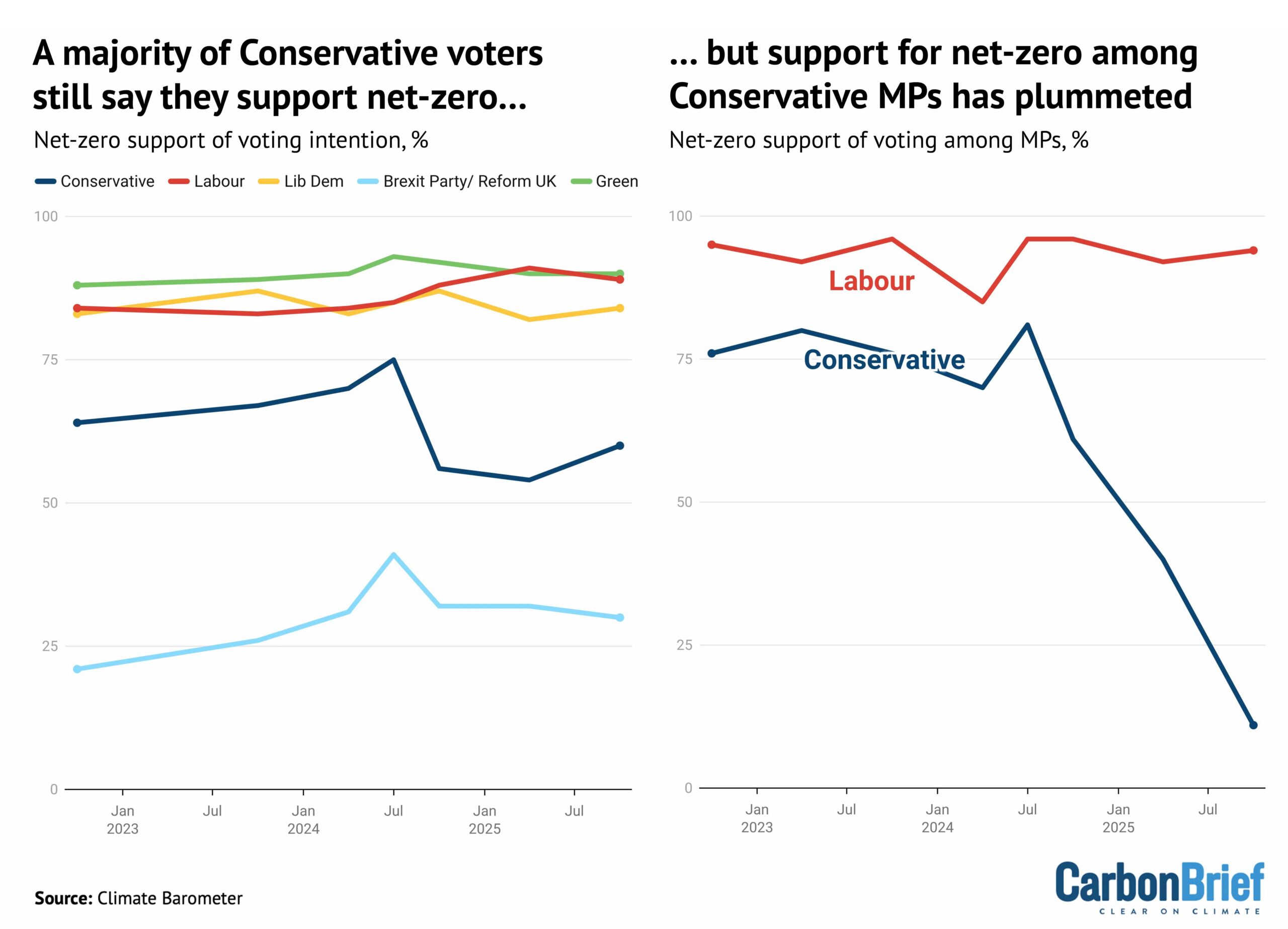

Curiously, while opposition to net-zero has surged among Conservative MPs, there is majority support for the target among those that plan to vote for the party, as shown below.

Dr Adam Corner, advisor to the Climate Barometer initiative that tracks public opinion on climate change, told Carbon Brief that those who currently plan to vote Reform are the only segment who “tend to be more opposed to net-zero goals”. He said:

“Despite the rise in hostile media coverage and the collapse of the political consensus, we find that public support for the net-zero by 2050 target is plateauing – not plummeting.”

Reform, which rejects the scientific evidence on global warming and campaigns against net-zero, has been leading the polls for a year. (However, it was comfortably beaten by the Greens in yesterday’s Gorton and Denton byelection.)

Corner acknowledged that “some of the anti-net zero noise…[is] showing up in our data”, adding:

“We see rising concerns about the near-term costs of policies and an uptick in people [falsely] attributing high energy bills to climate initiatives.”

But Akehurst said that, rather than a big fall in public support, there had been a drop in the “salience” of climate action:

“So many other issues [are] competing for their attention.”

UK newspapers published more editorials opposing climate action than supporting it for the first time on record in 2025, according to Carbon Brief analysis.

Global ‘greenlash’?

All of this sits against a challenging global backdrop, in which US president Donald Trump has been repeating climate-sceptic talking points and rolling back related policy.

At the same time, prominent figures have been calling for a change in climate strategy, sold variously as a “reset”, a “pivot”, as “realism”, or as “pragmatism”.

Genovese said that “far-right leaders have succeeded in the past 10 years in capturing net-zero as a poster child of things they are ‘fighting against’”.

She added that “much of this is fodder for conservative media and this whole ecosystem is essentially driving what we call the ‘greenlash’”.

Corner said the “disconnect” between elite views and the wider public “can create problems” – for example, “MPs consistently underestimate support for renewables”. He added:

“There is clearly a risk that the public starts to disengage too, if not enough positive voices are countering the negative ones.”

Watch, read, listen

TRUMP’S ‘PETROSTATE’: The US is becoming a “petrostate” that will be “sicker and poorer”, wrote Financial Times associate editor Rana Forohaar.

RHETORIC VS REALITY: Despite a “political mood [that] has darkened”, there is “more green stuff being installed than ever”, said New York Times columnist David Wallace-Wells.

CHINA’S ‘REVOLUTION’: The BBC’s Climate Question podcast reported from China on the “green energy revolution” taking place in the country.

Coming up

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean, Brasília

- 3 March: UK spring statement

- 4-11 March: China’s “two sessions”

- 5 March: Nepal elections

Pick of the jobs

- The Guardian, senior reporter, climate justice | Salary: $123,000-$135,000. Location: New York or Washington DC

- China-Global South Project, non-resident fellow, climate change | Salary: Up to $1,000 a month. Location: Remote

- University of East Anglia, PhD in mobilising community-based climate action through co-designed sports and wellbeing interventions | Salary: Stipend (unknown amount). Location: Norwich, UK

- TABLE and the University of São Paulo, Brazil, postdoctoral researcher in food system narratives | Salary: Unknown. Location: Pirassununga, Brazil

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’? appeared first on Carbon Brief.

Climate Change

Pacific nations want higher emissions charges if shipping talks reopen

Seven Pacific island nations say they will demand heftier levies on global shipping emissions if opponents of a green deal for the industry succeed in reopening negotiations on the stalled accord.

The United States and Saudi Arabia persuaded countries not to grant final approval to the International Maritime Organization’s Net-Zero Framework (NZF) in October and they are now leading a drive for changes to the deal.

In a joint submission seen by Climate Home News, the seven climate-vulnerable Pacific countries said the framework was already a “fragile compromise”, and vowed to push for a universal levy on all ship emissions, as well as higher fees . The deal currently stipulates that fees will be charged when a vessel’s emissions exceed a certain level.

“For many countries, the NZF represents the absolute limit of what they can accept,” said the unpublished submission by Fiji, Kiribati, Vanuatu, Nauru, Palau, Tuvalu and the Solomon Islands.

The countries said a universal levy and higher charges on shipping would raise more funds to enable a “just and equitable transition leaving no country behind”. They added, however, that “despite its many shortcomings”, the framework should be adopted later this year.

US allies want exemption for ‘transition fuels’

The previous attempt to adopt the framework failed after governments narrowly voted to postpone it by a year. Ahead of the vote, the US threatened governments and their officials with sanctions, tariffs and visa restrictions – and President Donald Trump called the framework a “Green New Scam Tax on Shipping”.

Since then, Liberia – an African nation with a major low-tax shipping registry headquartered in the US state of Virginia – has proposed a new measure under which, rather than staying fixed under the NZF, ships’ emissions intensity targets change depending on “demonstrated uptake” of both “low-carbon and zero-carbon fuels”.

The proposal places stringent conditions on what fuels are taken into consideration when setting these targets, stressing that the low- and zero-carbon fuels should be “scalable”, not cost more than 15% more than standard marine fuels and should be available at “sufficient ports worldwide”.

This proposal would not “penalise transitional fuels” like natural gas and biofuels, they said. In the last decade, the US has built a host of large liquefied natural gas (LNG) export terminals, which the Trump administration is lobbying other countries to purchase from.

The draft motion, seen by Climate Home News, was co-sponsored by US ally Argentina and also by Panama, a shipping hub whose canal the US has threatened to annex. Both countries voted with the US to postpone the last vote on adopting the framework.

The IMO’s Panamanian head Arsenio Dominguez told reporters in January that changes to the framework were now possible.

“It is clear from what happened last year that we need to look into the concerns that have been expressed [and] … make sure that they are somehow addressed within the framework,” he said.

Patchwork of levies

While the European Union pushed firmly for the framework’s adoption, two of its shipping-reliant member states – Greece and Cyprus – abstained in October’s vote.

After a meeting between the Greek shipping minister and Saudi Arabia’s energy minister in January, Greece said a “common position” united Greece, Saudi Arabia and the US on the framework.

If the NZF or a similar instrument is not adopted, the IMO has warned that there will be a patchwork of differing regional levies on pollution – like the EU’s emissions trading system for ships visiting its ports – which will be complicated and expensive to comply with.

This would mean that only countries with their own levies and with lots of ships visiting their ports would raise funds, making it harder for other nations to fund green investments in their ports, seafarers and shipping companies. In contrast, under the NZF, revenues would be disbursed by the IMO to all nations based on set criteria.

Anais Rios, shipping policy officer from green campaign group Seas At Risk, told Climate Home News the proposal by the Pacific nations for a levy on all shipping emissions – not just those above a certain threshold – was “the most credible way to meet the IMO’s climate goals”.

“With geopolitics reframing climate policy, asking the IMO to reopen the discussion on the universal levy is the only way to decarbonise shipping whilst bringing revenue to manage impacts fairly,” Rios said.

“It is […] far stronger than the Net-Zero Framework that is currently on offer.”

The post Pacific nations want higher emissions charges if shipping talks reopen appeared first on Climate Home News.

Pacific nations want higher emissions charges if shipping talks reopen

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits