For the first time, the growth in China’s clean power generation has caused the nation’s carbon dioxide (CO2) emissions to fall despite rapid power demand growth.

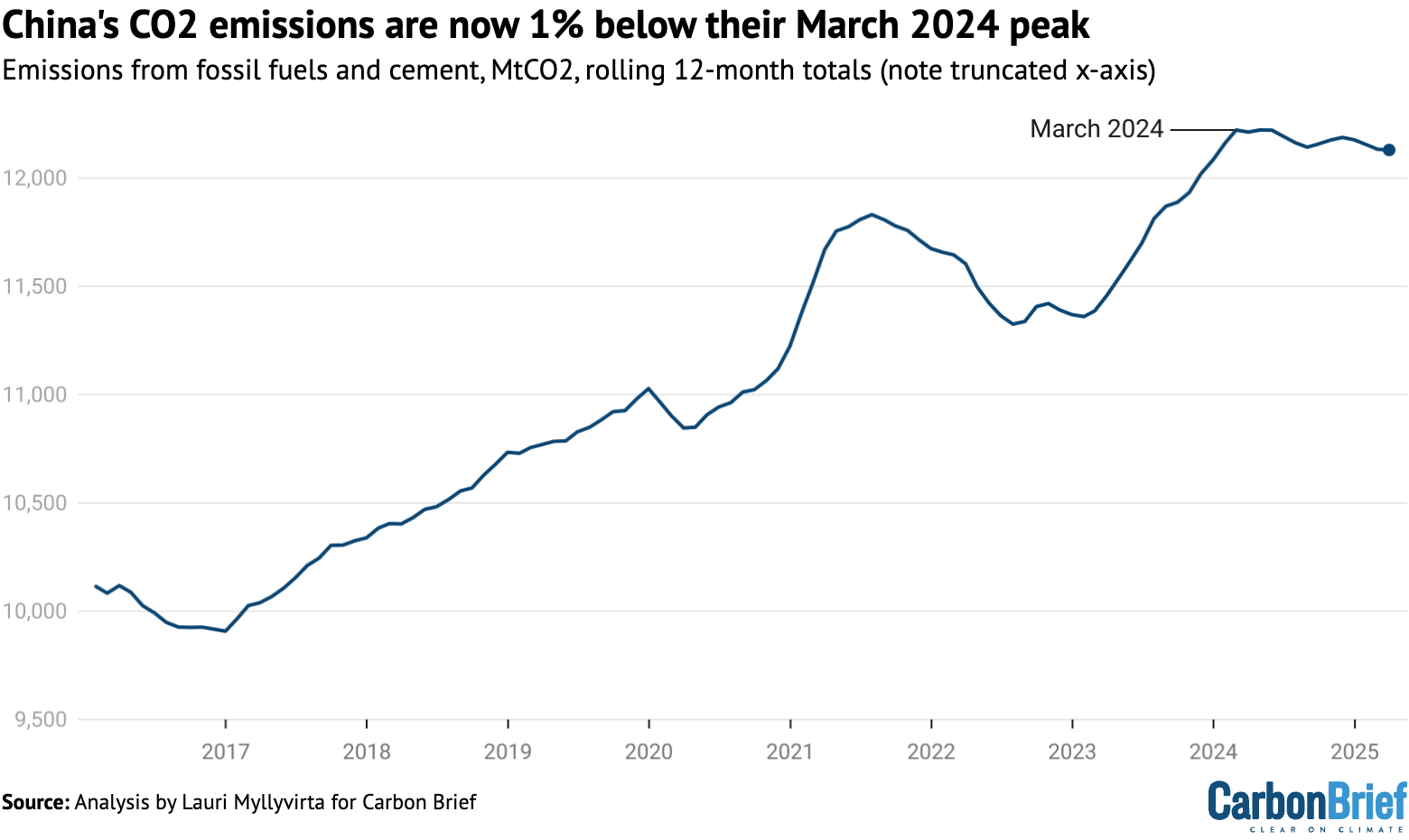

The new analysis for Carbon Brief shows that China’s emissions were down 1.6% year-on-year in the first quarter of 2025 and by 1% in the latest 12 months.

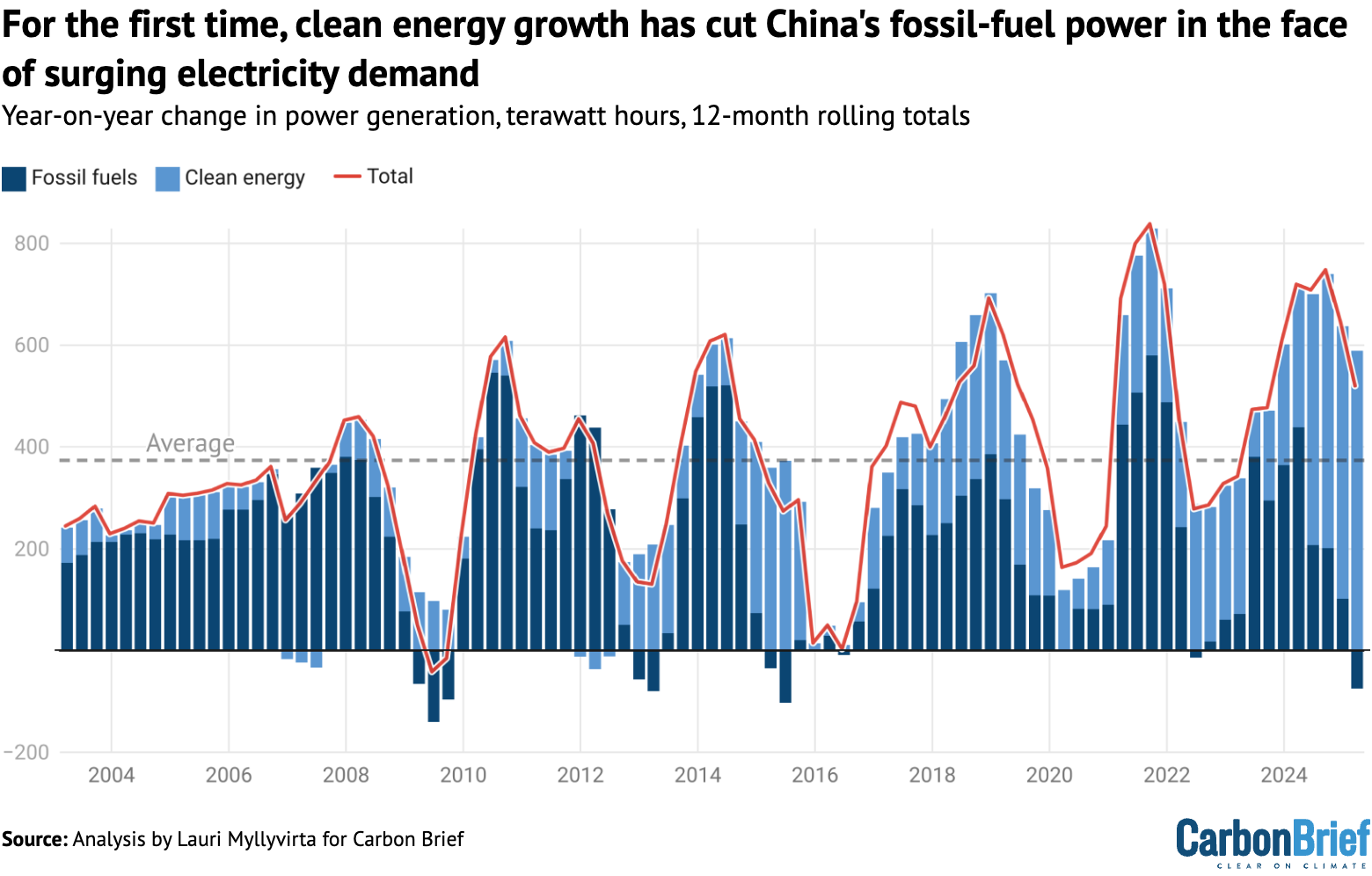

Electricity supply from new wind, solar and nuclear capacity was enough to cut coal-power output even as demand surged, whereas previous falls were due to weak growth.

The analysis, based on official figures and commercial data, shows that China’s CO2 emissions have now been stable, or falling, for more than a year.

However, they remain only 1% below the latest peak, implying that any short-term jump could cause China’s CO2 emissions to rise to a new record.

Other key findings include:

- Growth in clean power generation has now overtaken the current and long-term average growth in electricity demand, pushing down fossil fuel use.

- Power-sector emissions fell 2% year-on-year in the 12 months to March 2025.

- If this pattern is sustained, then it would herald a peak and sustained decline in China’s power-sector emissions.

- The trade “war” initiated by US president Donald Trump has prompted renewed efforts to shift China’s economy towards domestic consumption, rather than exports.

- A new pricing policy for renewables has caused a rush to install before it takes effect.

- There is a growing gap that would need to be bridged if China is to meet the 2030 emissions targets it pledged under the Paris Agreement.

If sustained, the drop in power-sector CO2 as a result of clean-energy growth could presage the sort of structural decline in emissions anticipated in previous analysis for Carbon Brief.

The trend of falling power-sector emissions is likely to continue in 2025.

However, the outlook beyond that depends strongly on the clean energy and emissions targets set in China’s next five-year plan, due to be published next year, as well as the economic policy response to the Trump administration’s hostile trade policy.

China’s emissions decline due to clean power

Over the past decade, China’s CO2 emissions from fossil fuels and cement have risen by nearly a fifth, but there have been ups and downs along the way.

The shallow decline in 2015 and 2016 was due to a slump that followed a round of stimulus measures, while zero-Covid controls caused a sharper fall in 2022. Overall, however, emissions have continued to increase, pausing only during periods of economic stress.

More recently, there have been signs that China’s CO2 emissions could be close to reaching a peak and plateau, or even a period of structural decline.

The latest data, for the first quarter of 2025, shows that China’s CO2 emissions have now been stable or falling for more than a year, as shown in the figure below.

However, with emissions remaining just 1% below the recent peak, it remains possible that they could jump once again to a new record high.

Therefore, the future path of China’s CO2 emissions hangs in the balance, depending on trends within each sector of its economy, as well as China’s response to Trump’s tariffs.

These sectoral trends are explored further in the sections below, along with signals on what could be coming next from Chinese policymakers as they consider the country’s international climate pledge for 2035 and the five-year plan for 2026-2030.

Power-sector emissions fall while other sectors rebound

The reduction in China’s first-quarter CO2 emissions in 2025 was due to a 5.8% drop in the power sector. While power demand grew by 2.5% overall, there was a 4.7% drop in thermal power generation – mainly coal and gas.

Increases in solar, wind and nuclear power generation, driven by investments in new generating capacity, more than covered the growth in demand. The increase in hydropower, which is more related to seasonal variation, helped push down fossil power generation.

Power-sector emissions fell by more than total generation from fossil fuels, as the share of biomass and gas increased, while average coal power plant efficiency improved.

Specifically, the average amount of coal needed to generate each unit of electricity at coal-fired power plants fell by 0.9% year-on-year.

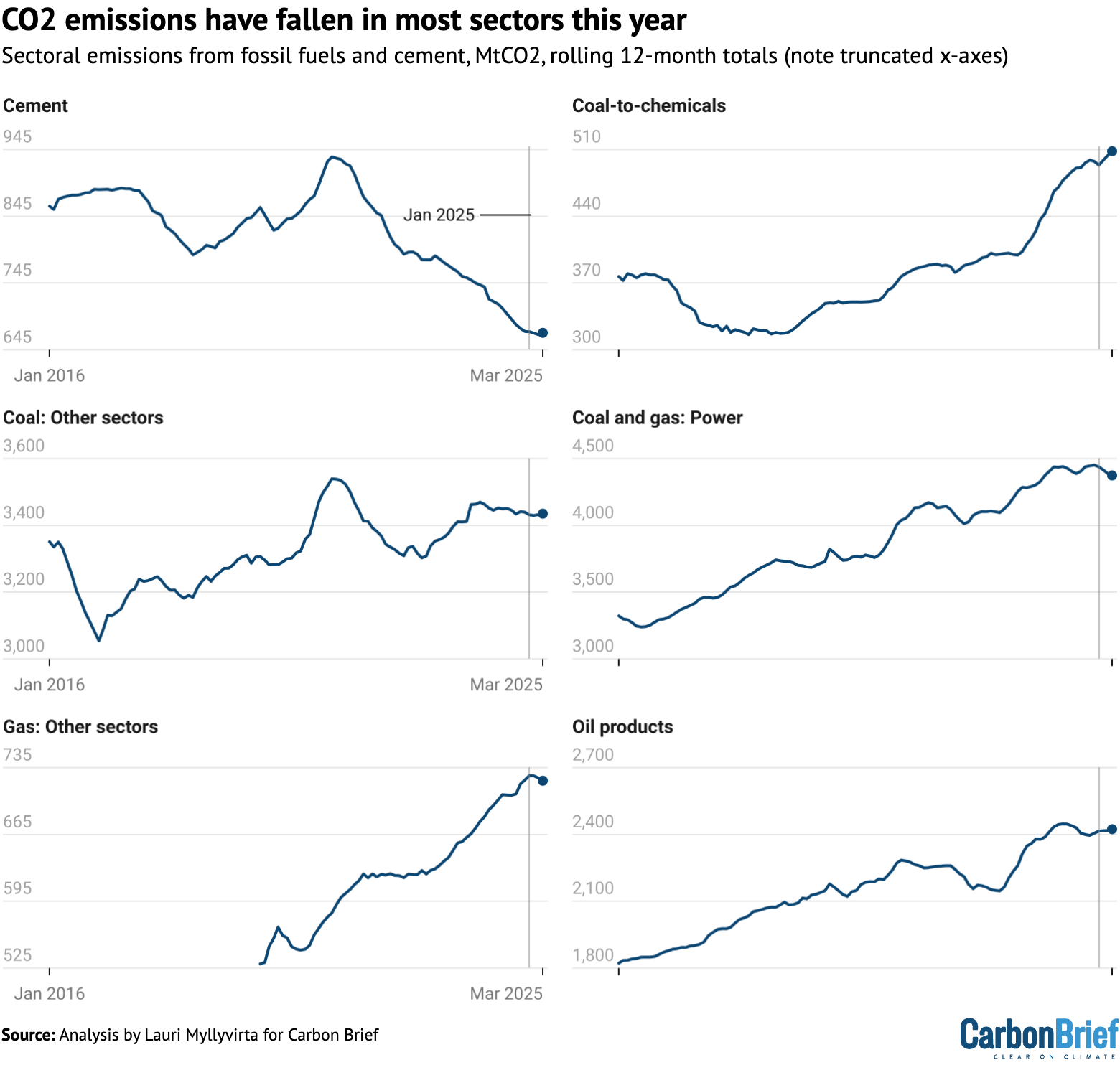

The first-quarter reduction in CO2 emissions from coal use in the power sector is shown at the bottom of the figure below, below CO2 changes in other sectors.

Outside of the power sector, emissions increased 3.5%, with the largest rises in the use of coal in the metals and chemicals industries.

The coal-to-chemicals industry is undergoing rapid expansion, driven by concerns about dependence on imported oil and gas. During the first quarter of 2025, it was also benefiting from more favourable economics due to lower coal prices and relatively high oil prices.

Crude steel production increased 0.6% year-on-year, metal products output by 6% and non-ferrous metals production by 2%. All of these increases were mainly due to a jump in March. Metals demand was boosted by the bump in exports ahead of the tariffs, but high output has continued well into April.

Real-estate construction “starts” fell by 24% and sales of new properties by 3%, indicating that the demand for cement, steel and glass from the construction sector continues to decline.

In contrast, economic output in vehicle and machinery production increased by 12% and 13%, respectively, signalling increased demand for metals.

Cement production fell by 1.4%, a slower rate of decrease than in previous years, likely due to an earlier start to weather-dependent construction activity thanks to warm weather.

Gas consumption increased by an estimated 6% in the power sector, due to a 14% increase in gas-fired power generation capacity, even as the average utilisation of the plants fell. However, gas consumption fell in other sectors, outweighing the increase for power.

Oil products consumption increased slightly, as shown by the bar at the top in the figure above. Warmer weather meant that weather-dependent construction and agricultural activity rose earlier in the year than usual.

However, structural factors, particularly vehicle electrification and the shift to liquified natural gas (LNG) in the freight sector, point to continued declines in oil demand.

Have China’s emissions peaked?

Following the 1.6% decline in the first quarter of 2025, China’s emissions have now been stable or falling for more than a year, starting from the beginning of March 2024.

However, emissions in the 12 months to the end of March 2025 were down only 1% from their recent peak, implying that any short-term jump could lead to a new record high.

After the sharp reduction in the first quarter, emissions from power generation are now down year-on-year for the most recent 12 months.

This has happened four times before over the past four decades – in 2009, 2012, 2015 and 2022. However, the current drop is the first time that the main driver is growth in clean power generation.

The falls in 2009 and 2012 were related to the global financial crisis and the Euro area crisis, while the drop in 2015 was driven by the construction and industrial sector slump that followed the 2008-12 stimulus program.

These economic shocks resulted in the sharp reduction in electricity demand shown in the figure below. The drop in 2022 was a combination of slow power demand growth due to strict “zero-Covid” measures and relatively strong clean-power additions.

Importantly, the growth in clean power generation in the first quarter of 2025 was not only larger than the rise in demand overall, it was also higher than the average increase in demand over the past 15 years, marked by the dashed line in the figure above.

Moreover, hydropower has been stable year-on-year in the past six months, implying that the clean-energy growth has been driven by increases in solar, wind and nuclear power capacity, not year-to-year variation in hydropower output.

Looking beyond electricity generation, all sectors registered a fall in emissions over the most recent four months from December 2024 to March 2025, except for coal-to-chemicals.

In order for China’s emissions overall to peak and then start declining, CO2 cuts in declining sectors will need to outweigh continued growth elsewhere.

For example, process emissions from cement production peaked in 2021 and have declined by 27% since then, as shown in the top left chart in the figure below.

Coal use outside the power and chemicals sectors peaked at the same time as cement, but has been rebounding since then and is now close to previous peak levels.

The China Coal Association expects coal use in the steel and building materials industries to fall, while coal consumption in the chemical industry is projected to continue growing.

Hopes of future growth in demand for coal are pinned on the chemical sector, described as a shift from using coal primarily as a fuel to a role as both a fuel and a raw material.

The association also believes that coal-fired power generation will resume growth – at least in the short term – but it recently revised down its projections for 2025 compared with the outlook at the end of 2024.

The tariff “war” may have affected expectations. One analysis suggests a 0.5 to 1 percentage point reduction in China’s GDP growth rate due to the tariffs could result in a similar reduction in demand for thermal coal – mainly used at power stations.

Oil product consumption has been declining since the post-Covid rebound ended in March 2024, falling 2% from its peak. The long-term trend is expected to be downwards, due to the electrification of transportation, despite rising demand for chemicals and aviation.

Gas use has been falling for a few months, but the trend is likely still increasing.

The table below lists the 12-month periods with the highest emissions for each sector, as well as the reduction since the latest peak in each case.

| Sector | Date of highest emissions | Reduction since peak |

|---|---|---|

| Cement | April 2021 | -28.2% |

| Coal and gas: Power | November 2024 | -1.7% |

| Coal-to-chemicals | March 2025 | Still increasing |

| Coal: Other sectors | April 2021 | -3.0% |

| Gas: Other sectors | December 2024 | -0.8% |

| Oil products | April 2024 | -1.0% |

| Total CO2 | February 2024 | -0.8% |

For all of the sectors other than cement production, it is too early to declare a definitive peak in emissions. Still, there are signs that other sectoral peaks could be past their peak, too.

Indeed, for oil products consumption and steel production, industry projections indicate that the future trend is likely to be falling.

For the power sector, clean-energy additions at or above current levels would likely lead to a structural peak, as clean-energy growth would more than cover electricity demand growth.

Together, these sectors cover more than 80% of China’s total emissions. If all of them enter a structural decline, then total emissions are very likely to do so too.

China pushes domestic demand in response to US tariffs

The economic and emissions outlook for this year and beyond will be affected by the Trump administration’s unprecedented trade tariffs – and China’s counter-measures.

The initial impact was a drop in emissions due to lower factory output in export-oriented coastal provinces and possible knock-on impacts on investment and consumer spending.

Conversely, the temporary easing of tariffs for 90 days will lead to a rush of orders from the US to make up for the short-lived slowdown in trade and to stockpile goods before the relief ends.

China’s reactions to the tariffs focused on counteracting the economic impacts with stimulus.

An anonymous comment piece in People’s Daily, the main Communist party affiliated newspaper, says the country should “strive to make consumption the main driving force and ballast stone of economic growth”, leveraging China’s large domestic market.

(The piece has the byline “People’s Daily commentator”, which implies that it is written by someone with authority.)

The article says that this will involve increasing consumer income, while easing financial and social burdens to boost purchasing power and willingness to consume.

While the temporary easing of tariffs will reduce the urgency of these measures, the US tariff rate on China, at 40%, remains much higher than it was before Trump’s presidency – and China’s leaders will likely want to prepare against the risk of renewed tariff hikes.

The focus will be creating domestic markets for the products China exports to the US. The long-held aim of rebalancing China’s economy towards consumption could finally become reality as a result. A successful rebalancing could mean less energy-intensive growth.

China’s response also includes redoubling its focus on “new quality productive forces”, a concept that emphasises new technology.

The concept includes the clean-energy industry, which has become such an important economic driver in China that it would be hard to leave out of stimulus plans.

A new list of low-carbon demonstration projects, published by the National Development and Reform Commission, provides a look at China’s priorities for clean-energy investment. Green hydrogen, energy storage, “virtual power plants” and industrial decarbonisation based on hydrogen are new growth areas.

In terms of the emissions implications of China’s response to Trump’s tariffs, the big question is whether stimulus focused at these favoured sectors – including the new low-carbon focus areas and other clean-energy industries – is deemed sufficient.

Some traditional recipients of stimulus spending, such as shipbuilding and public infrastructure, have already posted strong growth in the first quarter of this year as a result of stimulus measures announced in 2024.

New wind and solar pricing policy increases uncertainty

An additional source of uncertainty for China’s emissions comes in the form of its new electricity pricing policy for renewable energy, which enters into force in June.

The new policy removes price guarantees pegged to coal-power prices, with new wind and solar projects supposed to secure direct contracts with electricity buyers. This is likely to lead to lower prices being paid to new wind and solar projects.

However, it offers more favourable pricing – via “contracts for difference” – to the amount of new capacity needed to meet central government energy targets.

The immediate effect of the policy will likely be a rush of projects rushing to complete installation before the June deadline, so as to secure guaranteed prices.

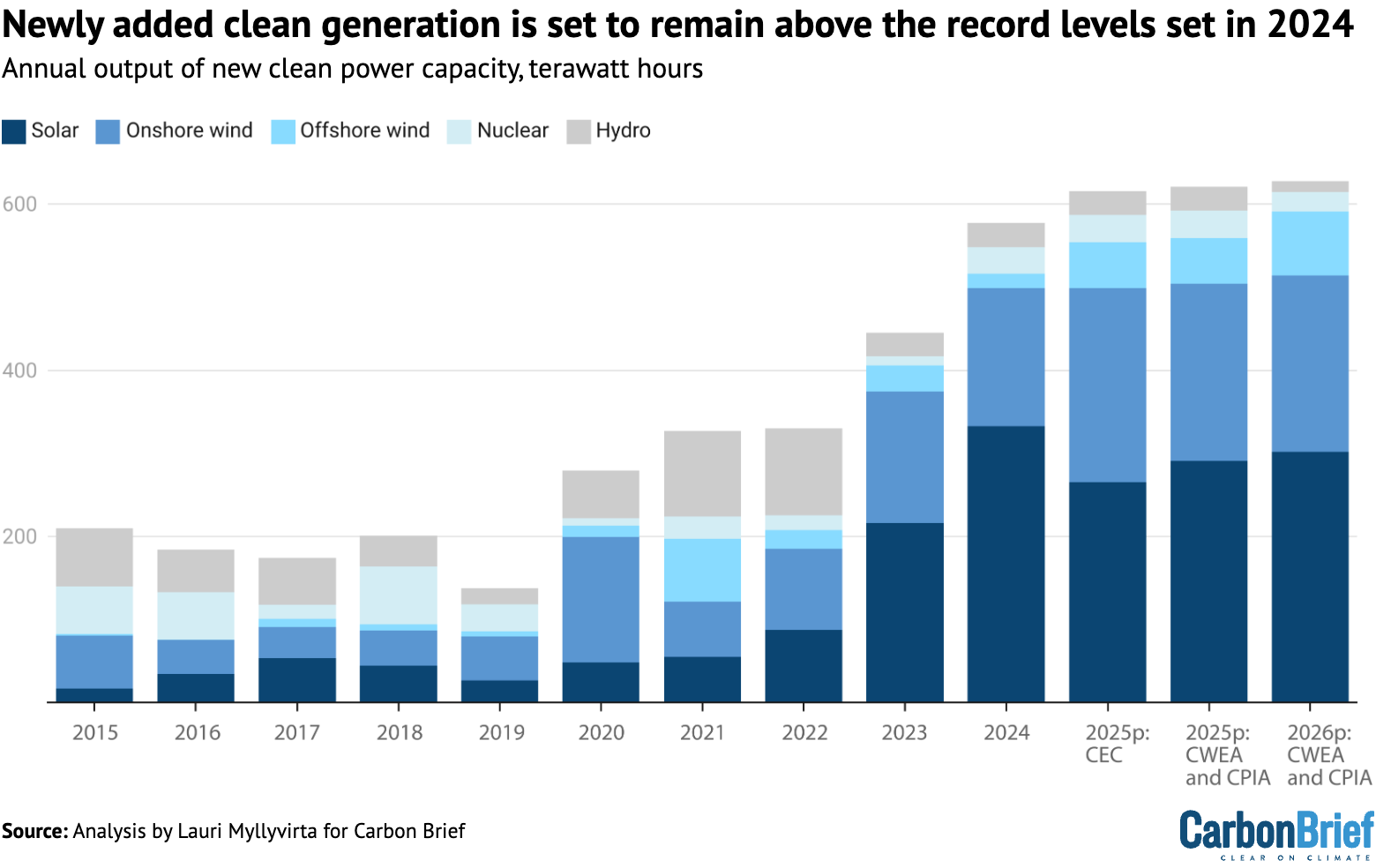

This rush was already apparent in the latest data: 23 gigawatts (GW) of solar and 13GW of wind was added in March alone, up 80% and 110% from previous records for the month.

Furthermore, this year’s installations are likely to be very strong, even topping last year’s record, as a lot of centralised solar power and wind-power projects are racing to complete before the end of the 14th five-year plan period.

The China Wind Energy Association expects a new record of 105-115GW installed this year across onshore and offshore wind projects – up from the record-breaking 80GW last year – based on very active bidding last year. It also expects volumes to stay at that level even in 2026 and to then grow further towards 2030.

The China Electricity Council predicts an even larger wind-power capacity addition of 120GW in 2025. Another analyst projects a 20% drop in wind-power capacity additions in 2026, but after an even steeper increase in 2025 to 120-130GW of capacity added. So he also expects 2026 installations to be far above the current record year of 2024.

For solar, the China Photovoltaic Industry Association forecasts a drop in installations of 8-23% this year, from the staggering record of 278GW last year. Even the low end of this projection would see installations stay at 2023 levels in 2025 and then recover from there. The China Electricity Council’s projection for solar additions in 2025 matches the low end of the industry association’s forecast.

The figure below, based on these various projections, shows that additional electricity generation from new clean power capacity is expected to remain above last year’s record-breaking levels in both 2025 and 2026.

The projections shown in the figure above illustrate that the energy industry expects to be able to navigate the new renewable pricing policy and to maintain a high level of wind and solar additions over the next two years.

The policy has, however, created a lot more uncertainty. The stop-go cycle of a flood of installations in the first half of this year and then a slowdown in the second half – likely especially in the distributed solar segment – is likely to be a tough time for the industry.

The uncertainty relates above all to two things. First is the local implementation of the policy, as provincial governments have a lot of leeway here. Given the economic significance of clean energy for many provinces, they can be expected to seek to implement the policy in a way that minimises disruptions to the industry.

The other source of uncertainty is central government targets. The pricing policy ties the availability of more favorable pricing to central government energy targets, after clean-energy growth outpaced those targets by a wide margin in the past few years.

This emphasises the importance of the targets set for the next five year plan. The National Energy Administration (NEA) is targeting “more than 200GW” per year of clean-energy capacity added, which is far lower than the 360GW added last year.

The effect of the pricing policy also depends on market conditions, of course, with a risk of oversupply of coal-fired power due to the ongoing rapid addition of new coal-fired power plants.

China’s nuclear construction also keeps accelerating, with another 10GW of reactor projects approved in April, on top of 10GW approved in each of the previous two years. These projects will contribute to clean power supply towards 2030 as they are completed.

China faces widening gap to Paris pledge

The uncertainty around wind and solar expansion also has implications for China’s international climate pledges under the Paris Agreement.

After exceptionally slow progress in 2020-23, China is significantly off track for its 2030 commitment to reduce carbon intensity – the emissions per unit of economic output. It is almost certain to miss its 2025 target. Carbon intensity fell by 3.4% in 2024, falling short of the rate of improvement needed to meet the 2025 and 2030 targets.

The government work plan for 2025 did not set a carbon intensity target. It only included a target for reducing the intensity per unit of GDP for energy supply from fossil fuels by 3%, excluding use for raw materials.

This provides an indirect indication of the targeted improvement in carbon intensity. In 2024, carbon intensity fell by 3.4%, while fossil energy intensity fell by 3.8%. If the ratio is similar in 2025, then carbon intensity would need to fall by around 2.5% at a minimum, allowing CO2 emissions to increase by more than 2%, if the target for 5% GDP growth is also met.

The absence of a carbon intensity target and the lack of emphasis on reducing carbon intensity also signals that meeting the target is not seen as a priority at the moment.

The government work plan emphasised the “dual-carbon” goals of peaking CO2 emissions before 2030 and achieving carbon neutrality before 2060.

However, these goals allow CO2 emissions to continue to increase until the end of the decade, implying the potential for a significant absolute emission increase from 2024 levels by 2030. The “dual-carbon” goals, even if met, therefore do not guarantee the delivery of China’s current key international climate commitment, the 2030 carbon-intensity target.

Even if emissions fell this year, improvements to carbon intensity would need to accelerate sharply in the next five years to meet China’s 2030 Paris commitment.

If China remains committed to its 2030 pledge, then this acceleration would need to be reflected in the targets set in the country’s next five-year plan.

Outlook for 2025 and beyond

The past 12 months mark a potentially significant turning point for China’s CO2 emissions, with clean-energy growth for the first time outpacing demand growth and displacing fossil fuel use in the power sector.

Record-breaking clean energy additions expected in 2025, despite new pricing policy uncertainties, suggest that the trend will continue this year.

The longer-term trajectory depends heavily on the targets set in the upcoming five-year plan and on the economic policy response to US tariffs and other economic headwinds.

In the short term, the US tariffs will dampen energy demand growth and emissions. Economic policy designed to offset the impacts of Trump’s tariffs will likely boost the clean-energy sector further and might lead to a shift towards domestic consumption as an economic driver, implying lower energy consumption growth relative to GDP.

On the other hand, previous rounds of economic stimulus in China have led to sharp increases in emissions. If China is to deliver stimulus that targets consumption and new technology, rather than emissions-intensive construction and heavy industry, then it will require a significant break with earlier patterns.

Whether power-sector emissions have peaked will be determined by a race between growth in clean energy supply and total power demand growth.

The new renewable electricity pricing policy, which ties the volume of “contracts for difference” given out to new solar and wind projects to national clean energy targets, further increases the importance of target-setting in China’s upcoming 2035 climate targets under the Paris Agreement and in the next 15th five-year plan, covering 2026-2030.

Sector-by-sector analysis suggests that, in addition to the power sector, emissions have likely also peaked in the building materials and steel sectors, as well as oil products consumption.

These sectors together represent over 80% of China’s fossil fuel-related CO2 emissions. However, there are uncertainties and potential for short-term rebound in all of these sectors.

The sector with remaining potential for substantial emissions growth is coal-to-chemicals. The drop in oil prices after US tariff announcements will undermine the profitability of this sector and likely lead to lower utilisation of plants, even as more capacity is added. China’s counter-tariffs on imports of petrochemical products from the US could have benefited the industry – but these have reportedly been waived.

All of this suggests that there is potential for China’s emissions to continue to fall and for the country to achieve substantial absolute emissions reductions over the next five years.

However, policy choices working in the opposite direction could just as easily see emissions increase further towards 2030.

About the data

Data for the analysis was compiled from the National Bureau of Statistics of China, National Energy Administration of China, China Electricity Council and China Customs official data releases, and from WIND Information, an industry data provider.

Wind and solar output, and thermal power breakdown by fuel, was calculated by multiplying power generating capacity at the end of each month by monthly utilisation, using data reported by China Electricity Council through Wind Financial Terminal.

Total generation from thermal power and generation from hydropower and nuclear power was taken from National Bureau of Statistics monthly releases.

Monthly utilisation data was not available for biomass, so the annual average of 52% for 2023 was applied. Power sector coal consumption was estimated based on power generation from coal and the average heat rate of coal-fired power plants during each month, to avoid the issue with official coal consumption numbers affecting recent data.

When data was available from multiple sources, different sources were cross-referenced and official sources used when possible, adjusting total consumption to match the consumption growth and changes in the energy mix reported by the National Bureau of Statistics.

CO2 emissions estimates are based on National Bureau of Statistics default calorific values of fuels and emissions factors from China’s latest national greenhouse gas emissions inventory, for the year 2018. Cement CO2 emissions factor is based on annual estimates up to 2024.

For oil consumption, apparent consumption is calculated from refinery throughput, with net exports of oil products subtracted.

The post Analysis: Clean energy just put China’s CO2 emissions into reverse for first time appeared first on Carbon Brief.

Analysis: Clean energy just put China’s CO2 emissions into reverse for first time

Greenhouse Gases

Analysis: Half of nations meet UN deadline for nature-loss reporting

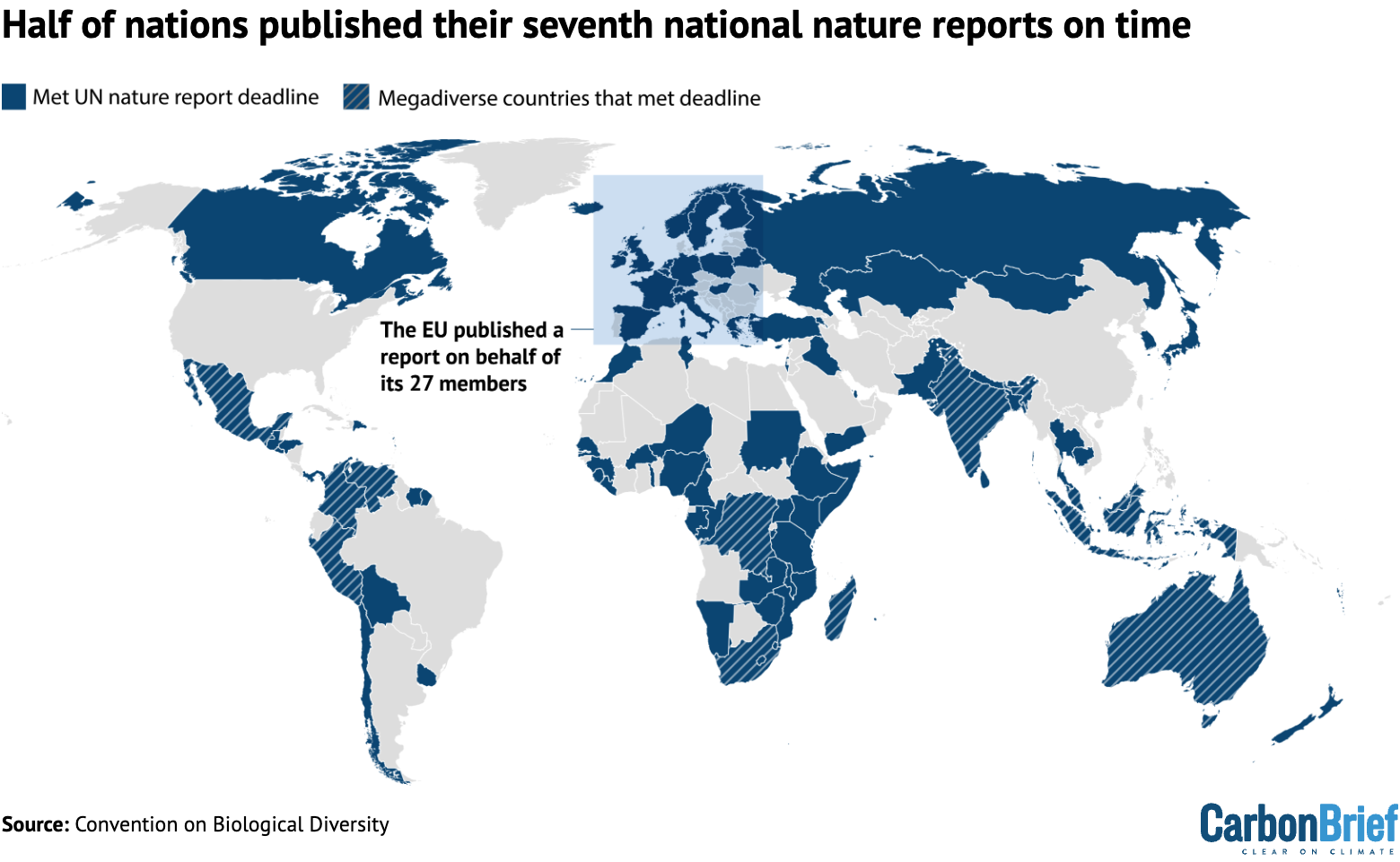

Half of nations have met a UN deadline to report on how they are tackling nature loss within their borders, Carbon Brief analysis shows.

This includes 11 of the 17 “megadiverse nations”, countries that account for 70% of Earth’s biodiversity.

It also includes all of the G7 nations apart from the US, which is not part of the world’s nature treaty.

All 196 countries that are part of the UN biodiversity treaty were due to submit their seventh “national reports” by 28 February, of which 98 have done so.

Their submissions are supposed to provide key information for an upcoming global report on actions to halt and reverse biodiversity loss by 2030, in addition to a global review of progress due to be conducted by countries at the COP17 nature summit in Armenia in October this year.

At biodiversity talks in Rome in February, UN officials said that national reports submitted late will not be included in the global report due to a lack of time, but could still be considered in the global review.

Tracking nature action

In 2022, nations signed a landmark deal to halt and reverse nature loss by 2030, known as the “Kunming-Montreal Global Biodiversity Framework” (GBF).

In an effort to make sure countries take action at the domestic level, the GBF included an “implementation schedule”, involving the publishing of new national plans in 2024 and new national reports in 2026.

The two sets of documents were to inform both a global report and a global review, to be conducted by countries at COP17 in Armenia later this year. (This schedule mirrors the one set out for tackling climate change under the Paris Agreement.)

The deadline for nations’ seventh national reports, which contain information on their progress towards meeting the 23 targets of the GBF based on a set of key indicators, was 28 February 2026.

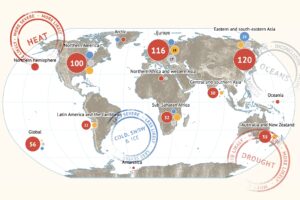

According to Carbon Brief’s analysis of the UN Convention on Biological Diversity’s online reporting platform, 98 out of the 196 countries that are part of the nature convention (50%) submitted on time.

The map below shows countries that submitted their seventh national reports by the UN’s deadline.

This includes 11 of the 17 “megadiverse nations” that account for 70% of Earth’s biodiversity.

The megadiverse nations to meet the deadline were India, Venezuela, Indonesia, Madagascar, Peru, Malaysia, South Africa, Colombia, Mexico, the Democratic Republic of the Congo and Australia.

It also includes all of the G7 nations (France, Germany, the UK, Japan, Italy and Canada), excluding the US, which has never ratified the Convention on Biological Diversity.

The UK’s seventh national report shows that it is currently on track to meet just three of the GBF’s 23 targets.

This is according to a LinkedIn post from Dr David Cooper, former executive secretary of the CBD and current chair of the UK’s Joint Nature Conservation Committee, which coordinated the UK’s seventh national report,

The report shows the UK is not on track to meet one of the headline targets of the GBF, which is to protect 30% of land and sea for nature by 2030.

It reports that the proportion of land protected for nature is 7% in England, 18% in Scotland and 9% in Northern Ireland. (The figure is not given for Wales.)

National plans

In addition to the national reports, the upcoming global report and review will draw on countries’ national plans.

Countries were meant to have submitted their new national plans, known as “national biodiversity strategies and action plans” (NBSAPs), by the start of COP16 in October 2024.

A joint investigation by Carbon Brief and the Guardian found that only 15% of member countries met that deadline.

Since then, the percentage of countries that have submitted a new NBSAP has risen to 39%.

According to the GBF and its underlying documents, countries that were “not in a position” to meet the deadline to submit NBSAPs ahead of COP16 were requested to instead submit national targets. These submissions simply list biodiversity targets that countries will aim for, without an accompanying plan for how they will be achieved.

As of 2 March, 78% of nations had submitted national targets.

At biodiversity talks in Rome in February, UN officials said that national reports submitted late will not be included in the global report due to a lack of time, but could still be considered in the global review.

Funding ‘delays’

At the Rome talks, some countries raised that they had faced “difficulties in submitting [their national reports] on time”, according to the Earth Negotiations Bulletin.

Speaking on behalf of “many” countries, Fiji said that there had been “technical and financial constraints faced by parties” in the preparation of their seventh national reports.

In a statement to Carbon Brief, a spokesperson for the Global Environment Facility, the body in charge of providing financial and technical assistance to countries for the preparation of their national reports, said “delays in fund disbursement have occurred in some cases”, adding:

“In 2023, the GEF council approved support for the development of NBSAPs and the seventh national reports for all 139 eligible countries that requested assistance. This includes national grants of up to $450,000 per country and $6m in global technical assistance delivered through the UN Development Programme and UN Environment Programme.

“As of the end of January 2026, all 139 participating countries had benefited from technical assistance and 93% had accessed their national grants, with 11 countries yet to receive their funds. Delays in fund disbursement have occurred in some cases, compounded by procurement challenges and limited availability of technical expertise.”

The spokesperson added that the fund will “continue to engage closely with agencies and countries to support timely completion of NBSAPs and the seventh national reports”.

The post Analysis: Half of nations meet UN deadline for nature-loss reporting appeared first on Carbon Brief.

Analysis: Half of nations meet UN deadline for nature-loss reporting

Greenhouse Gases

DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’?

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Absolute State of the Union

‘DRILL, BABY’: US president Donald Trump “doubled down on his ‘drill, baby, drill’ agenda” in his State of the Union (SOTU) address, said the Los Angeles Times. He “tout[ed] his support of the fossil-fuel industry and renew[ed] his focus on electricity affordability”, reported the Financial Times. Trump also attacked the “green new scam”, noted Carbon Brief’s SOTU tracker.

COAL REPRIEVE: Earlier in the week, the Trump administration had watered down limits on mercury pollution from coal-fired power plants, reported the Financial Times. It remains “unclear” if this will be enough to prevent the decline of coal power, said Bloomberg, in the face of lower-cost gas and renewables. Reuters noted that US coal plants are “ageing”.

OIL STAY: The US Supreme Court agreed to hear arguments brought by the oil industry in a “major lawsuit”, reported the New York Times. The newspaper said the firms are attempting to head off dozens of other lawsuits at state level, relating to their role in global warming.

SHIP-SHILLING: The Trump administration is working to “kill” a global carbon levy on shipping “permanently”, reported Politico, after succeeding in delaying the measure late last year. The Guardian said US “bullying” could be “paying off”, after Panama signalled it was reversing its support for the levy in a proposal submitted to the UN shipping body.

Around the world

- RARE EARTHS: The governments of Brazil and India signed a deal on rare earths, said the Times of India, as well as agreeing to collaborate on renewable energy.

- HEAT ROLLBACK: German homes will be allowed to continue installing gas and oil heating, under watered-down government plans covered by Clean Energy Wire.

- BRAZIL FLOODS: At least 53 people died in floods in the state of Minas Gerais, after some areas saw 170mm of rain in a few hours, reported CNN Brasil.

- ITALY’S ATTACK: Italy is calling for the EU to “suspend” its emissions trading system (ETS) ahead of a review later this year, said Politico.

- COOKSTOVE CREDITS: The first-ever carbon credits under the Paris Agreement have been issued to a cookstove project in Myanmar, said Climate Home News.

- SAUDI SOLAR: Turkey has signed a “major” solar deal that will see Saudi firm ACWA building 2 gigawatts in the country, according to Agence France-Presse.

$467 billion

The profits made by five major oil firms since prices spiked following Russia’s invasion of Ukraine four years ago, according to a report by Global Witness covered by BusinessGreen.

Latest climate research

- Claims about the “fingerprint” of human-caused climate change, made in a recent US Department of Energy report, are “factually incorrect” | AGU Advances

- Large lakes in the Congo Basin are releasing carbon dioxide into the atmosphere from “immense ancient stores” | Nature Geoscience

- Shared Socioeconomic Pathways – scenarios used regularly in climate modelling – underrepresent “narratives explicitly centring on democratic principles such as participation, accountability and justice” | npj Climate Action

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

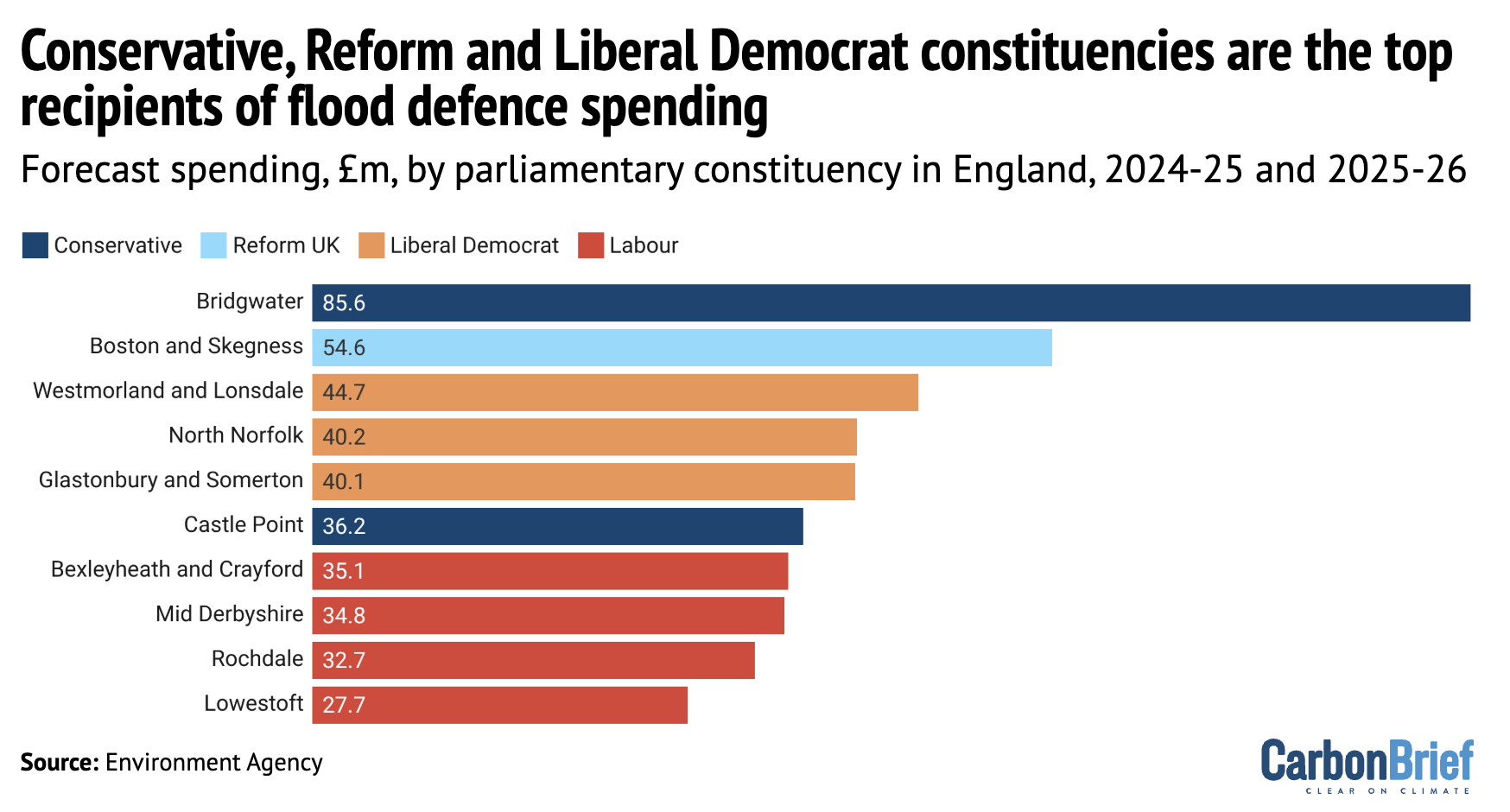

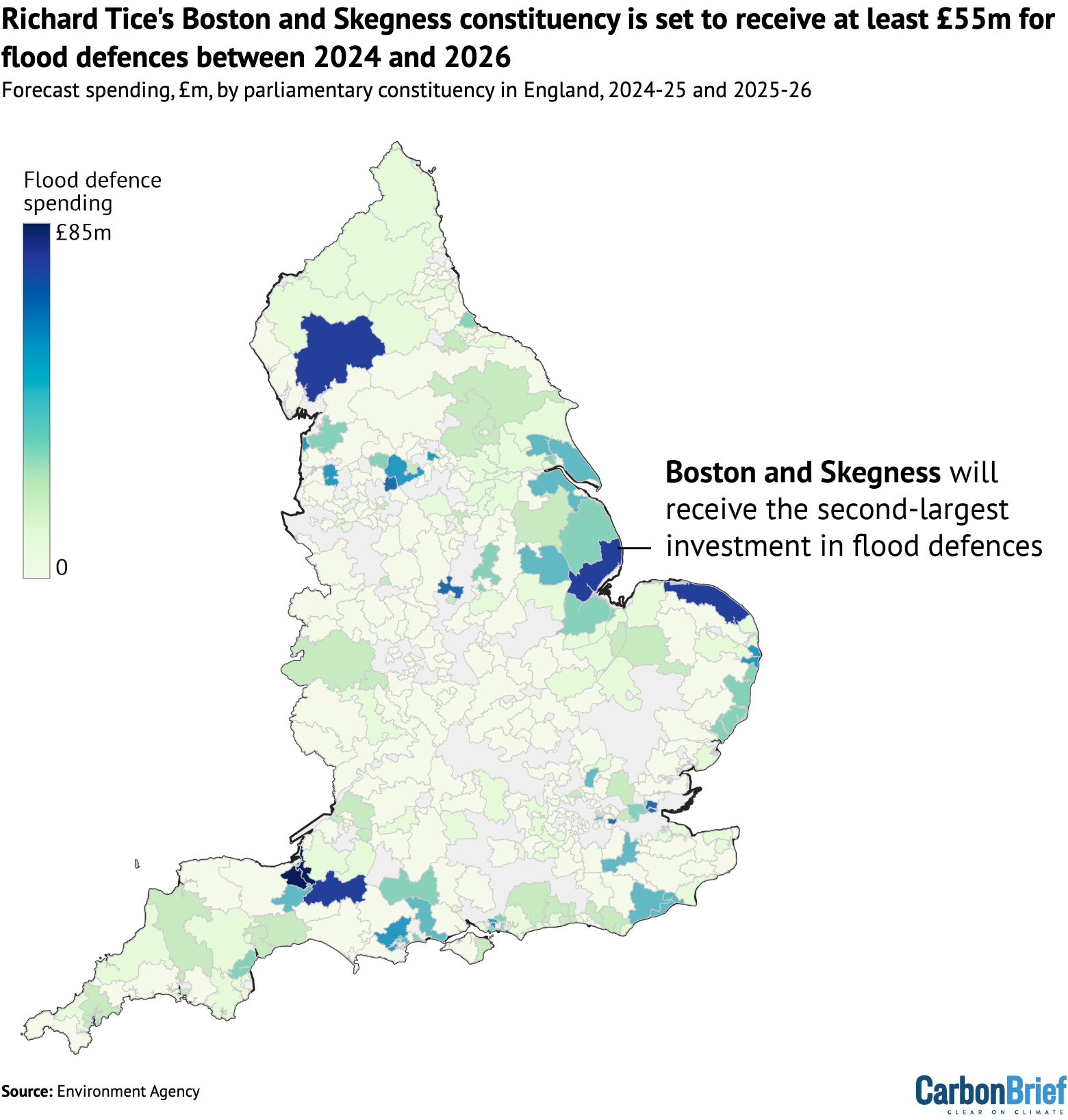

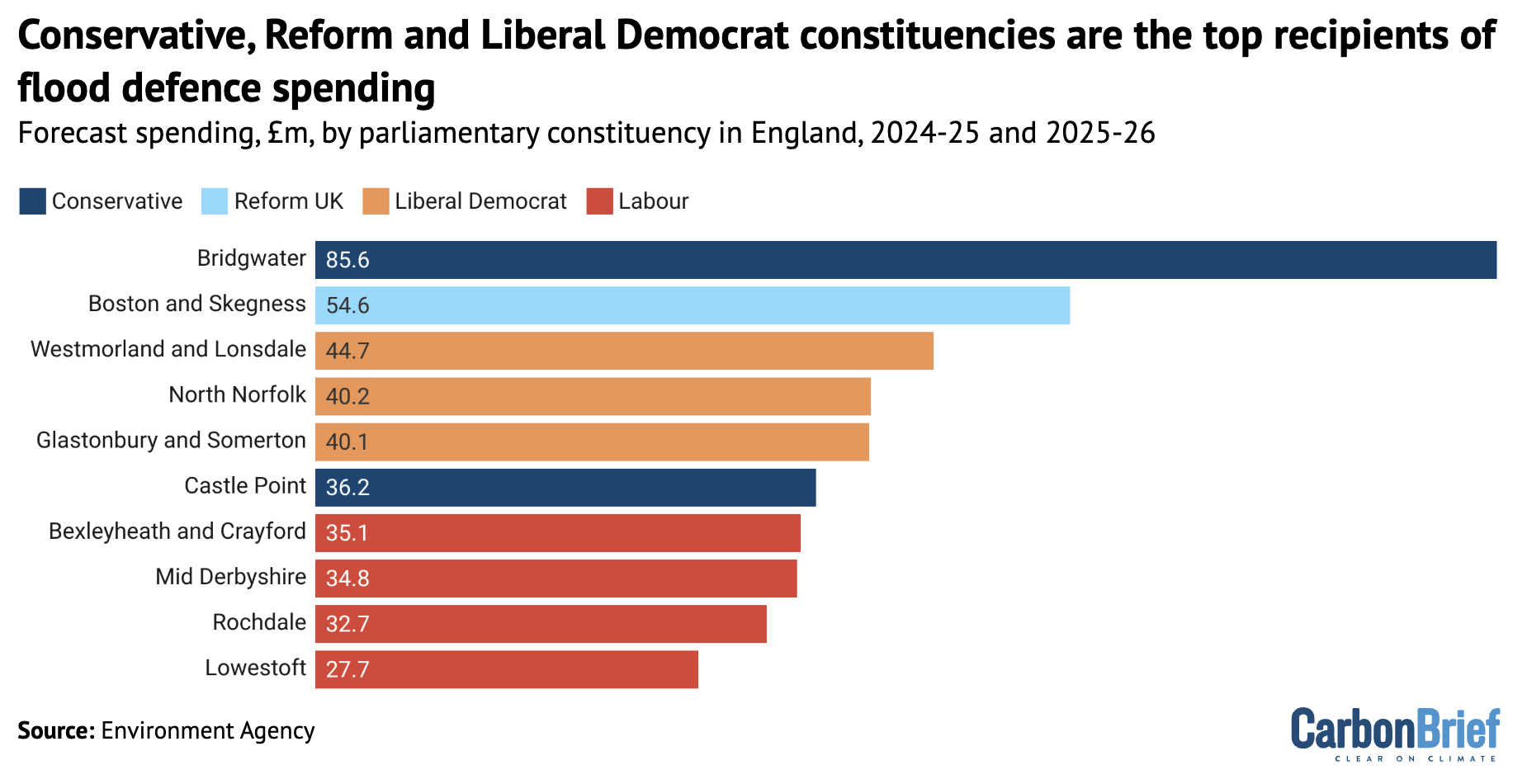

The constituency of Richard Tice MP, the climate-sceptic deputy leader of Reform UK, is the second-largest recipient of flood defence spending in England, according to new Carbon Brief analysis. Overall, the funding is disproportionately targeted at coastal and urban areas, many of which have Conservative or Liberal Democrat MPs.

Spotlight

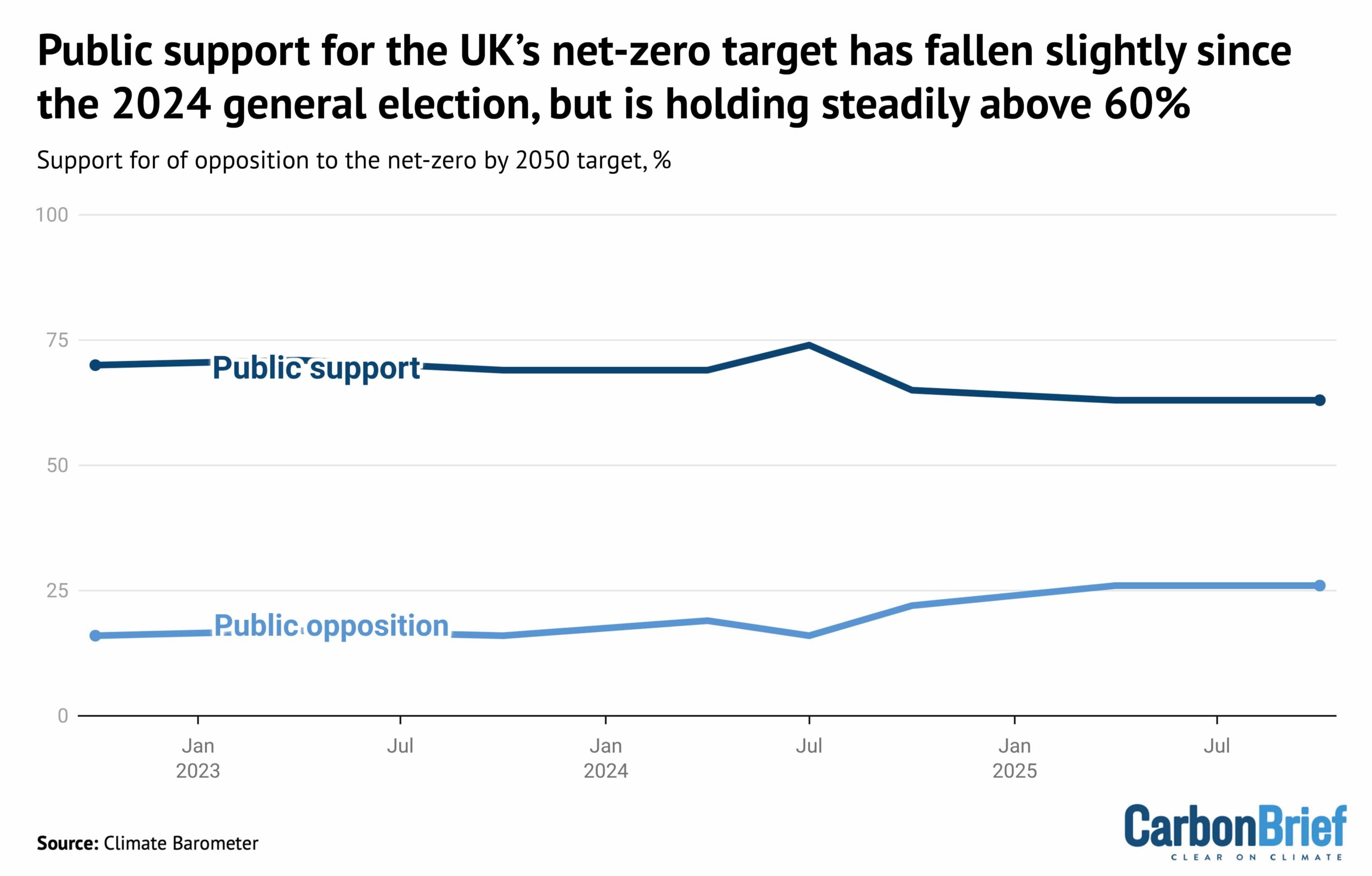

Is there really a UK ‘greenlash’?

This week, after a historic Green Party byelection win, Carbon Brief looks at whether there really is a “greenlash” against climate policy in the UK.

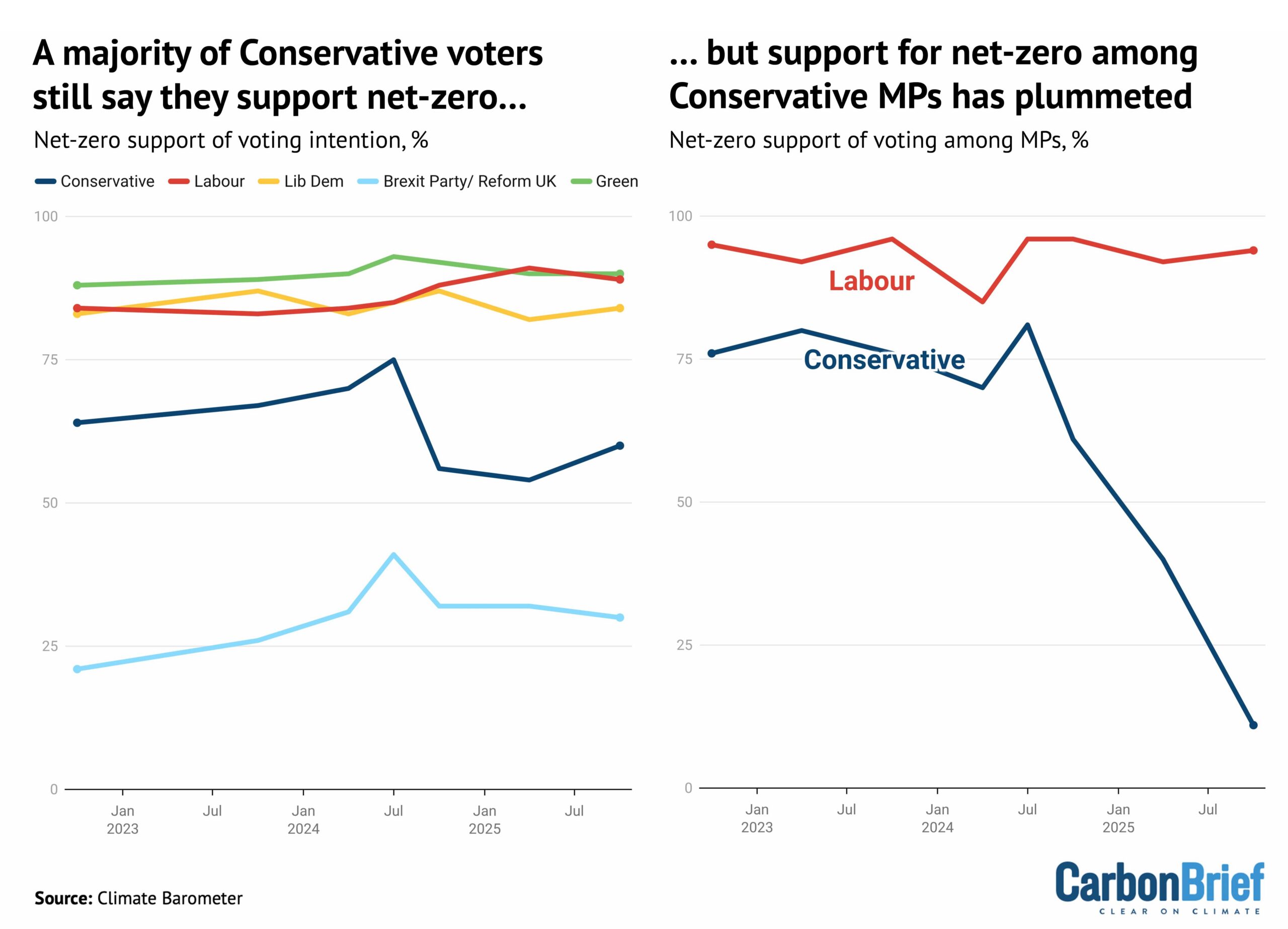

Over the past year, the UK’s political consensus on climate change has been shattered.

Yet despite a sharp turn against climate action among right-wing politicians and right-leaning media outlets, UK public support for climate action remains strong.

Prof Federica Genovese, who studies climate politics at the University of Oxford, told Carbon Brief:

“The current ‘war’ on green policy is mostly driven by media and political elites, not by the public.”

Indeed, there is still a greater than two-to-one majority among the UK public in favour of the country’s legally binding target to reach net-zero emissions by 2050, as shown below.

Steve Akehurst, director of public-opinion research initiative Persuasion UK, also noted the growing divide between the public and “elites”. He told Carbon Brief:

“The biggest movement is, without doubt, in media and elite opinion. There is a bit more polarisation and opposition [to climate action] among voters, but it’s typically no more than 20-25% and mostly confined within core Reform voters.”

Conservative gear shift

For decades, the UK had enjoyed strong, cross-party political support for climate action.

Lord Deben, the Conservative peer and former chair of the Climate Change Committee, told Carbon Brief that the UK’s landmark 2008 Climate Change Act had been born of this cross-party consensus, saying “all parties supported it”.

Since their landslide loss at the 2024 election, however, the Conservatives have turned against the UK’s target of net-zero emissions by 2050, which they legislated for in 2019.

Curiously, while opposition to net-zero has surged among Conservative MPs, there is majority support for the target among those that plan to vote for the party, as shown below.

Dr Adam Corner, advisor to the Climate Barometer initiative that tracks public opinion on climate change, told Carbon Brief that those who currently plan to vote Reform are the only segment who “tend to be more opposed to net-zero goals”. He said:

“Despite the rise in hostile media coverage and the collapse of the political consensus, we find that public support for the net-zero by 2050 target is plateauing – not plummeting.”

Reform, which rejects the scientific evidence on global warming and campaigns against net-zero, has been leading the polls for a year. (However, it was comfortably beaten by the Greens in yesterday’s Gorton and Denton byelection.)

Corner acknowledged that “some of the anti-net zero noise…[is] showing up in our data”, adding:

“We see rising concerns about the near-term costs of policies and an uptick in people [falsely] attributing high energy bills to climate initiatives.”

But Akehurst said that, rather than a big fall in public support, there had been a drop in the “salience” of climate action:

“So many other issues [are] competing for their attention.”

UK newspapers published more editorials opposing climate action than supporting it for the first time on record in 2025, according to Carbon Brief analysis.

Global ‘greenlash’?

All of this sits against a challenging global backdrop, in which US president Donald Trump has been repeating climate-sceptic talking points and rolling back related policy.

At the same time, prominent figures have been calling for a change in climate strategy, sold variously as a “reset”, a “pivot”, as “realism”, or as “pragmatism”.

Genovese said that “far-right leaders have succeeded in the past 10 years in capturing net-zero as a poster child of things they are ‘fighting against’”.

She added that “much of this is fodder for conservative media and this whole ecosystem is essentially driving what we call the ‘greenlash’”.

Corner said the “disconnect” between elite views and the wider public “can create problems” – for example, “MPs consistently underestimate support for renewables”. He added:

“There is clearly a risk that the public starts to disengage too, if not enough positive voices are countering the negative ones.”

Watch, read, listen

TRUMP’S ‘PETROSTATE’: The US is becoming a “petrostate” that will be “sicker and poorer”, wrote Financial Times associate editor Rana Forohaar.

RHETORIC VS REALITY: Despite a “political mood [that] has darkened”, there is “more green stuff being installed than ever”, said New York Times columnist David Wallace-Wells.

CHINA’S ‘REVOLUTION’: The BBC’s Climate Question podcast reported from China on the “green energy revolution” taking place in the country.

Coming up

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean, Brasília

- 3 March: UK spring statement

- 4-11 March: China’s “two sessions”

- 5 March: Nepal elections

Pick of the jobs

- The Guardian, senior reporter, climate justice | Salary: $123,000-$135,000. Location: New York or Washington DC

- China-Global South Project, non-resident fellow, climate change | Salary: Up to $1,000 a month. Location: Remote

- University of East Anglia, PhD in mobilising community-based climate action through co-designed sports and wellbeing interventions | Salary: Stipend (unknown amount). Location: Norwich, UK

- TABLE and the University of São Paulo, Brazil, postdoctoral researcher in food system narratives | Salary: Unknown. Location: Pirassununga, Brazil

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 27 February 2026: Trump’s fossil-fuel talk | Modi-Lula rare-earth pact | Is there a UK ‘greenlash’? appeared first on Carbon Brief.

Greenhouse Gases

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

The Lincolnshire constituency held by Richard Tice, the climate-sceptic deputy leader of the hard-right Reform party, has been pledged at least £55m in government funding for flood defences since 2024.

This investment in Boston and Skegness is the second-largest sum for a single constituency from a £1.4bn flood-defence fund for England, Carbon Brief analysis shows.

Flooding is becoming more likely and more extreme in the UK due to climate change.

Yet, for years, governments have failed to spend enough on flood defences to protect people, properties and infrastructure.

The £1.4bn fund is part of the current Labour government’s wider pledge to invest a “record” £7.9bn over a decade on protecting hundreds of thousands of homes and businesses from flooding.

As MP for one of England’s most flood-prone regions, Tice has called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

He is also one of Reform’s most vocal opponents of climate action and what he calls “net stupid zero”. He denies the scientific consensus on climate change and has claimed, falsely and without evidence, that scientists are “lying”.

Flood defences

Last year, the government said it would invest £2.65bn on flood and coastal erosion risk management (FCERM) schemes in England between April 2024 and March 2026.

This money was intended to protect 66,500 properties from flooding. It is part of a decade-long Labour government plan to spend more than £7.9bn on flood defences.

There has been a consistent shortfall in maintaining England’s flood defences, with the Environment Agency expecting to protect fewer properties by 2027 than it had initially planned.

The Climate Change Committee (CCC) has attributed this to rising costs, backlogs from previous governments and a lack of capacity. It also points to the strain from “more frequent and severe” weather events, such as storms in recent years that have been amplified by climate change.

However, the CCC also said last year that, if the 2024-26 spending programme is delivered, it would be “slightly closer to the track” of the Environment Agency targets out to 2027.

The government has released constituency-level data on which schemes in England it plans to fund, covering £1.4bn of the 2024-26 investment. The other half of the FCERM spending covers additional measures, from repairing existing defences to advising local authorities.

The map below shows the distribution of spending on FCERM schemes in England over the past two years, highlighting the constituency of Richard Tice.

By far the largest sum of money – £85.6m in total – has been committed to a tidal barrier and various other defences in the Somerset constituency of Bridgwater, the seat of Conservative MP Ashley Fox.

Over the first months of 2026, the south-west region has faced significant flooding and Fox has called for more support from the government, citing “climate patterns shifting and rainfall intensifying”.

He has also backed his party’s position that “the 2050 net-zero target is impossible” and called for more fossil-fuel extraction in the North Sea.

Tice’s east-coast constituency of Boston and Skegness, which is highly vulnerable to flooding from both rivers and the sea, is set to receive £55m. Among the supported projects are beach defences from Saltfleet to Gibraltar Point and upgrades to pumping stations.

Overall, Boston and Skegness has the second-largest portion of flood-defence funding, as the chart below shows. Constituencies with Conservative and Liberal Democrat MPs occupied the other top positions.

Overall, despite Labour MPs occupying 347 out of England’s 543 constituencies – nearly two-thirds of the total – more than half of the flood-defence funding was distributed to constituencies with non-Labour MPs. This reflects the flood risk in coastal and rural areas that are not traditional Labour strongholds.

Reform funding

While Reform has just eight MPs, representing 1% of the population, its constituencies have been assigned 4% of the flood-defence funding for England.

Nearly all of this money was for Tice’s constituency, although party leader Nigel Farage’s coastal Clacton seat in Kent received £2m.

Reform UK is committed to “scrapping net-zero” and its leadership has expressed firmly climate-sceptic views.

Much has been made of the disconnect between the party’s climate policies and the threat climate change poses to its voters. Various analyses have shown the flood risk in Reform-dominated areas, particularly Lincolnshire.

Tice has rejected climate science, advocated for fossil-fuel production and criticised Environment Agency flood-defence activities. Yet, he has also called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

This may reflect Tice’s broader approach to climate change. In a 2024 interview with LBC, he said:

“Where you’ve got concerns about sea level defences and sea level rise, guess what? A bit of steel, a bit of cement, some aggregate…and you build some concrete sea level defences. That’s how you deal with rising sea levels.”

While climate adaptation is viewed as vital in a warming world, there are limits on how much societies can adapt and adaptation costs will continue to increase as emissions rise.

The post Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding appeared first on Carbon Brief.

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits