Clean-energy technologies contributed more than 10% of China’s economic growth in 2024 for the first time ever, with sales and investments worth 13.6tn yuan ($1.9tn).

Clean-energy sectors drove a quarter of the country’s gross domestic product (GDP) growth in 2024 and have overtaken real-estate sales in value.

The new sector-by-sector analysis for Carbon Brief, based on official figures, industry data and analyst reports, shows the growing role of clean technology in China’s economy – particularly the so-called “new three” industries, namely, solar, electric vehicles (EVs) and batteries.

For this analysis, a broad definition has been used for “clean-energy” sectors, including renewables, nuclear power, electricity grids, energy storage, EVs and railways. These are technologies and infrastructure needed to decarbonise China’s production and use of energy.

Other key findings from the analysis include:

- Clean-energy investment reached 6.8tn yuan ($940bn), with annual growth of 7% cooling markedly – as expected – from the 40% expansion in 2023.

- China’s investment in clean energy was close to the global total put into fossil fuels in 2024 and was of a similar scale to the overall size of Saudi Arabia’s economy.

- The “new three” of EVs, batteries and solar continued to dominate the economic contribution of clean energy in China, generating three-quarters of the value added and, overall, attracting more than half of all investment in the sectors.

- The growth in economic output from clean-energy sectors played a key role in driving their overall contribution to GDP in 2024, whereas investment was the driver in 2023.

- Including the value of production, clean-energy sectors contributed 13.6tn yuan ($1.9tn) to China’s economy overall – just above 10% of total GDP.

- These sectors grew three times as fast as the Chinese economy overall, accounting for 26% of all GDP growth in 2024.

- Significantly, China would have missed its 5% target for GDP growth without the growth from clean technologies, expanding by 3.6% instead of the 5.0% reported.

There is likely to be further growth in clean-energy investment in 2025 as major projects race to finish before the end of the 14th five-year plan, covering 2021-2025.

Beyond this year, development of the clean-energy sectors depends strongly on the new targets and policies in the next five-year plan, which is being finalised this year.

- Clean energy reaches GDP milestone

- EVs and solar were the top growth drivers

- Role of cleantech manufacturing in emissions growth

- Falling prices boost adoption, but challenge producers

- Implications of rapidly growing clean-energy economy

- About the data

Clean energy reaches GDP milestone

In 2023, clean energy was behind an estimated 40% of economic growth in China, driven by a huge wave of investment in manufacturing capacity in the sector.

As noted in last year’s analysis, it was inevitable that the extraordinary growth rates of investment would cool down in 2024 – and the new data bears this out.

Nevertheless, investment in the clean-energy sectors continued to grow in 2024. Moreover, growth in the production of goods and services in the sectors held up, at over 20%.

As a result, clean-energy sectors made up more than 10% of China’s GDP in 2024 for the first time ever, as shown in the figure below.

The overall economic contribution from clean-energy sectors, at 13.6tn yuan ($1.9tn), is of a similar scale to many major economies, such as Saudi Arabia or Switzerland.

Equally, the sectors now make up a larger share of China’s economy than real-estate sales, at 9.6tn yuan, or agriculture at 9.1tn yuan.

EVs and solar were the top growth drivers

The value of production and investments in clean-energy sectors grew an estimated 13% overall in 2024 – and has increased by 50% since 2022, as shown in the figure below.

Investments in clean-energy sectors reached an estimated 6.8tn yuan ($940bn), up 7% year-on-year, contributing almost half of all growth in fixed asset investments.

The production of goods and services in the sectors grew by 21%, reaching 6.8tn yuan ($950bn).

Electric-vehicle production was the most valuable sector overall, followed by clean-power production, rail transportation, electricity transmission and storage and energy efficiency.

The table below includes a detailed breakdown by sector and activity.

| Sector | Activity | Value in 2024, CNY bln | Value in 2024, USD bln | Year-on-year growth |

|---|---|---|---|---|

| EVs | Investment: manufacturing capacity | 1,393 | 194 | 11% |

| EVs | Investment: charging infrastructure | 122 | 17 | 20% |

| EVs | Production of vehicles | 3,067 | 427 | 36% |

| Batteries | Investment: battery manufacturing | 205 | 29 | -35% |

| Batteries | Exports: batteries | 494 | 69 | 8% |

| Solar power | Investment: power generation capacity | 1,031 | 144 | 28% |

| Solar power | Investment: manufacturing capacity | 779 | 109 | -18% |

| Solar power | Electricity generation | 386 | 54 | 41% |

| Solar power | Exports of components | 607 | 85 | 14% |

| Wind power | Investment: power generation capacity, onshore | 417 | 58 | 5% |

| Wind power | Investment: power generation capacity, offshore | 48 | 7 | -44% |

| Wind power | Electricity generation | 440 | 51 | 14% |

| Nuclear power | Investment: power generation capacity | 129 | 18 | 49% |

| Nuclear power | Electricity generation | 200 | 28 | 3% |

| Hydropower | nvestment: power generation capacity | 95 | 13 | 19% |

| Hydropower | Electricity generation | 567 | 79 | 11% |

| Rail transportation | Investment | 851 | 118 | 11% |

| Rail transportation | Transport of passengers and goods | 990 | 138 | 3% |

| Electricity transmission | Investment: transmission capacity | 608 | 85 | 15% |

| Electricity transmission | Transmission of clean power | 46 | 6 | 17% |

| Energy storage | Investment: Pumped hydro | 403 | 56 | 13% |

| Energy storage | Investment: Grid-connected batteries | 134 | 19 | 70% |

| Energy storage | Investment: Electrolysers | 9 | 1 | 94% |

| Energy efficiency | Revenue: Energy service companies | 540 | 75 | 4% |

| Total | Investments | 6,765 | 942 | 7% |

| Total | Production of goods and services | 6,797 | 947 | 21% |

| Total | Total GDP contribution | 13,562 | 1889 | 13% |

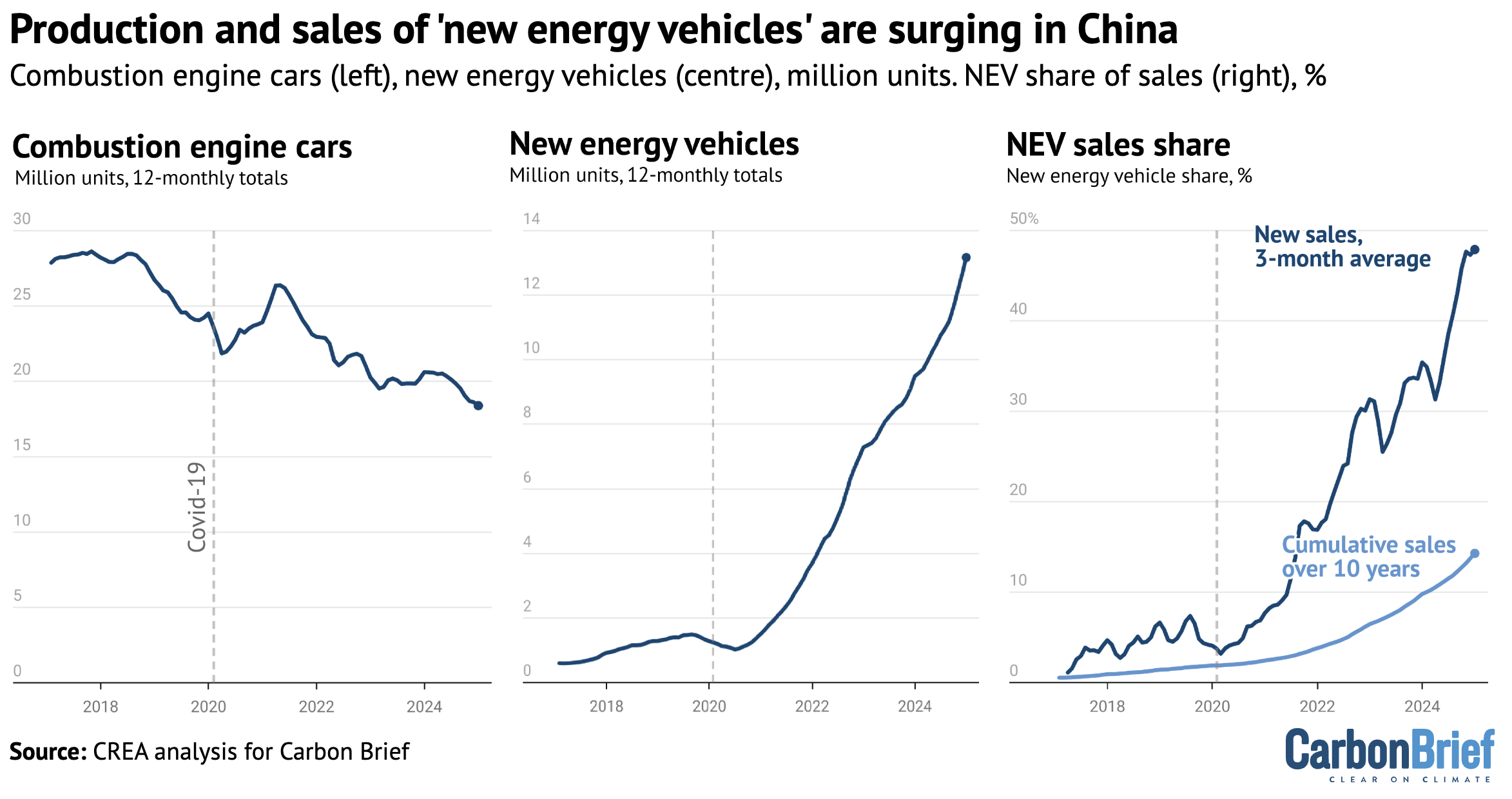

Electric vehicles and batteries

EVs and vehicle batteries were the largest contributors to China’s clean-energy economy in 2024, making up an estimated 39% of value overall.

Of this total, the largest share was from the production of battery EVs and plug-in hybrids – which together make up the bulk of what China calls “new energy vehicles” (NEVs) – worth more than 3tn yuan, followed by investment in NEV and battery manufacturing.

Investment in factories for making NEVs grew 11% to 1.4tn yuan, moderating from the high growth rates seen in 2023. The amount of money invested in new battery manufacturing facilities fell year-on-year, making a negative contribution to growth.

China produced 13m NEVs in 2024, rising 34% year-on-year. Some 22% of Chinese-made NEVs were exported, while the rest were sold domestically.

NEVs are the only growth sector for Chinese carmakers, as shown in the figure below. Moreover, NEVs made up 41% of total vehicle sales in 2024, up from 32% in 2023.

Domestic EV sales were supported by local government policies promoting vehicle replacement, but the strong sales also show that EVs have gained broad market acceptance.

New EV models have improved range and significantly shorter charging times – often under an hour – helping to ease consumer concerns. They also offer smart features such as “navigate on autopilot” self-driving, that provide a better driving experience.

Much of the growth in EV production is now in plug-in hybrid vehicles. The extent to which these cut emissions depends on their being driven mostly on electricity.

Real-world data suggests plug-in hybrids are rarely driven in electric mode in Europe. However, the electricity use of EV battery charging and swapping services in China rose by 51% in 2024, to levels consistent with a high level of electric driving from plug-in hybrids.

The growth in EV charging was supported by strong investment in charging infrastructure, with 4.2m charging points added in 2024, up 20% year-on-year. The total number of charging points reached 12.8m.

The average selling price of EVs in 2024 fell by just 8% year-on-year to 240,000 yuan ($33,000), despite intense competition in the sector.

While weaker than growth in domestic sales, EV exports still expanded 6.7% year-on-year, driven primarily by a 190% surge in the export of plug-in hybrids, while battery EV exports declined by 10.4%.

This trend may be linked to EU tariffs targeting battery EVs, but excluding hybrids.

The top growth markets were Brazil, Belgium, Mexico, the UAE and Indonesia, reflecting Chinese automakers’ efforts to expand in markets where they do not face high tariffs or to accelerate exports before tariff increases take effect.

Investment in overseas production capacity is also supporting growth. For example, BYD’s joint factory with BMW in Hungary is set to begin production in late 2025.

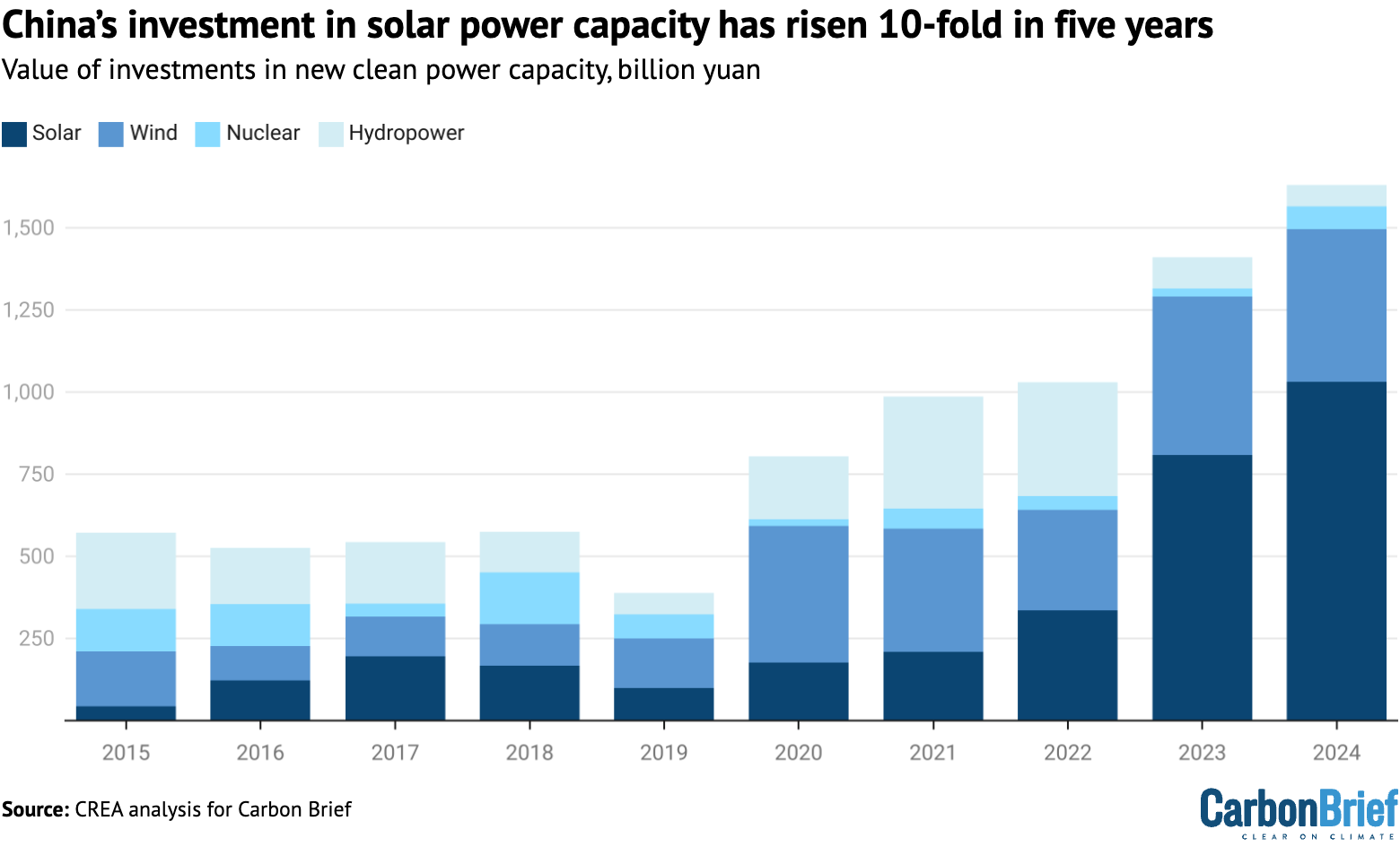

Solar

After EVs and batteries, the next-largest clean-tech contribution to China’s GDP in 2024 came from solar power, which completes the “new three” industries.

Solar generated 21% of the total value of the clean-energy industries in 2024, adding 2.8tn yuan ($390bn) to the national economy.

Within this, investment in power generation projects, at 1tn yuan ($140bn), overtook manufacturing investment (0.8tn yuan, $109bn) as the largest contributor to the value of the sector. The value of solar power technology exports (0.6tn yuan, $85bn) was the third-largest, followed by the value of the power generated from solar (0.4tn yuan, $54bn).

The figure below shows the surge of Chinese investments in new solar power capacity – which has grown 10-fold in just five years – alongside spending on new wind, hydro and nuclear capacity (see next section).

China added some 277 gigawatts (GW) of new solar capacity in 2024, up 28% year-on-year from the previous year’s 216GW, which was also a record. This increase included strong growth from both large-scale and distributed segments.

Centralised solar capacity grew the most in the western provinces of Xinjiang and Inner Mongolia, home to China’s gigantic “clean energy bases”. The relatively prosperous coastal provinces of Jiangsu, Zhejiang and Guangdong led the growth of distributed capacity.

As major manufacturing hubs, these coastal provinces have a large potential for distributed solar at industrial sites, where most of the power can be consumed locally.

Rising commercial electricity prices, along with pressure to meet energy-saving and carbon reduction targets, are further driving investment in industrial and commercial distributed solar.

Expansion of distributed solar in some other provinces is being limited by grid constraints. Henan, which topped the list of increases in distributed solar capacity in 2023, saw a slowdown in capacity additions, as residential solar-power producers have faced restrictions on selling power to the grid.

Solar manufacturing capacity additions slowed down sharply in 2024, reflecting falling product prices and a supply glut. Still, manufacturing capacity at the end of 2024 rose by 29% compared with a year earlier.

The production of solar cells only increased by 16%, showing that manufacturing capacity additions are running ahead of demand and leading to weakened capacity utilisation at solar production lines.

As a result, investments in solar manufacturing capacity are likely to slow down even further in the coming years.

Other clean power generation

Hydropower, wind and nuclear were responsible for 14% of the total value of the clean-energy sectors in 2024, adding some 1.9tn yuan ($264bn) to China’s GDP in 2024.

Nearly two-thirds of this (1.2tn yuan, $168bn) came from the value of power generation from hydropower, wind and nuclear, with investment in new power generation projects – shown in the chart above – contributing the rest.

Power generation grew 14% from wind, 11% from hydropower and 3% from nuclear. The rise in hydropower generation was mainly due to improved operating conditions as installed capacity only grew 1.2%.

Within investment, wind-power generation projects were the largest contributor to value, representing some 465bn yuan ($65bn) of spending in 2025. However, investment in nuclear projects, which increased by nearly half year-on-year, made the largest contribution to clean-energy spending growth. Investment in conventional hydropower declined slightly.

Wind-power investment was dragged down by a large drop in the commissioning of offshore wind capacity, which fell 44% year-on-year to just 4GW in 2024. This is expected to rebound strongly next year to 14-17GW.

Newly added onshore wind power capacity increased 5% year-on-year, reaching 76GW, on top of the blistering 85% increase in 2023.

Nuclear saw strong growth, with 3.9GW completed in 2024, up from 1.4GW a year earlier. As a result of record approvals of new projects in 2022-2024, China now has more than 50 GW of new nuclear generation capacity permitted or under construction, implying a major uptick in capacity additions in the next five years, the typical construction timeline for new projects in China.

There is likely to be further strong growth in clean power investments in 2025, as large schemes race to complete before the end of the five-year plan period at the end of the year.

Railways

Rail transportation made up 14% of the value of the clean-energy sectors, with revenue from passenger rail transportation the largest source of value.

Growth rates moderated from the forceful post-Covid rebound in 2023, when 39% growth was recorded, to 3%. The number of rail passengers increased 11.9% year-on-year.

The largest source of growth was investment in rail infrastructure, increasing 11% year-on-year. China added 3,000km of new railway line in 2024, with the total length of operating railways reaching 162,000km. This includes the Shanghai-Suzhou-Huzhou high-speed rail line, which opened at the end of the year.

Another 12,000km of high-speed rail will be opened by 2030. The goal is to establish a nationwide “1-2-3-hour travel circle”, where travel between cities within the same metropolitan area takes one hour, travel between adjacent cities takes two hours, and travel between major cities takes three hours.

Realising this vision involves connecting China’s entire coastline through a 350km per hour route by 2028, and to create a grid of eight east-to-west and north-to-south high-speed trunk lines.

Electricity grids and storage

Electricity transmission and storage was responsible for 9% of the total value of the clean-energy sectors in 2024, with real growth of 19%.

The most valuable sub-segment was investment in power grids, followed by investment in energy storage. This includes spending on pumped hydropower, grid-connected battery storage and hydrogen production. The transmission of clean power also increased an estimated 17%, due to rapid growth in clean power generation.

China’s installed electricity storage capacity growth rivaled the increase in coal- and gas-fired power generation capacity, for the first time on record.

A total of approximately 50GW of battery storage, pumped hydro and hydrogen production capacity was added, while fossil fuel-based power generation capacity increased by 54GW.

This is significant, because a key rationale for building coal- and gas-fired power plants has been capacity adequacy, where electricity storage facilities can supplant the need for fossil fuel-based capacity.

Almost 40GW of battery storage was added, increasing 70% year-on-year and reaching 74GW total grid-connected capacity.

The operating capacity of pumped hydropower reached 59GW, with 8GW added during the year and 30GW entering construction. Capacity under construction increased to 189GW, up 13% on year, indicating that capacity additions will accelerate substantially in the next few years.

Investment in hydrogen electrolyser projects doubled year-on-year, from 1.8GW in 2023 to 3-4GW in 2024.

By the end of 2024, China had 42 operational long-distance, ultra-high voltage transmission lines, with a total length of over 40,000km and transmission capacity exceeding 300GW. Another 12 lines are under construction.

One of the headline transmission projects completed during the year is an ultrahigh voltage transmission line connecting regions of Inner Mongolia and northern Hebei with large amounts of renewable and coal power, to demand centers in Beijing, Tianjin, Hebei, Shandong and Jiangsu provinces.

Investment in transmission and storage is bound to continue. China’s top economic planner the National Development and Reform Commission (NDRC), published a new power system action plan that aims to integrate more than 200GW of new wind and solar onto the grid per year in 2025-27, requiring significant investments in storage and transmission.

“Developing new forms of energy storage” was included in China’s government work report for the first time in 2024, signaling a stronger policy push for energy storage deployment.

Energy efficiency

Investment in energy efficiency, as measured by the aggregate turnover of large energy service companies (ESCOs) grew 4% year-on-year, the slowest growth rate among the sectors we track.

China’s energy and emissions policies have de-emphasised energy efficiency in recent years. Controlling total energy consumption and energy intensity – so-called energy dual control – was the centerpiece of China’s energy policy and climate commitments until the early 2020s, creating strong incentives for provinces and enterprises to improve energy efficiency.

The policy was re-jigged in 2023 to target reductions in the fossil fuel intensity of the economy, making clean energy a more attractive way for local governments to pursue the targets. Five-year plan targets for building energy efficiency retrofits were also lowered compared with the previous plan.

Role of cleantech manufacturing in emissions growth

The clean-energy sectors include energy-intensive manufacturing industries, particularly the production of batteries and polysilicon, a key raw material for solar panels.

In addition, electric vehicles, solar panels and wind turbines need energy-intensive raw materials such as aluminum, steel and glass.

For this reason, and due to the high public profile of these industries, many commentators have suggested that the manufacturing of clean energy technologies is a major driver of China’s energy demand growth and emissions.

In reality, however, their role in driving China’s emissions is limited. The production of the “new three” – EVs, batteries and solar – was responsible for an estimated 3.5% of China’s CO2 emissions and 0.9 percentage points of emissions growth in 2024

In addition, the analysis shows that these sectors contributed just 0.5 percentage points out of the overall 6.8% increase in China’s electricity demand in 2024.

Electric vehicle charging used an additional 0.8% of China’s total electricity consumption, making it responsible for approximately 0.3% of the country’s total CO2 emissions.

For a full accounting, these additional emissions from producing and fuelling clean energy technologies would need to be compared with the CO2 savings from using them instead of fossil-fuelled alternatives, such as coal-fired power stations or combustion-engine cars.

Falling prices boost adoption, but challenge producers

While almost all other economies fret over high inflation, China is struggling with deflation, a product of aggressive expansion of manufacturing and weak domestic demand.

Several key clean-energy industries are facing this issue, with supply gluts leading to weak revenue and profits growth despite growing volumes. Attention on this issue has masked the contribution of the industries to real growth.

In the manufacturing of solar panels, for example, the nominal value of the industry’s production fell by 41%, even as volumes showed strong growth.

Yet, the nominal value of investments in solar-power projects held steady as the volume of the projects increased strongly and the price of solar panels only makes up less than one third of the cost of solar-power generation projects.

The value of electricity generated from solar increased by 40%, pulling the overall contribution of the solar power industry to nominal GDP growth into positive territory.

In total, the value added of the clean energy industries grew an estimated 8.5% in nominal terms, slower than the 15% real growth rate but significantly faster than the growth rate of GDP, contributing 17% of nominal GDP growth.

In December 2024, a key annual economic policy meeting called for the creation of a “healthy environment for the development of green and low-carbon industries” industries. This suggests the government may introduce measures to address excess clean manufacturing supply and address the weak profitability of the sector.

Implications of rapidly growing clean-energy economy

For the second year in a row, clean-energy sectors played an indispensable role in meeting China’s key economic targets.

The combination of iIncreased supply and falling prices is leading to much faster deployment in China than practically anyone expected a few years ago and is also catalysing clean energy deployment in new overseas markets.

This growth is expected to continue into 2025, driven by major projects aiming to finish before the end of the current five-year plan.

Beyond 2025, development of China’s clean-energy sectors hinges on new targets and policies in the next five-year plan, covering 2026-2030, which is being finalised this year.

After the lightning capacity expansion of the past few years, clean-energy manufacturing is plagued by weak profitability and oversupply.

Returning the sectors to profitability would require both maintaining strong domestic demand and measures to address overcapacity. Grid constraints, particularly affecting solar power, would need to be resolved to sustain demand.

Early indications of the targets proposed by China’s key ministries for 2030 and 2035 fall short of maintaining the demand for key clean-energy technologies at the 2023–24 level.

Setting targets for the next five-year period that are below the current rate of deployment could turn the clean-energy sectors from a driver of GDP growth into a drag, as well as worsening the oversupply situation they are facing. In contrast, ambitious clean energy targets could maintain the sector’s positive contribution to the economy.

The government’s economic stimulus measures are likely to support investment in the clean-energy sectors, given their significant role in investment growth.

Moreover, the now critical role of clean-energy development in driving China’s economic expansion creates incentives for policymakers to ensure the economic health of the sector.

About the data

Reported investment expenditure and sales revenue has been used where available. When this is not available, estimates are based on physical volumes – gigawatts of capacity installed, number of vehicles sold – and unit costs or prices.

The contribution to real growth is tracked by adjusting for inflation using 2022–2023 prices. For 2024, the contribution to nominal growth – not adjusted for inflation – is estimated by either using nominal values directly, when reported, or adjusting real growth rates by reported year-on-year changes in prices or costs.

All calculations and data sources are given in a worksheet.

Estimates include the contribution of clean energy technologies to the demand for upstream inputs such as metals and chemicals.

This approach shows the contribution of the clean-energy sectors to driving economic activity, also outside the sectors themselves, and is appropriate for estimating how much lower economic growth would have been without growth in these sectors.

Double counting is avoided by only including non-overlapping points in value chains. For example, the value of EV production and investment in battery storage of electricity is included, but not the value of battery production for the domestic market, which is predominantly an input to these activities.

Similarly, the value of solar panels produced for the domestic market is not included, as it makes up a part of the value of solar power generating capacity installed in China. However, the value of solar panel and battery exports is included.

The estimates are likely to be conservative in some key respects. For example, Bloomberg New Energy Finance estimates “investment in the energy transition” in China in 2024 at $800bn. This estimate covers a nearly identical list of sectors to ours, but excludes manufacturing – the comparable number from our data is $600bn.

China’s National Bureau of Statistics says that the total value generated by automobile production and sales in 2023 was 11tn yuan. The estimate in this analysis for the value of EV sales in 2023 is 2.3tn yuan, or 20% of the total value of the industry, while EVs already made up 31% of vehicle production, and the average selling prices for EVs are slightly higher than for internal combustion engine vehicles.

The post Analysis: Clean energy contributed a record 10% of China’s GDP in 2024 appeared first on Carbon Brief.

Analysis: Clean energy contributed a record 10% of China’s GDP in 2024

Greenhouse Gases

DeBriefed 10 October 2025: Renewables power past coal; Legacy of UK’s Climate Change Act; Fukushima’s solar future

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Renewables overtake coal

‘HISTORIC FIRST’: Renewables have overtaken coal to become the world’s leading source of electricity for the first six months of this year in a “historic first”, BBC News said. The analysis, from the thinktank Ember, found the world generated “almost a third” more solar power in the first half of the year, compared with the same period in 2024, while wind power grew by “just over 7%,” reported the Guardian.

HEAVY LIFTING: According to the report, China and India were “largely responsible for the surge in renewables”, while the US and Europe “relied more heavily on fossil fuels,” the Guardian wrote. China built more renewables than every other country combined in the first half of this year, the newspaper added.

CONTINENTAL SHIFTS: A second report from the International Energy Agency (IEA) predicted a “surge” in global wind and solar capacity by 2030, but shaved 5% off its previous forecast, the Financial Times said. The IEA revealed that India is set to become the second-largest growth market for renewables after China, “with capacity expected to increase 2.5 times by 2030”, Down to Earth reported. The IEA also upped its forecast for renewables in the Middle East and north Africa by 23%, “helped by Saudi Arabia rolling out wind turbines and solar panels”, but halved the outlook for the US, the FT noted.

Around the world

- EV BOOM: Sales of electric and hybrid cars made up “more than half” of all new car registrations in the UK last month, a new record, according to data from the Society of Motor Manufacturers, reported BBC News.

- BANKING COLLAPSE: A global banking alliance launched by the UN to get banks to slash the carbon footprint of their loans and investments and help drive the transition to a net-zero economy by 2050 has collapsed after four years, Agence France-Press reported.

- CUTS, CUTS, CUTS: The Trump administration plans to cut nearly $24bn in funding for more than 600 climate projects across the US, according to documents reviewed by the Wall Street Journal.

- PEOPLE POWER: A farmer, a prison guard and a teacher were among those from the Dutch-Caribbean island Bonaire who appeared at the Hague on Tuesday to “accuse the Netherlands of not doing enough to protect them from the effects of climate change”, Politico reported.

400,000

The number of annual service days logged by the US National Guard responding to hurricanes, wildfires and other natural disasters over the past decade, according to a Pentagon report to Congress, Inside Climate News reported.

Latest climate research

- Politicians in the UK “overwhelmingly overestimate the time period humanity has left to bend the temperature curve”, according to a survey of 100 MPs | Nature Communications Earth and Environment

- Fire-driven degradation of the Amazon last year released nearly 800m tonnes of CO2 equivalent, surpassing emissions from deforestation and marking the “worst Amazon forest disturbance in over two decades” | Biogeosciences

- Some 43% of the 200 most damaging wildfires recorded over 1980-2023 occurred in the last decade | Science

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

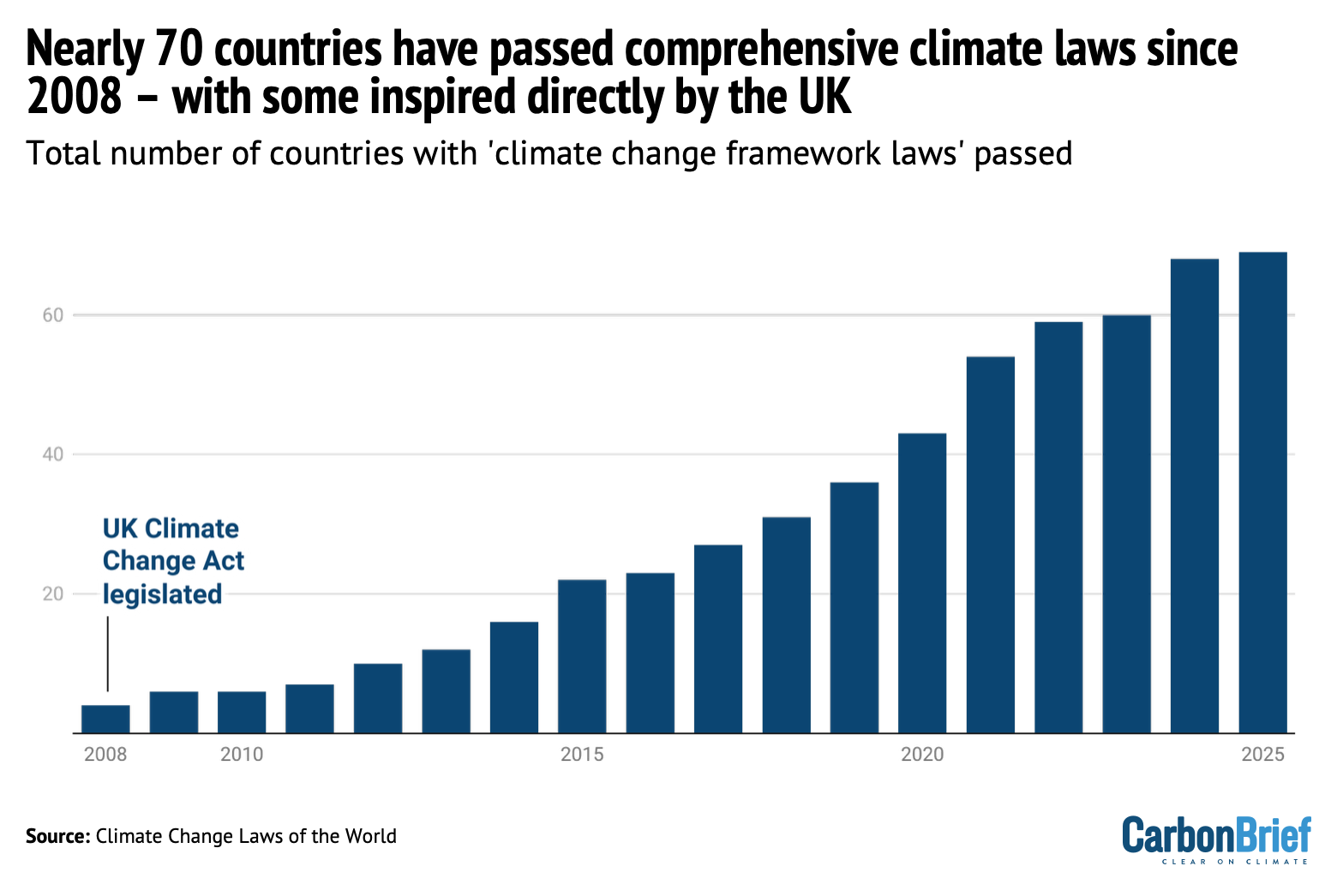

The UK’s Climate Change Act, landmark legislation that guides the nation’s response to climate change, is increasingly coming under attack from anti-net-zero right-leaning politicians. In a factcheck published this week, Carbon Brief explained how the UK’s Climate Change Act was among the first comprehensive national climate laws in the world and the first to include legally binding emissions targets. In total, 69 countries have now passed “framework” climate laws similar to the UK’s Climate Change Act, with laws in New Zealand, Canada and Nigeria among those explicitly based on the UK model. This is up from just four when the act was legislated in 2008. Of these, 14 are explicitly titled the “Climate Change Act”.

Spotlight

Fukushima’s solar future

This week, Carbon Brief examines how Fukushima helped to recover from nuclear disaster by building solar farms on contaminated farmland.

On 11 March 2011, an earthquake off the pacific coast of Japan caused 15m-tall waves to crash into the eastern region of Tōhoku, killing 19,500 people and injuring a further 6,000.

In the aftermath, flooding at the Fukushima Daichi nuclear power plant caused cooling systems to fail, leaching radioactive contaminants into the soil and leading to a major nuclear incident.

Some 1,200km2 around the site was restricted and up to 100,000 people were evacuated – in some cases forever.

In the years following, Japan entered a fraught debate about nuclear energy.

In 2010, nuclear power provided 25% of Japan’s electricity, but, in the years following the disaster, its 54 nuclear reactors were taken offline.

Successive governments have fought over reintroducing nuclear power. Today, some 14 reactors are back online, 27 have been permanently closed and another 19 remain suspended. (Japan’s newly-elected prime minister Sanae Takaichi has promised to make nuclear central to her energy strategy.)

Against this backdrop, Fukushima – a prefecture home to 1.8 million people – has emerged as a surprise leader in the renewables race.

In 2014, the Fukushima Renewable Energy Institute (FREA) opened with the twin goals of promoting research and development into renewable energy, while “making a contribution to industrial clusters and reconstruction”.

That same year, the prefecture declared a target of 100% renewable power by 2040.

Contaminated land

“A lot of these communities, I know, were looking for ways to revitalise their economy,” said Dr Jennifer Sklarew, assistant professor of energy and sustainability at George Mason University and author of “Building Resilient Energy Systems: Lessons from Japan”.

Once evacuation orders were lifted, however, residents in many parts of Fukushima were faced with a dilemma, explained Skarlew:

“Since that area was largely agricultural, and the agriculture was facing challenges due to stigma, and also due to the soil being removed [as part of the decontamination efforts], they had to find something else.”

One solution came in the form of rent, paid to farmers by companies, to use their land as solar farms.

Michiyo Miyamoto, energy finance specialist at the Institute for Energy Economics and Financial Analysis, told Carbon Brief:

“The [Fukushima] prefecture mapped suitable sites early and conducted systematic consultations with residents and agricultural groups before projects were proposed. This upfront process reduced land-use conflicts, shortened permitting timelines and gave developers clarity.”

As a result, large-scale solar capacity in Fukushima increased to more than 1,300 megawatts (MW) from 2012 to 2023, according to Miyamoto. Moreover, installed renewable capacity now exceeds local demand, meaning the region can run entirely on clean power when conditions are favourable, Miyamoto said.

Today, aerial pictures of Fukushima reveal how solar panels have proliferated on farmland that was contaminated in the nuclear disaster.

Charging on

Last year, 60% of Fukushima’s electricity was met by renewables, up from 22% in 2011. (The country as a whole still lags behind at 27%.)

And that is set to grow after Japan’s largest onshore windfarm started operations earlier this year in Abukuma, Fukushima, with a capacity of 147MW.

The growth of solar and wind means that Fukushima is already “ahead of schedule” for its 2040 target of 100% renewable power, said Miyamoto:

“The result is a credible pathway from recovery to leadership, with policy, infrastructure and targets working in concert.”

Watch, read, listen

OVERSHOOT: The Strategic Climate Risks Initiative, in partnership with Planet B Productions, has released a four-part podcast series exploring what will happen if global warming exceeds 1.5C.

DRONE WARFARE: On Substack, veteran climate campaigner and author Bill McKibben considered the resilience of solar power amid modern warfare.

CLIMATE AND EMPIRE: For Black history month, the Energy Revolution podcast looked at how “race and the legacies of empire continue to impact the energy transition”.

Coming up

- 12 October: presidential elections, Cameroon

- 13-14 October: Pre-COP, Brasilia, Brazil

- 13-18 October: World Bank Group/IMF annual meetings, Washington DC

- 14-17 October: 2nd extraordinary session of the Marine Environment Protection Committee at the International Maritime Organisation, London

- 15-16 October: Circle of Finance Ministers report

Pick of the jobs

- Buckinghamshire Council, principal climate change officer | Salary: £49,354-£51,759. Location: Aylesbury, Buckinghamshire

- Sustainable NI, sustainable business lead | Salary: £60,000. Location: Belfast, Northern Ireland

- Dialogue Earth, South Asia managing editor | Salary: £1,875 per month. Location: South Asia

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 10 October 2025: Renewables power past coal; Legacy of UK’s Climate Change Act; Fukushima’s solar future appeared first on Carbon Brief.

Greenhouse Gases

Guest post: How Caribbean states are shifting climate legislation

The Caribbean region is among the most vulnerable to climate change, despite historically contributing less than half of one percent of global greenhouse gas emissions.

Rising sea levels, extreme heat and more frequent and intense storms – such as the 2024 Hurricane Beryl, which made landfall in Grenada – pose urgent and growing threats to the small island states, coastal nations and overseas territories that comprise the Caribbean region.

With global progress to address climate change still too slow, Caribbean countries are taking matters into their own hands by enacting more robust legislation to help protect against climate risks.

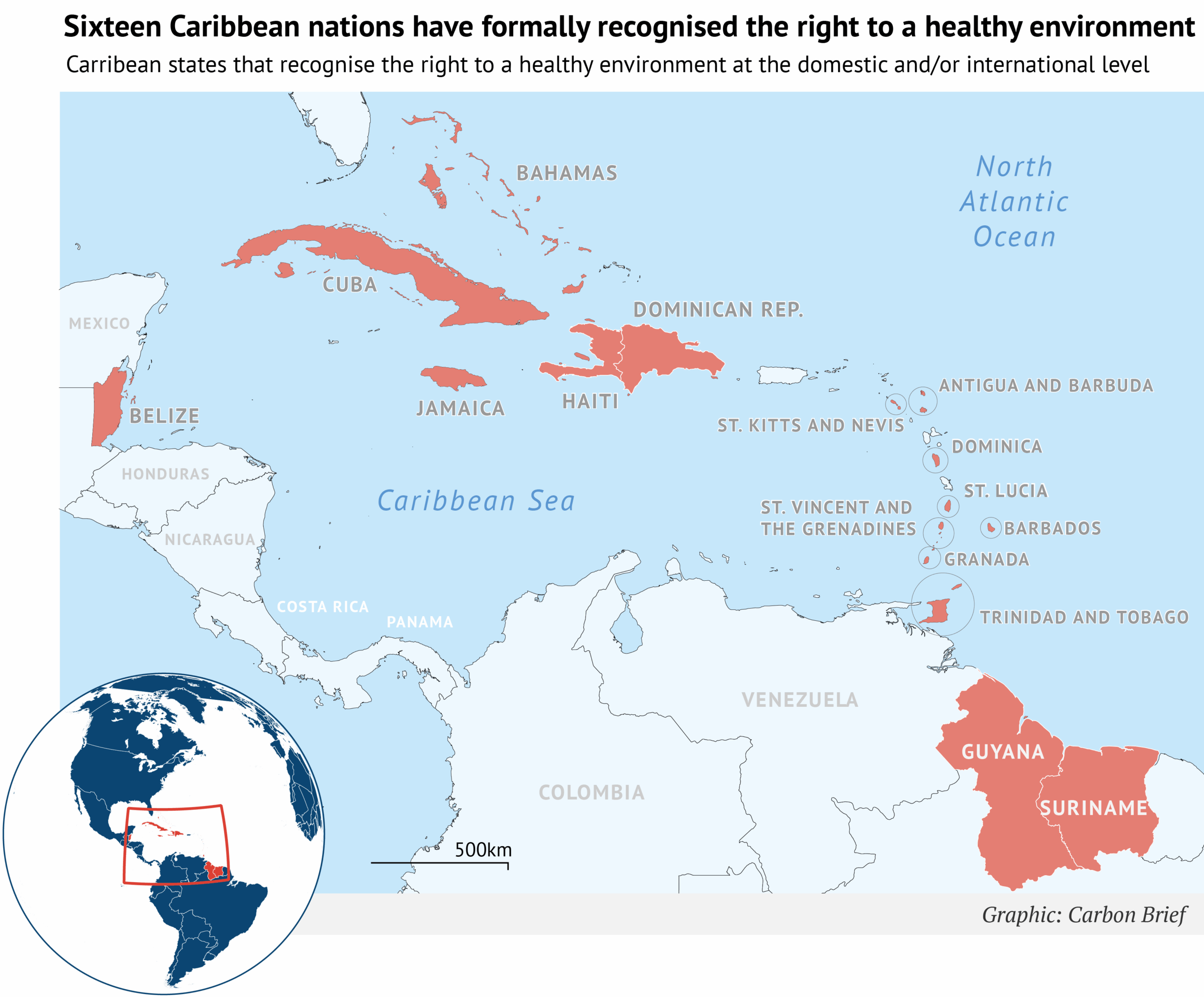

In a new study published in the Carbon and Climate Law Review, we identified 78 climate laws and legally binding decrees across 16 Caribbean states, as well as two constitutional references to climate change and a growing recognition of the right to a healthy environment.

Our analysis suggests that, together, these developments are not only enhancing resilience, but also positioning Caribbean states as influential actors in the global climate arena.

Caribbean climate laws on the rise

Climate governance in the Caribbean has expanded significantly in recent years. In the past decade, countries such as Cuba and the Dominican Republic have embedded climate obligations and programmatic guidelines into their national constitutions.

At the same time, legislative recognition of the human right to a healthy environment is gaining momentum across the region. Six Caribbean nations now affirm the right in their constitutions, while 15 have recognised it through international instruments, such as the UN Council, UN Assembly and the Escazu Agreement, as shown in the figure below.

More recently, there has been a notable rise in targeted, sector-specific climate frameworks that go beyond broader environmental statutes.

Saint Lucia stands out as the only country with a climate framework law, or a comprehensive national law that outlines long-term climate strategies across multiple domains. Meanwhile, several other Caribbean governments have adopted climate-specific laws that focus on individual sectors, such as energy, migration and disaster management.

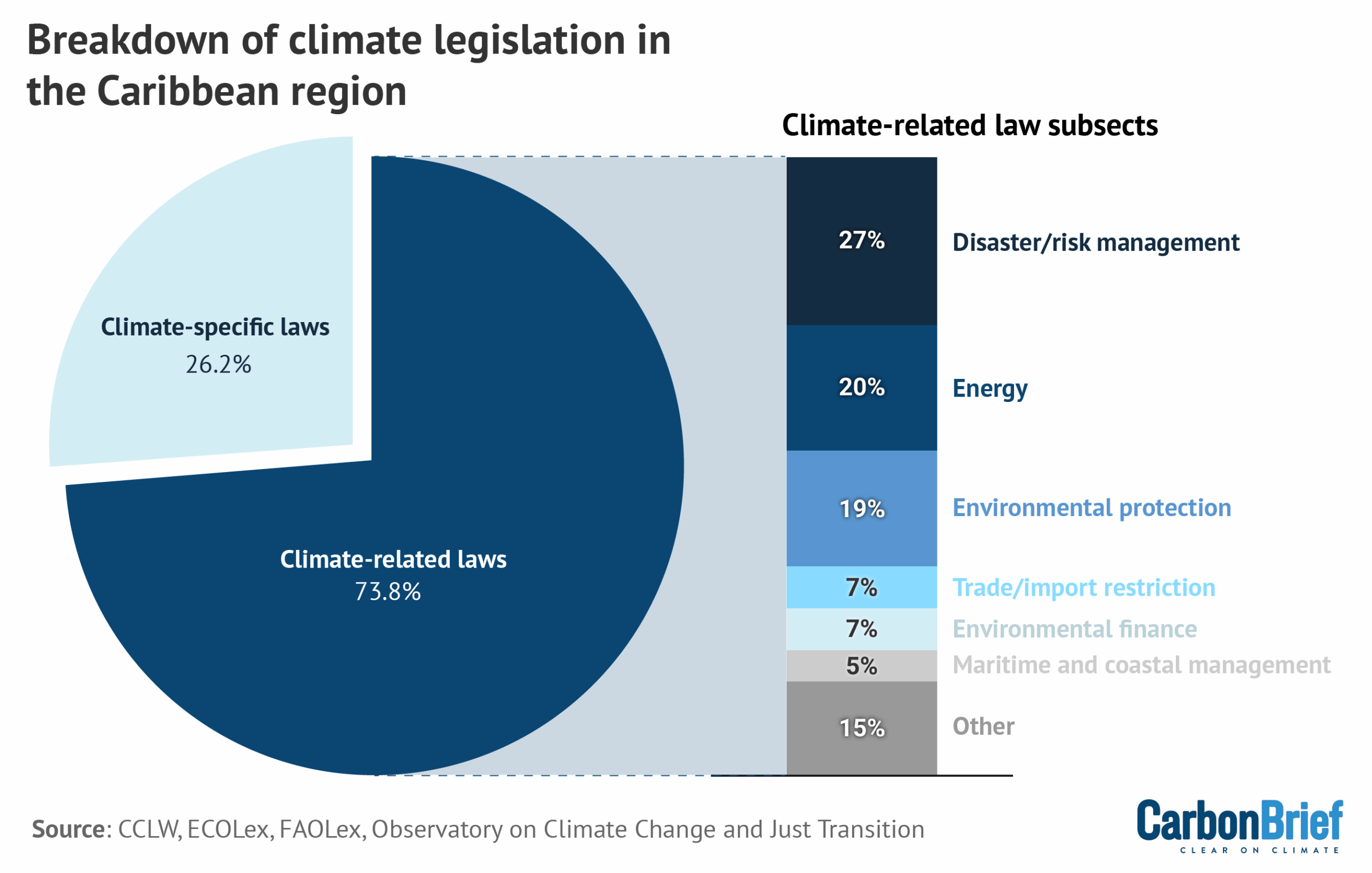

According to our analysis, more than a quarter of climate-relevant legislation in the region – comprising 21 laws and legally binding decrees – now has an explicit focus on climate change, as illustrated in the chart below.

Our research suggests that this represents an ongoing shift in legislative focus, reflecting changes in how climate legislation is being structured in one of the world’s most climate-vulnerable regions.

Caribbean nations are also advancing legal reforms to structure and institutionalise climate finance and market mechanisms directly into domestic law, aligned with Article 6.2 of the Paris Agreement.

For example, the Bahamas has introduced provisions for carbon credit trading, while Antigua and Barbuda, Barbados and Grenada have established national climate financing mechanisms to support mitigation and adaptation efforts.

Some states, including Belize and Saint Kitts and Nevis, have incorporated regional bodies such as the Caribbean Community Climate Change Centre – the climate arm of the intergovernmental Caribbean community organisation CARICOM – into national frameworks. This indicates an increasing alignment between regional cooperation and domestic law.

In addition to the influx of regulations specifically addressing climate change, Caribbean nations are also legislating broader environmental issues, which, in turn, could provide increased resilience from climate impacts and risks, as shown in the graph above.

Key trends in these types of climate-related laws include the expansion of disaster risk management governance, which addresses national preparedness for climate-induced weather events or related catastrophes. Likewise, energy law is an increasingly prominent focus, with countries including Antigua and Barbuda and Saint Vincent and the Grenadines integrating renewable energy and energy efficiency goals into national climate governance.

More broadly, many Caribbean nations have adopted wide-ranging and comprehensive environmental laws, many of which were developed in alignment with existing climate commitments. In combination, these legal developments reflect a dynamic and evolving climate governance landscape across the region.

Proactive vs reactive approaches

Despite general alignment with these broader regional trends, our research reveals distinct developmental pathways shaping domestic climate regulation.

In the eastern Caribbean, for example, we saw both proactive, long-term planning strategies and reactive, post-disaster reforms.

Saint Lucia’s multifaceted approach to climate resilience evolved steadily over the course of more than a decade. During this time, the country developed numerous adaptation plans, strengthened cross-sectoral coordination and engaged in institutional climate reforms in areas such as energy, tourism, finance and development.

More recently, the passage of Saint Lucia’s Climate Change Act in 2024 marked a milestone in climate governance, by giving legal force to the country’s obligations under the UNFCCC, the Kyoto Protocol and the Paris Agreement – making Saint Lucia one of the few small island states to incorporate global climate commitments into domestic law.

Our research indicates that this strategy has not only positioned the country as a more climate-resilient nation, but also solidified its access to international climate financing.

In contrast, Dominica’s efforts evolved more rapidly in the aftermath of Hurricane Maria in 2017, which destroyed over 200% of the country’s GDP. The storm’s impacts were felt across the country and hit particularly hard for the Kalinago people – the Caribbean’s last Indigenous community – highlighting the role of socioeconomic disparities in shaping climate vulnerability and resilience.

In response, the government passed the Climate Resilience Act, creating the temporary Climate Resilience Execution Agency for Dominica (CREAD).

Beyond establishing an exclusively climate-focused institution, the act aimed to embed resilience into governance by mandating the participation of vulnerable communities – including Indigenous peoples, women, older people and people with disabilities – in shaping and monitoring climate resilience projects.

As noted in a recent statement by the UN special rapporteur on Climate Change, Dr Elisa Morgera, these frameworks underscore the government’s ambition to become the world’s first “climate-resilient nation.”

Although challenges persist, Dominica’s efforts demonstrate how post-disaster urgency can drive institutional change, including the integration of rights and resilience into climate governance.

Uneven progress and structural gaps

Despite significant progress, our research shows that several key opportunities for climate governance across the Caribbean continue to exist, which could enable improvements in both resilience and long-term ambition.

The region’s legal landscape remains somewhat heterogeneous. While Saint Lucia has enacted a comprehensive climate framework law, the rest of the region lacks similar blanket legislation. This includes some states that entirely lack climate-specific laws, instead relying on related laws and frameworks to regulate and respond to climate-related risks.

Other nations have yet to adopt explicit disaster-risk management frameworks, leaving Caribbean populations vulnerable before, during and after climate emergencies. Most have yet to enshrine the right to a healthy environment at the national level.

Our research suggests that outdated legal frameworks are further limiting progress in addressing current climate risks. Because many of the longer-standing environmental laws in the region were adopted well before climate policy became a mainstream concern, some fail to address the nature, frequency and intensity of modern climate challenges, such as sea-level rise, tropical storms, wildfires, floods, droughts and other impacts.

More broadly, many Caribbean climate laws include limited integration of gender equity, Indigenous rights and social justice. As Caribbean nations such as Grenada and the Dominican Republic begin to link climate resilience with these issues, the region has an opportunity to lead by example.

Ultimately, capacity and resource constraints persist as significant barriers to implementation and adaptation.

The Caribbean region faces debt that exacerbates ongoing development challenges, a burden made heavier by the repeated economic shocks of climate-related disasters. Along with regional debt-for-resilience schemes, increased funding from high-emitting countries to support adaptation measures in climate-vulnerable nations – as endorsed under the Paris Agreement – is likely to be critical to ensuring the region’s climate laws can be executed effectively.

Global implications of Caribbean climate law

Our research suggests that Caribbean countries are outpacing other regions in terms of the scope and ambition of their climate laws. This legislation has the potential to serve as a model for climate-vulnerable nations worldwide.

Continuing efforts in the region show that legal frameworks in the field can not only drive resilience, embed rights and strengthen claims to international finance, but also highlight how regional cooperation and diplomacy can enhance global influence.

These findings demonstrate that innovation in climate law need not wait for action from major emitters, but can instead be led by those on the front lines of climate change.

The post Guest post: How Caribbean states are shifting climate legislation appeared first on Carbon Brief.

Guest post: How Caribbean states are shifting climate legislation

Greenhouse Gases

IEA: Renewables have cut fossil-fuel imports for more than 100 countries

More than 100 countries have cut their dependence on fossil-fuel imports and saved hundreds of billions of dollars by continuing to invest in renewables, according to the International Energy Agency (IEA).

It says nations such as the UK, Germany and Chile have reduced their need for imported coal and gas by around a third since 2010, mainly by building wind and solar power.

Denmark has cut its reliance on fossil-fuel imports by nearly half over the same period.

Renewable expansion allowed these nations to collectively avoid importing 700m tonnes of coal and 400bn cubic metres of gas in 2023, equivalent to around 10% of global consumption.

In doing so, the fuel-importing countries saved more than $1.3tn between 2010 and 2023 that would otherwise have been spent on fossil fuels from overseas.

Reduced reliance

The IEA’s Renewables 2025 report quantifies the benefits of renewable-energy deployment for electricity systems in fossil fuel-importing nations.

It compares recent trends in renewable expansion to an alternative “low renewable-energy source” scenario, in which this growth did not take place.

In this counterfactual, fuel-importing countries stopped building wind, solar and other non-hydropower renewable-energy projects after 2010.

In reality, the world added around 2,500 gigawatts (GW) of such projects between 2010 and 2023, according to the IEA, more than the combined electricity generating capacity of the EU and US in 2023, from all sources. Roughly 80% of this new renewable capacity was built in nations that rely on coal and gas imports to generate electricity.

The chart below shows how 31 of these countries have substantially cut their dependence on imported fossil fuels over the 13-year period, as a result of expanding their wind, solar and other renewable energy supplies. All of these countries are net importers of coal and gas.

In total, the IEA identified 107 countries that had reduced their dependence on fossil fuel imports for electricity generation, to some extent due to the deployment of renewables other than hydropower.

Of these, 38 had cut their reliance on electricity from imported coal and gas by more than 10 percentage points and eight had seen that share drop by more than 30 percentage points.

Security and resilience

The IEA stresses that renewables “inherently strengthen energy supply security”, because they generate electricity domestically, while also “improving…economic resilience” in fossil-fuel importer countries.

This is particularly true for countries with low or dwindling domestic energy resources.

The agency cites the energy crisis exacerbated by Russia’s invasion of Ukraine, which exposed EU importers to spiralling fossil-fuel prices.

Bulgaria, Romania and Finland – which have historically depended on Russian gas for electricity generation – have all brought their import reliance close to zero in recent years by building renewables.

In the UK, where there has been mounting opposition to renewables from right-wing political parties, the IEA says reliance on electricity generated with imported fossil fuels has dropped from 45% to under 25% in a decade, thanks primarily to the growth of wind and solar power.

Without these technologies, the UK would now be needing to import fossil fuels to supply nearly 60% of its electricity, the IEA says.

Other major economies, notably China and the EU, would also have had to rely on a growing share of coal and gas from overseas, if they had not expanded renewables.

As well as increasing the need for fossil-fuel imports from other countries, switching renewables for fossil fuels would require significantly higher energy usage “due to [fossil fuels’] lower conversion efficiencies”, the IEA notes. Each gigawatt-hour (GWh) of renewable power produced has avoided the need for 2-3GWh of fossil fuels, it explains.

Finally, the IEA points out that spending on renewables rather than imported fossil fuels keeps more investment in domestic economies and supports local jobs.

The post IEA: Renewables have cut fossil-fuel imports for more than 100 countries appeared first on Carbon Brief.

IEA: Renewables have cut fossil-fuel imports for more than 100 countries

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Greenhouse Gases1 year ago

Greenhouse Gases1 year ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Greenhouse Gases2 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change1 year ago

Climate Change1 year ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits

-

Renewable Energy3 months ago

US Grid Strain, Possible Allete Sale