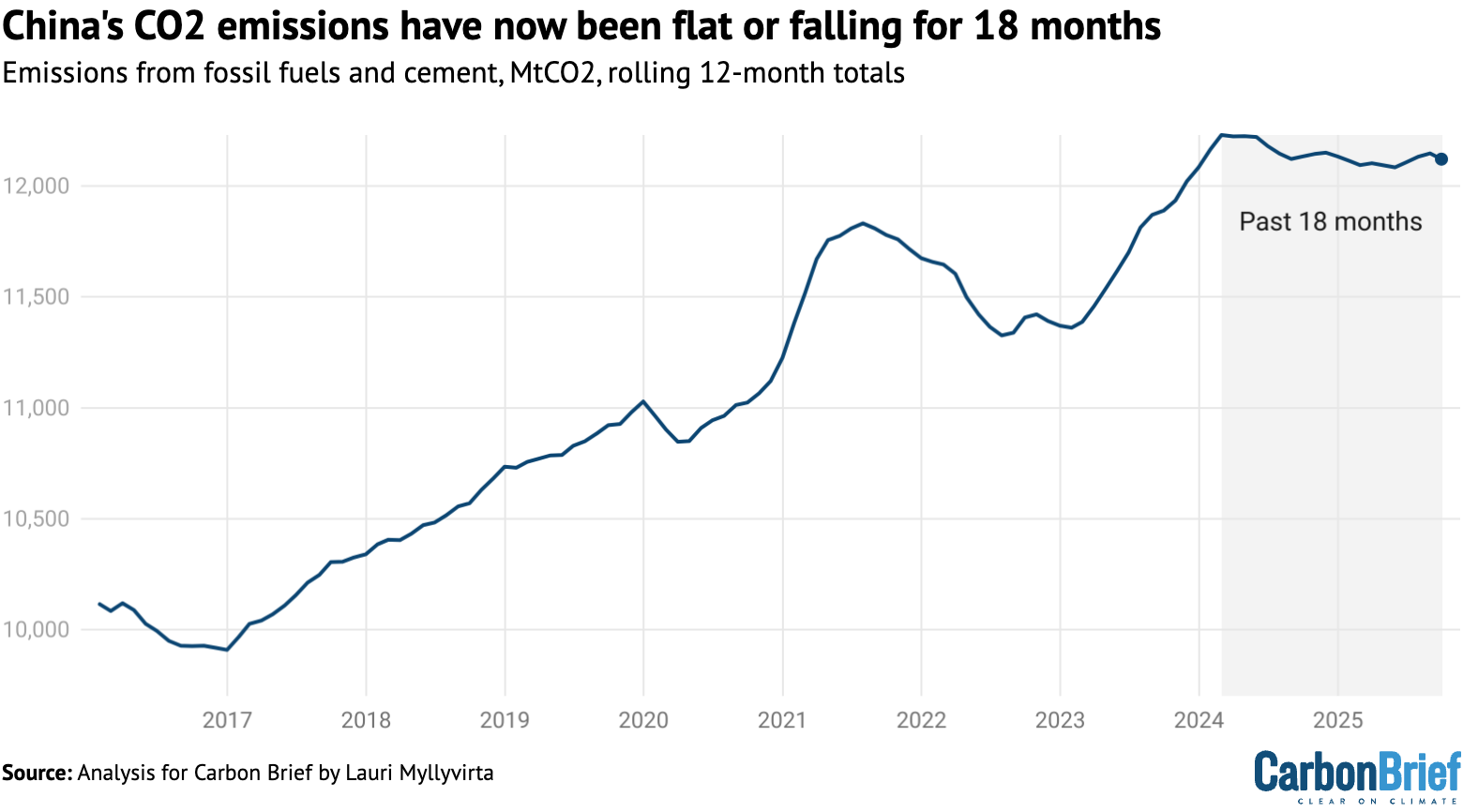

China’s carbon dioxide (CO2) emissions were unchanged from a year earlier in the third quarter of 2025, extending a flat or falling trend that started in March 2024.

The rapid adoption of electric vehicles (EVs) saw CO2 emissions from transport fuel drop by 5% year-on-year, while there were also declines from cement and steel production.

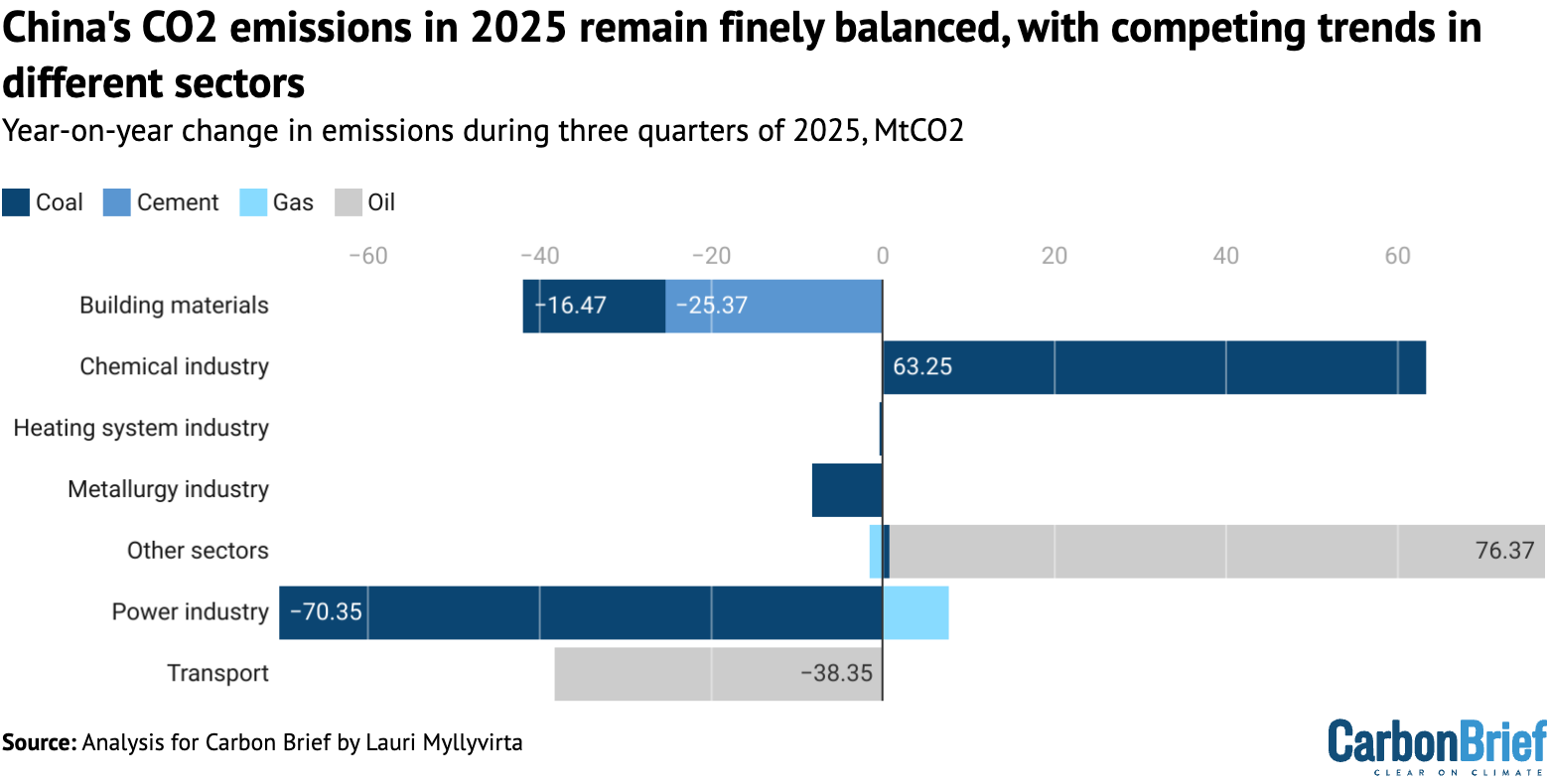

The new analysis for Carbon Brief shows that while emissions from the power sector were flat year-on-year, a big rise in the chemical industry’s CO2 output offset reductions elsewhere.

Other key findings include:

- Power-sector CO2 emissions were flat in the third quarter, even as electricity demand growth accelerated to 6.1%, from 3.7% in the first half of the year.

- This was achieved thanks to electricity generation from solar growing by 46% and wind by 11% year-on-year in the third quarter of 2025.

- In the first nine months of the year, China completed 240 gigawatts (GW) of solar and 61GW of wind capacity, putting it on track for a new renewable record in 2025.

- Oil demand and emissions in the transport sector fell by 5% in the third quarter, but grew elsewhere by 10%, as the production of plastics and other chemicals surged.

After the first three quarters of the year, China’s CO2 emissions in 2025 are now finely balanced between a small fall or rise, depending on what happens in the last quarter.

A drop in the full-year total became much more likely after September, which recorded an approximately 3% drop in emissions year-on-year.

Electricity demand – and associated emissions – have tended to grow fastest during the summer months, due to rapidly rising demand for air conditioning amid hotter summers.

If this pattern repeats, then China’s CO2 emissions will record a fall for the full year of 2025.

While an emission increase or decrease of 1% or less might not make a huge difference in an objective sense, it has heightened symbolic meaning, as China’s policymakers have left room for emissions to increase for several more years, leaving the timing of the peak open.

Either way, China is set to miss its target to cut carbon intensity – the CO2 emissions per unit of GDP – from 2020 to 2025, meaning steeper reductions are needed to hit the county’s 2030 goal.

Finely balanced emissions

China’s CO2 emissions have now been flat or falling for 18 months, starting in March 2024. This trend continued in the third quarter of 2025, when emissions were unchanged year-on-year.

This picture is finely balanced, however, with contrasting trends in different sectors of the economy underlying the ongoing plateau in CO2 emissions, shown in the figure below.

Emissions from the production of cement and other building materials fell by 7% in the third quarter of 2025, while emissions from the metals industry fell 1%. This is due to the ongoing real-estate contraction, as the construction sector uses most of the country’s steel and cement output.

Emission reductions from steel production continued to lag the reductions in output, which fell 3%. This is because the fall in demand was absorbed by the lower-carbon electric-arc steelmakers, whereas carbon-intensive coal-based steel production was less affected.

China has struggled to increase the share of electric-arc steelmaking despite targets, due to the large capacity base and entrenched position of coal-based steelmaking crowding out the lower-emission producers.

Power-sector emissions were unchanged year-on-year in the third quarter, as strong growth from solar and wind generation, along with small increases from nuclear and hydro, nearly matched a rapid rise in demand.

Emissions from transport fell by 5% over the period, but oil consumption in other sectors grew by 10%, driven by chemical industry expansion. This resulted in a 2% rise in oil consumption overall.

Gas demand and emissions grew by 3% overall in the three-month period, with consumption in the power sector up by 9% and by 2% in other sectors.

The figure below shows how emissions in each of these sectors has changed in the first nine months of 2025, for example, power-sector CO2 output is down 2% in the year so far.

The rapid recent growth of CO2 emissions in the chemical industry is a continuation of recent trends and, as such, the sector’s coal and oil use have both surged in 2025 to date.

The outlook for emissions in the final quarter of 2025 – and the year as a whole – depends on whether further declines in cement, transport and power are enough to offset increases elsewhere.

Solar and wind growth keep power sector emissions flat

In the power sector, China’s dominant source of CO2, emissions remained flat in the third quarter even as electricity demand grew strongly.

Electricity generation from solar and wind grew by 30%, with solar up 46% and wind power generation increasing 11%. With small increases from nuclear and hydropower, non-fossil power sources covered almost 90% of the increase in demand, even as demand growth accelerated to 6.1% in the third quarter, up from 3.7% in the first half of the year.

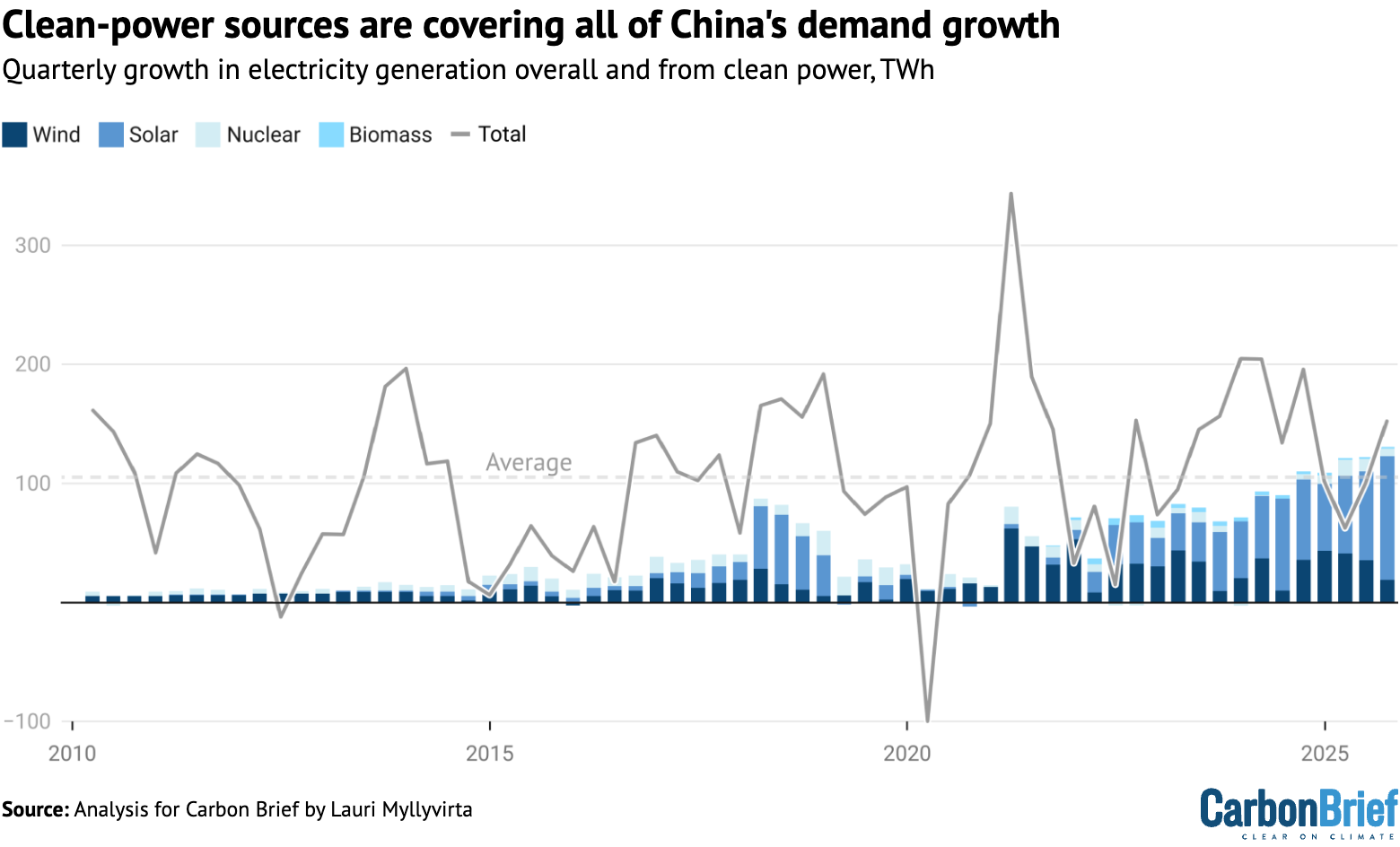

This is illustrated in the figure below, where the columns show the change in generation by each source of non-fossil power every quarter and the line shows the increase in electricity demand.

Despite a small increase in electricity generation from fossil fuels to cover the remaining 10% of demand growth, power sector emissions stayed unchanged in the third quarter of 2025.

This is because the average thermal efficiency of coal power – the amount of fuel per unit of output – improved slightly, while the share of gas-fired generation increased at the expense of coal.

The figure above shows that the growth in clean-power sources has been covering all or nearly all of the rise in electricity demand in recent quarters, but once again there is a fine balance.

As such, the outlook for the final quarter of 2025 and for power-sector emissions over the years ahead depends on the relative strength of rising demand and clean-power output.

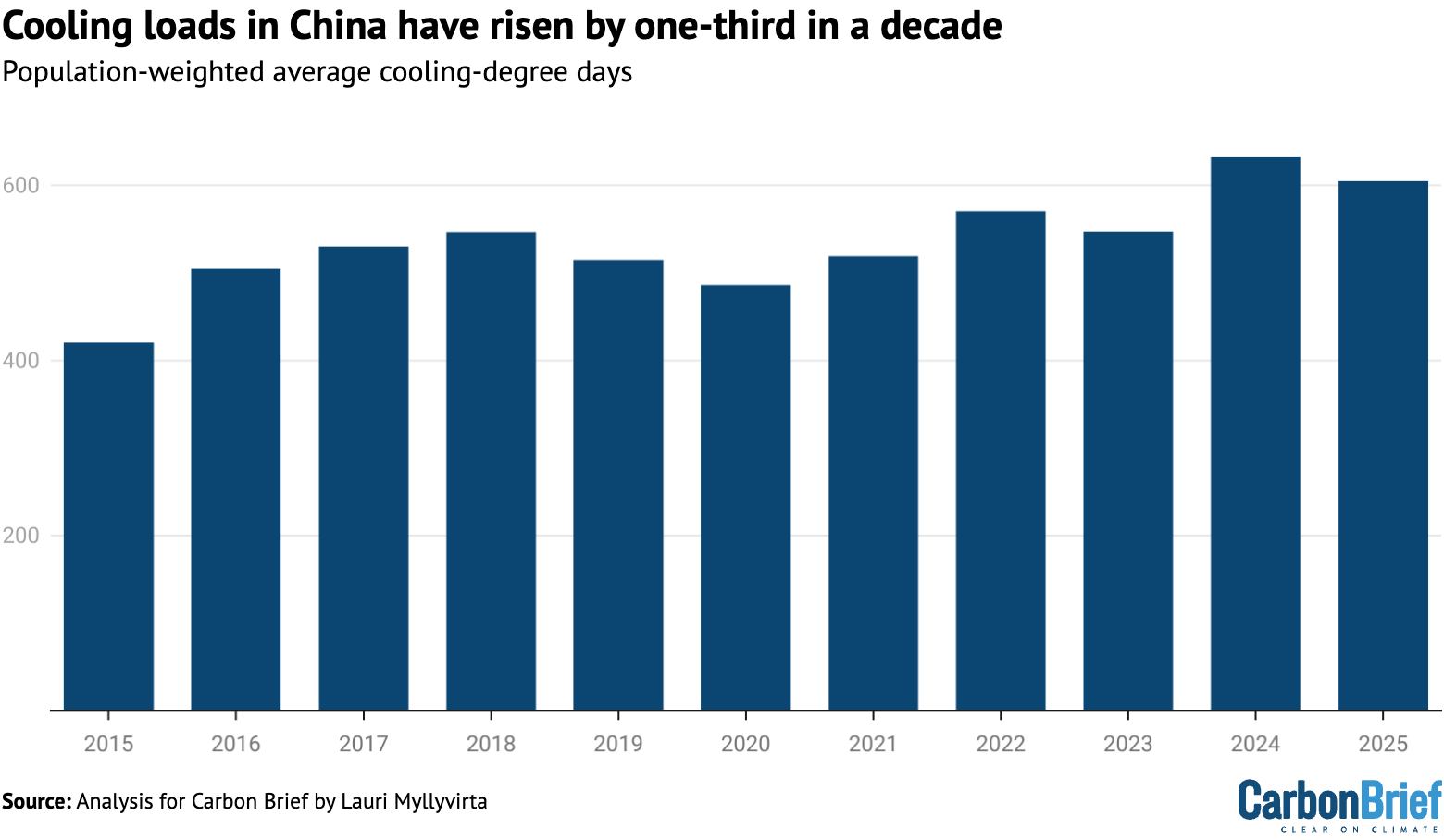

From 2021 to 2025, there has been a marked seasonal pattern in electricity demand growth, with more rapid rises in the summer peak “cooling season”, from June to August.

In these months, residential electricity consumption grew by a striking 13% per year, compared with just 6% during other parts of the year. Industry and service-sector consumption also grew faster in the summer months.

As a result, growth in total power demand has been significantly faster, at 6.8% during the summer months, compared with 4.6% in the rest of the year.

This is due to both increased prevalence of air conditioning and to hotter summers, with the average number of “cooling-degree days” increasing by one third from 2015–16 to 2024–25, as shown in the figure below.

This seasonal pattern implies that electricity consumption might ease off in the final quarter of 2025, which would set a lower bar for clean-power growth to meet or exceed rising demand.

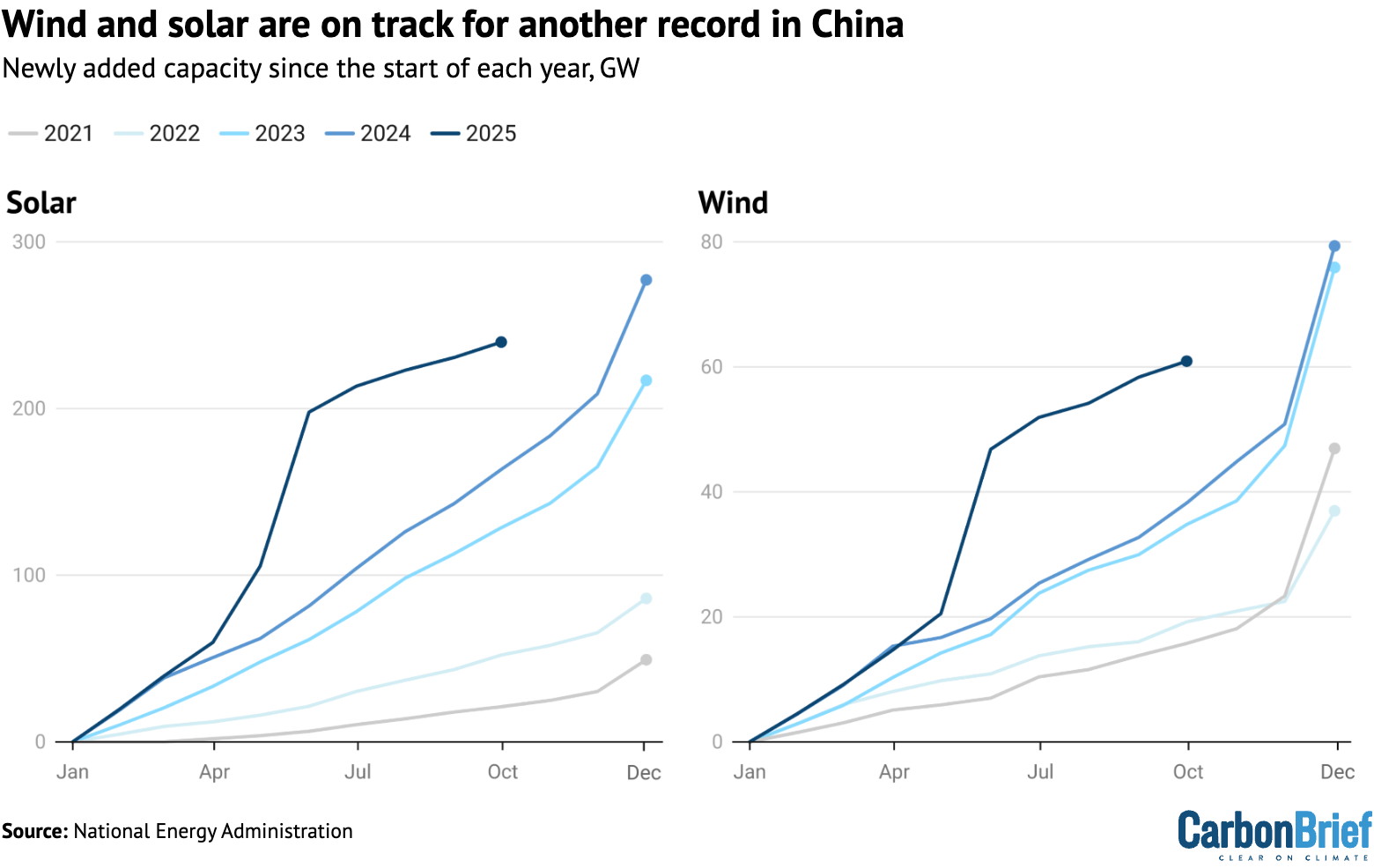

On the generation side, the first nine months of 2025 has seen China adding 240GW of solar and 61GW of wind power capacity. While the rate of new installations has slowed down sharply since May, China is still on track for a new record for the whole year as developers rush to complete projects included in the 14th five-year plan, which finishes at the end of 2025.

China had 181GW of wind and 234GW of utility-scale solar under construction in early 2025, according to the Global Energy Monitor. After the capacity additions in the first nine months of 2025, this leaves 120GW of wind and 123GW of utility-scale solar under construction, much of which is likely to be commissioned this year.

The rate of new wind and solar additions in 2025 to date is shown in the figure below, alongside comparable figures for each year since 2020.

The slowdown in installations in recent months is due to a new pricing system that requires developers of new solar and wind-power plants to secure contracts directly with buyers, instead of being guaranteed the benchmark price for coal power, which was the case until May.

The change in pricing led to a major rush to complete projects faster than originally scheduled, seen in the May 2025 bump in the figure above.

This left few projects to complete in the third quarter, meaning that the current slow pace in installations does not yet reflect the capacity growth that can be expected under the new system.

China’s power-sector emissions have been falling slowly since early 2024, due to the rapid growth of solar and wind power generation. The unprecedentedly large capacity additions have enabled non-fossil power generation to cover electricity demand growth, but only barely.

Any sustained slowdown in solar and wind deployment would mean that power-sector emissions would begin to creep up again, unless electricity demand slows sharply. This is not expected – the State Grid has forecast 5.6% annual demand growth until 2030, compared with 6.1% from 2019 to 2025.

One indicator pointing towards robust ongoing solar capacity growth is that the production of solar cells has continued at or above 2024 levels – even after the slowdown in installations in recent months – growing 8% year-on-year in the third quarter.

The amount of new solar-cell capacity produced in Chinese factories each month, minus exports, has tended to predict new domestic solar installations, with a lag.

However, the outlook for wind and solar growth in China is clouded by a large gap between industry and government expectations for the sector.

The China Wind Energy Association is targeting at least 120GW of wind-power capacity added per year in the next five years, while the China Photovoltaic Industry Association projects 235-270GW of solar added in 2026, rising to 280-340GW in 2030.

In contrast, president Xi Jinping recently announced that China would “strive to” bring the county’s installed solar and wind capacity to 3,600GW by 2035. This implies just 200GW of capacity added per year over the next decade, extending a target set earlier for 2025-27.

The pace of solar and wind deployment under the new pricing system depends heavily on the implementation of the national-level rules at the provincial level, particularly the choice of minimum pricing. Most provinces are yet to finalise their rules and only six provinces have published results from auctions for “contracts for difference” – the key policy instrument under the new rules – so far, with nine more auctions underway.

Meanwhile, the additions of new coal and gas-fired power capacity have accelerated, as the projects started after the government loosened permitting and started to promote coal-fired power projects in 2020 are starting to complete.

The result has been that the utilisation of coal-fired power capacity – the share of hours during which each unit is in operation – has begun to fall significantly, as power generation from coal has declined since April 2024. Utilisation peaked at 54% in the 12 months to February 2024 and fell to 51% in the 12 months to September 2025.

Another 230GW of coal-fired power capacity is under construction. If power generation from coal continues to stay stagnant and if all of this new capacity is added to the system, then utilisation would fall to 43%. This could prompt a rethink of the government’s promotion of coal-fired power projects.

Chemical industry’s runaway growth pushes up oil demand

In the oil sector, there are once again competing factors at work. China’s transport oil consumption has been falling since April 2024, driven in large part by the rapid adoption of EVs.

However, total oil consumption still increased 2% in the year to September, as a 4% fall in transport fuel use was more than offset by an 8% rise elsewhere, dominated by industrial demand.

Consumption fell by 4-5% across each of the three main transport fuels: diesel, used in trucks and other heavy vehicles; petrol, mainly used in cars; and jet fuel.

The reduction in petrol consumption accelerated in October, falling 8% year-on-year, erasing the usual spike seen at this time of year related to the week-long national holiday.

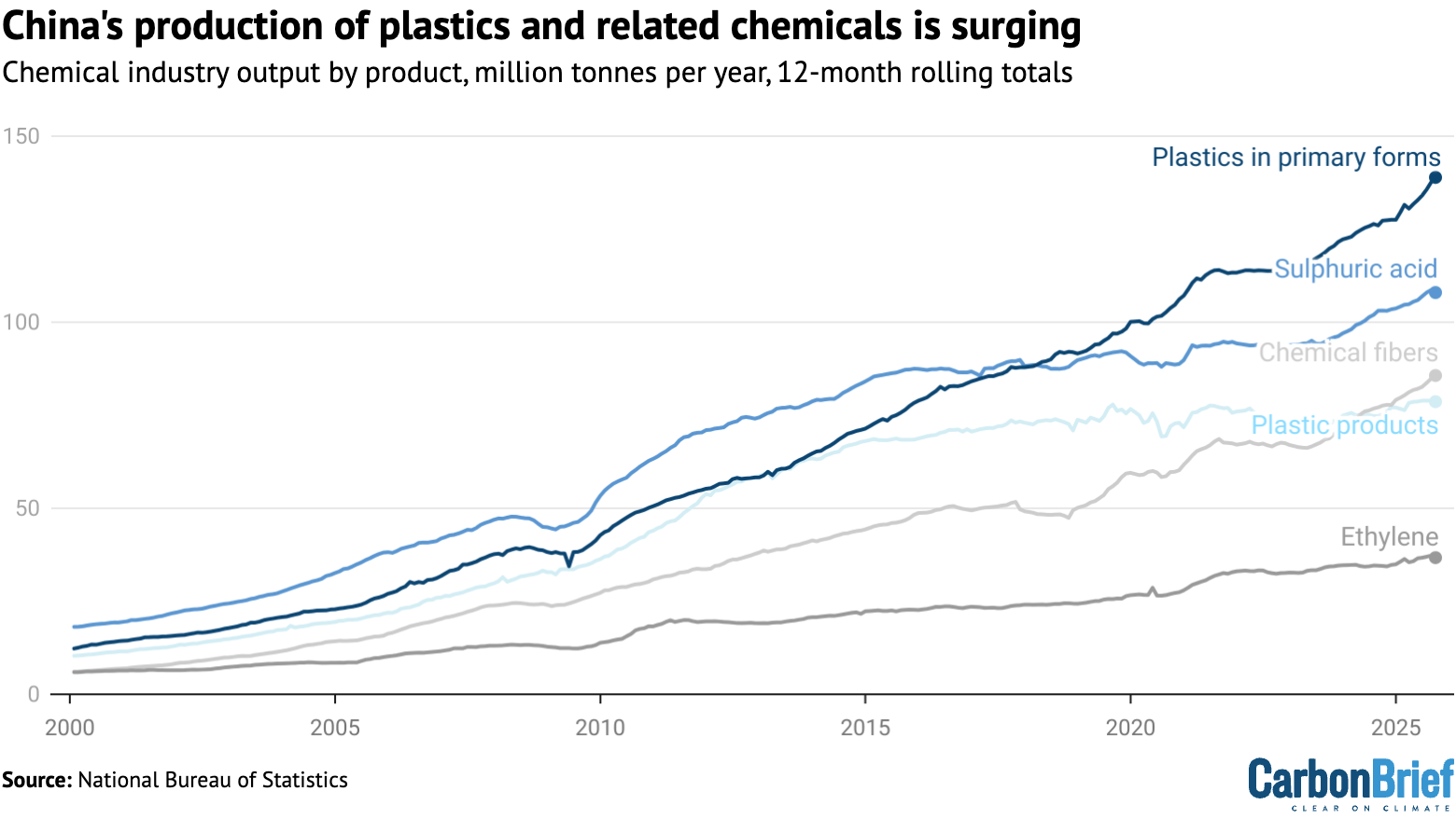

Within industry, the production of primary plastics grew 12% year-on-year in the first three quarters of 2025, while the production of chemical fibres grew by 11% and the production of ethylene by 7%. The increase in the output of these products accounts for the entire increase in oil use outside the transportation sector.

These sharp increases in chemical production are shown in the figure below.

One clear driver of the growth in plastics production is import substitution – replacing equivalent products imported from overseas – as well as growing exports.

China is still a net importer of primary plastics by value in 2025 so far, but only just. The value of imports fell by 8% while the value of exports increased by 8% in the first nine months of the year.

The five-year plan for 2021-25 targeted an increase in chemicals production to reduce the imports of key raw materials to less than 40% of demand, with projects launched to meet this target coming online this year.

More recently, the government has encouraged oil refineries to shift from the production of transport fuels to chemicals, in order to adapt to falling demand for oil in transportation. It set a target for the petrochemical and chemical sector’s economic output to grow by more than 5% per year in 2025-26.

The US-China tariff tit-for-tat has added further momentum to import substitution. The US has been China’s largest source of imports of polyethylene – the most widely used plastic in the world – since 2023, but China has expanded its domestic production in response to the trade spat.

Still, the change in China’s net exports of plastics cannot account for more than a fraction of the increase in output volume, however, as estimated based on reported polymer prices. This indicates that growing domestic demand is a major driver of the rapid growth in plastics production.

Packaging is the largest use of plastics in China, with the booming online retail and food delivery industry driving rapid growth.

Express parcel volumes grew 21% in 2024 and 17% through September 2025. The value of the single-use plastic tableware market averaged 21% annual growth from 2017 to 2022 and the revenue of the online food delivery industry is projected to grow 11% in 2025.

The government is taking measures to curb single-use plastics, but these would need to be intensified to fully counteract the growth rates seen in food deliveries and other drivers. The demand for high-performance materials in new manufacturing industries is also a significant driver.

Will China’s emissions peak early or rebound?

After the third quarter of 2025, it is clear that the plateau or slow decline of China’s CO2 emissions that started in early 2024 continues.

Whether emissions increased or decreased marginally in the first three quarters of the year is too close to call, given the uncertainties involved, but a drop in full-year emissions became much more likely after September, which recorded an approximately 3% drop in emissions year-on-year.

Still, either a small increase or decrease in the calendar year of 2025 remains possible and will be ultimately be decided by developments in the fourth quarter.

China’s emissions from fossil-fuel use are highly likely to increase this year, with the increase of coal and oil use in the chemical industry outweighing the reductions in emissions from the power, metals, building materials and transportation sectors. This will be balanced out by a fall in cement process emissions.

What is already clear is that the 2025 carbon-intensity target will be missed, as it would have required absolute emission reductions of 4% or more this year, after slow progress during the earlier years of the five-year period.

This also means that the carbon-intensity target in the next 15th five-year plan for 2026-2030 would need to be more ambitious than the one that China missed during the current period, to close the shortfall to the country’s 2030 intensity target.

China targeted an 18% reduction in 2021-25, but will only have achieved around 12% by the end of this year. It would then need a reduction of around 22-24% in the next five years to achieve its headline climate commitment for 2030, a 65% carbon-intensity reduction on 2005 levels.

Whether emissions fall this year – or not – has high symbolic significance. Having committed to peaking emissions “before 2030”, China’s policymakers have left their specific peaking year open.

China’s new greenhouse gas emission target for 2035, announced by Xi in September, was set as a reduction of 7-10% below an undefined “peak level”, making it clear that policymakers are still planning for – or at least leaving the door open to – a late peak, only just before 2030.

Setting this target from “peak levels” means that the timing and level of China’s emissions peak affects not only the path of its CO2 output in the next few years, but also the size of cuts needed to meet the 2035 goal – and presumably also subsequent targets thereafter.

The target of reducing emissions from “peak levels” could also create an incentive for provinces to increase emissions before the expected peak year, known as “storming the peak” in Chinese.

This incentive could be curbed by the creation of the “dual control” system for carbon intensity and total carbon emissions. The Central Committee of the Communist Party recently reiterated that this should happen during the next five-year period, but the specific timeline is an open question.

If the system is not operational from 2026, with annual carbon intensity and possibly absolute carbon emission targets allocated to provinces, then that could further allow for and incentivise emissions increases in the short term.

At the same time, China has made commitments to peak emissions before 2030, reduce coal consumption gradually during the 2026-30 period and to reduce carbon emissions per unit of GDP by more than 65% by 2030, from 2005 levels.

Meeting the last target – which China has made internationally as part of its 2030 Paris pledge – would require, in practice, that emissions in 2030 are limited at or below their 2024 level, given progress to date and expected GDP growth rates.

Realising these targets, in turn, would require clean-energy growth rates well above the minimum of 200GW of new wind and solar capacity per year, set by China’s 2035 pledge – unless the rate of energy-demand growth sees a sharp and unexpected slowdown.

Beating these minimum clean-energy growth rates would also be necessary if policymakers want to maintain the tailwind that these sectors have provided to China’s economy in recent years.

About the data

Data for the analysis was compiled from the National Bureau of Statistics of China, National Energy Administration of China, China Electricity Council and China Customs official data releases, from WIND Information, an industry data provider, and Sinopec, China’s largest oil refiner.

Wind and solar output, and thermal power breakdown by fuel, was calculated by multiplying power generating capacity at the end of each month by monthly utilisation, using data reported by China Electricity Council through Wind Financial Terminal.

Total generation from thermal power and generation from hydropower and nuclear power was taken from National Bureau of Statistics monthly releases.

Monthly utilisation data was not available for biomass, so the annual average of 52% for 2023 was applied. Power sector coal consumption was estimated based on power generation from coal and the average heat rate of coal-fired power plants during each month, to avoid the issue with official coal consumption numbers affecting recent data.

CO2 emissions estimates are based on National Bureau of Statistics default calorific values of fuels and emissions factors from China’s latest national greenhouse gas emissions inventory, for the year 2021. Cement CO2 emissions factor is based on annual estimates up to 2024.

For oil consumption, apparent consumption of transport fuels (diesel, petrol and jet fuel) is taken from Sinopec quarterly results, with monthly disaggregation based on production minus net exports. The consumption of these three fuels is labeled as oil product consumption in transportation, as it is the dominant sector for their use.

Apparent consumption of other oil products is calculated from refinery throughput, with the production of the transport fuels and the net exports of other oil products subtracted. Fossil-fuel consumption includes non-energy use, as most products are short-lived and incineration is the dominant disposal method.

The post Analysis: China’s CO2 emissions have now been flat or falling for 18 months appeared first on Carbon Brief.

Analysis: China’s CO2 emissions have now been flat or falling for 18 months

Greenhouse Gases

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

We handpick and explain the most important stories at the intersection of climate, land, food and nature over the past fortnight.

This is an online version of Carbon Brief’s fortnightly Cropped email newsletter.

Subscribe for free here.

Key developments

Food inflation on the rise

DELUGE STRIKES FOOD: Extreme rainfall and flooding across the Mediterranean and north Africa has “battered the winter growing regions that feed Europe…threatening food price rises”, reported the Financial Times. Western France has “endured more than 36 days of continuous rain”, while farmers’ associations in Spain’s Andalusia estimate that “20% of all production has been lost”, it added. Policy expert David Barmes told the paper that the “latest storms were part of a wider pattern of climate shocks feeding into food price inflation”.

-

Sign up to Carbon Brief’s free “Cropped” email newsletter. A fortnightly digest of food, land and nature news and views. Sent to your inbox every other Wednesday.

NO BEEF: The UK’s beef farmers, meanwhile, “face a double blow” from climate change as “relentless rain forces them to keep cows indoors”, while last summer’s drought hit hay supplies, said another Financial Times article. At the same time, indoor growers in south England described a 60% increase in electricity standing charges as a “ticking timebomb” that could “force them to raise their prices or stop production, which will further fuel food price inflation”, wrote the Guardian.

‘TINDERBOX’ AND TARIFFS: A study, covered by the Guardian, warned that major extreme weather and other “shocks” could “spark social unrest and even food riots in the UK”. Experts cited “chronic” vulnerabilities, including climate change, low incomes, poor farming policy and “fragile” supply chains that have made the UK’s food system a “tinderbox”. A New York Times explainer noted that while trade could once guard against food supply shocks, barriers such as tariffs and export controls – which are being “increasingly” used by politicians – “can shut off that safety valve”.

El Niño looms

NEW ENSO INDEX: Researchers have developed a new index for calculating El Niño, the large-scale climate pattern that influences global weather and causes “billions in damages by bringing floods to some regions and drought to others”, reported CNN. It added that climate change is making it more difficult for scientists to observe El Niño patterns by warming up the entire ocean. The outlet said that with the new metric, “scientists can now see it earlier and our long-range weather forecasts will be improved for it.”

WARMING WARNING: Meanwhile, the US Climate Prediction Center announced that there is a 60% chance of the current La Niña conditions shifting towards a neutral state over the next few months, with an El Niño likely to follow in late spring, according to Reuters. The Vibes, a Malaysian news outlet, quoted a climate scientist saying: “If the El Niño does materialise, it could possibly push 2026 or 2027 as the warmest year on record, replacing 2024.”

CROP IMPACTS: Reuters noted that neutral conditions lead to “more stable weather and potentially better crop yields”. However, the newswire added, an El Niño state would mean “worsening drought conditions and issues for the next growing season” to Australia. El Niño also “typically brings a poor south-west monsoon to India, including droughts”, reported the Hindu’s Business Line. A 2024 guest post for Carbon Brief explained that El Niño is linked to crop failure in south-eastern Africa and south-east Asia.

News and views

- DAM-AG-ES: Several South Korean farmers filed a lawsuit against the country’s state-owned utility company, “seek[ing] financial compensation for climate-related agricultural damages”, reported United Press International. Meanwhile, a national climate change assessment for the Philippines found that the country “lost up to $219bn in agricultural damages from typhoons, floods and droughts” over 2000-10, according to Eco-Business.

- SCORCHED GRASS: South Africa’s Western Cape province is experiencing “one of the worst droughts in living memory”, which is “scorching grass and killing livestock”, said Reuters. The newswire wrote: “In 2015, a drought almost dried up the taps in the city; farmers say this one has been even more brutal than a decade ago.”

- NOUVELLE VEG: New guidelines published under France’s national food, nutrition and climate strategy “urged” citizens to “limit” their meat consumption, reported Euronews. The delayed strategy comes a month after the US government “upended decades of recommendations by touting consumption of red meat and full-fat dairy”, it noted.

- COURTING DISASTER: India’s top green court accepted the findings of a committee that “found no flaws” in greenlighting the Great Nicobar project that “will lead to the felling of a million trees” and translocating corals, reported Mongabay. The court found “no good ground to interfere”, despite “threats to a globally unique biodiversity hotspot” and Indigenous tribes at risk of displacement by the project, wrote Frontline.

- FISH FALLING: A new study found that fish biomass is “falling by 7.2% from as little as 0.1C of warming per decade”, noted the Guardian. While experts also pointed to the role of overfishing in marine life loss, marine ecologist and study lead author Dr Shahar Chaikin told the outlet: “Our research proves exactly what that biological cost [of warming] looks like underwater.”

- TOO HOT FOR COFFEE: According to new analysis by Climate Central, countries where coffee beans are grown “are becoming too hot to cultivate them”, reported the Guardian. The world’s top five coffee-growing countries faced “57 additional days of coffee-harming heat” annually because of climate change, it added.

Spotlight

Nature talks inch forward

This week, Carbon Brief covers the latest round of negotiations under the UN Convention on Biological Diversity (CBD), which occurred in Rome over 16-19 February.

The penultimate set of biodiversity negotiations before October’s Conference of the Parties ended in Rome last week, leaving plenty of unfinished business.

The CBD’s subsidiary body on implementation (SBI) met in the Italian capital for four days to discuss a range of issues, including biodiversity finance and reviewing progress towards the nature targets agreed under the Kunming-Montreal Global Biodiversity Framework (GBF).

However, many of the major sticking points – particularly around finance – will have to wait until later this summer, leaving some observers worried about the capacity for delegates to get through a packed agenda at COP17.

The SBI, along with the subsidiary body on scientific, technical and technological advice (SBSTTA) will both meet in Nairobi, Kenya, later this summer for a final round of talks before COP17 kicks off in Yerevan, Armenia, on 19 October.

Money talks

Finance for nature has long been a sticking point at negotiations under the CBD.

Discussions on a new fund for biodiversity derailed biodiversity talks in Cali, Colombia, in autumn 2024, requiring resumed talks a few months later.

Despite this, finance was barely on the agenda at the SBI meetings in Rome. Delegates discussed three studies on the relationship between debt sustainability and implementation of nature plans, but the more substantive talks are set to take place at the next SBI meeting in Nairobi.

Several parties “highlighted concerns with the imbalance of work” on finance between these SBI talks and the next ones, reported Earth Negotiations Bulletin (ENB).

Lim Li Ching, senior researcher at Third World Network, noted that tensions around finance permeated every aspect of the talks. She told Carbon Brief:

“If you’re talking about the gender plan of action – if there’s little or no financial resources provided to actually put it into practice and implement it, then it’s [just] paper, right? Same with the reporting requirements and obligations.”

Monitoring and reporting

Closely linked to the issue of finance is the obligations of parties to report on their progress towards the goals and targets of the GBF.

Parties do so through the submission of national reports.

Several parties at the talks pointed to a lack of timely funding for driving delays in their reporting, according to ENB.

A note released by the CBD Secretariat in December said that no parties had submitted their national reports yet; by the time of the SBI meetings, only the EU had. It further noted that just 58 parties had submitted their national biodiversity plans, which were initially meant to be published by COP16, in October 2024.

Linda Krueger, director of biodiversity and infrastructure policy at the environmental not-for-profit Nature Conservancy, told Carbon Brief that despite the sparse submissions, parties are “very focused on the national report preparation”. She added:

“Everybody wants to be able to show that we’re on the path and that there still is a pathway to getting to 2030 that’s positive and largely in the right direction.”

Watch, read, listen

NET LOSS: Nigeria’s marine life is being “threatened” by “ghost gear” – nets and other fishing equipment discarded in the ocean – said Dialogue Earth.

COMEBACK CAUSALITY: A Vox long-read looked at whether Costa Rica’s “payments for ecosystem services” programme helped the country turn a corner on deforestation.

HOMEGROWN GOALS: A Straits Times podcast discussed whether import-dependent Singapore can afford to shelve its goal to produce 30% of its food locally by 2030.

‘RUSTING’ RIVERS: The Financial Times took a closer look at a “strange new force blighting the [Arctic] landscape”: rivers turning rust-orange due to global warming.

New science

- Lakes in the Congo Basin’s peatlands are releasing carbon that is thousands of years old | Nature Geoscience

- Natural non-forest ecosystems – such as grasslands and marshlands – were converted for agriculture at four times the rate of land with tree cover between 2005 and 2020 | Proceedings of the National Academy of Sciences

- Around one-quarter of global tree-cover loss over 2001-22 was driven by cropland expansion, pastures and forest plantations for commodity production | Nature Food

In the diary

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean | Brasília

- 5 March: Nepal general elections

- 9-20 March: First part of the thirty-first session of the International Seabed Authority (ISA) | Kingston, Jamaica

Cropped is researched and written by Dr Giuliana Viglione, Aruna Chandrasekhar, Daisy Dunne, Orla Dwyer and Yanine Quiroz.

Please send tips and feedback to cropped@carbonbrief.org

The post Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate appeared first on Carbon Brief.

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

Greenhouse Gases

Dangerous heat for Tour de France riders only a ‘question of time’

Rising temperatures across France since the mid-1970s is putting Tour de France competitors at “high risk”, according to new research.

The study, published in Scientific Reports, uses 50 years of climate data to calculate the potential heat stress that athletes have been exposed to across a dozen different locations during the world-famous cycling race.

The researchers find that both the severity and frequency of high-heat-stress events have increased across France over recent decades.

But, despite record-setting heatwaves in France, the heat-stress threshold for safe competition has rarely been breached in any particular city on the day the Tour passed through.

(This threshold was set out by cycling’s international governing body in 2024.)

However, the researchers add it is “only a question of time” until this occurs as average temperatures in France continue to rise.

The lead author of the study tells Carbon Brief that, while the race organisers have been fortunate to avoid major heat stress on race days so far, it will be “harder and harder to be lucky” as extreme heat becomes more common.

‘Iconic’

The Tour de France is one of the world’s most storied cycling races and the oldest of Europe’s three major multi-week cycling competitions, or Grand Tours.

Riders cover around 3,500 kilometres (km) of distance and gain up to nearly 55km of altitude over 21 stages, with only two or three rest days throughout the gruelling race.

The researchers selected the Tour de France because it is the “iconic bike race. It is the bike race of bike races,” says Dr Ivana Cvijanovic, a climate scientist at the French National Research Institute for Sustainable Development, who led the new work.

Heat has become a growing problem for the competition in recent years.

In 2022, Alexis Vuillermoz, a French competitor, collapsed at the finish line of the Tour’s ninth stage, leaving in an ambulance and subsequently pulling out of the race entirely.

Two years later, British cyclist Sir Mark Cavendish vomited on his bike during the first stage of the race after struggling with the 36C heat.

The Tour also makes a good case study because it is almost entirely held during the month of July and, while the route itself changes, there are many cities and stages that are repeated from year to year, Cvijanovic adds.

‘Have to be lucky’

The study focuses on the 50-year span between 1974 and 2023.

The researchers select six locations across the country that have commonly hosted the Tour, from the mountain pass of Col du Tourmalet, in the French Pyrenees, to the city of Paris – where the race finishes, along the Champs-Élysées.

These sites represent a broad range of climatic zones: Alpe d’ Huez, Bourdeaux, Col du Tourmalet, Nîmes, Paris and Toulouse.

For each location, they use meteorological reanalysis data from ERA5 and radiant temperature data from ERA5-HEAT to calculate the “wet-bulb globe temperature” (WBGT) for multiple times of day across the month of July each year.

WBGT is a heat-stress index that takes into account temperature, humidity, wind speed and direct sunlight.

Although there is “no exact scientific consensus” on the best heat-stress index to use, WBGT is “one of the rare indicators that has been originally developed based on the actual human response to heat”, Cvijanovic explains.

It is also the one that the International Cycling Union (UCI) – the world governing body for sport cycling – uses to assess risk. A WBGT of 28C or higher is classified as “high risk” by the group.

WBGT is the “gold standard” for assessing heat stress, says Dr Jessica Murfree, director of the ACCESS Research Laboratory and assistant professor at the University of North Carolina at Chapel Hill.

Murfree, who was not involved in the new study, adds that the researchers are “doing the right things by conducting their science in alignment with the business practices that are already happening”.

The researchers find that across the 50-year time period, WBGT has been increasing across the entire country – albeit, at different rates. In the north-west of the country, WBGT has increased at an average rate of 0.1C per decade, while in the southern and eastern parts of the country, it has increased by more than 0.5C per decade.

The maps below show the maximum July WBGT for each decade of the analysis (rows) and for hourly increments of the late afternoon (columns). Lower temperatures are shown in lighter greens and yellows, while higher temperatures are shown in darker reds and purples.

Six Tour de France locations analysed in the study are shown as triangles on the maps (clockwise from top): Paris, Alpe d’ Huez, Nîmes, Toulouse, Col du Tourmalet and Bordeaux.

The maps show that the maximum WBGT temperature in the afternoon has surpassed 28C over almost the entire country in the last decade. The notable exceptions to this are the mountainous regions of the Alps and the Pyrenees.

The researchers also find that most of the country has crossed the 28C WBGT threshold – which they describe as “dangerous heat levels” – on at least one July day over the past decade. However, by looking at the WBGT on the day the Tour passed through any of these six locations, they find that the threshold has rarely been breached during the race itself.

For example, the research notes that, since 1974, Paris has seen a WBGT of 28C five times at 3pm in July – but that these events have “so far” not coincided with the cycling race.

The study states that it is “fortunate” that the Tour has so far avoided the worst of the heat-stress.

Cvijanovic says the organisers and competitors have been “lucky” to date. She adds:

“It has worked really well for them so far. But as the frequency of these [extreme heat] events is increasing, it will be harder and harder to be lucky.”

Dr Madeleine Orr, an assistant professor of sport ecology at the University of Toronto who was not involved in the study, tells Carbon Brief that the paper was “really well done”, noting that its “methods are good [and its] approach was sound”. She adds:

“[The Tour has] had athletes complain about [the heat]. They’ve had athletes collapse – and still those aren’t the worst conditions. I think that that says a lot about what we consider safe. They’ve still been lucky to not see what unsafe looks like, despite [the heat] having already had impacts.”

Heat safety protocols

In 2024, the UCI set out its first-ever high temperature protocol – a set of guidelines for race organisers to assess athletes’ risk of heat stress.

The assessment places the potential risk into one of five categories based on the WBGT, ranging from very low to high risk.

The protocol then sets out suggested actions to take in the event of extreme heat, ranging from having athletes complete their warm-ups using ice vests and cold towels to increasing the number of support vehicles providing water and ice.

If the WBGT climbs above the 28C mark, the protocol suggests that organisers modify the start time of the stage, adapt the course to remove particularly hazardous sections – or even cancel the race entirely.

However, Orr notes that many other parts of the race, such as spectator comfort and equipment functioning, may have lower temperatures thresholds that are not accounted for in the protocol, but should also be considered.

Murfree points out that the study’s findings – and the heat protocol itself – are “really focused on adaptation, rather than mitigation”. While this is “to be expected”, she tells Carbon Brief:

“Moving to earlier start times or adjusting the route specifically to avoid these locations that score higher in heat stress doesn’t stop the heat stress. These aren’t climate preventative measures. That, I think, would be a much more difficult conversation to have in the research because of the Tour de France’s intimate relationship with fossil-fuel companies.”

The post Dangerous heat for Tour de France riders only a ‘question of time’ appeared first on Carbon Brief.

Dangerous heat for Tour de France riders only a ‘question of time’

Greenhouse Gases

DeBriefed 20 February 2026: EU’s ‘3C’ warning | Endangerment repeal’s impact on US emissions | ‘Tree invasion’ fuelled South America’s fires

Welcome to Carbon Brief’s DeBriefed.

An essential guide to the week’s key developments relating to climate change.

This week

Preparing for 3C

NEW ALERT: The EU’s climate advisory board urged countries to prepare for 3C of global warming, reported the Guardian. The outlet quoted Maarten van Aalst, a member of the advisory board, saying that adapting to this future is a “daunting task, but, at the same time, quite a doable task”. The board recommended the creation of “climate risk assessments and investments in protective measures”.

‘INSUFFICIENT’ ACTION: EFE Verde added that the advisory board said that the EU’s adaptation efforts were so far “insufficient, fragmented and reactive” and “belated”. Climate impacts are expected to weaken the bloc’s productivity, put pressure on public budgets and increase security risks, it added.

UNDERWATER: Meanwhile, France faced “unprecedented” flooding this week, reported Le Monde. The flooding has inundated houses, streets and fields and forced the evacuation of around 2,000 people, according to the outlet. The Guardian quoted Monique Barbut, minister for the ecological transition, saying: “People who follow climate issues have been warning us for a long time that events like this will happen more often…In fact, tomorrow has arrived.”

IEA ‘erases’ climate

MISSING PRIORITY: The US has “succeeded” in removing climate change from the main priorities of the International Energy Agency (IEA) during a “tense ministerial meeting” in Paris, reported Politico. It noted that climate change is not listed among the agency’s priorities in the “chair’s summary” released at the end of the two-day summit.

US INTERVENTION: Bloomberg said the meeting marked the first time in nine years the IEA failed to release a communique setting out a unified position on issues – opting instead for the chair’s summary. This came after US energy secretary Chris Wright gave the organisation a one-year deadline to “scrap its support of goals to reduce energy emissions to net-zero” – or risk losing the US as a member, according to Reuters.

Around the world

- ISLAND OBJECTION: The US is pressuring Vanuatu to withdraw a draft resolution supporting an International Court of Justice ruling on climate change, according to Al Jazeera.

- GREENLAND HEAT: The Associated Press reported that Greenland’s capital Nuuk had its hottest January since records began 109 years ago.

- CHINA PRIORITIES: China’s Energy Administration set out its five energy priorities for 2026-2030, including developing a renewable energy plan, said International Energy Net.

- AMAZON REPRIEVE: Deforestation in the Brazilian Amazon has continued to fall into early 2026, extending a downward trend, according to the latest satellite data covered by Mongabay.

- GEZANI DESTRUCTION: Reuters reported the aftermath of the Gezani cyclone, which ripped through Madagascar last week, leaving 59 dead and more than 16,000 displaced people.

20cm

The average rise in global sea levels since 1901, according to a Carbon Brief guest post on the challenges in projecting future rises.

Latest climate research

- Wildfire smoke poses negative impacts on organisms and ecosystems, such as health impacts on air-breathing animals, changes in forests’ carbon storage and coral mortality | Global Ecology and Conservation

- As climate change warms Antarctica throughout the century, the Weddell Sea could see the growth of species such as krill and fish and remain habitable for Emperor penguins | Nature Climate Change

- About 97% of South American lakes have recorded “significant warming” over the past four decades and are expected to experience rising temperatures and more frequent heatwaves | Climatic Change

(For more, see Carbon Brief’s in-depth daily summaries of the top climate news stories on Monday, Tuesday, Wednesday, Thursday and Friday.)

Captured

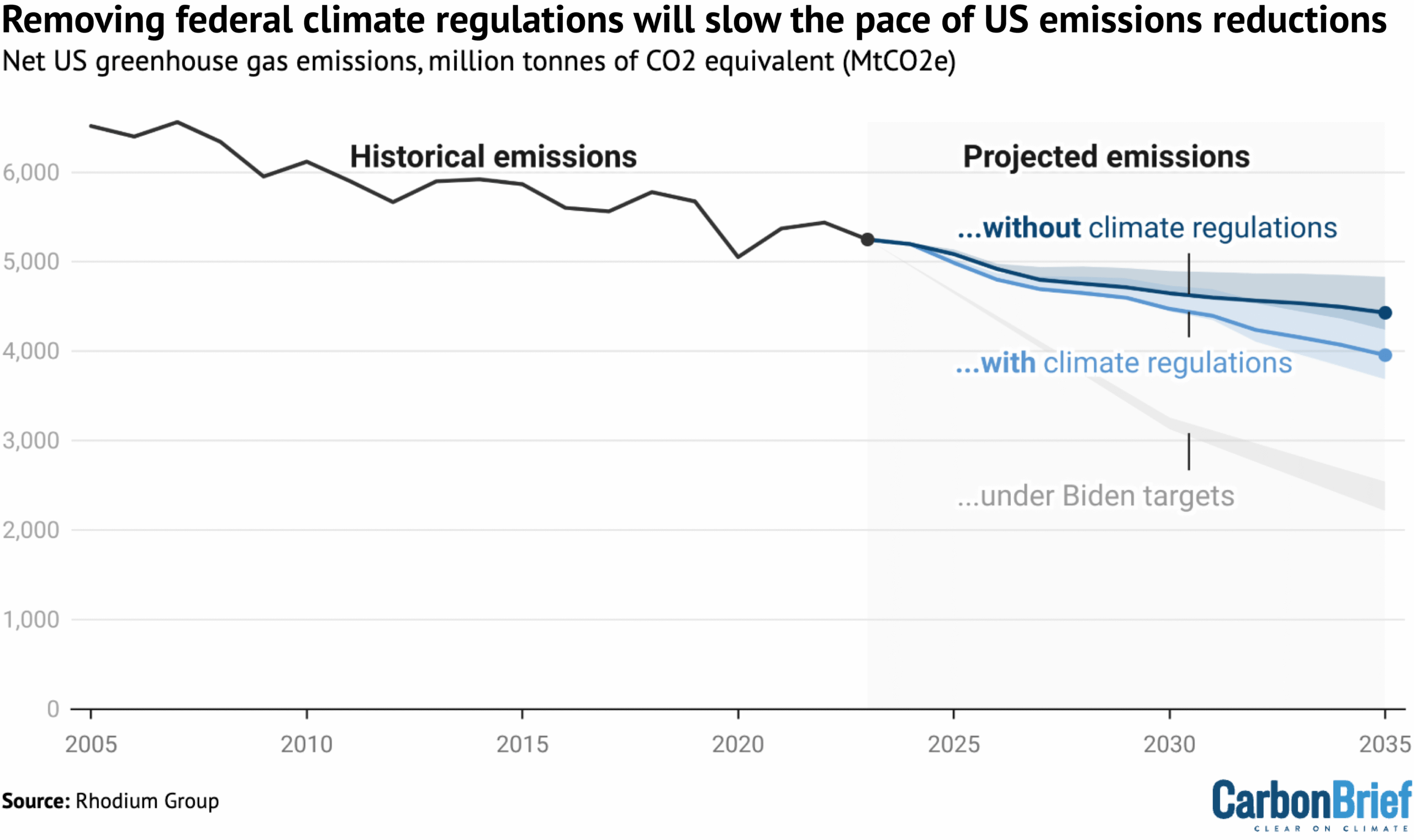

Repealing the US’s landmark “endangerment finding”, along with actions that rely on that finding, will slow the pace of US emissions cuts, according to Rhodium Group visualised by Carbon Brief. US president Donald Trump last week formally repealed the scientific finding that underpins federal regulations on greenhouse gas emissions, although the move is likely to face legal challenges. Data from the Rhodium Group, an independent research firm, shows that US emissions will drop more slowly without climate regulations. However, even with climate regulations, emissions are expected to drop much slower under Trump than under the previous Joe Biden administration, according to the analysis.

Spotlight

How a ‘tree invasion’ helped to fuel South America’s fires

This week, Carbon Brief explores how the “invasion” of non-native tree species helped to fan the flames of forest fires in Argentina and Chile earlier this year.

Since early January, Chile and Argentina have faced large-scale and deadly wildfires, including in Patagonia, which spans both countries.

These fires have been described as “some of the most significant and damaging in the region”, according to a World Weather Attribution (WWA) analysis covered by Carbon Brief.

In both countries, the fires destroyed vast areas of native forests and grasslands, displacing thousands of people. In Chile, the fires resulted in 23 deaths.

Multiple drivers contributed to the spread of the fires, including extended periods of high temperatures, low rainfall and abundant dry vegetation.

The WWA analysis concluded that human-caused climate change made these weather conditions at least three times more likely.

According to the researchers, another contributing factor was the invasion of non-native trees in the regions where the fires occurred.

The risk of non-native forests

In Argentina, the wildfires began on 6 January and persisted until the first week of February. They hit the city of Puerto Patriada and the Los Alerces and Lago Puelo national parks, in the Chubut province, as well as nearby regions.

In these areas, more than 45,000 hectares of native forests – such as Patagonian alerce tree, myrtle, coigüe and ñire – along with scrubland and grasslands, were consumed by the flames, according to the WWA study.

In Chile, forest fires occurred from 17 to 19 January in the Biobío, Ñuble and Araucanía regions.

The fires destroyed more than 40,000 hectares of forest and more than 20,000 hectares of non-native forest plantations, including eucalyptus and Monterey pine.

Dr Javier Grosfeld, a researcher at Argentina’s National Scientific and Technical Research Council (CONICET) in northern Patagonia, told Carbon Brief that these species, introduced to Patagonia for production purposes in the late 20th century, grow quickly and are highly flammable.

Because of this, their presence played a role in helping the fires to spread more quickly and grow larger.

However, that is no reason to “demonise” them, he stressed.

Forest management

For Grosfeld, the problem in northern Patagonia, Argentina, is a significant deficit in the management of forests and forest plantations.

This management should include pruning branches from their base and controlling the spread of non-native species, he added.

A similar situation is happening in Chile, where management of pine and eucalyptus plantations is not regulated. This means there are no “firebreaks” – gaps in vegetation – in place to prevent fire spread, Dr Gabriela Azócar, a researcher at the University of Chile’s Centre for Climate and Resilience Research (CR2), told Carbon Brief.

She noted that, although Mapuche Indigenous communities in central-south Chile are knowledgeable about native species and manage their forests, their insight and participation are not recognised in the country’s fire management and prevention policies.

Grosfeld stated:

“We are seeing the transformation of the Patagonian landscape from forest to scrubland in recent years. There is a lack of preventive forestry measures, as well as prevention and evacuation plans.”

Watch, read, listen

FUTURE FURNACE: A Guardian video explored the “unbearable experience of walking in a heatwave in the future”.

THE FUN SIDE: A Channel 4 News video covered a new wave of climate comedians who are using digital platforms such as TikTok to entertain and raise awareness.

ICE SECRETS: The BBC’s Climate Question podcast explored how scientists study ice cores to understand what the climate was like in ancient times and how to use them to inform climate projections.

Coming up

- 22-27 February: Ocean Sciences Meeting, Glasgow

- 24-26 February: Methane Mitigation Europe Summit 2026, Amsterdam, Netherlands

- 25-27 February: World Sustainable Development Summit 2026, New Delhi, India

Pick of the jobs

- The Climate Reality Project, digital specialist | Salary: $60,000-$61,200. Location: Washington DC

- Intergovernmental Panel on Climate Change (IPCC), science officer in the IPCC Working Group I Technical Support Unit | Salary: Unknown. Location: Gif-sur-Yvette, France

- Energy Transition Partnership, programme management intern | Salary: Unknown. Location: Bangkok, Thailand

DeBriefed is edited by Daisy Dunne. Please send any tips or feedback to debriefed@carbonbrief.org.

This is an online version of Carbon Brief’s weekly DeBriefed email newsletter. Subscribe for free here.

The post DeBriefed 20 February 2026: EU’s ‘3C’ warning | Endangerment repeal’s impact on US emissions | ‘Tree invasion’ fuelled South America’s fires appeared first on Carbon Brief.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits