In a recent post, California IS Different, But It’s Not TOO Different, I drew the distinction between the urbane sophistication of the state’s coastal region and the rural regions in its interior.

In a recent post, California IS Different, But It’s Not TOO Different, I drew the distinction between the urbane sophistication of the state’s coastal region and the rural regions in its interior.

As one may expect, there is a huge chasm in terms of politics between the two areas. Yes, California is a blue state, and Trump lost the 2024 presidential election to Harris by about 20%, but 20 points is actually fairly close compared to the thumping he gave Harris in the red states that he won by considerable landslides (see map).

Fortunately, California has masses of well-educated people in the counties adjacent to the Pacific Ocean who are generally quite liberal in their thinking. Yes, there are a growing number of ranchers in the state’s eastern parts, but, for now at least, they’re far outnumbered by the folks fighting the traffic jams and ridiculous real estate prices in IT, entertainment, defense, insurance, professional services, manufacturing, healthcare, and banking.

Renewable Energy

Inside Wind Turbine Insurance with Nathan Davies

Weather Guard Lightning Tech

Inside Wind Turbine Insurance with Nathan Davies

Allen and Joel are joined by Nathan Davies from Lloyd Warwick to discuss the world of wind energy insurance. Topics include market cycles, the risks of insuring larger turbines, how critical spares can reduce downtime and costs, why lightning claims often end up with insurers rather than OEMs, and how AI may transform claims data analysis.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining light on wind. Energy’s brightest innovators. This is the Progress Powering tomorrow.

Allen Hall: Nathan, welcome to the program. Thank you for having me. So you are, you’re our link to the insurance world, Nathan, and there’s been so many changes over the past 12, 24 months, uh, not just in the United States but worldwide. Before we get too deep into any one subject, can you just give us a top level like, Hey, this is what’s happening in the insurance world that we need to know.

So there’s

Nathan Davies: obviously a lot of scope, a lot of development, um, in the wind world. Um, you know, there’s the race to scale. Um, and from an insurance perspective, I think everybody’s pretty tentative about where that’s going. Um. You know, the, the theory that are we trying to [00:01:00] run before we can walk? Um, what’s gonna happen when these things inevitably go wrong?

Uh, and what are the costs gonna be that are associated with that? ’cause, you know, at the moment we are used to, to claims on turbines that are circa five megawatts. But when we start seeing 15 megawatt turbines falling over. Yeah, it’s, it’s not gonna be a good day at the office. So, um, in the insurance world, that’s the big concern.

Certainly from a win perspective at least.

Joel Saxum: Well, I think it’s, it’s a valid, uh, I don’t know, valid bad, dream. Valid, valid risk to be worried about. Well, just simply because of like the, the way, uh, so I’ve been following or been a part of the, that side of the industry for a little while here the last five, six years.

Um. You’ve seen The insurance world is young in renewables, to be honest with you. Right. Compared to a lot of other places that like say the Lord Lloyd’s market, they’ve been writing insurance for hundreds of years on certain [00:02:00] things that have, like, we kind of know, we know what the risks are. We, and if it develops something new, it’s not crazily new, but renewables and in wind in specific haven’t been around that long.

And the early stuff was like, like you said, right? If a one megawatt turbine goes down, like. That sucks. Yeah. For everybody, right? But it’s not the end of the world. We can, we can make this thing happen. You’re talking, you know, you may have a, you know, your million, million and a half dollars here, $2 million here for a complete failure.

And then the business interruption costs as a, you know, with a one megawatt producing machine isn’t, again, it’s not awesome, but it’s not like it, uh, it doesn’t break the books. Right. But then when we’re talking 3, 4, 5, 6. Seven megawatts. We just saw Siemens cesa sell the first of their seven megawatt onshore platforms the other day.

Um, that is kind of changing the game and heightening the risk and makes things a little bit more worrisome, especially in light of, I mean, as we scaled just the last five, [00:03:00] 10 years, the amount of. Failures that have been happening. So if you look at that and you start expanding it, that, that, that hockey stick starts to grow.

Nathan Davies: Yeah, yeah, of course. And you know, we, we all know that these things sort of happen in cycles, right? It’s, you go, I mean, in, in the insurance world, we go through soft markets. We go through hard markets, um, you know, deductibles come up, the, the clauses, the restrictions, all those things get tighter. Claims reduce.

Um, and then you get sort of disruptors come into the market and they start bringing in, you know, challenging rates and they start challenging the big players on deductibles and preferential rates and stuff like that. And, and then you get a softening of the market, um, and then you start seeing the claims around up again.

But when you twin that with the rate of development that we see in the renewables worlds, it’s, it’s fraught for all sorts of. Weird and wonderful things happening, and most of them are quite expensive.

Joel Saxum: Where in that cycle are we, in [00:04:00] your opinion right now? So we, like when I first came into the market and I started dealing with insurance, it was very, we kept hearing hardening, market hardening, market hardening market.

But not too long ago, I heard from someone else that was like, Hey, the market’s actually getting kind of soft right now. What are your thoughts on that? And, and or may, and maybe we let, let’s precursor that there’s a lot of people that are listening right now that don’t know the difference. What is a hard market?

What is a soft market? Can you give us that first?

Nathan Davies: When you’re going through a soft market, it’s, it’s a period where they’ve either been, um, a limited volume of claims or the claim values have been quite small. Um, so, you know, everybody gets. It’s almost like becoming complacent with it, right? It’s like, oh, you know, things are going pretty well.

We’re having it. It looks like the operators, it looks like the maintainers are, are doing a pretty good job and they know all of the issues that are gonna be working through in the lifetime of these products. So for the next however many years, we can anticipate that things are gonna gonna go pretty well.

But as you see those [00:05:00] deductibles come down, you start getting more of the attritional claims, like the smaller values, um, the smaller downtime periods, all that sort of thing, start coming in as claims. And all of a sudden insurers are like, well, hang on a second. All of a sudden we’ve got loads and loads of claims coming in.

Um. All of the premium that we were taking as being bled dry by, by these, these attritional claim. Um, and then you get like a big claim coming. You get a major issue come through, whether it’s, you know, a, a serial issue with a gearbox or a generator or a specific blade manufacturer, and all of a sudden the market starts to change.

Um, and insurers are like, well, hang on a second. We’ve got a major problem on our hands here. We’re starting to see more of this, this specific piece of technology being rolled out, um, worldwide. Um, we are in for a lot of potential claims on this specific matter in the future, and therefore we need to protect ourselves.

And the way that insurers do that is by [00:06:00] increasing or deductibles, um, increasing their premiums, all that sort of thing. So it’s basically that. Uh, raises the threshold at which a claim can be presented and therefore minimizes the, the outlay for insurers. So that’s sort of this, this cycle that we see. Um, I mean, I can’t, I’ve, I’ve only been in loss adjusting for six years, so I can’t say that I’ve seen, you know, um, multiple cycles.

I’ve, I’m probably at the end of my first cycle from a hardening to a softening market. Um. But also, again, I’m not in the underwriting side of things. I’m on the claims side of things, so I own, I’m only seeing it when it’s gone wrong. I don’t know about everything else that the insurance market sees.

Joel Saxum: Yeah, the, the softening part, I think as well from a macro perspective, when there’s a softening market, it tends to bring in more capital.

Right. You start to see more, more and more companies coming in saying, Hey, I’ve got, [00:07:00] and when I say companies, I mean other capital holders to beat for insurance, right? Like these, the big ones you see, the big Swiss and German guys come in and going, like, I got, I got $500 million I’ll throw into renewables.

It seems like to be a good, pretty good bet right now. And then the market starts to change and then they go, uh, oops. Yeah.

Nathan Davies: And that’s it. You know, you’ve got the, the StoreWatch of the renewable insurance market like your G cubes and, and companies like that who’ve been in the game for a very long time.

They’ve got a lot of experience. They’ve been burned. Um, they know what they want to touch and what they don’t want to touch. And then you get. Renewables, everybody wants to be involved. It covers their ESG targets. It’s, it’s a good look to move away from, you know, your, your oil and your coal and all the rest of it.

So, of course, companies are gonna come into it. Um, and if they’re not experienced.

Allen Hall: They will get banned. How much reliance do operators have at the moment on insurance? Because it does seem like, uh, Joel and I talk [00:08:00]to a lot of operators that insurance is part of their annual revenue. They depend upon getting paid a certain amount, which then opens up the door to how sort of nitpicky I’ll describe it as the claim.

They’ll file. Are you seeing more and more of that as, uh, some of the operators are struggling for cash flow, that there are going after more kind of questionable claims? Um, I think it depends on

Nathan Davies: the size of the operator. So you’ve, you’ve obviously got your, your big players, you’ve got your alls and your rws and all of those sort of guys who, the way that they manage their insurance, they’ve probably got, you know, special purpose vehicles.

They’ve got, um, sites or clusters of sites that they manage finances independently. They don’t just have the one big or pot. It’s, it’s, it’s managed sort of subdivisions. Um. Those, those guys, we don’t typically tend to see like a big push for a [00:09:00] payment on account partway through a claim. It’s, it’s typically sort of the smaller end of the scale where you might have, um, an operator that manages a handful of smaller, um, assets.

The way that we look at it is if you don’t ask, you don’t get, so when we talk to an insured, it’s like. Present your costs, you know, we’ll review them and it’s, it’s better that you present all of your costs and insurers turn around and say, you’re not eligible for this. You know, that that element of it will be adjusted, um, rather than not present something.

And it’s like, well, you know, your, your broker then comes further down the line when they say you could have claimed that element of, of the cost. So, um. Typically that’s the approach that we take is, is present everything and we’ll work through and let you know which elements aren’t claimable.

Joel Saxum: When we’re talking insurance policies, there can be, you know, like an operator, an owner of a turbine asset can have them.

Then there is construction policies and [00:10:00] there’s the EPC company might have a policy and ISP may have a policy. So, so many policies because at the end of the day, everybody’s trying to protect themselves. Like, we’re trying to protect the bottom line. Tr that’s what insurance us for, that’s why we’re here.

Um, but so, so, so, so gimme a couple things. Like in your opinion as, let’s look, well, I wanna stay in the operator camp right now, say, during a non non-commission policy, a actual operating policy, wind farm is in the ground, we’re moving along. What are some of the things that, from an, from a loss adjuster’s perspective, that a operator should be doing to protect themselves?

I mean, besides. Signing an insurance contract. Yes. But is it, is it good record keeping? Is it having spares on site? Is it, what does that look like from your perspective when you walk into something,

Nathan Davies: if you were to take the insurer’s dream operator, that would be somebody who, and you, you’ve kind of hit the nail on the head with a lot of those points, Joel, the, the.

The golden [00:11:00] operator would have like a stash of critical spares because the last thing they want to be relying on is, um, an OEM who, you know, they, they’ve, they’ve stopped manufacturing that bit of kit three years ago. They now want to sell you the latest and greatest. It’s 18 months lead time or something like that.

Oh yeah, absolutely. And so you are now having to look at potentially refurbishment through. Whether that’s through sort of approved, um, processes or not. Um, you might be looking at, um, sort of, um, aftermarket providers. You know, there, there’s, as soon as you are looking at an aged asset, you are, you are in a really complicated position in terms of your repairability.

Um, because, you know, a as we know, you get to sort of that three, five year period after you’ve purchased the product, you’re in real jeopardy of whether or not it’s gonna be. Gonna have that continued support from the original equipment manufacturer. So [00:12:00] critical spares is a really good thing to, it’s, it’s just obviously a really good thing to have.

Um, and how you can manage that as well is if you have, um, a customer of sites that are all using the, the same equipment, you could sort of share that between you. There, there could be. Um, so we, we’ve sinned that where, um. An umbrella company has multiple sites, multiple SPVs. Um, they were all constructed at the same sort of time.

They’ve got the same transformers, you know, the same switchgear, same infrastructure, and they hold a set of spares that cover these, all these sites. ’cause the last thing you want to do is buy a load of individual components for one site. You are then paying to maintain them, to store them to, you know, there’s, there’s a lot of costs that come with.

Along with that, that you, you don’t wanna be covering. If that’s just for the one site and it’s the [00:13:00] eventualities, that may never happen. So if you’ve got multiple sites and you can spread those costs, all of a sudden it’s a lot more, um. Could

Joel Saxum: you see a reality where insurers did that? Right? Where like a, like a, like a consortium of insurance companies gets together and buys, uh, half a dozen sets of blades and generators and stuff that they know are failures that come up, or they have a pool to pull from themselves to, to avoid these massive bi claims.

Nathan Davies: Yeah. I mean maybe there’s, maybe there’s the potential for a renewables pool. I mean, it’s always. Complicated. As soon as you start trying to bring sort of multiple companies together with an agreement of that sort of scale, it’s gonna be challenging. But, um, I mean, yeah, in an ideal world, that would be be a great place to be.

Um, so critical spares is, that’s, that’s a key thing we, we have seen. So we, we’ve got, um, one account that we work with that they’ve actually got a warehouse full of critical spares. [00:14:00] So they, they have a lot of, um, older turbine models, um, sort of typically, um, 2015 through to, well, yeah, from about 2012 to 2015.

Um, these sites were commissioned so they knew there was a, a finite lifetime, uh, replacement blades, generators, gear, boxes, what have you, and it’s like we’ve. A huge number of assets. So what we should do is retain certainly a number of gearboxes and generators that you, we can utilize across, um, the fleet.

And obviously they then keep a rolling stock of refurbishment and repairs on those. But they, they basically included in their, their premium spreadsheet, they’ve got all of their individual sites. Then they’ve got a warehouse that is full of all their spares, and that is an inuring asset, is their warehouse full of critical spares.

Joel Saxum: So what

Nathan Davies: happens to

Joel Saxum: that

Nathan Davies: person then? Does

Joel Saxum: their premiums go [00:15:00] down? Because they have those spares, they’ve got really low deductibles on their bi. So there’s a business case for it probably, right? Like if you’re sitting there, if you’re, if you’re, you’re an accountant, you can figure that out and say like, if we hold these spares for this fleet, like if you’re, if you’re a fleet, if you have a homogenous fleet, say you’ve got a thousand turbines that are basically all the same model.

W you should have centrally located amongst those wind farms, a couple of blade sets, a couple of generators, couple of pitch bearings, couple of this, couple of that. And you can use them operationally if you need to, but it’s there as spares, uh, for insurance cases. ’cause you’ll be able to re reduce your insurance premiums or your insurance deductibles.

Allen Hall: That’s remarkable. I don’t know a lot of operators in, at least in the United States that have done that, I’m thinking more of like Australia where it’s hard to get. Parts, uh, you, you probably do have a little bit of a warehouse situation. That’s really interesting because I, I know a lot of operators are thinking about trying to reduce their premiums and simple things like that would, I would imagine it make a huge difference [00:16:00] in what they’re paying each year and that that’s a smart move.

I, I wanna ask about the IEC and the role of certification in premiums. What does it mean and how do you look at it as an industry? Uh, one of the things that’s happening right now is there’s a number of, I think some of the major IEC documents in, in our world, in the lightning world are going through revision.

Does that, how do, how do you assess that risk that the IEC specs or the sort of the gold standard and you have the certification bodies that are using them to show that the turbines are fit for purpose. Is there a reliance upon them? Does, does it help reduce premiums if there’s an I-E-C-I-I, I’m not even sure how the industry, the insurance industry looks at it.

Or is it more of how the turbines perform in the first year or two, is how, what’s gonna really gonna drive the premium numbers? I mean, insofar as

Nathan Davies: I eecs, it’s, that’s a really tough question. It’s, it’s [00:17:00]interesting that you ask that. ’cause um, I mean certainly from the lightning perspective, the, the IEC. We look at on that the blades need to withstand a lightning strike of a known value, but even within that, they, within the IEC, there’s an allowance of like 2%, I think, um, for blade strikes that can still cause damage even if they’re within the rate of capacity of the LPS.

Um, so in the insurance world, this is a big gray area because each, um, operator has a, a turbine, uh, has a blade failure because of a lightning strike. They’ll then immediately go to the OEM and say, um, you know, we’ve had had a lightning strike, we’ve had a blade failure. Can you come and repair or replace the blade?

Sure, no bother. Um, down the line, we have an insurance claim for this repair or replacement. And insurers are like, well, what’s the lightning data? And if that’s within the [00:18:00] LPS standard, it’s like, well, why have. Why is this not covered under warranty? And, you know, you, your OEMs will always turn around and say, force majeure.

Um, it’s, it’s that 2%. So the IEC, even though that’s, you know, it’s, it’s best standards, it still has a degree of allowance that, um, the OEMs can slip through and be like, well this, this falls with insurance. And again, I can only speak for what I’ve seen, but that is. We see, I’d say, um, Lloyd Warwick, we probably see 50 plus notifications a year for blade damage from lightning and, um, almost every time if it’s within the capabilities of the LPX, the OEM or say towards majeure and Atlanta with insurers.

Allen Hall: Well, is there a force majeure for gearboxes or generators or transformers? [00:19:00] Is, is there a 2% rule for transformers? I don’t, I don’t think so. Maybe there is, but it is, it, it is a little odd, right, that, that there’s so many things that are happening in the insurance world that rely upon the certification of the turbine and the sort of the expected rates of failure.

I have not seen an operator go back and say, we have a 3% rate of, of damage of my transformers, so therefore I wanna file a claim. But that, that doesn’t seem to occur nearly as often as on the lightning side where it’s force majeure is used probably daily, worldwide. How do we think about that? How do we, how do we think about the transformer that fails versus the lightning damage?

Are they just considered just two separate things and uncontrollable? Is that how the insurance industry looks at it? If we, if we would

Nathan Davies: talk about transformers. So the fact is that we see on those can vary from, you know, it’s, it’s a minor electrical component that that goes, um, [00:20:00] which is relatively easy to pin down.

But then at the other end of the spectrum, you’ve got a fire where it’s. You know, with all, all the will in the world, you could go in and investigate, but you’re not gonna find the cause of that fire. Um, you know, the damage is so great that you, you could probably say, well, the ignition point is there because that’s where the most damages occurred and it’s spread out.

But, but how is that occurred? The know, and we, we do have that, that happens not frequently, but um. You know, as an engineer, I, I want to get to the bottom of what’s caused things, but, but all too often we come away from a claim where it’s like we don’t know exactly what’s caused it, but we can’t confirm that it’s excluded in the policy and therefore it, it must be covered and, you know, the claim is valid.

Um, so in, in terms of causation and the standards and all the rest of it.

Joel Saxum: It goes to an extent. So this is a, this is another [00:21:00] one. So Alan was talking about lightning and blades. Then we talked about transformers a little bit. I wanna talk about gear boxes for just a second, because gearbox usually, um, in, in my, my experience in, in the wind world, claims wise, it’s pretty black and white.

Was it, did it, did it fail? This is how it failed. Okay. Blah, blah, blah. Did was maintenance done at blah? So I heard the other day from someone who was talking about, uh, using CMS. On their, on their gener, on their, uh, gearbox, sorry. So it was an operator said, Hey, we should be, and, and a company coming to them saying, well, you should be monitoring CMS.

This is all the good things it can do for you operationally. And the operator, the owner of the turbine said, I don’t want it, because if I know there’s something wrong, then I can’t claim it on insurance if it fails. Does that ring

Nathan Davies: true to you? Part of our process would be to look at the data. Um, so we know nine times out of 10 there is condition [00:22:00] monitoring, there is start out there, there, all this stuff.

The operator, um, assistance tools, and if we can look at a gearbox vibration trend. Um, along with, you know, bearing temperature, uh, monitoring and all that sort of thing. And if you can see a trend where the vibrations are increasing, the temperatures are increasing, um, and there’s no operator maintain maintenance intervention, then, you know, if, if you, if you’ve received an alarm to say, Hey, there’s something wrong with me, you should probably come and have a look and you’ve done nothing about it, then.

It’s,

Joel Saxum: it’s not great. Okay. So, so that, so that it rings, it kind of in a sense, rings true, right? That what that operator was saying, like the way their mind was working at that stage. ’cause this is, this is during, again, like, so we, Alan and I from the uptime network and just who we are, like we know a ton of people, we know [00:23:00] solutions that are being sold and, and this her about this.

And I was like, man, that seems like really shortsighted, but there’s a reality to it that kind of makes sense, right? If they don’t have. I, it, it just seems unethical, right? It seems like if I don’t have the budget to fix this and I don’t wanna look at it, so I’m just waiting for it to fail. I don’t want the notifications so then I can claim it on insurance.

’cause I don’t wanna spend the money to go fix it. Like, seems, seems not cool.

Nathan Davies: Yeah. So the, I mean the, the process, the process of the insurance claim, if, if you want to look at it in almost an over simplistic way, um, a claim is notified. Um, to trigger an operational policy, there needs to be proof of damage, right?

So in this instance, your gearbox has failed, whether that’s gear, teeth have have been pulled off, you’ve had a major bearing failure, whatever it is. So there’s your damage. So insurers are now [00:24:00] engaged. Um, the rules of the game. It’s now on insurers to prove that whatever has caused that damage is an exclusion.

So in this instance, um, you know, that might be wear and tear, gradual deterioration, uh, could be rust. Um, and, and part of that is poor workmanship. Um, so if they have knowingly like. Cover their shut, their eyes covered, their ears just ignored this gearbox slowly crunching its way to, its, its inevitable death.

You know, it, it’s not reasonably unforeseen. It’s not an unpredictable event. This was going to happen if you can see that, that trend, um, towards the failure, um, and in that light, it would, in theory be an uninsured event. Um, but [00:25:00] we know that. 90 plus percent of owner operators have, at least on their drive train, they have some sort of condition monitoring, whether that’s, you know, temperature sensors, vibration sensors, uh, noise sensors, you know, all that sort of stuff.

We know that it’s there, but what’s really interesting in the claims process is. The first thing that we’ll ask is, where’s your proof of damage? Let’s see your alarm data, your scarda data, all this sort of thing.

Joel Saxum: Does the RFI get responded to?

Nathan Davies: Yeah, yeah, yeah. Um, and it’s like, oh no, we, you know, we don’t have the SCARDA data.

And we’ve had instances where a company, a company had turned around and said, oh, we don’t have any SCARDA data for the time of this event. It’s like, oh, that’s interesting. And worked our way through the process. And eventually insurers were like, you know what? We’re, we’re gonna deny this one. We’re not.

Things aren’t adding up, we are not happy with it. Um, and all of a sudden out the woodwork, we get scar data, we get the, the insured’s, um, failure report, [00:26:00] which I mean, there was computational flow dynamics. There were, there were like all sorts of weird and wonderful data that had been thrown into the, this failure analysis.

And it’s like, well, you’ve done our jobs for us. Why did you not just hand this over at the beginning? We know that this stuff exists, so. Just, just playing, playing dumb itch. It’s just a frustration really.

Allen Hall: It does seem like the operators think of loss adjustment in insurance companies as having a warehouse full of actuaries with mechanical calculators and they’re back there punching numbers in and doing these calculations on.

I lost this gearbox from this manufacturer at, at this timeframe, and, and I understand all this data. That’s not how it works, but I do think there’s this, uh, assumption that that. Uh, there’s a in wind energy that because of the scale of it, there’s a lot of, of backend research that’s happening. I, I don’t think that’s true, or, I mean, you can tell me if it’s true or not, [00:27:00] but I don’t think so.

But now, in the world of AI where I can start to accumulate large sets of data and I have the ability to process it with just a single person sitting in front of a laptop, is it gonna get a little harder for some of these claims that have Mercury, just really shady histories to get? Approved.

Nathan Davies: I, I think that’s inevitable.

You know, whenever we go and speak to an insurer, you know, insurers are always interested, are interested in what’s the latest claims data, what are the trends that we’re seeing, all this sort of thing. So we’ll sit down with them for an hour and a half and we’ll say, oh, this was interesting. This is what went well, this is what didn’t go so well.

And then they always sort of grab us just as we’re about to leave and we’ve, we’ve said our goodbyes, and they’re like, so you guys have a. Claims database. Right? Every time. Yep. And it’s like, how’d you feel about, about sharing your data? And it’s, it’s every insurer without failure. They’re like, let’s see your claims [00:28:00] database.

Okay. Right. So we can share, we can share some information. Obviously it needs to be sanitized. We don’t want to provide identifying information, all that sort of stuff. You’re looking at thousands and thousands of lines of data. And the big problem that we have with any database like this is, it’s only as good as the data that’s been entered, right?

So if, if every claims handler, if every loss adjuster is entering their own data into this database, my interpretation of, of a root cause failure, maybe different to somebody else’s. So what we are gonna start seeing in the next year to three years. Is the application of AI to these databases, to to sort of finesse the poor quality data that’s been entered by multiple, you know, it’s, it’s too many cooks.

Spoiled broth. All of these people have entered their own interpretation of data, will start to see AI finesse [00:29:00] that, and all of a sudden the output of it will be. Really, really powerful, much better risk models. Yeah. And I think that’s, that’s inevitable in the next two to five years. Um, and I think insurers will, but again, the, we go back to the cyclic thing.

So the, the data that we have is the claims that we’ve had over the past however many years, but all the while that the OEMs are manufacturing. New gearboxes, new generators, new blades. We don’t know about the problems that are gonna come out the woodwork. We can tell you about failures that might happen on aged assets, but we can’t tell you about what’s gonna fail in the future.

Allen Hall: Well, is there an appetite to do what the automobile world is doing on the automobile insurance? Have basically a plugin to monitor how the driver is doing the State Farm drive safe and [00:30:00] save. Yeah. Your little black box is, is that where eventually this all goes? Is that every turbine’s gonna have a little black box for the insurance company to monitor the asset on some large scale, but then that allows you then to basically to assess properly what the rates should be based on the actual.

Data coming from the actual turbines so that you, you can get a better view of what’s happening.

Nathan Davies: I mean, it’s challenging because obviously you can only get so much from, from that monitoring data. So arguably that’s, that’s like the scarda data. But then there’s, there’s the multiple other inputs that we’re looking at.

I’d say the vast majority of claims come from some form of human intervention. And how do you record that? Human intervention.

Allen Hall: Right? You, it’s like getting an oil change in your car. If the guy forgets to put the oil plug in. Pretty much you’re, you’re gonna get a mount down the road and engine’s gone. [00:31:00] And that’s, that may be the, that may be ultimately where this all goes.

Is that a lot of it’s just human error.

Nathan Davies: Yeah. It’s, you know, we, we can take the, the operating data, you can start to finesse maintenance reports and, and try to plug that into this data stream. But you can guarantee, like you can absolutely bet your bottom dollar, but when there’s an insurance claim and it’s like.

That one key document that you need that will answer that question, nobody knows

Allen Hall: where it is. This has been a great discussion and Nathan, we need to have you back on because you provide such great insights as to what’s happening in the insurance world and and the broader wind energy world and. That’s where I like talking to you so much.

Nathan, how do people get a hold of you? Can they reach you via LinkedIn?

Nathan Davies: Yeah, I’m on LinkedIn. Um, you can also find me, um, on the Lloyd Warwick website. Sounds great.

Allen Hall: Nathan, thank you so much for being on

Nathan Davies: the podcast. Right. Appreciate it. Thank you so much [00:32:00] guys.

Renewable Energy

What We Can and Cannot Control

As always, the Stoics have nailed it.

As always, the Stoics have nailed it.

This does raise the question, however: What actually is out of our control?

Does the individual American citizen have any control over whether or not a sociopathic criminal remains in office as the U.S. president?

Very little, but we still have the obligation to raise our voices and tell our congresspeople that Trump must be removed.

Renewable Energy

What Has Happened in the United States Recently

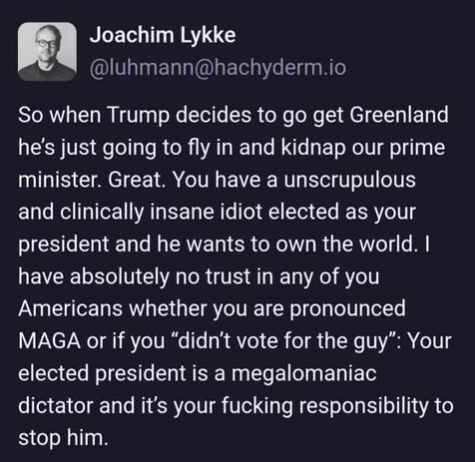

Here’s a good reminder of how the United States is regarded today.

Here’s a good reminder of how the United States is regarded today.

No, it’s not how like it was just a few years ago when we were a land of law, and we had allies all around the countries that supported honesty and democracy around the world.

Now, the leaders of Canada, Panama, and Greenland all fear for their safety, and the world lives in fear of the insanity into which the U.S. has descended.

-

Greenhouse Gases5 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change5 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval