Weather Guard Lightning Tech

North Star Funding, $2T Clean Energy Investment, Yokogawa Acquires BaxEnergy

UK’s North Star secures funding for 40 new offshore wind service vessels by 2040. The IEA reports clean energy investment will hit $2 trillion in 2024, though challenges remain in developing economies. Yokogawa acquires BaxEnergy and Lotus Infrastructure Partners acquires PNE AG’s U.S. renewable business.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Allen Hall: I’m Allen Hall, president of Weather Guard Lightning Tech, and I’m here with the founder and CEO of IntelStor, Phil Totaro, and the chief commercial officer of Weather Guard, Joel Saxum, and this is your News Flash. News Flash is brought to you by our friends at IntelStor. If you want market intelligence that generates revenue, then book a demonstration of IntelStor at IntelStor.com.

UK based North Star has secured up to 500 million in debt investment to fast track tech’s goal of adding 40 hybrid service providers. Operation vehicles to its fleet by 2040. The funding package includes term facilities and committed resources from institutional investors and banks. The capital infusion will support North Star’s continued growth in the offshore wind market.

The company currently has several new belt SOVs in operation and under construction for major offshore wind projects to fill 40 SOVs can’t come soon enough.

Philip Totaro: Indeed. And they’ve, as you mentioned, they’ve already got a fleet of. SOVs operational for various projects around Europe. These new ones where, I mean, 40, by 2040 is, is quite ambitious.

That’s, one, one per more than one per year. This is obviously going to come in handy for what the industry needs. And more importantly, it’ll give them the option to be able to re flag or re domesticate those vessels for use in, other markets where they’re going to be needed, like the U. S., potentially, again, up to a point where we have Jones Act issues or markets like South Korea, Brazil Taiwan, etc. So, it’s much needed.

Joel Saxum: So, for those of you who don’t know, or new to offshore wind, or haven’t followed the program before, an SOV is basically a floating hotel for all the offshore wind workers.

It has a lot of deck space, usually has a small crane, not a big work crane, but enough to move things around on deck, or, or transition some, some gear that’s needed, some tools, or some equipment to the transition piece on an offshore ship. Wind turbine. So basically, these are the big vessels that kind of are resident out in a wind farm.

They’ll go out for a couple weeks at a time until they have to do crew changes. Sometimes even doing crew changes at sea where the vessel just stays out there and a little transfer boat comes and moves people around. But these are the big vessels. These SOVs are the things that make the wind farms tick offshore.

Without them they’re not going to stay up and running for very long.

Allen Hall: The International Energy Agency reports that investment in clean energy technologies, including renewables, will be twice that of fossil fuels this year. Global spending on sectors such as wind, solar, grids, EV, nuclear, and energy storage is expected to reach about 2 trillion in 2024, while oil, gas, and coal receive dollars.

However, the IEA warns a persistent low investment in clean energy in emerging and developing economies due to high costs of capital. And Phil, we’ve seen this play out in Asia at the moment and in Africa.

Philip Totaro: Yes, and that’s probably where a lot of the new investment certainly supported by the World Bank or the International Monetary Fund would be made.

The, the reality of this is that we’re all. I say we, countries are all suffering with the, this high interest rate environment and as we record this the U. S. Federal Reserve said that they’re going to continue to maintain interest rates where they are which is really not helping matters at all.

So, it’s, it, we’re getting to a point where. This 2 trillion, whether that’s accurate or not, and I, I do question it because, when is the IEA ever produced an accurate forecast on, on anything to be, to be a little, a little blunt, I guess. But they, we, we can’t even spend the money if we were going to right now, because everybody’s just kind of taking a wait and see attitude with things.

They don’t want to have to debt refinance later. And so. They’d rather either invest their money elsewhere or just park it and hold on to it until they can get a better cost of capital.

Joel Saxum: I have read a couple articles lately that are kind of bemoaning the double standard. And this is a weird thing to talk about, but in developing countries, they are being told, you should be putting renewable energies in place.

You should be putting renewable energies in place as you sit today. But they, they were basically, the talk is they’re being basically handicapped by the fact that they don’t get to use the cheap, easy power generation or electricity generation technologies of the past that. Spurned economies of developed countries along during the industrial revolution.

So there’s this kind of a tit for tat thing going on there. Another thing, another note here as well, as there’s starting to become a market, and this is a really good thing. They’re starting to become a market for. used wind turbines actually to go to some developing countries. So, in the United States, when we have PTC driven projects where in 10 years, you’ll take something out of commission.

A lot of times those don’t have their life used up, right? They’ve got 10, 15, 20 years of life, or if you maintain them or. Update them. They’ve got 20, 25 years of life left in them. They’re starting to become a market for taking those assets apart, repurposing them and rebuilding them in developing countries or in places where it’s hard to get energy resources built.

So that’s, that’s a good thing.

Allen Hall: Yokogawa Electric Corporation has acquired BaxEnergy, a leading provider of renewable energy management solutions. BaxEnergy’s proven solutions have been adopted by major power companies across Europe to manage over 120 gigawatts of renewable energy operations in more than 40 countries.

This acquisition will enable Yoko Gawa to offer solutions globally supported by its consultation and after sales service through its worldwide network. Boy, Phil, the combination of big players at the moment, there’s still a lot of cash moving around for acquisitions.

Philip Totaro: And that’s what’s interesting about a deal like this is, okay, first of all, Yoko Gawa obviously does a lot of, control systems, sensor systems, particularly in oil and gas and other industries.

This gives them a bigger footprint in the power generation sector and ties them in further to utilities and, and renewable energy asset management and asset performance. But the, the bigger, the, the bigger picture here is that it’s coming at a time when as we talked about with high interest rates, you’re potentially going to see more deals happening because companies aren’t going to be able to go out there and get easy access to loans or other capital that they could use for growth.

And so the pathway to growth is potentially through partnership or merger and that’s going to probably continue. We’ve seen a lot of deals so far this year, and this is a trend that can continue.

Joel Saxum: Nice thing here that we see with this BaxEnergy being acquired is they’re, they’re now going to be able to offer their services to many more customers, right?

They’re going to have some capital behind them. They’ve got, of course, an expanded network behind them. Allen and I were just on the phone today with a group that we’re doing this kind of the same idea of some software that can analyze data and improve efficiencies, right? Their software BaxEnergy claims can improve efficiencies by up to 10%.

There’s a few companies out there doing this, but I, I believe there will be more and more of this data enabled performance upgrades coming to the wind industry and solar industry. For that matter,

Allen Hall: US infrastructure investor, Lotus infrastructure partners has acquired the U S arm of German renewable developer, PNE AG the acquired business now.

Now renamed Allium Renewable Energy has a pipeline of 18 wind, solar, and storage projects at various stages of development totaling over 3 gigawatts. Allium has already developed and monetized 877 megawatts of wind and solar projects to date. Lotus believes Allium’s projects identification and commercialization capabilities will significantly expand in its own renewable development efforts.

Most of the large players in the renewables space are backed by large banks or financial corporations. What are those large corporations like behind P& E doing with these these sales and mergers?

Philip Totaro: Lately, there’s been an uptick in infrastructure funds and investors wanting to get into renewable asset ownership because it’s an asset class that they understand now and they think they can make money with.

Morgan Stanley, which is the, has been the majority owner of P& E has been trying to offload, the whole company, frankly, for a long time. But it seems like with this deal, they’re, they’re doing it a bit more piecemeal now. And so, getting the U. S. based assets off to this infrastructure fund, freeze them up to then pursue other deals, potentially regionally focused deals, in Europe and, and P& E has some, smaller assets elsewhere in the world as well.

Some in South America, some in Asia where, those portfolios could also be segregated and, and sold off. It’s a bit unfortunate because P& E did a quite a good job over the past 10 to 12 years of, of building up the, the entire portfolio they’ve got. But this is also serving the market need is, as I just mentioned with the infrastructure funds wanting to, To plow more money into whatever portfolio they get their hands on, whether it’s something that can be repowered or a late stage project pipeline that’s already got, well down the interconnection queue and the interconnection studies to be able to get on the grid and start generating, PTC based revenue.

That’s, that’s what they want.

Joel Saxum: Yeah, as we’ve talked about in the last few weeks, there’s a couple of Canadian pension funds that have billions of dollars that they want to put in play and they can’t even find a spot to put it in play. So there’s a lot of money sitting on the sidelines right now that could be put into use.

But a lot of things are holding up interconnection queues and, the finance rates and some other things. So when you start to see, we’re starting to see a lot of these moves, not starting to, we’ve been seeing a lot of these moves. But with large money banks it’s going to continue to happen until some of this stuff busts loose.

I, I think it’ll be, hopefully, once the interest rates start to go down, it’ll be like a dam that starts to get some cracks in it and the water starts to flow as long as we can put it to use, depending on interconnection queues.

https://weatherguardwind.com/north-star-yokogawa-baxenergy-lotus-pne/

Renewable Energy

Explore Commercial Heat Pump Warranties: What Cyanergy Offers?

Renewable Energy

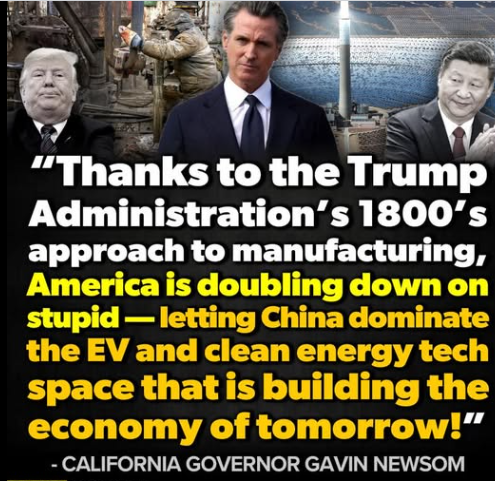

Handing the Keys to the Kingdom over to the Chinese

When I argue for environmental responsibility and the decarbonization of the grid, I often say:

When I argue for environmental responsibility and the decarbonization of the grid, I often say:

I know there are people who believe, perhaps because this is what they’re told by Donald Trump, that climate change is a hoax. But are there people who don’t believe in cancer? In the importance of our country’s investing in the industry that is destined the dominate the 21st Century?

Trump will be gone soon. Maybe you and I will be gone (in a different sense) before the effects of this administration’s folly in the EV and cleantech industry are fully felt.

But it’s inevitable, unless we turn this around, and soon.

Renewable Energy

Small, Vertical-Axis Wind Turbines (VAWTs)

In preparation for my first book, “Renewable Energy – Facts and Fantasies,” I interviewed Ray Lane, then managing partner of Kleiner Perkins, one of the world’s great venture capital firms, who told me about his stance with his prospects, “You build the first one. I’ll invest in the next 20. Then we’ll take the thing public and use that cash to build the next 5000.”

In preparation for my first book, “Renewable Energy – Facts and Fantasies,” I interviewed Ray Lane, then managing partner of Kleiner Perkins, one of the world’s great venture capital firms, who told me about his stance with his prospects, “You build the first one. I’ll invest in the next 20. Then we’ll take the thing public and use that cash to build the next 5000.”

I’m 99+% sure that the “first one” of these will never be built, i,e., installing these VAWTs at the base of functioning wind farms. The concept is asinine, as it defies the laws of fluid dynamics.

.

-

Climate Change4 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases4 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits

-

Climate Change2 years ago

Why airlines are perfect targets for anti-greenwashing legal action