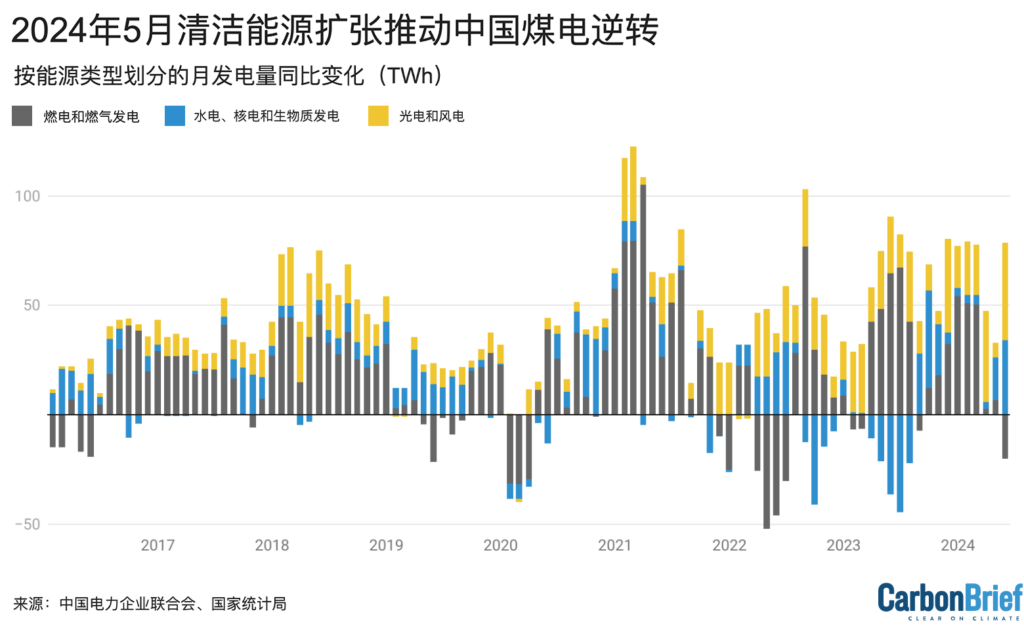

2024年5月,尽管用电需求持续增长,清洁能源发电量占到中国全国总发电量的44%,创下历史新高;燃煤发电量占比降至53%,达到历史低点。

基于官方数据和其他数据,Carbon Brief 的新分析揭示了煤炭在能源结构中占比下降的真实程度。

2023年5月,煤炭在中国发电量中所占比例为60%。一年后,这一数字下降了7个百分点。

该分析揭示的其他关键信息包括:

- 国家统计局按发电方式分列的月度发电量数据现在对风能和太阳能发电量计入非常有局限性。例如,它未纳入“分布式”屋顶光伏和较小的集中式太阳能发电站,因此只能捕捉到约一半的太阳能发电量。

- 国家统计局的月度总发电量为718太瓦时(TWh),而国家能源局报告提出月度电力需求为775太瓦时,两者的差距显著。实际上,由于发电厂和电网损耗,发电量肯定应高于需求量。

- 媒体报道曾猜测,创纪录的新增可再生能源装机容量会在5月份触及电网上限,但新数据显示情况并非如此。

- 2024年5月,中国电力需求同比增长49太瓦时(7.2%)。

- 与此同时,清洁能源发电量创纪录地增长了78太瓦时,其中太阳能发电量创纪录地增长了41太瓦时(78%),水力发电量从早些时候干旱造成的低点回升了34太瓦时(39%),风力发电量小幅增长了4太瓦时(5%)。

- 随着清洁能源的增长超过电力需求增长,化石燃料发电量被迫回落,出现了自2019年新冠大流行以来最大的月度降幅。天然气发电量下降了4太瓦时(16%),燃煤发电量下降了16太瓦时(4%)。

- 化石燃料发电量的下降意味着电力行业的CO2排放量下降了3.6%,而电力行业的CO2排放量约占中国温室气体排放总量的五分之二,是近年来排放增长的主要来源。

从2024年3月开始,中国化石燃料和水泥行业的CO2排放量由增变减。新的研究结果表明,这一趋势仍在继续。

如果目前风能和太阳能的快速部署得以继续,那么中国的CO2排放量很可能会继续下降,从而使2023年成为中国碳达峰的一年。

月度数据差异

国家统计局每月都会公布中国按发电方式分列的发电量数据。2024年5月的数据是在近一个月前的6月中旬公布,并被广泛报道。

然而,这些数据的局限性越来越大,因为其中不包括“分布式”光伏电站,如家庭和企业屋顶上安装的光伏系统。本文的分析表明,这使得大约一半的太阳能发电总量被遗漏。

如果仔细审视用电量,国家统计局发电量数据不完整这一事实显而易见:国家能源局报告的5月份用电量为775太瓦时,而国家统计局报告的发电量仅为718太瓦时。实际上,由于发电厂和输电过程中的损耗,发电量肯定远远大于用电量。

国家统计局报告的太阳能和风能发电量似乎很少,这引起了人们的困惑,并导致有报道声称中国的风能和太阳能发电表现不佳。

中电联收集的“利用率”数据可跟踪风能和太阳能发电的表现,显示相对于最大潜力的实际出力。这些数据通常包含在国家能源局发布的月度统计数据中。

国家能源局因在5月份发布的数据中略过了利用率,这导致彭博社和路透社猜测背后原因可能是风能和太阳能数据不佳。这一猜测在中电联直接提供其数据后基本被证明不成立,因为太阳能发电利用率大幅上升;风能利用率虽然下降,但在正常的年度变化范围内。

另一个数据集追踪了由于电网灵活性低而浪费的太阳能和风能发电量的比例,结果显示两者分别小幅增长了0.8和1.7个百分点。这对电厂运营者来说是个问题,但该升幅远未达到会显著影响利用率的程度——消纳率的年际变化幅度通常超过5%。

现在有足够的数据来破解国家统计局发电数据的局限性,并描绘出中国5月份发电结构的全貌。

首先值得一提的是,国家统计局的数据是以30天为一个月进行归一化处理的,这造成了部分数据不匹配。本文剩余部分使用归一化后的30天数据。

除了使用国家统计局数据,还可根据报告的装机容量和利用率来估算太阳能和风能发电量。通过将这些估计值与其他技术的报告发电量相结合,得出总发电量为783太瓦时,同比增长8%。

报告的750太瓦时用电量(按30天为一个月进行归一化)与估计的783太瓦时发电量相符,另有4.2%的差异是由于传输损耗造成的。

目前尚无输电损耗的月度数据,但2023年的平均值为4.5%,与报告的用电量和预估发电量之间的差距非常吻合。

创纪录的结果

综合各种数据可以看出,2024年5月太阳能发电量创纪录地增长了78%,远高于不完整的国家统计局数据中29%的同比增幅。

太阳能发电装机容量增加52%至691吉瓦(gigawatt),产能利用率从16%提高到19%,太阳能发电量从2023年5月的53太瓦时增至2024年5月的94太瓦时,增加了41太瓦时,创下中国各发电方式发电量中最大的增幅。

水电发电量的增幅位居第二,虽然发电量仅增长了1%,但利用率却从31%跃升至41%,因为该行业正从2022年至2023年创纪录的干旱中恢复过来。这使得水电发电量增加了39%(34太瓦时),达到115太瓦时。

风电装机大幅增长了21%,但其利用率却有所下降,这可能是由于风力条件逐月变化所致。因此,发电量的增幅相对较小,仅为5%(4太瓦时),达到83太瓦时。核电和生物质发电的发电量也有小幅增长,但核电站的利用率从87%下降到85%。

如下图所示,清洁能源发电量总计增长了78太瓦时。这足以超过49太瓦时的需求增长。

因此,尽管燃气发电装机增加了9%,但发电量却大幅下降16%,利用率急剧下降了24%。燃煤发电装机增加了3%,但发电量却下降了3.7%,平均利用率下降了7%。需求下降可能会抑制过去两年火热的对新建煤炭产能的投资。

燃煤和燃气发电量的变化,加之燃煤电厂热耗率的轻微下降,意味着电力行业的CO2排放量下降了3.6%。

在发电量发生上述变化后,中国的发电结构在2024年5月已大幅减少了对化石燃料的依赖。如下图所示,燃煤发电份额从去年同期的60%降至53%,是有记录以来的最低份额。

与此同时,太阳能发电占比从去年同期的7%上升到12%,创历史最高纪录。其余为风电(11%)、水电(15%)、核电(5%)、天然气发电(3%)和生物质发电(2%)。

非化石能源的总体份额达到创纪录的44%,间歇性可再生能源(太阳能和风能)的比例也创下新高,达到23%。

如上图所示,尽管需求不断增长,但太阳能和风能在中国电力结构中的份额正在迅速增加。2016年5月,它们仅占总量的7%。

与此同时,2024年5月,清洁能源发电装机继续强劲增长,新增太阳能发电装机19吉瓦 ,风电3吉瓦 ,核电1.2吉瓦。

在2024年的前五个月,中国新增了约79吉瓦的太阳能和20吉瓦的风能。如下图所示,这两个新增发电装机数字比去年分别增长了29%和21%,而去年的数字已经创下历史新高。

就太阳能发电具体而言,2024年5月的月新增装机高于4月,与2023年5月相比也有同比增长。

太阳能发电量的快速增长表明,太阳能产能的激增正在提供新的电力供应,其规模足以满足中国大部分的需求增长。

这进一步印证了中国的CO2排放量正处于结构性下降时期的观点。

如果清洁能源的新增装机保持在2023年和2024年初的水平,那么CO2排放量可能会持续下降,这将确定2023年是中国实现碳达峰的一年。

由于中国将在明年初宣布新的气候目标,政府对清洁能源增长的雄心水平仍有待观察。

关于数据

风能和太阳能发电量,以及按燃料划分的火电发电量系通过将每月末的发电装机乘月利用率计算得出,数据来自万得金融终端提供的中电联报告数据。

火电、水电和核电的总发电量来源于国家统计局的月度发布数据。由于无法获得生物质发电的月度利用率数据,因此采用2023年的年平均利用率52%。

发电产生的碳排放量估算基于中国最新的2018年国家温室气体排放清单中的排放因子,以及国家能源局公布的燃煤电厂月平均热耗率,并假设燃气电厂平均热耗率为50%。

The post 分析:中国清洁能源发展使五月燃煤发电份额降至53%的历史低点 appeared first on Carbon Brief.

Climate Change

Equity, Benefit-Sharing and Financial Architecture in the International Seabed Area

A new independent study by Dr Harvey Mpoto Bombaka (Centro Universitário de Brasília) and Dr Ben Tippet (King’s College London), commissioned by Greenpeace International, reveals that current International Seabed Authority revenue-sharing proposals would return virtually nothing to developing countries — despite the requirement under the UN Convention on the Law of the Sea (UNCLOS) that deep sea mining must benefit humankind as a whole.

Instead, the analysis shows that the overwhelming economic value would flow to a handful of private corporations, primarily headquartered in the Global North.

Download the report:

Equity, Benefit-Sharing and Financial Architecture in the International Seabed Area

Executive Summary: Equity, Benefit-Sharing and Financial Architecture in the International Seabed Area

https://www.greenpeace.org.au/greenpeace-reports/equity-benefit-sharing-and-financial-architecture-in-the-international-seabed-area/

Climate Change

Pacific nations would be paid only thousands for deep sea mining, while mining companies set to make billions, new research reveals

SYDNEY/FIJI, Thursday 26 February 2026 — New independent research commissioned by Greenpeace International has revealed that Pacific Island states would receive mere thousands of dollars in payment from deep sea mining per year, placing the region as one of the most affected but worst-off beneficiaries in the world.

The research by legal professor Dr Harvey Mpoto Bombaka and development economist Dr Ben Tippet reveals that mechanisms proposed by the International Seabed Authority (ISA) for sharing any future revenues from deep sea mining would leave developing nations with meagre, token payments. Pacific Island nations would receive only USD $46,000 per year in the short term, then USD $241,000 per year in the medium term, averaging out to barely USD $382,000 per year for 28 years – an entire annual income for a nation that is less than some individual CEOs’ salaries. Mining companies would rake in over USD $13.5 billion per year, taking up to 98% of the revenues.

The analysis shows that under a scenario where six deep sea mining sites begin operating in the early 2030s, the revenues that states would actually receive are extraordinarily small. This is in contrast to the clear mandate of the United Nations Convention on the Law of the Sea (UNCLOS), which requires mining to be carried out for the benefit of humankind as a whole.[1] The real beneficiaries, the research shows, would be, yet again, a handful of corporations in the Global North.

Head of Pacific at Greenpeace Australia Pacific Shiva Gounden, said:

“What the Pacific is being promised amounts to little more than scraps. The people of the Pacific would sacrifice the most and receive the least if deep sea mining goes ahead. We are being asked to trade in our spiritual and cultural connection to our oceans, and risk our livelihoods and food sources, for almost nothing in return.

“The deep sea mining industry has manipulated the Pacific and has lied to our people for too long, promising prosperity and jobs that simply do not exist. The wealthy CEOs and deep sea mining companies will pocket the cash while the people of the Pacific see no material benefits. The Pacific will not benefit from deep sea mining, and our sacrifice is too big to allow it to go ahead. The Pacific Ocean is not a commodity, and it is not for sale.”

Using proposals submitted by the ISA’s Finance Committee between 2022 and 2025, the returns to states barely register in national accounts. After administrative costs, institutional expenses, and compensation funds are deducted, little, if anything, remains to distribute [3].

Author Dr Harvey Mpoto Bombaka of the Centro Universitário de Brasília said:

“What’s described as global benefit-sharing based on equity and intergenerational justice increasingly looks like a framework for managing scarcity that would deliver almost no real benefits to anyone other than the deep sea mining industry. The structural limitations of the proposed mechanism would offer little more than symbolic returns to the rest of the world, particularly developing countries lacking technological and financial capacity.”

The ISA will meet in March for its first session of the year. Currently, 40 countries back a moratorium or precautionary pause on deep sea mining.

Gounden added: “The deep sea belongs to all humankind, and our people take great pride in being the custodians of our Pacific Ocean. Protecting this with everything we have is not only fair and responsible but what we see as our ancestral duty. The only equitable path is to leave the minerals where they are and stop deep sea mining before it starts.

“The decision on the future of the ocean must be a process that centres the rights and voices of Pacific communities as the traditional custodians. Clearly, deep sea mining will not benefit the Pacific, and the only sensible way forward is a moratorium.”

—ENDS—

Notes

[1] A key condition for governments to permit deep sea mining to start in the international seabed is that it ‘be carried out for the benefit of mankind as a whole’, particularly developing nations, according to international law (Article 136-140, 148, 150, and 160(2)(g), the UN Convention on the Law of the Sea).

For more information or to arrange an interview, please contact Kimberley Bernard on +61407 581 404 or kbernard@greenpeace.org

Climate Change

North Carolina Regulators Nix $1.2 Billion Federal Proposal to Dredge Wilmington Harbor

U.S. Army Corps of Engineers failed to explain how it would mitigate environmental harms, including PFAS contamination.

The U.S. Army Corps of Engineers can’t dredge 28 miles of the Wilmington Harbor as planned, after North Carolina environmental regulators determined the billion-dollar proposal would be inconsistent with the state’s coastal management policies.

North Carolina Regulators Nix $1.2 Billion Federal Proposal to Dredge Wilmington Harbor

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits