Pacifico Power LLC has partnered with Sumitomo Corp. to finance a portfolio of solar photovoltaic (PV) plus battery energy storage system (BESS) projects.

Pacifico secured $40 million in project tax equity funding from SCOA for a portfolio consisting of six projects totaling 27 MW of solar PV and 25 MWh of battery storage located in California and Massachusetts.

The projects will provide customers with an estimated cost savings of more than $46 million over the course of the portfolio’s useful lifetime, as well as support the ongoing transition to sustainable energy infrastructure.

SCOA will act as a tax equity partner, while Pacifico will remain a sponsor owner and operator of the projects through direct subsidiaries. This will be SCOA’s first investment in distributed generation.

The two projects in Massachusetts, developed under the Solar Massachusetts Renewable Target (SMART) program, are community solar developments wherein over half of the energy produced will be dedicated to serving low-to-moderate income households. Additionally, the portfolio includes four behind-the-meter projects in California that are designed to support C&I customers by integrating renewable energy into corporate sustainability strategies, while also reducing energy costs and enhancing reliability.

The projects were developed and constructed by Pacifico Power, with commercial operation expected by year-end 2024.

“We’re pleased to announce Pacifico’s latest financing partnerships with Sumitomo and MUFG as we continue to accelerate deployment of clean energy infrastructure nationwide,” states Kevin Pratt, president of Pacifico Power. “As one of the first participants to close a transferability bridge loan under the IRA and a tax equity vehicle of this nature, we’re excited to build on the momentum that Pacifico is experiencing within clean energy.”

The post Pacifico Power Nets Financing for Solar+Storage Assets appeared first on Solar Industry.

Renewable Energy

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

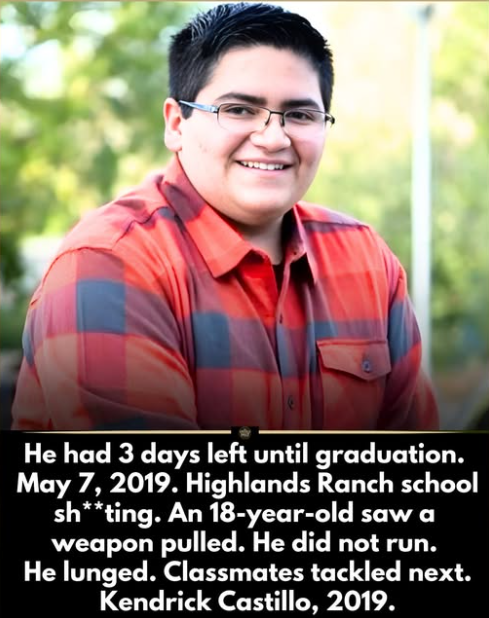

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

Renewable Energy

Forced Transgendering of America’s Little Kids

How often does this happen? How about never?

How often does this happen? How about never?

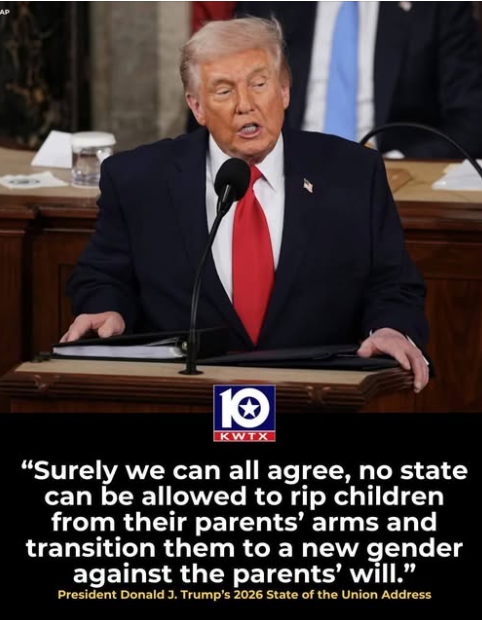

Trump loves to say that little boys go to school and come back home little girls.

He’s the most powerful person in the world for exactly one reason: We’re a nation of morons.

Renewable Energy

Illegal Aliens and U.S. Veterans

Two comments:

Two comments:

That the United States has homeless veterans is a national (and international) disgrace.

By definition, no one has the legal right to enter the U.S. illegally, but according to our constitution, everyone in America is entitled to due process.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits