COP30 host nation Brazil has pledged $1 billion to a new fund to protect rainforests it will launch at the UN climate summit in Belém this November. The announcement in New York by Brazil’s president marks the first investment in the fund, which is set to receive cash from nations and private investors.

The Tropical Forest Forever Facility (TFFF), proposed by Brazil, aims to raise funds to keep forests standing in tropical countries by generating returns on investments in financial markets. As initial capital, it is seeking $25 billion from donor countries and $100 billion from private investors such as pension funds, banks and asset managers.

The South American nation is the first to make a contribution to the TFFF, while other countries like Germany, Norway, UK and the United Arab Emirates have expressed support and participated in its design.

“Brazil will lead by example and become the first country to commit an investment in the fund with $1 billion,” President Luiz Inácio Lula da Silva told a high-level event on the sidelines of the UN General Assembly in New York on Tuesday. “I invite all partners in attendance to make equally ambitious contributions so that the TFFF becomes operational at COP30 in November.”

“In Belém, we will live the moment of truth for our generation of leaders. Tropical forests are critical to limit global warming to 1.5C. The TFFF is not charity. It’s an investment in humanity, in the planet against the threat of devastation caused by climate change,” Lula added.

Forest-rich countries currently face a funding gap of up to $70 billion every year to halt deforestation, researchers estimated in July. In August, all eight nations that are home to the Amazon Basin endorsed the TFFF, while the BRICS group of large emerging economies has also voiced support.

Donors urged to step up

Some forest nations at the high-level meeting in New York – including Colombia, Ghana and Madagascar, as well as UN and World Bank observers – gave their backing to the TFFF and praised Brazil’s contribution.

Colombia’s Environment Minister Irene Vélez said the TFFF “should be the beginning of the transformation of financial structures”. “It should be a revolutionary system that provides justice,” she added.

Vélez urged other donor countries to follow Brazil’s lead, warning “we don’t want another dead fund”.

Campaigners also reacted positively to Brazil’s pledge and urged rich nations to follow suit. Toerris Jaeger, executive director of the Rainforest Foundation Norway, said in a statement “it is remarkable that a tropical forest country is the first mover, with wealthier countries yet to commit”.

World Bank to host fund

Speaking in New York, World Bank CEO Ajay Banga confirmed that the bank will serve as trustee and interim host of the TFFF – a role it already fulfills for other climate funds such as the Fund for Responding to Loss and Damage.

“Our job is to lay the rails and maintain them so the trains can run. We want to leave founders, funders and participating countries free to focus on delivery,” Banga said.

The World Bank has been involved in the TFFF’s design, advising Brazilian authorities on how to structure the fund so it will qualify for a top AAA credit rating. This is key for the economics of the fund to work, as it would struggle to deliver on its promised payments with a lower rating.

Banga said Brazil’s leadership on the TFFF is advancing the “right market thinking” around forests. He added that, if scaled up, the fund’s benefits would result in “good economics and good development”.

Some developing countries and campaigners have been critical of the bank’s role in the loss and damage fund, accusing it of charging high hosting fees and compromising the fund’s independence. The US remains the largest World Bank shareholder.

Other pledges to follow

Despite Brazil’s initial contribution, other donor nations involved in the fund’s design did not come forward with pledges on Tuesday but emphasised its importance as a new way to encourage forest protection.

“The TFFF can not only help reduce deforestation, but also maintain incentives to protect forests in perpetuity. A launch at COP30 in the Amazon could be a game-changer for forest finance,” Andreas Bjelland Eriksen, Norway’s climate minister, said during the high-level event.

Bjelland Eriksen noted that some of the fund’s final details are in still process of being worked out, adding “Norway wholeheartedly wants the TFFF to become a reality and to succeed.”

The TFFF is not a negotiated fund under the UN climate convention, which means that richer developing countries could contribute without assuming traditional donor responsibilities under the UNFCCC. Some experts say this could help convince China and Gulf states to chip in for the initial $25 billion in public finance.

China and the UAE attended the event at UN headquarters and expressed support for a TFFF launch at COP30, but fell short of signalling any pledges.

“This mechanism when operational would be groundbreaking for climate finance and has the potential to reshape how we reward nature-rich countries in preserving our common natural habitats,” Razan Al Mubarak, the UAE’s envoy for nature, said in a statement read at the event.

The post Brazil pledges $1bn in first contribution to COP30 rainforest fund appeared first on Climate Home News.

Brazil pledges $1bn in first contribution to COP30 rainforest fund

Climate Change

Southern Right Whales Are Having Fewer Calves; Scientists Say a Warming Ocean Is to Blame

After decades of recovery from commercial whaling, climate change is now threatening the whales’ future.

Southern right whales—once driven to near-extinction by industrial hunting in the 19th and 20th centuries—have long been regarded as a conservation success. After the International Whaling Commission banned commercial whaling in the 1980s, populations began a slow but steady rebound. New research, however, suggests climate change may be undermining that recovery.

Southern Right Whales Are Having Fewer Calves; Scientists Say a Warming Ocean Is to Blame

Climate Change

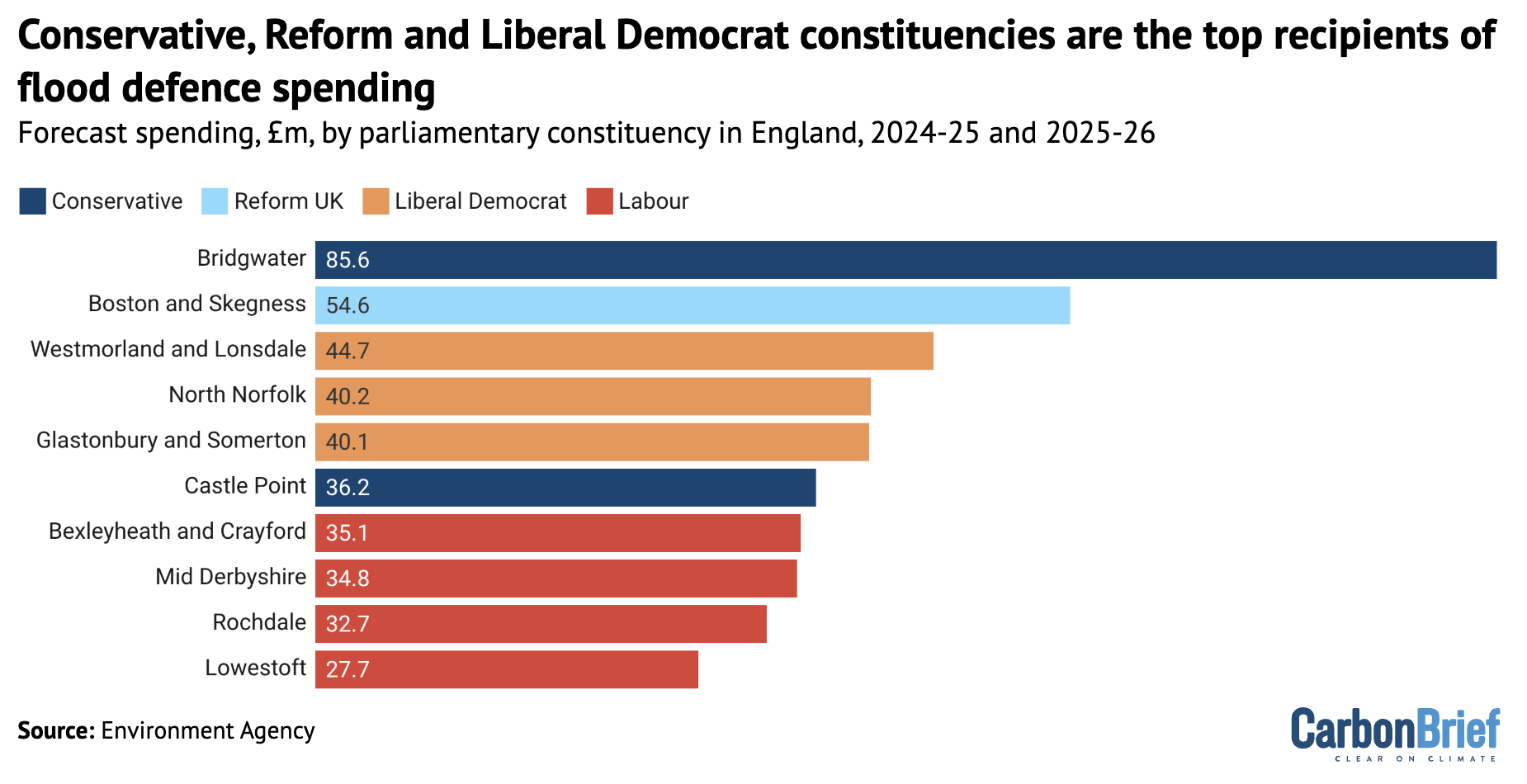

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

The Lincolnshire constituency held by Richard Tice, the climate-sceptic deputy leader of the hard-right Reform party, has been pledged at least £55m in government funding for flood defences since 2024.

This investment in Boston and Skegness is the second-largest sum for a single constituency from a £1.4bn flood-defence fund for England, Carbon Brief analysis shows.

Flooding is becoming more likely and more extreme in the UK due to climate change.

Yet, for years, governments have failed to spend enough on flood defences to protect people, properties and infrastructure.

The £1.4bn fund is part of the current Labour government’s wider pledge to invest a “record” £7.9bn over a decade on protecting hundreds of thousands of homes and businesses from flooding.

As MP for one of England’s most flood-prone regions, Tice has called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

He is also one of Reform’s most vocal opponents of climate action and what he calls “net stupid zero”. He denies the scientific consensus on climate change and has claimed, falsely and without evidence, that scientists are “lying”.

Flood defences

Last year, the government said it would invest £2.65bn on flood and coastal erosion risk management (FCERM) schemes in England between April 2024 and March 2026.

This money was intended to protect 66,500 properties from flooding. It is part of a decade-long Labour government plan to spend more than £7.9bn on flood defences.

There has been a consistent shortfall in maintaining England’s flood defences, with the Environment Agency expecting to protect fewer properties by 2027 than it had initially planned.

The Climate Change Committee (CCC) has attributed this to rising costs, backlogs from previous governments and a lack of capacity. It also points to the strain from “more frequent and severe” weather events, such as storms in recent years that have been amplified by climate change.

However, the CCC also said last year that, if the 2024-26 spending programme is delivered, it would be “slightly closer to the track” of the Environment Agency targets out to 2027.

The government has released constituency-level data on which schemes in England it plans to fund, covering £1.4bn of the 2024-26 investment. The other half of the FCERM spending covers additional measures, from repairing existing defences to advising local authorities.

The map below shows the distribution of spending on FCERM schemes in England over the past two years, highlighting the constituency of Richard Tice.

By far the largest sum of money – £85.6m in total – has been committed to a tidal barrier and various other defences in the Somerset constituency of Bridgwater, the seat of Conservative MP Ashley Fox.

Over the first months of 2026, the south-west region has faced significant flooding and Fox has called for more support from the government, citing “climate patterns shifting and rainfall intensifying”.

He has also backed his party’s position that “the 2050 net-zero target is impossible” and called for more fossil-fuel extraction in the North Sea.

Tice’s east-coast constituency of Boston and Skegness, which is highly vulnerable to flooding from both rivers and the sea, is set to receive £55m. Among the supported projects are beach defences from Saltfleet to Gibraltar Point and upgrades to pumping stations.

Overall, Boston and Skegness has the second-largest portion of flood-defence funding, as the chart below shows. Constituencies with Conservative and Liberal Democrat MPs occupied the other top positions.

Overall, despite Labour MPs occupying 347 out of England’s 543 constituencies – nearly two-thirds of the total – more than half of the flood-defence funding was distributed to constituencies with non-Labour MPs. This reflects the flood risk in coastal and rural areas that are not traditional Labour strongholds.

Reform funding

While Reform has just eight MPs, representing 1% of the population, its constituencies have been assigned 4% of the flood-defence funding for England.

Nearly all of this money was for Tice’s constituency, although party leader Nigel Farage’s coastal Clacton seat in Kent received £2m.

Reform UK is committed to “scrapping net-zero” and its leadership has expressed firmly climate-sceptic views.

Much has been made of the disconnect between the party’s climate policies and the threat climate change poses to its voters. Various analyses have shown the flood risk in Reform-dominated areas, particularly Lincolnshire.

Tice has rejected climate science, advocated for fossil-fuel production and criticised Environment Agency flood-defence activities. Yet, he has also called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

This may reflect Tice’s broader approach to climate change. In a 2024 interview with LBC, he said:

“Where you’ve got concerns about sea level defences and sea level rise, guess what? A bit of steel, a bit of cement, some aggregate…and you build some concrete sea level defences. That’s how you deal with rising sea levels.”

While climate adaptation is viewed as vital in a warming world, there are limits on how much societies can adapt and adaptation costs will continue to increase as emissions rise.

The post Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding appeared first on Carbon Brief.

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

Climate Change

US Government Is Accelerating Coral Reef Collapse, Scientists Warn

Proposed Endangered Species Act rollbacks and military expansions are leaving the Pacific’s most diverse coral reefs legally defenseless.

Ritidian Point, at the northern tip of Guam, is home to an ancient limestone forest with panoramic vistas of warm Pacific waters. Stand here in early spring and you might just be lucky enough to witness a breaching humpback whale as they migrate past. But listen and you’ll be struck by the cacophony of the island’s live-fire testing range.

US Government Is Accelerating Coral Reef Collapse, Scientists Warn

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits