The UK’s greenhouse gas emissions fell by 3.6% in 2024 as coal use dropped to the lowest level since 1666, the year of the Great Fire of London, according to new Carbon Brief analysis.

Major contributions came from the closure of the UK’s last coal-fired power station in Nottinghamshire and one of its last blast furnaces at the Port Talbot steelworks in Wales.

Other factors include a nearly 40% rise in the number of electric vehicles (EVs) on the road, above-average temperatures and the UK’s electricity being the “cleanest ever” in 2024.

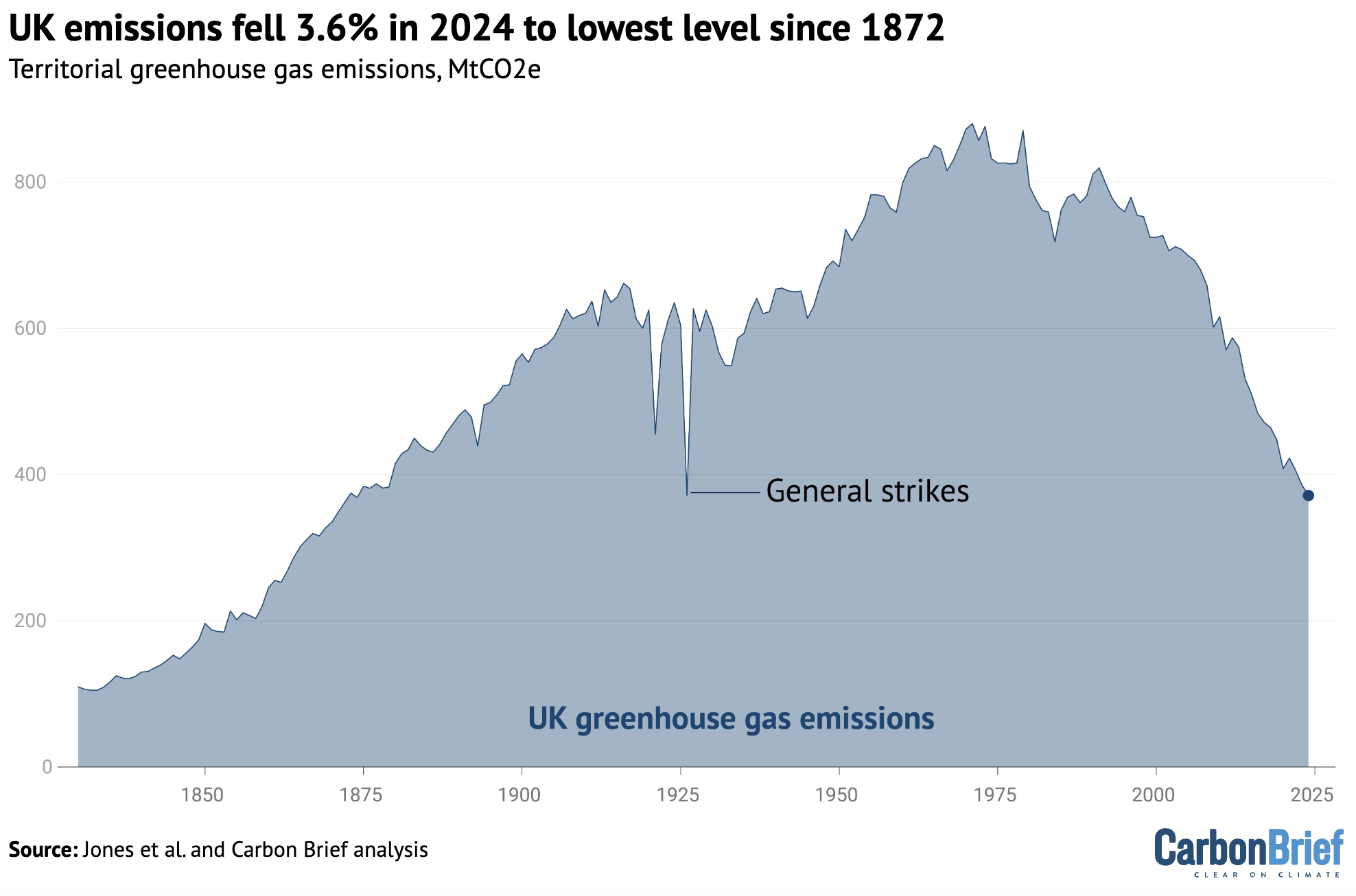

Carbon Brief’s analysis, based on preliminary government energy data, shows emissions fell to just 371m tonnes of carbon dioxide equivalent (MtCO2e) in 2024, the lowest level since 1872.

Other key findings from the analysis include:

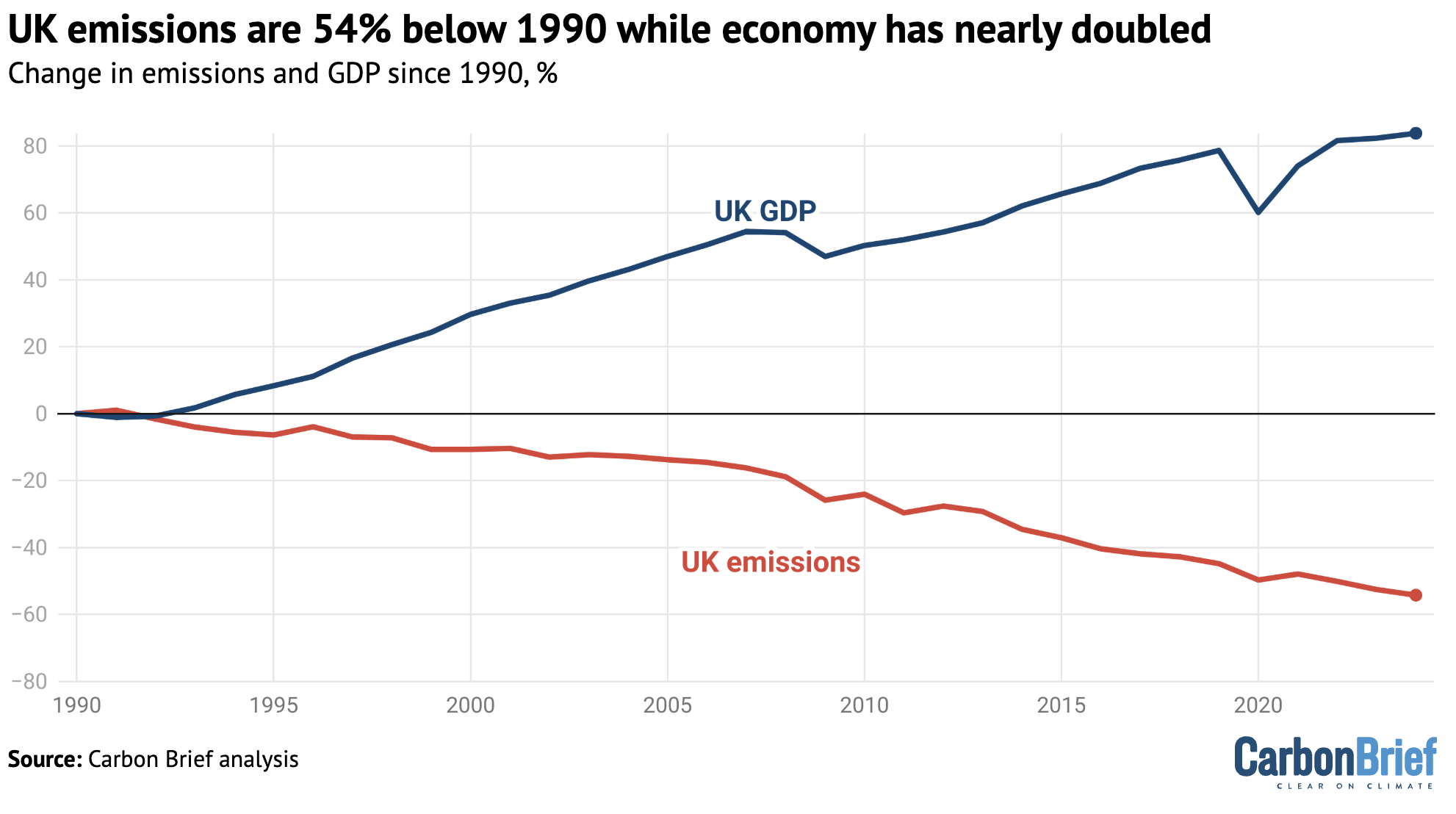

- The UK’s emissions are now 54% below 1990 levels, while GDP has grown by 84%.

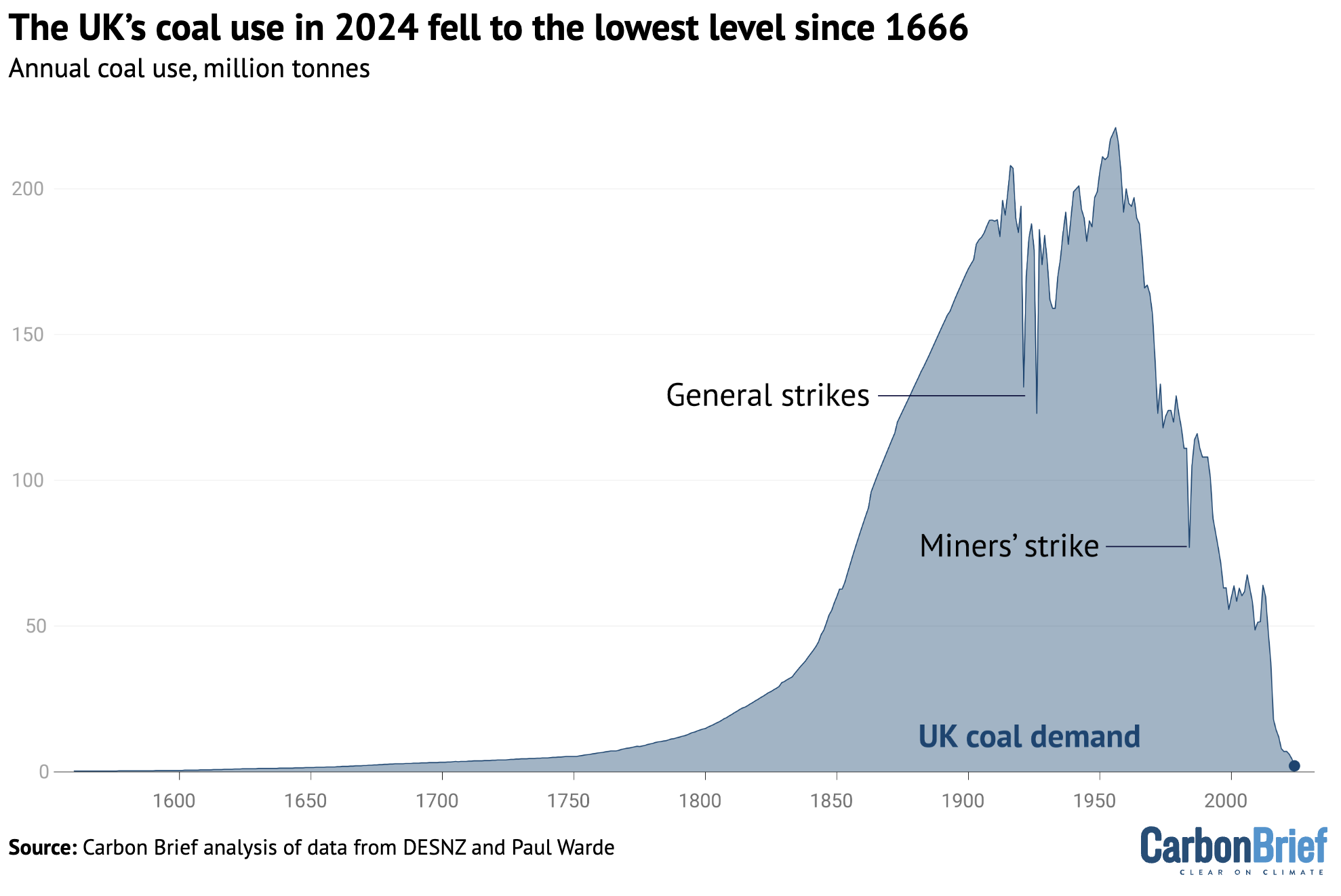

- About half of the drop in emissions in 2024 was due to a 54% reduction in UK coal demand, which fell to just 2m tonnes – the lowest level since 1666.

- Another third of the drop in 2024 emissions was due to falling demand for oil and gas, with the remainder down to ongoing reductions in non-CO2 greenhouse gases.

- UK coal demand fell at power stations (one-third of the reduction overall) and at industrial sites (two-thirds). In 2024, the UK closed its last coal-fired power station, as well as the final blast furnace at the Port Talbot steelworks. Furnaces at Scunthorpe paused operations. Both sites are due to convert to electric-arc furnaces that do not rely on coal.

- Oil demand fell 1.4% despite increased road traffic, largely due to the rise in the number of EVs. The UK’s 1.4m EVs, 0.8m plug-in hybrids and 76,000 electric vans cut oil-related emissions by at least 5.9MtCO2e, Carbon Brief analysis finds, only slightly offset by around 0.5MtCO2e from higher electricity demand.

- The UK’s EV motorists each saved around £800, on average, in 2024 – some £1.7bn in total – relative to the cost of driving petrol or diesel vehicles.

- Gas demand for heating increased, despite warmer average temperatures than in 2023, as prices eased from the peaks seen after the global energy crisis.

- However, gas demand fell overall due to lower gas-fired electricity generation, thanks to higher electricity imports and increased output from low-carbon sources.

The UK would need to cut its emissions by a larger amount each year than it did in 2024, to reach its international climate goal for 2035, as well as its national target to reach net-zero by 2050.

The analysis is the latest in a decade-long series of annual estimates from Carbon Brief, covering emissions during 2023, 2022, 2020, 2019, 2018, 2017, 2016, 2015 and 2014.

Lowest since 1872

The UK’s territorial greenhouse gas emissions – those that occur within the country’s borders – have now fallen in 26 of the 35 years since 1990.

(Consumption-based emissions, including CO2 embedded in imported goods and services, were increasing until 2007, but have since fallen at a similar rate to territorial emissions.)

Apart from brief rebounds after the global financial crisis and the Covid-19 lockdowns, UK emissions have fallen every year for the past two decades.

The latest 14MtCO2e (3.6%) reduction takes UK emissions down to 371MtCO2e, according to Carbon Brief’s new analysis.

This is the lowest since 1872 and on par with 1926, when there was a general strike, as shown in the figure below. In 1872, Queen Victoria was on the throne and Wanderers beat Royal Engineers in the first-ever FA Cup final, held at Kennington Oval in south London.

The UK’s emissions are now definitively below the level reached only temporarily during the height of Covid in 2020, having fallen steadily in each of the past three years.

They are now at levels not seen consistently since Victorian times.

Coal collapse

The largest factor in emissions falling last year, accounting for around 7MtCO2e or two-thirds of the reduction overall, was a massive 54% drop in UK coal demand.

In percentage terms, this was the fastest annual reduction in UK coal demand on record, in figures going back to the 16th century. (In absolute terms, the 2.4Mt fall in coal use in 2024 is easily eclipsed by the 34Mt reduction seen during the 1984 miners’ strike.)

The UK used just 2.1Mt of coal in 2024. As shown in the figure below, this is the lowest amount since 1666, when the UK’s capital city was engulfed in the Great Fire of London.

Roughly one-third of the drop in coal use overall last year was due to the closure of the UK’s last coal-fired power station, at Ratcliffe-on-Soar in Nottinghamshire. (For more on how the UK became the first G7 country to phase out coal power, see Carbon Brief’s in-depth interactive feature.)

The plant supplied power to the grid for the last time in September 2024, bringing to an end a 142-year era of using coal to generate electricity in the UK.

The shift away from coal power towards low-carbon sources has been one of the driving forces of UK emissions cuts in recent years.

Indeed, in the period since the UK’s Climate Change Act was passed, the amount of coal used to generate electricity has dropped by 99%, from 48Mt in 2008 to less than 1Mt in 2024. This accounts for the large majority (84%) of the total reduction in coal use over the same period.

Steel slide

In 2024, however, two-thirds of the drop in UK coal consumption – and one-third of the drop in emissions overall – came from lower coal use by heavy industry.

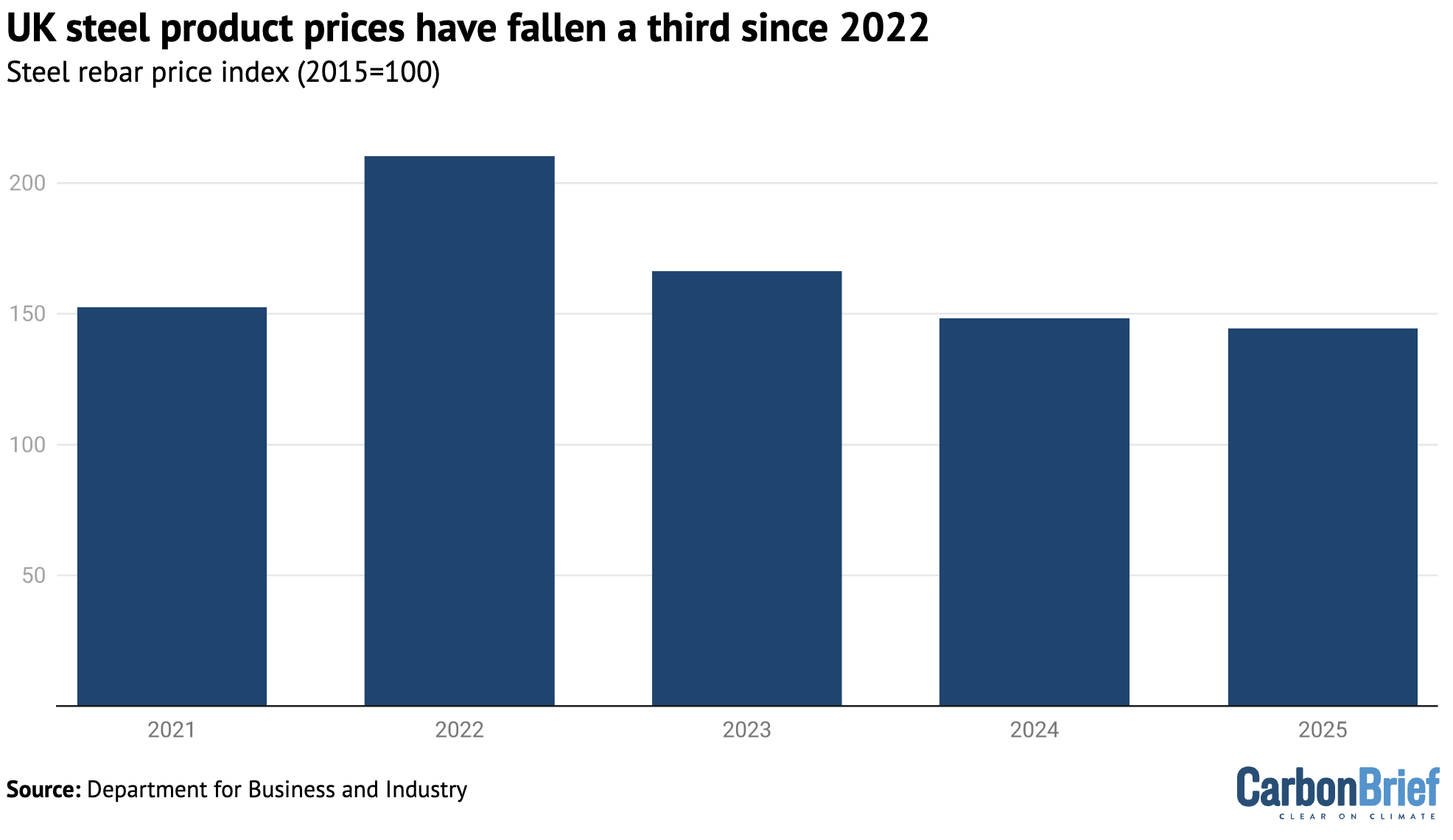

This was largely due to lower steel production, which fell from 5.6Mt in 2023 to 4.0Mt in 2024, a reduction of 29%. This 1.6Mt drop in production was mostly offset by a 1.3Mt increase in imports.

The Port Talbot steelworks in Wales shut down its last two blast furnaces in April and September, with owner Tata blaming losses of £1m a day for the closures.

Since the site last made a profit in 2022, UK and global steel prices have fallen sharply, as shown in the figure below. US credit rating agency Fitch Ratings says the decline in prices, down to weak demand and high exports from China, is “putting pressure on producers’ margins”.

Many commentators have tried to blame climate policy or electricity prices for the steel sector’s problems. However, energy only makes up a tiny fraction of coal-based steel production costs.

Moreover, steelmakers around the world – from China to South Africa – are facing similar challenges, with prices falling as a result of supply being significantly greater than demand.

Industry group Eurofer says the European market is being “flooded by cheap foreign steel”. It adds that economic headwinds in China, including its real-estate slowdown, have seen “around 100m tonnes of Chinese steel…flooding major markets at dumping prices”.

As such, it is not at all clear that the UK steel sector would have fared differently – or that the Port Talbot blast furnaces would have remained open – in the absence of climate policy.

For example, the sector is part of the UK emissions trading scheme (UKETS), meaning it nominally faces a carbon price that imports from outside the EU would not have to pay.

Yet UK (and EU) steelmakers continue to receive free allowances to shield them from the risk of “leakage” due to competition from abroad. The Port Talbot steelworks received more than 21m free allowances to cover its emissions in the period 2021-2025, worth roughly £1bn. Similarly, the Scunthorpe steelworks received nearly 17m allowances worth around £0.8bn.

From 2027, the UK plans to follow the EU in shifting from free allowances to a carbon border adjustment mechanism (CBAM), under which importers must pay an equivalent carbon price.

The closure of the UK’s blast furnaces is not the end of the story for steelmaking in the country. Indeed, Tata has pledged an investment worth £1.25bn to reopen its Welsh site with electric arc furnaces, which do not rely on coal. This includes up to £0.5bn from the government. Tata says it will have the capacity to produce 3Mt of steel per year from late 2027 or early 2028.

Production also paused in 2024 at the Scunthorpe steelworks, run by the Chinese-owned British Steel, reportedly due to managers ordering the wrong type of coal. Its blast furnaces are now operating again, but it is also looking to shift to electric arc furnaces with government support.

The UK steel industry has welcomed the shift to electric arc furnaces, but has called for efforts to reduce electricity prices, including the 2024 “supercharger” scheme that exempts heavy industry from additional costs relating to renewable subsidies and electricity network charges.

The government’s February 2025 steel strategy looks at issues including “overcapacity in global markets” and the “influence of electricity prices on the competitiveness of the steel sector”.

Rise of EVs

After coal, the next-largest chunk of emissions cuts in 2024 came from lower demand for oil and gas, which accounted for around a third of the reduction overall.

The 1.4% drop in oil demand is particularly interesting, given that traffic on the UK’s roads has been increasing in recent years.

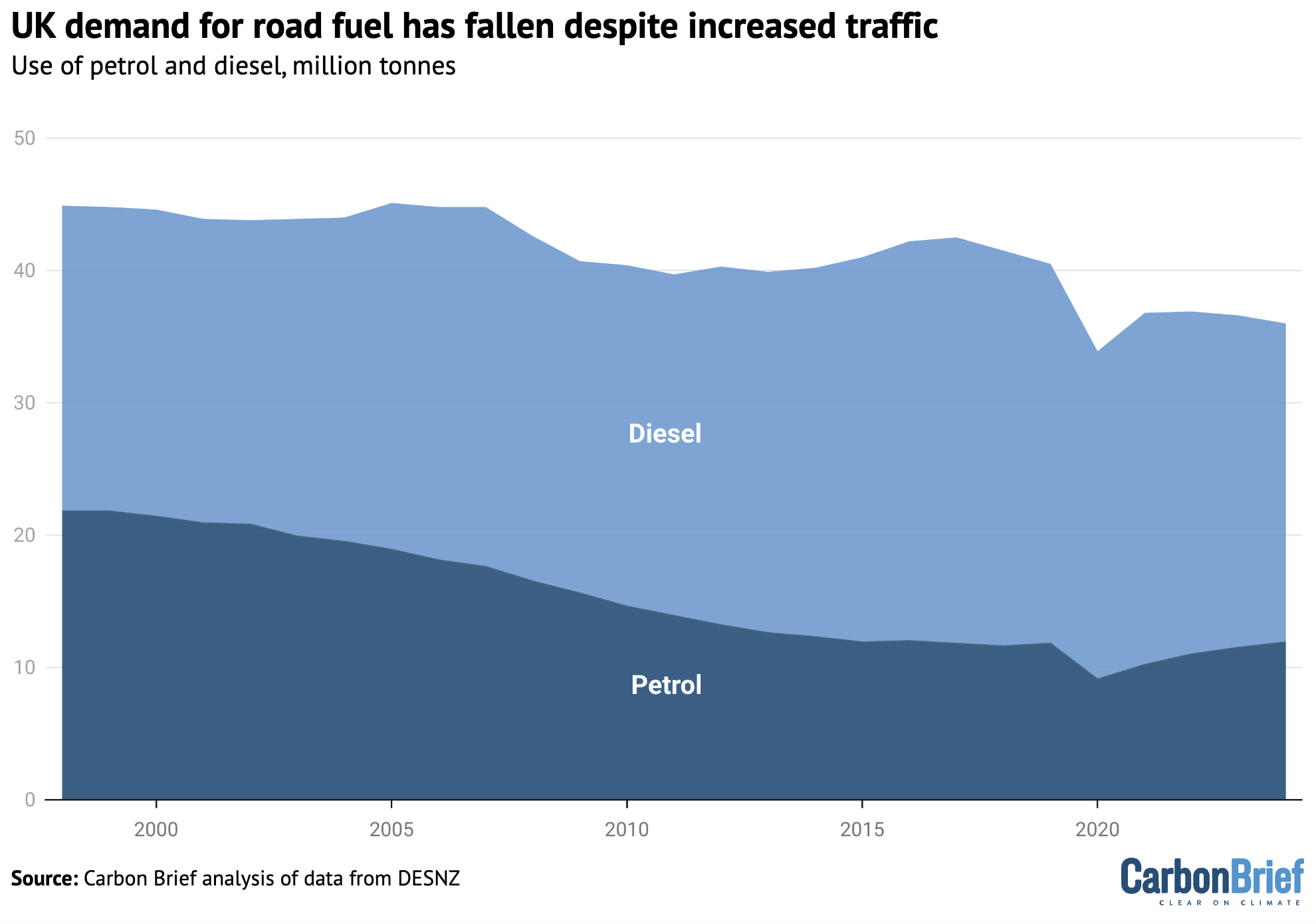

The number of miles driven on UK roads increased by more than 1% in 2024 and is now close to pre-pandemic levels. Yet UK demand for road-transport fuels fell by another 1.6% in 2024 and is now nearly 14% lower than it was in 2019, as shown in the figure below.

Along with improvements in fuel efficiency, the rise of EVs is a key part of this phenomenon.

The UK’s right-leaning newspapers have been busy finding new driving-related wordplay for what they have misleadingly described as a “stalling” market for EVs, which is apparently “going into reverse”.

The reality is that the number of EVs on the UK’s road rose from 1m in 2023 to 1.4m in 2024, an increase of 39% in just one year. The number of plug-in hybrids was up 28% to 0.8m.

Along with 76,000 electric vans, these EVs cut oil-related emissions by at least 5.9MtCO2e in 2024, Carbon Brief analysis finds, relative to similar vehicles burning petrol or diesel fuel.

These electrified vehicles have added around 4 terawatt hours to UK electricity demand in 2024, around 1% of the total. As such, the emissions associated with additional electricity generation, at around 0.5MtCO2e, offsets less than 10% of the savings from reduced oil use.

(On a lifecycle basis, EVs in the UK cut emissions by around 70% taking into account the emissions associated with manufacturing the cars, their batteries and fuelling them during use.)

Even more strikingly, the UK’s EV drivers saved around £1.7bn in lower fuel costs in 2024, Carbon Brief analysis finds, relative to petrol or diesel vehicles.

These savings, averaging roughly £800 per vehicle per year, conservatively assume that charging takes place at domestic retail electricity prices, rather than reduced-rate overnight tariffs.

Greenhouse gas emissions from burning gas also dipped in 2024, as demand for the fuel reached a record low. The roughly 2MtCO2e drop in emissions from gas made up around a sixth of the reduction in the UK overall and reflects the combined impact of competing trends.

Demand for heating in buildings (+3.8%) and offices (+0.6%) increased, despite temperatures being above average and higher than a year earlier. Industrial gas use also increased (+0.3%).

This is likely the result of lower fuel prices, which have eased since the peaks seen during the early phase of the global energy crisis precipitated by Russia’s invasion of Ukraine in 2022.

In contrast, gas demand for generating power fell by 13%, helping to make the UK’s electricity in 2024 the “cleanest ever”. This reduction was due to an increase in output from low-carbon sources, as well as an increase in the amount of cheap electricity imported from overseas.

A small, but still notable contributor to lower UK gas demand in 2024 came from reduced imports of liquified natural gas (LNG), which roughly halved compared with a year earlier.

Following Russia’s invasion, the UK had acted as an import hub for the rest of Europe, taking deliveries of LNG and then re-exporting the gas to the continent via pipelines. In 2024, however, European demand for gas eased and UK exports via the pipeline to Belgium also halved.

Import terminals use some of the gas they handle to “regasify” the supercooled LNG cargo that arrives by ship, turning it back into a gas that can be fed into pipelines. (The emissions associated with this process count towards the UK’s territorial total, even if the gas is burned overseas.)

In 2023, these terminals had used some 3TWh of gas, equivalent to the heating needs of half the homes in Birmingham. In 2024, LNG terminals used half this amount.

Emissions decoupling

While the UK’s emissions have fallen in most years since 1990, the baseline for the nation’s climate goals, the size of its economy has nearly doubled.

Specifically, emissions are “decoupling” from economic growth, having fallen to 54% below 1990 levels while GDP is up 84%, as shown in the figure below.

Taking an even longer view, the UK’s £2tn economy is now about 20 times larger than it was in 1872, after adjusting for inflation, whereas emissions are roughly the same.

Moreover, considering its population is now nearly 70 million people compared to 32m in 1872, the UK’s per-capita emissions have fallen two-fold, from 11.3tCO2e in 1872 to 5.4CO2e in 2024.

The 14MtCO2e drop in emissions in 2024 can be compared with the trajectory needed to reach the UK’s national and international climate pledges for 2035 and 2050.

If emissions fell by the same amount every year as they did in 2024, then the UK would miss both targets. It would need to cut emissions by 20MtCO2e each year to meet the 2035 target and by an average of 15MtCO2e per year to reach net-zero emissions by 2050.

In other words, annual emissions cuts would need to accelerate in the short- to medium-term, but could start to ease off later on. This is consistent with the cost-effective pathway to net-zero set out last month by the Climate Change Committee in its latest advice to the government.

Methodology

The starting point for Carbon Brief’s analysis of UK greenhouse gas emissions is preliminary government estimates of energy use by fuel. These are published quarterly, with the final quarter of each year appearing in figures published at the end of the following February. The same approach has accurately estimated year-to-year changes in emissions in previous years (see table, below).

| Year | Reported | Carbon Brief | Difference |

|---|---|---|---|

| 2010 | 2.4 | 2.6 | 0.2 |

| 2011 | -7.3 | -7.7 | -0.4 |

| 2012 | 2.9 | 3.6 | 0.7 |

| 2013 | -2.2 | -4.1 | -1.9 |

| 2014 | -7.5 | -7.5 | -0.0 |

| 2015 | -3.9 | -3.8 | 0.0 |

| 2016 | -5.2 | -5.7 | -0.4 |

| 2017 | -2.5 | -2.0 | 0.5 |

| 2018 | -1.5 | -1.8 | -0.3 |

| 2019 | -3.6 | -4.0 | -0.4 |

| 2020 | -8.8 | -8.9 | -0.0 |

| 2021 | 3.6 | 3.8 | 0.2 |

| 2022 | -4.2 | -3.5 | 0.7 |

| 2023 | -4.9 | -5.1 | -0.2 |

| 2024 | -3.6 |

Annual change in UK greenhouse gas emissions, %

One large source of uncertainty is the provisional energy use data, which is revised at the end of March each year and often again later on. Emissions data is also subject to revision in light of improvements in data collection and the methodology used, with major revisions in 2021.

The table above applies Carbon Brief’s emissions calculations to the comparable energy use and emissions figures, which may differ from those published previously.

Another source of uncertainty is the fact that Carbon Brief’s approach to estimating the annual change in emissions differs from the methodology used for the government’s own provisional estimates. The government has access to more granular data not available for public use.

Carbon Brief’s analysis takes figures on the amount of energy sourced from coal, oil and gas reported in Energy Trends 1.2. These figures are combined with conversion factors for the CO2 emissions per unit of energy, published annually by the UK government. Conversion factors are available for each fuel type, for example, petrol, diesel, gas and coal for electricity generation.

For oil, the analysis also draws on Energy Trends 3.13, which further breaks down demand according to the subtype of oil, for example, petrol, jet fuel and so on. Similarly, for coal, the analysis draws on Energy Trends 2.6, which breaks down solid fuel use by subtype.

Emissions from each fuel are then estimated from the energy use multiplied by the conversion factor, weighted by the relative proportions for each fuel subtype.

For example, the UK uses roughly 50m tonnes of oil equivalent (Mtoe) in the form of oil products, around half of which is from road diesel. So half the total energy use from oil is combined with the conversion factor for road diesel, another one-fifth for petrol and so on.

Energy use from each fossil fuel subtype is mapped onto the appropriate emissions conversion factor. In some cases, there is no direct read-across, in which case the nearest appropriate substitute is used. For example, energy use listed as “bitumen” is mapped to “processed fuel oils – residual oil”. Similarly, solid fuel used by “other conversion industries” is mapped to “petroleum coke”, and “other” solid fuel use is mapped to “coal (domestic)”.

The energy use figures are calculated on an inland consumption basis, meaning they include bunkers consumed in the UK for international transport by air and sea. In contrast, national emissions inventories exclude international aviation and shipping.

The analysis, therefore, estimates and removes the part of oil use that is due to the UK’s share of international aviation. It draws on the UK’s final greenhouse gas emissions inventory, which breaks emissions down by sector and reports the total for domestic aviation.

This domestic emissions figure is compared with the estimated emissions due to jet fuel use overall, based on the appropriate conversion factor. The analysis assumes that domestic aviation’s share of emissions is equivalent to its share of jet fuel energy use.

In addition to estimating CO2 emissions from fossil fuel use, Carbon Brief assumes that CO2 emissions from non-fuel sources, such as land-use change and forestry, are the same as a year earlier. The remaining greenhouse gas emissions are assumed to change in line with the latest government energy and emissions projections.

These assumptions are based on the UK government’s own methodology for preliminary greenhouse gas emissions estimates, published in 2019.

Note that the figures in this article are for emissions within the UK measured according to international guidelines. This means they exclude emissions associated with imported goods, including imported biomass, as well as the UK’s share of international aviation and shipping.

The Office for National Statistics (ONS) has published detailed comparisons between various different approaches to calculating UK emissions, on a territorial, consumption, environmental accounts or international accounting basis.

The UK’s consumption-based CO2 emissions increased between 1990 and 2007. Since then, however, they have fallen by a similar number of tonnes as emissions within the UK.

Bioenergy is a significant source of renewable energy in the UK and its climate benefits are disputed. Contrary to public perception, however, only around one-quarter of bioenergy is imported.

International aviation is considered part of the UK’s carbon budgets and faces the prospect of tighter limits on its CO2 emissions. The international shipping sector has a target to at least halve its emissions by 2050, relative to 2008 levels.

The post Analysis: UK emissions fall 3.6% in 2024 as coal use drops to lowest since 1666 appeared first on Carbon Brief.

Analysis: UK emissions fall 3.6% in 2024 as coal use drops to lowest since 1666

Greenhouse Gases

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

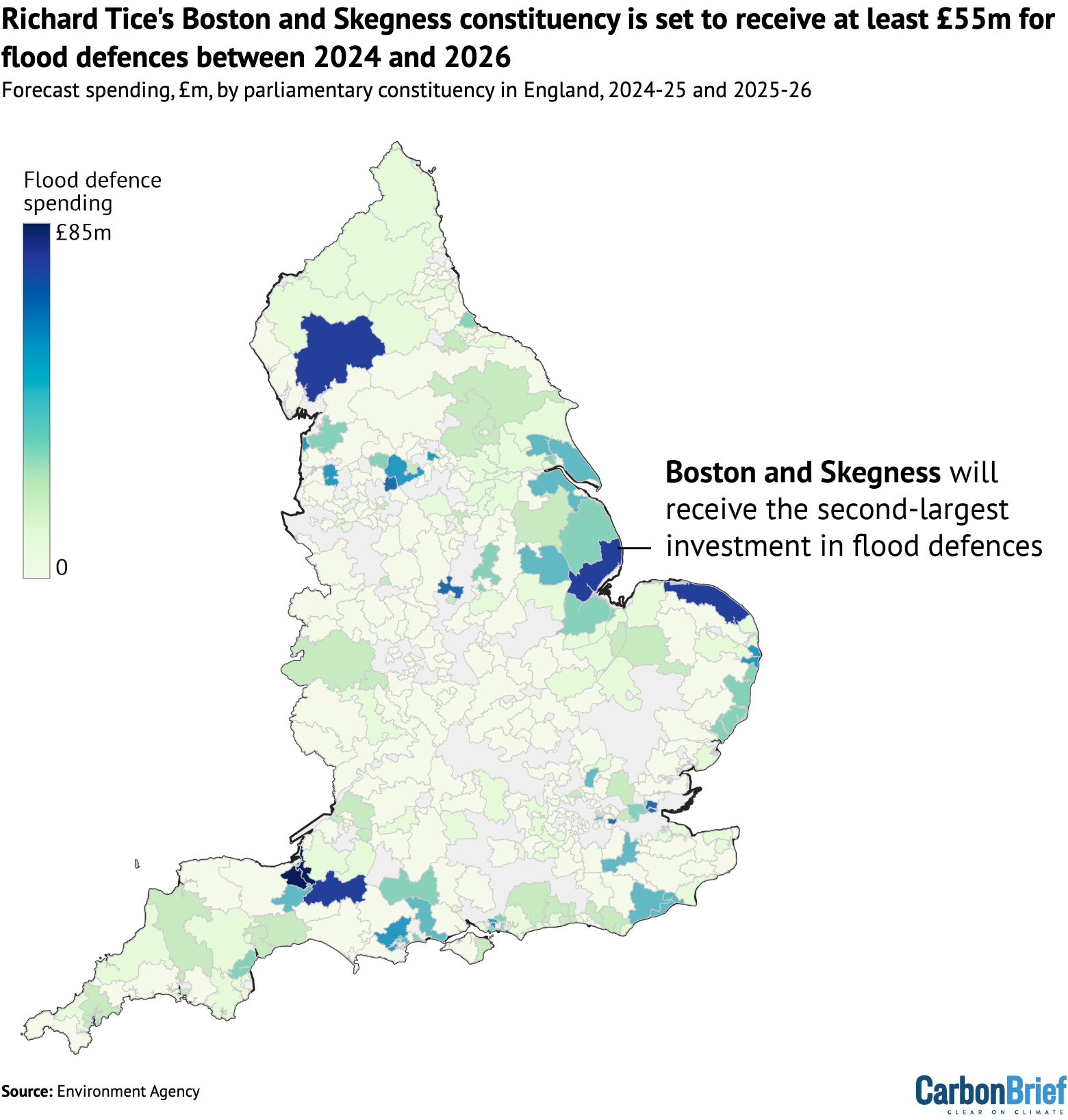

The Lincolnshire constituency held by Richard Tice, the climate-sceptic deputy leader of the hard-right Reform party, has been pledged at least £55m in government funding for flood defences since 2024.

This investment in Boston and Skegness is the second-largest sum for a single constituency from a £1.4bn flood-defence fund for England, Carbon Brief analysis shows.

Flooding is becoming more likely and more extreme in the UK due to climate change.

Yet, for years, governments have failed to spend enough on flood defences to protect people, properties and infrastructure.

The £1.4bn fund is part of the current Labour government’s wider pledge to invest a “record” £7.9bn over a decade on protecting hundreds of thousands of homes and businesses from flooding.

As MP for one of England’s most flood-prone regions, Tice has called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

He is also one of Reform’s most vocal opponents of climate action and what he calls “net stupid zero”. He denies the scientific consensus on climate change and has claimed, falsely and without evidence, that scientists are “lying”.

Flood defences

Last year, the government said it would invest £2.65bn on flood and coastal erosion risk management (FCERM) schemes in England between April 2024 and March 2026.

This money was intended to protect 66,500 properties from flooding. It is part of a decade-long Labour government plan to spend more than £7.9bn on flood defences.

There has been a consistent shortfall in maintaining England’s flood defences, with the Environment Agency expecting to protect fewer properties by 2027 than it had initially planned.

The Climate Change Committee (CCC) has attributed this to rising costs, backlogs from previous governments and a lack of capacity. It also points to the strain from “more frequent and severe” weather events, such as storms in recent years that have been amplified by climate change.

However, the CCC also said last year that, if the 2024-26 spending programme is delivered, it would be “slightly closer to the track” of the Environment Agency targets out to 2027.

The government has released constituency-level data on which schemes in England it plans to fund, covering £1.4bn of the 2024-26 investment. The other half of the FCERM spending covers additional measures, from repairing existing defences to advising local authorities.

The map below shows the distribution of spending on FCERM schemes in England over the past two years, highlighting the constituency of Richard Tice.

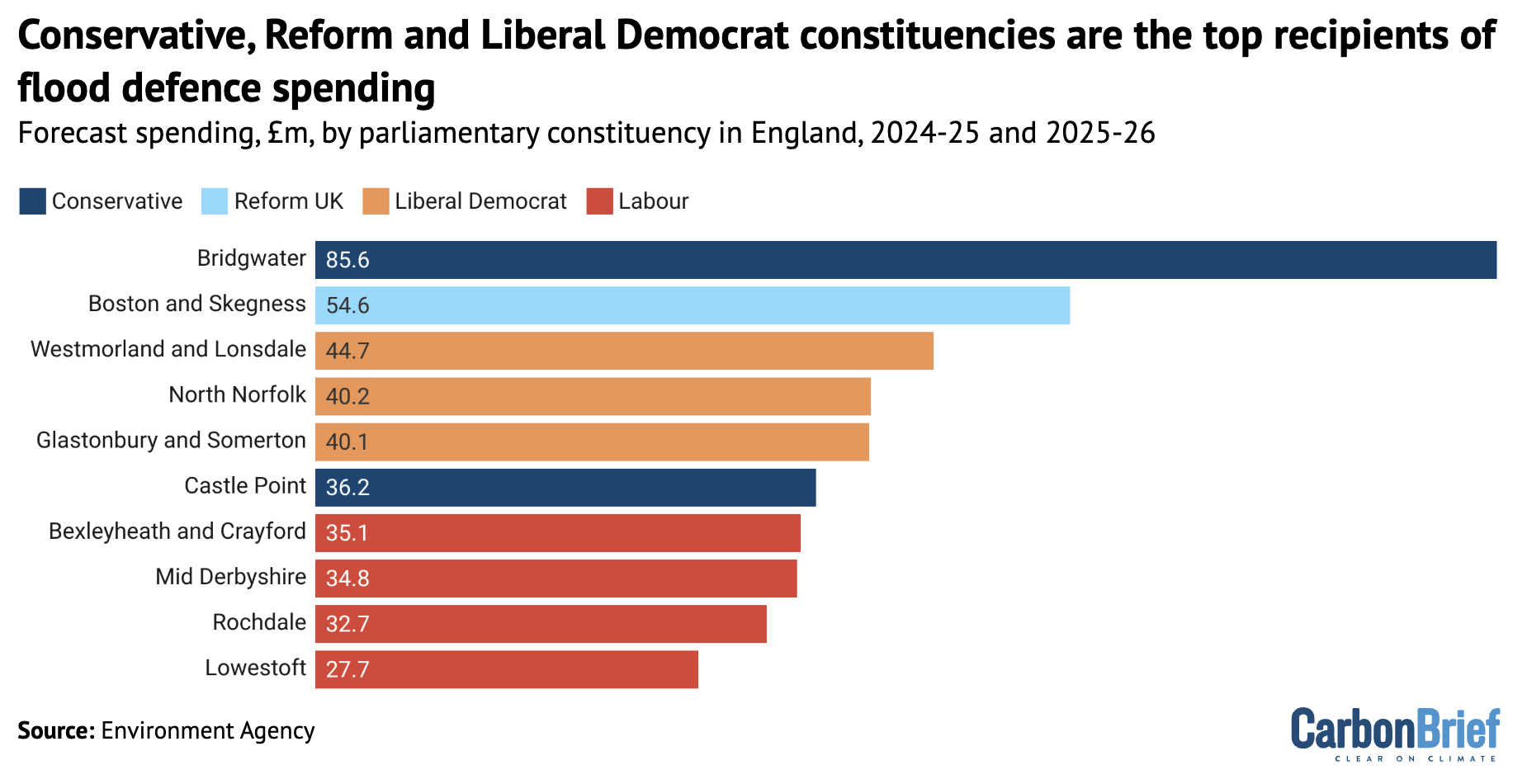

By far the largest sum of money – £85.6m in total – has been committed to a tidal barrier and various other defences in the Somerset constituency of Bridgwater, the seat of Conservative MP Ashley Fox.

Over the first months of 2026, the south-west region has faced significant flooding and Fox has called for more support from the government, citing “climate patterns shifting and rainfall intensifying”.

He has also backed his party’s position that “the 2050 net-zero target is impossible” and called for more fossil-fuel extraction in the North Sea.

Tice’s east-coast constituency of Boston and Skegness, which is highly vulnerable to flooding from both rivers and the sea, is set to receive £55m. Among the supported projects are beach defences from Saltfleet to Gibraltar Point and upgrades to pumping stations.

Overall, Boston and Skegness has the second-largest portion of flood-defence funding, as the chart below shows. Constituencies with Conservative and Liberal Democrat MPs occupied the other top positions.

Overall, despite Labour MPs occupying 347 out of England’s 543 constituencies – nearly two-thirds of the total – more than half of the flood-defence funding was distributed to constituencies with non-Labour MPs. This reflects the flood risk in coastal and rural areas that are not traditional Labour strongholds.

Reform funding

While Reform has just eight MPs, representing 1% of the population, its constituencies have been assigned 4% of the flood-defence funding for England.

Nearly all of this money was for Tice’s constituency, although party leader Nigel Farage’s coastal Clacton seat in Kent received £2m.

Reform UK is committed to “scrapping net-zero” and its leadership has expressed firmly climate-sceptic views.

Much has been made of the disconnect between the party’s climate policies and the threat climate change poses to its voters. Various analyses have shown the flood risk in Reform-dominated areas, particularly Lincolnshire.

Tice has rejected climate science, advocated for fossil-fuel production and criticised Environment Agency flood-defence activities. Yet, he has also called for more investment in flood defences, stating that “we cannot afford to ‘surrender the fens’ to the sea”.

This may reflect Tice’s broader approach to climate change. In a 2024 interview with LBC, he said:

“Where you’ve got concerns about sea level defences and sea level rise, guess what? A bit of steel, a bit of cement, some aggregate…and you build some concrete sea level defences. That’s how you deal with rising sea levels.”

While climate adaptation is viewed as vital in a warming world, there are limits on how much societies can adapt and adaptation costs will continue to increase as emissions rise.

The post Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding appeared first on Carbon Brief.

Analysis: Constituency of Reform’s climate-sceptic Richard Tice gets £55m flood funding

Greenhouse Gases

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

We handpick and explain the most important stories at the intersection of climate, land, food and nature over the past fortnight.

This is an online version of Carbon Brief’s fortnightly Cropped email newsletter.

Subscribe for free here.

Key developments

Food inflation on the rise

DELUGE STRIKES FOOD: Extreme rainfall and flooding across the Mediterranean and north Africa has “battered the winter growing regions that feed Europe…threatening food price rises”, reported the Financial Times. Western France has “endured more than 36 days of continuous rain”, while farmers’ associations in Spain’s Andalusia estimate that “20% of all production has been lost”, it added. Policy expert David Barmes told the paper that the “latest storms were part of a wider pattern of climate shocks feeding into food price inflation”.

-

Sign up to Carbon Brief’s free “Cropped” email newsletter. A fortnightly digest of food, land and nature news and views. Sent to your inbox every other Wednesday.

NO BEEF: The UK’s beef farmers, meanwhile, “face a double blow” from climate change as “relentless rain forces them to keep cows indoors”, while last summer’s drought hit hay supplies, said another Financial Times article. At the same time, indoor growers in south England described a 60% increase in electricity standing charges as a “ticking timebomb” that could “force them to raise their prices or stop production, which will further fuel food price inflation”, wrote the Guardian.

‘TINDERBOX’ AND TARIFFS: A study, covered by the Guardian, warned that major extreme weather and other “shocks” could “spark social unrest and even food riots in the UK”. Experts cited “chronic” vulnerabilities, including climate change, low incomes, poor farming policy and “fragile” supply chains that have made the UK’s food system a “tinderbox”. A New York Times explainer noted that while trade could once guard against food supply shocks, barriers such as tariffs and export controls – which are being “increasingly” used by politicians – “can shut off that safety valve”.

El Niño looms

NEW ENSO INDEX: Researchers have developed a new index for calculating El Niño, the large-scale climate pattern that influences global weather and causes “billions in damages by bringing floods to some regions and drought to others”, reported CNN. It added that climate change is making it more difficult for scientists to observe El Niño patterns by warming up the entire ocean. The outlet said that with the new metric, “scientists can now see it earlier and our long-range weather forecasts will be improved for it.”

WARMING WARNING: Meanwhile, the US Climate Prediction Center announced that there is a 60% chance of the current La Niña conditions shifting towards a neutral state over the next few months, with an El Niño likely to follow in late spring, according to Reuters. The Vibes, a Malaysian news outlet, quoted a climate scientist saying: “If the El Niño does materialise, it could possibly push 2026 or 2027 as the warmest year on record, replacing 2024.”

CROP IMPACTS: Reuters noted that neutral conditions lead to “more stable weather and potentially better crop yields”. However, the newswire added, an El Niño state would mean “worsening drought conditions and issues for the next growing season” to Australia. El Niño also “typically brings a poor south-west monsoon to India, including droughts”, reported the Hindu’s Business Line. A 2024 guest post for Carbon Brief explained that El Niño is linked to crop failure in south-eastern Africa and south-east Asia.

News and views

- DAM-AG-ES: Several South Korean farmers filed a lawsuit against the country’s state-owned utility company, “seek[ing] financial compensation for climate-related agricultural damages”, reported United Press International. Meanwhile, a national climate change assessment for the Philippines found that the country “lost up to $219bn in agricultural damages from typhoons, floods and droughts” over 2000-10, according to Eco-Business.

- SCORCHED GRASS: South Africa’s Western Cape province is experiencing “one of the worst droughts in living memory”, which is “scorching grass and killing livestock”, said Reuters. The newswire wrote: “In 2015, a drought almost dried up the taps in the city; farmers say this one has been even more brutal than a decade ago.”

- NOUVELLE VEG: New guidelines published under France’s national food, nutrition and climate strategy “urged” citizens to “limit” their meat consumption, reported Euronews. The delayed strategy comes a month after the US government “upended decades of recommendations by touting consumption of red meat and full-fat dairy”, it noted.

- COURTING DISASTER: India’s top green court accepted the findings of a committee that “found no flaws” in greenlighting the Great Nicobar project that “will lead to the felling of a million trees” and translocating corals, reported Mongabay. The court found “no good ground to interfere”, despite “threats to a globally unique biodiversity hotspot” and Indigenous tribes at risk of displacement by the project, wrote Frontline.

- FISH FALLING: A new study found that fish biomass is “falling by 7.2% from as little as 0.1C of warming per decade”, noted the Guardian. While experts also pointed to the role of overfishing in marine life loss, marine ecologist and study lead author Dr Shahar Chaikin told the outlet: “Our research proves exactly what that biological cost [of warming] looks like underwater.”

- TOO HOT FOR COFFEE: According to new analysis by Climate Central, countries where coffee beans are grown “are becoming too hot to cultivate them”, reported the Guardian. The world’s top five coffee-growing countries faced “57 additional days of coffee-harming heat” annually because of climate change, it added.

Spotlight

Nature talks inch forward

This week, Carbon Brief covers the latest round of negotiations under the UN Convention on Biological Diversity (CBD), which occurred in Rome over 16-19 February.

The penultimate set of biodiversity negotiations before October’s Conference of the Parties ended in Rome last week, leaving plenty of unfinished business.

The CBD’s subsidiary body on implementation (SBI) met in the Italian capital for four days to discuss a range of issues, including biodiversity finance and reviewing progress towards the nature targets agreed under the Kunming-Montreal Global Biodiversity Framework (GBF).

However, many of the major sticking points – particularly around finance – will have to wait until later this summer, leaving some observers worried about the capacity for delegates to get through a packed agenda at COP17.

The SBI, along with the subsidiary body on scientific, technical and technological advice (SBSTTA) will both meet in Nairobi, Kenya, later this summer for a final round of talks before COP17 kicks off in Yerevan, Armenia, on 19 October.

Money talks

Finance for nature has long been a sticking point at negotiations under the CBD.

Discussions on a new fund for biodiversity derailed biodiversity talks in Cali, Colombia, in autumn 2024, requiring resumed talks a few months later.

Despite this, finance was barely on the agenda at the SBI meetings in Rome. Delegates discussed three studies on the relationship between debt sustainability and implementation of nature plans, but the more substantive talks are set to take place at the next SBI meeting in Nairobi.

Several parties “highlighted concerns with the imbalance of work” on finance between these SBI talks and the next ones, reported Earth Negotiations Bulletin (ENB).

Lim Li Ching, senior researcher at Third World Network, noted that tensions around finance permeated every aspect of the talks. She told Carbon Brief:

“If you’re talking about the gender plan of action – if there’s little or no financial resources provided to actually put it into practice and implement it, then it’s [just] paper, right? Same with the reporting requirements and obligations.”

Monitoring and reporting

Closely linked to the issue of finance is the obligations of parties to report on their progress towards the goals and targets of the GBF.

Parties do so through the submission of national reports.

Several parties at the talks pointed to a lack of timely funding for driving delays in their reporting, according to ENB.

A note released by the CBD Secretariat in December said that no parties had submitted their national reports yet; by the time of the SBI meetings, only the EU had. It further noted that just 58 parties had submitted their national biodiversity plans, which were initially meant to be published by COP16, in October 2024.

Linda Krueger, director of biodiversity and infrastructure policy at the environmental not-for-profit Nature Conservancy, told Carbon Brief that despite the sparse submissions, parties are “very focused on the national report preparation”. She added:

“Everybody wants to be able to show that we’re on the path and that there still is a pathway to getting to 2030 that’s positive and largely in the right direction.”

Watch, read, listen

NET LOSS: Nigeria’s marine life is being “threatened” by “ghost gear” – nets and other fishing equipment discarded in the ocean – said Dialogue Earth.

COMEBACK CAUSALITY: A Vox long-read looked at whether Costa Rica’s “payments for ecosystem services” programme helped the country turn a corner on deforestation.

HOMEGROWN GOALS: A Straits Times podcast discussed whether import-dependent Singapore can afford to shelve its goal to produce 30% of its food locally by 2030.

‘RUSTING’ RIVERS: The Financial Times took a closer look at a “strange new force blighting the [Arctic] landscape”: rivers turning rust-orange due to global warming.

New science

- Lakes in the Congo Basin’s peatlands are releasing carbon that is thousands of years old | Nature Geoscience

- Natural non-forest ecosystems – such as grasslands and marshlands – were converted for agriculture at four times the rate of land with tree cover between 2005 and 2020 | Proceedings of the National Academy of Sciences

- Around one-quarter of global tree-cover loss over 2001-22 was driven by cropland expansion, pastures and forest plantations for commodity production | Nature Food

In the diary

- 2-6 March: UN Food and Agriculture Organization regional conference for Latin America and Caribbean | Brasília

- 5 March: Nepal general elections

- 9-20 March: First part of the thirty-first session of the International Seabed Authority (ISA) | Kingston, Jamaica

Cropped is researched and written by Dr Giuliana Viglione, Aruna Chandrasekhar, Daisy Dunne, Orla Dwyer and Yanine Quiroz.

Please send tips and feedback to cropped@carbonbrief.org

The post Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate appeared first on Carbon Brief.

Cropped 25 February 2026: Food inflation strikes | El Niño looms | Biodiversity talks stagnate

Greenhouse Gases

Dangerous heat for Tour de France riders only a ‘question of time’

Rising temperatures across France since the mid-1970s is putting Tour de France competitors at “high risk”, according to new research.

The study, published in Scientific Reports, uses 50 years of climate data to calculate the potential heat stress that athletes have been exposed to across a dozen different locations during the world-famous cycling race.

The researchers find that both the severity and frequency of high-heat-stress events have increased across France over recent decades.

But, despite record-setting heatwaves in France, the heat-stress threshold for safe competition has rarely been breached in any particular city on the day the Tour passed through.

(This threshold was set out by cycling’s international governing body in 2024.)

However, the researchers add it is “only a question of time” until this occurs as average temperatures in France continue to rise.

The lead author of the study tells Carbon Brief that, while the race organisers have been fortunate to avoid major heat stress on race days so far, it will be “harder and harder to be lucky” as extreme heat becomes more common.

‘Iconic’

The Tour de France is one of the world’s most storied cycling races and the oldest of Europe’s three major multi-week cycling competitions, or Grand Tours.

Riders cover around 3,500 kilometres (km) of distance and gain up to nearly 55km of altitude over 21 stages, with only two or three rest days throughout the gruelling race.

The researchers selected the Tour de France because it is the “iconic bike race. It is the bike race of bike races,” says Dr Ivana Cvijanovic, a climate scientist at the French National Research Institute for Sustainable Development, who led the new work.

Heat has become a growing problem for the competition in recent years.

In 2022, Alexis Vuillermoz, a French competitor, collapsed at the finish line of the Tour’s ninth stage, leaving in an ambulance and subsequently pulling out of the race entirely.

Two years later, British cyclist Sir Mark Cavendish vomited on his bike during the first stage of the race after struggling with the 36C heat.

The Tour also makes a good case study because it is almost entirely held during the month of July and, while the route itself changes, there are many cities and stages that are repeated from year to year, Cvijanovic adds.

‘Have to be lucky’

The study focuses on the 50-year span between 1974 and 2023.

The researchers select six locations across the country that have commonly hosted the Tour, from the mountain pass of Col du Tourmalet, in the French Pyrenees, to the city of Paris – where the race finishes, along the Champs-Élysées.

These sites represent a broad range of climatic zones: Alpe d’ Huez, Bourdeaux, Col du Tourmalet, Nîmes, Paris and Toulouse.

For each location, they use meteorological reanalysis data from ERA5 and radiant temperature data from ERA5-HEAT to calculate the “wet-bulb globe temperature” (WBGT) for multiple times of day across the month of July each year.

WBGT is a heat-stress index that takes into account temperature, humidity, wind speed and direct sunlight.

Although there is “no exact scientific consensus” on the best heat-stress index to use, WBGT is “one of the rare indicators that has been originally developed based on the actual human response to heat”, Cvijanovic explains.

It is also the one that the International Cycling Union (UCI) – the world governing body for sport cycling – uses to assess risk. A WBGT of 28C or higher is classified as “high risk” by the group.

WBGT is the “gold standard” for assessing heat stress, says Dr Jessica Murfree, director of the ACCESS Research Laboratory and assistant professor at the University of North Carolina at Chapel Hill.

Murfree, who was not involved in the new study, adds that the researchers are “doing the right things by conducting their science in alignment with the business practices that are already happening”.

The researchers find that across the 50-year time period, WBGT has been increasing across the entire country – albeit, at different rates. In the north-west of the country, WBGT has increased at an average rate of 0.1C per decade, while in the southern and eastern parts of the country, it has increased by more than 0.5C per decade.

The maps below show the maximum July WBGT for each decade of the analysis (rows) and for hourly increments of the late afternoon (columns). Lower temperatures are shown in lighter greens and yellows, while higher temperatures are shown in darker reds and purples.

Six Tour de France locations analysed in the study are shown as triangles on the maps (clockwise from top): Paris, Alpe d’ Huez, Nîmes, Toulouse, Col du Tourmalet and Bordeaux.

The maps show that the maximum WBGT temperature in the afternoon has surpassed 28C over almost the entire country in the last decade. The notable exceptions to this are the mountainous regions of the Alps and the Pyrenees.

The researchers also find that most of the country has crossed the 28C WBGT threshold – which they describe as “dangerous heat levels” – on at least one July day over the past decade. However, by looking at the WBGT on the day the Tour passed through any of these six locations, they find that the threshold has rarely been breached during the race itself.

For example, the research notes that, since 1974, Paris has seen a WBGT of 28C five times at 3pm in July – but that these events have “so far” not coincided with the cycling race.

The study states that it is “fortunate” that the Tour has so far avoided the worst of the heat-stress.

Cvijanovic says the organisers and competitors have been “lucky” to date. She adds:

“It has worked really well for them so far. But as the frequency of these [extreme heat] events is increasing, it will be harder and harder to be lucky.”

Dr Madeleine Orr, an assistant professor of sport ecology at the University of Toronto who was not involved in the study, tells Carbon Brief that the paper was “really well done”, noting that its “methods are good [and its] approach was sound”. She adds:

“[The Tour has] had athletes complain about [the heat]. They’ve had athletes collapse – and still those aren’t the worst conditions. I think that that says a lot about what we consider safe. They’ve still been lucky to not see what unsafe looks like, despite [the heat] having already had impacts.”

Heat safety protocols

In 2024, the UCI set out its first-ever high temperature protocol – a set of guidelines for race organisers to assess athletes’ risk of heat stress.

The assessment places the potential risk into one of five categories based on the WBGT, ranging from very low to high risk.

The protocol then sets out suggested actions to take in the event of extreme heat, ranging from having athletes complete their warm-ups using ice vests and cold towels to increasing the number of support vehicles providing water and ice.

If the WBGT climbs above the 28C mark, the protocol suggests that organisers modify the start time of the stage, adapt the course to remove particularly hazardous sections – or even cancel the race entirely.

However, Orr notes that many other parts of the race, such as spectator comfort and equipment functioning, may have lower temperatures thresholds that are not accounted for in the protocol, but should also be considered.

Murfree points out that the study’s findings – and the heat protocol itself – are “really focused on adaptation, rather than mitigation”. While this is “to be expected”, she tells Carbon Brief:

“Moving to earlier start times or adjusting the route specifically to avoid these locations that score higher in heat stress doesn’t stop the heat stress. These aren’t climate preventative measures. That, I think, would be a much more difficult conversation to have in the research because of the Tour de France’s intimate relationship with fossil-fuel companies.”

The post Dangerous heat for Tour de France riders only a ‘question of time’ appeared first on Carbon Brief.

Dangerous heat for Tour de France riders only a ‘question of time’

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits