Weather Guard Lightning Tech

Vestas Q4 Profits, EU Probes Goldwind Subsidies

Allen, Rosemary, and Yolanda, joined by Matthew Stead, discuss Vestas’ Q4 earnings beating competitors but disappointing investors, and the latest on the Wind Energy O&M Australia 2026 conference in Melbourne. Plus the European Commission opens a subsidy investigation into Goldwind, Texas sues over 3,000 dumped wind turbine blades, and Muehlhan Wind Service acquires Canadian AC883.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

The Uptime Wind Energy Podcast brought to you by StrikeTape, protecting thousands of wind turbines from lightning damage worldwide. Visit strike tape.com. And now your hosts.

Allen Hall: Welcome to the Uptime Wind Energy Podcast. I’m your host Alan Hall, and I’m here with Rosemary Barnes, Yolanda Padron. Matthew Stead down in Australia.

So welcome Matthew.

Matthew Stead: Great to be here. Thank you, Alan.

Allen Hall: We have a number of articles and interesting topics this week. Top of the list is Vestus. Vestus announced their Q4 numbers, and although the the revenue is great, uh, they, they had a profit of about 580 million euros. It was below what analysts expected, so the shares dropped about 6% on the news.

But the CEO of Vestus is saying, uh, full speed ahead. They’re, they’re willing to make some concessions. Vestus, as it sounds like, in terms [00:01:00] of thinning out the company a little bit, which I, that’s been a, a, a complaint from investors for a little while. But in, in terms of, uh, going forward in renewable energy, Vestus is still going to pursue that.

The offshore wind business looks like it’s gonna be profitable in 2027. And as we all know, and we, we see wind turbine prices, uh, quite a bit in each of our positions. Vestas is the most expensive one on the block, but they’re still winning a whole bunch of orders. And, and Matthew, uh, Vestas globally. I would say is the leader right now, if you look at Siemens GAA and GE Vestas is really winning a lot of the orders.

Matthew Stead: Yeah, I think a very strong reputation for quality. Um, I have to say, I’ve got some Vestas turbines behind me, so, um, all paid for by myself. They’ve always been well regarded for their, um, you know, quality of [00:02:00] product. And when I first got into wind, um, you know, probably 15 years ago, you know, they were, they were the leaders at that point in time.

And so, you know, quality. Reduces future o and m cost. I think

Rosemary Barnes: it’s not just about like the simple o and m, either it’s the risk that something really bad goes wrong and you’re just stuck with, you know, like a, a whole a hundred turbines that can’t be fixed or, you know, at least a large, a large chunk of them.

The more that I work in, in o and m, the more you see, like on occasion when you do have those serial issues that mean, you know, like. Sometimes all the blades in the wind farm have to be replaced or sometimes all the generators or you know, even if it’s not replaced, if you’ve gotta take them all out and do something and put ’em back in, it is just such a massive cost.

And, um, reducing the chance that that’s gonna happen is actually really valuable for insurance. And yeah, all sorts of other financial reasons.

Yolanda Padron: And even as an FSA customer, I feel like Vestus has a lot more transparency as to what actually is going on, [00:03:00] on site and more able to, to collaborate on, on like a site to site basis, which is very obviously helping them in getting a lot of return customers.

Allen Hall: Yeah. One of the key revenues for Vestus has been the FSA, where almost every project I’ve seen over the last couple of years has had a 2030 year FSA attached to it. Rarely do you see. Order without that, and that’s a long-term revenue stream. The, the thing about Vestus and the complaints that are happening, uh, around vestus are odd because if you look at Siemens Cab Mesa, they’re really struggling to be profitable.

And then GE Renova, which is really, really struggling to be profitable and they’re losing several hundred millions of dollars a year. Vestas is bringing in a profit, and, and yet the investors are wanting even more. I, I guess, is, is this just a relationship to the. Where you can invest money today. The stock market going up so high, gold and silver prices are at record highs.

Rosemary Barnes: Haven’t they just [00:04:00] crushed?

Allen Hall: They have a little bit. They’ve, they’ve rescinded some, but they’re still at really high numbers, right? So Gold Cross, what? $5,000 and ounce and then, uh, it was it 2000 a year ago? So the, the rise in the value of, of, uh, rear metals is crazy. Is there a plan you think Vestas is changing the way they’re gonna operate?

’cause uh, they’re talking about thinning out the ranks and they do seem to be becoming more vertically integrated with the acquisition of the TPI factories down in Mexico. GPI in India

Rosemary Barnes: before we make it sound too much like a paid segment from investors, I have to say I disagree that they’re like just crushing it with the, the FSAs.

I think that the full service agreements are across the board. Perform badly in Australia, at least I think it’s different elsewhere. Um, maybe it’s a good segue into, uh, talk about our event that we’ve got coming up to talk [00:05:00] about, um, the difficult operating conditions in Australia. But I, I think that best as, like everybody else has been surprised at how many things can go wrong in an Australia and wind farm.

And, um, I don’t, I I would’ve put them up on a pedestal for. Particularly noteworthy, um, brilliant service with the FSAs. I think, yeah, across the board everyone’s doing a little bit less than they should be, and I have no doubt that they’re also making a whole lot less money on those agreements than what they spent or spending a lot more than what they’re expecting.

So I don’t wanna be too harsh in my judgment.

Yolanda Padron: That’s fair. The bar is very low.

Rosemary Barnes: But what I do notice when I go to international events, um, and I, you know, I talk to, I’ve got a lot of ex-colleagues that’s still working in the industry and vest. Stands out as still investing a lot in r and d. And that doesn’t mean like crushing out a new platform every single year or every two years.

It’s not that. But they are investing in a lot of new technologies that are more incremental. They’re [00:06:00] looking at bigger technology leaps and um, you know, still investigating stuff like that. Like I think if I was to go back working for an OEM, that’s the kind of work I’d like to do. And investors does seem like it’s the main company that’s still doing a whole lot of that.

With the exception of, of the Chinese manufacturers, which are obviously doing like tons and tons of new development. But, um, I don’t have the insight into them like I do with the European ones.

Allen Hall: As you’re listening to this podcast, most of the people on this podcast are traveling to Melbourne, Australia for Woma 26.

That’s Wind Energy and M Australia. Big event. Matthew, the numbers are impressive. I’m getting a little bit scared. Run out of food and uh, seats because there is a massive influx in the last 24, 48 hours, which is great to see, but wind energy in Australia. Is huge, and the o and m aspect is one of those key pain points.

Matthew Stead: Yeah. I think, uh, thanks to Rosie and Alan, your argument, [00:07:00] um, a little while ago, your argument, which spurred the whole, um, the reason for the conference. Um, you know, the, the lack of, uh, Australian content, the lack of, um, poor. Conferences in Australia. I think unless you’d have that argument, um, this event wouldn’t, wouldn’t be there.

Allen Hall: Rosie did bring up that she had been to a number of conferences and so had I that were pretty much useless in terms of take home. What could we be able to use in the world and, and make the world just slightly better from our knowledge and. With all the policy talk and uh, discussion about sort of global warming things that it’s not really useful necessarily in making your operations run more efficiently.

And this was what Woma is all about is. Sharing information. Not everybody runs their operations the same. And you can learn from that of the way, uh, others do it. And at the same time, we’re bringing in experts from around the world to talk about some of [00:08:00] those really critical issues. One of them being leading edge erosion.

And Rosie’s been doing a lot of work in Australia on leading edge erosion and the complexities around that. Rosie, the leading edge erosion discussion and the panel involved in the people are gonna be on the panel are impressive. What are you looking forward to?

Rosemary Barnes: I’m looking forward to, um, getting the international perspective because leading edge erosion, I mean, there’s heaps of aspects of wind turbine operation that I think are just dramatically different in Australia, but I think leading edge erosion is the one that like really, really jumped out at me.

When I was, um, when I moved back to Australia and started looking at inspection reports for wind farms that were like one or two years old, and you see 90, 99% of turbines that have significant erosion like within a couple of years. It’s like, this is, this is not. Like, I’ve never, I’ve never seen this before.

It’s clear that no one is designing these products that are gonna peel off [00:09:00] within a couple of years. Um, and so that was what kind of got me thinking, you know what, like Australia is really different. Climatically and in terms of the weather. Um, and so we need to start not just getting our information from overseas, but also relating it back to Australia.

So I think that that’s what we’re trying really hard with the conference to do, is to like really ground it on Australian problems and solutions that have worked in Australia, but then draw on, you know, we don’t need to invent every single new product ourselves. Although there will also be. I, I’m very confident that, that we do need new products developed specifically for Australia.

Um, but you know, there are a lot of things out there we can really accelerate how quickly we can solve our Australian problems if we know what’s worked overseas in, you know, different places and just get ideas about how things work. So I think that’s a really good mix of, of local and international.

Matthew Stead: Yeah, as [00:10:00] we were talking before about, um, registrations, so we had. Definitely over 200 now. Um, and, um, I, I think we just need to warn people that we might need to cap it out. Um, so the venue’s told us two 50 maximum, so getting in quick

Allen Hall: and if you haven’t registered, you need to do so today. Go to WMA 2020 six.com.

It’s very easy to do. It’s an inexpensive conference and full of great information. And the one thing you wanna register for also when you’re there is the free Lightning workshop. On the Monday, so this, it will be February 16th. It’s a lightning workshop in the afternoon, and then the, the full event begins Tuesday the 17th, and running through Wednesday the 18th.

So you have two and a half full days of o and m. Knowledge sharing.

Matthew Stead: Don’t, don’t forget the workshops. There are two sessions of workshops with three, um, parallel sessions. And also don’t forget the chance to catch up with your buddies. So, uh, on the Monday [00:11:00] night, um, after the Lightning Masterclass, there’s, um, an event, you know, food and wine and drinks, et cetera.

And then also on the, the Tuesday after the first day, there’s also a chance to catch up

Allen Hall: and you’ll go to Wilma 2026. Com and register. Now.

Speaker: Australia’s wind farms are growing fast, but are your operations keeping up? Join us February 17th and 18th at Melbourne’s Pullman on the park for Wind energy o and m Australia 2026, where you’ll connect with the experts solving real problems in maintenance asset management and OEM relations.

Walk away with practical strategies to cut costs and boost uptime that you can use the moment you’re back on site. Register now at WM a 2020 six.com. Wind Energy o and m Australia is created by Wind professionals for wind professionals. Because this industry needs solutions, not speeches,

Allen Hall: the European Commission [00:12:00] has a message for Chinese wind turbine manufacturers.

We are watching. Uh, Brussels just opened an in-depth investigation into Goldwind, that’s one of China’s biggest turbine makers. The concern is really straightforward. European regulators believe Goldwin may have received government subsidies that given it unfair advantage. Over European competitors such as Vestus and Siemens, GOMESA, Nordics, and others, grants preferential tax treatment and below market loans are all on the table.

And if confirmed, the EU could impose corrective measures under its foreign subsidies regulation, which is a tool designed to keep the playing field level for everyone doing business in Europe. This has led to a number of heated exchanges in the press between China and the eu. China has, uh, said, Hey, eu, calm down.

It’s not that big of a deal. We, and we don’t really do this. And if you wanna point [00:13:00] fingers, uh, the EU has given a lot of money and resources to the wind turbine operations in the eu. So it’s a, a, a bunch of back and forth, which is an odd thing at the moment because China is really trying to penetrate the EU market and the UK market for that matter, offshore in particular.

Uh, Matthew, when you watch this go on and, and China obviously being the largest player in wind turbines, uh, there is some. Protection isn’t going into this. China has protected themselves from European manufactured turbines for the most part. Uh, it does seem like the EU has a leg to stand on and saying, Hey, if you’re gonna protect your borders, we’re gonna protect our borders.

How does this end up? Does this end up with, uh, China making turbines or getting turbines shipped into EU or. There’s just gonna be a prohibition.

Matthew Stead: Uh, actually, I’m a little bit surprised that this hasn’t happened already. [00:14:00] I mean, there’s obviously plenty of European investigations and I’m a little bit surprised it didn’t happen earlier.

Um, I, I guess my expectation is that, you know, this will be done and dusted and we can just move, move forward. Um, you know, my, my guesstimate is that it’ll be showing that, you know, this is all fine and, uh, yeah, just continue as per normal. Um, yep. Maybe, maybe critically. Um, I actually think a bit more competition in the industry is a good thing.

Um, and so I think the whole, you know, global industry can, can, can benefit.

Allen Hall: And when we’re talking about, uh, the construction of wind farms in the eu, the Chinese manufacturers always come up because they tend to be somewhere between 30 and 40% less expensive than the European counterparts for basically the same turbine.

What is the, the real linchpin there, because it does seem like operators and sted uh, evidently had a project going on where they’re looking at Chinese [00:15:00] turbines, but hasn’t made any decisions about it. There’s not a lot of history on the Chinese turbines. You can’t go back and pull, uh, o and m records.

You can’t see reliability rates. You can’t see what their insurance rates have been. And Rosie, I think you’ve talked about this quite a bit. It does seem like the manufacturing capability in China is quite good, but then we see things on LinkedIn quite often. We’re uh, there has been some really massive failures there.

How is the EU thinking about this? Is it really a competitive issue at this point, or is it a technology issue? What is the real. Uh, linchpin that it, it is, it everybody is trying to get at.

Rosemary Barnes: Yeah. Well I think Europe would be crazy to not support their wind industry because China is so big and has, um, you know, so many wind turbine manufacturers now that if Europe doesn’t specifically try to, you know, compete and survive, then I can [00:16:00] imagine no.

non-Chinese manufacturers in 10 years time, um, or you know, at least 20, which I think would be a shame because there is a huge, long history of really good engineering, um, in Europe. Yes. Uh, every country supports their manufacturers. China do it in many, maybe most of their export industries. Everybody knows that.

Chinese solar panels are subsidized most countries and regions, except that steel is heavily subsidized in, um, in China. And so there are in many countries restrictions on Chinese made wind turbine towers or tariffs on them. Because of that reason, it’s like pretty. It is pretty uncontroversial. Like it’s pretty obvious, right?

That um, if you don’t fight, then um, you say, yeah, we’ll accept all these cheap products then, um, you know, because that’s beneficial for our economy to have them cheap. That’s like a short term thing. It’s [00:17:00] a lot easier in a country like Australia where we don’t have competing industries for many of these, um, many of these products, it’s a bit easier to say, yes, we would love cheap solar panels and cheap wind turbines and cheap electric vehicles and cheap batteries.

But I mean, even Australia is trying to regain some of some of that, um, manufacturing capability.

Matthew Stead: But Rosie to, I guess Rosie to challenge you there. I mean, it won’t, it to improve the world’s, you know, position if we, you know, continue to drive prices down and drive a bit of innovation.

Rosemary Barnes: Yeah. If we drive prices down, but not if we drive, um, all competition out of business.

And then you’re left with just one country that controls the supply chain for absolutely everything, which they’re already very largely. Do in terms of, you know, like, yeah, batteries, EVs, uh, solar panels, um, heaps of the raw materials, you know, like rare earths and a lot of other critical, um, critical [00:18:00] minerals.

But I do think it’s a little bit different for Europe with wind because, um, if that, if that dies, it’s a big chunk of, um, just engineering knowledge that will just. Die with it. I would definitely, especially the countries like Denmark, where it is a, a significant industry for them, I have been a little bit surprised that they haven’t been supporting more the industry through some hard patches.

But yeah, let’s, um. It’ll be an interesting next few years.

Speaker 6: Delamination and bottomline failures and blades are difficult problems to detect early. These hidden issues can cost you millions in repairs and lost energy production. C-I-C-N-D-T are specialists to detect these critical flaws before they become expensive burdens. Their non-destructive test technology penetrates deep to blade materials to find voids [00:19:00] and cracks.

Traditional inspections completely. Miss C-I-C-N-D-T Maps. Every critical defect delivers actionable reports and provides support to get your blades back in service. So visit cic ndt.com because catching blade problems early will save you millions.

Allen Hall: Well, occasionally the wind industry has a recycling problem and down in Texas this has come to a head, uh, an Attorney General Ken Paxton. We as the Attorney General of Texas has sued global fiberglass solutions and affiliated companies for illegally dumping more than 3000 wind turbine blades in Sweetwater, Texas.

Uh, the company was hired to break down and recycle the blades many years ago. Instead, it stockpiled them at two unpermitted disposal sites. The attorney General is seeking civil [00:20:00] penalties, complete removal of the waste and full cleanup costs paid to the state. And Yolanda, you have seen this facility, I’ve seen this facility down by Sweetwater.

It is not a small site. It is massively large and has been there for a number of years. I, I guess there hasn’t been anybody willing to do it, and Global Fiberglass Solutions hasn’t stepped up to even start from what I understand. To take care of the problem. Is there a happy outcome of this? Does anybody else step into the, the fray and, and try to clean up these 3000 blades?

Yolanda Padron: We were talking a little bit about this offline, but Rosie you mentioned there’s so many companies that can recycle in general, right? We know just in Texas, there’s a lot of smaller companies. That could take on at least part of, of what’s going on here. And I think, I mean, it’s, it’s something that is [00:21:00] affecting the people that are living there.

It’s not just an eyesore. I mean, it’s just, I mean, nobody wants their home to be just this big dumping ground. It’s like a graveyard for blades. And it’s so sad to see that this is really affecting people and just their, how they view wind in the area because. Texas does really, really well with wind in general and that area gets a lot of money in.

It’s very oftentimes rural areas that don’t get a lot of funding that are getting a lot of funding for schools are getting a lot of funding for hospitals are, are making sure that their roads are paved. Just in general, a lot of jobs are coming into town and it’s, it should be a really great win-win and it’s just really sad to know that it’s come to this point after years and years where it just, all of the pros are outweighed by a huge calm that is a [00:22:00] huge dumping site in the middle of people.

General homes,

Rosemary Barnes: are they saying that it’s they’re storing the blades or did they just pretend that they recycled them and actually landfill them? What’s the Or? It’s unclear.

Allen Hall: They didn’t landfill them. I mean, in a sense, they didn’t bury them. They’re just sitting on the surface.

Yolanda Padron: Piled up.

Rosemary Barnes: I think a lot of this comes down to what, what does recycling mean?

What’s your definition of it? Um, and it, depending on what your definition is, there absolutely are plenty of, um, companies, you know, like all over. And I’m sure that there are many more in Texas than there would be in, um, yeah, in the Australian regions I’ve looked at. But there’ll be companies that. Um, already a shredding waste of, from multiple sources and putting it into products like concrete for non-structural applications like, um, footpaths or sidewalks, stuff like that.

Um, asphalt is another one. And then a little bit more high tech. You get, um, plastic products that [00:23:00] again, aren’t super duper structurally, um, demanding. So like, um. Decking materials or outdoor furniture, or even I saw one company who’s using recycled material in, um, rainwater tanks. I just really feel like any decent project manager could actually given enough money, like I’m, I’m not saying it’s an economic thing to do, like it’ll always be cheaper to landfill them, um, than to do something with them.

But if you’ve been given money to recycle them enough money. Any decent project manager could make that happen?

Allen Hall: Well, just down the road is ever Point Services. And Rosemary, I don’t know if I’ve introduced you to ever Point Services, Tyler Goodell, Candace Woods, uh, they are recycling blades in a totally different way.

They’re, they’re grinding them down, but they’re end use product is totally different than anything you have seen and all, although that is just getting ramped up from what I understand so far. The product they’re delivering has a [00:24:00] decent commercial value. It’s helping out in other industries. So it’s not just getting mixed with asphalt necessarily.

Those 3000 turbine blades have value. They really do. And ever point, I think if they were involved, would turn them into something really useful. So there is the opportunity to recycle these blades by grinding them down in different, in different ways. But there are new markets. For this product and I’m, I’m just a little shocked that no one’s really stepped forward to say, Hey, I, I’ll take those blazes, but because it’s in a lawsuit, I assume that’s the problem.

No wants to walk into there and say. Take responsibility for this thing that’s been hanging around for several years at this point.

Rosemary Barnes: I don’t know. I think I would disagree when, when you say those blades have value, I would be highly surprised if someone would just take them and make a profit from them. I would expect if I had 3000 blades in my backyard, I would expect to pay somebody to take them off my hands.

Um. That should have been covered by the fee that they were paid for this [00:25:00] recycling, right? So if that money’s gone now, then there is gonna be a challenge in, um, doing something with it. Because I just want to you reiterate that like recycling is not the economic thing to do with wind turbine blades. Now it’s not even the best thing to do in terms of an energy or environmental or climate change, um, consideration.

But if you are sure that you don’t want, um, to deal with the physicality of 3000 blades, um, then. You know, you and you’re prepared to pay to get rid of them, then there are definitely things that you can do.

Matthew Stead: Uh, I think this makes me like super angry because really if we look at it more from a social perspective, um, this is.

These pictures are shown all over the world, and whenever I talk to someone and say, Hey, yeah, I’m in the wind industry, they say, oh yeah, what about all those blades in Yeah, and the, the stockpile, blah, blah, blah. So really this, this incident has really screwed up the whole global industry. So it may have destroyed parts of Texas, but it’s also destroyed part of [00:26:00] the global industry.

Rosemary Barnes: I agree and it’s, it’s crazy because wind turbine blade waste is five to 10% of global composite waste. So the boats and cars and airplanes, um, and other composites are. They’re not piled up in a recognizable form. And so nobody is absolutely outraged that people are, you know, um, disposing of fiberglass boats every year.

Um, so yeah, I mean, that, that, that es me too. I have, um, I’ve spent a long time being annoyed about that fact, and I’ve kind of come around to the, the fact that universally people absolutely hate. Wind turbine blades to be wasted and it just needs to be solved. For that reason, it’s not, it doesn’t need to be solved because of the economics.

It doesn’t need to be solved because of the environment. It doesn’t need to be solved because of climate change, but it does really need to be solved because of the social perception.

Allen Hall: Well, as North American Wind Farms age, the companies that keep them running. Keep getting bigger. [00:27:00] And Mohan Wind Service, which if you haven’t worked with them, is a Danish turbine service provider.

Uh, and they’ve acquired the operating assets of Canada based AC 8 83. And our friends at AC 8 83 have been evidently working behind the scenes to make that deal go through, which is. Awesome. Actually, uh, the deal gives Mulan a local platform for blade repair and turbine services across Canada and the United States, uh, with more than three.

Thousand certified technicians in over 35 countries. Muhan says it is confident the long-term growth in North American market will, uh, continue to prosper. So Muhan come in and saying to AC 83 and others, uh, that they’re, uh, gonna be a, a real powerhouse in terms of a service provider in Canada and the United States and acquiring AC 83 is, is one of the good moves.

And we know Lars Benson, [00:28:00] who’s run that business, and Yannick Benson who operates that business today. This is a big deal for both of them and the company.

Matthew Stead: Yeah, I mean, uh, Lars is a great guy and I, I think this is wonderful that you get more economies of scale by, you know, these companies growing and it has to be, has to be great for the industry.

O obviously, you know, it’s a good thing for, for Lars and, um, Yanick. Um, but yeah. Yeah. Good on them for, for doing this. And you, we need more companies that are larger and able to operate across different industries. I know the seasonality might, might play into it. I don’t know. Maybe not. Um, but, and the more that companies can work across different regions, the better.

Allen Hall: Well, it just gives a C 83 a lot of operating power. So as a sort of a small, medium sized business, that’s one of the problems that you try to scale is just a lot of detail. Human resources, all the legal aspects, and. Uh, international travel people coming back and forth all the time. It is just a lot to operate.

Muhan gives them all that infrastructure support. So, [00:29:00] uh, the brain powers that lie at AC 8 83 to do great work can do that work. And they have the muhan to come underneath and provide the support and the, the financial stability. Matthew, as you point out, the season is pretty short up in Canada, uh, to make this thing go.

So this is really great news and we’re, I think we’re gonna see more. Of this type of structure happen where the companies that have grown and have shown value to the wind industry, regardless of where they’re located at, are gonna become prized possessions and, and larger companies are gonna want to come in and, and acquire them to expand their portfolio at the same time.

And there’s value there. I, I think a lot of ISPs around the world have shown themselves to be profitable, even in some really tough economic times. Uh, they’ve had. Done a good job. And it does seem like the industry is rewarding. Those companies that have put the effort in and have shown themselves to be the professionals that AC 83 is.

So this, [00:30:00] this is a really great development. And do we see this happening, uh, through 26 and 27? Because I think, I think that’s where the industry’s headed. But I talk to a lot of my counterparts who say, oh, there is no. Everything’s gloomy and doomy, and none of this is gonna happen, and these companies are gonna just fade away.

Where do you think this is headed at Matthew?

Matthew Stead: I think, um, we, we’ve done a little bit of work and we’ve been looking at the industry and I think, uh, if you compare it to, you know, construction or, you know, automotive or whatever, I, I think the, there is a, a strong opportunity for the industry to have some consolidation amongst companies.

So I think, um, you know, the industry is still a bit of a baby. You know, maybe whatever, 30 years there is still opportunity, um, for consolidation. You know, much like a few of the other more mature industries, like I said. Um, so I, I, I think there’ll be more of this, um, going on the next few years.

Allen Hall: That wraps up another episode of the Uptime Wind Energy Podcast.

If today’s [00:31:00] discussion sparked any questions or ideas. We’d love to hear from you. Reach out to us on LinkedIn and don’t forget to subscribe so you never miss an episode. And if you found value in today’s conversation, please leave us a review. It really helps other wind energy professionals discover the show for Rosie, Yolanda and Matthew.

I’m Alan Hall, and we’ll see you here next week on the Uptime Wind Energy Podcast.

Renewable Energy

How Renewable Energy Systems Can Boost Corporate ESG Scores

The post How Renewable Energy Systems Can Boost Corporate ESG Scores appeared first on Cyanergy.

https://cyanergy.com.au/blog/how-renewable-energy-systems-can-boost-corporate-esg-scores/

Renewable Energy

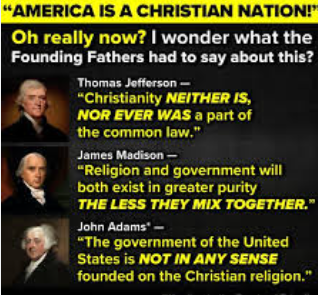

Was the United States Founded as a Christian Nation?

It really doesn’t matter if you or I agree.

It really doesn’t matter if you or I agree.

What matters is what the Founding Fathers said, which appears below.

Obviously, there are evangelical Trump supporters who couldn’t care less about the values that formed this nation. But I’ll take the word of the people who established this great nation over them any day of the week.

Renewable Energy

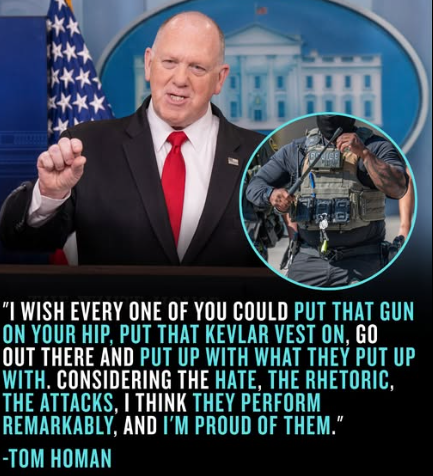

Put That Gun on Your Hip

I’d no more “put that gun on my hip” and attack people, almost none of whom have criminal records, than I’d chop off my right arm, you son of a bitch.

I’d no more “put that gun on my hip” and attack people, almost none of whom have criminal records, than I’d chop off my right arm, you son of a bitch.

-

Greenhouse Gases6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change6 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Renewable Energy2 years ago

GAF Energy Completes Construction of Second Manufacturing Facility