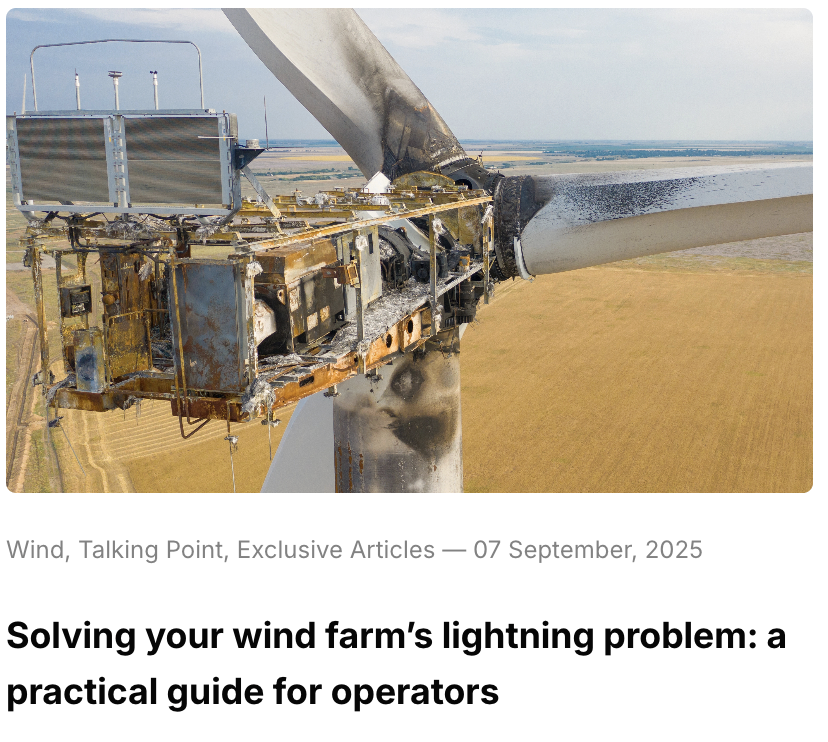

Weather Guard Lightning Tech

SkySpecs Supports European Wind Growth

Allen and Joel sit down with Michael McQueenie, Head of Sales for SkySpecs in Europe at the SkySpecs Customer Forum. They discuss the booming European wind energy market, SkySpecs’ role in asset management, and their expansion into solar farm operations.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining Light on Wind Energy’s brightest innovators. This is the Progress Powering Tomorrow.

Allen Hall: Welcome to the Uptime Wind Energy Podcast Spotlight. I have Joel Saxum with me. I’m Allen Hall, the host, and we are here with Michael McQueenie head of sales for SkySpecs over in Europe. Michael, welcome to the show.

Michael McQueenie: Thanks for having me.

Allen Hall: We are at SkySpecs customer Form 2025 and it has been a blowout event, so many operators from all over learning and exchanging information about how they operate their assets.

We wanted to have you on today because you’re our reference to Europe and what is happening with SkySpecs in Europe. America and Europe are on different pathways at the moment. What is that status right now in Europe? What are people calling you for today?

Michael McQueenie: the, European market is really booming.

we get calls from customers to support [00:01:00] with internal inspections, external inspections as we always have for, nearly a decade now. We are seeing a lot more, discussions around the, enablement services that we can offer. how did, how do we bring a blade engineer and how do we bring a CMS engineer into support and give us, give us more of an insight on the data that we have or, or the data that Skys fix are producing.

things are evolving. and, it’s a buoyant offshore industry at the moment.

Allen Hall: yeah, there’s like thousands of turbines going up right now. it used to be when you thought of. Deployment. Unlike Germany, for example, it’d be three turbines on the hillside.

Michael McQueenie: Yeah.

Allen Hall: Now we’re talking about in the uk have hundreds of turbines hitting the water.

Michael McQueenie: Yeah.

Allen Hall: And that’s change of scale has driven a lot of operators realize I need expertise in blades, I need expertise in CMS. I need an expert in gearbox, but I don’t necessarily need them full time.

Michael McQueenie: Yeah.

Allen Hall: Skys spec. Can you help me?

Michael McQueenie: the projects [00:02:00] are, they’re fewer projects, but they’re, the scale of these projects are massive.

the scale of the turbine scale of the projects and the impact the projects can have on, the country, as a whole is, is massive. So yeah, it’s, it is a. It’s a, it is a great time to be in Europe and to see the growth. it’s been, coming for a long time. I’ve worked with consultancies who are looking at feasibility studies, in offshore, and onshore.

But the, the growth has been. Just, it’s just around the corner. And I do feel like now with some of these big projects that they’re installing, and yeah, just given the size of the turbines, it’s it’s massive.

Joel Saxum: one of the things I want to, I think there’s an important context here is that we’re talking, we’re sitting in Ann Arbor, right?

we’re in the us You’re over in Europe. I worked for a Danish company for a while and it was always like this seven hour delay. Kinda can I get the in, can I get the support? Can they get the support? Can we work? How do we work back and forth? Sometimes it was cool because you’d send an email at two o’clock and when you woke up in the morning [00:03:00] it was done.

That was awesome. But also there was these delays. Now this is the interesting thing here is, and Skys facts. This morning we listened to Cheryl. always a great presentation. Yeah. the head of the TEI blade stuff here. She was delivering some insights, but with her was Thomas. Thomas is in Europe.

And you have CMS experts in Europe. You have the local talent that’s over there that can work with these operators on their timelines, on their regular day stuff. They’re not waiting as, and what I’m trying to get to is, is SkySpecs is not a Ann Arbor company. Skyspace is a global company in a big way.

And so this, so thinking like, oh, this is an American company, w. Will we use someone that’s more local no. No. Skyspace is a local European company as well.

Michael McQueenie: Yeah, and we’ve got the SMEs over there. it’s not just Cheryl, who’s a fantastic en engineer. Having your at your, disposal, Thomas is phenomenal.

customers are seeing real value in integrating him into their team, being the SME [00:04:00] for them, as you, as we said before. Being able to turn ’em off, on and off as required. Don’t, you’ve not got that the FTE cost right. to bring in an SME that, that needs to, support you with a, with an individual component of your, asset.

Yeah. Blades are a huge problem. The industry’s seeing that as they’re getting bigger, the problems are getting bigger. but yeah, having, a local presence in Europe is, massive. my inbox is full from, all the US. Inquiries and issues, during the night, just like you’re saying.

Yeah. And I wake up to dozens of emails with, requirements on inbox and my to-do list is full. But the, but the reality is yeah, we’re, grown in Europe. we are. Our real solid presence in Europe and we’ve, seen massive growth this year.

Joel Saxum: I think it, it’s part of the value chain there.

Touching on the Thomas and Cheryl. Right. So in SkySpecs over this week, we’ve been talking more and more about the, how you guys like to specifically work within a workflow. And that workflow being we have [00:05:00]inspections, we’re in the platform now we’re in horizon, bam. And we can enable the tech enabled services, which is those SMEs which you have inside.

The company and then rolling that forward to the repair vendor management, which is happening in a big way in the States. Yesterday I saw a number, $13 million in repairs managed by the Sky Spec team. That’s huge. And, that same capability. And we’re just talking blazes right now, like we haven’t even touched on CMS performance monitoring, financial asset monitoring.

That same concept is, is replica replicate in the EU as well.

Michael McQueenie: No, it absolutely is, Our customers have got problems, we can help them with the problems. Thomas is, as you said, we work in workflows and Thomas is, is looking to support customers with how they, touch their data as few times as they possibly can.

How do we get from A to B and how does a customer understand what their problems are and how they fix the problems? And sometimes an [00:06:00]SME is the, way to fix that. Thomas has provide, provided huge value to our customers. The design of workflows in Horizon is the, essence. It exists just to try and get from A to B and, and try and drive insights and then next steps.

And I think that’s the important part, being, this is the action to

Joel Saxum: get

Michael McQueenie: to the, we’ve got the data, we understand what the data’s telling us. here’s an insight, but actually what is the follow up? And, Thomas is designing that follow up for our customers and providing the support.

Allen Hall: and just a little bit comparison between the United States and Europe, when we still talk to anybody in the United States about a turbine.

Almost always, it’s a two megawatt, one and a half megawatt turbine, right? Occasionally a four. Sometimes someone says

Joel Saxum: yesterday like, oh, that’s a three megawatt

Allen Hall: turbine. Whoa, what’s big? And in Europe, three megawatts was like years ago, particularly offshore that, everything’s 6, 8, 10.

Michael McQueenie: Yeah.

Allen Hall: Plus

Michael McQueenie: 3.6 was the common [00:07:00] turbine.

Five, eight.

Allen Hall: Yeah.

Michael McQueenie: Years ago, that was, what everyone was working on. And, they’re a very reliable turbine. It’s, there was a reason why there were so many of them installed at that time. but nowadays, we’re helping OEMs with 50 megawatt turbines.

Allen Hall: and I think that’s the, thing that we just don’t see in the states is a turbine that’s 15 megawatts is down for a day.

Is so much more expensive and particularly offshore and the expenses go astronomical compared to onshore. Yeah, and Michael, I always see your position of you’re there to save. Millions of pounds or millions, of euros all the time because a shutdown there is huge.

Joel Saxum: Yeah.

Allen Hall: And because the grids are changing so much in Europe where they’re becoming more solar and wind dependent and coal is going to change away.

And

Joel Saxum: triage.

Allen Hall: Yeah. The triage bit, is that the SkySpecs is in that position to really help a lot our operators out. You’re [00:08:00] providing the insights and the guidance and the knowledge that. An operator probably doesn’t have, because they don’t have the staff to go do it. It’s a And can you enlighten us like what that is because we just don’t see a lot of that here.

Michael McQueenie: Yeah. I think there’s a good reason you don’t see that this was, we are just providing data to some of these, transactions. Whether it’s a due diligence, inspection, or an end of warranty. We are just providing the insights for the customers to. Make their own decisions. Um, so it’s not a SkySpecs decision.

We are just providing insights to, to allow them to make a, smart, educated, data-driven decision.

Joel Saxum: I think that’s important, concept too. ’cause like here, the Skys spec user form, of course, we’re in the States, so we’ve been talking and I think there’s only two or three people here from.

Yeah. From overseas. So we’ve been talking a lot about the one big, beautiful, what it means. That doesn’t mean that much to you in your daily life, right? No. But your daily life is a bit different with, you have more of a focus on. Maybe financial asset owners. ’cause the market’s different, right?

Michael McQueenie: yeah.

Absolutely. The, [00:09:00] simplification of process and actually having a workflow no matter what, it’s, whether we’re taking financial data, CMS data or performance, SC data, The simplification of that process and driving insights from it is literally the foundation of what SkySpecs have been here to do.

So providing, financial institutions funds with the ability to. Reach out and, make quick decisions, data-driven decisions. there’s some very smart people in these organizations, asset managers who are, A costly resource to the fund. What they really need to do is pull le pull levers as in when it’s required to.

We need some support with sc. We need some support with blades. How do we, how do they, bring that resource and that expertise in house without having the FTE? and the funds are, phenomenal companies. They’re, growing fast. They don’t want the linear growth of people. to go along with that, that, growth of their portfolio.

So it’s important that we build relationships and make sure that we’re helping them [00:10:00] in every side of their business, whether it’s financial decisions or, technical decisions.

Joel Saxum: I think there’s a, there’s an important takeaway from this week as well, listening to all the SkySpecs, the people, the presentations, the communications, the, collaborations, the conversations.

Some of ’em a little bit later at night than other ones. I, won’t name any names, but. Listening to those things and understanding this. So a few weeks ago when I was talking with, we talked with Josh Garrell a little bit ago, and I, shared this with him. I saw a McKinsey report that said, SkySpecs, inspection company.

SkySpecs to me is not an inspection company. they do the best inspections in the world, in wind, in my opinion. Yes. However, there’s so much more, there’s so much more there. And it is, it’s really a full support in my opinion, for the CMS to scada, the performance monitoring, the financial asset modeling, the tech enabled insights, repair, vendor management.

There’s so many other solutions within this umbrella that I think a lot of people don’t see.

Allen Hall: And the one case study that came up yesterday, Michael, I think [00:11:00] that I found interesting was the offshore. Inspections before blades are hung. Yeah. And we see a lot of times in the states where blades are damaged in transport, we think, okay, yeah, the truck damaged it.

Okay, fine, we can fix it on the ground. But on the offshore case, that simple repair now has to happen out in the ocean, and that goes from a couple of thousand dollars to 10. Pounds to tens of thousands of pounds or more to get that resolved. And you had a case just like that.

Michael McQueenie: Yeah, and I think it’s hundreds of thousands if we’re being honest.

Yeah. If you start looking at vessel costs, crew costs, everything else. But actually what I like about it is that OEMs are actually becoming way more proactive because they know the cost of an up tower repair compared to, an onshore repair. So having the foresight to. Have the inspections completed at the right time.

Working with us on timelines, using technology to perform the inspections, getting through as many as we can, as quickly as we can, [00:12:00] addressing the problems, doing the analysis, and then actually solving the problem before it goes offshore is massive drainage that, how many times is a bleed lifted from the factory to installation.

Lot. It’s a lot. It’s a lot, It’s handled a lot. So there’s a opportunity for something to go wrong, as you said, oh, it’s been knocked, it’s, there’s something wrong. Something’s happened. but solving that is the OEM’s responsibility. So they’re becoming much more proactive in my opinion. we’ve, we’ve had a lot of use cases this week, and it’s always been about the, owners, the operators, how we’ve saved them money, how we provided them value.

The OEMs are looking to us to help them on that front as well, whether it’s robotic or whether it’s, providing analysis or, or a platform to, to manage the data. we are working with, with them in offshore, but the problems are so much bigger.

Allen Hall: I think the OEMs are learning from Skys spec, so watching what operators are doing to hedge their bets to protect their assets.

And SkySpecs is pretty much involved in all of that. [00:13:00] Now the OEMs are watching the operators saying, why are we not doing that? We’re seeing that in

Joel Saxum: the lightning.

Allen Hall: Absolutely. We’re seeing enlightening. We’re seeing it in CMS now. We’re seeing it in a number of areas where the OEMs have watched SkySpecs maneuver and provide better value to their customers that the OEMs are trying to mirror,

Joel Saxum: I touch on another case study because Alan, you and I sat in on this one yesterday, and if so, I’m gonna put my, my, I’m a European operator hat on. and this is a little weird. I don’t, I have a good accent. Not, I’m not gonna try that, but okay. Say I’m going to, I have a smaller wind farm, right?

So I may have, 20 turbines of a specific model, and I would like to understand where am I at for performance benchmarking? Am I doing well or not? I don’t have a huge fleet. European fleets are not that big unless you’re offshore. As specifically compared to the US where our wind farms are a hundred, 120 turbines.

Sun Z is a thousand turbines, right? That’s a wind farm. So the problem is different, [00:14:00] but Skys spec has that data. If this is your site, let’s look at how your site is doing compared to. These 1500 of the same models around the world. And then you can look at that, understand your performance benchmark, and then start diving into the issues that may be causing it, to not perform as well.

And then fixing them and getting it up to speed to what it should be compared to everybody else. And I thought, man, what a use case, especially in the European market.

Michael McQueenie: No, absolutely. and we always talk about benchmarking. We’ve, I’ve been with companies who have tried benchmarking in the past, looking at KPIs.

How do you benchmark your performance of your turbine against something similar? And I think Skyspace are starting to get that right. we’ve, got the sc the scatter data and looking at the biggest impact in damages or the biggest failure faults that you have on your turbine and how we, how it can help you.

Push the OEMs. Yeah, just give them a prod to,

Joel Saxum: we saw

Michael McQueenie: case studies on that

Joel Saxum: yesterday.

Michael McQueenie: The case studies we’ve seen this week have actually been incredible, and that’s probably the, biggest takeaway for a lot of [00:15:00]people. Just try and understand how we’ve helped. The, customers achiever a return or, what we’ve saved them, over time.

those have been probably the biggest takeaway for me this week. just people are starting to understand and appreciate the returns they could see if they engage with us on all these other products. But the performance side of thing, benchmarking is, a really interesting topic.

Completely away from just looking at performance data. Everyone in the room over the last couple of days. Is, dancing around the, topic of benchmarking because, they’re, very, protective of the data. Yes. but I think people, and we’ve spoke about maybe for the last 12 months, they have shown an interest in, oh, I can share some data and if it’s anonymized, that I’d be happy to take part in that.

But. I’d love to see, that taking a step further, I’d love to see that. I think everyone in the industry, everyone in that room would benefit from, [00:16:00]from data sharing to, to learn from each other with freely optimiz data. Yeah, absolutely.

Allen Hall: there have been a number of announcements this week also from SkySpecs.

Some of the bigger ones are the move into solar and Europe. There’s a lot of solar power in Europe, particularly some parts of Europe. That could be a massive amount of phone calls your way, Michael. oh, sky Spec is doing blades. Turbines and solar. I’ll take it.

Joel Saxum: Yeah.

Allen Hall: And I think there’s been a huge demand for that for the last several years, but it’s just been, you’ve been so busy with turbine problems, so honestly that you haven’t had the ability to get to solar.

Now with some of the tools you just brought in, you can.

Michael McQueenie: Yeah, I think we, we started off just blades, as we all know. Yeah. As you said, if we were just an inspection company. the acquisitions we’ve made, over the last few years have been taking us to the point where we’re now covering full turbine asset health monitoring.

And that was an important part. once we achieve that, now you can, you gain a [00:17:00] bit of clarity. we can start to look at diversification into new asset types. Solar’s been something I’m asked about once a month from European customers, and prospects. So we’ve tempered expectations for quite a long time.

We, we know we were going to move into solar at some point. we’ve got, we’ve got a really big opportunity I think, we’re very well positioned to, to help solar operators. Yeah,

Allen Hall: I think, I think there’s the variability in solar. From the different manufacturer. There’s so many manufacturers of panels and are inverters and even some of the configurations, the, support structures have issues, but SkyScan specs is gonna make that a lot easier because the tools are better now than they were five years ago.

Michael McQueenie: Yeah, no, absolutely. And we’ve got a massive customer base with that mix of wind, solar battery. So we, have to come up with that solution and, the tools are perfectly placed.

Allen Hall: Yeah.

Michael McQueenie: It’s the same engineers that will be asked.

Joel Saxum: See

Michael McQueenie: now [00:18:00] you’re dealing with solar. There’ll be no questions asked.

There will be. That’s happening already. You fixed wind for us. There’s, I’m gonna change your job description as wind engineer plus solar.

Allen Hall: Yeah. And then it’s gonna be

plus

Allen Hall: best, right?

Michael McQueenie: That,

reviewable energy engineer,

Joel Saxum: that’s what it will be. But I think there’s a, there’s some things here too to share with the European crowd is, there has been some strategic additions to the leadership team, Ben Token coming on as the CTO helping with some of that data architecture in the background.

And then what will be the future of you guys have, there’s always work to be done, right? But have gotten really close to having a big, perfect little model of this is how you manage a wind asset. now that can be control C, C control V, solar, control C control V best, and that’s the future of what Skys spec is going to become a renewable energy company.

And that’s the future.

Michael McQueenie: Yeah. I think that the additions to the business have been pretty visionary. Yeah. rich and Ben are both. Phenomenal individuals will, that will drive us to, success in all these other areas. [00:19:00] rich has, been part of the business and has from the board from a, for a number of years now, and, I think he’s now seeing the.

How special the business is. How special it could be. Yeah. Once we, start that diversification.

Joel Saxum: Yeah. I’ve seen Rich here at the, ’cause we are in Ann Arbor at the forum. It’s Wednesday. So we’ve, we’re on day two, and I’ve seen Rich floating around talking with some of the customers, talking with a lot of the SkySpecs employees.

I’ve had a few conversations with him and. That man has a big smile on his face all day long.

Michael McQueenie: Yeah.

Joel Saxum: He sees the opportunity. he’s happy to engage. He wants to talk with people. he’s gonna be a big part of the future of the group. And I, think it’s exciting to see him here.

Michael McQueenie: He really has, I think both of them have, really accelerated the excitement and the, development of all the tools.

everyone’s rallying behind them to

Joel Saxum: Yeah.

Michael McQueenie: to try and make sure that, we, get to the next tech.

Joel Saxum: Yeah. Last night we talked with, Ben about big data and analytics. We’re recording it now. So we’re, telling we’re gonna try to get him down to [00:20:00] Australia to speak to the Australian crowd during our event down there in February about big data analytics and his background, what Skys books is doing with it.

Allen Hall: Yeah. And big data is the future. Everybody knew it three years ago. Yeah. We’re finally at the level we can start processing it and make use of it. I think Michael, you’re in a unique position and SkySpecs is in a really unique position in Europe. The world is looking to Europe on renewables. The expansion of renewables, how coal has essentially gone away.

Gas is still kicking around. France has a, still a good bit of nuclear and rightly It’s a great resource for them. but the solar, wind battery play is gonna be the, big push over the next several years. Without SkySpecs, it’s gonna be really hard to be successful there and to get the revenue stream that you expected out of it.

Your phone has to be ringing off the hook all the time. Yeah.

Michael McQueenie: The, co-location story has been building momentum for a couple of years now, and right now it’s [00:21:00] just, everyone’s talking about it, the battery, adding batteries to sites and co-locating solar with wind. And, yeah, it’s, been, it is a really exciting thing.

it’s skys picks are really well positioned to help every one of them.

Allen Hall: So how do people get ahold of you? And is LinkedIn the best place? Just go, Michael McQueenie and SkySpecs.

Michael McQueenie: Yeah, most people, I’m fairly well connected in the European market. A lot of people will have my details, but yeah, LinkedIn, absolutely.

Allen Hall: Okay, great. Michael, I love having you, on webinars and in person for these, interview sessions because Joel and I learn so much. you’re just a great resource and if you’re interested in SkySpecs and, and the services that they offer. In Europe, get ahold of Michael. He will get you set up and get you into the horizon platform and get you solutions.

So Michael, thank you so much for being on the podcast.

Michael McQueenie: Thank

Allen Hall: you very much for it. It’s been [00:22:00] great.

https://weatherguardwind.com/skyspecs-european-wind/

Renewable Energy

Wind Industry Operations: In Wind’s Next Chapter, Operations take center stage

Wind Industry Operations: In Wind’s Next Chapter, Operations take center stage

This exclusive article originally appeared in PES Wind 4 – 2025 with the title, Operations take center stage in wind’s next chapter. It was written by Allen Hall and other members of the WeatherGuard Lightning Tech team.

As aging fleets, shrinking margins, and new policies reshape the wind sector, wind energy operations are in the spotlight. The industry’s next chapter will be defined not by capacity growth, but by operational excellence, where integrated, predictive maintenance turns data into decisions and reliability into profit.

Wind farm operations are undergoing a fundamental transformation. After hosting hundreds of conversations on the Uptime Wind Energy Podcast, I’ve witnessed a clear pattern: the most successful operators are abandoning reactive maintenance in favor of integrated, predictive strategies. This shift isn’t just about adopting new technologies; it’s about fundamentally rethinking how we manage aging assets in an era of tightening margins and expanding responsibilities.

The evidence was overwhelming at this year’s SkySpecs Customer Forum, where representatives from over 75% of US installed wind capacity gathered to share experiences and strategies. The consensus was clear: those who integrate monitoring, inspection, and repair into a cohesive operational strategy are achieving dramatic improvements in reliability and profitability.

Takeaway: These options have been available to wind energy operations for years; now, adoption is critical.

Why traditional approaches to wind farm operations are failing

Today’s wind operators face an unprecedented convergence of challenges. Fleets installed during the 2010-2015 boom are aging in unexpected ways, revealing design vulnerabilities no one anticipated. Meanwhile, the support infrastructure is crumbling; spare parts have become scarce, OEM support is limited, and insurance companies are tightening coverage just when operators need them most.

The situation is particularly acute following recent policy changes. The One Big Beautiful Bill in the United States has fundamentally altered the economic landscape. PTC farming is no longer viable; turbines must run longer and more reliably than ever before. Engineering teams, already stretched thin, are being asked to manage not just wind assets but solar and battery storage as well. The old playbook simply doesn’t work anymore.

Consider the scope of just one challenge: polyester blade failures. During our podcast conversation with Edo Kuipers of We4Ce, we learned that an estimated 30,000 to 40,000 blades worldwide are experiencing root bushing issues. ‘After a while, blades are simply flying off,’ Kuipers explained. The financial impact of a single blade failure can exceed €300,000 when you factor in replacement costs, lost production, and crane mobilization. Yet innovative repair solutions, like the one developed by We4Ce and CNC Onsite, can address the same problem for €40,000 if caught early. This pattern repeats across every major component. Gearbox failures that once required complete replacement can now be predicted months in advance. Lightning damage that previously caused catastrophic failures can be prevented with inexpensive upgrades and real-time monitoring. All these solutions are based on the principle that predicted maintenance is better than an expensive surprise.

Seeing problems before they happeny, and potential risks

The transformation begins with visibility. Modern monitoring systems reveal problems that traditional methods miss entirely. Eric van Genuchten of Sensing360 shared an eye-opening statistic on our podcast: ‘In planetary gearbox failures, they get 90%, so there’s still 10% of failures they cannot detect.’ That missing 10% represents the catastrophic failures that destroy budgets and production targets. Advanced monitoring technologies are filling these gaps. Sensing360’s fiber optic sensors, for example, detect minute deformations in steel components, revealing load imbalances and fatigue progression invisible to traditional monitoring. ‘We integrate our sensors in steel and make rotating equipment smarter,’ van Genuchten explained.

Other companies are deploying acoustic systems to identify blade delamination, oil analysis for gearbox health, and electrical signature analysis for generator issues. Each technology adds a piece to the puzzle, but the real value comes from integration. The impact of load monitoring alone can be transformative.

As van Genuchten explained, ‘Twenty percent more loading on a gearbox or on a bearing is half of your life. The other way around, twenty percent less loading is double your life.’ With proper monitoring, operators can optimize load distribution across their fleet, extending component life while maximizing production.

But monitoring without action is just expensive data collection. The most successful operators are those who’ve learned to translate sensor data into operational decisions. This requires not just technology but organizational change, breaking down silos between monitoring, maintenance, and management teams.

In Wind Energy Operations, Early intervention makes the million-dollar difference

The economics of early intervention are compelling across every component type. The blade root bushing example from We4Ce illustrates this perfectly. With their solution, early detection means replacing just 24-30 bushings in about 24 hours of drilling work. Wait, and you’re looking at 60+ bushings and 60 hours of work. Early detection doesn’t just prevent catastrophic failure; it makes repairs faster, cheaper, and more reliable.

This principle extends throughout the turbine. Early-stage bearing damage can be addressed through targeted lubrication or minor adjustments. Incipient electrical issues can be resolved with cleaning or connection tightening. Small blade surface cracks can be repaired in a few hours before they propagate into structural damage requiring weeks of work.

Leading operators are implementing tiered response protocols based on monitoring data. Critical issues trigger immediate intervention. Developing problems are scheduled for the next maintenance window. Minor issues are monitored and addressed during routine service. This systematic approach reduces both emergency repairs and unnecessary maintenance, optimizing resource allocation across the fleet.

Turning information into action

While monitoring generates data, platforms like SkySpecs’ Horizon transform that data into operational intelligence. Josh Goryl, SkySpecs’ Chief Revenue Officer, explained their evolution at the recent Customer Forum: ‘I think where we can help our customers is getting all that data into one place.

The game-changer is integration across data types. The company is working to combine performance data with CMS data to provide valuable insights into turbine health. This approach has been informed by operators across the world, who’ve discovered that integrated platforms deliver insights that siloed data can’t.

The platform approach also addresses the reality of shrinking engineering teams managing expanding portfolios. As Goryl noted, many wind engineers are now responsible for solar and battery storage assets as well. One platform managing multiple technologies through a unified interface becomes essential for operational efficiency.

The Integration Imperative for Wind Farm Operations

The most successful operators aren’t just adopting individual technologies; they’re integrating monitoring, inspection, and repair into a seamless operational system. This integration operates at multiple levels.

At the technical level, data from various monitoring systems feeds into unified platforms that provide comprehensive asset visibility. These platforms don’t just display data; they analyze patterns, predict failures, and generate work orders.

At the organizational level, integration means breaking down barriers between departments. This cross-functional collaboration transforms O&M from a cost center into a value driver. Building your improvement roadmap For operators ready to enhance their O&M approach, the path forward involves several key steps:

Assessing the Current State of your Wind Energy Operations

Document your maintenance costs, failure rates, and downtime patterns. Identify which problems consume the most resources and which assets are most critical to your wind farm operations.

Start with targeted pilots Rather than attempting wholesale transformation, begin with focused initiatives targeting your biggest pain points. Whether it’s blade monitoring, gearbox sensors, or repair innovations, starting with your largest issue will help you see the biggest benefit.

• Invest in integration, not just technology: the most sophisticated monitoring system is worthless if its data isn’t acted upon. Ensure your organization has the processes and culture to transform data into decisions – this is the first step to profitability in your wind farm operations.

Build partnerships, not just contracts: look for technology providers and service companies willing to share knowledge, not just deliver services. The goal is building capability, not dependency.

• Measure and iterate: track the impact of each initiative on your key performance indicators. Use lessons learned to refine your approach and guide future investments.

The competitive advantage

The wind industry has reached an inflection point. With increasingly large and complex turbines, monitoring needs to adapt with it. The era of flying blind is over.

In an industry where margins continue to compress and competition intensifies, operational excellence has become a key differentiator. Those who master the integration of monitoring, inspection, and repair will thrive. Those who cling to reactive maintenance face escalating costs and declining competitiveness.

The technology exists. The business case is proven. The early adopters are already reaping the benefits. The question isn’t whether to transform your O&M approach, but how quickly you can adapt to this new reality. In the race to operational excellence, the winners will be those who act decisively to embrace the efficiency revolution reshaping wind operations.

Unless otherwise noted, images here are from We4C Rotorblade Specialist.

Contact us for help understanding your lightning damage, future risks, and how to get more uptime from your equipment.

Download the full article from PES Wind here

Find a practical guide to solving lightning problems and filing better insurance claims here

Wind Industry Operations: In Wind’s Next Chapter, Operations take center stage

Renewable Energy

BladeBUG Tackles Serial Blade Defects with Robotics

Weather Guard Lightning Tech

BladeBUG Tackles Serial Blade Defects with Robotics

Chris Cieslak, CEO of BladeBug, joins the show to discuss how their walking robot is making ultrasonic blade inspections faster and more accessible. They cover new horizontal scanning capabilities for lay down yards, blade root inspections for bushing defects, and plans to expand into North America in 2026.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining Light on Wind. Energy’s brightest innovators. This is the Progress Powering Tomorrow.

Allen Hall: Chris, welcome back to the show.

Chris Cieslak: It’s great to be back. Thank you very much for having me on again.

Allen Hall: It’s great to see you in person, and a lot has been happening at Blade Bugs since the last time I saw Blade Bug in person. Yeah, the robot. It looks a lot different and it has really new capabilities.

Chris Cieslak: So we’ve continued to develop our ultrasonic, non-destructive testing capabilities of the blade bug robot.

Um, but what we’ve now added to its capabilities is to do horizontal blade scans as well. So we’re able to do blades that are in lay down yards or blades that have come down for inspections as well as up tower. So we can do up tower, down tower inspections. We’re trying to capture. I guess the opportunity to inspect blades after transportation when they get delivered to site, to look [00:01:00] for any transport damage or anything that might have been missed in the factory inspections.

And then we can do subsequent installation inspections as well to make sure there’s no mishandling damage on those blades. So yeah, we’ve been just refining what we can do with the NDT side of things and improving its capabilities

Joel Saxum: was that need driven from like market response and people say, Hey, we need, we need.

We like the blade blood product. We like what you’re doing, but we need it here. Or do you guys just say like, Hey, this is the next, this is the next thing we can do. Why not?

Chris Cieslak: It was very much market response. We had a lot of inquiries this year from, um, OEMs, blade manufacturers across the board with issues within their blades that need to be inspected on the ground, up the tap, any which way they can.

There there was no, um, rhyme or reason, which was better, but the fact that he wanted to improve the ability of it horizontally has led the. Sort of modifications that you’ve seen and now we’re doing like down tower, right? Blade scans. Yeah. A really fast breed. So

Joel Saxum: I think the, the important thing there is too is that because of the way the robot is built [00:02:00] now, when you see NDT in a factory, it’s this robot rolls along this perfectly flat concrete floor and it does this and it does that.

But the way the robot is built, if a blade is sitting in a chair trailing edge up, or if it’s flap wise, any which way the robot can adapt to, right? And the idea is. We, we looked at it today and kind of the new cage and the new things you have around it with all the different encoders and for the heads and everything is you can collect data however is needed.

If it’s rasterized, if there’s a vector, if there’s a line, if we go down a bond line, if we need to scan a two foot wide path down the middle of the top of the spa cap, we can do all those different things and all kinds of orientations. That’s a fantastic capability.

Chris Cieslak: Yeah, absolutely. And it, that’s again for the market needs.

So we are able to scan maybe a meter wide in one sort of cord wise. Pass of that probe whilst walking in the span-wise direction. So we’re able to do that raster scan at various spacing. So if you’ve got a defect that you wanna find that maximum 20 mil, we’ll just have a 20 mil step [00:03:00] size between each scan.

If you’ve got a bigger tolerance, we can have 50 mil, a hundred mil it, it’s so tuneable and it removes any of the variability that you get from a human to human operator doing that scanning. And this is all about. Repeatable, consistent high quality data that you can then use to make real informed decisions about the state of those blades and act upon it.

So this is not about, um, an alternative to humans. It’s just a better, it’s just an evolution of how humans do it. We can just do it really quick and it’s probably, we, we say it’s like six times faster than a human, but actually we’re 10 times faster. We don’t need to do any of the mapping out of the blade, but it’s all encoded all that data.

We know where the robot is as we walk. That’s all captured. And then you end up with really. Consistent data. It doesn’t matter who’s operating a robot, the robot will have those settings preset and you just walk down the blade, get that data, and then our subject matter experts, they’re offline, you know, they are in their offices, warm, cozy offices, reviewing data from multiple sources of robots.

And it’s about, you know, improving that [00:04:00] efficiency of getting that report out to the customer and letting ’em know what’s wrong with their blades, actually,

Allen Hall: because that’s always been the drawback of, with NDT. Is that I think the engineers have always wanted to go do it. There’s been crush core transportation damage, which is sometimes hard to see.

You can maybe see a little bit of a wobble on the blade service, but you’re not sure what’s underneath. Bond line’s always an issue for engineering, but the cost to take a person, fly them out to look at a spot on a blade is really expensive, especially someone who is qualified. Yeah, so the, the difference now with play bug is you can have the technology to do the scan.

Much faster and do a lot of blades, which is what the de market demand is right now to do a lot of blades simultaneously and get the same level of data by the review, by the same expert just sitting somewhere else.

Chris Cieslak: Absolutely.

Joel Saxum: I think that the quality of data is a, it’s something to touch on here because when you send someone out to the field, it’s like if, if, if I go, if I go to the wall here and you go to the wall here and we both take a paintbrush, we paint a little bit [00:05:00] different, you’re probably gonna be better.

You’re gonna be able to reach higher spots than I can.

Allen Hall: This is true.

Joel Saxum: That’s true. It’s the same thing with like an NDT process. Now you’re taking the variability of the technician out of it as well. So the data quality collection at the source, that’s what played bug ducts.

Allen Hall: Yeah,

Joel Saxum: that’s the robotic processes.

That is making sure that if I scan this, whatever it may be, LM 48.7 and I do another one and another one and another one, I’m gonna get a consistent set of quality data and then it’s goes to analysis. We can make real decisions off.

Allen Hall: Well, I, I think in today’s world now, especially with transportation damage and warranties, that they’re trying to pick up a lot of things at two years in that they could have picked up free installation.

Yeah. Or lifting of the blades. That world is changing very rapidly. I think a lot of operators are getting smarter about this, but they haven’t thought about where do we go find the tool.

Speaker: Yeah.

Allen Hall: And, and I know Joel knows that, Hey, it, it’s Chris at Blade Bug. You need to call him and get to the technology.

But I think for a lot of [00:06:00] operators around the world, they haven’t thought about the cost They’re paying the warranty costs, they’re paying the insurance costs they’re paying because they don’t have the set of data. And it’s not tremendously expensive to go do. But now the capability is here. What is the market saying?

Is it, is it coming back to you now and saying, okay, let’s go. We gotta, we gotta mobilize. We need 10 of these blade bugs out here to go, go take a scan. Where, where, where are we at today?

Chris Cieslak: We’ve hads. Validation this year that this is needed. And it’s a case of we just need to be around for when they come back round for that because the, the issues that we’re looking for, you know, it solves the problem of these new big 80 a hundred meter plus blades that have issues, which shouldn’t.

Frankly exist like process manufacturer issues, but they are there. They need to be investigated. If you’re an asset only, you wanna know that. Do I have a blade that’s likely to fail compared to one which is, which is okay? And sort of focus on that and not essentially remove any uncertainty or worry that you have about your assets.

’cause you can see other [00:07:00] turbine blades falling. Um, so we are trying to solve that problem. But at the same time, end of warranty claims, if you’re gonna be taken over these blades and doing the maintenance yourself, you wanna know that what you are being given. It hasn’t gotten any nasties lurking inside that’s gonna bite you.

Joel Saxum: Yeah.

Chris Cieslak: Very expensively in a few years down the line. And so you wanna be able to, you know, tick a box, go, actually these are fine. Well actually these are problems. I, you need to give me some money so I can perform remedial work on these blades. And then you end of life, you know, how hard have they lived?

Can you do an assessment to go, actually you can sweat these assets for longer. So we, we kind of see ourselves being, you know, useful right now for the new blades, but actually throughout the value chain of a life of a blade. People need to start seeing that NDT ultrasonic being one of them. We are working on other forms of NDT as well, but there are ways of using it to just really remove a lot of uncertainty and potential risk for that.

You’re gonna end up paying through the, you know, through the, the roof wall because you’ve underestimated something or you’ve missed something, which you could have captured with a, with a quick inspection.

Joel Saxum: To [00:08:00] me, NDT has been floating around there, but it just hasn’t been as accessible or easy. The knowledge hasn’t been there about it, but the what it can do for an operator.

In de-risking their fleet is amazing. They just need to understand it and know it. But you guys with the robotic technology to me, are bringing NDT to the masses

Chris Cieslak: Yeah.

Joel Saxum: In a way that hasn’t been able to be done, done before

Chris Cieslak: that. And that that’s, we, we are trying to really just be able to roll it out at a way that you’re not limited to those limited experts in the composite NDT world.

So we wanna work with them, with the C-N-C-C-I-C NDTs of this world because they are the expertise in composite. So being able to interpret those, those scams. Is not a quick thing to become proficient at. So we are like, okay, let’s work with these people, but let’s give them the best quality data, consistent data that we possibly can and let’s remove those barriers of those limited people so we can roll it out to the masses.

Yeah, and we are that sort of next level of information where it isn’t just seen as like a nice to have, it’s like an essential to have, but just how [00:09:00] we see it now. It’s not NDT is no longer like, it’s the last thing that we would look at. It should be just part of the drones. It should inspection, be part of the internal crawlers regimes.

Yeah, it’s just part of it. ’cause there isn’t one type of inspection that ticks all the boxes. There isn’t silver bullet of NDT. And so it’s just making sure that you use the right system for the right inspection type. And so it’s complementary to drones, it’s complimentary to the internal drones, uh, crawlers.

It’s just the next level to give you certainty. Remove any, you know, if you see something indicated on a a on a photograph. That doesn’t tell you the true picture of what’s going on with the structure. So this is really about, okay, I’ve got an indication of something there. Let’s find out what that really is.

And then with that information you can go, right, I know a repair schedule is gonna take this long. The downtime of that turbine’s gonna be this long and you can plan it in. ’cause everyone’s already got limited budgets, which I think why NDT hasn’t taken off as it should have done because nobody’s got money for more inspections.

Right. Even though there is a money saving to be had long term, everyone is fighting [00:10:00] fires and you know, they’ve really got a limited inspection budget. Drone prices or drone inspections have come down. It’s sort, sort of rise to the bottom. But with that next value add to really add certainty to what you’re trying to inspect without, you know, you go to do a day repair and it ends up being three months or something like, well

Allen Hall: that’s the lightning,

Joel Saxum: right?

Allen Hall: Yeah. Lightning is the, the one case where every time you start to scarf. The exterior of the blade, you’re not sure how deep that’s going and how expensive it is. Yeah, and it always amazes me when we talk to a customer and they’re started like, well, you know, it’s gonna be a foot wide scarf, and now we’re into 10 meters and now we’re on the inside.

Yeah. And the outside. Why did you not do an NDT? It seems like money well spent Yeah. To do, especially if you have a, a quantity of them. And I think the quantity is a key now because in the US there’s 75,000 turbines worldwide, several hundred thousand turbines. The number of turbines is there. The number of problems is there.

It makes more financial sense today than ever because drone [00:11:00]information has come down on cost. And the internal rovers though expensive has also come down on cost. NDT has also come down where it’s now available to the masses. Yeah. But it has been such a mental barrier. That barrier has to go away. If we’re going going to keep blades in operation for 25, 30 years, I

Joel Saxum: mean, we’re seeing no

Allen Hall: way you can do it

Joel Saxum: otherwise.

We’re seeing serial defects. But the only way that you can inspect and or control them is with NDT now.

Allen Hall: Sure.

Joel Saxum: And if we would’ve been on this years ago, we wouldn’t have so many, what is our term? Blade liberations liberating

Chris Cieslak: blades.

Joel Saxum: Right, right.

Allen Hall: What about blade route? Can the robot get around the blade route and see for the bushings and the insert issues?

Chris Cieslak: Yeah, so the robot can, we can walk circumferentially around that blade route and we can look for issues which are affecting thousands of blades. Especially in North America. Yeah.

Allen Hall: Oh yeah.

Chris Cieslak: So that is an area that is. You know, we are lucky that we’ve got, um, a warehouse full of blade samples or route down to tip, and we were able to sort of calibrate, verify, prove everything in our facility to [00:12:00] then take out to the field because that is just, you know, NDT of bushings is great, whether it’s ultrasonic or whether we’re using like CMS, uh, type systems as well.

But we can really just say, okay, this is the area where the problem is. This needs to be resolved. And then, you know, we go to some of the companies that can resolve those issues with it. And this is really about played by being part of a group of technologies working together to give overall solutions

Allen Hall: because the robot’s not that big.

It could be taken up tower relatively easily, put on the root of the blade, told to walk around it. You gotta scan now, you know. It’s a lot easier than trying to put a technician on ropes out there for sure.

Chris Cieslak: Yeah.

Allen Hall: And the speed up it.

Joel Saxum: So let’s talk about execution then for a second. When that goes to the field from you, someone says, Chris needs some help, what does it look like?

How does it work?

Chris Cieslak: Once we get a call out, um, we’ll do a site assessment. We’ve got all our rams, everything in place. You know, we’ve been on turbines. We know the process of getting out there. We’re all GWO qualified and go to site and do their work. Um, for us, we can [00:13:00] turn up on site, unload the van, the robot is on a blade in less than an hour.

Ready to inspect? Yep. Typically half an hour. You know, if we’ve been on that same turbine a number of times, it’s somewhere just like clockwork. You know, muscle memory comes in, you’ve got all those processes down, um, and then it’s just scanning. Our robot operator just presses a button and we just watch it perform scans.

And as I said, you know, we are not necessarily the NDT experts. We obviously are very mindful of NDT and know what scans look like. But if there’s any issues, we have a styling, we dial in remote to our supplement expert, they can actually remotely take control, change the settings, parameters.

Allen Hall: Wow.

Chris Cieslak: And so they’re virtually present and that’s one of the beauties, you know, you don’t need to have people on site.

You can have our general, um, robot techs to do the work, but you still have that comfort of knowing that the data is being overlooked if need be by those experts.

Joel Saxum: The next level, um, commercial evolution would be being able to lease the kit to someone and or have ISPs do it for [00:14:00] you guys kinda globally, or what is the thought

Chris Cieslak: there?

Absolutely. So. Yeah, so we to, to really roll this out, we just wanna have people operate in the robots as if it’s like a drone. So drone inspection companies are a classic company that we see perfectly aligned with. You’ve got the sky specs of this world, you know, you’ve got drone operator, they do a scan, they can find something, put the robot up there and get that next level of information always straight away and feed that into their systems to give that insight into that customer.

Um, you know, be it an OEM who’s got a small service team, they can all be trained up. You’ve got general turbine technicians. They’ve all got G We working at height. That’s all you need to operate the bay by road, but you don’t need to have the RAA level qualified people, which are in short supply anyway.

Let them do the jobs that we are not gonna solve. They can do the big repairs we are taking away, you know, another problem for them, but giving them insights that make their job easier and more successful by removing any of those surprises when they’re gonna do that work.

Allen Hall: So what’s the plans for 2026 then?

Chris Cieslak: 2026 for us is to pick up where 2025 should have ended. [00:15:00] So we were, we were meant to be in the States. Yeah. On some projects that got postponed until 26. So it’s really, for us North America is, um, what we’re really, as you said, there’s seven, 5,000 turbines there, but there’s also a lot of, um, turbines with known issues that we can help determine which blades are affected.

And that involves blades on the ground, that involves blades, uh, that are flying. So. For us, we wanna get out to the states as soon as possible, so we’re working with some of the OEMs and, and essentially some of the asset owners.

Allen Hall: Chris, it’s so great to meet you in person and talk about the latest that’s happening.

Thank you. With Blade Bug, if people need to get ahold of you or Blade Bug, how do they do that?

Chris Cieslak: I, I would say LinkedIn is probably the best place to find myself and also Blade Bug and contact us, um, through that.

Allen Hall: Alright, great. Thanks Chris for joining us and we will see you at the next. So hopefully in America, come to America sometime.

We’d love to see you there.

Chris Cieslak: Thank you very [00:16:00] much.

Renewable Energy

Understanding the U.S. Constitution

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Here’s their quiz, which should be called the “Constitutional Trivia Quiz.”, whose purpose is obviously to convince Americans of their ignorance.

When I teach, I’m going for understanding of the topic, not the memorization of useless information.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits