Weather Guard Lightning Tech

Orsted Investor Call Insights, GE Vernova Prepares for Lift-off

The latest episode of the Uptime Wind Energy Podcast tackles the major offshore wind project cancellations on the U.S. East Coast. Ørsted recently halted development of its Ocean Wind 1 and 2 projects off New Jersey. The decision highlights ongoing challenges in the American offshore wind market like permit delays, supply chain issues, and lack of specialized vessels. Rosemary, Joel, Phil, and Allen analyze Ørsted’s financial position, problems with U.S. inter-agency coordination, and impacts on future offshore wind PPAs. GE Vernova’s reduced losses in wind energy put it on course for a 2024 stand-alone company but there are risks ahead. Our Wind Farm of the Week is Grand Bend Wind Farm in Canada.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

Uptime 190

Allen Hall: The Nuremberg Technotrain, the rave, seven hour rave train that runs through Germany. Come on. Can you imagine being in that train?

Rosemary Barnes: I’ve been to some German raves. You have been to a rave in Berlin? Is that true? Yeah. I’ve been to like special underground clubs. Wouldn’t you, if you were in Berlin and had the opportunity?

Of course you would. Come on.

Allen Hall: No, I am not going. To a rave in Berlin. That’s not in my top 10. Sorry.

Rosemary Barnes: I went to this one with my little sister when she lived in Germany, which was probably like 15 years ago, or maybe even more. And yeah, it was in some disused industrial building, like an old factory or something.

And they had this artwork made out of just like scrap. Random scrap, and one of them was sitting on the bar, and then every, half hour or whatever, they would just turn it on and would just breathe out this big fireball, just, everyone would just get out of the way of this sculpture breathing out a fireball and just keep on dancing.

Allen Hall: Rosemary, I, this is so out of character. I can’t believe you’re within a hundred meters of a rave. That’s insane.

Rosemary Barnes: Probably these days it might be more likely to go to a Taylor Swift concert than a than a rave, but purely for if there was a seating option. I enjoy a seated option at a music event these days.

Allen Hall: I had no idea. When I brought it up, I was like, there’s nobody who’s been to a German rave. Oh yeah. I’ve been to the German rave all the time.

Rosemary Barnes: You are crazy. If you’re going to go to Berlin and not go see any electronic music, it’s very good. There’s a good, a very good electronic music thing.

If I was in New Orleans, I would go see some jazz, you’ve just, you’ve got to go see the cool thing where you go. Invite me along to some events and I’ll tell you what the cool thing is happening in that city and yeah, help you to get a little bit of cultural experience.

Allen Hall: Orsted held an investor conference call November 1st and Phil, there’s so much discussion within that investor call. They eventually had to stop it. That investor call went about 90 minutes. Usually those calls go one hour and that’s it. And the Q and A sessions are pretty short. So it’s usually about 40 minutes of presentation material and 20 minutes of Q and A from investors.

But this one was like the opposite. It was about 20, 25 minutes of PowerPoint presentation followed by an hour. Ish of big name banks and investment firms asking very pointed questions of Orsted. And this all revolves around Orsted ceasing operations at 2 in New Jersey. This is a big deal because it creates what they call an impairment.

And Phil, you’re going to have to explain what exactly what an impairment is, but They’re talking about an impairment of roughly 28 billion crowns Danish currency, which is roughly 4 billion US dollars. A few months, a even about a month ago, they thought that was only gonna be about 2 billion. So they’ve essentially doubled that forecast in a matter of a month.

And I know, going from two to 4 billion, two and four are small numbers, but when you put the B behind it, it really matters. That’s a lot of money. And the reason they’re having this issue is that when they ceased Operation Ocean Wind 1 in particular, they had put a lot of money in it. They have a lot of orders in for wind turbines and cables and everything else.

Stopping that creates penalties, essentially, for stopping them. And New Jersey, the state of New Jersey is going to have some penalties apply, and we can talk through that as we go along. But, Phil, first off, why the stoppage at Oceanwind

Phil Totaro: 1? Orsted felt that the project was not, uh, financially viable. One might question why the timing of it, because…

After so much deliberation so many months worth of, getting the government to agree to, certain, the release of those tax incentives that they were supposed to be getting in the first place. Getting the supply chain contracts in place, as you indicated it’s an interesting timing to pull the plug right at this moment.

And it’s caused a lot of ire. Amongst the folks in New Jersey, particularly those within the government, there are certainly some people who are, mostly on the lookout for whales and whatnot that are happy about the fact that it’s being canceled. But in the meantime, Orsted’s actually at least done the.

The fiscally responsible thing, by not pursuing an untenable project, however I’m, I’m scratching my head as to how they reconcile, alright, you’ve signed supply chain contracts, but you’re saying that the supply chain is the issue. If the supply chain’s not meeting their obligations under those contracts, then how is Orsted eating all of those contracts in the first place?

And why are they liable? Why are they, taking the impairments are one thing, but the write down is another. They have a $530 million US dollar write down as a result of just in, in the most recent quarterly report. Anyway the question is, yes, they’ve sunk a lot of money into this.

But the, it’s better to not build a financially untenable project, but I’m curious as to how they let it go this far and why I can’t seem to reconcile how they aren’t putting the onus on the supply chain companies if they’re the ones who are faltering. And are creating a situation where it’s untenable for them to build the project, then why aren’t the supply chain companies seeing, half their market cap drop?

Why

Allen Hall: worst it? Yeah, and Joel I think from what I’ve seen, they are obligated to make those purchases to buy for ocean wind, it’s GE turbines or Haliad X turbines. And the discussion. From Orsted was, although the gross termination fees for all the supply chain, uh, effort is about 18 billion crowns, which is a little over 2 billion that they may be able to repurpose those turbines over in the UK, essentially take the electronics out, convert them from 60 Hertz to 50 Hertz.

And move them somewhere else. So they were hoping to either reuse or sell or something. The turbines and the cables and all the things that they had on order. Does that make a little bit of sense, Joel, if contractually? Because I think Phil is right, like why not just cancel the contracts? But it seems like in Ocean Wind 1 they’re going to end up taking all the equipment.

Joel Saxum: Yeah, so they’ll, the contracts, smart contracts or any contract of that size to mobilize a supplier, you have to give them some kind of guarantee and promise, right? Like nobody, if I’m not, you’re not going to order say you’re an oil field company. You’re not going to go and order 200 pickups from a GM dealer.

And then you’re just going to go okay, cool. Whenever you figure it out we’ll have the trucks ready for you. They’re gonna say hey, we need some prepayment or some guarantee up front. And this is all specialized equipment, right? So if they’re going to do, or if Orsted’s gonna get a contract in place to build these GE turbines or to build, 120 miles of cable they’re gonna have to have had, get some, give a little bit of promise up front.

Now, The level of that promise, I’m not in GE’s commercial team. I don’t know what that is. I would imagine that they’ve had milestones being final investment decision. All of a sudden they owe a little bit more to get these guys moving. Because it’s not that simple, right? It’s not an easy thing to go make all these specialized cable and make all these specialized turbines.

So they will have had to put some kind of promise down or some kind of guarantee of the sorts to the turbine manufacturers or the other sub components out there. And like you said, if they’re building stuff other where other places, there’s also revolution wind and some other things happening there.

So they’ve got some projects that are going on in different theaters in the world and on different leases and things like that, that they can repurpose those contracts for. However it’s, it’s not ideal, right? It’s not ideal for anybody in that supply chain. Phil said why haven’t we seen the other people dive, the GEs of the world and whatnot that are supplying those turbines.

They have some some guarantees, but on the other side of it, some of the other supply companies aren’t publicly traded. So we don’t really know what goes on inside of them. Let me go through the list

Allen Hall: of sites here and then what the equipment is. Ocean wind one and two were Heliad X turbines.

This is the, when we got into the patent dispute about Siemens Gamesa, everybody remember that and the settlement there, right? So ocean wind one, and I think two were involved in that, uh, rev revolution wind, which is down in Connecticut and Rhode Island. Those are Siemens Gamesa turbines, and that project is still a go.

Sunrise 1 and 2, that’s an Orsted and Eversource combo for those projects. And those are supposed to be Siemens Gamesa turbines. And, last one is Skipjack. Which gets mentioned in the Orsted discussion here, that’s happening down in Maryland. Actually, the turbines are off the coast of Delaware, but the power is going to Maryland.

Those are also GE Halliade, or supposed to be GE Halliade. But that whole project’s on pause. They’re not spinning in another nickel on that project. So you have Ocean Wind 1 and 2 that are stopped. Skipjack, which is in pause. Sunrise, which can’t offload anything at the point, at this point. A revolution, which the one that’s progressing South Fork’s another one that actually is progressing.

So in the bigger scheme of things, the big gigawatt projects are all stopped. That’s what it looks like right now. Doesn’t seem to matter who the wind turbine manufacturer is, even though it seems like GE is part of the problem here. You’re right. No one on the GE side has said anything about this.

Does that make sense, Phil?

Phil Totaro: Vestas put out a statement saying that they weren’t going to be impacted by Orsted’s decisions. There you go. There you go. There, there are definitely ways you could repurpose some of the contracts, yes. The question is, Skipjack was the other one that sounded like, you mentioned it’s paused, but it sounds like that one is likely to be cancelled as well.

Again, I don’t know if they’re going to sit here and cite These supply chain issues, these magical supply chain issues, which, okay, if this, if the contracts have already been struck and in order to qualify for ITC credit, you have to put at least, I think it’s 5 percent down on, what is likely to be more than a billion dollar contract in the first place, then.

That’s, that’s something they’re probably not going to be able to claw back, but just like building the project in the first place versus not building it you’re not obligated necessarily to spend money that you haven’t already spent. You may cancel a contract and face penalties for cancelling the contract, but ultimately it’s less money than an unviable project.

So I’m still there’s something that we’re all missing as a result of this whole thing. What we can say about it is that it’s clear that the U. S. in general has not Really done enough and it’s interesting in the context of hey, let’s get four more lease areas set up in the Gulf of Mexico Which, we just had an auction down there and it was a flop.

The U. S. hasn’t really done enough to create an environment in which everybody’s ready to invest and, more importantly, everyone’s ready to recognize the fluctuations in price that happen with, throughout the rest of the energy sector. So here’s what I don’t necessarily understand, we’re having these huge discussions where, contracts get cancelled on offshore wind, you’re seeing, in New York, what was going to be 10.

6 gigawatts get built is now going to be 6. 4 if that and, when oil and, or petroleum prices fluctuate, nobody goes running down the streets, with their hair on fire, screaming that it’s, a huge problem. I’m, again, I don’t, I, we go back to why didn’t New York renegotiate?

That would have at least kept the ball rolling on these projects being built. Why is the governor of New Jersey now demanding an extra 300 million on top of the, cancellation fee that, that Orsted’s gonna have to pay for Ocean Wind 1 and 2? Because he’s feeling aggrieved at that whole process of them, getting the state legislators on board with giving Orsted those tax credits that they were supposed to get in the first place.

And so now he, he wants an extra 300 million on top of it. That, that must be nice. So I just, if I’m an investor right now looking at the U. S. market, I’m looking elsewhere. That is this, the message that the federal government and some of these state governments are sending to the industry as a whole right

Joel Saxum: now.

I want to, I feel I want to go to that, what Murphy said that the governor of New Jersey there today’s decision by Orsted to abandon its commitments to New Jersey is outrageous and calls into question the company’s credibility and competence. Those are strong words from a, from a. An elected official.

Allen Hall: Let’s ask an impartial party here. Is Ørsted, Rosemary, is Ørsted incompetent? I don’t

Rosemary Barnes: have any reason to say that they are, I don’t think. I think this all sounds pretty rational. From, I can understand why all players involved have acted the way that they have. But yeah, I don’t think that there’s a whole lot of eyes on, 10 years in the future.

I think everybody is. Responding to, short term financial problems and not worrying about long term relationships that they’re going to, yeah, they’re going to need in a decade time. I think that, yeah, it’s time for a few people to, take a step back, take a deep breath and just think, is it worth winning this battle or, have we got some longer strategic war that we’re going to need to.

Have certain partners for and maybe, yeah, best not to just blow up everything all over the place because you couldn’t actually can. Will New York

Allen Hall: and New Jersey need Orsted and Equinor in the next 10 years to build out some offshore and maybe even some onshore wind?

Rosemary Barnes: Yeah, I think that the way that New York is behaving now is suggesting to me that they think that they can do without any wind energy at all.

And if they do think that, then I’d like to know what their plan is because, they’ve already ruled out a few things. And you can’t, you don’t need every single energy generation technology available to, make a reliable grid, make a clean grid, to make a cheap grid. But the more of the, main players that you rule out, the harder it becomes to make it cheap, clean, reliable, you’re going to start missing on some of those metrics and.

I, yeah, growing up would say what compromises am I willing to make? Am I willing to pay twice as much for my electricity just to make a point about the wind industry? Would we rather go back to nuclear? Would we rather go back to fossil fuels? I’m not saying the answer is definitely wind and I wouldn’t like to see the wind industry become like, Yeah, like the nuclear industry where every single project runs over budget by a hundred or two hundred percent and over schedule by a similar amount I don’t want to see that for the wind industry, I want us to , I want us to grow up a bit as well and start thinking about how can we learn from the mistakes of these projects. And if it means you’ve gotta put in place hedges for some of your major costs for the future, then you do that to make sure that yeah, that you are gonna be able to supply projects that you’ve committed to.

I just think it’s bad. Looks all around. And yeah, like I said, I think that, if you continue down this path, then we’re going to end up really similar to what the nuclear industry is like, and I’ve got nothing against nuclear, but you, anyone that’s looking rationally at the situation would have to say that, nuclear power in the Western world, at least, is not, a shining example of technology development done well.

It’s a lot of expensive projects that make ridiculous promises and then fail to deliver and leave the, public on the… on the hook for paying increasing bills. And there’s no reason why wind energy needs to go down that way, but it is starting to look like that, to be honest.

Allen Hall: Hey, Uptime listeners.

We know how difficult it is to keep track of the wind industry. That’s why we read PES Wind Magazine. PES Wind doesn’t summarize the news, it digs into the tough issues, and PES Wind is written by the experts, so you can get the in depth info you need. Check out the wind industry’s leading trade publication, PES Wind at PESWind.

com.

Joel Saxum: So following on with what Rosemary said, I want to just, I want to give a voice to, or at least shine light on what may be happening in conversations that aren’t a part of this podcast, right? We’re all wind industry supporters. The people that listen to the podcast, for the most part, all wind industry supporters.

So we want things to succeed. We want things to do well. And we’re looking at what happened here? How can this happen? Why are these people acting this way? What could we have done to fix this? But on the other side of things, like reading an article today about the people that actually were happy that this failed.

There was a ton of of people that have been trying to fight big wind up and down the east coast that we filed lawsuits, and we did this, and, there’s this lawsuit, and that lawsuit, and this group, and that agency, and these different things. I don’t know if those actually have a play in, the decision making that Orr said had, if they’re actually…

thEy seem pretty frivolous for the most part, but what this does, I think, is it gives a voice to the other side. So the other side saying, and like I said, I’m switching hats here just to give a voice to their side, saying this makes anti wind people a little bit more happy because they can say hey, this is a subsidy propped up ITC, PTC IRA bill industry that can’t weather the storm, like Phil was saying, of fluctuating prices and, fluctuating prices in the market, whether it’s interest rates, fluctuating price of capital, fluctuating price of commodities, of people, of steel, of whatever that may be, like the hydrocarbon industry does because Hydrocarbon industry is also famous for taking massive profits when things are good.

Whereas the wind industry has come in and they run at such a close, skin of the teeth margin to try to get by, because it is expensive for a renewable energy transition. And the grander scheme of things, I think, like the other, like I said, the opposing side of this is, yes we beat this, but in the…

They’re not seeing the larger the renewable energy transition goals that, you may need some government support, you may need some help along the way to get this industry in here that doesn’t run at these massive margins. Nobody wants to see, wind come in on build offshore and when times are good they’re just reaping profits and everybody else is having to pay them like they, like the oil and gas companies do at certain points in time.

The industry is, it’s not apples to apples when it comes to the operating model. And because of that the, the extra fluctuation in prices has really hurt it. And so while I see that this could be the, a victory for anti win people, I think in the grand scheme of things, like Rosemary is saying as well, you’re not thinking about the long run.

You’re not thinking about, what happens if we don’t actually make this transition and the implications of that.

Allen Hall: Yeah, and I do think there is some mixed signals at the moment, and New Jersey and New York are really quietly trying to bury Ørsted, and here’s why I say that. Ørsted’s saying that Sunrise One, which is a big project when it got rejected for a rate increase.

Remember, a few months ago, weeks ago now, they were asking for, to raise the PPA price that they agreed upon because of interest rates. And New York said no and rejected it. In the recent third auction that New York just held, they were paying more, higher PPA prices than what Orsted was asking for.

So Orsted’s a little confused by that wait a minute, we offered you less, three, yeah, I think Equinor’s in that same boat. Yeah, equinor is still saying Sunrise One is still possible because of some tax implications here they’re gonna bring the cable. Land through a brownfield, and that allows them another 10 percent ITC bonus because of that and, but in order to, there’s a new rebid, right?

So New York decided to do a quick rebid, which is supposed to happen like Q4, Q1, right, 2024. bUt Orsted and Equinor are prohibited from bidding in this thing. So the companies that could bid, that are ready to go, that have bite auction sites, right, they have the leases, are at the moment prohibited.

Now you’re not going to read that everywhere in the press, which is weird, right? But if you listen to the Orsted investor call, they clearly say it, that they’re having a problem because they want to re bid SunriseOne. But they can’t, they also mentioned during that call that they had used Sunrise 2 during that third auction that they had put a bid in, in that third auction, and it was rejected.

So Sunrise 1 is rejected and now it’s tied up, Sunrise 2, basically the same plot of the bite got rejected by New York. So if I’m Orsted, I’m thinking New York has it out for me, they don’t want any, anything to do with Orsted, it seems so And you could say, I think Ecuador is thinking the same thing because they’re in the same boat.

That is a problem. And back to Rosemary’s point, are they, is this something at a higher level that is really going to hurt them in the long run? Because the reason that Orsted’s saying all this thing in ocean wind turned to a problem for New Jersey is because of delays. Permit delays, supply chain delays, that eventually rolled into the availability of a jackup vessel.

Now Phil, before we get into Jones Act, because this is where this is going, they had an opportunity for a jackup vessel to do these projects. If it got pushed out too late, which is what was about to happen, that jackup vessel was gone. And so they had to sign in another one, which would happen years later that vessel become available again.

And at that point, the cost of the project would explode. Therefore, ocean wind 1 and 2 were stopped because of this jacket vessel problem. Now, if that is a driving factor, What is being done to address the lack of ships? Anything?

Phil Totaro: There’s plenty of ships if you want to get ’em in China, but if you wanna comply with the Jones Act, then you gotta have a US flagged vessel, don’t you?

Yeah. I think one of

Joel Saxum: the problems here is that there’s, and this is a federal to state to community, whatever government agency you wanna talk about in the United States for sure is inter-agency communication and inter-agency Strategic planning is. It’s like absent. It’s like we have slack. We all work remote and we can communicate all day long with each other fantastically.

I don’t think the U. S. government has a slack system because they don’t communicate with each other, right? They have this, they have the Biden administration setting these goals. They’re not to get this goal. Let’s go right down to the foundation of the goal of 30 by 2030, 30 gigawatts offshore wind by 2030.

To get this, you need to have all the pieces playing together. There needs to be a web of people interconnected, working and pulling and rowing boats in the same direction, trying to get the same things done. There’s simply not. That’s the reality of it. The communi You can say all you want at the top, but if that doesn’t get communicated down with plans and interconnected communication and action, it’s not gonna happen.

As we’ve been watching these things, we talked on the show three or four months ago about problems with getting ports just getting a port facility, getting a quayside built. And there was like, what, seven or eight or nine agencies involved in this decision up in, I think that was in Massachusetts or something, right?

That’s one single little port, right? That’s one little port. That’s one tiny part of this thing. We just got, Alan and I did an interview with a gentleman today and we, and very smart man. From Norton Rose Fulbight David Burton talking about… All this tax equity investing and all these different things.

This is the IRA bill that partially props up offshore wind in the United States. However, there’s guidance that hasn’t even been let out to the public and might come end of this year, might come in six months, might come in nine months. That’s still hanging out there and this bill was passed 14 months ago to get to, to spur on this, all of this innovation and all of this build out of.

Onshore wind, offshore wind, the green energy transition, all of the above. But all of those things still aren’t even settled. So if you can’t get your ducks in a row and the people in one room to communicate an action plan it’s pretty basic business, in my mind. Most of them live in the same city. Go to one Starbucks and figure it out.

Yeah,

Allen Hall: permitting it is a big issue. I think Orsted’s trying to get away from blaming governments and the words that Mads Knipper talked about the governor and the state of New Jersey was, Hey, we’ve tried to work in good faith and I understand they’re upset, but we were trying our best and we think they did a good job.

So he’s trying to mend the fences, but New Jersey is not, it’s not going to play that way and is really attacking them.

Phil Totaro: And I think this goes back to the point you made before about how it feels like both New York and New Jersey are maybe a little bit fatootzed at, the whole process that this is, had to go through.

They, these are both states that are highly dependent on coal and natural gas in the first place. And it feels like they’re trying to compel Orsted, and Equinor for that matter, to just sell the lease areas to somebody else and have somebody else step in and build. Like they’d be okay if somebody else built.

Potentially, particularly like an American company, although there’s not that many of those lying around who are going to spend the cash on building an offshore wind project, which is why we got all the Europeans to buy the leases in the first place. So I don’t. I don’t know what the answer is here.

I just wanted

Rosemary Barnes: to ask a question. I’ve been reading this book how big things get done. Have you guys read that? It’s by a Danish guy, Bent Fluebjerg. Yes. Yeah. Yeah. So there’s this table I keep on coming back to in the back. It’s got all of these large scale projects and it’s split them into project type and then calculated the main cost overrun by looking at, a large number of projects in each one.

And yeah, so at the top is nuclear storage, Olympic games, nuclear power, the most cost overrun on average. So that’s, yeah, 238 percent average cost overrun for nuclear storage and 120 percent overrun for nuclear power. And then at the bottom is solar power with 1 percent mean cost overrun, energy transmission, 8 percent and wind power with 13%.

So it’s third from the bottom. It’s not, everybody is tearing their hair out over how could this happen that, a project costs more than you thought it would and you want to renegotiate, but it’s not as if that’s maybe it’s unheard of in renewable energy, costs have just been decreasing so fast and it’s very easy to promise a price and then live up to it because your costs are probably going to be lower by the time that you go to build it than when you promised it.

So now wind isn’t like that at the moment costs are going up very similar to what a lot of other industries, a lot of other kinds of technology have had to face. My question is, do you think that wind power is, becoming more of a, just a normal kind of project that does sometimes have cost overruns depending on what’s happening in the broader economic climate.

Yeah. People just need to shift their thinking.

Joel Saxum: Yeah I think one of the differences there between wind, say, a wind project and a hydroelectric dam or something of that sort. Is those projects are very much the ones that have the high cost overruns. They’re very much have uncontrolled costs in them.

So uncontrolled costs being things that maybe not uncontrolled, but loosely controlled a lot of trucking, a lot of earthwork, a lot of dirt work, a lot of fuel, a lot of those things. So if you’re building a dam, you’ve got people out there in excavators digging, you’re paying by the hour for them while you may have been bid, but those things are easier to have an overrun.

Whereas if you’re building a wind farm, basically you have. Fixed, you should have fixed costs. You have equipment, limited amount of civil work, and then materials. So I think it’s the projects that have heavier civil work or heavier like concrete usage or things like that where there’s a little bit more loosely controlled that have that higher overrun whereas wind is, wind and solar are pretty much you gotta buy the materials and getting the stuff installed is usually pretty, pretty small portion of the cost compared to the materials.

Phil Totaro: In the state of New York, one of their major utilities, Central Hudson, has asked for a, and apparently is going to be approved, for a 30 per month, per customer, rate increase to pay for, amongst other things, natural gas, and natural gas treatment. Thank you. Some additional transmission. And, is anybody having a gigantic debate over that?

No. That rate increase is pretty much gonna get rubber stamped, if it hasn’t been already. They asked for this rate increase back in July, I think, and the early indication was in the early part of September, that this was gonna get approved. so You don’t see, again, you don’t see people tearing their hair out, as Rosemary said earlier, about the fact that they’re having to pay 30 per month more, it’s spread out over a number of years but it’s still, 30 a month more for

Joel Saxum: gas.

I would say if I was to make the shortest answer, that’s because. When you’re talking energy created by hydrocarbons, you’re not talking about a bipartisan political issue. When it comes to wind, it’s a bipartisan political issue and more of the arguments are political over technical and that’s the problem.

And when you’re talking hydrocarbons, people aren’t going to fight that as much because it fits the regime of conservative versus liberal. And we should talk

Allen Hall: about the leadership at Orested for a minute and what the investment community response to these latest announcements was in that call.

There were a lot of concern investment groups. In fact, one of them uh, was offering advice, which I’ve never heard of in an investor call saying, we don’t know how pre consulting, which you never want from investors, right? What that investor was asking was. We don’t know how to value you. We know you have a lot of value, but we don’t see it.

And our clients are wondering what we should do. On top of it, we don’t feel like there’s a plan. Everything’s in fluctuation, and we don’t know where you are headed or how you’re going to manage these things. So we’re uncomfortable providing guidance. And when Orsted said they didn’t need any equity The market obviously doesn’t believe them and when Orsted said they’re going to pay their dividend like they planned to pay it, the markets don’t believe them.

So there’s a leadership issue in terms of trust. Whether they’ve earned it or it’s unearned just because of the situation they’re in, I don’t know. But one of the items that popped up, and I think it was a really good question, was Why did Orsted pay New Jersey a hundred million dollars in escrow saying they were going to complete Ocean Wind 1 and then literally a week or two later said they weren’t?

And that money gets tied up. I think they paid, I think that money’s in a bank account somewhere. Along with 200 million dollars that’s in escrow for supply chain development. That’s where the 300 million dollars is coming from is that New Jersey, I think right now, has 300 million dollars sitting in an account in escrow that Orsted can’t, That’s a real leadership question, right?

That 100 million is a lot of money. And you can’t change your mind, you should have made the decision before writing that check. Phil, am I missing something here? It just seems like the investment community is really concerned about the outcome of this.

Phil Totaro: Yeah as I mentioned at the top of this, there’s a difference between the impairments that they have and the write down, the 530 million write down.

That’s 300 million as part of that write down because it’s cash that they’ve spent or is otherwise tied up, as you mentioned, and they can’t get it back. At the end of the day, I think that’s the real question that investors have, is why did you guys sign such strange contracts, such, contracts with language that tied you up in a way that was going to be financially disastrous if you do exactly this.

If you decide to pull the plug on the project, you are still locked in to, having spent and committed this this money. And that’s why I say, for the governor of New Jersey to come out and say the things that he did and then say that, Okay we’ll take this 300 million, but they were, he was literally expecting more it’s almost hey, we spent a lot of time on helping you guys get your act together with all these tax issues and the permitting, et cetera so you should further compensate us for that.

I’ve never necessarily seen, maybe that happens in, I don’t want to pick on any countries, but, Kazakhstan or some place like that where, it’s like you want to go in and build a project and then decide you don’t maybe they’ll keep your deposit. But such inflammatory language in the US from, a democratic governor who again is supposedly supportive of wind energy.

And more importantly, the union jobs that it’s going to create. Why burn the bridge?

Allen Hall: I think Orsted is not really in financial trouble. I do think long term they’re going to be viable. Come on. They’re, they’ll be fine. They’ll be fine. Ecuador will be fine. New York? New Jersey? Probably not so fine.

I think they’re the ones in the long term that are going to get hurt by this because what are they going to do? As Phil was talking about, they’re going to raise gas prices in New York. I think that will continue. They don’t have any way to control it, really, and if they’re serious about reducing carbon dioxide emissions.

They’re stuck, right? They’re stuck doing more expensive projects than offshore

Joel Saxum: wind. And if you’re the next people that come in, or the next company or group of companies that come in to try to develop the same space that Ocean Winds 1 and 2 occupied, and or any of these other offshore wind leases have been pulled, what are they going to do?

Phil and Rosemary, we said it earlier in the episode, the PPA prices are going to go up because they’re going to insulate themselves against risk. So the prices of energy coming from the offshore wind resource are only going to get higher on the east coast because of all of this fallout. And when it comes to Orsted, they’re…

Building offshore wind off the coast of Denmark for Ørsted, Ørsted and Lego, that’s the two big Danish companies everybody knows, right? It’s a bit easier, because you just call the Crown Prince and you get it done. Or even if you’re going into some of the other places Ørsted’s at, Taiwan, other places it’s just easier to get that, that, those assets built.

And then you come over here and it’s every time you turn, it’s like a Jean Claude Van Damme movie, every time you turn you’re getting hit from every angle and you gotta fight all these people off. Doing backflip kicks and all these things to try to save yourself. And it’s you know what, we guys, we’ve had enough.

We’re not playing this game. You know what I mean? We’re not taking all these black guys. We’ll just go elsewhere and take our capital, invest it in places that want to have

Rosemary Barnes: us. I do think it’s like pretty, pretty short term, pretty alpha male. Yeah, I’m winning this negotiation, but my city won’t have any electricity in 10 years.

Kind of. It might be really good for a politician to win their next election, but definitely don’t see it as having the city, the state, sorry, the state’s long term interests at, at heart.

Phil Totaro: Lightning is an act of God, but lightning damage is not. Actually, it’s very predictable WeatherGuard.

It dramatically improves the effectiveness of the factory LPS so you can stop worrying about lightning damage.

Allen Hall: Visit weatherguardwind. com

Phil Totaro: to learn more, read a case study, and schedule a call today.

Allen Hall: Moving on to better news, G. E. Vernova published some numbers, some their fiscal numbers. Remember that G.

E. Vernova is going to split off into a separate company come Q2 of 2024. So there is a big push to right that ship and become profitable. So the recent numbers which are published at the end of the third quarter indicate that the renewables portion of G. E. Vernova, so there’s two pieces of renewable and then there’s power, which is the gas turbine division for the most part.

thE renewables division, the wind turbine part is still losing money at about a 200 to 300 million dollar per quarter clip. It’s better. It was 900 million dollars a year ago. Also. It’s less, but they still haven’t got cashflow positive. And they’ve released some numbers also on sales and the traffic that way, and the order book, it looks positive, like they are really making progress on getting more orders in, getting things financially for the future set up, but as of right now, it still looks close.

It’s going to be really close by Q2 of 2024. They’ll probably be just break even. And Phil I think this is a problem for Vernova because once they separate into essentially GE Aerospace, because healthcare has been divided off already, so GE Aerospace splits from GE Electricity, Power, Vernova there’s no piggy bank.

GE Aerospace is profitable. GE Vernova is slightly profitable when combined, but there’s, if something were to happen, like a huge cancellation by Orsted. That’s a problem. And I, I don’t know how they start to navigate this unless they stock up on lawyers and get really tight on reading contracts and making sure they’re not going to get caught up in an Orsted like situation over the next couple

Phil Totaro: of years.

Yeah, but keep in mind as well, Alan, with the numbers you mentioned, they also came out and said that their offshore wind division is losing about a billion a year and will do for the next couple of years. That was before. This announcement from Orsted about the cancellation of these projects, so that could make things a little worse The other thing to keep in mind remember when we talked probably about five or six months ago about the fact that they brought new leadership into GE, Vernova and Renewable Energy, now Vernova the reality of that is they were talking about already being profitable by the third quarter of this year.

That’s obviously not happened, but, as you said, they are trending in the right direction. The offshore wind segment of the business is not helping. At this point, and the question is how much more of a drag is that really going to end up being they’ve had some sales in Europe with the Haliot X, they’ve had some firm orders in the U.

S. and also not firm orders yet in, in the U. S. The Brazilian market is still yet to take off, which one wonders if they’re going to even play a part down there because they already pulled out their onshore wind business. Where? Yeah, the question is, where are they going to sell these turbines?

They will get some more sales in Europe, but how much market share can they really also? Expect with Siemens Gamesa is self imploding now, and, it looks like Vestas may dominate with some of the Chinese companies also coming into the fray. I don’t know, this is very, it’s still a tenuous time.

Again, I will agree with the notion that GE, Vernova is looking better than they were. But they’re not quite out of the woods yet.

Joel Saxum: Okay. So one of the things I think GE needs to be aware of right now, if I’m sitting in that boardroom almost every morning, I’m probably reviewing what’s happening with Siemens Gamesa because it with Siemens Gamesa is massive problems.

And if the four and a half, five and a half billion dollar or billion euro right down that they’re going to have, if something like that is to happen to GE, because we already seen, and then I’m not saying this is happening to GE right now, but we’ve seen a lot of issues with their Cypress platform. in, in being installed in Europe with blades breaking off and things happening.

So if GE splitting off, like you said, the piggy bank goes away when you remove them from aerospace. So now they’re going to be having to stand alone on them on themselves. And if they had to end up having an issue with some kind of warranty claim or something of this sort, that could be a big problem for them.

So on the heels of that, okay, GE is also LM wind power. They own them. So that will be a part. That’s a part of the GE Vernova basically family as well. And we believe, through some really good investigation, slash the easiest investigation of Project Danish of all time in the state of Colorado that they may be building a new LM LM wind power blade factory.

I think it was in Pueblo if if I’m correct. GE Vernova investing in, taking advantage of some of this IRA bill tax credits to build a manufacturing plant here in the states. For some of their new platforms. They’re going to have order book start to climb to be able to keep that factory gin in as well.

So again, I just go back to it’s good that they’re trending in the positive direction. However, for any Western OEM right now, the ice is pretty dang thin. So keep keep watching out. Alan and I were doing a little bit of lightning research from a Halloween storm that rolled across Michigan and on to Lake Huron and then looking to see what would happen to the turbines if there were some on the coast and he said, Hey, take a peek at this.

Let me see if there’s any wind farms here. And one of the wind farms that was right in the middle of this area that got affected by the storm was the Grand Bend. Wind farm owned by Northland Power in Canada. So the project is located right on the eastern shore of Lake Huron. So they’re going to get some interesting phenomenon there weather wise.

And operations and maintenance, of course, the people that are on that wind farm, they know the issues that they’ve got. It’s a 50 50 partnership. Developed with a few First Nations groups within Canada. And I’m going to get these… Probably pretty wrong, but I’m going to say Kewanongnong and Amjiwanong First Nations groups.

It has a 20 year power purchase agreement with the Ontario Power Authority, 40 turbines and will power about 29, 000 homes. So Grand Bend Wind Farm in Western Ontario. You are our Wind Farmer

Allen Hall: of the Week. That’s going to do it for this week’s Uptime Wind Energy Podcast. Thanks for listening.

Please give us a 5 star rating on your podcast platform and subscribe in the show notes below to Uptime Tech News, our weekly newsletter. And check out Rosemary’s YouTube channel, Engineering with Rosie. And we’ll see you here next week on the Uptime Wind Energy Podcast.

Orsted Investor Call Insights, GE Vernova Prepares for Lift-off

Renewable Energy

BladeBUG Tackles Serial Blade Defects with Robotics

Weather Guard Lightning Tech

BladeBUG Tackles Serial Blade Defects with Robotics

Chris Cieslak, CEO of BladeBug, joins the show to discuss how their walking robot is making ultrasonic blade inspections faster and more accessible. They cover new horizontal scanning capabilities for lay down yards, blade root inspections for bushing defects, and plans to expand into North America in 2026.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining Light on Wind. Energy’s brightest innovators. This is the Progress Powering Tomorrow.

Allen Hall: Chris, welcome back to the show.

Chris Cieslak: It’s great to be back. Thank you very much for having me on again.

Allen Hall: It’s great to see you in person, and a lot has been happening at Blade Bugs since the last time I saw Blade Bug in person. Yeah, the robot. It looks a lot different and it has really new capabilities.

Chris Cieslak: So we’ve continued to develop our ultrasonic, non-destructive testing capabilities of the blade bug robot.

Um, but what we’ve now added to its capabilities is to do horizontal blade scans as well. So we’re able to do blades that are in lay down yards or blades that have come down for inspections as well as up tower. So we can do up tower, down tower inspections. We’re trying to capture. I guess the opportunity to inspect blades after transportation when they get delivered to site, to look [00:01:00] for any transport damage or anything that might have been missed in the factory inspections.

And then we can do subsequent installation inspections as well to make sure there’s no mishandling damage on those blades. So yeah, we’ve been just refining what we can do with the NDT side of things and improving its capabilities

Joel Saxum: was that need driven from like market response and people say, Hey, we need, we need.

We like the blade blood product. We like what you’re doing, but we need it here. Or do you guys just say like, Hey, this is the next, this is the next thing we can do. Why not?

Chris Cieslak: It was very much market response. We had a lot of inquiries this year from, um, OEMs, blade manufacturers across the board with issues within their blades that need to be inspected on the ground, up the tap, any which way they can.

There there was no, um, rhyme or reason, which was better, but the fact that he wanted to improve the ability of it horizontally has led the. Sort of modifications that you’ve seen and now we’re doing like down tower, right? Blade scans. Yeah. A really fast breed. So

Joel Saxum: I think the, the important thing there is too is that because of the way the robot is built [00:02:00] now, when you see NDT in a factory, it’s this robot rolls along this perfectly flat concrete floor and it does this and it does that.

But the way the robot is built, if a blade is sitting in a chair trailing edge up, or if it’s flap wise, any which way the robot can adapt to, right? And the idea is. We, we looked at it today and kind of the new cage and the new things you have around it with all the different encoders and for the heads and everything is you can collect data however is needed.

If it’s rasterized, if there’s a vector, if there’s a line, if we go down a bond line, if we need to scan a two foot wide path down the middle of the top of the spa cap, we can do all those different things and all kinds of orientations. That’s a fantastic capability.

Chris Cieslak: Yeah, absolutely. And it, that’s again for the market needs.

So we are able to scan maybe a meter wide in one sort of cord wise. Pass of that probe whilst walking in the span-wise direction. So we’re able to do that raster scan at various spacing. So if you’ve got a defect that you wanna find that maximum 20 mil, we’ll just have a 20 mil step [00:03:00] size between each scan.

If you’ve got a bigger tolerance, we can have 50 mil, a hundred mil it, it’s so tuneable and it removes any of the variability that you get from a human to human operator doing that scanning. And this is all about. Repeatable, consistent high quality data that you can then use to make real informed decisions about the state of those blades and act upon it.

So this is not about, um, an alternative to humans. It’s just a better, it’s just an evolution of how humans do it. We can just do it really quick and it’s probably, we, we say it’s like six times faster than a human, but actually we’re 10 times faster. We don’t need to do any of the mapping out of the blade, but it’s all encoded all that data.

We know where the robot is as we walk. That’s all captured. And then you end up with really. Consistent data. It doesn’t matter who’s operating a robot, the robot will have those settings preset and you just walk down the blade, get that data, and then our subject matter experts, they’re offline, you know, they are in their offices, warm, cozy offices, reviewing data from multiple sources of robots.

And it’s about, you know, improving that [00:04:00] efficiency of getting that report out to the customer and letting ’em know what’s wrong with their blades, actually,

Allen Hall: because that’s always been the drawback of, with NDT. Is that I think the engineers have always wanted to go do it. There’s been crush core transportation damage, which is sometimes hard to see.

You can maybe see a little bit of a wobble on the blade service, but you’re not sure what’s underneath. Bond line’s always an issue for engineering, but the cost to take a person, fly them out to look at a spot on a blade is really expensive, especially someone who is qualified. Yeah, so the, the difference now with play bug is you can have the technology to do the scan.

Much faster and do a lot of blades, which is what the de market demand is right now to do a lot of blades simultaneously and get the same level of data by the review, by the same expert just sitting somewhere else.

Chris Cieslak: Absolutely.

Joel Saxum: I think that the quality of data is a, it’s something to touch on here because when you send someone out to the field, it’s like if, if, if I go, if I go to the wall here and you go to the wall here and we both take a paintbrush, we paint a little bit [00:05:00] different, you’re probably gonna be better.

You’re gonna be able to reach higher spots than I can.

Allen Hall: This is true.

Joel Saxum: That’s true. It’s the same thing with like an NDT process. Now you’re taking the variability of the technician out of it as well. So the data quality collection at the source, that’s what played bug ducts.

Allen Hall: Yeah,

Joel Saxum: that’s the robotic processes.

That is making sure that if I scan this, whatever it may be, LM 48.7 and I do another one and another one and another one, I’m gonna get a consistent set of quality data and then it’s goes to analysis. We can make real decisions off.

Allen Hall: Well, I, I think in today’s world now, especially with transportation damage and warranties, that they’re trying to pick up a lot of things at two years in that they could have picked up free installation.

Yeah. Or lifting of the blades. That world is changing very rapidly. I think a lot of operators are getting smarter about this, but they haven’t thought about where do we go find the tool.

Speaker: Yeah.

Allen Hall: And, and I know Joel knows that, Hey, it, it’s Chris at Blade Bug. You need to call him and get to the technology.

But I think for a lot of [00:06:00] operators around the world, they haven’t thought about the cost They’re paying the warranty costs, they’re paying the insurance costs they’re paying because they don’t have the set of data. And it’s not tremendously expensive to go do. But now the capability is here. What is the market saying?

Is it, is it coming back to you now and saying, okay, let’s go. We gotta, we gotta mobilize. We need 10 of these blade bugs out here to go, go take a scan. Where, where, where are we at today?

Chris Cieslak: We’ve hads. Validation this year that this is needed. And it’s a case of we just need to be around for when they come back round for that because the, the issues that we’re looking for, you know, it solves the problem of these new big 80 a hundred meter plus blades that have issues, which shouldn’t.

Frankly exist like process manufacturer issues, but they are there. They need to be investigated. If you’re an asset only, you wanna know that. Do I have a blade that’s likely to fail compared to one which is, which is okay? And sort of focus on that and not essentially remove any uncertainty or worry that you have about your assets.

’cause you can see other [00:07:00] turbine blades falling. Um, so we are trying to solve that problem. But at the same time, end of warranty claims, if you’re gonna be taken over these blades and doing the maintenance yourself, you wanna know that what you are being given. It hasn’t gotten any nasties lurking inside that’s gonna bite you.

Joel Saxum: Yeah.

Chris Cieslak: Very expensively in a few years down the line. And so you wanna be able to, you know, tick a box, go, actually these are fine. Well actually these are problems. I, you need to give me some money so I can perform remedial work on these blades. And then you end of life, you know, how hard have they lived?

Can you do an assessment to go, actually you can sweat these assets for longer. So we, we kind of see ourselves being, you know, useful right now for the new blades, but actually throughout the value chain of a life of a blade. People need to start seeing that NDT ultrasonic being one of them. We are working on other forms of NDT as well, but there are ways of using it to just really remove a lot of uncertainty and potential risk for that.

You’re gonna end up paying through the, you know, through the, the roof wall because you’ve underestimated something or you’ve missed something, which you could have captured with a, with a quick inspection.

Joel Saxum: To [00:08:00] me, NDT has been floating around there, but it just hasn’t been as accessible or easy. The knowledge hasn’t been there about it, but the what it can do for an operator.

In de-risking their fleet is amazing. They just need to understand it and know it. But you guys with the robotic technology to me, are bringing NDT to the masses

Chris Cieslak: Yeah.

Joel Saxum: In a way that hasn’t been able to be done, done before

Chris Cieslak: that. And that that’s, we, we are trying to really just be able to roll it out at a way that you’re not limited to those limited experts in the composite NDT world.

So we wanna work with them, with the C-N-C-C-I-C NDTs of this world because they are the expertise in composite. So being able to interpret those, those scams. Is not a quick thing to become proficient at. So we are like, okay, let’s work with these people, but let’s give them the best quality data, consistent data that we possibly can and let’s remove those barriers of those limited people so we can roll it out to the masses.

Yeah, and we are that sort of next level of information where it isn’t just seen as like a nice to have, it’s like an essential to have, but just how [00:09:00] we see it now. It’s not NDT is no longer like, it’s the last thing that we would look at. It should be just part of the drones. It should inspection, be part of the internal crawlers regimes.

Yeah, it’s just part of it. ’cause there isn’t one type of inspection that ticks all the boxes. There isn’t silver bullet of NDT. And so it’s just making sure that you use the right system for the right inspection type. And so it’s complementary to drones, it’s complimentary to the internal drones, uh, crawlers.

It’s just the next level to give you certainty. Remove any, you know, if you see something indicated on a a on a photograph. That doesn’t tell you the true picture of what’s going on with the structure. So this is really about, okay, I’ve got an indication of something there. Let’s find out what that really is.

And then with that information you can go, right, I know a repair schedule is gonna take this long. The downtime of that turbine’s gonna be this long and you can plan it in. ’cause everyone’s already got limited budgets, which I think why NDT hasn’t taken off as it should have done because nobody’s got money for more inspections.

Right. Even though there is a money saving to be had long term, everyone is fighting [00:10:00] fires and you know, they’ve really got a limited inspection budget. Drone prices or drone inspections have come down. It’s sort, sort of rise to the bottom. But with that next value add to really add certainty to what you’re trying to inspect without, you know, you go to do a day repair and it ends up being three months or something like, well

Allen Hall: that’s the lightning,

Joel Saxum: right?

Allen Hall: Yeah. Lightning is the, the one case where every time you start to scarf. The exterior of the blade, you’re not sure how deep that’s going and how expensive it is. Yeah, and it always amazes me when we talk to a customer and they’re started like, well, you know, it’s gonna be a foot wide scarf, and now we’re into 10 meters and now we’re on the inside.

Yeah. And the outside. Why did you not do an NDT? It seems like money well spent Yeah. To do, especially if you have a, a quantity of them. And I think the quantity is a key now because in the US there’s 75,000 turbines worldwide, several hundred thousand turbines. The number of turbines is there. The number of problems is there.

It makes more financial sense today than ever because drone [00:11:00]information has come down on cost. And the internal rovers though expensive has also come down on cost. NDT has also come down where it’s now available to the masses. Yeah. But it has been such a mental barrier. That barrier has to go away. If we’re going going to keep blades in operation for 25, 30 years, I

Joel Saxum: mean, we’re seeing no

Allen Hall: way you can do it

Joel Saxum: otherwise.

We’re seeing serial defects. But the only way that you can inspect and or control them is with NDT now.

Allen Hall: Sure.

Joel Saxum: And if we would’ve been on this years ago, we wouldn’t have so many, what is our term? Blade liberations liberating

Chris Cieslak: blades.

Joel Saxum: Right, right.

Allen Hall: What about blade route? Can the robot get around the blade route and see for the bushings and the insert issues?

Chris Cieslak: Yeah, so the robot can, we can walk circumferentially around that blade route and we can look for issues which are affecting thousands of blades. Especially in North America. Yeah.

Allen Hall: Oh yeah.

Chris Cieslak: So that is an area that is. You know, we are lucky that we’ve got, um, a warehouse full of blade samples or route down to tip, and we were able to sort of calibrate, verify, prove everything in our facility to [00:12:00] then take out to the field because that is just, you know, NDT of bushings is great, whether it’s ultrasonic or whether we’re using like CMS, uh, type systems as well.

But we can really just say, okay, this is the area where the problem is. This needs to be resolved. And then, you know, we go to some of the companies that can resolve those issues with it. And this is really about played by being part of a group of technologies working together to give overall solutions

Allen Hall: because the robot’s not that big.

It could be taken up tower relatively easily, put on the root of the blade, told to walk around it. You gotta scan now, you know. It’s a lot easier than trying to put a technician on ropes out there for sure.

Chris Cieslak: Yeah.

Allen Hall: And the speed up it.

Joel Saxum: So let’s talk about execution then for a second. When that goes to the field from you, someone says, Chris needs some help, what does it look like?

How does it work?

Chris Cieslak: Once we get a call out, um, we’ll do a site assessment. We’ve got all our rams, everything in place. You know, we’ve been on turbines. We know the process of getting out there. We’re all GWO qualified and go to site and do their work. Um, for us, we can [00:13:00] turn up on site, unload the van, the robot is on a blade in less than an hour.

Ready to inspect? Yep. Typically half an hour. You know, if we’ve been on that same turbine a number of times, it’s somewhere just like clockwork. You know, muscle memory comes in, you’ve got all those processes down, um, and then it’s just scanning. Our robot operator just presses a button and we just watch it perform scans.

And as I said, you know, we are not necessarily the NDT experts. We obviously are very mindful of NDT and know what scans look like. But if there’s any issues, we have a styling, we dial in remote to our supplement expert, they can actually remotely take control, change the settings, parameters.

Allen Hall: Wow.

Chris Cieslak: And so they’re virtually present and that’s one of the beauties, you know, you don’t need to have people on site.

You can have our general, um, robot techs to do the work, but you still have that comfort of knowing that the data is being overlooked if need be by those experts.

Joel Saxum: The next level, um, commercial evolution would be being able to lease the kit to someone and or have ISPs do it for [00:14:00] you guys kinda globally, or what is the thought

Chris Cieslak: there?

Absolutely. So. Yeah, so we to, to really roll this out, we just wanna have people operate in the robots as if it’s like a drone. So drone inspection companies are a classic company that we see perfectly aligned with. You’ve got the sky specs of this world, you know, you’ve got drone operator, they do a scan, they can find something, put the robot up there and get that next level of information always straight away and feed that into their systems to give that insight into that customer.

Um, you know, be it an OEM who’s got a small service team, they can all be trained up. You’ve got general turbine technicians. They’ve all got G We working at height. That’s all you need to operate the bay by road, but you don’t need to have the RAA level qualified people, which are in short supply anyway.

Let them do the jobs that we are not gonna solve. They can do the big repairs we are taking away, you know, another problem for them, but giving them insights that make their job easier and more successful by removing any of those surprises when they’re gonna do that work.

Allen Hall: So what’s the plans for 2026 then?

Chris Cieslak: 2026 for us is to pick up where 2025 should have ended. [00:15:00] So we were, we were meant to be in the States. Yeah. On some projects that got postponed until 26. So it’s really, for us North America is, um, what we’re really, as you said, there’s seven, 5,000 turbines there, but there’s also a lot of, um, turbines with known issues that we can help determine which blades are affected.

And that involves blades on the ground, that involves blades, uh, that are flying. So. For us, we wanna get out to the states as soon as possible, so we’re working with some of the OEMs and, and essentially some of the asset owners.

Allen Hall: Chris, it’s so great to meet you in person and talk about the latest that’s happening.

Thank you. With Blade Bug, if people need to get ahold of you or Blade Bug, how do they do that?

Chris Cieslak: I, I would say LinkedIn is probably the best place to find myself and also Blade Bug and contact us, um, through that.

Allen Hall: Alright, great. Thanks Chris for joining us and we will see you at the next. So hopefully in America, come to America sometime.

We’d love to see you there.

Chris Cieslak: Thank you very [00:16:00] much.

Renewable Energy

Understanding the U.S. Constitution

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Here’s their quiz, which should be called the “Constitutional Trivia Quiz.”, whose purpose is obviously to convince Americans of their ignorance.

When I teach, I’m going for understanding of the topic, not the memorization of useless information.

Renewable Energy

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

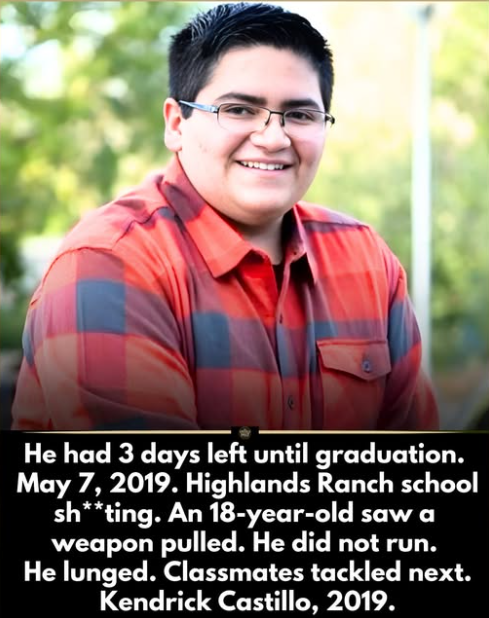

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits