Weather Guard Lightning Tech

Wind Energy Europe Update, Invenergy’s Build-Transfer Model, RTSYS’s Offshore AI Wildlife Detection

Joel gives an update from Wind Energy Europe in Bilbao. Developers like Invenergy are building renewable projects and transferring ownership to utilities after completion – what is the advantage? Are wind turbines creating microclimates which could positively impact crop yields? Plus, an article in PES Wind magazine highlights RTSYS’s offshore wildlife protection system using AI to accurately detect sea life.

Sign up now for Uptime Tech News, our weekly email update on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on Facebook, YouTube, Twitter, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary Barnes’ YouTube channel here. Have a question we can answer on the show? Email us!

Pardalote Consulting – https://www.pardaloteconsulting.com

Weather Guard Lightning Tech – www.weatherguardwind.com

Intelstor – https://www.intelstor.com

PES Wind – https://pes.eu.com/wind/

Philip Totaro: I was a toy tester for Fisher Price. When I was young, because they’re in my hometown outside of Buffalo. And I helped the team in that invented the pocket rocker, which was the kids version of the Sony Walkman, which is very popular back in the eighties.

Allen Hall: Wait a minute. Is this the one when it had a little microphone on it that you could record things with?

Is this what I, I remember this. Don’t I? That was really popular. That’s good. That’s actually a retro item that’s coming back into favor. People are looking for those things. But so why you, Phil? Why were you chosen out of thousands of children?

Philip Totaro: Companies headquartered in my hometown of East Aurora, New York.

And my mother was taking a sabbatical from teaching when, I was very young. So I was like four or five years old. And was in the business of selling kids dolls and toys and stuff like that, although not necessarily directly affiliated with Fisher Price, but she must have just gotten to know somebody over there.

And I want to believe that this wasn’t just like a cheap daycare thing that she could just drop me off at Fisher Price and they would let me play with toys and she didn’t have to deal with me. But So I, I got to play with, all kinds of the, they used to have a thing called Constructs I used to love that they, I got to play with all the cool Fisher Price toys before, anybody in the world ever got to see them but the Pocket Rocker was the one that, because of the popularity of the Sony Walkman back in the 80s, Fisher Price wanted to have the kids version of the Sony Walkman.

And they, had me, I remember being like five year old sitting in this boardroom and it was enormous. It was like literally if you’ve seen like Putin’s conference table, it was like that, that long with, with chairs and stuff.

Joel Saxum: You funded your mother’s retirement at the same time.

You didn’t know you were actually getting paid. She was taking your checks.

Philip Totaro: I don’t know of how much anybody got compensated for any of that. To be honest, free daycare. That’s what it was. I hope we, yeah, I know. I hope it was more than just free daycare, but I haven’t seen any royalties from any of that.

Allen Hall: This is before, child safety came into favor on children’s toys, where they took out all the small pieces and all the red items and all the lead that came out of toys. Yeah, that was the good old days. Is it just that one item, Phil?

Philip Totaro: That’s the one that was commercially popular. I’m sure I gave them product feedback on, cause we, they used to put you in these little rooms where they had, a double sided mirror, although you didn’t know it was, you’re a five year old, you don’t know that it’s a double sided mirror, but it’s a little creepy cause you’re sitting there just like playing with toys and people are watching you play with toys.

And it’s what is he doing now? And they’re taking notes and they’re,

Allen Hall: Joel, in Wisconsin, did they give you toys or just tell you to go outside and play with sticks?

Joel Saxum: Yeah, sticks, or my dad’s favorite one was, in the wintertime when he was annoyed with you, go outside and take all the snow from the front yard and put it in the back yard, and all the snow from the back yard and put it in the front yard.

That’s what he used to say. And my smart mouth, I got in trouble. One time we said this, okay, that makes sense, but where are we going to put it in the meantime? Cause you can’t put it on top of the other snow. And then he’s just get outside. I like your dad.

Allen Hall: He worked on a win, win scenario right there.

Well, Joel just got back from Spain. He’s actually not home yet. He’s still over in Europe, enjoying the weather. I don’t know about that. No, it’s raining and cold here. Go South. I can only tell you to go South, somewhere that’s going to be good weather. But you were in Bilbao for Wind Energy Europe, and we have not gotten the data dump from the show.

So you got to tell us how it was, what happened, what did you see?

Joel Saxum: For sure. Bilbao as a city really turned out for the show. You saw as soon as you landed in the airport. Welcome to Wind Europe Bilbao 2024. The streets were lined with flags Wind Europe 2024. The way the city, the way the city put it on was great.

Of course, Iberdrola has a big headquarters there. So Iberdrola was played a large part in the festivities. As Iberdrola in the wind world is Avangrid, Scottish power. They’re, yeah they’re huge. They’re one of the largest operators out there and power producers in general.

So 12, 000 ish people, they said. I will, I can attest to the fact that, yeah, that everybody I talked to had a hard time finding hotel rooms and places to stay. I know some people that were in hotels an hour away and commuting every morning driving rental cars to the show and other people that had to like pool, pool all their employees together and go get Airbnbs in, a half hour, 45 minutes away just to find a place to stay.

Billbao, great city to go to. I would say takeaways from the show. It was, for me, it was a return of OEMs. The last few years, you see the Vestas booth here and there, and you see a Siemens Gamesa booth. At Hamburg or something like that, but like in the States you really haven’t even seen them at the Clean Power events.

This one was all of the above. You had Enercon, Nordex, GE Vernova, first booth under the new name was there, that was cool. Siemens Gamesa, Vestas a lot of the big offshore players as well. So you had Ocean Winds was there, they turned out for in a large way. RWE turned out in a large way.

So some interesting tracks, and maybe we can dive into this a little bit, but as far as sessions and speaking, of course, when you’re up there, they get together a lot of the politicians in the EU and the U S side, we don’t have that as much. They may have one or two people do a keynote or something in American clean power.

This was whole panels with a dozen country leaders and foreign industry ministers all speaking. And one of the big themes was of course trying to make the European wind energy, Industry stand on its own legs make sure the supply chain was there, make sure that they’re utilizing EU supply chain, EU parts, EU people, and keeping that money locally.

Because when you look at the, as Phil pointed out when we were talking off air, the PPA prices have to support the value of the turbines and the value of the people there. Otherwise the thing that they’re, everybody in the eus in the western world in general is worried about.

is the kind of Chinese influx that may happen. Economics are economics.

Allen Hall: What was the attendance on, by Tier 2 and Tier 3 suppliers? Were they out in force?

Joel Saxum: Yeah, I would say, out in force, yes. A lot of, it’s, your, when you’re up as Bilbao, you’re right on the water there, so you had a lot of offshore players.

An interesting thing, I think I saw more than a handful of floating offshore platform companies. So everybody trying to show their Hey, here’s our platform. Here’s our platform. And when you talk innovation, That was the innovative part of it. As far as innovation on the show floor, nothing new.

Of course, doing the podcast, we’re abreast of all the new technologies that are out there as far as sense sensing 360, we talked about them the other day, they were there the same kind of a couple, some AI analytics companies and things like that, but nothing groundbreaking, nothing brand new, nothing.

Oh man. Did you guys see this booth? Did you go check this one out? The same players, same people. Like I say tier two and tier three suppliers. Not a whole lot of ISPs, but I think that’s in general a trend lately, simply because they’re people are shored up for the year.

They’ve got their contracts written because of the, high demand and technicians, so they don’t really need to put money into a booth. I can just go there and, make their meetings and those kinds of things. Quite a few people I talked to. Rather than doing new business this was the trend as well.

Rather than new business, it was, Hey, it’s just an opportunity to catch up take care of 10 meetings in two days where it would otherwise, you’d have to travel for all of those or try to catch them virtually. Interestingly enough on our side as well, the, or the insurance industry showed up fairly well as they do at most European events.

Cause London is where everything’s based out of. So good show. A lot to see there, but nothing crazy and innovative. I wouldn’t say that. No, no new drone tech, no new blade add on. Didn’t see a nothing. I talked to a lot of people, some people, some of the people that I was there with on booths with talking to, they were there specifically for that reason.

Hey, I’m here for my company as the engineering lead to go and see what everybody else in the marketplace is doing and same kind of stuff.

Allen Hall: Wow. You would think with the amount of money being pushed into the renewable space that you would see some technology pop out. Maybe they’re waiting for the Hamburg show.

That the thought? Could be. I just want to tie into your offshore experience over in Bilbao. I was reading the latest PES Win magazine, which you can get at PESWin. com if you haven’t taken a look at it yet. And since I have Joel back on the podcast this week, I wanted to ask him about this RTSYS Offshore Wildlife Protection System.

So it’s an acoustic monitoring system that floats out in the water and The, they have hydrophones and sensors that can detect sea life. And, but they’ve now added, this is a smart move on their part, added an AI feature where they can detect the sea life more at a high accuracy rate. The AI algorithm is called BioSound and it’s built into their their buoy or.

Boy, as Rosemary would call it, it’s called Ruby, R U B H Y. So the AI part is called Ruby H it’s called Ruby AI, R U B H Y A I. All right. But the detection rate is. Phenomenal. And they’re saying for for mammal vocalizations they’re getting over 90 percent detection and less than 1 percent of a false alarm.

And then for clicks, which I assume is like dolphins, right? You’re getting 95 percent detection with less than 1 percent false alarm. That is remarkably high. What is AI adding to this to make these detection numbers so high? I

Joel Saxum: think there’s, you have to think about the environment they’re operating in as well.

So there’s, physics is in their favor here. When you try to sub, subtend waves, right? When you speak, it’s just a sound wave. Whoa. Through the air, a lot of things can mess with that sound wave in the air because there’s not that much mass that it’s touching. If you send a wave through water, it tends to have high fidelity.

So there’s a physics component to why they’re able to detect very well. So they know what they’re supposed to be listening for, but when those sounds are actually emitted in the wild, they have a I’d say fidelity is the word I’m trying to say, but they, that, that sound wave forms is delivered better.

You can hear, if you go to certain water columns, you can hear whales for kilometers away, miles away in the water because of the actual frequency at which they emit sound, and that water particles, unlike air particles, are right next to each other. So they, the wave travels better through water than it does through air.

So they have that working for them, right? Something else to say here too, when you ever say hydrophone, people always think it’s like, Oh, what is this thing? It’s a microphone that goes in the water. There’s nothing fancy about that, right? But it just picks up vibrations. Traditionally, like in, back in the day, you’d drop a hydrophone over the water or into the water and then you’d just have it transmitted in a speaker on the top side and you’d just listen to it.

And if you were a marine mammal observer or whatever, you may listen and listen and you didn’t hear anything, okay, you reel it back up and move on. But now you have the ability to constantly monitor what’s pick up multiple species you can actually map activity through these things if you have multiple out in an area, you can pinpoint activity based on the directions it’s coming from if you have a hydrophone array out.

So you can pinpoint distance and locations and all kinds of things from this. It’s really cool technology. Actually basis of some of this stuff is from the United States military doing acoustic monitoring for submarines during the Cold War.

Allen Hall: So I assume that the US Navy is using some sort of AI now to detect submarines and this is just a connection, just downstream is to detect.

Seals and whales. I

Joel Saxum: would be willing to bet that when they put this thing in the water, they had to get clearance from the United States, from the Department of Defense to put this thing out there. Because there’s a whole, yeah, along the continental shelf of the eastern part of the United States, all the way up to Greenland, there is a system of acoustics underwater on the seafloor to monitor for anything.

And this, when you start getting, playing acoustic signals back and forth, you can start to mess data up. So it’s bouncing around. So I’m for sure they would have to get some kind of clearance to put this thing out there.

Allen Hall: So the false alarms that they are detecting, which is less than 1%, maybe a submarine.

Could be. Wow. Okay. That’s amazing. The AI technology, you see it everywhere now. Everything has AI. Yeah. Absolutely. Being applied to it, but this actually makes sense to me. It’s one of the few times where I thought oh, yeah It would make sense to put it AI Trying to detect species because that’s a really difficult thing to do and you really don’t want a human doing that because it’s gonna make A lot of errors.

So here you go.

Joel Saxum: Yeah, human can only listen for so long before they get bored then they like Did I hear that or not? I’m not sure.

Philip Totaro: Except to this podcast where everybody’s very excited to keep listening.

Allen Hall: If you want more excitement, you need to check out the latest edition of PES Wind Magazine. Just go to PESwind.

com.

Get the latest on wind industry news, business and technology sent straight to you every week. Sign up for the Uptime Tech Newsletter at weatherguardwind. com slash

Allen Hall: news. U. S. developer Invenergy has secured. A little over a billion dollars in construction financing, led by Nataxis Corporate and Investing Banking, or Nataxis CIB, as it’s commonly called, for four renewable energy projects in Kansas and Texas.

The projects, with a combined capacity of almost 700 megawatts, include a 200 megawatt diversion wind tunnel. Project in Texas, the 135 megawatt Flat Ridge 4 and 153 megawatt Flat Ridge 5 wind projects in Kansas and a 190 megawatt Pixley solar project also in Kansas. Now, the way this is working, guys, is that Invenergy is developing and doing the construction, but when they turn the switch, they’re going to hand these wind and solar projects over to AEP.

for commercial operations, but it’s not AEP top level. It’s some of the sub corporations that AEP is involved with. And this is becoming the standard. Invenergy is doing a lot of development work and then the regulated asset owner then takes over once it’s up and running, what is driving that? Is it just because the technical expertise that Invenergy brings, which obviously they do, they’ve been on a number of projects, or is it just de risking the whole thing from both sides.

Philip Totaro: Yeah, this it’s interesting because the build operate and then transfer ownership business model has been around for a while. What’s driving this in the U. S. more recently is a desire to redeploy capital on new kind of greenfield projects, particularly because, of the production tax credit.

The attractiveness of the production tax credit means that it’s a bit easier to get project finance, even though it’s at a higher interest rate now and higher lending rate and, longer tenors and all that sort of thing for loans. You’re necessarily talking about, being able to project development and permitting considerations notwithstanding, getting an interconnection agreement is obviously a pain in the butt at the moment and assuming that your county or township hasn’t been banned or has some kind of moratorium on wind and solar development, you’re, you want to, build as much as you can as fast as you can to try and take advantage of this current production tax credit regime.

For Invenergy’s from Invenergy’s position, what they’re doing is they’re approaching this saying we’re just going to, build, we’re going to also operate and maintain assets on behalf of these owners, but, It makes more sense for us to to get out once the project development’s been been completed and try and redeploy that capital into other greenfield developments that are already in the consenting and permitting pipeline for them.

Joel Saxum: They’re also building in a financial model for themselves too because with these projects, like a lot of the other AEP projects. Invenergy will build it they’ll finance it, they’ll go through all the development stage, build it, and then they hand the keys over to AEP, but they also keep a key for themselves because then they do the services on the, on that wind farm for a long time.

Sometimes, depending on what their service contract length is. But they, so they’ve got work for their people there too. So there’s a, those are also recurring revenue model for them there. It’s just not. Under a PPA. It’s interesting to me as well, and Phil, maybe I’m going to ask you this question because I’m in the middle of trying to buy a house.

Do these guys pay the same kind of interest rates? That is normal. If the Fed is, if the Fed is at 7%, are they paying 7 percent for their, for this 1. 27 billion, even though they only hold onto it for a year or two, how does that work?

Philip Totaro: No, it’s a good question. So they don’t necessarily pay the. What’s called the prime rate.

They will pay a bit of a premium above that. How much of a premium does depend on, reputation and scale and other things. So that’s, no, it is a, it’s a fair question. But they’ve got, Invenergy’s done what, probably about Four gigawatts of wind and I can’t remember it’s probably at least two and a half gigawatts of solar development you know that they’ve overseen they still own either outright or co owned about three and a half to four gigawatts of wind so You know, and the co ownership now, like you said, is, has been significantly diluted down a lot of these projects, they might still own a nominal 1% where, you know, Southern Company, or AEP, or one of these utility companies owns the other 99% but it’s, they still find these operations and maintenance contracts to be lucrative enough and to be honest they’re getting at least 10 years.

That’s actually part of the agreement that they have when they sell the asset is they get at least 10 years if not longer to be able to to operate and maintain.

Joel Saxum: So I got two questions for you on that one then. All right. So the first one is, okay, say they got 10 years once commissioning date.

This is I’m talking to Invenergy. Do they get 10 years on that project? Does it usually take I mean with the queues and stuff if they’re to say like we’re gonna build a wind farm here Is that 20 years with the 10 years of operation? So they got 10 years of basically development time, build out time, commissioning date, and then some services So they get about 20 years of life on each one of these projects?

Of I don’t know. It’s not always revenue, right? Cause some of it’s a cost center.

Philip Totaro: It’s, it’s a good point because at the end of the day, like, even it’s just, we know like the production tax credit is driving a lot of repowering these days. They may end up renegotiating an extra 10 years on asset operations and maintenance.

We haven’t seen enough of that yet. A lot of that hasn’t percolated its way out into the consciousness of the industry at this point because a lot of the Invenergy developed projects aren’t at least 10 years old or older since COD to be able to be repowered yet. So we’ll see how that plays out with with those assets.

Joel Saxum: Yeah, I, I would imagine. Yes. So my other question then is, okay, so how does the contract normally play out? Does the contract normally play out? Hey, I’m invenergy, I’m gonna go build this wind farm. And I start citing, I start doing all this work, and then five or six years into it or whatever, I go Alright, let’s find a buyer for this thing.

Or is that from day one? Is AEP come to, or Invenergy go, Hey, let’s build a wind farm here. When you guys finish building it, we’ll buy it from you.

Philip Totaro: Yeah, no, it’s again, fair question. And this kind of goes back to what Alan was suggesting earlier, is that you’re, If a utility doesn’t want to have a significant amount of assets in a regulated portfolio, then this is actually a very good business model to employ to have someone else basically do all the development work and then just take a majority ownership of an operational asset once it’s achieved COD.

So to your question, Joel, it seems the past, independent developers that weren’t subsequently, like your Apex or, Apex also still owns some assets, but similar to how a lot of other, project development focused companies work. They will necessarily start that process of developing something on their own and then go find a buyer, but now it’s probable that utilities are starting to request more and more of this type of business model.

So it could be that getting the utility on board as an asset acquirer and potentially a power buyer fac helps facilitate the project development. Certainly the financial side of it, because, once you know that there’s that level of certainty, the financiers are gonna rubber stamp your tax equity agreement or, if you’re are, if you’re leveraging a debt finance then, again it’s a rubber stamp deal.

Allen Hall: Does it help with the interconnect, Phil? That Invenergy is involved in the project, and they’ve done a number of these successfully. Does that raise their application?

Philip Totaro: Yeah, because another real interesting question, point here is, when you go into the interconnection queue, you have certain, studies you have to do, you’ve got to determine what the impact of the project is going to be on the grid, etc.,

etc. And, whether or not new substations need to be built, how big they need to be, whether you need to expand existing ones, and, whether transmission lines are capable of handling the extra capacity. But the thing is, they, the regional ISOs or RTOs won’t let you connect without either corporate PPA you don’t have to have the deal signed, but you have to have at least something in place.

That’s pending. A utility PPA, a corporate PPA, or they have spare capacity in the merchant market. And what’s holding up a lot of these projects in interconnection queues right now is they lack that they’re all saying we’re trying to get a corporate PPA. We’re trying to get a utility PPA.

Utilities don’t want, tons of power unless they’re sun setting, coal or gas or something. Corporates, it’s an increasing market, but it’s still finite. And again, the merchant market is also finite in terms of. The regional ISO doesn’t want to allow too much capacity on the grid in a one year because it’ll start depressing the merchant market prices.

And everybody who’s already in the merchant market is going to complain. So they’re selective about how much capacity they allow into the merchant market. And if they’ve, especially for companies that are, that have an expiring PPA as well. If you signed a PPA 20 years ago and it’s expiring and you want to transition your capacity into the merchant market, you get precedence over, a new interconnect because your power generation capacity is already in place.

And then that takes away, a certain chunk of megawatts that would be available to be deployed into the merchant market, this year, because you already are taking that that capacity away. The short answer is yes, it does help with your interconnect when you’ve got either a corporate or a utility power offtake.

So this is also an ancillary benefit to, this business model is it’s going to make your permitting and your interconnection review go faster. No win.

Allen Hall: Hey, Uptime listeners. We know how difficult it is to keep track of the wind industry. That’s why we read PES wind magazine.

PES Wind doesn’t summarize the news. It digs into the tough issues and PES Wind is written by the experts so you can get the in depth info you need. Check out the wind industry’s leading trade publication, PES Wind at PESWind. com.

If we stay in the Midwest for a few more minutes there has been a report from an economics professor from the University of Colorado that says that wind turbines create microclimates that can have a positive effect on crop yields. Now, the microclimates can be anything from atmospheric effects that impact crop carbon concentration, CO2 essentially, oxygen content, and humidity.

What was found in this report is that the temperature extremes get narrowed down, so it doesn’t get at as cold at night or as hot during the day around the wind turbines, which can help benefit crops. Now they also interviewed a farmer in this little article and he’s, and who said that’s all great.

But when they came and did construction, that actually decreased my crop yields. But the checks in the mailbox are awesome. So I think from the farmer’s side, Joel, isn’t that where the benefit is that you can really have a hard time with microclimates, right?

Joel Saxum: Yeah. At the end of it, at the end of the day.

Absolutely. Economics are better when the wind turbines are there. And we’ve also actually seen reports that say that wind turbines on. increase the value of that land as opposed to people trying to fight against with the nimbyism and whatnot. So a question I have from this is when they say microclimates in the small range and like around the turbines, are they saying like the hundred feet around the turbines?

Are they saying like in an area of the wind farm? One of the thoughts I have is yeah, of course. Okay. If there’s like the concrete pad and the steel is going to absorb heat and immediately around that, it’s going to stay warmer in the nighttime. Like I, I get that. That’s just physics.

Philip Totaro: So there, there’s been some studies going back to, I think, 2017, 2018 on this. I’m actually taking a look at one right now that was published in 2021 from NREL where they said that there’s an effect which can extend 30 kilometers downwind of the wind farm. So not just the turbine. And now this isn’t necessarily the localized heating and the microclimate, but there, the impact to.

From the wake and everything, and the wake can end up carrying particulates and dust and seeds and things like that might be airborne. There’s absolutely an impact that a wind farm will have on, on, the local vegetation. The good news is that this recent report from the University of Colorado confirms the fact that there is actually a positive beneficial impact on crop yield.

Which I think is again important because if it were the opposite we’d be hearing about it if farmers all over the Midwest were seeing all these wind turbines come into place and then it was adversely impacting their crop yields. The lease payments in the mailbox are good, but this is their core business, and they definitely don’t want that impacted by wind turbines.

I think, again, if you want to talk about a win, everybody seems to be pretty making out pretty well as a result of, installing wind turbines in their on their land.

Allen Hall: Whatever it is, whatever the effect is the tax implications are always more important than microclimates.

And when we look at U. S. offshore, the U. S. Treasury has been writing some rules more recently. About the little kicker, the 10 percent kicker, you can get on tax credits for locating equipment in low income communities or communities that had relied on fossil fuel industries for employment, and the industry has been pushing to put SCADA.

Equipment in these areas to get that 10 percent kicker and it looks like the administration is going to let them do that So which I think is really important here And when we talk about this farmer in Iowa with the microclimates Everybody’s looking for a benefit, right? Everybody wants to have Make these projects profitable.

What we’re finding in these offshore markets is that there’s a lot of pushback from the operators and the OEMs about the tax structure because they’re not that profitable at the minute and looking for these add ons to get another 10 percent here or there, wherever they can. And a year ago, that wasn’t nearly as loud as what I’m hearing about it now.

And it has taken the Treasury, Phil, way too long to issue these rules, in my opinion, if they want wind to be 30 gigawatts by 2030. Are we going to see more of this happen now that there’s an election coming up in a couple of months? Are they going to be pushing out these regulations to get some of these projects kicked off?

Philip Totaro: Certainly if the current administration thinks they’re going to lose the election, then yeah, they absolutely want to get as much in place as as they can do. That’s one thing that’s potentially influencing that. But the reality of it is, again, we’ve talked ad nauseum on the show about, interest rates and inflation impacting offshore investments.

This is basically something that can be an extra, keep in mind that this 10 percent is on top of the 30 percent ITC that they can claim which gives them the option to, recoup a little more. Of the the capital investment up front, keep in mind that the reason that capital investments for offshore wind have increased and PPAs have necessarily needed to increase is because of, the higher interest rates.

So when you have a higher interest rate environment, you’re also going to have to, Hand out a little more in in the subsidy regime to, to make up for the Delta in the absolute value between what you would have spent on your capex before high interest rates and what you have to spend now if you want to develop a profitable project.

So thank you. This is the cost of doing business if you’re the government in terms of supporting an industry, the, a fledgling industry that you’re trying to get off the ground or in the water.

Joel Saxum: There you go. So let’s boil down with this, what this really in, in my mind, I guess this is what this thing means.

This means we’re going to give you an extra 10 percent on your ITC credits. Hey, wind company, we’re going to give you an extra 10 percent on your ITC credits if you put some kind of investment into either low income or traditionally demographics or geographies, towns, whatever this may be area environmental or not environmental, but economic areas that have been affected by fossil fuel generation or low income or whatever.

So if you are now wind operator, you’re like, Hey, we’ve got to put some money into, building a remote operations center and SCADA center somewhere. If we put it here, we can get an extra 10 percent ITC. So they go and they build it there. It’s actually a benefit to them because the real estate and development costs for building this nice building will probably be cheaper to be honest with you.

In that area, they bring a little bit of an economic boom to that area and with some construction jobs or, whatever that may be. And then now you have people that report there to work every day and they’re frequenting the restaurants in the area and going to the gas stations and lifting that area up.

So there’s a win, I guess we say win, but there’s a lot of things that I can, I’m not going to say that again. The development costs. Yeah, so they’re getting some, they’re getting some, increased ITC percentages. The development costs are actually probably less than they would have been if you were gonna go put the, an ROC center in downtown New York or something like that.

So there’s some advantages all around for it, but at the end of the day, I think I’ll go back to what you said, Alan. We’re in an election year, and this is a heartstrings election issue. Hey we now we’ve given more money back to the operators to get more clean energy and green energy.

It screams one side of the aisle to me, if you’re looking for pandering for votes.

Allen Hall: And speaking of votes, down in Virginia our friends at Tetra Tech actually did Dominion Wind, a service of Giving some images of what the Dominion wind farm would look like once it’s installed. So everybody calms down a minute.

And I don’t know if you saw these images, you can just Google it guys. But if the turbines are about 800 feet tall, but they’re like 25 odd miles offshore. And so the images are striking because the the way they set up the image just isn’t like they want to Put it in a human’s perspective.

So they have a guy fishing off the dock and then you see the turbines I mean they are little tiny blips out in the distance You can barely see them and that it would have to be like on a completely clear day it doesn’t happen all that often.

Philip Totaro: But Allen it’s impacting my viewshed and I want money.

Allen Hall: And they got money That’s the point, Phil.

They did get money.

Joel Saxum: Yeah, from Santa Barbara.

Allen Hall: Yeah yeah, where does it stop, right? It’s historic view sheds. Whatever that means, I don’t know what that means. Because if there was a boat out there 25 miles away, you wouldn’t say boo about it. But you were not even going to notice these things.

And it’d be one thing if it’s really close to shore, like the original, what, A couple of turbans that they put in the water, Dominion did, years ago, two, right? And they were pretty close to shore, relatively. But these are so far offshore, it’s getting crazy. And they’re putting in further offshore there’s one wind farm proposed, what, 80 kilometers offshore?

Like 50 miles? Holy moly, that’s a long way to go. Is this really happening? Or back to Joel’s point, it’s an election year, and we can drop some money in some buckets in some districts that we want. Is that what’s happening? Because this doesn’t make any sense otherwise.

Joel Saxum: Rewind this and go down to the Gulf Coast of Texas and Louisiana and see if those people ever got payments for looking at oil rigs out of their back doors.

Because I can guarantee you they did not.

Allen Hall: And that’s the frustrating bit, right? Is if I go back to the 30 by 30, which I have heard very little of lately, but if 30, 30 gigawatts by 2030 is going to happen, then this nonsense needs to get It’s actually 13 by 30 now. Is it less, is it 13 now or is it less than 13?

It may be 8. It should be. Where are we now, Phil?

Philip Totaro: With what’s going to be built and what’s in the pipeline, what you’re likely to see by 2030 is actually around half. It’s about, 12 to 15 gigawatts, again, depending on, a few things, but we’re definitely there is, I said this on the show, like almost a year ago, like there is physically no way we can ramp up the infrastructure, the investment required in factories and domestication of, monopile production, transition piece production.

Even turbines in enough time frame to actually hit 30 gigawatts by 2030. It’s physically impossible at this point, even if you spent all the money you could possibly spend, which is not happening by the way. We’re not going to hit that.

Joel Saxum: To put a line together for this and just not that it’s going to hit 2030 because I’m betting the under, I’m going to tell you that, but give us an over under value, someone in Vegas will do this for us.

Allen Hall: Oh, that’s probably a thing, Joel. They probably will. And speaking of offshore projects, Ocean Wind has acquired full ownership of South Coast Wind Project off the coast of California. Boston, Massachusetts, my state. It was previously a 50 50 joint venture between Ocean Winds and Shell New Energies.

Shell is walking away from renewable projects at the moment, Phil. This offshore project is just one of them. I don’t think it’s specific to offshore, but it does seem like Shell is moving away. Pulling back from renewables.

Philip Totaro: Yeah they’ve also just sold an on, another onshore project, a stake in an onshore wind project and some solar assets to infrared capital partners as well.

So they, they’ve pulled out of solar investments in Brazil. They’re reining in investments in renewables and repositioning and repivoting back to oil and gas because it’s what’s making money at the moment. But you know, they claim that they haven’t really changed their strategy, just maybe the timing of the execution which, I guess you could also say they’ve been saying that for 15, 20 years because at the end of the day, that’s what the, that’s what it boils down to.

If wind and solar are profitable enough for them to invest, They’re going to plow as much money as humanly possible into that. But if oil and gas represents a better financial return for them, then they’re going to always go back to their core business. So

Joel Saxum: it’s as simple as that. Hydrocarbons are a good place to make money right now, and the markets speak.

They speak real loud. They speak over the top of ESG goals.

Allen Hall: That’s going to do it for this week’s Uptime Wind Energy podcast. Thanks for listening. Please give us a five star rating on your podcast platform and subscribe in the show notes below to Uptime Tech News, our weekly newsletter. And check out Rosemary’s YouTube channel, Engineering with Rosie.

And we’ll see you here next week on the Uptime Wind Energy podcast.

Wind Energy Europe Update, Invenergy’s Build-Transfer Model, RTSYS’s Offshore AI Wildlife Detection

Renewable Energy

BladeBUG Tackles Serial Blade Defects with Robotics

Weather Guard Lightning Tech

BladeBUG Tackles Serial Blade Defects with Robotics

Chris Cieslak, CEO of BladeBug, joins the show to discuss how their walking robot is making ultrasonic blade inspections faster and more accessible. They cover new horizontal scanning capabilities for lay down yards, blade root inspections for bushing defects, and plans to expand into North America in 2026.

Sign up now for Uptime Tech News, our weekly newsletter on all things wind technology. This episode is sponsored by Weather Guard Lightning Tech. Learn more about Weather Guard’s StrikeTape Wind Turbine LPS retrofit. Follow the show on YouTube, Linkedin and visit Weather Guard on the web. And subscribe to Rosemary’s “Engineering with Rosie” YouTube channel here. Have a question we can answer on the show? Email us!

Welcome to Uptime Spotlight, shining Light on Wind. Energy’s brightest innovators. This is the Progress Powering Tomorrow.

Allen Hall: Chris, welcome back to the show.

Chris Cieslak: It’s great to be back. Thank you very much for having me on again.

Allen Hall: It’s great to see you in person, and a lot has been happening at Blade Bugs since the last time I saw Blade Bug in person. Yeah, the robot. It looks a lot different and it has really new capabilities.

Chris Cieslak: So we’ve continued to develop our ultrasonic, non-destructive testing capabilities of the blade bug robot.

Um, but what we’ve now added to its capabilities is to do horizontal blade scans as well. So we’re able to do blades that are in lay down yards or blades that have come down for inspections as well as up tower. So we can do up tower, down tower inspections. We’re trying to capture. I guess the opportunity to inspect blades after transportation when they get delivered to site, to look [00:01:00] for any transport damage or anything that might have been missed in the factory inspections.

And then we can do subsequent installation inspections as well to make sure there’s no mishandling damage on those blades. So yeah, we’ve been just refining what we can do with the NDT side of things and improving its capabilities

Joel Saxum: was that need driven from like market response and people say, Hey, we need, we need.

We like the blade blood product. We like what you’re doing, but we need it here. Or do you guys just say like, Hey, this is the next, this is the next thing we can do. Why not?

Chris Cieslak: It was very much market response. We had a lot of inquiries this year from, um, OEMs, blade manufacturers across the board with issues within their blades that need to be inspected on the ground, up the tap, any which way they can.

There there was no, um, rhyme or reason, which was better, but the fact that he wanted to improve the ability of it horizontally has led the. Sort of modifications that you’ve seen and now we’re doing like down tower, right? Blade scans. Yeah. A really fast breed. So

Joel Saxum: I think the, the important thing there is too is that because of the way the robot is built [00:02:00] now, when you see NDT in a factory, it’s this robot rolls along this perfectly flat concrete floor and it does this and it does that.

But the way the robot is built, if a blade is sitting in a chair trailing edge up, or if it’s flap wise, any which way the robot can adapt to, right? And the idea is. We, we looked at it today and kind of the new cage and the new things you have around it with all the different encoders and for the heads and everything is you can collect data however is needed.

If it’s rasterized, if there’s a vector, if there’s a line, if we go down a bond line, if we need to scan a two foot wide path down the middle of the top of the spa cap, we can do all those different things and all kinds of orientations. That’s a fantastic capability.

Chris Cieslak: Yeah, absolutely. And it, that’s again for the market needs.

So we are able to scan maybe a meter wide in one sort of cord wise. Pass of that probe whilst walking in the span-wise direction. So we’re able to do that raster scan at various spacing. So if you’ve got a defect that you wanna find that maximum 20 mil, we’ll just have a 20 mil step [00:03:00] size between each scan.

If you’ve got a bigger tolerance, we can have 50 mil, a hundred mil it, it’s so tuneable and it removes any of the variability that you get from a human to human operator doing that scanning. And this is all about. Repeatable, consistent high quality data that you can then use to make real informed decisions about the state of those blades and act upon it.

So this is not about, um, an alternative to humans. It’s just a better, it’s just an evolution of how humans do it. We can just do it really quick and it’s probably, we, we say it’s like six times faster than a human, but actually we’re 10 times faster. We don’t need to do any of the mapping out of the blade, but it’s all encoded all that data.

We know where the robot is as we walk. That’s all captured. And then you end up with really. Consistent data. It doesn’t matter who’s operating a robot, the robot will have those settings preset and you just walk down the blade, get that data, and then our subject matter experts, they’re offline, you know, they are in their offices, warm, cozy offices, reviewing data from multiple sources of robots.

And it’s about, you know, improving that [00:04:00] efficiency of getting that report out to the customer and letting ’em know what’s wrong with their blades, actually,

Allen Hall: because that’s always been the drawback of, with NDT. Is that I think the engineers have always wanted to go do it. There’s been crush core transportation damage, which is sometimes hard to see.

You can maybe see a little bit of a wobble on the blade service, but you’re not sure what’s underneath. Bond line’s always an issue for engineering, but the cost to take a person, fly them out to look at a spot on a blade is really expensive, especially someone who is qualified. Yeah, so the, the difference now with play bug is you can have the technology to do the scan.

Much faster and do a lot of blades, which is what the de market demand is right now to do a lot of blades simultaneously and get the same level of data by the review, by the same expert just sitting somewhere else.

Chris Cieslak: Absolutely.

Joel Saxum: I think that the quality of data is a, it’s something to touch on here because when you send someone out to the field, it’s like if, if, if I go, if I go to the wall here and you go to the wall here and we both take a paintbrush, we paint a little bit [00:05:00] different, you’re probably gonna be better.

You’re gonna be able to reach higher spots than I can.

Allen Hall: This is true.

Joel Saxum: That’s true. It’s the same thing with like an NDT process. Now you’re taking the variability of the technician out of it as well. So the data quality collection at the source, that’s what played bug ducts.

Allen Hall: Yeah,

Joel Saxum: that’s the robotic processes.

That is making sure that if I scan this, whatever it may be, LM 48.7 and I do another one and another one and another one, I’m gonna get a consistent set of quality data and then it’s goes to analysis. We can make real decisions off.

Allen Hall: Well, I, I think in today’s world now, especially with transportation damage and warranties, that they’re trying to pick up a lot of things at two years in that they could have picked up free installation.

Yeah. Or lifting of the blades. That world is changing very rapidly. I think a lot of operators are getting smarter about this, but they haven’t thought about where do we go find the tool.

Speaker: Yeah.

Allen Hall: And, and I know Joel knows that, Hey, it, it’s Chris at Blade Bug. You need to call him and get to the technology.

But I think for a lot of [00:06:00] operators around the world, they haven’t thought about the cost They’re paying the warranty costs, they’re paying the insurance costs they’re paying because they don’t have the set of data. And it’s not tremendously expensive to go do. But now the capability is here. What is the market saying?

Is it, is it coming back to you now and saying, okay, let’s go. We gotta, we gotta mobilize. We need 10 of these blade bugs out here to go, go take a scan. Where, where, where are we at today?

Chris Cieslak: We’ve hads. Validation this year that this is needed. And it’s a case of we just need to be around for when they come back round for that because the, the issues that we’re looking for, you know, it solves the problem of these new big 80 a hundred meter plus blades that have issues, which shouldn’t.

Frankly exist like process manufacturer issues, but they are there. They need to be investigated. If you’re an asset only, you wanna know that. Do I have a blade that’s likely to fail compared to one which is, which is okay? And sort of focus on that and not essentially remove any uncertainty or worry that you have about your assets.

’cause you can see other [00:07:00] turbine blades falling. Um, so we are trying to solve that problem. But at the same time, end of warranty claims, if you’re gonna be taken over these blades and doing the maintenance yourself, you wanna know that what you are being given. It hasn’t gotten any nasties lurking inside that’s gonna bite you.

Joel Saxum: Yeah.

Chris Cieslak: Very expensively in a few years down the line. And so you wanna be able to, you know, tick a box, go, actually these are fine. Well actually these are problems. I, you need to give me some money so I can perform remedial work on these blades. And then you end of life, you know, how hard have they lived?

Can you do an assessment to go, actually you can sweat these assets for longer. So we, we kind of see ourselves being, you know, useful right now for the new blades, but actually throughout the value chain of a life of a blade. People need to start seeing that NDT ultrasonic being one of them. We are working on other forms of NDT as well, but there are ways of using it to just really remove a lot of uncertainty and potential risk for that.

You’re gonna end up paying through the, you know, through the, the roof wall because you’ve underestimated something or you’ve missed something, which you could have captured with a, with a quick inspection.

Joel Saxum: To [00:08:00] me, NDT has been floating around there, but it just hasn’t been as accessible or easy. The knowledge hasn’t been there about it, but the what it can do for an operator.

In de-risking their fleet is amazing. They just need to understand it and know it. But you guys with the robotic technology to me, are bringing NDT to the masses

Chris Cieslak: Yeah.

Joel Saxum: In a way that hasn’t been able to be done, done before

Chris Cieslak: that. And that that’s, we, we are trying to really just be able to roll it out at a way that you’re not limited to those limited experts in the composite NDT world.

So we wanna work with them, with the C-N-C-C-I-C NDTs of this world because they are the expertise in composite. So being able to interpret those, those scams. Is not a quick thing to become proficient at. So we are like, okay, let’s work with these people, but let’s give them the best quality data, consistent data that we possibly can and let’s remove those barriers of those limited people so we can roll it out to the masses.

Yeah, and we are that sort of next level of information where it isn’t just seen as like a nice to have, it’s like an essential to have, but just how [00:09:00] we see it now. It’s not NDT is no longer like, it’s the last thing that we would look at. It should be just part of the drones. It should inspection, be part of the internal crawlers regimes.

Yeah, it’s just part of it. ’cause there isn’t one type of inspection that ticks all the boxes. There isn’t silver bullet of NDT. And so it’s just making sure that you use the right system for the right inspection type. And so it’s complementary to drones, it’s complimentary to the internal drones, uh, crawlers.

It’s just the next level to give you certainty. Remove any, you know, if you see something indicated on a a on a photograph. That doesn’t tell you the true picture of what’s going on with the structure. So this is really about, okay, I’ve got an indication of something there. Let’s find out what that really is.

And then with that information you can go, right, I know a repair schedule is gonna take this long. The downtime of that turbine’s gonna be this long and you can plan it in. ’cause everyone’s already got limited budgets, which I think why NDT hasn’t taken off as it should have done because nobody’s got money for more inspections.

Right. Even though there is a money saving to be had long term, everyone is fighting [00:10:00] fires and you know, they’ve really got a limited inspection budget. Drone prices or drone inspections have come down. It’s sort, sort of rise to the bottom. But with that next value add to really add certainty to what you’re trying to inspect without, you know, you go to do a day repair and it ends up being three months or something like, well

Allen Hall: that’s the lightning,

Joel Saxum: right?

Allen Hall: Yeah. Lightning is the, the one case where every time you start to scarf. The exterior of the blade, you’re not sure how deep that’s going and how expensive it is. Yeah, and it always amazes me when we talk to a customer and they’re started like, well, you know, it’s gonna be a foot wide scarf, and now we’re into 10 meters and now we’re on the inside.

Yeah. And the outside. Why did you not do an NDT? It seems like money well spent Yeah. To do, especially if you have a, a quantity of them. And I think the quantity is a key now because in the US there’s 75,000 turbines worldwide, several hundred thousand turbines. The number of turbines is there. The number of problems is there.

It makes more financial sense today than ever because drone [00:11:00]information has come down on cost. And the internal rovers though expensive has also come down on cost. NDT has also come down where it’s now available to the masses. Yeah. But it has been such a mental barrier. That barrier has to go away. If we’re going going to keep blades in operation for 25, 30 years, I

Joel Saxum: mean, we’re seeing no

Allen Hall: way you can do it

Joel Saxum: otherwise.

We’re seeing serial defects. But the only way that you can inspect and or control them is with NDT now.

Allen Hall: Sure.

Joel Saxum: And if we would’ve been on this years ago, we wouldn’t have so many, what is our term? Blade liberations liberating

Chris Cieslak: blades.

Joel Saxum: Right, right.

Allen Hall: What about blade route? Can the robot get around the blade route and see for the bushings and the insert issues?

Chris Cieslak: Yeah, so the robot can, we can walk circumferentially around that blade route and we can look for issues which are affecting thousands of blades. Especially in North America. Yeah.

Allen Hall: Oh yeah.

Chris Cieslak: So that is an area that is. You know, we are lucky that we’ve got, um, a warehouse full of blade samples or route down to tip, and we were able to sort of calibrate, verify, prove everything in our facility to [00:12:00] then take out to the field because that is just, you know, NDT of bushings is great, whether it’s ultrasonic or whether we’re using like CMS, uh, type systems as well.

But we can really just say, okay, this is the area where the problem is. This needs to be resolved. And then, you know, we go to some of the companies that can resolve those issues with it. And this is really about played by being part of a group of technologies working together to give overall solutions

Allen Hall: because the robot’s not that big.

It could be taken up tower relatively easily, put on the root of the blade, told to walk around it. You gotta scan now, you know. It’s a lot easier than trying to put a technician on ropes out there for sure.

Chris Cieslak: Yeah.

Allen Hall: And the speed up it.

Joel Saxum: So let’s talk about execution then for a second. When that goes to the field from you, someone says, Chris needs some help, what does it look like?

How does it work?

Chris Cieslak: Once we get a call out, um, we’ll do a site assessment. We’ve got all our rams, everything in place. You know, we’ve been on turbines. We know the process of getting out there. We’re all GWO qualified and go to site and do their work. Um, for us, we can [00:13:00] turn up on site, unload the van, the robot is on a blade in less than an hour.

Ready to inspect? Yep. Typically half an hour. You know, if we’ve been on that same turbine a number of times, it’s somewhere just like clockwork. You know, muscle memory comes in, you’ve got all those processes down, um, and then it’s just scanning. Our robot operator just presses a button and we just watch it perform scans.

And as I said, you know, we are not necessarily the NDT experts. We obviously are very mindful of NDT and know what scans look like. But if there’s any issues, we have a styling, we dial in remote to our supplement expert, they can actually remotely take control, change the settings, parameters.

Allen Hall: Wow.

Chris Cieslak: And so they’re virtually present and that’s one of the beauties, you know, you don’t need to have people on site.

You can have our general, um, robot techs to do the work, but you still have that comfort of knowing that the data is being overlooked if need be by those experts.

Joel Saxum: The next level, um, commercial evolution would be being able to lease the kit to someone and or have ISPs do it for [00:14:00] you guys kinda globally, or what is the thought

Chris Cieslak: there?

Absolutely. So. Yeah, so we to, to really roll this out, we just wanna have people operate in the robots as if it’s like a drone. So drone inspection companies are a classic company that we see perfectly aligned with. You’ve got the sky specs of this world, you know, you’ve got drone operator, they do a scan, they can find something, put the robot up there and get that next level of information always straight away and feed that into their systems to give that insight into that customer.

Um, you know, be it an OEM who’s got a small service team, they can all be trained up. You’ve got general turbine technicians. They’ve all got G We working at height. That’s all you need to operate the bay by road, but you don’t need to have the RAA level qualified people, which are in short supply anyway.

Let them do the jobs that we are not gonna solve. They can do the big repairs we are taking away, you know, another problem for them, but giving them insights that make their job easier and more successful by removing any of those surprises when they’re gonna do that work.

Allen Hall: So what’s the plans for 2026 then?

Chris Cieslak: 2026 for us is to pick up where 2025 should have ended. [00:15:00] So we were, we were meant to be in the States. Yeah. On some projects that got postponed until 26. So it’s really, for us North America is, um, what we’re really, as you said, there’s seven, 5,000 turbines there, but there’s also a lot of, um, turbines with known issues that we can help determine which blades are affected.

And that involves blades on the ground, that involves blades, uh, that are flying. So. For us, we wanna get out to the states as soon as possible, so we’re working with some of the OEMs and, and essentially some of the asset owners.

Allen Hall: Chris, it’s so great to meet you in person and talk about the latest that’s happening.

Thank you. With Blade Bug, if people need to get ahold of you or Blade Bug, how do they do that?

Chris Cieslak: I, I would say LinkedIn is probably the best place to find myself and also Blade Bug and contact us, um, through that.

Allen Hall: Alright, great. Thanks Chris for joining us and we will see you at the next. So hopefully in America, come to America sometime.

We’d love to see you there.

Chris Cieslak: Thank you very [00:16:00] much.

Renewable Energy

Understanding the U.S. Constitution

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Hillsdale College is a rightwing Christian extremist organization that ostensibly honors the United States Constitution.

Here’s their quiz, which should be called the “Constitutional Trivia Quiz.”, whose purpose is obviously to convince Americans of their ignorance.

When I teach, I’m going for understanding of the topic, not the memorization of useless information.

Renewable Energy

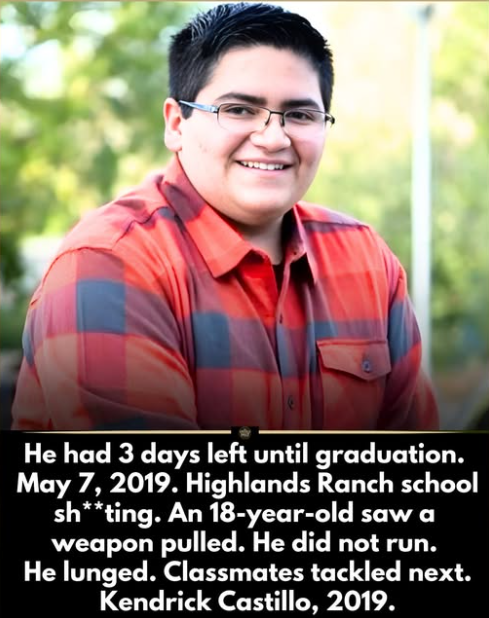

Bravery Meets Tragedy: An Unending Story

Here’s a story:

Here’s a story:

He had 3 days left until graduation.

Kendrick Castillo was 18. A robotics student. College bound. Accepted into an engineering program. The final week of school felt like countdown, not crisis.

Then a weapon appeared inside a classroom.

Students froze.

Kendrick did not.

Witnesses say he moved instantly. He lunged toward the attacker. No hesitation. No calculation.

Two other students followed his lead.

Gunfire erupted.

Kendrick was fatally sh*t.

But his movement changed the room.

Classmates were able to tackle and restrain the attacker until authorities arrived. Investigators later stated that the confrontation disrupted the attack and likely prevented additional casualties.

In seconds, an 18-year-old made a decision most adults pray they never face.

Afterward, the silence was heavier than the noise.

At graduation, his name was called.

His diploma was awarded posthumously. The arena stood in collective applause. An empty seat. A cap and gown without the student inside it.

His robotics teammates remembered him as curious. Competitive. Kind. Someone who solved problems instead of avoiding them.

He had planned to build machines.

Instead, he built a moment.

A moment that classmates say gave them time.

Time to escape.

Two points:

If you can read this without tears welling up in your eyes, you’re a far more stoic person than I.

Since Big Money has made it impossible for the United States to implement the same common-sense gun laws that exist in the rest of the planet, this story will reduplicate itself into perpetuity.

-

Greenhouse Gases7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Climate Change7 months ago

Guest post: Why China is still building new coal – and when it might stop

-

Greenhouse Gases2 years ago

Greenhouse Gases2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change2 years ago

Bill Discounting Climate Change in Florida’s Energy Policy Awaits DeSantis’ Approval

-

Climate Change2 years ago

Spanish-language misinformation on renewable energy spreads online, report shows

-

Climate Change2 years ago

Climate Change2 years ago嘉宾来稿:满足中国增长的用电需求 光伏加储能“比新建煤电更实惠”

-

Climate Change Videos2 years ago

The toxic gas flares fuelling Nigeria’s climate change – BBC News

-

Carbon Footprint2 years ago

Carbon Footprint2 years agoUS SEC’s Climate Disclosure Rules Spur Renewed Interest in Carbon Credits